Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) Has Become Canada’s First Publicly Traded Company to Offer Telehealth AND Prescription Deliveries

Nobody likes going to the doctor. And not just the appointment.

We’re talking about going to the doctor where you need to wait in a room with a bunch of other patients for an hour with old magazines and an antiseptic smell.

Telehealth solves all of that, and we saw it in full action this past 18 months as market share for companies offering this essential service soared.

Companies like Mednow Inc. are making our lives way easier by taking telemedicine services one step further by adding its revolutionary virtual pharmacy to its offering. Why would we ever go back to the old way of doing things?

It seems that many are on board with the new norm for healthcare, with the global telehealth market jumping from $50 Billion in 2019 up to a staggering $144.3 Billion in 2020.1

Inevitably, investors are pouring into this sector like crazy at every level from angel to early-stage to startups to M&A.2

Inevitably, investors are pouring into this sector like crazy at every level from angel to early-stage to startups to M&A.2

In fact, the revolution has already caused digital health investments to hit an all-time high of $57.2 billion in 2021, a 79% leap from 2020.3

A company by the name of WELL Health Technologies Corp. (TSX:WELL) garnered support from billionaire investor Mr. Li Ka-shing aka Superman, who is one of the most influential businessmen in Asia, and raised over $300 Million.

In turn, WELL saw its stock go from CAD$1.28 to CAD$6.89 in just two years from October 2019 to October 2021 – a 438% increase!4

Fast-moving mergers are also sweeping through the sector. For example, the Teladoc/Livongo merger in August 2020 was worth $18.5 Billion,5 giving the companies a joint enterprise value of $37 Billion.6

The same year, while the rest of the economy was swirling around the drain, telehealth IPOs boomed.

American Well Corporation saw a 42% spike on its first day of trading7 and skyrocketed past $40 on October 8, 2020, while, GoodRx Holdings popped 53% on its IPO,8 jumping from $33 up to $46 on its first day.9

Think it’s a fluke?

While past events are not always indicative of what may happen in the future, it may be helpful to review some relevant historical trends – for instance, let’s take a look back to 2018.

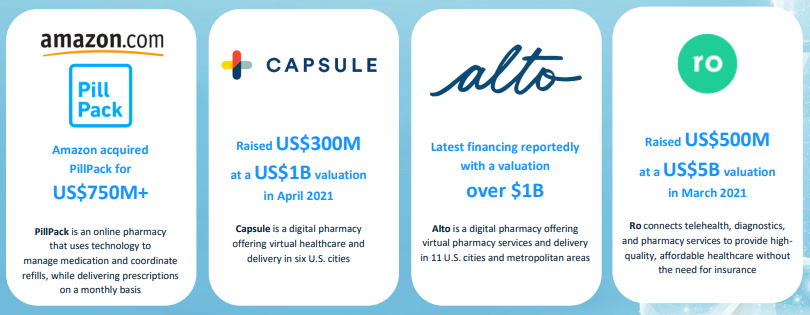

What happened then? A little company you may have heard of called Amazon bought PillPack for US$753 million (or approximately CAD$950 million today).10

Since that little-known purchase by the world’s largest retailer, things have really taken off.

Here are a few of the other deals that have taken place:

Money talks, and this industry is having a field day.

It’s that market that played a role in leading Amazon to jump into online pharmacies by buying PillPack for $753M.12

It’s also why Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) could potentially be a prime acquisition target, especially considering the M&A activity in the telemedicine space that took place last year.

Mednow’s management reasonably believes that these deals were the opening salvo in what may be the next growth market within telemedicine.

What market is that? It’s virtual pharmacies.

It only makes sense. Many people are now visiting doctors and receiving health treatment virtually… It was only a matter of time before they also wanted to receive their medication that way too.

