One stock that’s still dirt cheap — but not for long…

- Record-shattering demand combined with crippling supply chain disruptions are driving the marine sector sky high, with boating stocks seeing gains like 153%, 248%, and even 491% in 18 months.

- And for good reason. Boat sales have nearly doubled in the past decade, launching marine products and services to a $49.3 billion industry1.

- Customers are left waiting for months, as inventory shortages drive boat prices up nearly 10% this year alone.

- Now, investors and consumers alike are eagerly watching as newcomer, Boatim (OTC:BTIMOTC:BTIM), does for recreational boating what Carvana, Vroom and CarMax did for vehicles.

There’s a new investment trend that’s going to catch a lot of investors by surprise, leaving many of them flat-footed and stuck on the sidelines.

With the supply chain breakdown affecting nearly every sector, from autos and tech devices, to consumer staples, the booming e-commerce boating industry has simply flown under the radar.

And if there is one thing investors love, it’s getting in early on an undiscovered market. Especially one that offers them the triple-bagger gains this sector is now becoming known for.

Over the past two years, boating stocks have outpaced the market as a whole. That means there is tremendous opportunity for investors who find the right stocks.

Even Forbes is advising investors to get in now, in an article aptly titled:

“The Yachting Industry Is On Track For A Post-Pandemic Boom In 2021”2

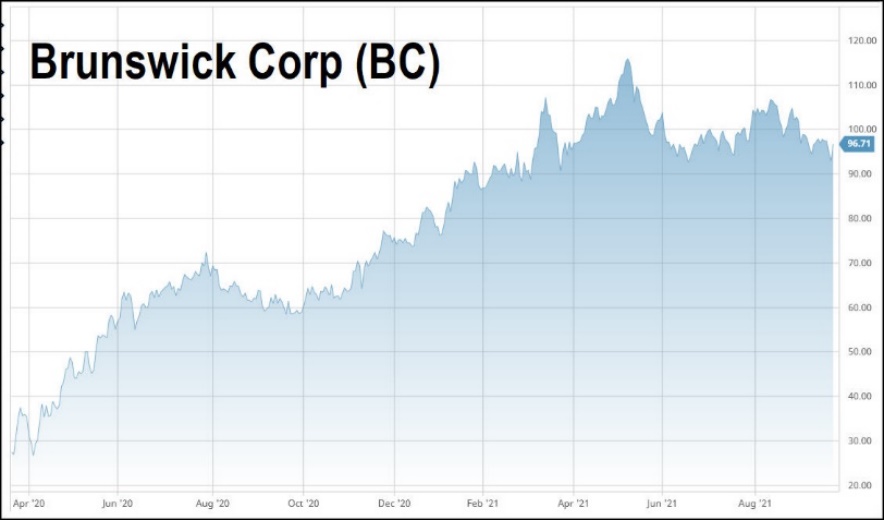

Brunswick Corp (NYSE: BC), which makes Mercury, Mariner, Boston Whaler and Bayliner boats, was trading at around $27 a share in late March 2020.

But then the pandemic drew an unexpected influx of marine enthusiasts to the market.

By mid-September 2021, the Brunswick Corp stock was selling for $94 a share – a gain of 248% in just 18 months.

That was enough to potentially turn every $5,000 into $17,400.

