If you’re looking for fast profits, put this innovative biotech at the top of your watch list.

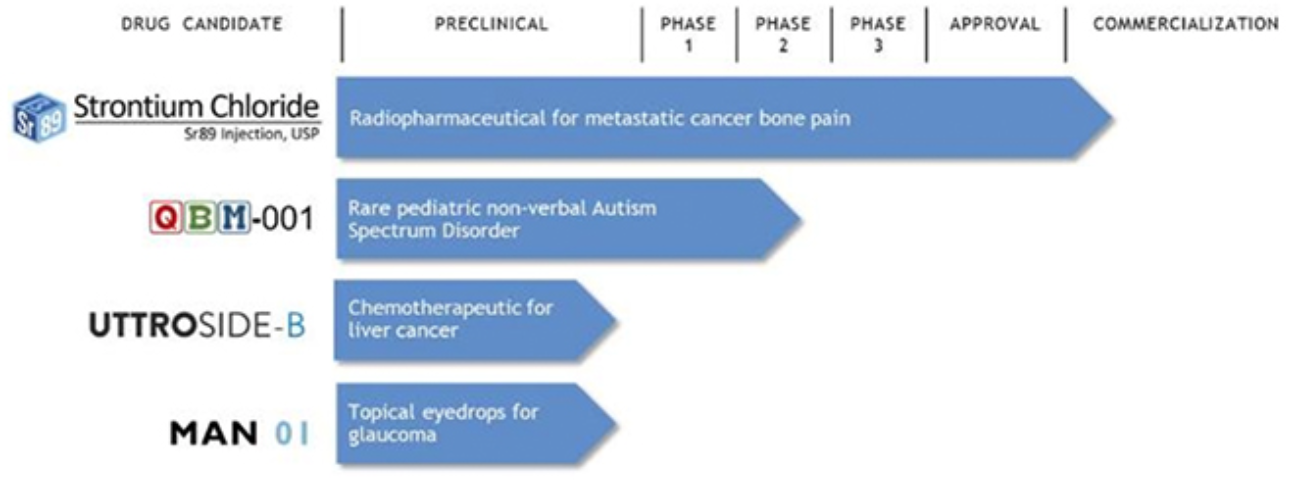

Q BioMed, Inc. (OTC: QBIO) is pursuing multiple pathways to revenue, with drugs in the pipeline for the treatment of non-opioid metastatic cancer pain, liver cancer, rare autistic spectrum disorders, and glaucoma.

As you likely know already…America leads the world in biotechnology discovery. Nowhere on the planet will you find more new discoveries commercialized than here…and that makes the U.S. the number one market for you to shop for and invest in ground-breaking tech.

What’s more, the field is rich with micro-cap companies that could one day make shareholders fabulous wealth. These promising companies share one common trait; they’re all unknown.

Nearly three-quarters of all U.S. biotechnology companies employ fewer than 50 persons. It’s fair to say that hardly any of them make the news until a breakthrough is announced. For the individual investor, that’s typically too late to get in.

Uncovering such companies exposes a treasure trove of potential. That’s why we were thrilled to discover Q BioMed (OTC: QBIO).

This undervalued company has a totally unique strategy for profiting in biotech that should appeal greatly to the cautious investor seeking outsized wealth-building opportunities.

This is not a single company with just one big idea. QBIO is staffed with biotech investing specialists who winnow through mountains of early-stage biotech companies to isolate a handful with exceptional promise. Once identified, QBIO pulls each into their intellectual property portfolio, then proactively accelerates the product development trajectory toward commercialization.

Q BioMed does what very few individual investors can do…it sifts through thousands of potential technologies and dedicates its own resources to make winners of the few that it selects.

That makes Q BioMed one of the most attractive biotech opportunity buys we’ve seen in years.

The company takes an entirely unique approach to biotech investing. It offers shareholders a diversified portfolio of expertly vetted early-stage biotech R&D assets that hold significant promise of achieving a commercialized breakthrough in multiple therapeutic areas.

And because they have skin in the game…you can count on their portfolio to hold and retain the most promising of assets!

Multiple pathways to profit: Not one, or two…but four separate product development trajectories

The strategy is brilliant. Create a pipeline through which multiple innovative biomedical assets can be nurtured through to commercialization, all with the intent to minimize risk and accelerate shareholder value for QBIO shareholders.

At present, Q BioMed directs the development progress of four highly promising pharmaceutical products. The success of any one of these innovative products could send QBIO shares soaring. One look at the Q BioMed portfolio makes that obvious.

