This microcap’s big breakthrough allows them to mine and refine 99.5% pure lithium carbonate in hours, instead of years.1

Editorial Feature | Oct 14, 2022 | Industry

- Brains have bested brawn, as a new technology looks set to revolutionize lithium extraction from brine, allowing under $1 Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF) to move quickly towards production.

- The company could soon blitz the battery market with lithium carbonate from their Incahuasi holdings, now that they’re preparing for initial test production.

- Plans should kickoff in short order, as the mining team is well-versed in what it takes to make that happen. Their project leader explored and built the lithium processing plant at Rincon, which recently sold to Rio Tinto for $1 billion.

- And now, on the heels of a Ford – Rio Tinto partnership to secure their battery material supply chain, Toyota is following suit. Just 10 days later, the automaker announced their joint venture with Panasonic has entered into a supply agreement with Ioneer for 4,000 tonnes of lithium carbonate per year.

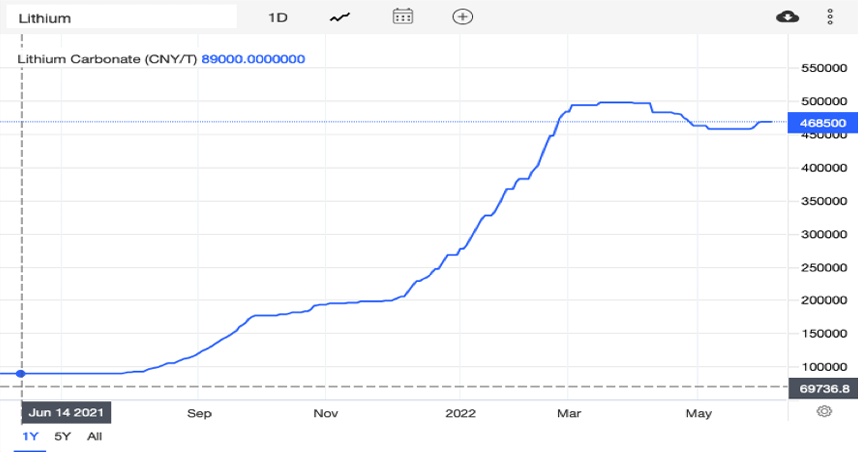

From cutthroat auctions, and multi-billion-dollar mergers, to a huge advancement in mining technology… The events in the lithium market have understandably garnered interest from investors of all walks of life. And for good reason. The price of lithium carbonate alone is a clear sign of the earnings that could await the right moves into lithium.

A year ago, in June, a metric ton of lithium carbonate sold for about $10,000.2 At the time, it was said to be an outrageous price.

Just over one year later, that same ton of lithium holds a price tag of over $70,000.3

Yet, the most stunning fact about that 600% price hike is this: investors still have not missed the boat with lithium.

As surprising as this is, the market is still in its infancy. The era of the lithium-battery-powered electric vehicles is just picking up speed. Fitch Solutions forecasts that between 2021 and 2030, the global EV market will explode to more than 83 million vehicles on the road worldwide, compared to only 300,000 in 2020.4

That’s why there has never been a better time than now to look into Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF).

