There's an old saying in the mining business, "The best place to mine is where they mined before.”

This Could Be The Biggest Mexican Silver Operation To Launch In Years

Editorial Feature | Aug 5, 2022 | Commodities

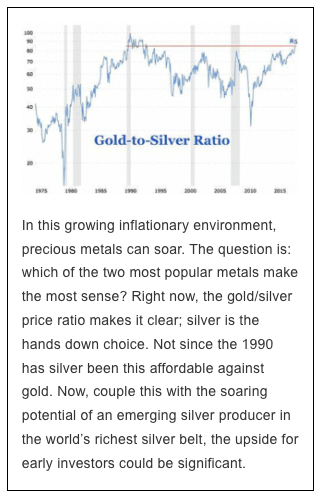

Early shareholders stand to win big as Sierra Madre Gold and Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) embarks on the next key stages that could bring a world-class silver project into production.

If you know Mexican silver mining… it’s clear the opportunity here is enormous.

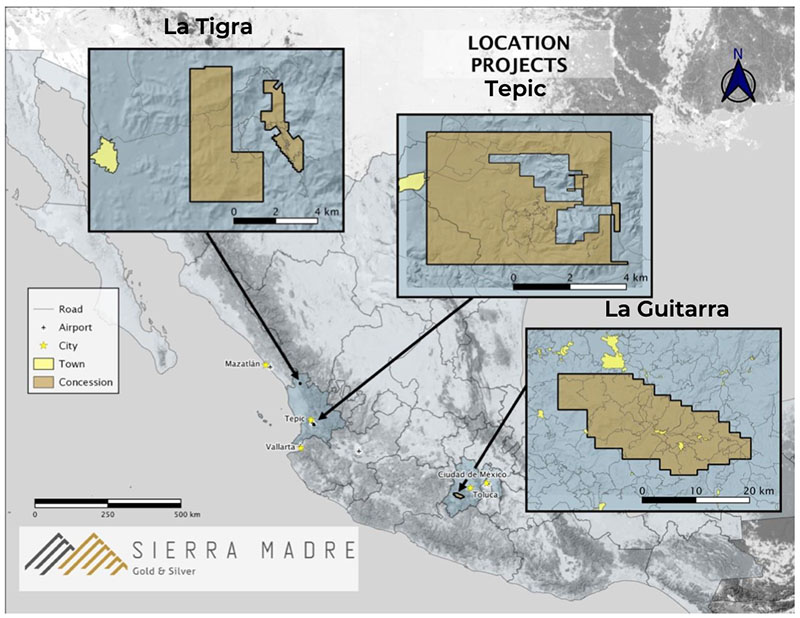

Earlier this year, Sierra Madre Gold and Silver announced acquisition of La Guitarra, one of three major projects they own in Mexico’s most prolific gold and silver belt.

Company management had been waiting for years to move on La Guitarra – more than 14 years to be exact.

Company management had been waiting for years to move on La Guitarra – more than 14 years to be exact.

Earlier this year they finally got their shot.

Now, they’re advancing quickly to put this site on a front burner.

What’s in play here could be transformative, not just for Sierra Madre, but for the company’s shareholders as well. At present, Sierra Madre trades as if it were a junior exploration company developing a long-term project.

Typically, such a timeline could stretch over a number of years.

That’s not the case here. The La Guitarra acquisition advances that timeline dramatically.

With La Guitarra in its portfolio, Sierra Madre now has everything in place to restart production on a silver mine that was revenue-generating through 2018. At that time, mining operations were suspended as the previous owners contemplated the next best steps to move the mine to its full production potential.

Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) ended up being that next step, and for very good reason.

Now, after four years on standby, everything is on site and ready to go, including a 500 ton-per-day ore mill and a tailings site where high concentrations of silver can move to quick production.

