When you take a look at this small company it's no surprise why.

TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF) has amassed a team of tobacco heavyweights from Philip Morris International, Altria, and Newport maker, Lorillard.

-

This micro-cap company has no real competitors.

-

No competitors means the micro-cap alone could pose an essential threat to some of the globe’s biggest tobacco stocks… Phillip Morris (NYSE:PM) and Altria NYSE:MO).

-

Rumors of the product, Beyond Tobacco™, along with the company’s veteran industry-insider management team is why lots of investors already had this micro-cap on their radars.

-

Billionaire talent spotters are already on board as TAAT hits 1,956% sales growth

-

With $21.8 million in product rolling off its production line… it’s time to act before the rest of Wall Street catches up.

Rare is the day when you can say with a straight face, that a micro-cap stock with a $3 share price could possess the breakthrough magic to make a $1 trillion industry bend to its will.

Even rarer is the day when one of the world’s most famous investors pours $20 million of personal money into a micro-cap with a $290 million market cap.

But that’s exactly the scenario investors could discover today when they look closely at TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF).

That’s because a TAAT Global biochemist made what’s being seen as a market-shattering breakthrough… beyond disruptive.

TAAT’s scientist developed a cigarette that contains no tobacco.

It’s a groundbreaking smoke with all the tobacco cigarette taste… but without the addiction.

Seeing Beyond The Horizon

TAAT’s breakthrough is so significant that it caught the attention of one of the world’s greatest investors – Debbie Chang – who put $20 million of her own money into TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF).2

Chang is the co-founder of Hong Kong-based venture capital fund, Horizons Ventures Ltd.

She has a knack for backing winners.

Horizons got into Skype, in 2005, one year before eBay (NASDAQ:EBAY) paid $2.5 billion for it.

Another of Horizons’ successful investment was to grab an early sliver of Facebook (NASDAQ:FB). It would fetch nearly $1.5 billion today.

$20 Million Is A Lot Of Money… Now, Look At The Return They Made On Just A Bit More

Horizons also reportedly holds around 8% of Zoom Video Communications (NASDAQ:ZM) worth around $10 billion in late 2020.3

That’s a mighty, mighty, return for backing the San Jose-based mega-tech company with around $36 million back in 2013.

It’s no surprise the Horizons team does well. It’s super accomplished because one of Horizons’ other founders is Li Ka-shing.

He’s the world’s 11th richest person with an estimated wealth of $26 billion, according to Forbes.4

These partners are serious about money. They pride themselves on disruptive investments.

In lifestyle stocks, TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF) and its groundbreaking Beyond Tobacco™ cigarette with full tobacco taste is the epitome of disruptive.

A Smoking Hot Rise to Earnings

Investors on the sidelines today should pay attention to how fast this is unfolding.

In January 2021, TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF) became available in for sale in Ohio… where 60% of stores had placed reorders within three weeks.ii

In February 2021 it launched its first online sales of its “Beyond Tobacco” mix…

In July 2021, it was already in the black… counting bottom line profitsiii.

TAAT’s sales had leaped 1,956% in one year, and rose 88% from the previous quarter.

That means this is exact moment, in the right place for investors to capture the full rise of a startup company that’s clearly set for success.

And Nobody’s Equipped to Catch Up

TAAT has a giant moat around its business that no competitor can cross…

TAAT’s patented Beyond Tobacco is alone in the market… Phillip Morris (NYSE:PM), Altria (NYSE:MO), and British American Tobacco (NYSE:BTI) can’t copy it.

That means, you could be in on TAATs big win while the last-century dinosaurs are out in the cold.

