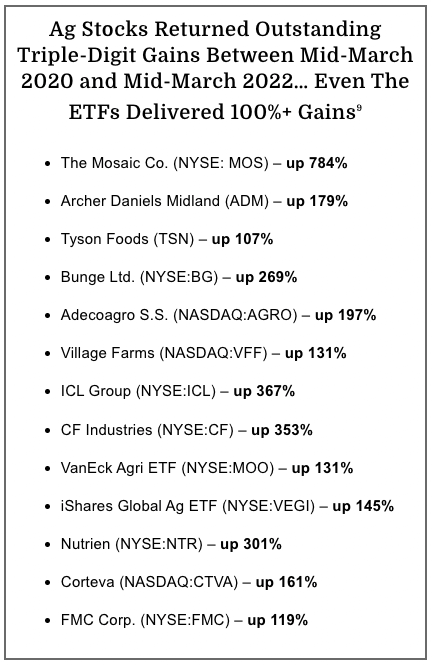

Take one look at the numbers and you’ll be hungry for Ag stocks too.

- FOLLOW THE MONEY – A critical supply chain disruption has devastated the fertilizer market, sending costs sky high. In Iowa, a state that produces 10% of the U.S. food supply1, the pig manure that farmers bought at $10 a ton in 2020 soared to prices running from $40 to $70 in 2021.

- SET TO MEET DEMAND – One startup company now provides a scientific advancement that could revolutionize how food is grown – making it faster, cheaper, safer, and more nutritious.

- MARKET POWER – This innovative method of restoring nutrient-stripped topsoil has major global implications. Better still, it has stock-price implications.

- TIME TO JUMP IN – The question now is how quickly CGS International Inc. (OTC:CGSI) could join the agriculture sector’s long list of triple-digit winners?

A quiet company looks positioned for success, thanks to a breakthrough with the potential to redefine agriculture in the 21st century.

Of course, lots of investors will miss what looks to be a no-brainer opportunity because they simply overlook agriculture stocks.

Of course, lots of investors will miss what looks to be a no-brainer opportunity because they simply overlook agriculture stocks.

But an ag startup with the means to enhance food production across the globe has the potential to be as explosive as a biotech with a new drug or treatment.

So, while a once little-known NASDAQ biotech called EDAP TMS (EDAP) soared 319% between March 2020 and March 2022, thanks to an innovation in prostate cancer treatment…2

Another small startup, in the agriculture space, unveiled a breakthrough that could be used for the benefit of all mankind.

And Wall Street is just now waking up to its moonshot potential.

That’s why investors need to latch onto CGS International Inc. (OTC:CGSI), because it is now poised to become one of the year’s top innovators.

Bigger, Better, Cleaner Crops

CGS International’s (OTC:CGSI) subsidiary, World Agri Minerals, has found an all-natural way to dramatically increase agricultural yields.

That includes bumper crops of grains that can feed billions of people… grains such as rice, wheat, and soybeans. As well as increased yields in fruits and vegetables, hemp, and legal cannabis.

In short, the idea that should draw focus is the universal nature of CGS International’s (OTC:CGSI) advancement in fertilizer.

Their revolutionary new product, Genesis 89, could help cut costs for families getting pounded at the grocery store by wallet-busting inflation.

More importantly, Genesis 89 could play a role in solving the problem of widescale food insufficiency in developing countries.

Here’s the whole story…

The Secret To Greater Yields

The breakthrough occurred in the aftermath of a natural disaster – the 2004 tsunami that devastated coastal areas of Indonesia.

The tsunami poured so much salt water on farmland that experts forecast that the fields could lie fallow for a decade.

But something intriguing happened to the growing season just after the tsunami. The tragedy was not multiplied by salt-rich sea water.

Instead, some of the hardest hit farms witnessed a surprising result, they experienced bumper crops such as never before seen.

The Associated Press reported the outcome this way:3

“From atop the coconut tree where he fled to escape the onrushing water, Muhammad Yacob watched the tsunami turn his rice paddy into a briny, debris-strewn swamp.

Nine months later, Yacob and his wife are harvesting their best-ever crop – despite fears that saltwater had poisoned the land.”

“The seawater turned out to be a great fertilizer,” said Yacob, 66, during a break from scything the green shoots. “We are looking at yields twice as high as last year.”

