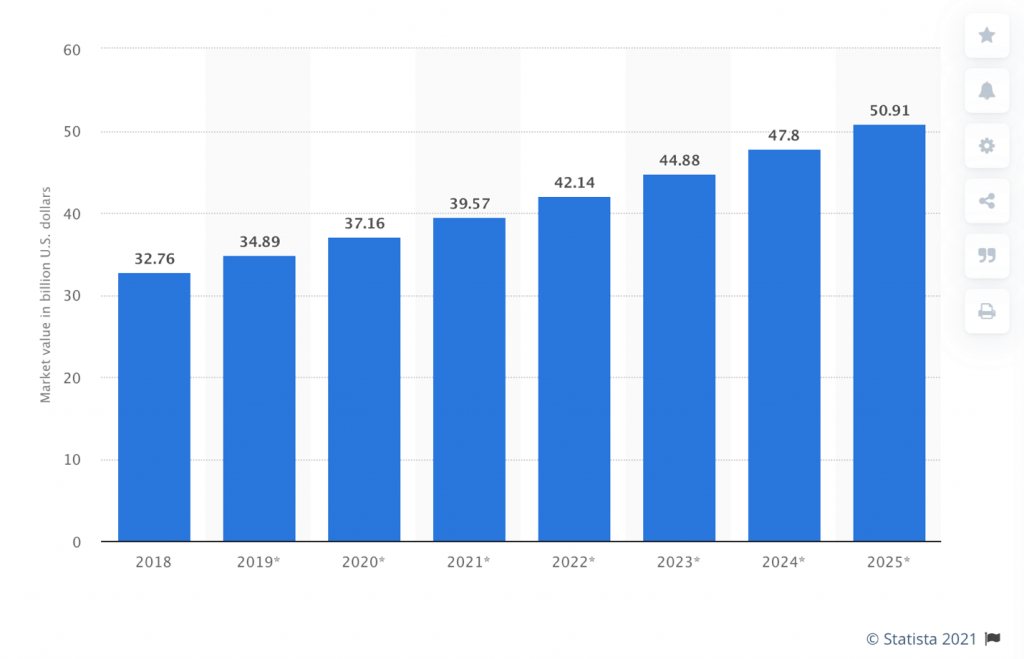

That’s a massive 35.2% compound annual growth rate (CAGR) that could propel this Canadian startup to enormous gains in the coming months. 1

- Canadian-based Beyond Medical Technologies (CSE:DOCT) (CSE:DOCT) has emerged as a serious threat to Chinese mask dominance particularly in North America. It’s now set to rocket in value as it enters this enormous new market for masks and personal protective equipment.

- Even the U.S. Congress has been impacted… and you may be surprised to learn just how.

As the pandemic spread nationwide, Americans were shocked to learn that China had locked a virtual monopoly on essential medical equipment…notably, that included face masks. And while the initial shortages have relaxed, don’t think this is going away any time soon.

China has become the largest [mask] manufacturing hub – around 50% of the global production is from China alone.2

For the first time in history, Western cultures are becoming masked cultures…and billions more masks will be required than have every been produced in the recent past.

The numbers are staggering.

Over the course of the next four years, global demand for reusable face masks is forecast to grow by 35.2% annually.

Face masks market value worldwide from 2018 to 2025 (in billion U.S. dollars)

In North America, where public mask usage was once rare, usage has skyrocketed. Masks have now become ubiquitous in a population approaching 600 million people.3 It’s an unprecedented explosion in demand for any product.4

Market forecasts make clear that masks are here to stay and China’s tight grip on global supplies is about to fail.

As it does, Beyond Medical Technologies (CSE:DOCT) (CSE:DOCT) expects to see significant revenue growth as North America shifts supply channels from Asia to domestic production. That could have a stunning impact on the company’s share prices.

“North America is likely to dominate the medical face mask market share with the unit share expected to reach over 7.8 billion units by 2025.” 5

How big could that be for Beyond Medical?

Despite the fact that mask production capacity soared with the pandemic, most of that expansion occurred in China. Domestic mask production still isn’t up to speed, meaning this market remains wide open.

