Why one little-known company could hold the key to North American energy security, as we enter into the early stages of a 10-year lithium mega trend.

- An historic shift to electric vehicles is triggering a new boom in lithium prices. Battery-grade lithium carbonate, has skyrocketed in price 4%,1 so far in 2021 to $12,635 per ton, outperforming the S&P 500 by almost 8 to 1.2

- And with a recent report by the International Energy Agency (IEA) projecting the number of electric vehicles to grow 1,200%3 by the end of the decade, junior resource mining companies are soaring as well.

- Now, Vancouver-based Spey Resources Corp. (CSE:SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF) may have just stumbled upon the deal of the century: an option to acquire a 100% interest in the Candela II Project in South America’s prolific Lithium Triangle.

The Entire World is Going Electric, Driving Lithium Prices Sky-High

There is little doubt that much of the world is turning away from fossil fuels to electric power.

According to a new report by Fitch Solutions, the global electric vehicle fleet will grow an average of 23.6% a year between 2021 and 2030, reaching 83.6 million vehicles on the road worldwide by 2030 compared to only 300,000 in 2020.4

Although lithium prices pulled back three years ago when production outpaced demand, many analysts believe the overall trend remains very bullish.

The International Energy Agency (IEA) estimates the need for lithium will increase by up to 70 times5 over the next 20 years.

For its part, Fitch Solutions projects that for every 1 million electric vehicles on the road, the electric vehicle market will need 60,000 tons6 of lithium. At that rate, the world will need between 2 and 5 million tons of high-grade lithium over the next five to ten years.

Current production is estimated to be only around 82,000 tons7 annually worldwide – a small fraction of what will be needed.

You don’t have to be a Wall Street trader to connect the dots here.

Millions of battery-powered cars will hit the road in the 2020s. And each year they’ll need more and more lithium.

Lithium demand will continue to go up. One bullish point to lithium producers.

Then as lithium demand soars, so will lithium prices to spur the build-out of new mines and meet the growing demand from EVs. Another bullish point to lithium producers.

All this hints that lithium producers might be in for a hell of a decade.

And Low-priced, undiscovered lithium exploration stocks like Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC:SPEYF) are best positioned to leverage the sharp upturn in prices.

Resource Investors Are Eager For a Repeat of the Boom in Lithium Mining Stocks That Arose in 2015-2018.

Over the past year, investors have already seen share prices of lithium exploration companies rise sharply:

Lithium Americas Corp (Nasdaq: LAC) shot up 274%8 in the past 52 weeks.

Sociedad Quimica y Minera (NYSE: SQM) soared 141% in the same period.

Standard Lithium Corp (OTCL STLHF) skyrocketed 497%10.

And Piedmont Lithium (Nasdaq: PLL) is up a stunning 866%11.

And that was just based on anticipation of the imminent shift from oil to electric.

Imagine the spike in lithium demand as a $2.3 trillion infrastructure plan rolls out across the United States.

How To Play One Of The World’s Dominant Trends

Now, it’s Spey Resources Corp. (CSE:SPEY, OTC:SPEYFCSE: SPEY, OTC:SPEYF) turn to draw investor’s attention.

Its recent acquisition of Tech One Lithium Resources, a private company with an option to acquire 100% of the mineral concessions in the Candela II lithium brine project, is located in Argentina’s famous Lithium Triangle.

Although found in most places in the world, lithium can only be economically mined when it is found insufficient concentrations, either in hard rock ore or as a component in underground rivers or “brine.”

Production of lithium from brine sources is the most economical – with the world’s top source of lithium brines being the “Lithium Triangle,” a region of the Andes mountains that includes parts of Argentina, Chile, and Bolivia.

Global lithium reserves are currently estimated at around 17 million12 metric tons (MT) – of which two thirds, or 10.3 million13 tons, are found in Chile and Argentina.

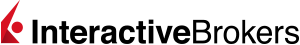

The Candela II project covers 741 acres14 on the lithium-rich Argentine salt flats of the Incahuasi salar, where only two other companies are currently exploring: Chinese lithium giant Ganfeng Lithium (OTC: GNENF) and the Australian lithium conglomerate Orocobre, Ltd (OROCF).

