This Stock Could Be Slated To Win The “Climate Solutions Race”

Editorial Feature | Mar 21, 2023

Everything You've Been Told About Reversing Global Warming Could Simply Be Dead Wrong – Pond Technologies’ (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) Patented Solution Could Completely Change the Game!

See this weird little tank with red lights?

While it doesn’t seem like much to the average person, insiders know it could be about to disrupt some of the biggest industries on Earth.

We’re talking about food, beverages, nutraceuticals, fish and animal feed, biotech, and bioremediation.

That’s a combined $730 BILLION market this tank could soon significantly revolutionize!1

As Bloomberg points out…

Venture Capitalists & Private Equity Investors Already Put $53.7 BILLION Into Tech Of This Kind In 2021.2

So investors who understand what this is about are standing in front of what could be a gold mine.

As you read on, you’ll discover why this tank will transform a variety of industries.

And how one Canadian company that developed… and patented this special tank… is bringing you one of the biggest stock stories of the decade.

This company is called Pond Technologies’ (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF).

But first, we’re going to tell you something…

Earth's Survival May Very Well Depend On This Company's Patented Technology

Because as disruptive as this tank is across all types of industries, there’s one particular impact it could have on our planet’s health.

We’re talking about climate change…

As NASA points out, global warming “will worsen in the decades to come.”3

And thanks to Pond Technologies Holdings Inc.’s (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) patented “tank tech”, many experts predict humanity can reverse this crisis.

No, this isn’t like any other global warming solution you’ve heard of, like limiting greenhouse gas emissions, developing electric vehicles, or restricting farming.

These old solutions may sound reasonable, but they’re not the fastest or easiest — we’re talking about an entirely new breakthrough that works “with” climate change… not “against” it.

When scientists first discovered the possibility of this breakthrough a while back, they were blown away by how much simpler and more effective it was.

Some even call it…

“The Secret Weapon To Combating Climate Change” 4

However, it wasn’t until Pond Technologies (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) came along with its “special tank” that this breakthrough became feasible on a large, industrial scale.

And that is why we’re so excited to share with you this story right before the mainstream financial media catches on.

But… before we discuss Pond Technologies’ technology, you need to understand the catalyst behind its massive potential.

Because this investment opportunity isn’t simply about another flashy tech.

It’s about the recent global push toward net-zero carbon emissions that every investor needs to hear about.

So let us explain what this all means to you, by revealing…

Why “Smart Money” Could Continue Pouring Into Pond Technologies

Reason #1 – Pond Technologies Holdings Inc. (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) Riding Soaring Demand!

Right now, smart money is flooding into the carbon credit market like never before, according to Forbes.5

Right now, smart money is flooding into the carbon credit market like never before, according to Forbes.5

Billionaire investor Mark Cuban, for example, has been buying $50,000 in carbon offset tokens and putting them on the Blockchain every 10 days.6

That could be MANY times over each $50,000 stake by now, showing how bullish a big-time investor like Cuban is about this space.

And it’s easy to see why.

Recent record-levels of CO2 emissions have caused the carbon credit market to soar to $270 BILLION!7

This is a huge phenomenon – so much so that it is about to spawn a brand-new investment type in Canada, carbon credit ETFs8…

And you wouldn’t guess it, but in Europe…

This Type Of Investment Has Even Outperformed Profitable Ones Like Bitcoin! (yes, that Bitcoin)9

In fact, analysts predict it could continue to surge, which demonstrates the ever-growing pressure on green initiatives.10

With so much momentum going on… this could be extremely exciting for the right investors who choose the right opportunities.

As many experts believe, the carbon credit market is crucial so that achieving global net-zero emissions is not just a pipe dream, but a reality that humanity can reach one day.

Because it could be the only way to hold corporations accountable for their carbon footprint, through legal and financial mechanisms.

That’s why the carbon market has not only recorded an unprecedented Compound Annual Growth Rate (CAGR)… but has also made headlines everywhere in 2021.

