Live Current Media (OTCQB: LIVC)(OTCQB: LIVC)

Now Rolling Up the Fastest Growing Online Communities in America Today

Editorial Feature | Aug 17, 2022 | Tech

This is the new world of young America… An emerging $198 billion market dominated by 18 to 35 age adults pouring into live streaming events, created and curated by the participants themselves.

It’s taking a new generation to completely change the way that media and entertainment is made and experienced.

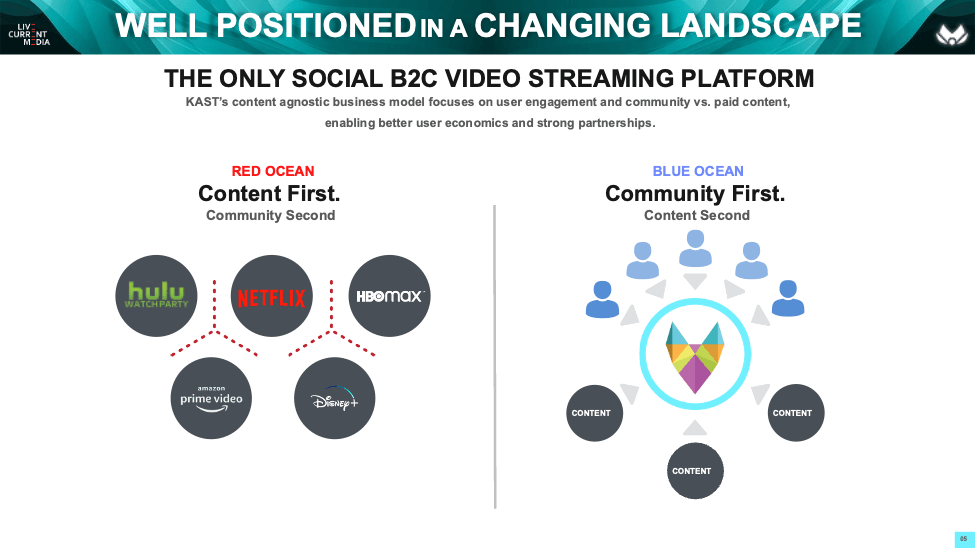

Netflix, Disney, HBO, and others are being relegated to second place as purely spectator entertainment. A new generation is emerging where the spectator becomes participant.

When digital content began streaming into homes, content providers like Netflix soared, from around $15/share ten years ago, to a breathtaking $690 near the end of 2021.

Then, in a matter of just a few months, Netflix shares collapsed to under $200.

Similar track records can be found with other streaming content providers. In January 2020, Hulu was soaring, then taken out and integrated with Disney. Shares dipped to around $60, then within a year, soared past $196. Now shares trade at roughly half that price.

Others, like Sling TV, HBO, Paramount, etc. have all become buried in larger holding companies…but the news is consistent.

Audiences are falling off sharply and leading the decline is the much sought after 18-35 demographic.

In a bombshell report released this past January, entertainment icon, Variety.com, published a scathing article entitled,

“Fading Ratings, A Special Report on TV’s Shrinking Audiences“.

From that report, Variety confirms the sharp downtrend in audiences noting that:

“…the proportion of the audience aged 18-49 is declining faster than the overall rate of decline.” 1

The point is this.

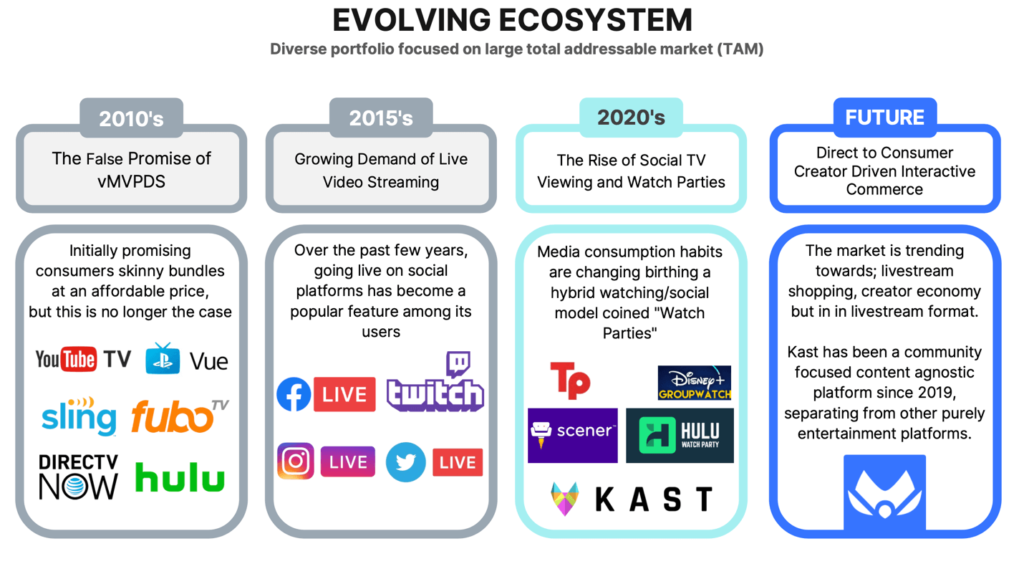

Younger audiences are moving beyond content-driven streaming services to a next-generation of community-based, live entertainment events.