Q BioMed is now actively advancing the development of four key pharmaceutical innovations. Each promises breakthroughs in much-needed therapies for:

- Treatment of Metastatic Bone Cancer Pain

- Amelioration of Pediatric Non-Verbal Autism Spectrum Disorder

- Chemotherapeutic Interventions for Liver Cancer

- Topical Eyedrop Treatment for Glaucoma

Any one of these assets under Q BioMed’s umbrella could trigger a multi-billion-dollar breakout! Here’s our reasoning on why you should be looking into a position in QBIO with utmost urgency.

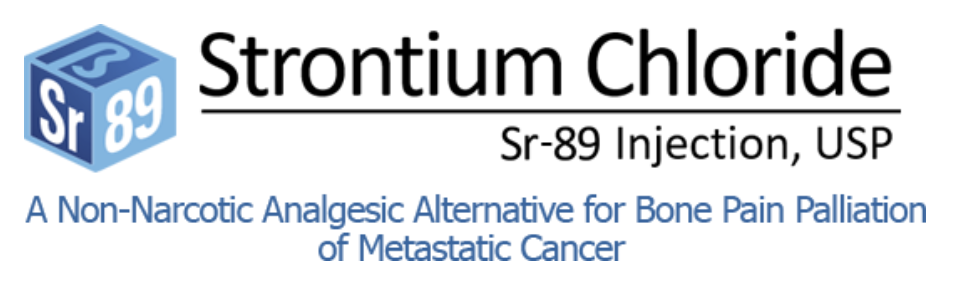

First and foremost, Q BioMed appears just months away from final FDA approval of its new manufacturing facility for its FDA approved non-opioid pain-killer, Strontium 89 Chloride, indicated for the treatment of the intense pain associated with metastatic bone cancer.

According to company reports, Strontium Chloride is just months short of final FDA approval and commercialization. The time to move on QBIO is now!

The future value could be off the charts. Public Broadcasting Service (PBS) reports that current pain intervention therapies have triggered the deadliest drug epidemic in American history. Established protocols for intense pain management using opioids; have lead to 27,000 deaths annually from addictive drug overdose.

Approval of a proven, non-addictive drug as powerful as these narcotics for the hundreds of thousands of cancer patients suffering from bone pain could not come soon enough.

Q BioMed’s Strontium Chloride asset, apparently just months away from likely commercialization, could trigger explosive growth in the company’s market cap. Now is the time to seriously consider securing a QBIO position on this drug alone.

This presents an urgent call to action. A company announcement regarding Strontium Chloride’s progress toward commercialization could come at any time. Being so close to approval, that key announcement could trigger a huge price spike in QBIO shares, which is why we urge anyone considering a QBIO buy to act without delay.

We also believe that QBIO shareholders should not hastily cash in on any early gains following a positive Strontium Chloride announcement. With three additional products in the pipeline, substantial additional upside may follow. We see QBIO a strong consideration for a buy-and-hold strategy.

Before we get into the details of these other three Q BioMed assets, we want to steer your attention to why we think QBIO sits substantially underpriced in today’s market.

As you proceed with your due diligence you undoubtedly will note that QBIO currently trades at or below $2.00 a share, a 52-week low. Consider yourself lucky to discover it now; this is so typical of biotech!

Early shareholders leap in on the promise of a new biotech breakthrough then lose patience at the slow pace of product development. Just months before a breakout, a winning biotech could be trading at a low point simply because many impatient shareholders moved on.

This is where we believe QBIO is priced today; severely undervalued. More sellers than buyers over the last few months created an exceptional buying opportunity. Those sellers may soon be kicking themselves for losing patience. The company reports it’s on the threshold of potential market-breaking news with its Strontium Chloride asset. This is not time to sell; this could be the best time to buy!

We believe that $2/share may quickly prove QBIO shares to be substantially undervalued. Of course, that’s our opinion…we strongly encourage you to do your own research to confirm our assessment.

You can learn a lot right now by watching this short video interview with Q BioMed’s Chaairman and CEO, Denis Corin. Mr. Corin speaks about Q BioMed’s unique accelerated R&D business model and the company’s prospects for growing shareholder value through 2018 and 2019.

We also recommend that you carefully consider the buy-and-hold strategy. Take some early profits if you like, but we suggest you think about leaving some on the table. Here’s why.