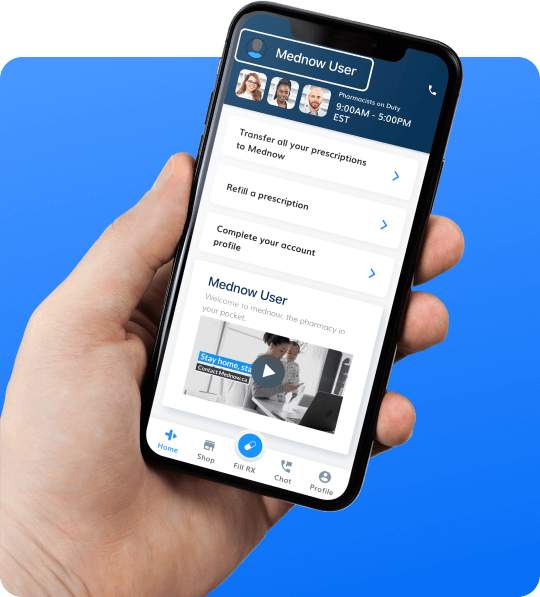

Mednow recognized this pending market shift early and has since become Canada’s only publicly-traded virtual pharmacy.

With $264B in healthcare spending overall, Canada’s pharmacy market is currently worth $47 billion.13 But while there’s over 10,000 pharmacies in Canada, only a handful have an online delivery model!

Mednow was created to fill that gap and it is now working towards doing just that – acting both as a regular retail pharmacy AND a virtual pharmacy.

Reason #1 - Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) Stands Out in a Rapidly Evolving Marketplace

Healthcare is smack dab in the middle of a revolution thanks to CV-19 and the trend of consumers adopting remote, tech-enabled services like DoorDash, which went public in December 2020 in an IPO valued at over $25 billion.14

It appears that people simply may not want to go back. Taxis have been replaced by Uber, Lyft, DiDi, and more, and proprietary takeout and groceries have been replaced by DoorDash, Skip the Dishes, Uber Eats, and more.

As mentioned, $57.2 billion was invested into digital health investments last year alone, up 79% from 2020.16

But here’s the thing for investors – most telemedicine companies have similar platforms and similar services. Yes, San Francisco-based 1Life Healthcare and Boston-Based American Well (Amwell) have in-office care… but their telemedicine services are similar.

But here’s the thing for investors – most telemedicine companies have similar platforms and similar services. Yes, San Francisco-based 1Life Healthcare and Boston-Based American Well (Amwell) have in-office care… but their telemedicine services are similar.

Mednow is like a breath of fresh air to this marketplace. Not only can it tap into all the telemedicine excitement, but management believes that it also has a major advantage over the competition with a different business model and a significant revenue-generating differentiator…

…the ability to sell prescriptions anywhere it can make deliveries.

Now that Mednow has started scaling up across the country, that advantage could prove to be a major catalyst for gaining market attention and creating shareholder value in the coming weeks and months.

Reason #2 - Telemedicine Company With Vast Upside Potential

As seen in the table below, compared to generic telemedicine companies, Mednow (TSXV:MNOW)(OTCQB:MDNWF) (TSXV:MNOW), (OTCQB:MDNWF) market cap has significantly more upside potential that it could realize if it gains greater market penetration in 2022.

The BIG THING working in Mednow’s favor is out of the 10,000+ Canadian pharmacies only a handful have an online delivery model. Mednow’s virtual pharmacy is in a unique position to prevail in the marketplace.

The BIG THING working in Mednow’s favor is out of the 10,000+ Canadian pharmacies only a handful have an online delivery model. Mednow’s virtual pharmacy is in a unique position to prevail in the marketplace.

Management believes that Mednow can also quickly extend its market reach thanks to its connection with CarePharmacies.ca.17

And the company just reported its Q1 2022 financial results showing that revenue increased over 4.5X QoQ, and more than 13.5X YoY.

The release of the financial results included an operational update, highlighting the recent acquisitions of Liver Care Canada Inc., London Pharmacare, and Infusicare.

Keep in mind, this is all before Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) builds and opens retail pharmacies in Manitoba, Alberta, and Quebec, as it plans to in 2022!18

Reason #3 - First-Mover Advantage in One of the Fastest Growing Telemedicine Solution Areas19