So, for the chance to create an impactful investment for yourself…

It’s Urgent That You Align Yourself Correctly With The Carbon Credit Market

You see, back then, the carbon credit market used to be reserved primarily for governments, companies involved, and insiders due to its complexity.

But things are about to change…

Many innovative tech companies are at a point where they can tackle the climate change crisis in a way that retail investors will understand.

Pond Technologies Holdings Inc.’s (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) is one because, as you’ll see in a sec…

It’s invented a proprietary solution that could help large-scale carbon emitters like factories, oil refineries, and every other type imaginable significantly lower their carbon footprint…

And as a result, help these emitters (their clients) profit big time from the massive carbon credit market.

Simply put, Pond Technologies is now swimming in huge demand because of the climate change tipping point.

Which is why it is poised for exciting growth, as it rolls out its tech worldwide.

Reason #2 – Pond Technologies Holdings Inc.'s (TSXV:POND)(OTC:PNDHF) (TSXV:POND)(OTC:PNDHF) Holds Patented Breakthrough Tech

Remember that “special tank” we talked about earlier?

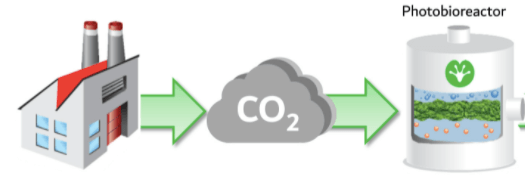

It’s called a bioreactor, and it uses proprietary technology developed by Pond Technologies.

As previously mentioned, governments are now putting more pressure than ever on carbon dioxide emitters (e.g. factories, oil refineries, etc.) to reduce their environmental footprints.

When you combine that with the lucrative incentives of the carbon credit market, you’ll see a flood of emitters looking for ways to reduce their carbon impact…

While still maintaining their productivity and bottom line.

And that’s exactly what this one-of-a-kind technology, the bioreactor, allows them to do.

How?

By connecting the bioreactor to a factory’s smokestack, for example…

The produced CO2 is redirected and goes straight into the tank, where a proprietary process transforms the gas into algae growth.

In a minute, you’ll see why algae is a BIG reason why Pond (TSXV:POND)(OTC:PNDHF) (TSXV:POND)(OTC:PNDHF) is poised to be extremely profitable…

For now, let’s focus on CO2 — because the idea of transforming instead of limiting CO2 emissions is truly revolutionary.

Think for a moment why it’s been a struggle to get these factories to stop polluting our planet.

Is it because they’re selfish capitalists who could care less about the environment? Maybe.

But it’s more so because their hands are tied by productivity and bottom line.

And now? You’ve got a solution that lets them keep producing without destroying the environment, and lets them massively profit from carbon credits at the same time.

So why wouldn’t MILLIONS of factories around the world want what Pond technologies offers?

Pond Technologies’ makes money by not just licensing out the technology, but also monitoring the entire CO2 transformation process for the emitters (their clients).

As you can imagine, this technology isn’t cheap, but carbon emitters will likely pay whatever it takes to maintain, if not boost their ROI in the long run.

A Situation That Could Offer Early Investors The Opportunity of a Lifetime!

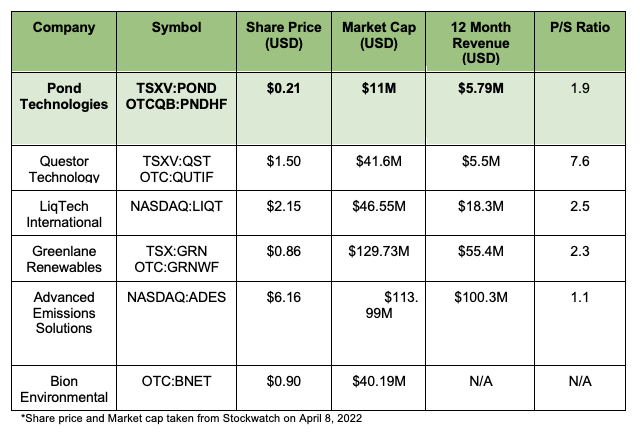

Certainly, you may wonder if similar tech already exists, and the truth is… yes, they do, but hold on…

Because whatever exists out there is hardly comparable to Pond Technologies (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) tech.