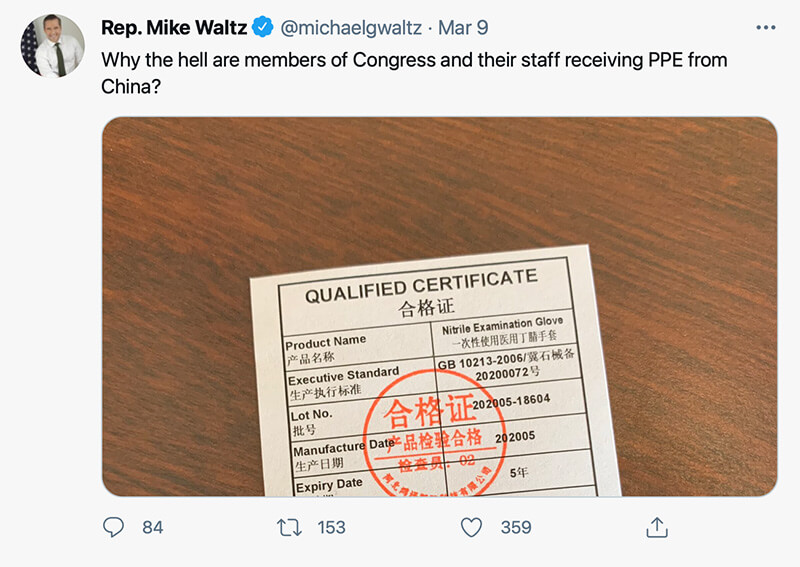

News recently broke that even the U.S. Congress remains stuck with Chinese masks[1]. That’s a huge problem. A report published by the British Broadcast Channel (BBC) states that the quality of those masks has been terrible to the point of being non-functional. The problem has been reported from counties across Europe. It’s a problem that has spread worldwide as Chinese mask makers exploit production capacity to profit from the enormous spike in demand. On Mach 9, 2021, online publisher, Townhall, quotes:

“A number of European governments have rejected Chinese-made equipment designed to combat the coronavirus outbreak. Thousands of testing kits and medical masks are below standard or defective, according to authorities in Spain, Turkey and the Netherlands.”

In the United States, Republican Congressman Michael Waltz sounded the alarm in a tweet demanding an end to the purchase of all foreign-made masks. In his tweet, Congressman Waltz asks:

“Why the hell are members of Congress and their staff receiving PPE from China?”

Right now, it appears that the Chinese could simply be faking it. Their products may look like masks, but there’s reasonable doubt that the quality is there. No surprise. This is a country known for dumping bogus goods on western consumers.

Management reports that “a scramble is now underway in China” to meet in country and global demand. By the time product is released to North American markets, the quality can be highly suspect. The reasons are simple.

Chinese authorities report that mask factories are running well in excess of capacity. Production once dedicated to shoes, iPhones and cars have been retooled to produce masks. Machines designed for producing diapers and sanitary pads are now producing materials for masks. Under these conditions, the North American market could be the dumping grounds for sub-standard products.

And western countries have had enough.

Pressure is building to shut out China-made masks and establish supply lines with North American manufacturing. Beyond Medical Technologies (CSE:DOCT) (CSE:DOCT) is moving aggressively in scaling to the anticipated demand.

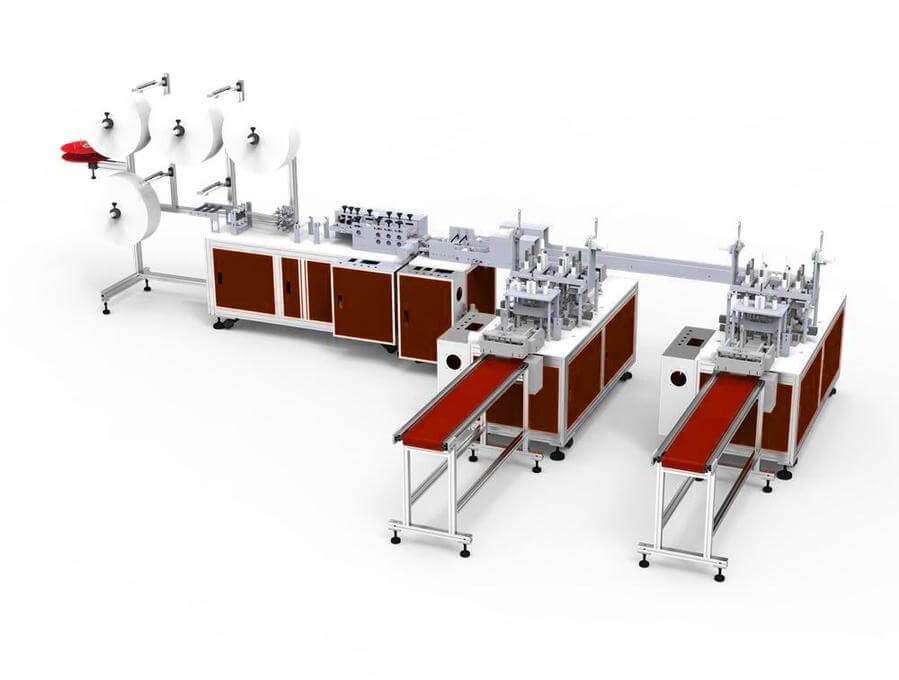

Beyond Medical launched its Micron Technologies division to focus exclusively on the production of high-quality, medically efficacious masks. Dedicated facilities have been brought online using the most advanced equipment available for the complexities of high-volume production of masks in three functional grades.