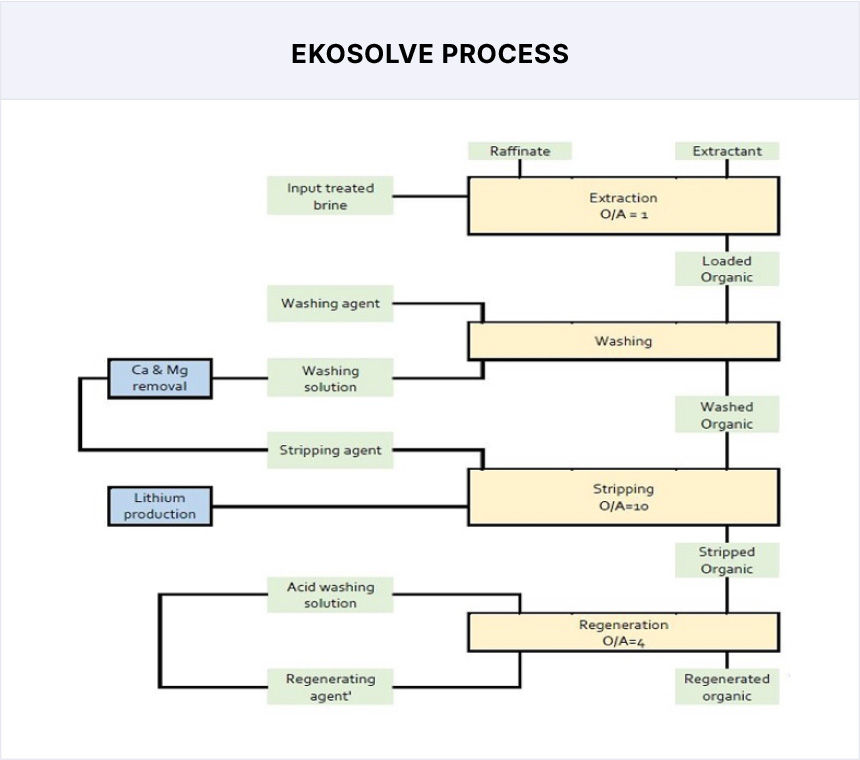

Ekosolve Technology Offers Tremendous Advantage Over Spey’s Argentine Competitors

Spey has a proven technology that it’s using to turn lithium brine into 99.5% pure lithium carbonate in hours instead of years.

Moreover, Spey also controls more than 20.2 square miles in Argentina’s lithium-rich and world-renowned Lithium Triangle.

It’s estimated that the Triangle holds about 54% of the world’s lithium resources.5 That’s why it’s home to major publicly traded miners with a combined market cap in excess of $103 billion.6 7 They include:

- Jiangxi Ganfeng Lithium (market cap of $23 billion )

- Albemarle (market cap of $27 billion)

- Tianqi Lithium (market cap of $164 billion)

- Sociedad Química y Minera de Chile (market cap of $27 billion)

- and Mineral Resources Ltd. (market cap of $10 billion)

Make no mistake about it, Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF) is right at home among those giants, because it has something they don’t… Ekosolve.

Ekosolve is a proprietary mining technology that uses solvents to rapidly separate lithium from brine and into lithium carbonate.

Spey Resources licensed Ekosolve from the University of Melbourne, Australia, which developed and patented it. Initially, the cutting-edge technology was developed to make lithium mining from hard rock / spodumene economical.

But, when this technology is used for leeching lithium from brine, the process is so streamlined it takes about three hours to produce lithium carbonate.

That’s opposed to nearly two years with brine that evaporates the traditional way in collection ponds.

Ekosolve also has a massive advantage when it comes to all-in mining costs, mainly due to the technology’s ability recover so much lithium from the brine: at least 90% with a 99.5% purity.

Thanks to Ekosolve, Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF) cost per metric ton should be a fraction of the price of traditional lithium brine operations.

S&P Global Market Intelligence found that the total all-in cash costs for a traditional brine operation is about $5,580.9

Now, here’s the real kicker. Ekosolve’s startup costs are also friendly.

That means Spey Resources would have the capability to quickly establish a sizable processing plant.

That could translate to a significant return and cost savings on the initial test production.10

Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF) could be one of those rare junior natural resource company that doesn’t need a merger or buyout to become a major player in the lithium mining industry

Big Money In Argentina

Of Spey’s two Argentine properties, the Incahuasi project in the world-famous Salta Province, is the one investors should focus on. Called the Candela II project, its neighbors are Jiangxi Ganfeng Lithium (OTC:GNENF) and Allkem Ltd (OTC:OROCF).

The two majors command substantial share prices, with Ganfeng trading about $12, with a $23 billion market cap, and Allkem around $8.50, with a $5 billion market cap.

Neither of Spey’s acclaimed neighbors are currently using Ekosolve technology.

Ganfeng, however, is hungry. In the past year, they spent nearly $300 million acquiring Argentina-based projects.