The explanation for the post-tsunami bumper crop was actually quite simple, even though it went against well-established methodologies.

Tapping An Unexpected Source Of Nutrients And Minerals

When the ocean surged inland, and covered the crops, it brought with it an abundance of deep-ocean minerals and microbes that soaked into the soil.

The monsoon that followed washed away the excess sodium, leaving a rich concentration of minerals that penetrated the earth.

Essentially, the ocean’s fertile biosystem had both re-energized and fortified soil that had been farmed for centuries.

It’s this discovery that CGS International (OTC:CGSI) is now bringing to farms across the globe.

You see, oceans are a storehouse of minerals that have been deposited over the millennia by rivers, streams, and glaciers, as well as volcanic activity in the ocean floor.

And CGS International taps into that rich storehouse – Genesis 89 is a seawater extract containing 80+ beneficial elements and microelements from the more than 50,000 species of microorganisms that live in the sea, such as phytoplankton, micro-flora and micro-fauna.

More than 10 years of research has been invested in a hunt to harvest essential microorganisms that are found on land, to create a product perfectly balanced for a wide range of agricultural needs.

In short, Genesis 89 and Genesis 89 Gold products…

- Improve root growth

- Increase the potential for nutrient uptake

- Support the plant’s immune system, and…

- Shorten the growing cycle.

The best part is that a healthier plant is less vulnerable to pests, cold, drought, and disease, ensuring farmers a stronger, more robust harvest in less time.

But the real key to the effectiveness of their product lies in the way the Trace Minerals are processed. Because the elements in Genesis 89 aren’t chemically or heat treated, these microorganisms arrive at the farm alive – ready to restore the mineral and nutrient content that was depleted by large-scale farming practices.

And the results have been astounding.

Proven Results—Now It’s Just A Matter Of Scaling Up

If you’re not familiar with Canaccord Genuity, it is an investment bank that focuses on smaller companies, like CGS International. Companies with big ideas and innovations, but that are still in an early phase of development.

Canaccord Genuity conducted a four-month trial with Genesis 89, involving three separated rows of tomato plants.

What the trial revealed was impressive.

Compared to a control group that was unfertilized, the plants treated by Genesis 89 produced tomatoes that were 6% larger.

That may not seem that significant when looking at the numbers from a small control study, but imagine what an increased 6% yield could do when applied large-scale to farmland. The economics of an increase that substantial could be a gamechanger for farmers across the globe.

And while bigger yields are a huge benefit to the agricultural industries bottom line, restoring soil health is the real win here, because it ensures fertile ground for generations to come.

Turning Back Time On Worn-Out Soil

After eons of farming, and a century of industrial farming, the topsoil in farm fields across the globe is anemic. Tired. Worn out.

Nearly half of the world’s most productive soil has disappeared to aggressive farming.4 Here at home, cropland topsoil is eroding 10 times faster than it can be replenished, making vast swaths of farmland nutrient-dead zones.

According to the Guardian, the world grows 95% of its food in the uppermost layer of soil, making topsoil one of the most important components of our food system.5

Topsoil is where the nutrition is.

Lack of topsoil also means the earth’s ability to filter water, absorb carbon, and feed people plunges.

Better Soils Create Better Food

Farmers aren’t the only ones suffering from the growing poverty of our soils. It’s a problem hidden in plain sight, right on your dinner table.6

- Since the 1940s, vegetables and fruits have lost 76% of their copper and 59% of their zinc on average.

- A famous study from University of Texas found that 43 different fruits and vegetables had significant declines in protein, calcium, phosphorus, iron, vitamin B2 and vitamin C between 1950 and 1999.

- The Kushi Institute, an organization tasked with advancing the understanding of the role macrobiotics play in healthful living, found that calcium levels in fresh vegetables dropped 27%, iron fell 37%, vitamin A dropped 21%, and vitamin C was down 30% over the past decades.

And all that time, farmers were dumping fertilizers with these minerals on the ground hoping it would help. It’s a losing battle, because dying soil can’t use the extra minerals efficiently, meaning it takes huge amounts of product to have any considerable impact.

Supply Chain Woes Add Fuel To An Already Critical Shortage

That’s an issue worsened by a global shortage of the materials necessary to make these fertilizers.