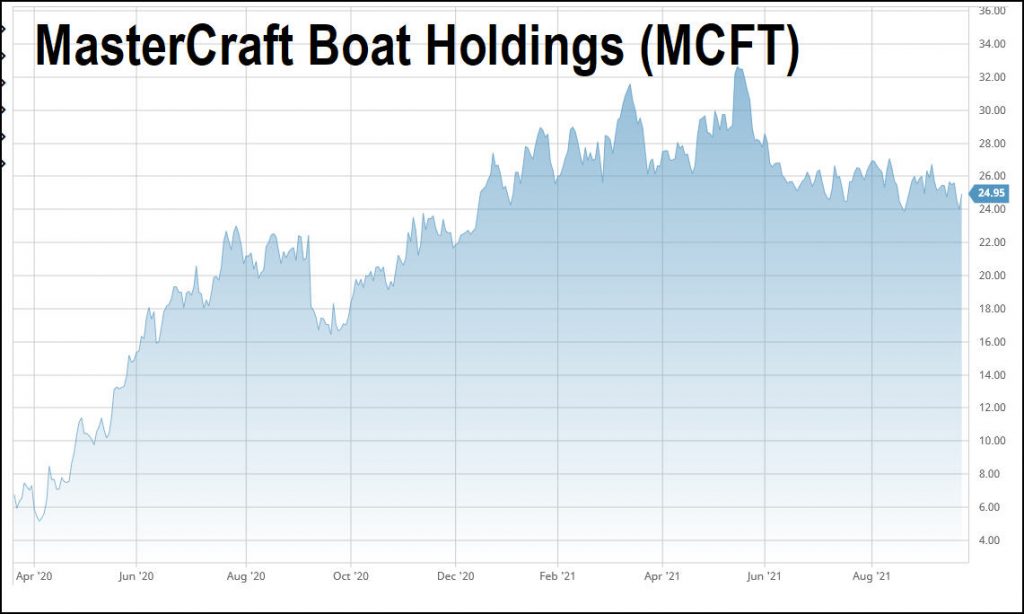

A similar thing happened with MasterCraft Boat Holdings Inc (MCFT), which manufactures recreational powerboats out of Tennessee and has seen soaring profits throughout 2020 and 2021.

Investors scooped up all the shares they wanted for as little as $5.15 per share in early April 2020.

By late 2021, those same shares were selling for more than $24.50 each – a gain of 375%.

Then there is MarineMax (HZO), North America’s largest recreational boat and yacht retailer, which shot up from just $8.192 a share in March 2020 to $48.473 a share in September 2021 – a gain of 491%4 in the same period.

Anyone who invested $5,000 in MarineMax early in the pandemic potentially walked away with up to $24,550 in profits.

To put that in perspective, during the same period Apple (AAPL) rose in value only 153%5,

That means MarineMax did 3 times better than even Apple.

That’s why investors are so excited by a new boating e-commerce platform that aims to bring 21st century technologies to a marine industry that has, until now, operated in the dark ages.

First-of-its-kind, AI-driven e-commerce platform could be “Carvana for Boats”

One of the most exhilarating moments in investors’ lives happens when they come across an opportunity that evokes this single thought:

‘Damn, why didn’t I think of that?’

That’s usually a powerful reaction to an uncomplicated company that’s meeting a huge need or desire.

Think FedEx (FDX), now about $300 a share, once under $2. Or Walmart (WMT), now about $150 a share, once pocket change at 5 cents.

Visionary companies.

That’s why you need to meet the Boatim team.

As boating enthusiasts, they witnessed firsthand an industry woefully in need of a technological overhaul.

Even a couple years back, few resources were available for consumers looking to purchase marine equipment and services, or for the retailers looking to advertise their products to an eager, ready-to-buy customer-base.

In an effort to fill this growing need, Boatim (OTC:BTIMOTC:BTIM) was launched in 2018, bringing on a brilliant team of engineers to begin transforming his lifelong pastime into a potential fortune.

