There’s a major push happening in the world of casinos, as many of the world’s largest brick-and-mortar gambling houses began migrating their services online1— a shift that accelerated even more during the era of CV-19.2

Making this transition more painless is the EBITDA-positive and rapidly-growing B2B SaaS company Bragg Gaming Group (TSX:BRAGTSX:BRAG) that’s providing casinos and gaming businesses around the globe with a seamless turnkey solution to the exponential potential of online gambling.

Prior to the global health crisis, one of the only ways most casino enthusiasts could play their favourite games would be to travel to a land-based casino in cities such as Las Vegas and/or Atlantic City.

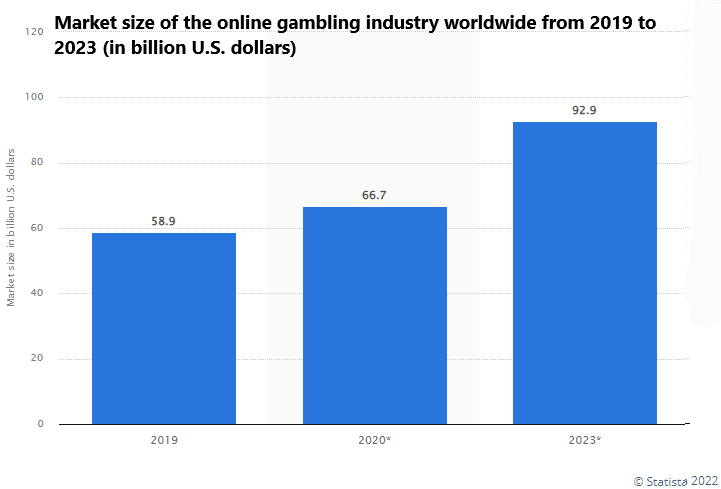

While these markets continue to attract significant crowds of people, it’s clear from the numbers that online gambling is here to stay.

The casino landscape has completely changed, especially in the United States, Europe and Asia where legal online gambling has taken off.

The Global Online Gambling Market is now being projected to reach US$97.7 billion by 2025, growing at a healthy CAGR of 11.31%.3

In the USA alone, the gambling business boomed like never before in 2021, breaking all time revenues with $44 billion!—with online betting revenue rising more than 300% in the one-year period ending in October.4

Bragg Gaming Group not only identified this rapidly expanding market, but gained an early-mover advantage by helping online gambling companies over the last few years continue to grow aggressively, and help land-based gambling companies migrate online.