- Prices for manure have hit new highs in Iowa—the “pig poop” that farmers bought at $10 a ton in 2020 soared to prices running from $40 to $70 in 2021.

- Fertilizer expenses in North Dakota are more than twice last year’s

- Biosolids from waste treatment sludges are seeing demand rise to seven times the rate of last year.7

- Phosphorus, too, is getting harder to find. Most of it comes from mines in the US, China, and Morocco, but geologists say that those supplies could be completely gone within 50-100 years. Meanwhile, each year phosphorus miners have to tap into more and more difficult and inaccessible sources.

Worse, there is a supply crisis brewing due to the conflict in Ukraine.

Russia is the world’s biggest exporter of fertilizers… but disruptions in shipping, as well as higher prices for natural gas, a key ingredient for fertilizer manufacturing, have intensified the need for reliable, domestic sources.

Western sanctions, including those against Russian banks, are curtailing exports further by constraining financing.

As a result, the urea futures market has seen a 32% jump since on Feb. 24, while diammonium phosphate futures are up more than 13%.8

Now, with spring planting set to get underway, North American markets were counting on bumper harvests to help lower food costs. But as U.S. farmers begin to sow crops, they suddenly face sharply higher costs that are expected to slice the profit a farmer earns per acre by 20%.

Coming to market with a solution to help farmers around the world recover these costs could put CGS International (OTC:CGSI) in the spotlight.

The Problem Wall Street Hasn’t Seen

Yet Could Be Your Sweet Spot

That’s what makes CGS International (OTC:CGSI) the most important emerging company in the multi-billion dollar farm industry. This is the one company you should be watching if you like to be early on growth mega-trends.

CGS’s unique products can actually put the life back into our dying soil.

And best of all for investors who are alert to this opportunity… they have literally no competition.

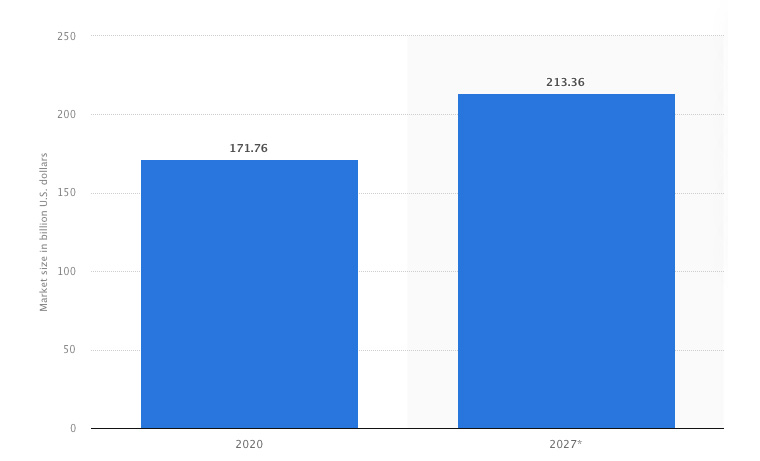

Global Fertilizer Market Size 2020,

With A $213 Billion Forecast for 2027

The giants in the fertilizer business like Nutrien (NYSE:NTR–$25 billion in annual sales) and Mosaic (NYSE:MOS–$10 billion in annual sales) are too happy mining for phosphate and bagging up minerals to sell to farmers. They are not in the biology/life sciences business.

So the giants have literally left the door wide open.

And the farmers are paying attention. They know that the traditional fertilizers they’re buying are just a stopgap. You can’t throw potash, nitrogen, and phosphorus on dead ground and expect much to happen. It takes a rich population of microbes, bacteria, and live content to break down these minerals so plants can use them.

They know the hurdles farmers face, and they know they need CGS’s help.

8 Reasons To Add CGS International (OTC:CGSI) To Your Watch List Right Now

- SUCCESS – The agriculture sector has been home to a slew of triple-digit gains during the past two years. Value is hard to come by. That’s why CGS International’s (OTC:CGSI) share price could represent tremendous value for investors with long-term views.

- CONSERVATIVE INVESTORS WIN – Agriculture sector investing is just heating up, producing a myriad of triple-digit winners over the last 24 months – even conservative ETFs have delivered 130%+ gains lately.

