Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) is riding the copper price momentum and it could quite possibly have the best project in the best mining jurisdiction in Canada

Ever been to Pamplona for the running of the bulls? Maybe you’ve seen a crazy video of it.

Each year in the second week of July, six bulls are released every day into the narrow streets of Pamplona and several hundred people set off after them, scrambling chaotically for half a mile as crowds watch from the safety of balconies.

If you’ve ever seen a video, you know that these bulls are unstoppable.

They move forward like a tidal wave pushing, stomping, and throwing everything out of the way.

Well right now, copper is the running bull that no one can stop.

And it is already creating some serious wins in the sector.

One of the top-performing copper stocks this year, Oroco Resource, is up 61% year-to-date, from C$1.81 on January 4 to C$2.92 on October 25.

This jump comes after another serious bull run in 2020, when Oroco reported an estimated resource of 822 million tonnes at its Santo Tomas project in Mexico. Investors saw it go from just C$0.50 on January 6, 2020, to C$1.85 on December 28, 2020.

That’s a 270% gain – for those who invested.

Another big winner is Taseko Mines…

After winning the rights to mine its Florence project in Arizona in March 2021,1 Taseko has continued pushing towards production.2 And thanks to elevated copper prices and attractive economics, the stock has been on a rocket ride higher ever since.

The twelve-month return from October 26, 2020 to October 25 2021 is 137% rising from C$1.23 to C$2.92 in just one year.

But that’s nothing compared to Foran Mining Corp. which went from C$0.27 on October 27, 2020, to C$2.30 a year later on October 27, 2021.

That’s 751%. In a single 12-month period.

Why are these stocks, and Foran Mining gaining so much, so fast? The company has boosted its resources estimates, has created plans for it to be a global carbon-neutral mining company, and Fairfax Financial Holdings made a huge C$100 million private placement!

It’s tough to miss out on these gains and see them after the fact.

Thankfully we’ve managed to find the next hidden gem in Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) a Canadian resource development company focused on developing and expanding the Kutcho high-grade copper-zinc project in Northern British Columbia.

Thankfully we’ve managed to find the next hidden gem in Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) a Canadian resource development company focused on developing and expanding the Kutcho high-grade copper-zinc project in Northern British Columbia.

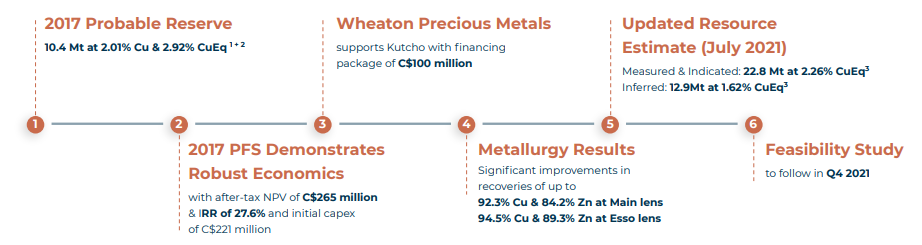

This project has institutional investors like Wheaton Precious Metals putting together a $100 million financing package for Kutcho Copper.

Why? Production is on the way.3

This is the new project we were talking about that the market needs.

Mining companies always see their biggest growth right around the time of bringing production online as they begin to generate revenue.

The Kutcho Project is right at the precipice of that moment.

Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) is racing toward a feasibility study in Q4 2021 that investors will be watching closely.

