This “Overlooked” Battery Material is Projected to Skyrocket 1,437% by 2030 due to Global Electrification and EV’s

Editorial Feature | July 11, 2023 | Tech

Graphite is the largest single component in lithium-ion batteries and a mineral critical to the electrification of the world. Yet, there is no commercial production of natural graphite anywhere in the United States.

“(Batteries) are called lithium-ion — but really it should be called nickel-graphite. Because it’s mostly nickel and graphite.” – Elon Musk

The Opportunity at a Glance

The World’s Appetite for Graphite is Voracious… and Growing

- Electric Vehicle (EV) sales are projected to grow at a 29% clip each year through 2030.

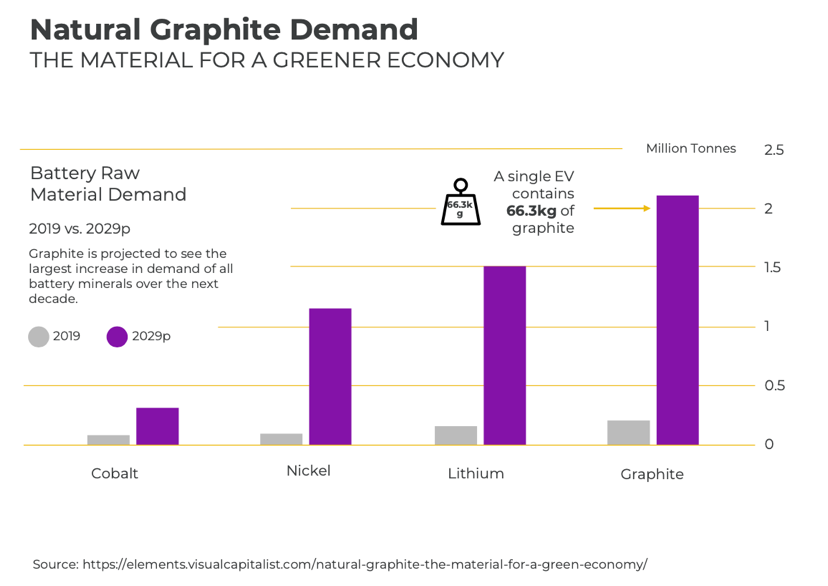

- Graphite makes up 29% of the average lithium-ion battery — making it the single largest component. The average EV uses 146 pounds of graphite in the battery alone.

- Natural graphite demand for EV batteries is expected to grow 1,437% by the end of the decade.1

- Natural graphite is essential for a number of other technologies, including solar power and energy storage.

- Graphite was added to the list of Critical Minerals in February 2022 by the Department of Defense and was deemed crucial to America’s national security.

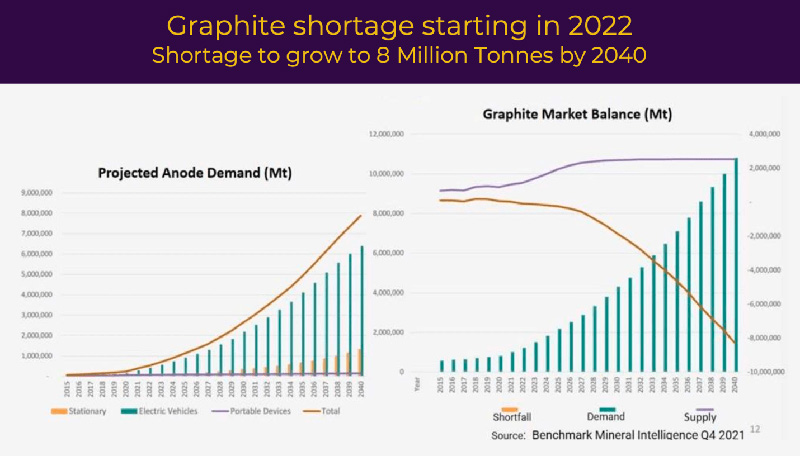

- The world had a graphite shortfall last year — and it is expected to get worse, topping out at an 8 million tonne shortage by 2040.