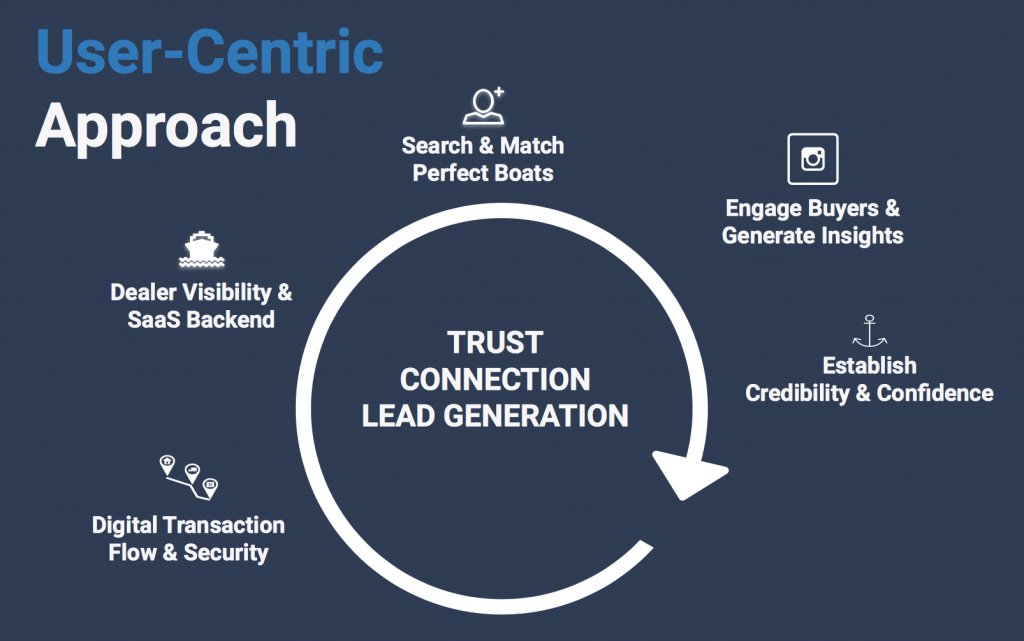

Within a handful of years, Boatim churned out a highly advanced, user-centric, e-commerce platform for the buying and selling of boats.

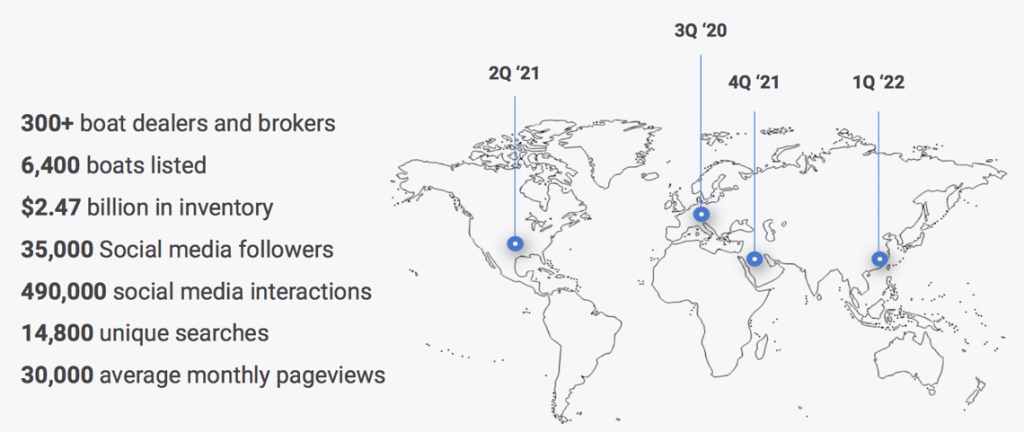

Today, Boatim boasts a massive $2.67 billion international inventory, with more than 6,400 boats, listed by 300+ boat dealers and brokers.

Plus, the quarterly growth rate of dealer signups is coming in at over 20%, meaning those numbers could grow dramatically in the near-term.

And the proprietary algorithms that drive this software combine artificial intelligence with big data, giving consumers never-before-seen access to the options and information necessary to make an informed purchase.

In fact just last May Boatim (OTC: BTIM) made an agreement with a major data provider that greatly expanded their capabilities.6

Now, not only can consumers scan the more than $2.47 billion7 worth of boating inventory available on Boatim.com, but they have access to detailed reporting that show the boat’s lifetime historical record, potential accidents, repairs, and upgrades.

While that may be something many of us take for granted in this day and age, it was not that long ago that companies like Carvana revolutionized car buying by making such detailed vehicle history reports accessible on their site.