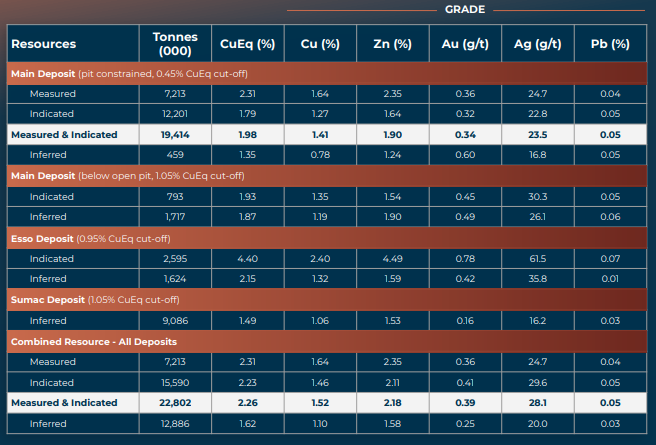

On top of that, they had to update its mineral resource – this is turning out to be bigger than planned. The updated mineral resource in the Measured and Indicated category totals 22.8 million tonnes averaging 1.52% copper and 2.18% zinc (2.26% CuEq) representing over 1.1 billion pounds of copper equivalent contained metal comprising 765 million pounds of contained copper, 1.1 billion pounds of contained zinc, 288 koz of contained gold, and 20.6 Moz of contained silver.

This is the moment.

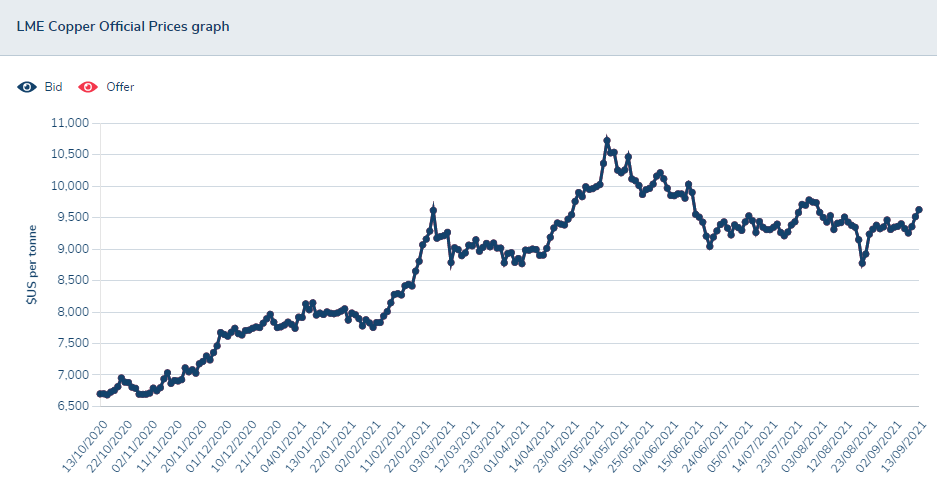

Goldman Sachs made a super-bull call of $11,000 per metric tonne of copper in the next 12 months,4 which isn’t much higher than its October 15 record high of $10,518 per tonne on the Comex market.5

Meanwhile, Bank of America Commodity Strategist Michael Widmer is predicting the price could hit $20,000 per metric ton by 2025.6

There’s no disagreement when it comes to copper, prices are going to keep going up.

So what gives?

Well, only two major copper mines entered production in the last four years. CV-19 shut down production in most of the world. And everything hitting the market is being bought up instantly.

The Kutcho Project is on the precipice of the most important moment in the company’s work so far.

This is the move from development to production that everyone has been waiting for.

5 Reasons Kutcho Copper (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) Could Be the Canadian Copper Play of the Year

Reason #1: The Fast-Track for Development

Kutcho Copper has a clearly defined path to develop its 100%-owned copper-zinc project, with the next step of feasibility results coming up very soon.

The key to a strong mining project is a clearly defined path to production or to sell the project.

Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) is developing the Kutcho project, which is owned 100% by the company, and is eyeing permission applications by 2022, so it can move as fast as possible.

More imminently are the soon-expected results from the ongoing feasibility study.

President and CEO Vince Sorace commented on October 12 that the study is moving quickly, and it is anticipated to be completed in approximately three weeks. In other words, we are just a few weeks away from a serious catalyst for Kutcho. [1]

The completion of the feasibility study will launch the company into the permitting process for the project. Again in this area, Kutcho has thought of it all.