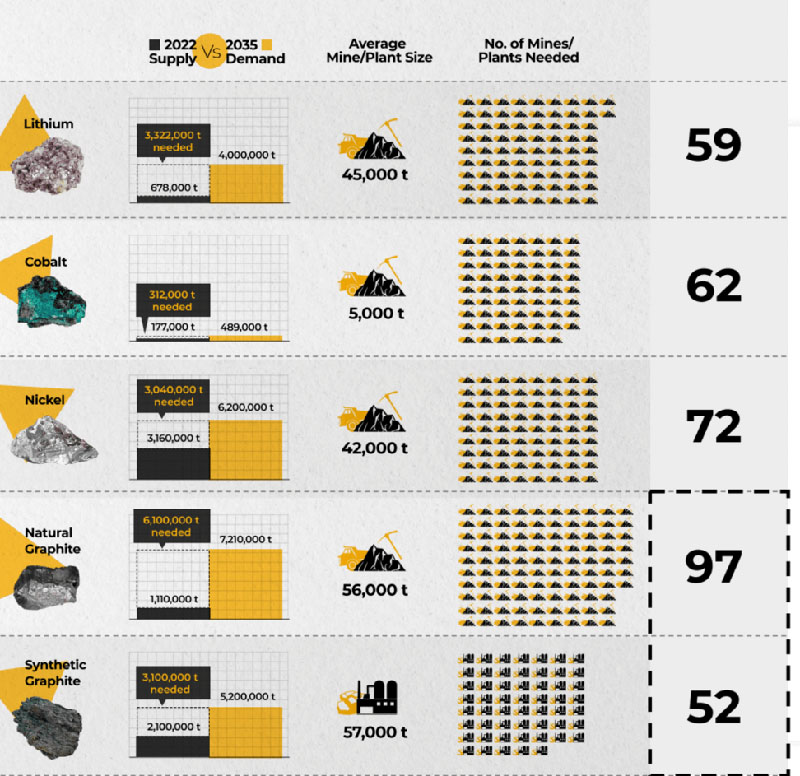

- To avoid the worst of the supply crunch, it is projected that the world requires 97 new graphite mines online by 2035, each one producing an average of 56,000 tonnes a year.

- Graphite price increases are expected as a result of: massive growth projected for raw concentrate and processed material for EV batteries; global supply controlled by a handful of producers; now we see a push by United States federal government to establish the entire green energy supply chain.

- The price for Lithium, which accounts for only >8% of the total weight of an EV battery, grew a whopping 700% in the last year and is expected to continue to increase. For the reasons noted above, Graphite prices are poised to increase as well, which is expected to lift the entire graphite sector with it.

China Dominates the Graphite Supply Chain

- China produces around 82% of all the world’s graphite — which means the country gets to set the market for graphite sales.

- China also is becoming a large importer of graphite due to battery manufacturing.

- In 2020 China grew to be the 7th largest importer of graphite.2

- On a number of occasions, China has used its market dominance to withhold access to critical assets. In 2010, China cut Japan off from rare earth metals in a geopolitical dispute, and in 2014 it did the same to Australia. If China shut off the supply of graphite to the US, it is expected that it would decimate the EV and high-tech industries.

- The US is especially vulnerable to a supply stranglehold. The last time the US produced graphite domestically was in 1950, over 70 years ago.

- With that in mind, the Biden administration has earmarked $135 billion to developing domestic EV production — including sourcing and refining critical and strategic resources like graphite.

- Department of Energy is earmarking $10 billion towards securing the domestic strategic metals supply chain.

Reflex Advanced Materials (CSE:RFLX OTC:RFLXFCSE:RFLX OTC:RFLXF) is Positioning Itself to Contribute to the Development of US Graphite Supply