We’ll explain why, so take a look at this:

What you’re seeing is an old method of converting CO2 into algae.

It’s true, scientists already know algae is the most efficient11 natural way to “remove” carbon dioxide from the atmosphere.

In fact, algae can do so up to 400 TIMES FASTER12 than a tree…

Seriously, it could be a much better solution than reforestation and others, which is why…

“There Is An Early Tech Race Going On In This Space.”

But the primitive you just saw requires a large pond, about the size of a few football fields.

And since it’s outdoors, algae growth is totally dependent on climate, only occurs on the water surface (is a waste of space), and is also vulnerable to contamination.

The bottom line?

It is archaic, expensive, hard to maintain, wasteful, and not scalable.

Now, as opposed to all that, Pond Technologies’ (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) bioreactor is only a few drums wide, and operates within a contained environment.

This means total algae growth control, higher yield, 24/7/365 operation, and overall less space.

As a result, it’s incredibly scalable, which boils down to one simple fact:

Pond Technologies’ is the best, if not the only long-term solution.

And to brace for copycats, Pond Technologies already has 26+ patents… and 48+ others pending to protect its process and technology.

That’s why…

Pond Technologies (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) Could Be Poised To Become A Legitimate Monopoly

And even potentially be as exciting as other tech monopolies like Microsoft, Tesla, and Facebook.

These juggernauts made life-changing profits for investors who got in early.

And Pond Technologies could potentially be another replay of those major successes — if not even potentially bigger…

Why? Well, simply because the climate change crisis is a much greater stake. Glaciers and the polar ice caps are melting at an unprecedented pace. Arctic sea ice is being lost at a rate of 13% per decade and over the past 30 years, the oldest and thickest ice in the Arctic has declined by 95%!13

This is just one reason why the carbon credit market is booming in the first place.

But wait, there are more revenue opportunities for Pond Technologies’…

You see, those tons upon tons of algae that grow in the bioreactor year-round? They won’t end up in the trash.

They alone can make Pond Technologies (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) a lot of money.

We're Talking About A $730 BILLION Market 14 This Company Could Tap Into…

Which has nothing to do with climate change.

Or carbon credits

But everything to do with these industries:

- Food, beverages, nutraceuticals (10 billion)

- Fish and animal feeds (20 billion)

- Biotech (600 billion)

- Bioremediation (100 billion)

How?

All you need to know is this:

Pond Technologies’ repurposes the algae into products that are highly demanded by those industries, such as…

- Human grade food

- Fish and animal feed

- Pharmaceuticals

- And more…

… then sell them on behalf of the emitters (their clients).

So not only is Pond Technologies (TSXV:POND)(OTC:PNDHF) (TSXV:POND)(OTC:PNDHF) making money from licensing and servicing their tech, but also from algae-based products that don’t cost extra to make.

Consider the revenue potential in the fish feed market alone.

Right now, there are about 7,634 large greenhouse gas/carbon emitters in the US (yes, just in the US)15 that emit a whopping 2.6 BILLION tonnes of CO2 every year.16

That works out to about 340,581 tonnes of CO2 on average per facility.

Pond Technologies’ patented scalable technology can convert every 2 tonnes of CO2 into 1 tonne of algae,17 meaning it can generate over 170,000 tonnes of algae biomass annually.

And in the fish feed market, microalgae biomass currently sells for between $2-$4 per kilogram OR roughly $2,000-$5,000 per tonne.18

That means an average carbon-emitting factory has the potential to generate millions per year in valuable algae for a high-demand market with limited competition all thanks to Pond (TSXV:POND)(OTC:PNDHF).

In exchange, Pond collects payment for the equipment plus technology access fees, consulting services and an ongoing 5% royalty on the final product.

I’ll let you do the math on that one (hint: it’s a lot).

In case you’re wondering if algae-based fish feed is in high demand, the answer is Yes.