Their partner, Lithium Americas just dropped $491 million to acquire Millennial Lithium. It’s all part of a trend that found Chinese lithium miners and battery makers investing a whopping $1.58 billion on development-stage lithium projects, according to S&P Global Market Intelligence.12

The demand for new lithium projects is so extreme right now, that an auction for a controlling stake in a Chinese mine garnered 3,448 bids and ultimately sold for about $299 million.13

But that’s not the crazy part.

According to Bloomberg, more than 980,000 people watched the auction online over the course of the five-day event.

That’s understandable when you factor in that the International Energy Agency forecast that the price for lithium, cobalt and nickel will remain elevated for years to come.14

Fortunately, North American investors don’t have to jump through hoops to invest in an Argentina lithium opportunity.

They only need to call their brokers and discuss Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF).

Go Long On Supply

At this stage, the coming lithium supply crunch is no secret. It’s a crisis that can only be solved by massive amounts of new resources.

A well-respected analyst put it best.

Glyn Lawcock, then UBS’s renowned Global Head of Mining Research, issued this dire warning:

“There is not sufficient supply to meet this demand projection based on our knowledge of known projects today. That includes all projects whether they are under construction, in feasibility or still in exploration.” 17

Lawcock’s warning is now entrenched in the lithium culture.

Global X ETF analysts report that lithium miners need to plan for scenarios where annual demand exceeds 1.1 million metric tons of lithium by 2025, as EVS reach parity with internal combustion cars.18 That’s happening faster than anyone could have anticipated.

- In late 2020, Volkswagen raised its planned investment in digital and electric vehicle technologies to $86 billion over the coming five years as it seeks to hold onto its crown as the world’s largest carmaker in a new green era.19

In last year’s plan, the German car and truck maker, which owns brands including VW, Audi, Porsche, Seat and Skoda, had earmarked $72 billion for electric and self-driving vehicles out of its $182 billion budget.20

- In February 2021, Ford announced plans to double its investment toward electric and autonomous vehicles to $29 billion through 2025. The bulk of the spending – $22 billion –is for EVs.21

- General Motors plans to only sell EV’s by 2035. It’s spending $27 billion to launch 30 EVs by then.22

- Even Amazon.com is on board. It delivers 10 billion packages a year. In mid-September 2019, the world’s largest e-commence company ordered 100,000 electric delivery vehicles from U.S. vehicle design and manufacturing startup Rivian Automotive.23

- Anheuser-Busch has rolled out a 21 EV truck pilot program in California.24

- Volvo Trucks is building 23 heavy-duty electric trucks using a $44.8 million grant from the California Air Resources Board.25

- Everyone’s darling Tesla (NASDAQ:TSLA) aimed to build 500,000 EVs worldwide last year but come up just short of that target with 499,550 vehicles delivered globally.24

EV Makers Race To Secure Supply Chain Partnerships With North American Miners

As usual, Elon Musk was ahead of his time when he encouraged the need for allied partnerships between mining companies and electric vehicle makers in order to strengthen the North American lithium supply chain.

In response to data that showed there had been a 1,654% rise in the lithium price in the last ten years, Musk stated, the…

“Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.”

Soon after, on an April earnings call, Musk claimed,

“We think we’re going to need to help the industry on this front. I’d certainly encourage entrepreneurs out there who are looking for opportunities to get into the lithium business.”

Only months later, Rio Tinto and Ford announced a joint venture agreement to secure lithium, aluminum, and copper from the Rincon lithium project in Argentina, as well as other operations across North America.

Toyota Motor Corp. quickly followed suit, announcing a joint battery venture with Panasonic Corp. to purchase lithium from Ioneer Ltd’s Rhyolite Ridge mining project, in Esmeralda County, Nevada. As part of the agreement, Ioneer plans to supply 4,000 tonnes of lithium carbonate per year for a total of five years to Prime Planet Energy & Solutions (PPES), which was formed by Toyota and Panasonic.

The deal comes with a hefty commitment from PPES. It states that Ioneer’s lithium will be used to build battery parts inside the United States, specifically for American-made EVs15.

Mining Team Known For A Outstanding Deal

Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF) is a small company with a huge advantage thanks to the foresight of its CEO, Nader Vatanchi.