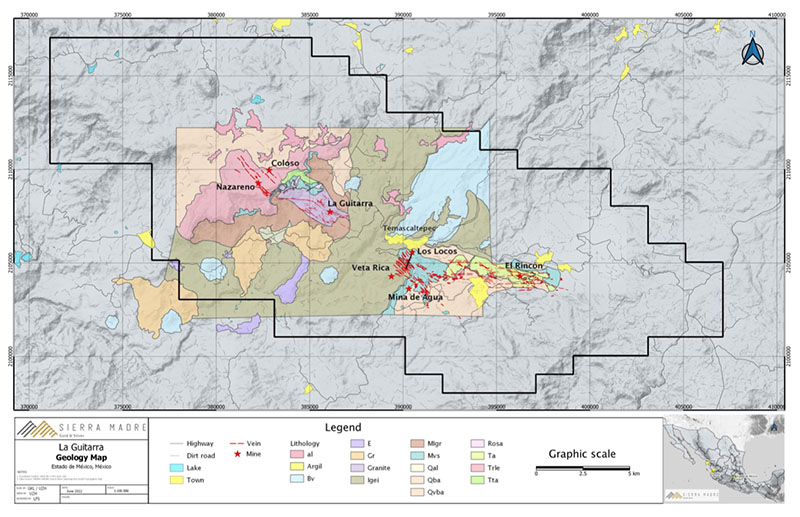

Many experts consider the La Guitarra region to be among the last remaining undeveloped silver prospects in the region. In fact, it may be the biggest.

That’s saying a lot, but it comes as no surprise to Sierra Madre COO, Greg Liller, who’s own history with La Guitarra spans back to the mid 2000s.

A Deal More Than A Decade In The Making

Hollywood script writers couldn’t have penned a more fascinating story of ‘lost and found.’

Greg Liller first began exploration of La Guitarra upon becoming President of Genco Resources. Genco had acquired La Guitarra from Wheaton River in 2004. At that time it was the smallest of Wheaton’s Mexican mines and received no funding for exploration and development.

In 2002, La Guitarra was reported to have produced only 13,400 gold equivalent ounces.

Liller visited Guitarra at Genco’s request in mid 2006. Data available at the time suggested to Liller that a massive unrecognized and undeveloped resource was in play that could be brought to production. Genco thought that with Liller on board, they had the team to do it.1

Things turned sour after a hostile proxy battle for control of the company and Mr. Liller soon had enough. He left the company with the thought that one day he’d be back, just not with Genco.

To his credit, he never took his eye off the prize.

Then in 2012, La Guitarra was acquired by a major producer, First Majestic Silver.

Mining.com reported that from 2016 through 2018, First Majestic operated La Guitarra, producing 4.3 million ounces of silver equivalent.

But the company’s geologists felt that La Guitarra had much greater potential if the right technical and management teams were put in charge. Mining operations were suspended as First Majestic pondered the best approaches for exploiting the undeveloped resources that were anticipated here.

That set the stage for Mr. Liller’s return to La Guitarra.

And it was accomplished with the launch of Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) and their ultimate acquisition of the La Guitarra project.

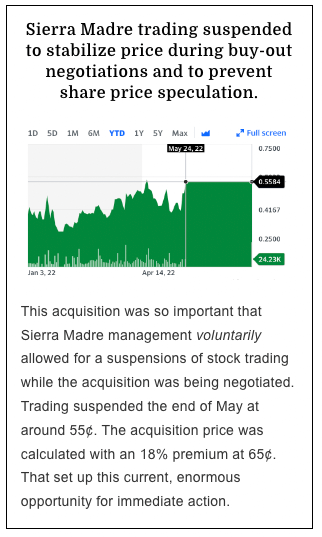

Now, what’s intriguing about this “acquisition” is that First Majestic didn’t exactly remove the project from their portfolio. In fact, the company actually retained just shy of 48% ownership…and they did it with an all-stock deal valued at $35 million.

No cash, just stock in Sierra Madre.

That begs a critical question…

Why would First Majestic “sell” a project, while maintaining such a heavy investment in it?

Simply put, First Majestic saw the mine’s potential with their own eyes and wanted to put a top team on the project.

To do that, they called in one of the best-known Mexican mine development teams in the world, a man who spent years pouring over La Guitarra’s data:

Sierra Madre’s very own COO, Greg Liller.

In essence, Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) didn’t buy La Guitarra as much as it was hired by First Majestic to get this mine going to its full potential.

One Of The Biggest, Undeveloped Silver Resources In All Of Mexico

Historic exploration at La Guitarra documented an initial resource potential exceeding 21.5 million ounces of silver equivalent. However, with over 100 underexplored epithermal veins distributed across five main systems…that 21.5 million could be just a fraction of what remains to be discovered.

From his previous work at La Guitarra, Liller knew exactly what was in play here…and how to exploit it.

Everything has fallen in place to finally bring this site to silver producing prominence.

The resource potential from those veins may not yet be fully quantified, but for future silver production, Tiller knew that the prospects for this site could be world class.

The Window Is Still Open On This Fast-Moving Opportunity

Sierra Madre has since raised $7.8 million in private placement financing to advance next step exploration work.

Sierra Madre has since raised $7.8 million in private placement financing to advance next step exploration work.