The platform is built on the emerging capabilities of Augmented Reality (AR) technology and, as trends now confirm, it is destined to be transformative.

Only a handful of companies are moving into this space today. And noteworthy among them is Live Current Media (OTCQB: LIVC)(OTCQB: LIVC).

Over the last year, Live Current Media has aggressively built and acquired the resources to take a leading role in the fast-growing Augmented Reality space.

Keep in mind, this is NOT just about virtual reality headsets and gaming consoles. It’s a complete paradigm shift, encompassing how consumers ‘attend’ live sporting events, concerts, movies, and even how they interact across social media platforms.

The New ‘Largest’ Generation Is Fueling This Market

Any chance you were around for the rise and fall of Blockbuster Video?

It was a company blinded by shortsightedness. It didn’t see technology on the rise, thus in 2000, Blockbuster turned down the chance to buy the fledgling Netflix for a mere $50 million!2

Ten years later, the company was issuing bankruptcy warnings and drowning in a billion dollars of debt.

Maybe they should have bought Netflix?

Here’s the twist though. Netflix appears to be going into its own crash event, likely the result of rapidly declining young audiences who are seeking new, more exciting, more immersive entertainment.

That’s the promise of Augmented Reality and unless Netflix acquires that capability, it too stands to be left behind by the new generation of audience.

You may be wondering, what exactly is augmented reality?

Augmented Reality allows users to participate in real time with others on a global scale, sharing content, media and experience interactively. An example might be a watch party orchestrated around a sports event or travel experience.

Participants don’t just watch; they socialize and interact with one another in real time. For those who grew up with social media and smartphones in hand…this is the logical extension of that space.

And it’s a space that is soaring. Leftronic.com describes augmented reality as,

“…a disruptive force with the capacity to transform the world as we know it.”3

What’s more…it’s a technology that is forecast to go well beyond entertainment. AR is forecast to break out of the entertainment sector by mid-decade to become an essential productivity tool in, among other things, healthcare, manufacturing, education, and retail.

The statistics are stunning. Forecasts are that the AR market will reach $198 billion in 2025.

That’s confidently asserted by 39% of technology leaders who strongly agree that augmented reality will become as ubiquitous as mobile by 2025.

Without getting buried in tech facts, that AR growth projection is strongly on track now that the rollout of a nationwide 5G network is well underway.

That means now is the time to get in front of this next-gen wave.

New technologies fueled explosive growth of technology giants you know so well. Investors who caught one early, often saw large gains as a result.

Live Current Media can put you on the next wave that is swelling right now.

Simply stated, Live Current Media offers investors an entry-level to a next generation technology leader.

The company has been actively growing on an online “hangout” platform for friends that acts as a “virtual living room”.

The platform allows individuals to live-share experiences in real time, engage within a community, and build relationships with like-minded people. Community members can arrange private gaming sessions and competitions, or set up watch parties for new films, sporting events or online content.

Acquisition-Hungry Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) Expands Their Digital Footprint

Just recently, the company announced signing an LOI agreement to acquire the augmented reality, virtual reality, and NFT company, Guru Experience, in an all-stock transaction. Though it sounds esoteric, Guru Experience brings with it a deep technology base for expanding Live Current Media capabilities and participants.

Prior to the proposed acquisition, Guru Experience developed a full-suite digital experience platform for museums, zoos, aquariums and cultural sites.

Their user-friendly platform allows for users to engage in audio tours, augmented reality, geolocated content, interactive maps, games, scavenger hunts, ticketing and queuing.

By creating a bridge between these cultural institutions and a 21st-century audience, Guru’s proprietary software can enhance the visitor experience and offer strategies to meet their educational and financial goals.

While it is yet to be seen how exactly this new acquisition will steer the company’s growth, it seems clear the Live Current Media is looking to bolster their platform infrastructure with this innovative software.

Regarding the acquisition, CEO, Mark Ollila stated,

“Guru brings us important capabilities in AR/VR and NFTs – both of which enhance our market leading media streaming application and position us well for new metaverse opportunities – and critically, a great experience and customer focused team that has successfully created a profitable product with great growth potential. We have known them for some time and are excited to be bringing the team on board.”

