Red-Hot Electric Vehicle Stocks Post Gains as High as 1,400% in Just 6 Months

Investors looking for outsized profits in 2021 are taking a hard look at the exploding luxury EV market.

Just recently, a number of high-end car companies have begun producing electric models to compete with Tesla. For 2021, these include the Audi e-tron GT, BMW i4, Lotus Evija, Aston Martin Rapide E, Porsche Taycan, Mercedes-Benz EQS, and Polestar 2.

They range in price from Polestar’s relatively modest $60,000 all the way up to the Lotus Evija, priced at between $1.8 and $2.5 million.

Yet the real action for investors may lie elsewhere.

Huge Profits in the Luxury EV Car Market

Several under the radar companies, such as Duesenberg Technologies (OTC:DUSYFOTC:DUSYF) have begun engineering electric vehicles inspired by America’s iconic cars of the past, updated with state-of-the-art design and technology.

For example, recently the British sports car maker AC announced it would produce a limited run of electrified tributes to its Le Mans factory cars of the 1960s. The company will manufacture a dozen AC Cobra Le Mans Electrics with a 617-hp all-electric powertrain that delivers 738 foot-pounds of torque. The cost: $788,000 each.

The designer Peter Brock at the American company Superperformance has created an EV version of his Superperformance chassis, inspired by the 1964 Shelby Daytona, that can go from 0 to 60 in 3.4 seconds. It currently sells for around $525,000.

In fact, there is a cottage industry now, among gearheads and hobbyists, in converting classic cars to all-electric.

An Estonian company called e-Drive Retro now produces a plug-in electric drivetrain of its own design that can replace the internal combustion drivetrain of cars built from the 1950s through and 1970s — such as its flagship EV version of the Triumph TR6.

You can now buy all-electric versions of the 1957 Ford Fairlane, Shelby Cobra, 1980 Fiat 124 Spider, Porsche 911, 1968 Mustang, Volkswagon Beetle, even the 1978 Ferrari 308 GTS popularized in the American TV series “Magnum, P.I.”

Bringing Back the Duesenberg Ultra-Luxury Car

For investors, though, the company that is attracting a lot of interest is Duesenberg Technologies (OTC:DUSYFOTC:DUSYF). It’s one of the few upstart luxury EV manufacturers that is publicly traded — and the only one that is developing new vehicles inspired by the iconic Duesenberg car brand.

Why the Duesenberg? Well, as American car writer Jeff Peek puts it, “The Duesenberg… was arguably the finest American automobile ever built.”

The brainchild of Malaysian businessman and classic car enthusiast Joe Lim, Duesenberg Technologies has brought together a team of engineers and designers from luxury car manufacturers and electric vehicle pioneers.

These include Chief Design Officer Chris Reitz, former head designer at the Fiat Group; Jurgen Barth, chief technical advisor with 50 years’ experience at the Porsche racing teams; Ian Thompson; with over 35 years experience in vehicle engineering including several Watershed Electric Vehicles under his belt, former Siemens tech specialist Bronson Tan; and Brendan Norman, a former executive at BMW and Audi/Volkswagen and since with over 12 years experience in the electric vehicle space.

Duesenberg Technologies (OTC:DUSYFOTC:DUSYF) plans to develop updated, high-tech versions of classic models from the old Duesenberg Motors Company, an American manufacturer of high-end luxury automobiles that existed from 1913 until 1937 in the Midwest.

Throughout the 1920s and ‘30s, Duesenberg cars were direct competitors for the most luxurious European automobiles of that era, such as Rolls Royce and Mercedes-Benz. Gary Cooper, Clark Gable, the Duke of Windsor and scores of other famous celebrities spent handsomely for the prestige and power of owning a Duesenberg

The cars remain, for classic car enthusiasts, the ultimate symbol of luxury and high-performance in cars.

“In the simplest of terms, the Duesenberg SSJ was the best automobile in the world.” – Safet Satara

Recently, actor Gary Cooper’s 1935 Duesenberg SSJ sold for a jaw-dropping $22 million record at an auction in Pebble Beach – far more than the previous record holder, the very first Shelby Cobra ever made, which sold for $13.75 million in 2016.

Other iconic classics sold for a fraction of the Duesenberg’s price, such as the 1955 Maserati A6GCS/53 Spider (only $5.17 million) and the 1955 Porsche 550 Spyder ($4.455 million).