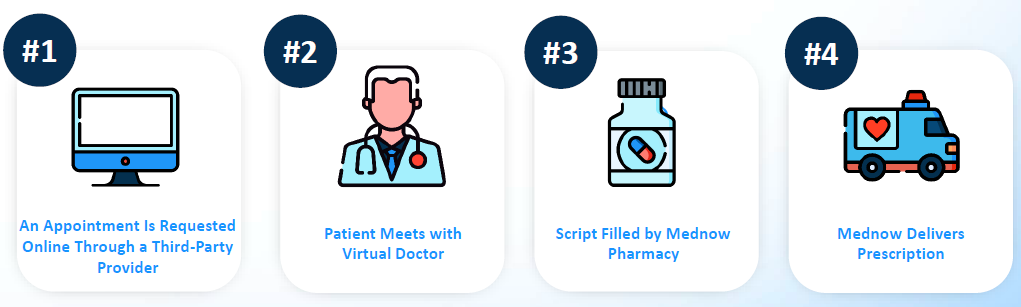

Mednow was quick to realize that telemedicine and teleconsultation is here to stay and that patients typically see PHARMACISTS up to 10x more frequently than their family PHYSICIANS.20

That’s why Mednow’s model of bringing the pharmacy to the patient is potentially so disruptive.

That’s why Mednow’s model of bringing the pharmacy to the patient is potentially so disruptive.

This unique business model separates Mednow from the competition and enables it to stand out in the marketplace.

After raising C$6.5M in a Q3 2020 seed round,21 Mednow went public in early March with a $37M upsized IPO.22

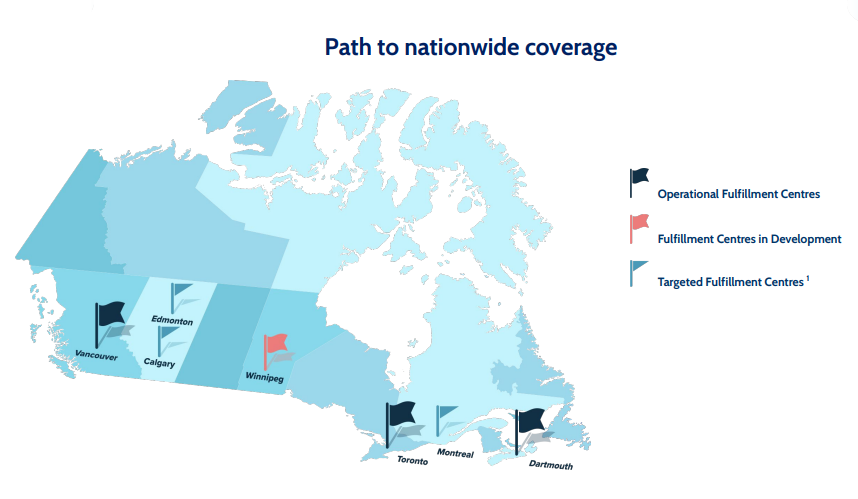

Since joining the public markets, Mednow has been working hard to open new warehouses in Canada, with a goal to achieve national coverage by the summer of 2022.

Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) business model includes such breakthroughs as:

- Free, contactless, same-day and next-day delivery of prescriptions right to the patient’s doorstep

- Medvisit, acquired by Mednow to provide doctor home visits for primarily acute and episodic illness and injury treatment.

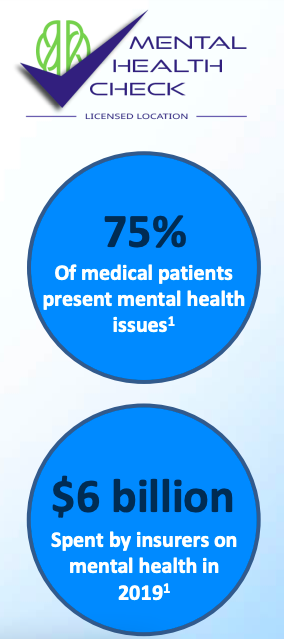

- Mental health support through Mental Health Check, a service offered by Life Support Mental Health Inc., a company that Mednow has a significant equity interest in.