The company now has significant production capability for three grades of mask now in high demand:

- Non-medical Masks: These are the disposable masks commonly worn by the public for general health and safety. They are inexpensive, yet proven effective for the intended use of preventing the spread of disease in public settings. They are not, however, certified for use in critical medical settings such as in operating rooms or critical care facilities.

- Medical Grade 3-Ply Surgical Masks: Grade 3 masks are disposable masks specifically designed for use in settings where close contact with high-risk of exposure is prevalent. The obvious use is in medical treatment facilities, but the need also extends outside to fist-responders such as police, fire and trauma teams.

- N95 Masks: These are the highest grade of mask designed for use in medical and environmental setting where the very best protection from inhalation of pathogens and pollutants is required.

Stepping in to fill a growing hole in the market...a hole that likely won’t close any time soon.

Americans plan to stick with masks! 7 Breitbart News reported in early March that:

“Most people plan to continue to wear masks in public, even after receiving their full coronavirus vaccine doses, an Axios/Ipsos survey released this week found.”

As Chinese and foreign made supply lines ae shut down, Beyond Medical Technologies (CSE:DOCT) (CSE:DOCT) believes a substantial new consumer market will emerge for the company’s non-medical face masks.

The same holds true for medical professionals, first responders and others whose health and safety is critically dependent upon the quality of the masks they use.

Investors seeking rapid growth opportunities would do well to investigate Beyond Medical Technologies without delay. The initial gains could be most dramatic as the company gains fresh traction taking over accounts once dominated by Chinese interests.

Micron Technologies is just one of two health services divisions now operating at Beyond Medical Technologies (CSE: DOCT).

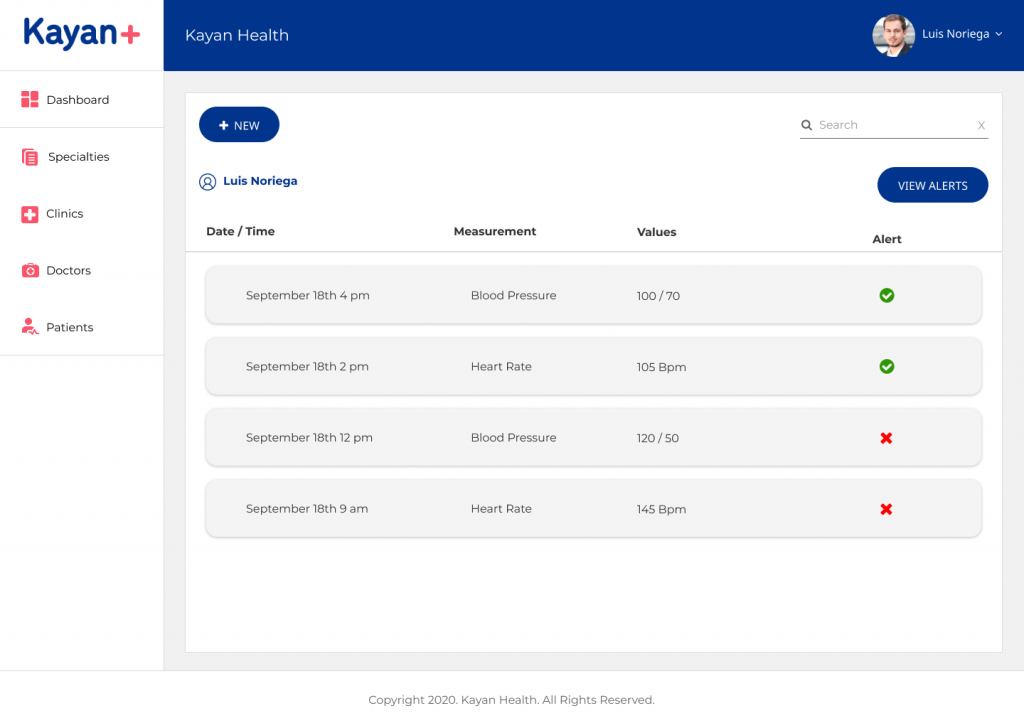

Beyond Medical Technologies’ Kayan+ division has established an artificial intelligence technology that integrates three key areas of health care targeting patients living in remote settings. With its technology, health care providers are enabled to monitor patient symptoms and triage care requirements through the use of wearable devices. The technology allows a patient to access care through “Doctor on Demand” and streamline communication with a caregiver via real-time chat, high quality voice, and video calls.