The market for fishmeal and fish oil is expected to reach a massive $14.28 trillion this year.19

And everyone wants a solution to the current way of sustaining and harvesting seafood, which is damaging the planet massively.20

Unlike current products on the market, algae-based fish feed is much less intensive and literally helps save the environment by removing emissions.

Simply put, it’s a breakthrough replacement solution.

That’s why Pond Technologies could be about to disrupt this billion-dollar market, and could produce multiple windfalls in royalties based on the number of clients – again, we’re only talking about the US.

The best part? Fish feed is just one of many markets the company could disrupt – there’s also human food, animal feed, pharmaceuticals, and more, and they’re all growing fast!

Bottom line is, carbon dioxide is literally “free gold” for Pond Technologies… simply because the company has the patented tech to take full advantage of it.

As you read below, you can clearly see why the first signs of exciting growth are already obvious.

Reason #3 – Pond Technologies’ (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) Notable Relationships To Accelerate Growth

Pond Technologies just partnered with AB Agri.21

One Of The World’s Largest Manufacturers &

Distributors Of Premium Animal Feed Products

This engagement between them consists of two parts:

A supply agreement, where AB Agri will install Pond Technologies’ bioreactor system for C$2.9 million…

As well as a license agreement, under which Pond Technologies will receive up to C$2.6 million in the technology access fees, PLUS…

An ongoing royalty based on the production of algae grown for animal feed.

In a nutshell, this is nearly C$6 million from just one single deal…

And we haven’t even included the royalty payments Pond (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) will continue to receive.

If you think about it:

This Bioreactor Could Be A Limitless “Passive Income Machine” For The Company.

And when you multiply this cash cow of a technology by the number of carbon emitters around the world…

You’ll see why a $730 billion market potential22 could just be a conservative estimate.

Now, experience has shown you can evaluate a company’s growth potential based upon its alliances, so let us tell you more…

A government entity called The National Research Council of Canada, a national science research and technology organization, has also backed Pond Technologies (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) as an advisor, and it’s no surprise why…

Government Entity Acting As Advisory To Speed Up Growth

Everyone knows the world leaders are all pushing green initiatives, which is why when Pond Technologies came along, the government had every reason to support its success – and that means…

POND could maximize its potential faster than anyone can imagine!

And because of that, St Mary’s, a major producer of cementitious materials in Ontario, invested heavily in Pond Technologies…

And Malone Group, a leading consulting firm, has partnered with Pond Technologies to help accelerate their project to new heights.

Of course, we can go on and on about Pond Technologies’ (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) backers, including an undisclosed Fortune 500 oil and gas company (come back for the reveal soon), but the point is…

The company has every catalyst to drive its stock to uber-success.

Here’s the thing: we can’t promise you any particular investment is a guarantee…

But we are confident you can put two and two together at this point, considering what could be an undeniable pile of evidence you’ve just learned.

And so let us add one more piece to that pile:

Reason #4 – Pond Technologies Holdings Inc.’s (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) Growing Revenue & Blue Sky Potential

Now, if you haven’t learned about the massive carbon credits market,

If you haven’t seen their patent-protected technology breakthrough,

And if you haven’t heard about the $730 billion23 market potential…

You would probably be surprised to discover:

Pond Technologies’ Revenue Jumped By A Staggering 70% From 2020 To 2021.

In Q3 2021, Pond Technologies reported $2.16 million in revenue compared to $1.27 million a year prior, and up nearly 70% from Q2 2021 which was $700,00024

The company’s Q3 2021 margin was 42% ($902,000), a massive 416% improvement from 13% ($175,000) in Q3 2020.

Pond Technologies (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) has also seen strong revenue growth that may continue to trend higher in future quarters. Pond’s TTM revenues in FY2021 were 104.55% higher YoY, suggesting an aggressive positive growth trend so far. The same can be said for the company’s profitability which continued to increase, up nearly 300% for FY2021 YoY.

** All figures above in CAD

But now you know it’s only the beginning, and the sky’s the limit.

Because history proves that when you see a pattern like this, acceleration could already be within reach.

A perfect example are all the FAANG stocks that smart investors heavily invested in.

And now, this could be a second chance for anyone who missed out on them a decade ago.