The immediate objective will be to validate the historical resource data with an updated, 2022 compliant N43-101 report, scheduled for release later this year.

Past production at La Guitarra has proven the resource potential…what comes next is to determine how much silver (and gold) remains to be found in the 100+ epithermal veins that are known to be present.

That puts a mark on the calendar for investors seeking an early entry stake in a company that may be significantly undervalued pending this report’s release.

This one step alone is likely to have a significant impact on the company’s trading volume and share prices.

But it’s not the only factor at play, as Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) continues to advance exploration on two more key projects along the same gold belt.

Two More Ways To Win With Sierra Madre

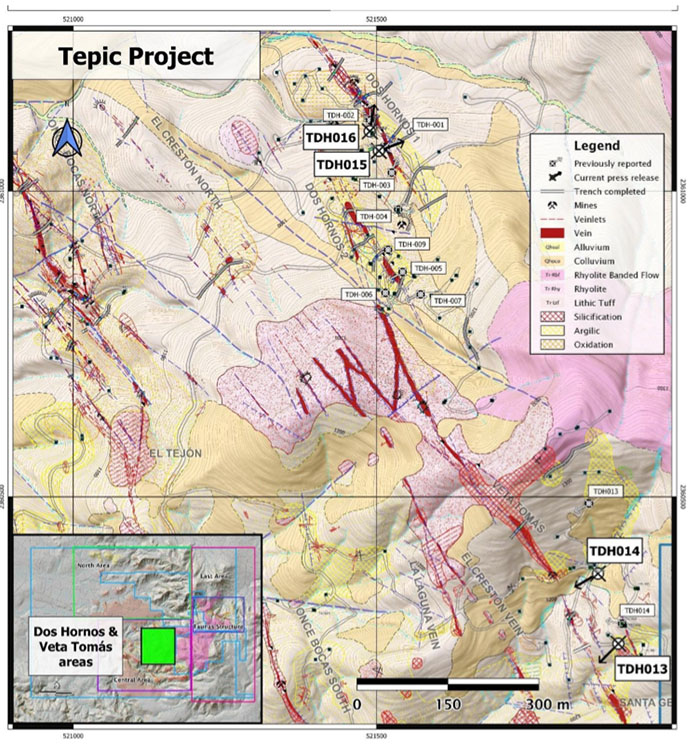

The first of these is the Tepic Project, over 6,500 acres of known gold and silver resources. This is an enormous resource area, with upwards to 1.5 billion ounces of silver equivalent reserves already discovered… and that number is still growing.3

Prior to closing the deal with First Majestic for the La Guitarra project, Sierra Madre launched operations on two under-developed Mexican silver prospects with enormous potential. Management knew the resources and moved aggressively to reel them in. With millions of dollars in the bank and a seasoned team of exploration and mining experts, they launched project development plans that produced almost immediate, exciting results. Work is ongoing and the potential for dramatic growth in shareholder value looms large.

Newly discovered veins, like those being explored right now by Sierra Madre, hold promise to add millions more to the region’s resources and ultimate reserve data.

Sierra Madre acquired the Tepic Project in 2020. Approximately 3.5 kilometers of previously identified strike length came with the acquisition.

Within a few short months, Sierra Madre geologists more than quadrupled the strike length to fifteen kilometers. Work continues and this number could grow sharply over the coming months.

The discovery and resource potential at Tepic could be off the charts. Resource calculations at the time of acquisition remain “unofficial”, but the data was compelling to Sierra Madre management following their pre-acquisition due diligence.

An historical estimate of economical in-ground mineral assets in 2013 totaled 10.3 million ounces of silver equivalent resources with an economical cut-off of 75 grams/ton.

A decade later, those numbers may improve sharply as lower production costs and improved technology make recovery of ore more economical, particularly on rising silver prices and soaring global demand projections for the near future.

However, management cautions in its current Investor presentation (emphasis added) “that an independent Qualified Person (“QP”), as defined in National Instrument 43-101 (“NI 43-101”), has not yet completed sufficient work on behalf of Sierra Madre to classify the historic estimate as a current Measured, Indicated or Inferred Mineral Resource, and Sierra Madre is not treating the historical estimate as a current Mineral Resource. Sierra Madre will need to validate previous work to produce a mineral resource that is current for CIM purposes.”

That last point is key.

Sierra Madre management is strongly convinced of the accuracy of the 2013 resource estimate, so much so that they made it the basis for their acquisition offer. However, this 2013 data, despite its presumed accuracy, cannot be used to calculate fair market value.