The company has strong open dialogues with First Nations.

Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) has already begun negotiating the economic participation agreements with the Tahltan Nation, one of the biggest in British Columbia, and a particularly mining-savvy Nation.

Current mine life is about 12 years. That’s a significant mine life in the copper space, and Kutcho Copper will have a comfortable run even with that long. However, Kutcho isn’t satisfied with ‘comfortable’.

The company is also planning for a near-mine expansion program. The goal of an expansion program is to expand the resource and extend the mine life beyond the initially estimated 12-years.

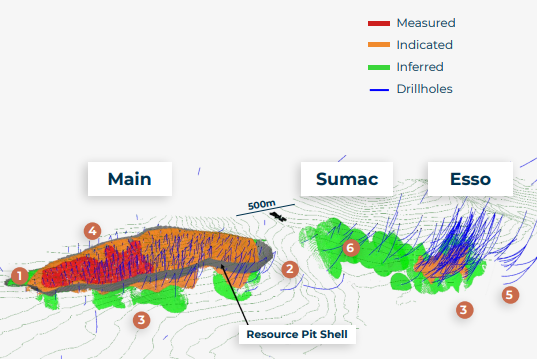

The near-mine expansion program will likely begin with around the Main and Sumac lenses first, with potential expansion available at each target to connect the sites and fill in the middle zones through new mapping and geological surveys.

This is all possible and made simple since the Kutcho Project is a very accessible project with on-site and nearby infrastructure within subtle terrain. Barriers to development and production are low to non-existent for this project. There is already 100 km of existing ground access. Plus, there’s an airstrip on the property.

In nearby Stewart, BC, there are port facilities about 400 km from Dease Lake via Highway 37. Not many countries provide a better environment for mining than Canada.

Think about this – Canada has the second-largest landmass in the world. For mining, you need land. This is a country that is playing a pivotal role in the global mining economy, providing the biggest and most economically viable opportunities for miners through its vast, connected, and well-developed land.

This is the ideal place for the Kutcho Project.

Reason #2 - Copper Price and Stocks are Outperforming

There is no stopping copper prices and copper stocks at this point. The cat is out of the bag.

It’s the metal that has the best conductivity.

Analysts keep raising targets, companies keep demanding more, and new economically viable mines are extremely rare.

Everything from home appliances, mobile phones, vehicles and computers use copper.

Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) is mining for a metal that is required – not wanted – for serious infrastructure proposals like President Joe Biden’s Infrastructure Spending Bill.

Bills like those around the world paired with initiatives mean that electrification is coming for every part of the economy. Our roads, streetlights, charging stations, and everything else cities, states, and countries need to run, will be run on electricity.

It’s no wonder Bank of America is saying copper is the new oil and predicting prices to skyrocket to $20,000 per tonne by 2025.8

Every copper miner is on fire right now, but Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) presents the best value because of its imminent feasibility study report in Q4 2021. We already know when the next catalyst for Kutcho will be, no need to guess.

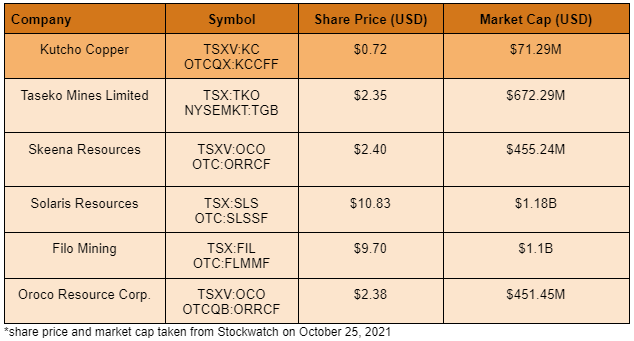

Take a look at just how undervalued this soon-to-be producing company compares to its peers:

That leaves the potential for growth for Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) sky high.