At the time it was a novel and highly impactful transformation.

Consumers loved the transparency and ease in which they were able to access critical information about their potential purchase. And as a result, Carvana quickly grew in popularity, both for consumers and for investors.

Carvana shares quickly soared from $158 when the company went public in April 2017, to $3219 per share in September 2021.

That’s a total return of 2,040% — or more than 20 times your money — over just four years!

Unbelievably, nothing like that had existed for boat sales. Antiquated guidebooks and newspaper ads still dominated the industry, until just recently…

Little by little, Boatim’s tech team have been building out what has quickly become the most comprehensive online marketplace for all things marine.

A One-Stop Shop for Marine Purchases

But Boatim, Inc. (OTC:BTIMOTC:BTIM) aims to be much bigger than merely an e-commerce site for boat sales, the way Carvana or Vroom are for cars.

Don’t get me wrong, that alone is a massive market that could accelerate the growth this tiny company. Especially when you consider that there currently are a staggering 17 million recreational boats in the U.S. alone10.

Joseph Johnson and his team have a much grander vision.

Their goal is to build a comprehensive platform that allows marine enthusiasts access to everything they need, whether in the harbor or on the seas, including insurance, maintenance and repair services, navigational support, and location-specific opportunities for recreation.

And for the companies conducting commerce in the marine industry…

From boat brokers and retailers to boat finance companies, insurance companies, marinas, dry docks, and rental agencies, this innovative platform offers access to a captive audience in need of these services.

Boatim’s website and mobile app are free to users, and generate revenue through listing placements and B2C subscription plans as well as through on-platform advertising.

With the total boating and marine products market now worth a staggering $49.3 billion and growing fast, the F2P model used by Boatim (OTC:BTIMOTC:BTIM) could gain a significant share of the market.

On-Site Access To Financing And Insurance

In June, Boatim (OTC:BTIMOTC:BTIM) announced the launch of new financing and insurance products on its platform.11 In the past, consumers who purchased a boat had to go elsewhere else to find financing and insurance options. Now, all that can be done in one place.

This is a major development.

It’s estimated that most of the $20 billion12 in annual boat purchases involve financing, and the number of providers is very limited.

The same is true of insurance. Thanks to a partnership with American Marine Insurance (AMI), a major provider of nautical insurance, users of Boatim can receive competitive quotes easily, without ever leaving their site.13

Coming Soon, Navigational Services And Recreational Opportunities

Boatim’s tech team is moving quickly to continue improving and expanding on the platform’s offerings by integrating navigational resources and maps. This would allow boaters to easily map out, and download expedition routes in advance.

And using real-time data from business directories across the globe, they will also be able to plan stops at restaurants and other local attractions.

Ripe for a Takeover Bid

Of course, like many startup e-commerce companies, Boatim is still small and relatively undervalued. Investors can still pick up shares of the still-undiscovered Boatim (OTC:BTIMOTC:BTIM)

for mere pennies – under $0.5014 a share. At that price, it doesn’t take a very big move to see an immediate potential return. And that may not take very long.

Boating is big business… and it’s getting bigger and bigger each year.

As a result, big money is moving into the once-sleepy industry – and into the online boating market in particular.

Back in January, the private equity firm Permira acquired Boats Group, which provides data and software solutions to 4,000 brokers worldwide through its brands Boat Trader, Boats.com and others. According to one report on International Boat Industry, some 80 percent of Boats Group’s revenue of $75 million came from its online website, Boats.com

The price for buying the company: a reported $850 million.

That’s more than 10 times its annual revenue.

That’s another good reason why investors are taking a close look at Boatim (OTC:BTIMOTC:BTIM).

With a proprietary technology, and only a handful of online boating platforms available, it could be in a favorable position as its share of the marketplace grows.

Reason #1: New Niche. Boating stocks have seen triple-digit profits in the past two years, with Brunswick Corp (NYSE: BC) up 248% between April 2020 and September 2021, MasterCraft Boat Holdings Inc (MCFT) up 375% and MarineMax (HZO) up 491% in the same period.