The Candela II project covers 741 acres14 on the lithium-rich Argentine salt flats of the Incahuasi salar, where only two other companies are currently exploring: Chinese lithium giant Ganfeng Lithium (OTC: GNENF) and the Australian lithium conglomerate Orocobre, Ltd (OROCF).

Orocobre is currently selling for around $7 a share and Ganfeng for around $12 per share– or between 23 and 40 times the price of Spey Resources Corp. (CSE:SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF).

As of this writing, Spey Resources shares are selling for under $0.30 – so two thousand shares can be bought for a modest investment of less than $600.

At that price, it doesn’t take a very big move in the price of lithium to see an immediate potential return. In addition, the buyout potential is very real as evidenced by Orocobre’s recent acquisition of smaller domestic peer Galaxy Resources (GXY.AX) for $1.4 billion.15

History Making Founders

Small but established Canadian exploration company, Spey Resources Corp. (CSE:SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF) was previously known for its Silver Basin Project in the Revelstoke Mining Division of British Columbia.

But in 2020, it was alerted to the special situation developing in Argentina’s Incahuasi Salar by project leader Phil Thomas, a geologist with extensive experience exploring the salt flats of northern Argentina.

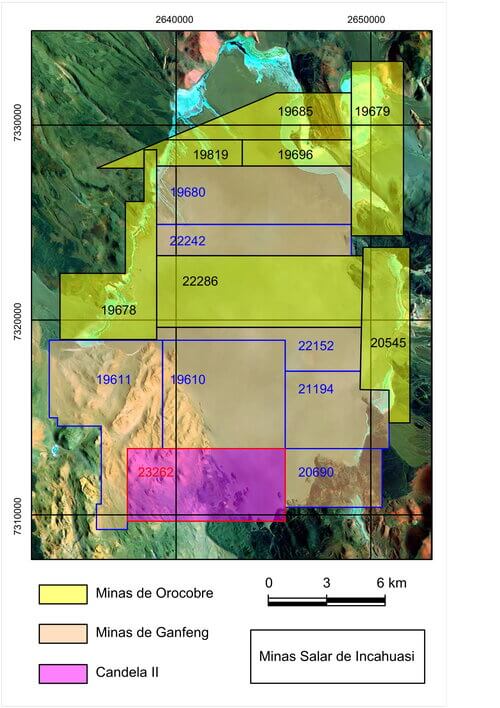

Spey Resources’s chief executive office Nader Vatanchi, working with Thomas and Dr. Carlos Soretino, an expert on lithium mining in Argentina and a co-inventor of the Ekosolve lithium production system, instantly recognized what they believe is an historic opportunity.

The company was able to quickly raise sufficient capital to acquire Tech One Lithium Resources Corporation, allowing them access to the exploration license for the Candela II Project in the Incahuasi Salar.16

They have also raised the capital necessary to completely fund an ambitious exploration program, expected to begin in early June.

The Economics of Lithium Production Make the Incahuasi Salar Very Attractive.

Assuming a 40-meter drilling depth, lithium brine concentrations of 300 parts per million, and a very basic flow rate of 10,000 liters a minute, a lithium facility in this region could potentially produce 287,000 tons17 of lithium carbonate.

In addition, Spey Resources Corp. (CSE:SPEY, OTC:SPEYFCSE: SPEY, OTC:SPEYF) inherits from the previous owner a facility fee agreement to utilize the Ekosolve™ Lithium Solvent Exchange Extraction process.

This will allow it to efficiently manage the processing of the brines to produce lithium carbonate with a grade higher than 99.2% and a recovery of 97%.

At a current price for battery-grade lithium of around $12,635 per ton, that could represent potential revenues of up to $3.6 billion18.

7 Reasons to Consider Spey Resources Corp. (CSE: SPEY, OTC: SPEYF) for Your Portfolio

Reason #1: Its exploration project is located in the middle of the Lithium Triangle, where an estimated two thirds of the world’s 17 metric tons of lithium is believed to exist

Reason #2: Spey Resources is one of only three companies currently exploring the Incahuasi Lithium Salar, a vast salt flat located two miles above sea level in Argentina’s Catamarca Province.