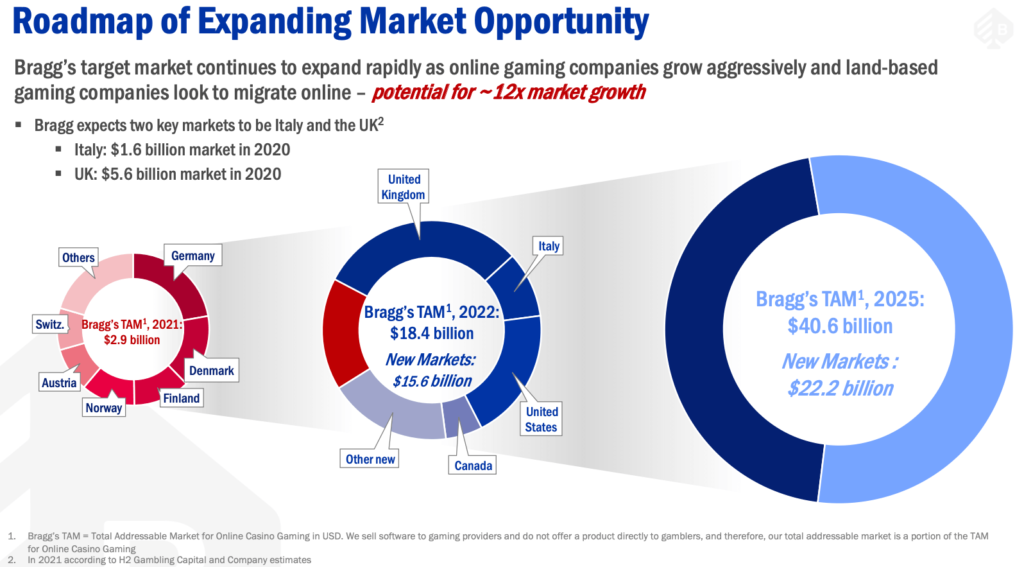

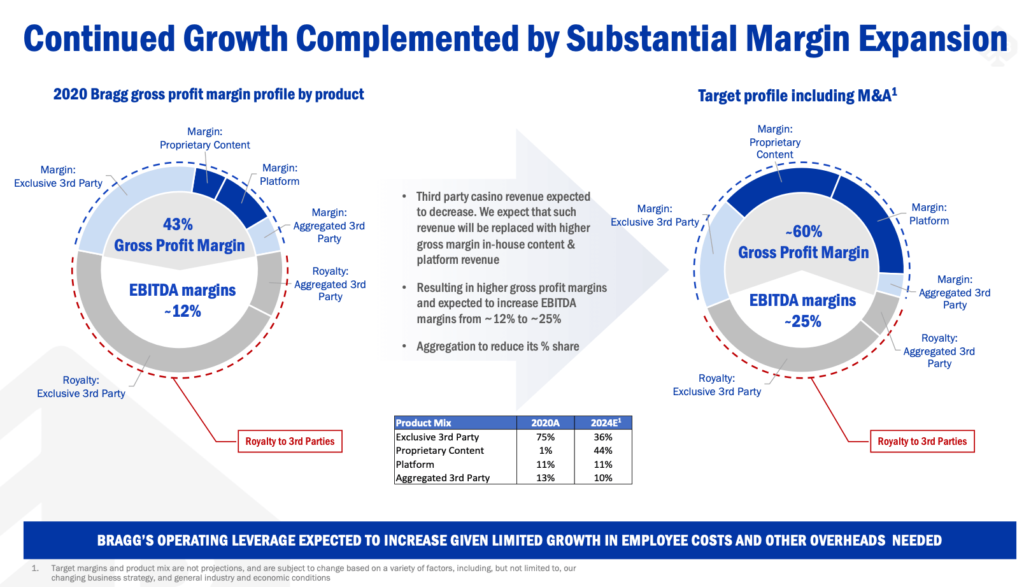

Over the coming quarters, Bragg Gaming Group (TSX:BRAGTSX:BRAG) expects to increase its gross profit margins significantly and its EBITDA margins from ~12% to ~20-25%—and now with new market entries on deck, the company has a new Total Addressable Market (TAM) growth potential of 12x!

Now let’s break down the numerous reasons that the B2B business model of Bragg Gaming Group is THE BEST WAY to invest in the online casino gaming revolution.

- It’s an EBITDA-Positive Gambling Stock: Through its creative revenue-share SaaS model, BRAG is different from the B2C companies it serves as a B2B provider.

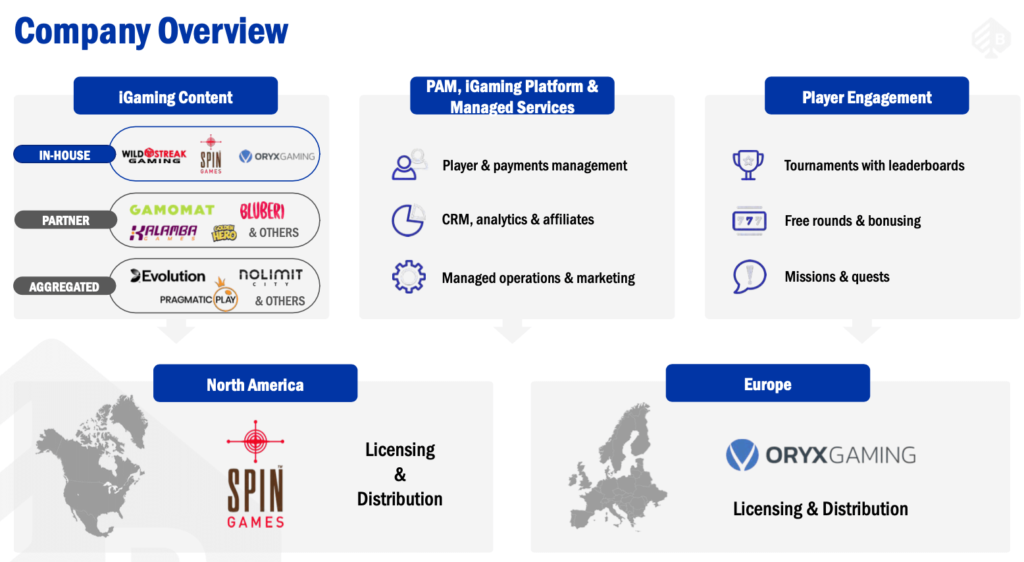

- Diverse Revenue Streams: From full turnkey iGaming solutions, to in-house studio game development, to premium games studies and content aggregation, Bragg Gaming Group has multiple streams of revenue coming in to bolster its books.

- Proprietary and Premium Gaming Content: In order to succeed in gaming, you need to have games people WANT to play, and BRAG comes with an epic lineup of in-house, partner and aggregated content, totaling between 13k-14k games on the platform.

- Data-Driven Company Built for Win-Win Results with Clients: Partners of Bragg want to continue, because their full turnkey solutions handle so many of their operational and marketing needs, they can focus on acquiring and retaining players, and making both BRAG and its clients more money.