- User-friendly interface for easy upload, transfer, and refill of prescriptions

- PillSmart™ medication management system that organizes each patient’s pills by dose in an easy-to-use pouch

- Karie home personal health companion that organizes, schedules, and dispenses pills with one-button technology, ensuring that patients are taking the right meds at the right time

Reason #4 - Mednow's (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF)Aggressive Market Expansion and M&A Activity

In order to maintain its competitive advantage, Mednow intends to push forward with aggressive market expansion. Over the fall, the company focused its efforts on expanding within Canada. Then on November 22, 2021, Mednow made a strategic investment in a company operating in the US telehealth market, the US telehealth market was worth a whopping $144.38 billion in 202023 and has continued to grow since.24

Mednow announced a $500,000 investment in Doko Medical, a US virtual health provider that operates in 38 US states, with plans to obtain national coverage in 202225. Doko Medical has over 100 physicians and healthcare workers using its platform to provide urgent care and medical health services to patients including CV-19 tests, prescriptions, mental health, sick notes, referrals and video visits.

Mednow has also worked hard to expand its presence in the Canadian market.

On September 10, Mednow expanded its pharmacy business in Nova Scotia after receiving a license from the Nova Scotia College of Pharmacists. The company now offers digital pharmacy services through three fulfillment centers in Ontario, British Columbia and Nova Scotia.26

Then, less than two weeks later, Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) signed an agreement to acquire a brick and mortar pharmacy in BC to align with its goal of building a national pharmacy footprint.

Then, less than two weeks later, Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) signed an agreement to acquire a brick and mortar pharmacy in BC to align with its goal of building a national pharmacy footprint.

In Toronto, the company received approval from the Ontario College of Pharmacists at its location on Eastern Avenue, and is fully operational. Expansion plans in Alberta, Manitoba, and Quebec are all underway – an ambitious and potentially incredible roadmap to a national presence in just a short time-frame.

But, that’s not all. Mednow is also working to open fulfillment centers in other Canadian provinces and has already filed applications for a Winnipeg fulfillment center that will allow the company to service both Manitoba and Saskatchewan.

Mednow is basically building its own “Silk Road” – and the further it reaches across the country, the more money it can tap into from prescription fulfillment.

Mednow completed the acquisition of Medvisit, Canada’s largest, and longest standing doctor home visit provider in August to enhance its multidisciplinary, full spectrum healthcare services in Canada.

In the last fiscal year alone, Medvisit’s network of over 100 doctors across Ontario provided approximately 30,000 patient home visits and has served over 400,000 patients since inception.27

Those visits clocked a revenue of approximately $3 million for the year, and approximately $790,000 in profit. Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) goal of providing a comprehensive and holistic offering of health services is now more complete.

Through this, Mednow is building its national footprint in the hopes of securing big-name clients from coast to coast who want to help their employees during this unprecedented health crisis – something that in all likelihood is going to become the “new normal”.

Through this, Mednow is building its national footprint in the hopes of securing big-name clients from coast to coast who want to help their employees during this unprecedented health crisis – something that in all likelihood is going to become the “new normal”.

Mednow took a huge step in this market when it invested in Life Support Mental Health Inc., which provides mental health support to patients through an assessment tool administered by a health professional through Mental Health Check.28

On November 18, 2021 Mednow also entered into an agreement to acquire Infusicare Canada Inc., whose wholly-owned subsidiary is a specialty pharmacy in London, Ontario.29 The pharmacy is located in the Arva Clinic, which offers comprehensive support for patients receiving biologic drugs for rheumatoid arthritis (RA) and other specialty medications.

This is expected to kick off Mednow’s entry into the specialty pharmacy market, and bring in accretive revenue to Mednow’s balance sheet.30 This also gives Mednow the ability to expand same-day delivery services to London, Ontario – marking its 4th major Canadian city.

In their last fiscal year, Infusicare had C$9.3 million in revenue and approximately C$400,000 in gross profit, a boost to Mednow’s income, and it’s presence as it continues to scale.

Think that’s big? How about the company’s acquisitions of Liver Care Canada Inc. and London Pharmacare Inc.? These acquisitions bolster Mednow’s specialty pharmacy services, adding hepatology and liver disease treatment expertise to its offerings.

Plus, headline numbers are great – combining Liver Care, London Pharmacare, the previously mentioned acquisition of InfusiCare Canada, and the aggregate revenue from Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) last fiscal year brings total revenue to C$33.6 million.

This is a big boost to the company’s offering of specialty pharmacy and clinical services.31

Another milestone Mednow achieved in the last couple months was the establishment of Mednow for Business, the company’s institutional services business.32

Through partnerships with companies, brokers and insurance companies, Mednow is creating a gateway for employers to offer the best benefits to its employees, increase productivity and decrease the cost of benefit plans through a digital first and patient-centric healthcare platform.