Q BioMed’s three other assets hold additional growth potential that could quickly trigger multiple rounds of double-digit growth in QBIO share prices.

Let’s consider the potential in Q BioMed’s QBM-001 treatment for a rare, devastating pediatric disorder, which has no existing treatment therapy.

The disease is Pediatric Non-Verbal Autism Spectrum Disorder. It is beyond the scope and purpose of this report to get into the medical details, suffice it to say that this is a devastating condition that cripples 20,000 American children annually, with staggering lifetime cost in the millions of dollars.

In this video, Mr. Corin explains how Q BioMed stands on the brink of a revolutionary breakthrough for treating this devastating childhood disease.

If approved by the FDA, Q BioMed’s QBM-001 will be the first ever pharmaceutical intervention for this disease, Pediatric Non-Verbal Autism Spectrum Disorder. The drug is currently being formulated and prepared for a Phase 2/3 pivotal clinical trial and because it is targeting a rare disease with no known Rx therapies, we also believe that QBM-001 is a prime candidate for orphan drug designation and a fast track to approval.

Approval of this potential multi-billion dollar drug could, therefore, come quickly (in biotech terms) and should that happen as we believe it might, QBIO shareholders stand to see a significant uptick in share prices over and above anything triggered by the Strontium Chloride asset.

What makes Q BioMed (QBIO) unique in the biotech sector

In a nutshell, Q BioMed is diversified; its shareholder value is not tied to just one R&D process and product. We believe this substantially increases the potential for gains while suppressing the risks of loss.

The company describes itself as a biotechnology development company that nurtures highly promising technologies and accelerates the R&D process through to commercialization. The objective is simple. Rapidly grow shareholder value by managing multiple assets.

At present, the company directs the development of four core products in its biotechnology portfolio.

Strontium Chloride and QBM-001 are well advanced in the development process. Strontium Chloride is, in fact, so close to final manufacturing approval that the window for securing a ground floor position in QBIO shares may be closing fast. Couple that with the potential for fast-tracking QBM-001 and we feel that the time to act on this is now.

Still early in development are Q BioMed’s UTTROSIDE-B and MAN 01 products. Each is entering Phase 1 clinical trials, which is a significant validation of preliminary R&D. What attracts us more to the potential of these two assets is the commercialization potential.

UTTROSIDE-B is a promising new chemotherapeutic treatment for liver cancer. Sadly, the market potential for this drug is soaring. According to a recent report from the Center for Disease Control (CDC) the incidence of liver cancer is growing rapidly and “the rate of deaths due to liver cancer is increasing faster than for any other type of cancer.”

The cause for this is due in large part to the near-epidemic level of hepatitis C infections in the aging adult population. The CDC reports that “approximately 3.5 million Americans are living with chronic hepatitis C infections”. All of these patients live with the extremely high risk of developing liver cancer, which UTTROSIDE-B seeks to treat.

Unfortunately, liver cancer is very difficult to cure. As a result, mortality rates are quite high. In 2018, estimates are that nearly 30,200 Americans will succumb to the disease making it the fifth leading cause of cancer death in America. We believe that the high incidence rate coupled with a paucity of effective treatments can make UTTROSIDE-B a highly promising asset when commercialized.

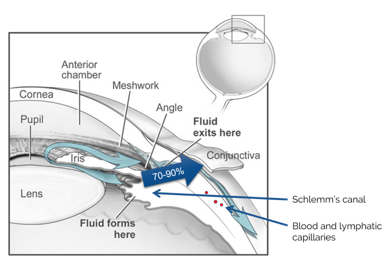

Also in Q BioMed’s portfolio is MAN 01, a product in development to treat glaucoma using a topically applied medication. The implications of this product’s commercialization are staggering.

Q BioMed reports that 60 million people worldwide are afflicted with glaucoma today. Without proper treatment, glaucoma can lead to irrecoverable blindness. It is not a disease to be ignored and though 2.2 million Americans are among those with the disease, 50% don’t know that they have it!

Q BioMed reports that 60 million people worldwide are afflicted with glaucoma today. Without proper treatment, glaucoma can lead to irrecoverable blindness. It is not a disease to be ignored and though 2.2 million Americans are among those with the disease, 50% don’t know that they have it!