- Licensed, Certified and PROVEN Across the Globe:Gaining access to new markets is the name of the game in online casino gaming, and Bragg Gaming Group (TSX:BRAGTSX:BRAG) has successfully grown to include operations across Europe, North America and Latin America, with more markets on the way!

- Significant Growth Potential:Based on its current financials, and the fact that it’s been EBITDA positive for quite some time already, all signs point to Bragg continuing its rapid expansion into new and proven lucrative markets, with Total Addressable Market (TAM) potential of ~12x growth through 2025.

- Highly Experienced Leadership Team: Built upon a group of industry heavyweights with deep connections in media, gaming, and tech world.

IGaming Companies Ramping Up Customer Acquisition To Capitalize On A New Market

You may wonder why certain companies in the space aren’t already seeing significant profits given the exploding market potential.

But as a savvy investor, you must look beyond the surface.

DraftKings is one of many companies that has seriously invested in business growth, so much so they are willing to incur a temporary profit dip to acquire brand awareness and customers.

According to the investment bank Craig Hallum, it makes sense for iGaming companies to focus on generating more long-term profitability by scaling fast, instead of playing conservatively and not gaining early traction.5

And as new legal markets open up, companies like DraftKings and Skillz need to spend more money.

In 2020, DraftKings spent a whopping $499 million (77% of revenue) to gain a stake in new states that opened up, including Michigan, Virginia and Tennessee and bolster support for Illinois.

As a result of having spent millions in marketing spend,6 DraftKings has seen its revenue grow by almost 40% between Q1 2020 and Q1 2021.7

Another company, Skillz, grew its revenue by 70% year-over-year8 by reinvesting a whopping 112% of their money back in marketing in Q3 last year!9

Experts expect that as market share grows and regulation gets implemented across North America, the money that companies spend to acquire customers will later pay off in a significant increase in profits .

Costs could eventually shrink, but the market has already been successfully captured.

In this sense, this phenomenon is actually a healthy sign of a new, fast-growing industry.

Yet, Bragg Gaming Group (TSX:BRAGTSX:BRAG) stands out…

Because unlike these other stocks, Bragg directly benefits from the money being poured into the industry thanks to its revenue-share model, which is also why it’s one of the first companies to already post CONSISTENT positive EBITDA quarter-after-quarter!

Bragg is steadily growing in satisfied B2B customers, leading to very respectable double-digit EBITDA Margins, and expanding gross profit margins of over 51%, reporting:

- Revenue increase of 9.9% to $14.27M

- Gross profit increase of 30.1% to $7.36M

- Margins expanding 43.4% to 51.4%

- An adjusted EBITDA of $1.56M with 11.0% margin

- Wagering generated by customers jump of 4.8% to $3.57B

And that’s just the beginning. The company just released ins Q4 and FY 2021 AND 2022 projections, with even more growth expected (more on that later).

Oh, and did we mention that Bragg is continuing to expand into new markets. Since January 2021, the company’s ORYX Gaming has gone live with its player-popular content in Switzerland, Germany, Greece, the Netherlands, the UK and the Czech Republic.

This is huge considering that H2 Gambling Capital projects the aggregate 2022 online casino total addressable market for these six countries to be approximately US $5.9 billion.

Bragg’s current TAM is approximately US $12.5 billion and is expected to further increase to more that US $18 billion by the end of 2022, reflecting expectations for initial activations this year in several iGaming markets, in Ontario, and across other global iGaming markets.

The reason why Bragg Gaming Group is outprofiting others is because it is a B2B company.

It’s a B2B company that uses a very healthy revenue-share SaaS model.

Translation: Bragg doesn’t need to spend millions on marketing to gain more users.

Instead, Bragg is behind the scenes providing content and SaaS solutions to these front-facing B2C companies in order to help them succeed.

It’s a win-win strategy. When the client generates revenue from its customers, so too does Bragg Gaming Group.

Bragg has everything these B2C gaming companies need, especially after its acquisition of Wild Streak Games, by providing content to their clients, allowing them to put their skins and branding onto the games themselves.

Bragg, through its pending Spin Games acquisition, would add to their portfolio of clientele many of the biggest names in the industry, including MGM Resorts, FanDuel, Golden Nugget, Penn National Gaming, Caesars, and even DraftKings themselves.

As Major Investments Continue to Capitalize on the Casino Industry’s Online Migration, This Could Potentially Be Your Best Chance to Get Involved as Well

It’s worth noting for Bragg Gaming Group (TSX:BRAGTSX:BRAG) and its investors that there’s no shortage of investment money flowing into the online migration of the casino industry right now.

DraftKings, is one of the world’s largest vertically integrated sports betting operators, with 50+ operators across more than 15 regulated US and Global markets.