In January 2022, Mednow partnered with PACE Consulting Benefits and Pensions Ltd. and PACE Consulting MGA Services Inc. to allow PACE to market Mednow’s digital pharmacy and healthcare platform to its network of plan members.

PACE is one of Canada’s largest independent group advisory firms, specializing in Group Benefits, Group Retirement, and Group MGA/advisor support services.

PACE is one of Canada’s largest independent group advisory firms, specializing in Group Benefits, Group Retirement, and Group MGA/advisor support services.

This is yet another tool for Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) to connect with employer looking for an improved standard of benefits, and limit the costs for benefit plans.

Reason #5 - Medication Management Another Big Part of Mednow’s Success!

A big problem with prescription medications is patients either failing to take them or taking them incorrectly.

This is called “medication non-adherence,” and Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) is tackling the problem head on.

According to Medavie Blue Cross, medication non-adherence in the US: 33

- Accounts for up to 50% of treatment failures34

- Causes about 50% of Americans to not take their meds as prescribed35

- Leads to 125,000 preventable deaths each year in the US and about $300B in avoidable healthcare costs36

In Canada, medication non-adherence is estimated to cost the healthcare system $4 billion annually.37

By far, the biggest reason for non-adherence is forgetfulness. That’s why Mednow has created unique dose packages that it calls the PillSmart™ medication management system.38

By far, the biggest reason for non-adherence is forgetfulness. That’s why Mednow has created unique dose packages that it calls the PillSmart™ medication management system.38

With no extra cost to the patient, Mednow’s PillSmart system organizes each patient’s pills by dose in easy-to-use pouches sorted by day and date.

If a patient wants even more help avoiding non-adherence, they can also get Mednow’s Karie Health Device.

If a patient wants even more help avoiding non-adherence, they can also get Mednow’s Karie Health Device.

Karie is an automatic medication dispenser that organizes, schedules, and delivers a patient’s medication with the touch of a button.39

Both Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) PillSmart and Karie help ensure that patients are taking the right medication at the right time, and that helps keep people out of emergency rooms and nursing homes.

That’s the kind of patient care that’s loved by doctors, governments, and caregivers.

Mednow management believes it is also the kind of cutting-edge innovation and revenue generation that markets look for when getting behind a company.

Leading the Way With Knowledge & Experience

Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) leadership team doesn’t just have the proven ability to build and scale a successful company and range of services, it also has the pedigree and access to the large networks that give the company a distinct competitive advantage.

Co-founders Ali Reyhany and Felipe Campusano co-founded CarePharmacies.ca, the largest pharmacist-controlled independent pharmacy chain in Canada with over 50 locations from coast to coast.

They also grew their previous venture to $150M in revenue before securing a $30M investment from the private equity arm of France’s 5th largest bank.

Here’s a brief look at Mednow’s top team members.

Karim Nassar, MBA - Chief Executive Officer & Co-Founder

- Computer engineer with 15 years in pharmacy, technology, & healthcare logistics

- International marketing division at VitalAire Home Healthcare, helping build their Western Canada home oxygen logistics network

- Previously led retail & specialty pharmacy strategy initiatives at McKesson and Innomar Strategies, a subsidiary of AmerisourceBergen

- Former Vice President of Digital Strategy at CarePharmacies.ca

Ali Reyhany, RPh - Director, Co-Founder, & President

- 15+ years’ experience in the Canadian healthcare industry

- Proven operator & creator of profitable businesses

- CEO and Co-Founder of CarePharmacies.ca

- One of Canada’s Top 40 Under 40 for 2020 (BNN Bloomberg & Financial Post)40

Felipe Campusano, RPh - Director & Co-Founder

- Co-Founder of CarePharmacies.ca

- Purchased first pharmacy upon graduating from pharmacy school

- Has expanded his pharmacy & healthcare operations to 70+ businesses with annual revenue of ~$180M

- Founder and Chair of Liver Care Canada, a network of specialty liver disease treatment clinics

Ben Ferdinand - Chief Financial Officer

- CPA, CMA designation and holds the ICD.D designation from the Institute of Corporate Directors

- Previously served as CFO to a publicly traded medical health and wellness company (acquisitions of over $300 million, with over $70 million in capital raised)

- Served on the boards of CanDeal Inc., a provider of electronic debt trading services (co-owned by Canada’s six major bank-owned dealers and TMX) and Shorcan Brokers Ltd., an interdealer debt broker.