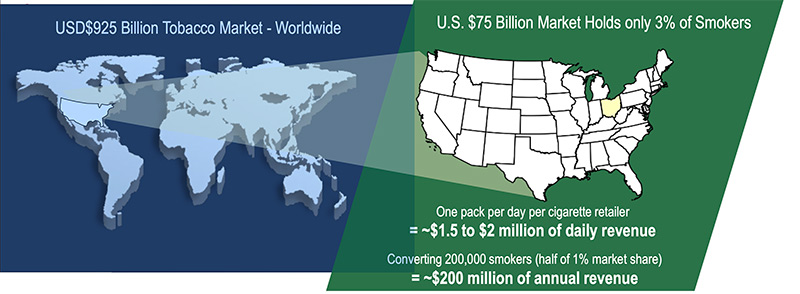

Because with 1.3 billion cigarette smokers in the world… 34 million in the US alone…. every one of them is a potential TAAT customer.

Biden Administration Announces Imminent Ban On Menthol Cigarettes

A recent announcement has laid out the Biden administration’s plans to ban menthol cigarettes and flavored cigars, saying “Banning menthol—the last allowable flavor—in cigarettes and banning all flavors in cigars will help save lives, particularly among those disproportionately affected by these deadly products.”

Should this new policy move forward, TAAT could become the only menthol cigarette manufacturer on the market overnight.

Big Tobacco Is Worried

It’s not often investors get a chance to be in at the start when a new company and a new idea overthrows the existing lords of commerce.

This will be like watching Maxwell House fade away after 100 years as the king of coffee sales when Starbucks appeared.

But this is happening much faster. Now that TAAT has perfected and rolled out its Beyond Tobacco cigarettes, Altria, Philip Morris, and British Tobacco are trying to figure out what next.

Setti Coscarella, CEO of TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF) says it’s no coincidence that these companies have started using the phrase “Beyond Nicotine” in their marketing.

Things look so dire that the CEO of Philip Morris, maker of Marlboros, says he wants to end tobacco sales in the UK by 2030. And Altria is trying to turn customers toward non-combustible tobacco products.iv

233% Jump In Sustained Demand Makes TAAT Global The Rare Micro-Cap That’s Flashing An Urgent “Buy” 6

Also no idle claim is the fact that TAAT Global is now making 57,000 10-pack cartons a month – which works out to at least 684,000 cartons a year.7

It’s a 233% jump in production that’s due to the sustained post-rollout demand in a test market.

And that is a huge hint for investors – maybe the best green light of the year, so far.

That’s because at an average of $32 a carton, TAAT Global (CSE: TAAT, OTC:TOBAF) is staring down $21.8 million in 2021 revenue just for openers…8

And demand could be set to explode because the market proved TAAT should be going nationwide.

It’s all because TAAT Global’s Beyond Tobacco™ cigarette burns, draws, smokes, and tastes like tobacco… say again, it tastes like tobacco.

But TAAT’s cigarettes are made of hemp and other natural products, so they contain no nicotine.

TAAT Global’s big breakthrough was taking hemp and developing a patent-pending formula with natural ingredients that when combined smoke and taste like tobacco.

Beyond Tobacco™

TAAT’s founder Joe Deighan named his trademarked faux tobacco, Beyond Tobacco.

Because TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF) is adamant about its cigarettes as an alternative, and not a smoking cessation product, the company will employ a similar style rollout as the wildly success route Beyond Meat took.

Beyond Meat (NSADAQ:BYND) is a plant-based meat substitute that does not sell itself as a vegan product. Therefore it demands shelf space in a grocery’s meat section.

And Beyond Meat’s share price is testimony to its solid strategy – between its May 2, 2019 IPO and March 15, 2021, shares soared more than 220% from $46 to $148.9

And Beyond Meat’s share price is testimony to its solid strategy – between its May 2, 2019 IPO and March 15, 2021, shares soared more than 220% from $46 to $148.9

The Rollout Is On

Now, like Beyond Meat, TAAT Global is being rewarded for its groundbreaking products.

The authenticity of TAAT Global’s three products – a regular full bodied cigarette, a light cigarette, and a menthol – have met with significant and sustained demand during the company’s recent initial rollout in Ohio.

There, Beyond Tabacco™ cigarettes are being market tested in gas stations and convenience stores, pretty much the places where people buy their smokes.

But TAAT is cheaper than tobacco cigarettes… $3.99 compared to $7 or more… and around $32 for a carton compared to $52 a carton.10

Going Nationwide

After two months, it looks as though TAAT’s brand-new-to-the-market products have gained traction.