Experts say this shows the premium value that is placed on the Duesenberg brand among luxury car buyers.

As Top Speed car writer Safet Satara puts it, “In the simplest of terms, the Duesenberg SSJ was the best automobile in the world…. the most luxurious and the best-built thing rolling the streets of Hollywood and the world.”

He adds that “If you were to ask me what car company I’d like to see resurrected, it would be the Duesenberg.”

It looks like classic car lovers like Satara will get their wish.

The updated Duesenberg vehicles will be manufactured using modern techniques and technologies yet with full Duesenberg factory support, warranty and certification.

The first prototype Duesenberg Technologies (OTC:DUSYFOTC:DUSYF) vehicle is a sleek, high-tech fastback dubbed “Le Grand Torpedo,” an ultra-luxury limousine with a distinctive butterfly compartment opening and inspired by the classic Duesenberg Model A and Model S lines.

Built with an advanced composite and aluminum and steel chassis, Le Grand Torpedo features an Integrated HUB motor with a built-in torque vectoring system and that is powered by third-generation Lithium-Ion batteries. The car will come with a full array of driver-assist technologies, including an advanced driver monitoring systems, Autonomous capabilities around steering, braking and cruising, and smart cockpit digital instrument cluster.

The initial run of “founders” vehicles will be limited to 100, and will be released with special treatments to the vehicles and an exclusive invitation to each owner to personally choose the interior fittings placed in their vehicles in consultation with one of the original expert designers from the Duesenberg Design Team in Barcelona, Spain.

These initial vehicles will be priced in excess of $500,000 each, in the same class as the Ferrari SF90 Stradale, Rolls-Royce Phantom and Ford GT. The company’s manufacturing facilities, based in Nevada, are scheduled to have the first vehicles ready by the summer of 2023.

The Duesenberg business model is to establish a sustained presence at the top of the Prestige Automobile Mountain.

EV Stocks on Fire in 2020 and 2021

For investors, the attraction of luxury EV manufacturers such as Duesenberg Technologies (OTC:DUSYFOTC:DUSYF) is the 27% profit margin projected for the ultra-high-end market – and the exploding electric car market generally.

According to a recent report published by Allied Market Research, the global electric vehicle industry is expected to skyrocket from $162 billion in 2019 to $802 billion by 2027, an increase of 395 percent in just eight years and a compounded growth rate of 22.6 percent annually.

Governments worldwide are setting new zero-emission mandates that will require only EV- or hydrogen-powered vehicles to be sold in just 10 to 15 years.

And a report from Bloomberg estimates that electric vehicles will be 10 percent of all vehicles sold by 2025 (about 8 million units) and this will grow to 28 percent by 2030 (26 million units).

That may be the reason why many small, publicly traded EV manufacturers have seen the value of their shares rise sharply in recent months.

Lordstown Motors Corp (RIDE), which makes an EV pickup, has seen its shares double in value in 2020 – from $12 a share in August to $27 a share in December. That’s a 125 percent return in less than a year.

Nikola Corp. (NKLA), which manufactures EV long-haul trucks, started the year at around $10.70 a share and now trades for around $30 – an increase of 180 percent in a year.

Workhorse Group (WKHS), another electric truck manufacturer, saw its shares rise from $1.57 per share in March 2020 to around $28 a share by December – a gain of 1,683 percent in less than a year.

