…and it could be about to happen to a little-known company named Discover Wellness Solutions (WLNS:CSE)

- It happened to Aurora Cannabis (ACB:NYSE) – in only two years, the company multiplied revenues to over $50 million… and shares shot from under $5 all the way to $150, a 3,400% increase.

- It happened to Aphria (APHA:NASD) – in twenty-four months sales grew to $37 million… and the stock soared from under a buck to over $17, for a 2,000+% increase.

- And it happened to Cronos Group (CRON:NASD) – in less than three years, revenues rose from zero to $17 million… and investors could have seen their investments multiply 86-fold.

You’re about to find out…

You see, as we speak Discover Wellness is putting the finishing touches on a brand new, industrial-scale CBD extraction facility.

As soon as renovations are complete, WLNS will be able to immediately start mass producing large quantities of highly lucrative CBD concentrate.

In fact, this year the company expects to produce over 19,000 pounds of it.

At today’s prices, that could generate $34 million dollars of revenue – instantly transforming Discover Wellness Solutions (WLNS:CSE) into one of the largest CBD companies in North America… and igniting a major growth surge.

And that’s why this opportunity is exciting…

You see, investors who made the biggest profits on Aurora, Aphria, and Cronos had one thing in common:

- THEY GOT IN EARLY– before sales shot higher… before the companies started generating tens of millions of dollars.

- THEY GOT IN EARLY– before sales shot higher… before the companies started generating tens of millions of dollars.

It's called the "investing sweet spot”. And just like those companies…

But that’s not all…

Discover Wellness is positioned for major long-term growth as well. That’s because the Company’s property is easily scalable.

In fact, it has the potential to expand 4-fold – to over 100,000 square feet.

At that size, WLNS will be capable of producing more than 100,000 pounds of CBD concentrate a year… a potential windfall worth over $150 million.

What would that do for Discover Wellness?

To put it in perspective…

- When Aphria (APHA:NASD) first hit $150 million the company was worth $2.2 billion.

- When Aurora Cannabis (ACB:NYSE) hit that mark, investors valued it at a mind-boggling $17.1 billion.

- And when Canopy Growth (CGC:NASD) cracked $150 million in revenue in 2019, the stock traded for over $30 a share.

This is one of those rare opportunities to get in right at the sweet spot before growth starts to surge.

Now, “sweet spot investing” isn’t for everyone – it involves risk.

But if you’re a savvy investor who’s looking for the type of opportunity that has major growth potential (like those who cashed-in on CRON, APHA, and ACB), here are seven reasons to consider WLNS…

1)

- As we speak, Discover Wellness is putting the finishing touches on a 23,400 square foot CBD extraction facility. In fact, renovations to repurpose the fully-licensed area of the facility are expected to be complete in the next few weeks.

2)

- Once completed, the facility will be able to process over 1 million pounds of hemp per year… making it one of the largest CBD extraction operations in western Canada

3)

- Discover Wellness (WLNS:CSE) has received delivery and is sitting on 550,000 pounds of high-CBD hemp that is ready to process as soon as its facility is complete. This means the company will start ramping-up extraction operations and generating revenue in the coming weeks

4)

- Discover Wellness (WLNS:CSE) is built from the ground-up for rapid growth and scalability. Its 7.4-acre property and facility is scalable to over 100,000 square feet – 4-fold growth potential. At maximum capacity, the facility will be able to produce more than 100,000 pounds of CBD concentrate annually which, at today’s prices, could generate over $150 million of revenue.

5)

- WLNS is partnered with leading plant genetics and cultivation firm SynerGenetics Biosciences. SynerGenetics specializes in the development of high-CBD (15%+), low-THC (<0.3%) strains. That means these strains provide higher yield per pound of hemp compared to others and WLNS has exclusive rights to them.

6)

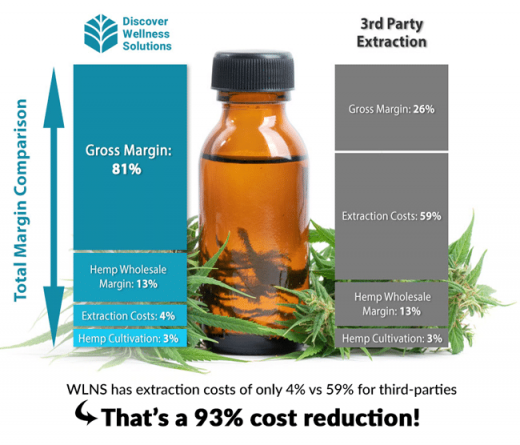

- Discover Wellness is focused on becoming the lowest cost producer of CBD concentrate in the industry. The company is vertically integrated from seed to sale, enabling the company to cut costs by up to 93% and increase margins 3-fold. This will position the company for long-term growth and to capture market share from competitors.