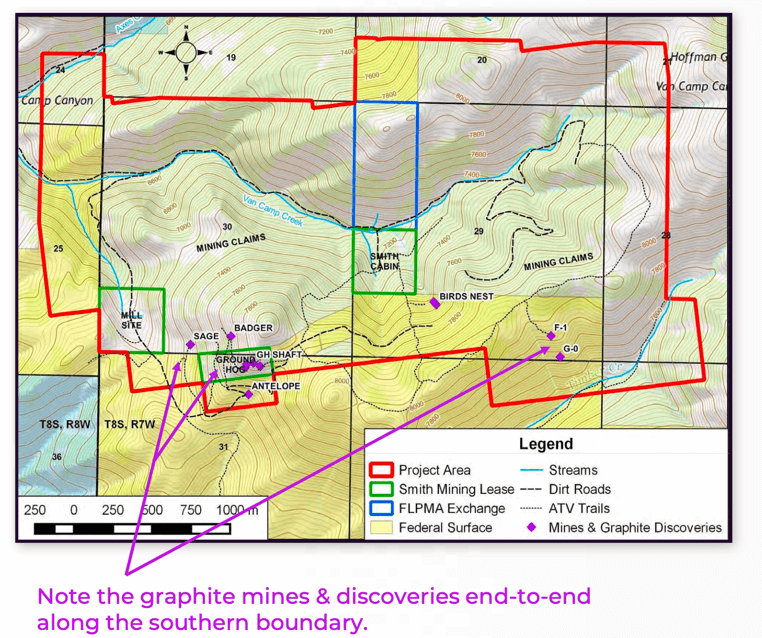

- Reflex Materials Ruby Project, in southern Montana is a past producing graphite mine that was active nearly 70 years ago. The site has numerous USGS surveys, assays, and visible mineral outcrops of graphite from surface.

- The Ruby Graphite Mine operated by the Crystal Graphite company in the early 1900’s mined graphite from Ruby which was used for the WW2 effort.

- Over 2500 Tonnes of graphite was mined until 1950.

- The Ruby Project samples show graphite grades in excess of 95% concentrations as per USGS surveys completed in 1969.

- The Ruby Project contains both flake graphite and vein graphite. Vein graphite generally has higher purity than flake graphite and is therefore generally more economic to extract.

- Reflex management has begun the process of customer qualification with potential small and mid level CSPG (Coated, spherionized, purified graphite) customers. Small and mid level CSPG customers can provide the highest margins for eventual sale rather than focusing on securing 1 large OEM.

- Reflex isn’t just aiming to revitalize production of graphite from its existing mine. It’s planning to create a cradle-to-consumer North American supply chain

- There are billion dollar market cap companies already dominating the graphite sector — like Syrah Resources Ltd. Syrah has a operational mine in Mozambique and is a building a government grant funded Anode Battery plant in Alabama.

One of the Largest Infrastructure Projects in History

Today, humanity is attempting one of the greatest collective projects since the early days of the industrial revolution.

A transition away from a fossil fuel economy to renewable energies.

The process is already underway. Electric Vehicle (EV) sales are increasing at a rapid pace — going up around 29% every year, with growth accelerating over time.

Solar power is expected to grow from $176 billion last year, to $256 billion by 20283.

Wind is jumping as well — approximately doubling in the US since 2013, and projected to nearly quadruple by 20504.

Other countries are seeing even more rapid growth.

And there is one thing that all of this clean tech has in common.

The need for battery storage.

EVs run on batteries. Solar plants and wind farms need batteries to store power for when the sun doesn’t shine, or the air is still and not moving.

Investors have been jumping at the chance to get in on this trend — investing heavily in lithium and other battery metals that support our transition to a clean energy economy.

But many investors are missing the real opportunity.

While lithium gets the press, graphite has the prospect to be a bigger factor in the clean economy.

After all, while lithium-ion batteries have made lithium famous, only about 3% of the batteries are made of lithium.

The largest single component in these next-gen batteries? That’s graphite — which makes up nearly 30% of lithium-ion batteries.

In fact, the average EV uses 146 pounds of graphite to make its batteries — 29% of total battery material, and by far the most used component.

Unsurprisingly, this also makes graphite the metal with the greatest projected growth over the next decade.

Benchmark Mineral Intelligence, a London based research firm projects EV battery demand for graphite to go up 1,437% by 2030.

All told, the various battery metals are expected to need a supply jump of 500% as a whole by 2050, in an attempt to keep up with demand5.

This isn’t surprising when you consider the scale of the transition our motorized vehicles are undergoing.

In 2022, EV sales made up about 10% of all vehicle sales — up from 8.3% the previous year6.

That’s a huge jump from last decade, when EVs made up 1% of sales or less.