Sean Hurley - Chief Growth Officer

- 10+ years’ experience in scaling and building growth teams

- Experience scaling start-ups, including Opencare, Animoto, and ChefHero

- Founder of Pathright, an enterprise focused on helping others market and grow their company

9 Reasons Why Mednow (TSXV:MNOW)(OTCQB:MDNWF)(TSXV:MNOW), (OTCQB:MDNWF) Should Be on Your Watchlist:

- The digital healthcare market is growing substantially. 41

- Medvisit is the largest and longest-standing doctor home visit company in Canada, giving Mednow a significant portion of the market share.

- There is big gap in Canada’s on-demand virtual pharmacy market and Mednow is aiming to fill that gap

- Mednow’s acquisition of Medvisit and Life Support Mental Health solidifies its mission of providing a holistic experience for patients.

- Mednow is not only Canada’s first publicly-traded virtual pharmacy, but it also has a recent $37M IPO under its belt

- By combining cutting-edge virtual pharmacy services with more traditional telemedicine services, Mednow has separated itself from the competition

- Only Mednow offers free same-day and next-day delivery of medications right to customers’ doorsteps

- Mednow makes customer well-being a priority with its PillSmartTM system and Karie device that both help improve medication adherence – products that many pharmacies don’t offer

- Experienced leaders are also co-founders of CarePharmacies.ca and quickly grew their previous venture to $150M in revenue42

1https://www.globenewswire.com/en/news-release/2021/09/06/2291743/0/en/Telehealth-Market-Size-Is-Anticipated-to-Reach-USD-636-38-Billion-by-2028-Exhibit-a-CAGR-of-32-1.html

2 https://news.crunchbase.com/news/telehealth-dealthmaking-up/

3 https://www.fiercehealthcare.com/digital-health/digital-health-startups-around-world-raked-57-2b-2021-up-79-from-2020

4 Historical stock prices and trends are not indicative of future stock prices and trends for this company or others.

5 https://teladochealth.com/newsroom/press/release/livongo-merger/

6 https://www.cnbc.com/2020/08/05/teladoc-acquires-livongo-creates-37-billion-health-tech-company.html

7 https://www.fiercehealthcare.com/tech/telehealth-company-amwell-spikes-public-debut-outsized-742m-ipo

8 https://www.cnbc.com/2020/09/23/goodrx-gdrx-ipo.html

9 Historical stock prices and trends are not indicative of future stock prices and trends for this company or others.

10 https://www.cnbc.com/2019/05/10/why-amazon-bought-pillpack-for-753-million-and-what-happens-next.html

11 https://www.reuters.com/article/us-altopharmacy-funding-exclusive-idUSKBN1ZT19K

12 https://www.cnbc.com/2019/05/10/why-amazon-bought-pillpack-for-753-million-and-what-happens-next.html

13 https://tinyurl.com/xzpcecdc

14 https://www.wsj.com/articles/doordash-sets-ipo-terms-pushing-valuation-above-25-billion-11606747049

15 https://1qip72enmt91xz5z814ig4ve-wpengine.netdna-ssl.com/wp-content/uploads/2021/08/8.17.21-Mednow-Corporate-Presentation-Q3-2021-vF.pdf

16 https://www.fiercehealthcare.com/digital-health/digital-health-startups-around-world-raked-57-2b-2021-up-79-from-2020

17 https://carepharmacies.ca/

18 https://investors.mednow.ca/mednow-reports-q1-2022-financial-results-and-operational-milestones/

19 https://www.prnewswire.com/news-releases/global-telemedicine-market-report-2021-2026-web-based-apps-and-services-are-growing-40-faster-than-proprietary-client-based-solutions-301328119.html

20 https://journals.sagepub.com/doi/full/10.1177/1715163517745517

21 https://betakit.com/mednow-ca-raises-6-5-million-to-connect-canadians-with-pharmacies-virtually/