More than 60% of the retailers that have carried TAAT for three weeks or more have placed at least one reorder, with many reorders increasing in volume.11

That success led TAAT to engage CROSSMARK Inc. for its national rollout.

Texas-based CROSSMARK has more than 25,000 employees, who help CROSSMARK directly service more than 100,000 convenience stores across the United States.12

- On August 16, TAAT announced it was selling in 500 retail outlets.

- A week later, it had added seven more states to its list.

- And on Sept 24, well ahead of schedule, TAAT was sold in 1,000 stores.

- In October, TAAT’s CEO said it would at least double its outlets again in the next six months.

- Online sales make TAAT available in all states… and next, TAAT eyes the world

England and Australia Are Next

In August, Public Health England issued a Confirmation of Registration that allows TAAT™ to be sold in Great Britain.

The company promptly shipped 43,000 packs of TAAT™ Original, Smooth, and Menthol to its new market.v

TAAT will also sell in Ireland.

The big news is from Down Under, though. TAAT is sending a full ship container of its cigarettes to Australia. Australia has the highest average price in the world, with a 20-stick pack of Marlboro’s averaging $25.12 there.

You read that right, per pack. The room for price competition and profits could mean an enormous win for TAAT.

Attack On Menthols Could Be TAAT’S Super Sweet Spot

From an investor’s standpoint there’s tremendous news buried in TAAT’s solid rollout news.

It’s that TAAT Global’s Menthol cigarettes sold out first.

Menthol cigarettes make up about 30% of the U.S.’s $94 billion cigarette market.13

But menthols are under attack.

California and Massachusetts have banned them, under the notion that the tasty smokes are easy to start and hard to quit.14

And in February 2020, the U.S. House of Representatives passed a bill banning menthols nationwide. The senate has yet to take action on the bill.15

It won’t matter. In April, the FDA announced it planned to ban menthol in cigarettes in 2022.

You can hear menthol cigarettes’ death knell ringing loud and clear.

When they’re fully banned, you can bet some of menthol’s $30 billion in sales will flow to the black market and the internet.

But some of that $30 billion could flow to the company with the only true alternative menthol cigarette – TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF).

As it regards this potential windfall, 1% of the menthol market is worth $300 million.

Plenty Of Wildcards That Could Send TAAT Global’s Business Into The Stratosphere

While TAAT Global shows the potential to be 2021’s most talked about micro-cap success, its future looks sensational.

In fact, TAAT has a single attribute that big tobacco would fall on its knees and beg for…

Because Beyond Tobacco™ cigarettes are not made from tobacco, TAAT can advertise its products on television.

Because Beyond Tobacco™ cigarettes are not made from tobacco, TAAT can advertise its products on television.

Now, there’s this huge professional football championship game held in early February each year that sues the heck out of anyone using its name.

The game is televised, and tens of millions of people tune in just to see the outrageous commercials the big game attracts.

Just imagine the impact on global sales that a TAAT Global commercial would have during the big game, or the best movie awards show, or the best music awards show, or the best television show awards show.

This could be a good reason why TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF)

now has more than 100 active trademark applications for TAAT™ and/or Beyond Tobacco™ in a total of 54 countries.

It’s Not Hype To Say That…TAAT GLOBAL Has Blue Chip Leadership

That’s also a sign of farsighted management.

And TAAT Global has top-shelf management of which most micro-caps could only dream.

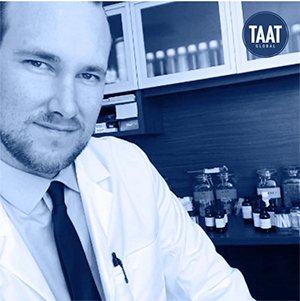

As noted above, Joe Deighan is TAAT’s Founder. He also in charge of research and development and production.

Before TAAT, Deighan founded vape liquid maker JJuice in 2012, which gained distribution in all U.S. states and in 26 other countries, in addition to private label production for other brands. He sold JJuice in a private all-cash deal that was approaching $1 million.