But it’s nothing compared to what’s to come.

The International Energy Agency forecasts that there will be a combined 125 million EV cars and trucks on the road over the next decade7.

Given that there will be more vehicles on the road in general in coming years, that means the EV market will multiply more than 10x over the next few decades.

That requires a lot of graphite.

But graphite isn’t just essential to EV production. It is also an essential component for solar panels.

It is essential for the batteries that variable energy sources require — like solar, wind, and tidal energy.

One Of The Wonders Of The Modern World

We’re only at the beginning of understanding the many uses of graphene, the highly processed version of natural graphite, which sells for up to $200,000 per tonne.

It is already proving an essential ingredient in some cancer-killing medical treatments8.

Graphene is more conductive than ordinary graphite, making it an essential input for high-end electronics that require speed and efficiency.

And graphene is in testing for a variety of new applications — everything from water purification, to lightweight bulletproof armor.

The important point here is, graphite is in high demand — so high in fact that there aren’t enough production-ready graphite deposits in place to keep up.

Indeed — graphite is facing the most serious shortfalls over the coming years, out of all the clean tech metals.

Increased graphic demand and inventory shortages due to global electrification has created this ideal set-up for a multi-year secular boom9.

In fact, the dependence of clean tech and high tech applications on graphite is so great, the US has listed graphite as one of 35 critical strategic metals on10 which the US economy depends.

That’s why the US has allocated $135 billion to development of the EV industry and commodity supply chain — goosing graphite production in the process.

That’s why there’s another $3 billion the US is spending on advanced battery inputs and production11. And the US government is actively funding graphite processing facilities in the US such Syrah Resources (SYR:ASX) being awarded $222M to expand NATURAL graphite Active Anode Material (AAM) plant in Louisiana using graphite sourced from Mozambique mine12.

It’s of critical importance to the US Federal Government because the country’s graphite supply chain currently doesn’t exist.13

The Right Plan at the Right Time

To begin with, Reflex Materials owns the rights to one of the only known vein graphite assets in the USA.

Located in southern Montana, the Ruby Project was an active graphite mine for the first half the 20th century.

When WW2 ended and it became cheaper to source graphite overseas, production shut down — but there are strong indications of there being graphite remaining on the site.

The most recent samples taken from the Ruby Project show graphite in concentrations of 95%-98%.

The Ruby Project is also ideally located. It is right next to the rail connections that service the entire USA. Near the town of Dillon, Montana with a large workforce.

The Ruby Project is also a short distance to a new solar plant facility — which is a great source for clean energy.

Right now, the Reflex Advanced Materials is undertaking an extensive mineral exploration program to show the viability and economics of its Ruby Graphite project in Montana. This includes plans for a summer 2023 drill program to begin defining a resource.

The company hopes the Ruby Project to be operational by 2026, in good timing for when those clients have analyzed the graphite material from Ruby and confirmed the chemistry is suitable for the application they plan to use with the CSPG.

But the Ruby Project is not just attractive because it is a historical mine. It also is the only known site in the USA that produces both flake and vein graphite.

Both kinds are important — because both fill different needs. And, when properly processed, both can prove enormously profitable.

Which brings us to the other part of Reflex Materials plan.

Graphite Value Chain

Many in the EV Anode battery industry know that simply mining graphite concentrate is not the most profitable part of the business…

Consider — in Brazil, they are currently extracting graphite at a 90%+ concentration. That costs about $600/tonne to produce, and sells for $1,000-$1,200 a tonne as graphite concentrate.

If you then further refine that graphite — shaping, coating and purifying — you would spend about $3,800 processing, and sell it for $7,000-$10,000 on the open market today.

And the most processed and valuable downstream product — refining graphite into a multi-layer graphene — can sell for $200,000 a tonne.

Reflex Advanced Materials plans to build a plant capable of refining raw graphite to a concentrate and would look to JV or acquire the capabilities to process graphite concentrate to CSPG and Graphene products.

Which one is used will depend on the input — different types of graphite are better suited to different types of refining.

But, with the Ruby Project, Reflex Materials should have graphite suited for every level of refinement.

But again, that is not the entire story.