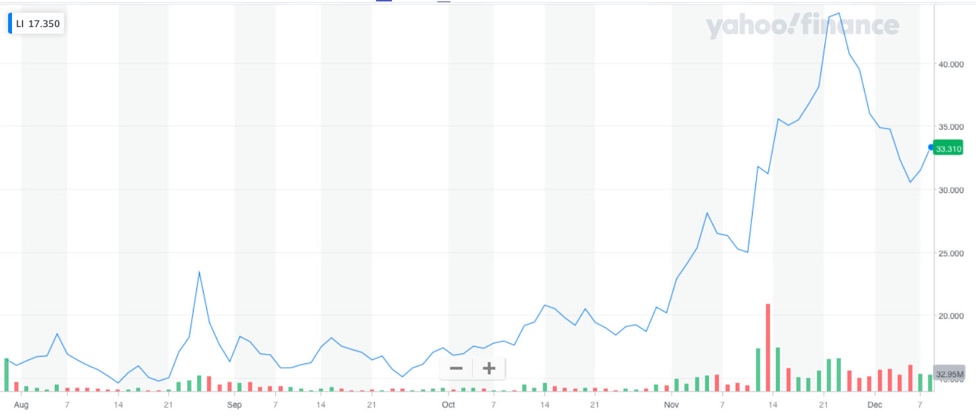

Li Auto (LI), a Chinese EV company trading on U.S. exchanges, saw its ADR shares jump from $14.60 last August to $40 in December – a gain of 173 percent in just four months.

And Nio (NIO), another Chinese EV manufacturer, has done even better. Its shares have risen from $3.27 in May 2020 to $52 at the end of the year – a gain of 1,490 percent in six months.

Current plans call for Duesenberg Technologies to “pre-sell” its first 100 vehicles, all customized, to high-net-worth individuals, allowing the company to reach profitability within just three years.

Selling 100 to 1,000 units annually of the customized Le Grand Torpedo, Duesenberg Technologies could see its revenue grow quickly from $50 to $500 million. The company itself projects initial EBITA profits of $100 million within the first five years.

For a small startup with a market cap of only $22 million, these are exciting projections. Duesenberg Technologies (OTC:DUSYFOTC:DUSYF) is currently selling for less than $1 per share. Yet if its attempt to revive the Duesenberg brand catches on with luxury car buyers, that could change overnight.

For more information on Duesenberg Technologies, visit its website.

For information on the exploding luxury EV market, click here.

1 https://autowise.com/2021-electric-cars/

2 https://autowise.com/2021-electric-cars/

3 https://www.msn.com/en-us/autos/classic-cars/ac-cobra-le-mans-electric-announced/ar-BB1aKUyC#!

4 https://www.roadandtrack.com/car-culture/a10312/superformance-brock-coupe/

5 https://carbuzz.com/news/the-shelby-cobra-is-going-electric

6 https://www.msn.com/en-us/autos/classic-cars/ac-cobra-le-mans-electric-announced/ar-BB1aKUyC#!

7 https://www.popsci.com/classic-cars-get-an-electric-upgrade-from-e-drive-retro/

8 https://www.digitaltrends.com/cars/best-electric-conversions-of-classic-cars/

9 https://www.hagerty.com/media/automotive-history/is-the-duesenberg-model-j-the-greatest-american-car-ever-built/

10 https://www.autoblog.com/2018/08/27/1935-duesenberg-ssj-record-22-million-gary-cooper-pebble-beach/

11 https://www.topspeed.com/cars/duesenberg-ssjthe-most-expensive-american-car-ar182562.html#:~:text=In%20the%20simplest%20of%20terms,of%20Hollywood%20and%20the%20world.

12 https://carbuzz.com/cars/above-300k

13 https://www.globenewswire.com/news-release/2020/06/08/2045017/0/en/Electric-Vehicle-Market-to-Reach-802-81-Billion-Globally-by-2027-Allied-Market-Research.html#:~:text=Portland%2C%20OR%2C%20June%2008%2C,22.6%25%20from%202020%20to%202027.

14 https://www.globenewswire.com/news-release/2020/06/08/2045017/0/en/Electric-Vehicle-Market-to-Reach-802-81-Billion-Globally-by-2027-Allied-Market-Research.html#:~:text=Portland%2C%20OR%2C%20June%2008%2C,22.6%25%20from%202020%20to%202027.

15 Online percentage calculator at: https://percentagecalculator.net/

16 https://www.cnn.com/2020/10/03/cars/california-2035-zev-mandate/index.html

17 https://about.bnef.com/electric-vehicle-outlook/

18 https://www.barchart.com/stocks/quotes/RIDE/interactive-chart

19 https://www.barchart.com/stocks/quotes/RIDE/interactive-chart

20 https://percentagecalculator.net/

21 https://www.barchart.com/stocks/quotes/NKLA/profile. See also https://nikolamotor.com

22 https://www.barchart.com/stocks/quotes/NKLA/interactive-chart

23 https://www.barchart.com/stocks/quotes/NKLA/interactive-chart

24 https://percentagecalculator.net/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Duesenberg Technologies.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.