DraftKings, is one of the world’s largest vertically integrated sports betting operators, with 50+ operators across more than 15 regulated US and Global markets.

Among those markets, DraftKings is now launching in the $1 billion New York sports betting market.10

In the first 9 months of 2021, DraftKings more than doubled its sales and marketing spending to $703 million, with $303.7 million spent in the third quarter.11

But its biggest splash of the last year was the $1.56 billion acquisition of Golden Nugget Online—which remains a touchy subject, as two stockholder suits are ongoing over the potentially dilutive12 transaction.13

Then there’s Penn National Gaming and its flagship business Barstool Sports. Their shares gained $2.1 billion in market capitalization between February 2020 and January 2022.

Then there’s Penn National Gaming and its flagship business Barstool Sports. Their shares gained $2.1 billion in market capitalization between February 2020 and January 2022.

The company’s revenue expanded at an average rate of 20% per year from $3 billion in 2016 to $5.3 billion in 2019, however it experienced a 30% top-line contraction in 2020 due to mandated closures and subsequent restrictions.14

And Bragg Gaming Group (TSX:BRAGTSX:BRAG) through Spin Games, has supplier licensing agreements in place with BOTH DraftKings and Penn National Gaming.

Another example in the space is International Gaming Technology (IGT), which recently scored a deal with the recognizable brand WWE for the exclusive licensing rights to develop and distribute WWE-branded Omnichannel Lottery Games and turnkey promotional programs featuring company logos, Superstars, events and programs.15

Another example in the space is International Gaming Technology (IGT), which recently scored a deal with the recognizable brand WWE for the exclusive licensing rights to develop and distribute WWE-branded Omnichannel Lottery Games and turnkey promotional programs featuring company logos, Superstars, events and programs.15

IGT currently has a local presence and relationships with governments and regulators in more than 100 countries around the world.

As money continues to flow into this space, there’s no shortage of interest in the behind-the-scenes play Bragg Gaming Group (TSX:BRAGTSX:BRAG) brings to the table.