The incidence of glaucoma is further exacerbated by America’s growing incidence of type 2 diabetes. Diabetics are at much higher risk of developing glaucoma symptoms, which suggests an urgent need for an effective, patient-administered treatment. MAN 01 may be the right product at the right time. It is being developed as a patient-administered daily eyedrop that relieves pressure in the eye, one of the main symptoms that cause glaucoma. MAN 01 holds promise to become a multi-billion-dollar asset in the Q BioMed portfolio.

What to do now…

- Q BioMed (QBIO) deserves immediate and serious consideration as an entry to the highly lucrative profit opportunities prevalent in the early-stage biotech arena.

- Referring back to the four key points presented at the top of this article, we feel that:

- QBIO minimizes risk in ground-floor biotech investing through a diversified portfolio of assets in development.

- QBIO maximizes the potential for outsized shareholder profits by only selecting assets that hold exceptional market value when commercialized.

- QBIO expertly mines the early-stage biotech sector to extract only the very best, most promising emerging technologies.

- QBIO offers its shareholders an entry to professionally managed early-stage biotech investing with a single shareholder position.

Keep this in mind as you consider adding QBIO to your growth portfolio. Share prices in biotech can move rapidly on a release of a single piece of news. Shares you buy today at $2.00 could double in a matter of just days, perhaps even hours. QBIO deserves your immediate attention.

And, as you ponder the profit potential in QBIO, keep in mind that unlike conservative “steady growth” stocks that can take years to deliver big results, QBIO holds the potential to deliver massive gains virtually overnight! An exaggeration perhaps, but we need to emphasize this point.

We urge you to take immediate steps to determine if Q Biomed, Inc. (QBIO) is a right addition to your growth portfolio. Even a few days’ delay could leave huge profits behind you. Take a look at their presentation today…

markettactic.com has received permission to send its readers a special investor kit prepared by the company. To register to receive this kit and future updates on Q Biomed, Inc. (QBIO), enter your email address in the box below.

2 ibid.

3 https://www.pbs.org/wgbh/frontline/article/how-bad-is-the-opioid-epidemic/

4 https://www.cdc.gov/nchhstp/newsroom/docs/factsheets/viral-hep-liver-cancer.pdf

5 ibid.

6 https://www.medicinenet.com/liver_cancer_hepatocellular_carcinoma/article.htm#what_is_the_medical_treatment_for_liver_cancer

7 https://cancerstatisticscenter.cancer.org/#!/

IMPORTANT NOTICE AND DISCLAIMER: This stock profile should be viewed as a paid advertisement. The publisher, Market Tactic, understands that in an effort to enhance public awareness of Q BioMed Inc. and its securities through the distribution of this advertisement, Cayvan Consulting Ltd. paid all of the costs associated with creating and distribution of this advertisement. The publisher was paid the sum of approximately $500 per week while the advertisement campaign was active for their contributions. This report is for information purposes only and is neither a solicitation or recommendation to buy nor an offer to sell securities. Market Tactic is not-a-registered-investment-advisor. Market Tactic is not a broker-dealer. Information, opinions and analysis contained herein are based on sources believed to be reliable, but no representation, expressed or implied, is made as to its accuracy, completeness or correctness. The opinions contained herein reflect our current judgment and are subject to change without notice. Market Tactic accepts no liability for any losses arising from an investor’s reliance on the use of this material. Market Tactic and its affiliates or officers currently hold no shares of these stocks. Market Tactic and its affiliates or officers will not purchase or sell shares of common stock of these stocks, in the open market at any time without notice. Certain information included herein is forward-looking within the context of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements concerning manufacturing, marketing, growth, and expansion. The words “may”, “would,” “will,” “expect,” “estimate,” “anticipate,” “believe,” “intend,” ” project,” and similar expressions and variations thereof are intended to identify forward-looking statements. Such forward-looking information involves important risks and uncertainties that could affect actual results and cause them to differ materially from expectations expressed herein. * Market Tactic does not set price targets on securities. Never invest into a stock discussed on this website or in this email alert unless you can afford to lose your entire investment. This publication, its publisher, and its editor do not purport to provide a complete analysis of any company’s financial position. The publisher and editor are not, and do not purport to be, broker-dealers or registered investment advisors. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC filings. Investing in securities is speculative and carries a high degree of risk. Past performance does not guarantee future results. This publication is based exclusively on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains “forward-looking” statements, including statements regarding expected continual growth of the featured company and/or industry. The publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the company’s actual results of operations. Factors that could cause actual results to differ include the size and growth of the market for the company’s products and services, the company’s ability to fund its capital requirements in the near term and long term, pricing pressures, etc.