7)

- Discover Wellness just secured its first major international distribution deal in one of the most populous Asian countries: Thailand. It's hoping to secure a major foothold early-on in the newly emerging CBD industry which just got approval from the Thai government for mass market consumption.

8)

- With its industrial-scale facility about to be completed – and 550,000 pounds of hemp ready to process – WLNS is on the verge of a major growth surge.

- Based on processing only half the current inventory of hemp, the company could generate over $34 million of revenue this year. If it happens, it would immediately propel WLNS into one of the top revenue generators in the industry.

Few investors realize it, but Discover Wellness is quietly positioning itself to be a powerhouse in the CBD concentrate industry.

You see, the biggest bottleneck in the global CBD supply chain is the extraction process.

In order to produce anything with CBD, the chemical compound must first be isolated and extracted from hemp plants that have been harvested from farms.

This requires industrial scale processing facilities, state-of-the-art extraction technologies, and the extensive use of chemical solvents.

Of course, because the most critical factor is consumer health and safety, the entire process has become heavily regulated.

In fact, between getting the required legal licenses and adhering to different building codes, equipment specs, occupational health and safety standards, good manufacturing practices (GMP), and ISO Standards – compliance for CBD extraction facilities has become one of the biggest roadblocks for companies to get their products to market.

Plus, it’s expensive.

If a plant isn’t built from the ground-up for scalability and cost-effectiveness, a company can quickly be buried by low prices.

This is exactly what’s happening right now to some of the biggest players in the industry…

CBD-focused companies like Charlotte’s Web Holdings and cbdMD (NYSEAmerican:YCBD) are suffering major losses because of high-cost operations…

- Charlotte's Web Holdings (CWBHF:OTC): had an operating loss of $39.8 million last year…

- cbdMD (YCBD:AMEX): saw an operating loss of $11.4 million.

And while these majors are trapped in a death spiral of cascading losses…

You see, Discover Wellness’ (WLNS:CSE) brand new facility is designed from the ground-up to be one of the lowest-cost producers of CBD concentrate in the industry.

And when a company can produce the same product (or a better one) at a lower cost…

It can snatch-up market share and become a dominant player in the industry.

In fact, having lower costs is the secret sauce some of the most successful companies in history use.

- Walmart: became the largest brick & mortar retailer in the world because it was able to achieve costs below its competitors and that translated into cheaper prices for customers.

- Amazon: is now worth over $1.5 trillion dollars because its lower-cost distribution network enables them to sell and ship goods cheaper and faster than anyone else.

- Saudi Aramco, the monopoly oil producer in Saudi Arabia, has the lowest oil extraction costs in the world and dominates global supply chain. As a result, it can flood the market with cheap oil and single-handedly alter the price of crude to crush its competition.

- And Coca Cola: while its recipe is often thought as the key to Coke’s success, its global empire was actually achieved through lower costs, massive economies of scale, and being able to price their product lower than others.

As we speak, Discover Wellness is putting the finishing touches on one of the largest CBD extraction operations in Western Canada.

Their team of engineers are fine-tuning the plant for efficiency and are deploying the latest equipment that will enable the company to cut costs drastically.

In fact, WLNS’ new facility is projected to reduce extraction costs by a whopping 93%.

- This kind of competitive advantage is exactly what could help WLNS become a dominant player in the CBD industry.

Of course, having a plant is only half the battle. You still need large quantities of hemp to process.

To secure a steady supply, Discover Wellness went out and forged a partnership with leading plant genetics and cultivation firm SynerGenetics Biosciences.

SynerGenetics has the ability to cultivate over 2 million pounds of hemp annually – so there is little worry about supply as Discover Wellness scales operations.

- What’s better, SynerGenetics specializes in the development of their own proprietary high-CBD, low-THC hemp strains.

There are hundreds of different strains of hemp in the market today. And just like how some apple trees produce more apples than others, some hemp strains produce more CBD.

And CBD levels play a critical role in a successful extraction operation.

You see, a higher CBD percentage means a higher yield per pound of hemp. And a higher yield per pound means more CBD concentrate to sell. This can have a dramatic impact on profits.

- Let me repeat: Discover Wellness is the only company in the world with access to these highly-specialized strains.