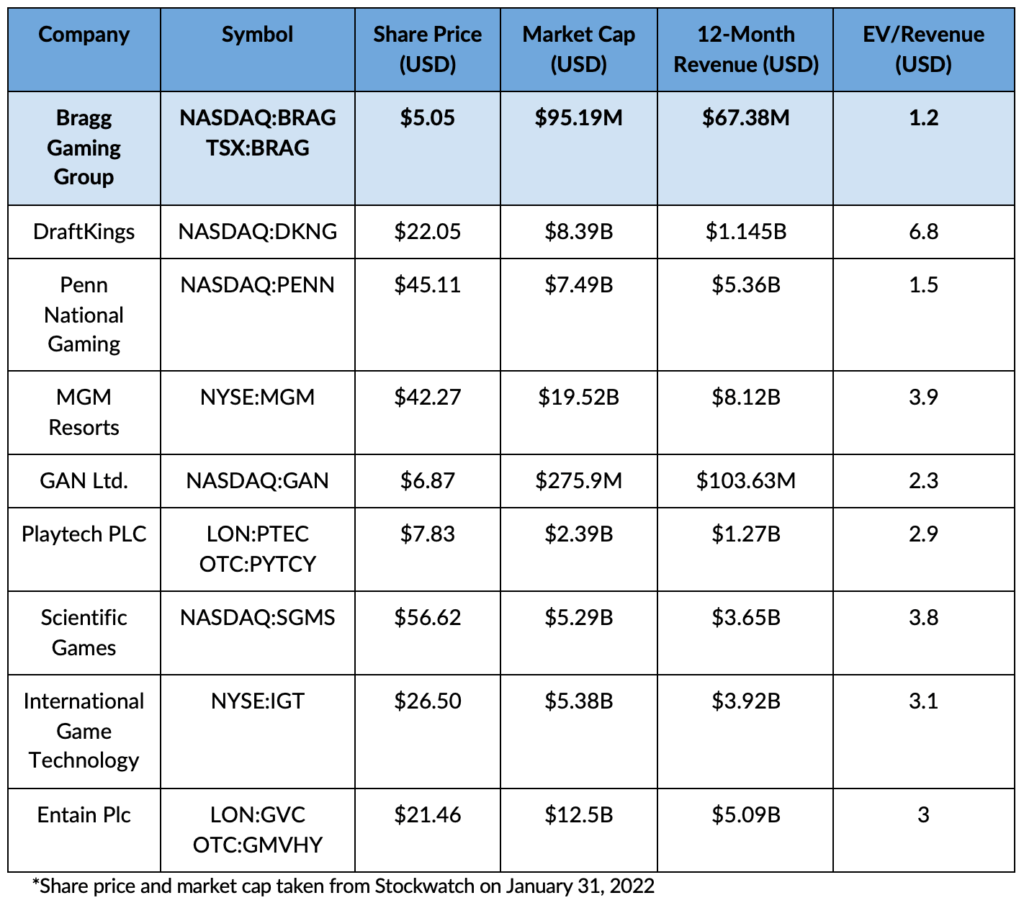

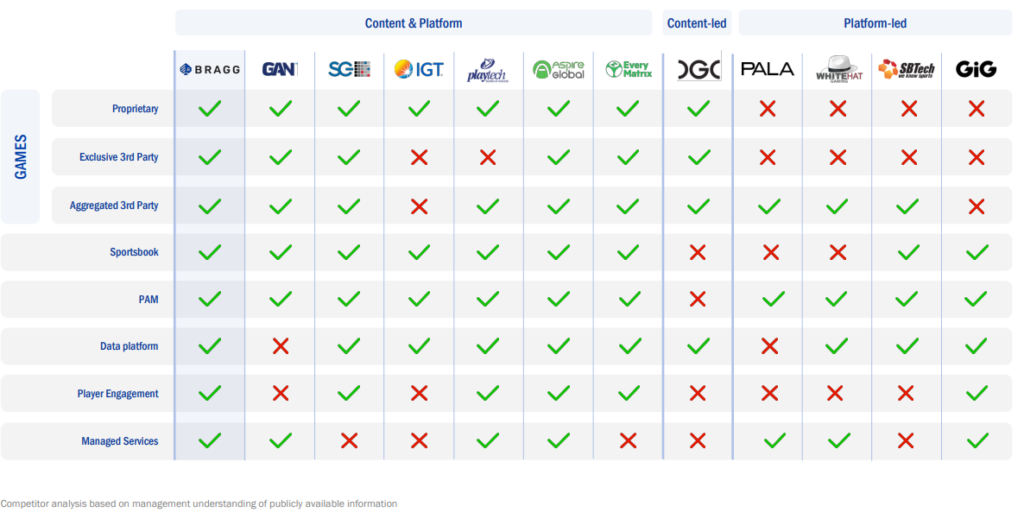

BRAG is a Pick-and-Shovel Play That Stands Out from the Competition

As a bricks-and-mortar casino operator, a company like MGM Resorts or Penn National Gaming isn’t considered a direct competitor, but rather a would-be client of Bragg Gaming Group which is a B2B, SaaS business models, and provides the proverbial pick-and-shovel play to players in the industry.

Bragg’s real comparables are companies like GAN, IGT, and Scientific Games—all of which have partnerships with Bragg’s subsidiary Wild Streak Gaming.

IGT is a global leader in gaming, with compelling content, substantial investment in innovation, player insights, operational expertise, and leading-edge technology.

But IGT has a lot of infrastructure costs for the hardware it deploys to brick-and-mortar casinos, while Bragg Gaming Group brings a cost-efficient platform through online solutions.

Bragg’s platform allows their clients to get started quite quickly, with turnkey solutions in the digital realm that can be initiated without physical delivery to a brick-and-mortar location. This allows for easier rollouts around the world.

Proprietary and Premium Content

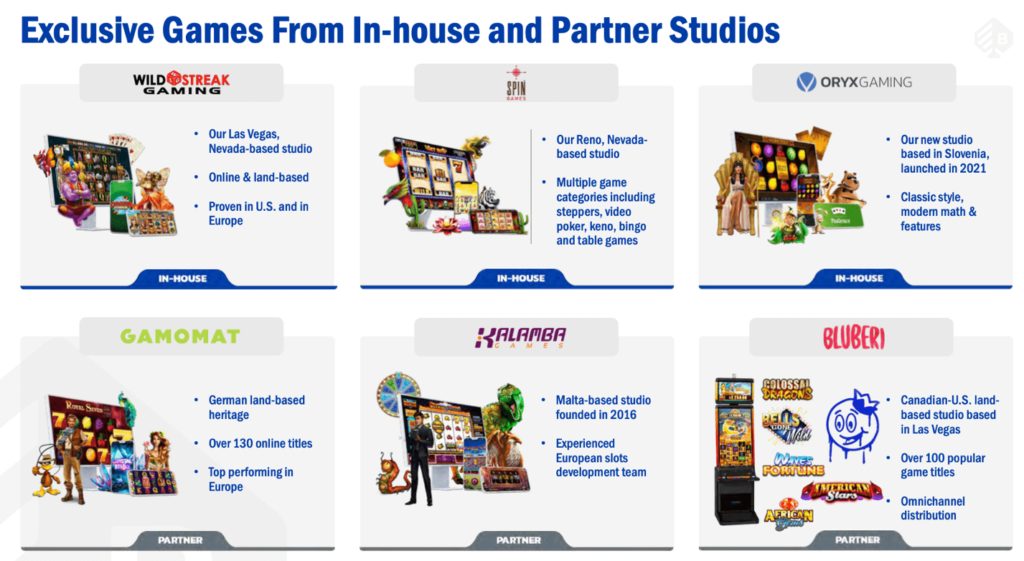

On its platform, Bragg Gaming Group (TSX:BRAGTSX:BRAG) has 13k-14k games, many from in-house and partner studios.