That’s to your advantage right now because for technical reasons, Sierra Madre cannot report a mineral resource on its balance sheet.

This may be a significant reason why Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) trades where it does today, as a junior penny stock, not as a more advanced company with proved resources in the ground.

Without an updated, official NI 43-101 compliant resource report, Wall Street investors have been slow to pull the trigger.

There’s a lot of wait-and-see in that crowd. But that hasn’t slowed experienced private money and institutional investors. When word got out about Sierra Madre’s acquisition intent, money came pouring in.

To help get their stock launched, management’s immediate priority is to update resource data and publish an NI 43-101 compliant resource calculation, hopefully later this year.

With that, ALL resources can be accrued to shareholder value.

Virtually overnight, the value in Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) shares could be triggered by millions of ounces of newly published silver equivalent resources.

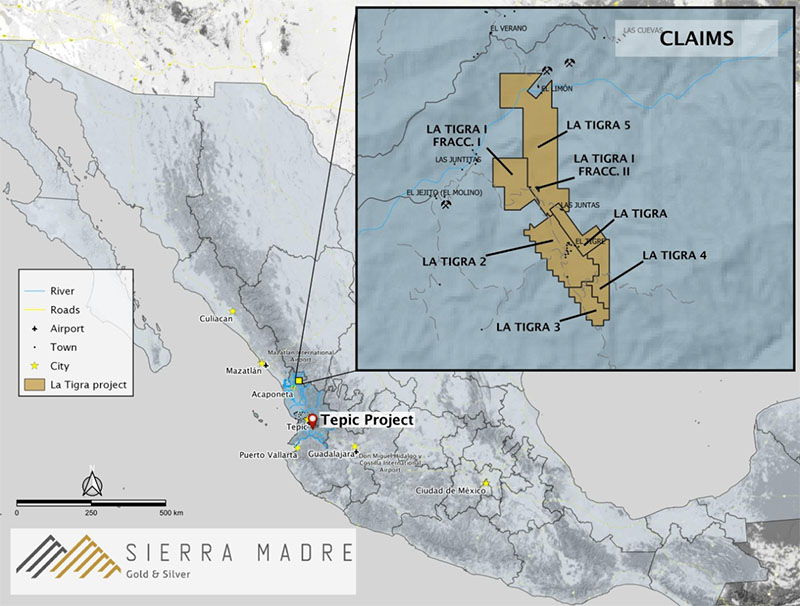

Sierra Madre’s second project to the north, La Tigra, lies in historical silver and gold production regions that date back to the turn of the last century. Production wound down three decades ago when both metals sold at a fraction of today’s prices.

Outdated, inefficient mining techniques simply made these historic mines uneconomical. Failures and shutdowns became an epidemic throughout the Sierra Madre belt.

For about one-hundred years, miners simply picked the easy stuff. Millions of ounces in silver and gold appear to have been left untouched. With modern mining technology, coupled with gold and silver prices many-times higher than in the past, enormous resources over and above historical data could be calculated at both Tepic and La Tigra.

Metal prices and reserves are interlinked. As prices rise, resource figures can be raised with lower grade or deeper buried mineralization, which can be added to net asset value (NAV) and further propel stock valuations.

Documenting The Potential Of These Overlooked Resources

Previous operators at these projects, La Tigra and Tepic, simply didn’t have the cash nor experience to bring these prospects to full potential. The management team at Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) has both…millions of dollars and years of exploration/mining experience.

Two years ago they made the moves that closed the deals.

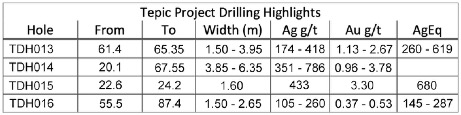

Sierra Madre acquired controlling interest over both prospects and they wasted no time getting started with exploration development. In less than two months they made their first big announcement at Tepic. They completed 21 drilled reverse circulation holes, seven returning exceptional new discoveries in silver, with significant gold showings as well.

The Sierra Madre team has since continued to prove out these findings with a program just this past May that consisted of 16 core holes, of which all returned sections of at least 75 g/t silver.

- Hole TDH002 returned 12.1m @ 0.64 g/t Au, 145.8 g/t Ag (194 g/t AgEq)

- Hole TDH007 returned 2.55m @ 3.04 g/t Au, 878.4 g/t Ag (1106 g/t AgEq)

As important, all these discoveries were made at an average depth of under 100 meters. At that depth, results are already well over economical recovery grades, which are the starting point for documenting NI 43-101 compliant resource and reserve calculations.

As mentioned above, the Tepic project is one of two in this area.