CBD concentrate is like liquid gold. In its purest form, it can sell for more than marijuana – upwards of $1,800 a pound.

And demand for it is skyrocketing…

CBD sales in the U.S. are forecast to multiply 8-times over by 2025 and hit $20.5 billion– up from $2.7 billion in 2019. What’s more, the growth in the CBD market is expected to outpace the marijuana industry more than three-fold over the next four years.

Why? Because more countries across the globe are embracing CBD over marijuana. Just in the past few years:

- The U.S. passed the 2018 Farm Bill legalizing CBD across the nation – making it accessible to 328 million people.

- The U.K. passed CBD-friendly laws – that’s another 67 million people…

- Mexico also went pro-CBD – 128 million people there…

- Canada legalized recreational use of all kinds of cannabis, CBD included – 37 million more people…

- Last year, South Africa rescheduled CBD use – 59 million people…

- And just three months ago, the European Union’s highest court ruled that CBD is not a narcotic drug… potentially opening the doors for CBD products to reach 445 million European Union residents.

That’s over 1 BILLION people with potential access to CBD today. Meanwhile only four nations have fully legalized marijuana.

And as the tidal wave of countries passing CBD friendly laws grows, the potential market size for companies like Discover Wellness (WLNS:CSE) expands exponentially.

In fact, economic analysis firm Research and Markets expects the CBD industry to be worth $123.2 billion worldwide by 2027.

Discover Wellness also just secured its first major international distribution deal.

In fact, the company is hoping to secure a strong foothold in one of the most populous Asian countries: Thailand.

Thailand is home to more than 69 million people and just a few weeks ago, passed new laws permitting the sale of low-THC CBD product to the public.

Thailand is home to more than 69 million people and just a few weeks ago, passed new laws permitting the sale of low-THC CBD product to the public.

Thailand is one of the first Asian countries in the world to legalize CBD products as a consumer product. That means you will soon see CBD in all kinds of food and beverages, and on retail shelves.

Discover Wellness is jumping on the opportunity, hoping to capture market share with a first-mover advantage. The company has connected with a local group that has deep ties into the Thai business, education, government and agricultural sectors.

The first phase of this business relationship involves proprietary high-CBD industrial hemp seeds. That is meant to be a stepping stone to development and involvement in higher margin CBD consumer products.

Discover Wellness also just secured its first major international distribution deal.

In fat, the company is hoping to secure a strong foothold in one of the most populous Asian countries: Thailand.

Thailand is home to more than 69 million people and just a few weeks ago, passed new laws permitting the sale of low-THC CBD product to the public.

Thailand is one of the first Asian countries in the world to legalize CBD products as a consumer product. That means you will soon see CBD in all kinds of food and beverages, and on retail shelves.

Discover Wellness is jumping on the opportunity, hoping to capture market share with a first-mover advantage. The company has connected with a local group that has deep ties into the Thai business, education, government and agricultural sectors.

The first phase of this business relationship involves proprietary high-CBD industrial hemp seeds. That is meant to be a stepping stone to development and involvement in higher margin CBD consumer products.

Let me break this down for you…

- Discover Wellness is about to complete construction of an industrial-scale CBD extraction facility…

- It’s loaded with an inventory of half a million pounds of high-CBD hemp ready to process…

- It just signed its first major international distribution agreement...

- And it could start pumping out tens of thousands of pounds of CBD concentrate – that could generate millions of dollars in revenue – in the coming months.

Folks, this is the “sweet spot” we’ve been looking for.

It’s a chance to position yourself early, right before growth kicks into high gear.

Plus, WLNS has a major partnership with a leading hemp and cultivation firm.

The partnership locks-down a steady supply of future hemp to rapidly scale growth AND gives the company exclusive access to some of the highest CBD-THC ratio strains in the industry.

And don’t forget about Discover Wellness’ extraction cost advantage…

Its low-cost operation could propel it to become the dominant player in a red-hot industry and sustain long-term growth.

You may have missed out on Aurora, Aphria, and Cronos…

Take a look a Discover Wellness Solutions (WLNS:CSE).

-

Or Contact Terry from Investor Relations at

1-888-228-5128

SHARE OWNERSHIP. The Publisher does not own any interest in Discover Wellness Solutions or its securities and does not have any right orintent to acquire such an interest. Stock ownership is an additional reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor ora registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the companies’ technology, the success of the companies’ drilling excursions, the size and growth of the market for the companies’ products and services, the companies’ ability to fund their capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASEOF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY. ARUGlobalInc.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.