This emphasizes the importance of having fresh, new premium, proprietary content that keeps users engaged and coming back.

Clients of Bragg Gaming Group are in the midst of a saturated and competitive iGaming industry. Which means that B2C companies must spend time and resources on marketing and promoting to generate new users.

This is why leaning on Bragg is so beneficial for its clients, as it provides great content—including a new and exciting list of exclusive and proprietary offerings.

But also, Bragg delivers other exclusive features, including its unique-to-market FUZE data-driven player engagement tools.

Not only does Bragg have a massive, and growing, network of premium and proprietary games, it also offers the tools to keep users coming back and remain engaged.

Bragg Gaming Group (TSX:BRAGTSX:BRAG) brings a growing portfolio of company-owned assets, that includes, but not limited to:

- In-House – Wild Streak Gaming, Spin Games, ORYX Gaming

- Partner – Gamomat, Bluberi

- Aggregate – Evolution, Pragmatic

Bragg comes with a fully proprietary tech stack, all built in-house. That means it’s all built from scratch, not legacy.

Just look at how Bragg’s features chalk up against the competition:

Nevada-based Wild Streak Gaming is Bragg’s wholly-owned premium US gaming content studio.

Wild Streak has a popular portfolio of casino games that are offered across land-based and online casino operators in global markets including the US, Europe and the UK.

On deck is the pending closing of the acquisition of Spin Games, which already has a sizable established distribution presence in the US.

Not only did Spin launch one of the first certified RGS products in the US, it is licensed in New Jersey, Pennsylvania, Michigan, Connecticut, and British Columbia, Canada.

Oh, and did we mention that Spin Games is a fully integrated supplier to companies like:

Data-Driven Company with All of the Tools Needed to Help its Clients Succeed

Bragg Gaming Group (TSX:BRAGTSX:BRAG) Player Account Management iGaming Platform (PAM) is the full turnkey solution which includes managed operational and marketing services.

This product-independent PAM allows clients to manage their entire product suite—casino, sportsbook and lottery—with a single account, single wallet, omni-channel and cross-product platform.

The PAM platform provides Bragg Gaming Group’s clients with several tools, including:

- Acquisition and Conversion – through extensive campaign and affiliate management, KYC, Risk Management, and AML.

- Retention – through customer support, content management, VIP management, promotions, and CRM;

- Reactivation – the ability for customer segmentation, churn management, and lifecycle management, for reactivation.

Bragg Gaming Group (TSX:BRAGTSX:BRAG) also delivers data-driven player engagement through its proprietary tool FUZE, which currently has no available equal on the market.

It’s a sophisticated suite of data-driven player engagement tools for iGaming operators from Bragg Gaming Group, designed and developed by its wholly-owned subsidiary, Oryx Gaming.

FUZE helps enhance the player experience, boost online casino operator KPIs, and increase players’ lifetime value (LTV), all from a single platform.

It brings tournaments with realtime leaderboards, quests, free rounds, promo push notifications, mystery jackpots, achievements, and a recommendation engine.16

Prior to FUZE there was limited market access to this type of unique tool set, save for DraftKings.

Another company called Blue Ribbon provided player engagement tools. DraftKings saw the immense value of these tools, and acquired Blue Ribbon (for an undisclosed amount), only to now use these tools exclusively for themselves.17

Win-Win Revenue Sharing Business Model

Bragg Gaming Group (TSX:BRAGTSX:BRAG) revenue-share model incentivizes clients to utilize their tools and help them build as much value/revenue as possible from users.

This win-win business model drove Bragg’s revenue growth projections for Q4 and FY 2021, as well as significantly increased its 2022 projections.

Here are the numbers from company’s recent update:

- Q4 2021 revenue of approximately US $17.6 million and Adjusted EBITDA of approximately US $1.5 million

- Full Year 2021 revenue of approximately US $66.1 million and Adjusted EBITDA of approximately US $8 million

- 2022 Full Year Revenue ranging from US $78-82 million, reflecting 21% year-over-year (YoY) growth and Adjusted EBITDA guidance ranging from US $10.8-12 million, reflecting YoY growth of 43%

What’s also impressive is how the number of unique players using Bragg Gaming Group games and content increased by 14.4% up to 2.1 million.18 19

Licensed, Certified, and PROVEN

Bragg Gaming Group (TSX:BRAGTSX:BRAG) has been consistently growing its presence across the world through establishing partnerships and integrations with some of the world’s biggest gaming companies, through its Wild Streak Gaming, Oryx Gaming, and the newly acquired Spin Games.