While he graduated with a Bachelors of Arts in Criminology from the famous Simon Fraser University, Mr. Vatanchi ultimately followed his entrepreneurial desires.

While he graduated with a Bachelors of Arts in Criminology from the famous Simon Fraser University, Mr. Vatanchi ultimately followed his entrepreneurial desires.

He’s also currently CEO of Musk Metals Corp. (CSE:MUSK), CEO of Forty Pillars Mining Corp. (CSE:PLLR), and of Triangle Industries Ltd., a reporting issuer.

His reputation for mining success allowed him to attract a top-notch team. Among them are mining notables such as Phil Thomas, Ian Graham, and David Carabanti.

Mr. Thomas has extensive lithium brine experience in exploration and project construction. For going on 20 years, he’s explored salars such as Incahuasi, Pocitos, Rincon, Guayatayoc, Salinas Grandes, Cauchari, Hombre Muerto and Pozuelos.

Moreover, his team was responsible for exploring and building the lithium carbonate plant at Rincon in 2005. Rio Tinto (NYSE:RIO) then bought the Rincon property for nearly $1 billion.16

As for Mr. Graham, he’s quickly becoming a mining legend. He spent 20 years with the major mining companies Anglo American and Rio Tinto, and is well-known for modeling project economics.

Mr. Graham’s mine and advanced projects include the Diavik Diamond Mine in Canada’s Northwest Territories, Resolution Copper in Arizona, the Eagle Nickel Mine in Michigan, Bunder Diamonds in India, and the Milestone Potash Project.

Finally, Mr. Carabanti is a veteran of the Incahuasi salar, having worked there for Ganfeng Lithium. It’s not hard to imagine that prior relationship could be a big advantage for Spey, considering that acquisition-hungry Ganfeng sits nearby.

This superbly accomplished leadership is but one of the…

7 Reasons To Consider Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF) Before The Looming Supply Crunch Makes Headlines

Historic Prices

As we write this in June 2022, the price of lithium carbonate has skyrocketed 600% in the past year from about $10,000 a metric ton to more than $70,000.

83 Million Evs In The Next Eight Years

Volkswagen will lead this drive with a goal of building 15 million EVs in the next five years. GM wants to build 1 million EVs a year.

Demand Will Likely Outstrip Supply

If the average EV battery size holds, the world is going to need at least 20.8 billion pounds, or 10.4 million tons, of lithium over the next decade.

Spey Is Perfectly Positioned To Meet The Need

Its exploration project is located in the middle of the Lithium Triangle, where an estimated two-thirds of the world’s 19 million metric tons of lithium is believed to exist.

Big-Time Neighbors

Spey Resources is one of only three companies currently exploring the Incahuasi Salar… the other two are Ganfeng Lithium and Allkem. Both are major miners with multi-billion- dollar market caps.

Ekosolve Technology

This cutting-edge lithium extraction process can produce lithium carbonate in hours not years. This could allow Spey Resources to produce at a fraction of the price of a traditional lithium brine operation.

Low-Cost Opportunity, Superb Potential

While Spey Resources may still occasionally trade well under $1, it’s neighbors in the Incahuasi Lithium Salar, Ganfeng Lithium and Allkem, currently trade for $12 and $ 8.50. Investors with eyes to the future should take heed.

With the hunt for new lithium part of a global initiative you could expect Spey Resources to stay in the news for years to come. That’s why now could be the very best time to latch onto its affordably priced shares. That means it’s time to call your broker or advisor and show him or her this report. Then discuss the new opportunity in lithium and, in particular, with Spey Resources.

Because, when you take your position now in Spey Resources Corp. (CSE: SPEY, OTC:SPEYFCSE: SPEY, OTC: SPEYF), you could find yourself among the earliest and biggest winners. With the hunt for new lithium part of a global initiative you could expect Spey Resources to stay in the news for years to come.

That’s why now could be the very best time to latch onto its affordably priced shares.

That means it’s time to call your broker or advisor and show him or her this report. Then discuss the new opportunity in lithium and, in particular, with Spey Resources. Because, when you take your position now in Spey Resources (CSE: SPEY, OTC: SPEYF), you could find yourself among the earliest and biggest winners.