The rest of the team is strong in the tobacco and convenience store spaces.

CEO – Setti Coscarella is a serial entrepreneur who entered the world of tobacco at Philip Morris International in 2017 where he was a lead strategist for its Reduced-Risk Products division.

He worked with thousands of individual smokers to better understand how to position smoking alternatives to them and developed programs that could help smokers discover and successfully convert to RRPs.

CHIEF REVENUE OFFICER – Tim Corkum built a storied career in tobacco. A former executive at Philip Morris International he led international commercialization initiatives for combustible cigarettes and new products in the Reduced-Risk Products.

Over a 21-year tenure at PMI, Corkum held senior positions in Business Development, Sales Strategy, Corporate Affairs, and Key Account Management.

ADVISOR – Michael Saxon served in various positions for more than 20 years with Altria and Philip Morris International. He was the head of Altria’s Corporate Venture Fund and lead PMI’s business activities as General Manager for Norway and Denmark. Most recently, Michael founded and is presently CEO of SXN Strategy Partners in Richmond, VA, which advises boards and executive teams of “blue chip” institutional investors as well as venture capital and private equity firms on long-term strategies.

ADVISOR – Kit Dietz served on the board of directors of Newport cigarette maker Lorillard leading up to its estimated $27.4 billion acquisition in June 2015. Later, he was named “Dean of the Industry” in 2017 by the Convenience Distribution Association for his national-level contributions to the distribution trade. He has more than three decades experience in convenience wholesale, including top management roles with well-known convenience distributors in the northern United States.

ADVISOR – Dr. Cindy Orser was a tenured professor at the University of Idaho.

She holds more than 20 patents and has 65 peer-reviewed publications with over 2,000 citations.

Outside of academia, she has held executive scientist roles at biotechnology and analytical diagnostic companies that have been contractors for federal agencies in the United States including the United States Department of Agriculture, the Department of Homeland Security, and three institutes of the National Institutes of Health.

This super accomplished leadership is but one of the…

9 Reasons Why There Could Never Be A Better Time Than Now To Make A Move Into TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF)

- NOTORIETY – Tons of investors have had their eyes on TAAT. TAAT’s been on their radars because if it delivered on its promise of true tobacco taste in a tobacco-free cigarette, TAAT could have an exclusive worldwide market.

- SUSTAINED DEMAND – TAAT Global is delivering. To keep up with sustained demand its production line is cranking out what could be at least $21.8 in first-year product.

- LEVERAGE – Word of TAAT’s success is due to get out. Investors who move into TAAT today are positioned to leverage the enthusiasm of those who could spend the spring and summer jumping on the TAAT bandwagon.

- THE ONE TRUE FACT THAT THAT SAYS BUY TAAT NOW –TAAT’s breakthrough caught the attention of one of the world’s greatest investors – Debbie Chang – who put $20 million of her own money into the company. First into Facebook, Skype, and Zoom, she’s now the first big money into TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF).

- MASSIVE MARKET – The U.S.’s tobacco cigarette market is about $100 billion. That makes 1% of the market $1 billion and O.1% is $100 million… so, even at 0.1%, it’s almost like if TAAT Global stumbles it could still be a decent success, especially for its early-in investors.

- MASSIVE MARKET II – The approximately 1.3 billon smokers in the world represent a bit more or a bit less that a $1 trillion market. TAAT is not in business to cure their addiction. TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF) is offering them a tobacco-free alternative. Again, with $1 trillion on the table, if TAAT can maintain a solid production schedule, it’s almost like not matter what, even if the company only does so-so, its earliest investors could be huge winners.

- MENTHOL – the $30 billion legal menthol cigarette market is on the critical list, banned in California and Massachusetts, and under congress’ microscope. TAAT has a pure menthol cigarette that tastes like it’s made from tobacco. That makes 1% of the legal menthol cigarette market worth $300 million… 0.1% worth $30 million.