Sierra Madre also acquired the nearby La Tigra project and launched immediate exploration to identify the resource potential there as well. This past May, the company began its maiden drilling program, which consisted of three drill holes has shown promising initial results. So promising that Sierra Madre has filed for an additional mining concession covering 1,653 hectares to the West of the current project for further exploration.

Mr. Liller, reports,

“These are the first holes drilled in the Districo del Tigre and thus far we have hit encouraging shallow mineralization in all of them. I am particularly impressed with Hole 3, intersecting 32 metres of 1.0 g/t gold, as we had estimated the overall El Tigre mine zone to be somewhat narrower, in the range 10 to 12 metres. Holes 4 and 5 are currently away for assay and holes 6 and 7 are currently being drilled.”

What to do now…

Millions of ounces in gold and silver may be in play with Sierra Madre Gold & Silver…little of which is reflected in today’s share price for lack of a contemporary NI 43-101 resource report. That could change quickly as the company moves aggressively to correct that situation…starting with the 10.3 million ounces silver equivalent reported in 2013 at La Tigra.

Should those millions be made “official” soon, it could be the fuel that sends Sierra Madre rocketing. And with the price of both gold and silver set to explode, this could be one of the biggest wealth builders you’ll find on the market today.

Now is the time to get started with your due diligence. Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) shares have already captured the attention of institutional investors (a rarity for a junior) as well as seasoned resource investors who recognize opportunity when they see it.

Start today by going online to the company website for past and current news releases detailing exploration progress at the Tepic and La Tigra projects. Then register your email address to download the current Sierra Madre investor presentation and receive future company news releases.

1https://www.imdex-cascabel.com/Companies/g/z_Genco.htm

2https://www.mining.com/first-majestic-completes-acquisition-of-silvermex-resources/

4https://finance.yahoo.com/quote/SMDRF/

5https://www.mining.com/first-majestic-sells-la-guitarra-silver-mine-to-sierra-madre-in-all-share-deal-worth-35-million/

6https://goldprice.com/gold-silver-ratio/

7https://investorshub.advfn.com/Silvermex-Resources-GGCRF-14442

8https://www.kitco.com/leadgen/companies/silvermex/

9https://sierramadregoldandsilver.com/presentations/corporate_presentation.pdf

10https://sierramadregoldandsilver.com/read/auto-news-1653483680

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Sierra Madre Gold and Silver Ltd. (“SMDRF”) and its securities, SMDRF has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by SMDRF) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company SMDRF and has no information concerning share ownership by others of in the profiled company SMDRF. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to SMDRF industry; (b) market opportunity; (c) SMDRF business plans and strategies; (d) services that SMDRF intends to offer; (e) SMDRF milestone projections and targets; (f) SMDRF expectations regarding receipt of approval for regulatory applications; (g) SMDRF intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) SMDRF expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute SMDRF business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) SMDRF ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) SMDRF ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) SMDRF ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of SMDRF to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) SMDRF operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact SMDRF business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing SMDRF business operations (e) SMDRF may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Sierra Madre Gold and Silver Ltd..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Sierra Madre Gold and Silver Ltd. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Sierra Madre Gold and Silver Ltd. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Sierra Madre Gold and Silver Ltd.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Sierra Madre Gold and Silver Ltd.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Sierra Madre Gold and Silver Ltd. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Sierra Madre Gold and Silver Ltd. industry; (b) market opportunity; (c) Sierra Madre Gold and Silver Ltd. business plans and strategies; (d) services that Sierra Madre Gold and Silver Ltd. intends to offer; (e) Sierra Madre Gold and Silver Ltd. milestone projections and targets; (f) Sierra Madre Gold and Silver Ltd. expectations regarding receipt of approval for regulatory applications; (g) Sierra Madre Gold and Silver Ltd. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Sierra Madre Gold and Silver Ltd. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Sierra Madre Gold and Silver Ltd. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Sierra Madre Gold and Silver Ltd. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Sierra Madre Gold and Silver Ltd. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Sierra Madre Gold and Silver Ltd. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Sierra Madre Gold and Silver Ltd. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Sierra Madre Gold and Silver Ltd. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Sierra Madre Gold and Silver Ltd. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Sierra Madre Gold and Silver Ltd. business operations (e) Sierra Madre Gold and Silver Ltd. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Sierra Madre Gold and Silver Ltd. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Sierra Madre Gold and Silver Ltd. or such entities and are not necessarily indicative of future performance of Sierra Madre Gold and Silver Ltd. or such entities.