Most recently Bragg was granted licenses in the Netherlands20, a supplier license in the UK21, and a license in Greece22, as well as a five-year content licensing agreement with popular Las Vegas-based casino gaming content provider Bluberi.23

Significant Growth Potential

Bragg Gaming Group’s current financials highlight the company’s ability to remain EBITDA-positive.

This streak stretches back all the way to Q1 2019.

Bragg’s incredible growth potential comes thanks to its ever expanding target market, and consistent track record of success in every market it enters.

As online gaming companies grow aggressively and land-based gaming companies look to migrate online, Bragg Gaming Group (TSX:BRAGTSX:BRAG) projects this Total Addressable Market potential is primed for ~12X market growth.

In particular, the company expects its key markets to be:

- Italy, which was valued at $1.6 billion in 202024

- The UK, which was valued at $5.6 billion in 202025

- North America, which is projected to surpass $20 billion by 202626

So far, the move into the UK has been a success.27 By this addition alone, and other markets where Bragg has already applied for licences including the US and Canada, the company expects its global market expansion initiatives to increase its TAM six-fold in 2022 to more than US$18 billion.28

Bragg Gaming Group Has One More HUGE Advantage: An Elite Leadership Team

For a cutting-edge tech sector to succeed, not only is dev talent a major advantage, but also regulatory expertise as well.

This is why Bragg Gaming Group (TSX:BRAGTSX:BRAG) has a BIG competitive advantage. The company not only has extremely talented people working behind the scenes, but it also has the connections and know-how to seamlessly enter new markets.

Bragg’s leadership team includes:

Paul Godfrey – Interim CEO and Chair of the Board: Experienced media veteran, who currently also serves as Executive Chairman of Postmedia Network, a Canadian news media company representing more than 125 brands across multiple print, online, and mobile platforms. Godfrey has previously served as a Councillor, Alderman and Metropolitan Council Chairman in the city of Toronto, as CEO of the Toronto Sun newspaper, CEO of the Toronto Blue Jays Baseball Club, and Chair of the Ontario Lottery and Gaming Corporation.

Ronen Kannor – CFO: Brings over 18 years of experience in variety of financial management roles within the real estate and online gaming sectors. Most recently, Kannor served as Chief Financial Officer at Stride Gaming Plc, an online gaming operator, a position he held from 2014 until 2020. During his tenure, he led the reorganization and the initial public offering (IPO) of the company onto the London Stock exchange (AIM). He was also involved in numerous M&A transactions and was pivotal in the eventual sale of the business to Rank PLC.

Yaniv Spielberg – CSO: Lawyer and co-founder of a number of tech-focused businesses. In 2018, Spielberg was a part of the team that completed the RTO to establish Bragg Gaming Group. Prior to his role at Bragg, he was a founding member of Legacy Eight Group, a private equity fund focused on acquiring and operating global online gaming companies.

Lara Falzon – COO: Ms. Falzon brings significant gaming industry expertise to her new role. Ms. Falzon previously served as Operational CFO of NetEnt and CFO at Red Tiger Gaming. As CFO of casino software provider Red Tiger Gaming, she navigated its sale to NetEnt AB for over US$315 million. She also played an integral role in the sale of NetEnt to the world’s leading live casino company, Evolution Gaming (now Evolution), for US$2.1 billion. She also served as Group CFO at Evoke Gaming Ltd. and Group Financial Controller at King, creator of the Candy Crush franchise. Ms. Falzon is a member of the Association of Chartered Accountants.

Doug Fallon – Director of Content: Doug Fallon joined as Group Director of Content when in June 2021 Bragg acquired Wild Streak Gaming, a premium slots studio founded by Doug in 2015. With over 20 years’ experience in the gaming industry, Doug’s background includes over ten years’ experience at Aristocrat Technologies including in global marketing as VP Global Games Marketing, in game design as VP Creative Direction and in product design and management as VP Global Core Games

- EBITDA-Positive Gaming Stock: BRAG’s revenue-share SaaS model sets it apart as a B2B provider from B2C competitors.

- Multiple Revenue Streams: Game development, turnkey iGaming solution, premium games studies, content aggregation and more provide diverse revenue streams.

- Proprietary Content: BRAG’s lineup of in-house, partner and aggregated content totals 13k-14k games.

- Quality Partnerships: Turkey solutions let partners focus on acquiring and retaining players. A win-win for everyone!

- Global Presence: BRAG’s operations extend across Europe, North America, and Latin America, with further expansion planned for the future.