And here’s some really big news that’s just now being made public.

The Kayan+ division recently announced a joint agreement to collaboratively develop and deploy groundbreaking artificial intelligence technology, Predictiv™, that identifies a patient’s risk for certain disease onset in advance of early or first symptoms.

Predictiv analyzes a patient’s DNA profile to identify any genetic predisposition to a disease process and alert caregivers to the potential for near-term or future onset. As is often the case, early intervention is vitally important to successful treatment. Beyond Medical believes that widespread use of its Predictiv technology can become one of the most important new diagnostic technologies introduced to medicine.

The company announced it plans to attach Predictiv to its Kayan+ technology platform, which will allow Predictiv to be deployed at point of treatment as well as remotely. Through its remote capability, Predictiv could be made quickly available to physicians and caregiving facilities globally.

These are fast-moving developments that deserve immediate attention. If you believe that Beyond Medical Technologies (CSE:DOCT) (CSE:DOCT) can be a good fit to your wealth-building portfolio, then now is the time to begin your due diligence.

First step would be to visit the company website where you will find the latest news that provides further details into the company’s products and technology. Second, contact your broker to put Beyond Medical Technologies on your stock watch list to stay abreast of daily developments and share price movement. You might even consider getting some skin in the game by adding a few shares while its stock trades in entry-level ranges.

To be clear, whatever choice you make, know that Beyond Medical Technologies should be considered as a high-risk opportunity. If you choose to invest, do so only after you have done your own due diligence and only with resources that you feel confident in putting at risk for substantial loss. At the same time, keep in mind that for wealth-building, few investment opportunities can be rewarding as a rising medical technology company.

Here are five key reasons why Beyond Medical Technologies (CSE:DOCT) (CSE:DOCT) may be an ideal fit to your growth investment objectives:

- Beyond Medical Technologies’ medical mask division, Micron Technologies is now up and running, prepared to meet soaring demand for three categories of masks now in short supply from non-Chinese manufacturers. These masks are being produced as non-medical face coverings, medical-grade surgical masks, and N95 grade masks. All Beyond Medical Technologies are fully certified for intended uses.

- China has dominated global mask supply lines and has recently come under heavy fire for churning our millions of sub-standard, low-quality masks. Demand for non-China masks can be expected to surge after it became public that the U.S. Congresspersons and staff were found to be still using China sourced masks.

- Forecasts are that the market for masks will continue to soar over prior years and hit $6.8 billion by 2025. Important to note that the market for masks in North America is likely to ditch China-made sources and shift to domestic sources like Beyond Medical Technologies. This could trigger a massive flow of new orders with dramatic changes in distribution of market share.

- Beyond Medical Technologies’ Kayan+ division stands to see significant, rapid growth as its remote patient triage and health management technology spreads widely into underserved regions of America and the world. Through its remote capability, Predictiv could be made quickly available to physicians and caregiving facilities globally.

- Beyond Medical Technologies may also be launching one of the most significant of health assessment and diagnostic technologies to come along in years. Its collaborative agreement to deploy Predictiv DNA-based technology through Kayan+ networking holds promise to elevate diagnostics and disease management to an entirely new level.

All told, Beyond Medical Technologies (CSE:DOCT) (CSE:DOCT) stands out as an excellent opportunity to establish a ground-floor position in a company that could one day be a dominant force in domestic as well as world health care. Now is the ideal time to get in front of this by launching your due diligence without delay. This is a fast moving situation with explosive growth potential.

1 https://finance.yahoo.com/news/worldwide-reusable-face-mask-industry-213000697.html

2 https://www.prnewswire.com/news-releases/the-medical-face-mask-market-is-expected-to-grow-at-a-cagr-of-over-26-during-the-period-20192025-301078857.html

3 https://worldpopulationreview.com/continents/north-america-population

4 https://finance.yahoo.com/news/global-reusable-face-mask-market-203000646.html

5 https://www.prnewswire.com/news-releases/the-medical-face-mask-market-is-expected-to-grow-at-a-cagr-of-over-26-during-the-period-20192025-301078857.html

6 https://townhall.com/tipsheet/katiepavlich/2021/03/09/congress-is-using-personal-protective-equipmentfrom-china-n2585968

7 https://www.breitbart.com/politics/2021/03/09/survey-most-americans-to-continue-wearing-masks-in-public-even-after-being-vaccinated/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Beyond Medical Technologies.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.