Already Uniquely Positioned In Two Multi-Billion-Dollar Markets:

Gaming and Video Streaming

Amazon was one of the first to see the future of both gaming and video streaming, paying a staggering $1.1 billion back in 2014 to buy Twitch, the leading live streaming gaming platform, after a bidding war with Google.

That was the earliest sign of a looming convergence between gaming and video streaming, a convergence exemplified by Live Current Media (OTCQB: LIVC)(OTCQB: LIVC).

At the time of the Amazon acquisition, hardly anyone in the investing world had ever heard of Twitch. Yet at the time of the sale, it already had the fourth highest internet traffic in the U.S., after Netflix, Google, and Apple.14 Today Twitch has more than 15 million daily active users and is worth an estimated $3.79 billion.15

And all signs suggest that both the gaming and video streaming industries are still in their infancies.

Unfortunately, the average investor cannot participate in the acquisition of private billion-dollar companies. Which is where Live Current comes in. You don’t have to have Mark Zuckerburg on speed dial to invest in publicly traded companies.

A $148 Billion Market On Its Way To $842 Billion

According to one report, the global video streaming industry could hit $149.34 billion by 2026, registering a CAGR of 18.3% during the previous years.12

But that’s nothing compared to data gathered by Fortune Business Insights. They are projecting global video streaming market could reach a staggering $842.93 billion by 2027, growing at an average annual compounded rate of 12% a year over the next five years.9

Live Current Media is well positioned in this burgeoning space, as a result of a strategic merger the company completed this spring.

Investors pricked up their ears hearing of the announcement of the completion of the previously announced merger between the mobile gaming app publisher Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) and Evasyst (Kast), a company based in San Diego, that has developed “virtual living room” video streaming technologies

The introduction of this actively growing platform brings with it a subscriber base of 4 million registered users.

Currently, the video “watch party” platform is designed to generate revenue through the recurring, subscription-based model, but Live Current Media plans to continue to expand their tools and capabilities to develop new revenue streams within their existing user base.

The upside here is quite substantial and poised for significant growth.

And the company has wasted no time rolling out their plans to continue this trajectory. Just this past June, Live Current Media announced another key acquisition.

In an all cash transaction, they acquired the code and social media assets for the video meme platform Neverthink.TV.

Neverthink was a social platform for creating and sharing meme videos. According to Crunchbase, 6.6M Euros were invested into the Neverthink platform through 2019 and the platform attracted fifteen million users, 85,000 creators, and 700 million total video views.

Live Current Media is planning to integrate elements of the Neverthink platform to add user value to its current product range.

Moving forward, the company intends to acquire 3+ companies over the next 12 months, and more than 10 within the next 36 months.

That’s why now is the time to determine if Live Current Media fits to your wealth-building strategies. Live Current Media may still be small, but as a prospect for growth into a multi-billion-dollar space, it may also be greatly undervalued against its long-term potential.

Media interest is picking up, and with it so has investor interest.

For more information about Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) and its investment potential, visit the company’s website here.

1https://variety.com/vip-special-reports/fading-ratings-a-special-report-on-tvs-shrinking-audiences-1235142986/#!

2https://www.zippia.com/blockbuster-llc-careers-1327661/history/

3https://leftronic.com/blog/augmented-reality-statistics/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Live Current Media (“LIVC”) and its securities, LIVC has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by LIVC) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company LIVC and has no information concerning share ownership by others of in the profiled company LIVC. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to LIVC industry; (b) market opportunity; (c) LIVC business plans and strategies; (d) services that LIVC intends to offer; (e) LIVC milestone projections and targets; (f) LIVC expectations regarding receipt of approval for regulatory applications; (g) LIVC intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) LIVC expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute LIVC business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) LIVC ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) LIVC ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) LIVC ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of LIVC to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) LIVC operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact LIVC business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing LIVC business operations (e) LIVC may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Live Current Media.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Live Current Media and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Live Current Media or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Live Current Media. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Live Current Media’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Live Current Media future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Live Current Media industry; (b) market opportunity; (c) Live Current Media business plans and strategies; (d) services that Live Current Media intends to offer; (e) Live Current Media milestone projections and targets; (f) Live Current Media expectations regarding receipt of approval for regulatory applications; (g) Live Current Media intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Live Current Media expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Live Current Media business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Live Current Media ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Live Current Media ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Live Current Media ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Live Current Media to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Live Current Media operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Live Current Media business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Live Current Media business operations (e) Live Current Media may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Live Current Media or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Live Current Media or such entities and are not necessarily indicative of future performance of Live Current Media or such entities.