- Potential in a Huge Market: Expansion is a focus in new and proven markets, in a Total Addressable Market (TAM) potential of ~12x growth through to 2025.

- Unrivalled Leadership: BRAG’s management team has experience and deep connection in media, gaming, and tech.

1 https://www.techguide.com.au/news/internet-news/why-us-gambling-giants-are-moving-online/

2 https://toronto.ctvnews.ca/pandemic-leads-to-increase-in-online-gambling-credit-counsellors-say-1.5649580

3 https://www.globenewswire.com/news-release/2021/04/19/2212384/28124/en/Global-97-69-Billion-Online-Gambling-Market-to-2025-Increasing-Investment-in-Software-and-Technology-and-the-Use-of-Cryptocurrencies.html

4 https://www.washingtonpost.com/business/2021/12/31/gambling-record-pandemic/

5 https://dl.mvp.ringcentral.com/company/23817764865/file/1581899325450?stored_file_id=4459992735756

6 https://www.actionnetwork.com/legal-online-sports-betting/draftkings-reports-increased-revenue-marketing-2020-earnings

7 https://draftkings.gcs-web.com/static-files/ed26e1f8-dc9c-461b-b91b-f12d4b10e54f

8 https://investors.skillz.com/financials/quarterly-results/default.aspx

9 https://www.fool.com/investing/2021/11/08/skillz-spends-aggressively-on-marketing-in-q3/

10 https://www.forbes.com/sites/willyakowicz/2022/01/06/caesars-draftkings-fanduel-to-run-new-yorks-1-billion-mobile-sports-betting-market/

11 https://frontofficesports.com/sports-betting-companies-spending-billions-on-u-s-market/

12 https://investorplace.com/2021/12/dkng-stock-is-weak-from-losses-dilution-fears/

13 https://www.law360.com/articles/1452065/golden-nugget-stockholders-sue-for-docs-on-1-56b-merger

14 https://www.forbes.com/sites/greatspeculations/2022/01/10/speculating-on-mgm-resorts-this-stock-could-provide-better-gains/

15 https://finance.yahoo.com/news/igt-signs-multi-agreement-wwe-213100239.html

16 https://oryxgaming.com/fuze-player-engagement/recommendation-engine/

17 https://www.draftkings.com/about/news/2021/04/draftkings-acquires-blueribbon-tel-aviv-based-leading-global-jackpot-and-gamification-company/

18 https://www.bragg.games/press-releases-1/2021/11/8/bragg-gaming-group-2021-third-quarter-revenue-rises-99

19 Bragg Gaming Group Investor Presentation, Slide 12

20 https://www.bragg.games/press-releases-1/2021/11/26/oryx-igaming-platform-launches-newly-licensed-jacksnl-in-the-netherlands

21 https://www.bragg.games/press-releases-1/2021/11/22/bragg-gaming-groups-oryx-gaming-receives-landmark-uk-supplier-license

22 https://www.bragg.games/press-releases-1/2021/8/9/oryx-gaming-awarded-license-in-greece

23 https://www.bragg.games/press-releases-1/2021/11/8/bragg-secures-exclusive-five-year-content-licensing-agreement-with-bluberi

24 Bragg Gaming Group Investor Presentation, Slide 11

25 Bragg Gaming Group Investor Presentation, Slide 11

26 https://www.globenewswire.com/news-release/2021/12/01/2343869/0/en/Online-Gambling-Market-Size-Share-North-America-Europe-APAC-Industry-Forecasts-2026-Graphical-Research.html

27 https://www.bragg.games/press-releases-1/2021/11/22/bragg-gaming-groups-oryx-gaming-receives-landmark-uk-supplier-license

28 Bragg Gaming Group Investor Presentation, Slide 11

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Bragg Gaming Group

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Bragg Gaming Group and has no information concerning share ownership by others of any profiled Bragg Gaming Group The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Bragg Gaming Group or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Bragg Gaming Group Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Bragg Gaming Group ’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Bragg Gaming Group future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Bragg Gaming Group industry; (b) market opportunity; (c) Bragg Gaming Group business plans and strategies; (d) services that Bragg Gaming Group intends to offer; (e) Bragg Gaming Group milestone projections and targets; (f) Bragg Gaming Group expectations regarding receipt of approval for regulatory applications; (g) Bragg Gaming Group intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Bragg Gaming Group expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Bragg Gaming Group business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Bragg Gaming Group ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Bragg Gaming Group ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Bragg Gaming Group ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Bragg Gaming Group to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Bragg Gaming Group operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Bragg Gaming Group business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Bragg Gaming Group business operations (e) Bragg Gaming Group may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Bragg Gaming Group or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Bragg Gaming Group or such entities and are not necessarily indicative of future performance of Bragg Gaming Group or such entities.