So here’s your takeaway: the sooner you put Pond Technologies on your watchlist, the sooner you’ll be able to see first-hand what a $730 BILLION25 disruption would look like.

Imagine the impact today, and act before the ship sets sail.

Reason #5 – Pond Technologies’ (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF) Superb Management Team

Grant Smith – CEO

Executive with 25+ years experience in the global health supplements and ingredients space. Co-Founder & partner at RFI Ingredients, a large manufacturer for ingredients to well known consumer brands across North America. Prior to this, Grant served in a leadership role at various major consumer packaged goods companies in North America.

Thomas Masney – CFO

Worked with Goldman Sachs & GE in venture capital, mergers & acquisitions, and for both Ernst & Young and Price Waterhouse in audit and corporate recovery. Thomas brings with him a strong understanding of the mining, construction, manufacturing, technology, and e-commerce industries.

Peter Howard – VP of Project Development

Senior business development and cleantech executive. Climate change and sustainability consulting experience with PwC and Zerofootprint, developing multimillion-dollar business lines. Senior policy advisor to Canadian governments on climate change policy.

Dan O’Connor – VP of Business Development

An entrepreneur in the control systems and biofuels industries, Dan has extensive understanding of what it takes to bring new and emerging industries to scale and commercialization. Dan has also been involved in the Cannabis area where he was involved as a consultant in business development and ultimately in negotiations involving the sale of the company to a larger industry player.

RECAP: 5 Reasons “Smart Money” Could Keep Pouring Into Pond Technologies (TSXV:POND)(OTC:PNDHF)(TSXV:POND)(OTC:PNDHF)

- Pond Technologies Riding Soaring Demand! (Mark Cuban’s all-in… new investment type created… carbon credit surging… all prompting POND’s target market to flock to them).

- Pond Owns Patented Breakthrough Tech! The company developed IP breakthrough technology that could reverse climate change.

- Pond Technologies Holdings Inc.’s Notable Relationships To Accelerate Growth (the company easily secured millions in contracts, with bigwig backers from the regulatory, investment, and industrial background).

- Pond Technologies’ Growing Revenue & Blue Sky Potential (70% revenue jump in a year, with signs of acceleration already visible).

- Pond Technologies Holdings Inc.’s Superb Management Team (leadership with the right background to reach the company’s maximum potential).

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Pond Technologies Holdings Inc. (“POND “) and its securities, POND has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by POND ) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company POND and has no information concerning share ownership by others of in the profiled company POND . The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to POND industry; (b) market opportunity; (c) POND business plans and strategies; (d) services that POND intends to offer; (e) POND milestone projections and targets; (f) POND expectations regarding receipt of approval for regulatory applications; (g) POND intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) POND expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute POND business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) POND ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) POND ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) POND ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of POND to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) POND operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact POND business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing POND business operations (e) POND may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Pond Technologies Holdings Inc.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Pond Technologies Holdings Inc. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Pond Technologies Holdings Inc. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Pond Technologies Holdings Inc. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Pond Technologies Holdings Inc. ’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Pond Technologies Holdings Inc. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Pond Technologies Holdings Inc. industry; (b) market opportunity; (c) Pond Technologies Holdings Inc. business plans and strategies; (d) services that Pond Technologies Holdings Inc. intends to offer; (e) Pond Technologies Holdings Inc. milestone projections and targets; (f) Pond Technologies Holdings Inc. expectations regarding receipt of approval for regulatory applications; (g) Pond Technologies Holdings Inc. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Pond Technologies Holdings Inc. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Pond Technologies Holdings Inc. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Pond Technologies Holdings Inc. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Pond Technologies Holdings Inc. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Pond Technologies Holdings Inc. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Pond Technologies Holdings Inc. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Pond Technologies Holdings Inc. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Pond Technologies Holdings Inc. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Pond Technologies Holdings Inc. business operations (e) Pond Technologies Holdings Inc. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Pond Technologies Holdings Inc. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Pond Technologies Holdings Inc. or such entities and are not necessarily indicative of future performance of Pond Technologies Holdings Inc. or such entities.