- SUCCESS BREEDS SUCCESS – The sustained momentum from its only rollout to date, in Ohio, spurred on TAAT Global to put the pedal to the metal and increase production by 223%. Soon, TAAT could be in 100,000 convivence stores nationwide.

- NATIONAL MEDIA EXPOSURE – FORBES featured TAAT GLOBAL on Feb. 3, 2021. That story had an interesting twist. Keith Gill, one of the guys who were driving Gamestop (GME) through the roof, had TAAT Global at the top of his watch list.

Watch-And-Wait Time Could Already Be Over With TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF)… Now It’s Time To Make A Move

Investors who dream of grabbing a skyrocketing micro-cap stock should probably waste little time in calling their broker or advisor.

Print this story out and show it to them. Or email them a link.

TAAT Global’s potential has been teasing investors for nine long months.

The tease is over. The production line is rolling. Test market results are exciting because the demand for Beyond Tobacco™ cigarettes is sustained.

The horses are on the track, and TAAT Global (CSE:TAAT | OTC:TOBAF)(CSE:TAAT | OTC:TOBAF)

looks like the headline making odds-on favorite.

1 https://www.forbes.com/sites/shuchingjeanchen/2014/03/12/li-ka-shing-and-horizons-ventures-the-making-of-a-venture-capital-powerhouse/?sh=1ff538c31b0a

2 https://www.thearmchairtrader.com/horizons-ventures-debbie-chang-warrants-taat/

3 https://www.famcap.com/2020/12/investment-office-of-the-year-horizons-ventures/

3 https://finance.yahoo.com/company/horizons-ventures?h=eyJlIjoiaG9yaXpvbnMtdmVudHVyZXMiLCJuIjoiSG9yaXpvbnMgVmVudHVyZXMifQ==&.tsrc=fin-srch

4 https://www.who.int/news-room/fact-sheets/detail/tobacco

5 https://www.globenewswire.com/news-release/2021/02/10/2172857/0/en/TAAT-TM-Increases-Manufacturing-Output-by-233-to-Over-57-000-Cartons-Per-Month-in-Response-to-Sustained-Demand-in-Ohio.html

6https://www.globenewswire.com/news-release/2021/02/10/2172857/0/en/TAAT-TM-Increases-Manufacturing-Output-by-233-to-Over-57-000-Cartons-Per-Month-in-Response-to-Sustained-Demand-in-Ohio.html

7Assuming a $3.20 a carton price… also https://www.theglobeandmail.com/investing/markets/stocks/TAAT-CN/pressreleases/1187210/

8 https://finance.yahoo.com/quote/BYND/history?period1=1458000000&period2=1615766400&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true

9 Source: TAAT

10 https://www.theglobeandmail.com/investing/markets/stocks/TAAT-CN/pressreleases/1187210/

11 https://www.theglobeandmail.com/investing/markets/stocks/TAAT-CN/pressreleases/1187210/

12 https://www.wsj.com/articles/california-lawmakers-approve-ban-on-menthol-cigarettes-11598639354

13 https://www.wsj.com/articles/california-lawmakers-approve-ban-on-menthol-cigarettes-11598639354

14 https://www.wsj.com/articles/california-lawmakers-approve-ban-on-menthol-cigarettes-11598639354

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling TAAT Global.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled TAAT Global and has no information concerning share ownership by others of any profiled TAAT Global The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any TAAT Global or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the TAAT Global Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled TAAT Global’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding TAAT Global future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to TAAT Global industry; (b) market opportunity; (c) TAAT Global business plans and strategies; (d) services that TAAT Global intends to offer; (e) TAAT Global milestone projections and targets; (f) TAAT Global expectations regarding receipt of approval for regulatory applications; (g) TAAT Global intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) TAAT Global expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute TAAT Global business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) TAAT Global ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) TAAT Global ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) TAAT Global ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of TAAT Global to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) TAAT Global operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact TAAT Global business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing TAAT Global business operations (e) TAAT Global may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of TAAT Global or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of TAAT Global or such entities and are not necessarily indicative of future performance of TAAT Global or such entities.