Construction and infrastructure already uses roughly 40% of all copper. Imagine what that share might be if the Infrastructure bill passes and funding starts pouring into the development of cities around North America.

That’s a lot of copper.

Copper prices keep moving higher every week because of one fundamental issue: there simply isn’t enough supply to fill the demand.

New projects like Kutcho’s are a diamond in the rough, and its twelve-year mine life gives it plenty of runway to keep operating beyond that timeline if possible.

Reason #3: Financial Strength

Kutcho Copper is fully funded and is well-connected thanks to management of capital markets for easy access to the connections and capital required.

Wheaton Precious metals is one of the largest precious metal companies in the world – and they are providing a total financing package exceeding C$100 million for Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF).

That includes the non-binding Term Sheet for a C$20 million secured convertible term debt loan, plus C$4 million in equity financing which allowed the company to acquire the Kutcho Project from Capstone Mining Corp.

This large financing package funded that acquisition and will pay for the exploration and development of the Kutcho copper-zinc-silver-gold project.

Some other highlights from this incredible deal include:

- US$7 million advanced on an early deposit basis under the precious metals purchase agreement (PMPA) to fund completion of the feasibility study and permitting-related expenditures on the Kutcho Project.

- US$58 million advanced as part of the PMPA towards funding the construction of the Kutcho Project.

Wheaton saw the potential economics of the project were huge and made an investment to match.

Reason #4 - Mineral Resource Estimate Keeps Getting Bigger

The Kutcho Project keeps delivering pleasant surprises at every turn. The company notes that this project in particular has incredible expansion potential. While the current numbers read big – and they are – this could just be the base that Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) will build on.

The key for the Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) projects are the multiple VMS sulphide horizons.

Additional Benefits of the project’s mineral resource and near mine target summary as it stands right now include:

- Open Pit Shell: 459,000 tonnes Main deposit Inferred Mineral resources resides within the current open pit shell and are available for potential conversion into the Measured and Indicated Mineral resource categories

- The Main-Sumac Gap: identifies a 400 m by 380m panel between Main and Sumac that is untested by drilling

- Open Down Dip: 36% of Main and 50% of Esso are open down dip and outside of the current resource model

- FWZ Expansion: lies beneath Main and is open in all directions. Drill hole E057, on its eastern margin, intersected 1.5 m of 3.54% Cu, 6.94% Zn, 316.9 g/t Ag and 1.47 g/t Au

- Esso-West Expansion: target lies 300 m west of Esso where drilling returned 7.2 m of 2.0% Cu, 5.2% Zn and ~17 g/t Ag in hole E094B3

- Sumac: The entire Inferred Mineral resource at the Sumac deposit, consisting of 9,086,000 tonnes is available for potential resource expansion and resource conversion from the Inferred to Measured and Indicated resource categories

The open-pit with the Main deposit has been a focus for Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) with the Main-Sumac Gap presenting a 400m by 380 m panel between Main and Sumac that is untested by drilling.

So what this means is that there is a huge opportunity to expand the open pit to the unexplored areas of this site. That could double or triple the project’s scope if it goes well.

Double or triple would also be a great return as the stock could begin to reflect that higher potential for the project.

REASON #5 - Experienced Management Management Team

Vince Sorace – 30+ years experience in business and capital markets, raised over $250M in equity & debt financings. Prior roles include Founder, President & CEO of various private and public resource companies. As the Founder, President, and CEO of private and public resource companies, Mr. Sorace understands the industry and capital markets better than anyone else. Kutcho has been able to finance the Kutcho Project acquisition and development with the help of Wheaton.

Rob Duncan – 26 years experience in mineral exploration for majors including Rio Tinto & Inmet and extensive technical background in VMS systems including Kudz Ze Kayah & Wolverine in Yukon’s Finlayson District. Mr. Duncan brings the kind of exploration expertise Kutcho needs to maximize the economics of the Kutcho Project.