Reason #2: Explosive Growth. The boating market is seeing a massive surge worldwide, with sales of new boats doubling in the past decade and total annual revenues in the U.S. alone hitting $49.3 billion in 2020.

Reason #3: Virgin Territory. The boating world is a decade or more behind the automobile industry in its use of online platforms. While there are boating sales platforms available, there are few if any platforms that provide the kind of “one stop shopping” that Boatim envisions.

Reason #4: Proven Success. Boatim is not a startup but an up-and-running company, with offices in Barcelona and Miami. It currently has an inventory of 6,400 boats and yachts worth an estimated $2.47 billion.

Reason #5: Multiple Streams of Income. Boatim’s unique platform and databases allow it to offer a wide variety of products and services to boating consumers worldwide, including financing, boat histories and insurance.

Reason $6: Possible Buyout Candidate. Brunswick Corp (BC) bought Freedom Boat Club last year, and Permira acquired Boats Group this year for $850 million, because digital assets have huge value right now. Expedia bought VRBO’s parent, Home Away, for $3.9 billion, simply for its rental platform. Something similar could potentially happen with Boatim.

Reason #7: Ground Floor Opportunity. The price for BTIM is currently under $0.50 per share. That means investors can enjoy a significant share position for a very modest investment: five thousand shares can be bought for less than $2,500.

Today is the day to make a move into Boatim (OTC:BTIMOTC:BTIM) for what could be its lowest share price. That would give you a chance to put yourself among the earliest and biggest winners.

To get started on your due diligence, head to Boatim website, which has all the information you need including up to date company news.

But, before you do take any action, make sure to show your investment advisor or broker a copy of this story.

Then, chances are, you’ll both be in agreement that Boatim is a tech startup like no others.

1 https://boatingindustry.com/news/2021/06/10/nmma-report-indicates-continued-sales-momentum/

2 https://www.barchart.com/stocks/quotes/HZO/price-history/historical

3 https://www.barchart.com/stocks/quotes/HZO/price-history/historical

4 https://percentcalc.com/

5 From$56 a share on March 23, 2020, to$142.92 a share on September 21, 2021, a gain of 153.5%. See https://www.barchart.com/stocks/quotes/AAPL/price-history/historical

6 https://press.boatim.com/article/boatim-announces-partnership-for-boat-history-report?hsLang=en

7 https://investor.boatim.com/

8 https://catalyst-insights.com/ipo-of-the-week-carvana/

9 https://www.barchart.com/stocks/quotes/CVNA/price-history/historicalAnd

10 http://www.nmma.org/assets/cabinets/Cabinet462/Brief%20-%20Boating%20Facts%20&%20Demographics.docx

11 https://finance.yahoo.com/news/boatims-boat-financing-feature-now-141800062.html

12 https://finance.yahoo.com/news/boatims-boat-financing-feature-now-141800062.html

13 https://press.boatim.com/article/boatim-enters-us-boat-insurance-market?hsLang=en

14 https://www.barchart.com/stocks/quotes/BTIM/price-history/historical

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Boatim Inc..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Boatim Inc. and has no information concerning share ownership by others of any profiled Boatim Inc.. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Boatim Inc. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Boatim Inc.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Boatim Inc.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Boatim Inc. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Boatim Inc. industry; (b) market opportunity; (c) Boatim Inc. business plans and strategies; (d) services that Boatim Inc. intends to offer; (e) Boatim Inc. milestone projections and targets; (f) Boatim Inc. expectations regarding receipt of approval for regulatory applications; (g) Boatim Inc. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Boatim Inc. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Boatim Inc. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Boatim Inc. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Boatim Inc. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Boatim Inc. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Boatim Inc. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Boatim Inc. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Boatim Inc. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Boatim Inc. business operations (e) Boatim Inc. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Boatim Inc. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Boatim Inc. or such entities and are not necessarily indicative of future performance of Boatim Inc. or such entities.