Reason #3: The initial trenching, drilling and other testing has already begun on the Candela II project. Results could appear in months, even weeks.

Reason #4: Assuming initial trenching and drill tests prove positive, the company could see a resource size of some 287,000 tons of lithium carbonate.

Reason #5: At a current price for battery-grade lithium carbonate of $12,635 per ton, that represents potential future revenues of some $3.6 billion.

Reason #6: Lithium prices have risen 88.4% so far in 2021 – and the International Energy Agency (IEA) estimates the need for lithium will increase by up to 70 times over the next 20 years.

Reason #7: Spey Resources Corp. (CSE:SPEY, OTC:SPEYFCSE: SPEY, OTC:SPEYF) share price is now under $0.50 per share. Yet the only other two companies exploring the Incahuasi Lithium Salar, Ganfeng and Orocobre, are currently selling for between $7 and $12 per share.

With the need for new sources of lithium quickly becoming a worldwide crisis, you could expect Spey Resources to stay in the news for years to come. That’s why now could be the very best time to latch onto its affordably priced shares.

It’s time to take a closer look at Spey Resources Corp. (CSE:SPEY, OTC:SPEYFCSE: SPEY, OTC:SPEYF). You can visit their website and see more details on their projects here.

Or ask your broker about Spey Resources today.

And remember to always do your own due diligence on any stock before you buy.

Learn More About Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC:SPEYF) at your brokerage today!

Learn More About Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC:SPEYF) at your brokerage today!

1NOTE: Footnotes for internal compliance review only. https://www.mining-journal.com/energy-minerals-news/news/1406529/lithium-carbonate-prices-have-nearly-doubled-in-2021-benchmark

2As of May 10, the S&P 500 index shows a year to date return of 11.51% compared to 88.4% for lithium carbonate. 88.4% divided by 11.51% = 7.68 times.

3https://percentagecalculator.net/

4https://www.miningweekly.com/article/lithium-prices-to-normalise-as-demand-increases-fitch-solutions-2021-05-07

5https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

6https://www.miningweekly.com/article/lithium-prices-to-normalise-as-demand-increases-fitch-solutions-2021-05-07

7https://www.statista.com/statistics/606684/world-production-of-lithium/

8Percentage return as of May 11, 2021, on Morningstar: https://www.morningstar.com/stocks/xnys/lac/trailing-returns

9https://www.morningstar.com/stocks/xnys/sqm/trailing-returns

10https://www.morningstar.com/stocks/pinx/stlhf/trailing-returns

11https://finance.yahoo.com/quote/PLL/chart?p=PLL

12https://investingnews.com/daily/resource-investing/battery-metals-investing/lithium-investing/lithium-deposit-types-brine-pegmatite-and-sedimentary/

13https://investingnews.com/daily/resource-investing/battery-metals-investing/lithium-investing/lithium-reserves-country/

14300 hectares per

15https://www.reuters.com/business/australias-orocobre-buys-galaxy-make-worlds-fifth-largest-lithium-company-2021-04-19/

16https://www.speyresources.ca/news-releases/spey-resources-acquires-tech-one-lithium-resources-corp

17Powerpoint, p. 7

18287,000 tons x 12,635 per ton = $3,626,245,000

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Spey Resources Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Spey Resources Corp. and has no information concerning share ownership by others of any profiled Spey Resources Corp. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Spey Resources Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Spey Resources Corp. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Spey Resources Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Spey Resources Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Spey Resources Corp. industry; (b) market opportunity; (c) Spey Resources Corp. business plans and strategies; (d) services that Spey Resources Corp. intends to offer; (e) Spey Resources Corp. milestone projections and targets; (f) Spey Resources Corp. expectations regarding receipt of approval for regulatory applications; (g) Spey Resources Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Spey Resources Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Spey Resources Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Spey Resources Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Spey Resources Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Spey Resources Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Spey Resources Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Spey Resources Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Spey Resources Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Spey Resources Corp. business operations (e) Spey Resources Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Spey Resources Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Spey Resources Corp. or such entities and are not necessarily indicative of future performance of Spey Resources Corp. or such entities.