1https://aisresources.com/lithium-2/incahuasi-lithium-salar-project/

2https://tradingeconomics.com/commodity/lithium

3https://tradingeconomics.com/commodity/lithium

4https://www.miningweekly.com/article/lithium-prices-to-normalise-as-demand-increases-fitch-solutions-2021-05-07

5https://resourceworld.com/lithium-triangle/

6https://www.nsenergybusiness.com/features/largest-lithium-mining-companies/

7https://investingnews.com/daily/resource-investing/battery-metals-investing/lithium-investing/top-lithium-producers/

8https://pages.marketintelligence.spglobal.com/Lithium-brine-vs-hard-rock-demo-confirmation-MJ-ad.html

9https://pages.marketintelligence.spglobal.com/Lithium-brine-vs-hard-rock-demo-confirmation-MJ-ad.html

10https://www.speyresources.ca/ekosolve-technology

11https://www.speyresources.ca/ekosolve-technology

12https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/china-mining-battery-companies-sweep-up-lithium-supplies-in-acquisition-blitz-67205411

13https://www.bloomberg.com/news/articles/2022-05-23/how-hot-is-lithium-now-a-chinese-mine-auction-draws-3-448-bids?srnd=hyperdrive&sref=VcSM8PCz

14https://iea.blob.core.windows.net/assets/e0d2081d-487d-4818-8c59-69b638969f9e/GlobalElectricVehicleOutlook2022.pdf

15https://money.usnews.com/investing/news/articles/2022-07-31/toyota-panasonic-battery-jv-to-buy-lithium-from-ioneers-nevada-mine

16https://www.greencarcongress.com/2021/12/20211222-rincon.html

17https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=7f74b9351a44

18https://www.globalxetfs.com/whats-driving-the-electric-vehicle-lithium-and-battery-markets-in-2019/

19https://www.reuters.com/article/volkswagen-strategy/vw-boosts-investment-in-electric-and-autonomous-car-technology-to-86-billon-idUSKBN27T24O

20https://www.reuters.com/article/volkswagen-strategy/vw-boosts-investment-in-electric-and-autonomous-car-technology-to-86-billon-idUSKBN27T24O

21https://www.motortrend.com/news/ford-ev-investment-2025/

22https://www.motortrend.com/news/ford-ev-investment-2025/

23https://www.cnbc.com/2019/09/19/amazon-is-purchasing-100000-rivian-electric-vans.html

24https://www.anheuser-busch.com/newsroom/2019/10/anheuser-busch-to-deploy-21-byd-electric-trucks-as-part-of-state1.html

25https://www.trucks.com/2018/12/12/volvo-build-electric-trucks-north-american-market/

26https://www.cnbc.com/2021/01/02/tesla-tsla-q4-2020-vehicle-delivery-and-production-numbers.html

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Spey Resources (“SPEY”) and its securities, SPEY has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by SPEY) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company SPEY and has no information concerning share ownership by others of in the profiled company SPEY. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to SPEY industry; (b) market opportunity; (c) SPEY business plans and strategies; (d) services that SPEY intends to offer; (e) SPEY milestone projections and targets; (f) SPEY expectations regarding receipt of approval for regulatory applications; (g) SPEY intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) SPEY expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute SPEY business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) SPEY ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) SPEY ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) SPEY ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of SPEY to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) SPEY operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact SPEY business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing SPEY business operations (e) SPEY may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Spey Resources.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Spey Resources and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Spey Resources or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Spey Resources. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Spey Resources’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Spey Resources future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Spey Resources industry; (b) market opportunity; (c) Spey Resources business plans and strategies; (d) services that Spey Resources intends to offer; (e) Spey Resources milestone projections and targets; (f) Spey Resources expectations regarding receipt of approval for regulatory applications; (g) Spey Resources intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Spey Resources expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Spey Resources business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Spey Resources ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Spey Resources ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Spey Resources ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Spey Resources to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Spey Resources operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Spey Resources business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Spey Resources business operations (e) Spey Resources may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Spey Resources or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Spey Resources or such entities and are not necessarily indicative of future performance of Spey Resources or such entities.