22 https://investors.mednow.ca/mednow-announces-upsized-closing-of-approximately-37000000-initial-public-offering-led-by-gravitas-securities-eight-capital-and-stifel-gmp-and-subsequent-listing-on-the-tsx-venture-exchange-under/

23 https://www.globenewswire.com/en/news-release/2021/09/06/2291743/0/en/Telehealth-Market-Size-Is-Anticipated-to-Reach-USD-636-38-Billion-by-2028-Exhibit-a-CAGR-of-32-1.html

24 https://www.globenewswire.com/en/news-release/2021/09/06/2291743/0/en/Telehealth-Market-Size-Is-Anticipated-to-Reach-USD-636-38-Billion-by-2028-Exhibit-a-CAGR-of-32-1.html

25 While this reflects the company’s objective, it is subject to a number of risks and uncertainties and there is no guarantee that this will occur within the time frame expected or at all.

26 https://finance.yahoo.com/news/mednow-commences-operation-nova-scotia-110000944.html

27 https://ca.finance.yahoo.com/news/mednow-acquires-medvisit-canada-largest-110000281.html

28 https://ca.finance.yahoo.com/news/mednow-invests-life-support-mental-110000487.html

29https://financialpost.com/pmn/press-releases-pmn/business-wire-news-releases-pmn/mednow-enters-into-agreement-to-acquire-infusicare-canada-inc

30 While this reflects Mednow’s expectations, it is subject to a number of risks and uncertainties and there is no guarantee that it will occur.

31 https://investors.mednow.ca/mednow-enters-into-agreement-to-acquire-liver-care-canada-inc-and-london-pharmacare-inc/

32 https://www.businesswire.com/news/home/20211021005309/en/Mednow-Reports-Q4-2021-Financial-Results-and-Operational-Milestones

33 https://www.medaviebc.ca/en/insights/posts/medication-non-adherence

34 https://www.pillsy.com/articles/medication-adherence-stats

35 https://www.pillsy.com/articles/medication-adherence-stats

36 https://www.uspharmacist.com/article/medication-adherence-the-elephant-in-the-roomu

37 https://www.medaviebc.ca/en/insights/posts/medication-non-adherence

38 https://ksusentinel.com/2021/03/16/north-america-medication-adherence-packaging-market-is-predictable-to-reach-us-518-78-million-by-2027-with-cagr-of-6-3/

39 https://retail-insider.com/retail-insider/2020/12/all-encompassing-virtual-platform-aims-to-disrupt-canadas-pharmacy-industry/

40 https://www.bnnbloomberg.ca/canada-s-top-40-under-40-the-next-leaders-for-2020-1.1513685

41 https://docs.google.com/document/d/1BtNzzHQJ0GD4pT-l2CdX93oRmlM6Gf6skAqAww_FdXY/edit

42 Historical revenue performance and investment success is not indicative of future results.

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Mednow Inc. (“MNOW”) and its securities, MNOW has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by MNOW) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company MNOW and has no information concerning share ownership by others of in the profiled company MNOW. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to MNOW industry; (b) market opportunity; (c) MNOW business plans and strategies; (d) services that MNOW intends to offer; (e) MNOW milestone projections and targets; (f) MNOW expectations regarding receipt of approval for regulatory applications; (g) MNOW intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) MNOW expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute MNOW business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) MNOW ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) MNOW ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) MNOW ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of MNOW to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) MNOW operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact MNOW business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing MNOW business operations (e) MNOW may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Mednow Inc.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Mednow Inc. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Mednow Inc. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Mednow Inc. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Mednow Inc.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Mednow Inc. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Mednow Inc. industry; (b) market opportunity; (c) Mednow Inc. business plans and strategies; (d) services that Mednow Inc. intends to offer; (e) Mednow Inc. milestone projections and targets; (f) Mednow Inc. expectations regarding receipt of approval for regulatory applications; (g) Mednow Inc. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Mednow Inc. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Mednow Inc. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Mednow Inc. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Mednow Inc. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Mednow Inc. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Mednow Inc. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Mednow Inc. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Mednow Inc. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Mednow Inc. business operations (e) Mednow Inc. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Mednow Inc. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Mednow Inc. or such entities and are not necessarily indicative of future performance of Mednow Inc. or such entities.