Stephen Quin – 30 years experience in mining & corporate affairs, former President, CEO & Director of Midas Gold, President & CEO of Sherwood Copper and President & COO of Capstone Mining.

Bill Bennett – Former BC MLA

Cherie Leeden – Local Director of Hog Ranch Minerals Inc. for ASX listed Rex Minerals Ltd which is advancing a 1.4 million ounce gold project in Nevada and is CEO of Gold Bull Resources Corp (TSX:GBRC).

Kutcho Copper Corp. (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF) has multiple executive-level leaders on its team that include CEOs of gold, copper, and other resource companies.

To have so many highly-skilled industry operators at one company? Unheard of.

It can be difficult to find the right mining stocks when so many companies are filled with promise but no execution plan.

Kutcho Copper has EVERYTHING all in one company, and investors aren’t waiting to see if hopes and dreams materialize. The company’s short timeline to the feasibility study results (Q4 2021) , and highly prospective economic potential.

The math adds up, the timer is almost finished, and this project is consistently more exciting with every passing week.

Want to get an inside look at Kutcho Copper and where is it headed next?

RECAP: 5 Reasons Why Kutcho Copper Impresses Us (TSXV:KC, OTCQX:KCCFFTSXV:KC, OTCQX:KCCFF)

- Development Track: Kutcho Copper has a clearly defined path to develop its 100%-owned copper-zinc project, with the next step of feasibility results coming up very soon.

- Copper Prices Continue to Climb: Green tech demand and economic recoveries are pushing copper prices through the roof. No one knows exactly how high it could go anymore, as expectations keep getting blown away.

- Mineral Resource: The Kutcho Project is still expanding in scope as the company realizes that there is so much more potential than initially thought. Every stage of the drill campaign proves that.

- Financial Stability: One of the world’s largest precious metals companies – Wheaton Precious Metals – has set Kutcho Copper up with a $100 million financing package to cover EVERY bill.

- Impressive Management Team: Led by Vince Sorace, Rob Duncan and Steven Quinn, this team has proven that they have the Midas touch.

1 https://www.mining.com/taseko-wins-court-battle-over-florence-project-shares-up/

2 https://www.tasekomines.com/investors/news-releases/taseko-mines-reports-improving-production-at-gibraltar-mine-and-provides-florence-project-update

3 https://kutcho.ca/news/2017/desert-star-announces-20-million-convertible-term-debt-loan-with-wheaton-precious-metals-increases-total-financing-package-to-c100-million/

4 https://www.cnbc.com/2021/04/14/goldman-says-copper-is-the-new-oil-raises-price-forecast.html

5 https://www.mining.com/copper-price-hits-new-high-on-low-inventories/

6 https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

7 https://www.globenewswire.com/news-release/2021/10/12/2312438/0/en/Kutcho-Copper-Nears-Completion-of-the-Feasibility-Study-on-its-High-Grade-Copper-Zinc-Project.html

8 https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Kutcho Copper Corp. .

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Kutcho Copper Corp. and has no information concerning share ownership by others of any profiled Kutcho Copper Corp.. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Kutcho Copper Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Kutcho Copper Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Kutcho Copper Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Kutcho Copper Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Kutcho Copper Corp. industry; (b) market opportunity; (c) Kutcho Copper Corp. business plans and strategies; (d) services that Kutcho Copper Corp. intends to offer; (e) Kutcho Copper Corp. milestone projections and targets; (f) Kutcho Copper Corp. expectations regarding receipt of approval for regulatory applications; (g) Kutcho Copper Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Kutcho Copper Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Kutcho Copper Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Kutcho Copper Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Kutcho Copper Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Kutcho Copper Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Kutcho Copper Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Kutcho Copper Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Kutcho Copper Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Kutcho Copper Corp. business operations (e) Kutcho Copper Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Kutcho Copper Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Kutcho Copper Corp. or such entities and are not necessarily indicative of future performance of Kutcho Copper Corp. or such entities.