Doing Things the Right Way

Reflex Advanced Materials (CSE:RFLX OTC:RFLXFCSE:RFLX OTC:RFLXF) takes seriously its environmental stewardship of the Ruby Project.

That’s why the company is using the most ecologically friendly methods to remove the graphite from the earth.

Vein graphite can be extracted using quarry type methods— not a mine — so that less land is disturbed.

After the graphite ore is removed, all remaining rocks and minerals are put back in place, to minimize effects on the landscape. And that reclaimed land is then soiled and planted with native flora — creating a landscape that will appear nearly untouched.

It only makes sense to perform in an ecologically responsible way, if your company is part of the clean tech supply chain.

Taken as a whole, Reflex Advanced Materials is a tremendous value. It’s sitting on a one of the only USA graphite projects in the lower 48 states, with plans to crank out material at up to $10,000 a tonne.

Other graphite companies trade at very high multiples. Syrah Resources Ltd. has a market cap over $1.3 billion and operates a mine in Mozambique and is building a Anode processing facility in Alabama. Graphite One — operating in Alaska, has a massive graphite deposit— has a market cap over $100 million.

And then Reflex Materials, with a market value of under $30 million, with strong prospects – in a supportive jurisdiction to start.

To learn more about Reflex Advanced Materials (CSE:RFLX, OTC:RFLXF) check out the company website.

1https://www.benchmarkminerals.com/

2https://oec.world/en/profile/bilateral-product/graphite/reporter/chn

3https://finance.yahoo.com/news/global-solar-power-market-size-092500852.html

4https://www.energy.gov/map-projected-growth-wind-industry-now-until-2050

5https://www.worldbank.org/en/news/press-release/2020/05/11/mineral-production-to-soar-as-demand-for-clean-energy-increases

6https://www.teslarati.com/electric-vehicle-sales-2022/

7https://www.cnbc.com/2018/05/30/electric-vehicles-will-grow-from-3-million-to-125-million-by-2030-iea.html

8https://www.grapheneuses.org

9Source for graphics: https://www.benchmarkminerals.com/

10https://www.usgs.gov/news/national-news-release/interior-releases-2018s-final-list-35-minerals-deemed-critical-us

11https://www.energy.gov/articles/biden-administration-doe-invest-3-billion-strengthen-us-supply-chain-advanced-batteries

12https://www.reuters.com/business/energy/australias-syrah-expand-us-graphite-plant-after-220-mln-grant-2022-10-20/

13https://min-met.com/blog/china-produces-82-of-the-worlds-graphite-in-2021/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Reflex Advanced Materials (“RFLX”) and its securities, RFLX has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by RFLX ) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company RFLX and has no information concerning share ownership by others of in the profiled company RFLX . The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to RFLX industry; (b) market opportunity; (c) RFLX business plans and strategies; (d) services that RFLX intends to offer; (e) RFLX milestone projections and targets; (f) RFLX expectations regarding receipt of approval for regulatory applications; (g) RFLX intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) RFLX expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute RFLX business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) RFLX ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) RFLX ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) RFLX ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of RFLX to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) RFLX operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact RFLX business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing RFLX business operations (e) RFLX may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Reflex Advanced Materials

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Reflex Advanced Materials and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Reflex Advanced Materials or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Reflex Advanced Materials. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Reflex Advanced Materials’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Reflex Advanced Materials future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Reflex Advanced Materials industry; (b) market opportunity; (c) Reflex Advanced Materials business plans and strategies; (d) services that Reflex Advanced Materials intends to offer; (e) Reflex Advanced Materials milestone projections and targets; (f) Reflex Advanced Materials expectations regarding receipt of approval for regulatory applications; (g) Reflex Advanced Materials intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Reflex Advanced Materials expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Reflex Advanced Materials business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Reflex Advanced Materials ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Reflex Advanced Materials ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Reflex Advanced Materials ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Reflex Advanced Materials to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Reflex Advanced Materials operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Reflex Advanced Materials business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Reflex Advanced Materials business operations (e) Reflex Advanced Materials may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Reflex Advanced Materials or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Reflex Advanced Materials or such entities and are not necessarily indicative of future performance of Reflex Advanced Materials or such entities.