- PROVEN RESULTS – The investment bank, Canaccord Genuity, reported that Genesis 89 delivered stellar results compared to plants that weren’t fertilized with it, a whopping 6% increase in yield.

- SAVING THE TOPSOIL – Genesis 89 could spark a revolution in how food is grown… making it faster, cheaper, safer, and more nutritious.

- SUPPLY WOES AS DEMAND GROWS – As Farmers begin to sow crops for the spring season, they are now facing higher costs, expected to slice the profit earned per acre by 20%.

- MASSIVE GROWTH – The international fertilizer sector is forecast to grow $40 billion to $213 billion by 2027. To do that, it will need new companies to augment supply. That is a huge opening for a startup such as CGS International.

As spring turns to summer, rapidly rising fertilizer costs could hit the mainstream as it forces already soaring food prices even higher.

The supply crunch and its threat to the food supply will likely soon be making headlines. And when it does, commodity investors could clamor into this now quiet sector.

Already CGSI seems to be moving onto their radars… evidenced by a significant increase in daily trading volumes.

That’s big news for an OTC startup.

But, it means time could be running short to take a close look at this small startup with big potential.

Visit the company’s website. Call your broker and get his feedback, too. We think he’ll see the potential in CGS International (OTC:CGSI).

1https://globaledge.msu.edu/states/iowa

2https://finance.yahoo.com/quote/EDAP/history?p=EDAP

3https://www.tampabay.com/archive/2005/09/26/farmers-reap-top-yields-after-tsunami/

4https://www.theguardian.com/us-news/2019/may/30/topsoil-farming-agriculture-food-toxic-america

5https://www.theguardian.com/us-news/2019/may/30/topsoil-farming-agriculture-food-toxic-america

6https://www.scientificamerican.com/article/soil-depletion-and-nutrition-loss/

7https://www.bloomberg.com/news/articles/2021-12-09/global-shortage-of-fertilizers-sends-demand-for-dung-soaring

8https://gro-intelligence.com/insights/russia-ukraine-crisis-ignites-fertilizer-prices-at-critical-time-for-world-crops

9https://finance.yahoo.com/quote/ADM/history?p=ADM

https://finance.yahoo.com/quote/TSN/history?p=TSN

https://finance.yahoo.com/quote/BG/history?p=BG

https://finance.yahoo.com/quote/MOS/history?p=MOS

https://finance.yahoo.com/quote/AGRO/history?p=AGRO

https://finance.yahoo.com/quote/VFF/history?p=VFF

https://finance.yahoo.com/quote/ICL/history?p=ICL

https://finance.yahoo.com/quote/CF/history?p=CF

https://finance.yahoo.com/quote/MOO/history?p=MOO

https://finance.yahoo.com/quote/VEGI/history?p=VEGI

https://finance.yahoo.com/quote/NTR/history?p=NTR

https://finance.yahoo.com/quote/CTVA/history?p=CTVA

https://finance.yahoo.com/quote/FMC/history?p=FMC

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of CGS International (“CGSI”) and its securities, CGSI has provided the Publisher with a budget of approximately $75,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by CGSI) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company CGSI and has no information concerning share ownership by others of in the profiled company CGSI. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to CGSI industry; (b) market opportunity; (c) CGSI business plans and strategies; (d) services that CGSI intends to offer; (e) CGSI milestone projections and targets; (f) CGSI expectations regarding receipt of approval for regulatory applications; (g) CGSI intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) CGSI expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute CGSI business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) CGSI ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) CGSI ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) CGSI ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of CGSI to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) CGSI operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact CGSI business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing CGSI business operations (e) CGSI may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling CGS International

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled CGS International and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any CGS International or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the CGS International Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled CGS International’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding CGS International future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to CGS International industry; (b) market opportunity; (c) CGS International business plans and strategies; (d) services that CGS International intends to offer; (e) CGS International milestone projections and targets; (f) CGS International expectations regarding receipt of approval for regulatory applications; (g) CGS International intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) CGS International expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute CGS International business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) CGS International ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) CGS International ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) CGS International ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of CGS International to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) CGS International operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact CGS International business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing CGS International business operations (e) CGS International may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of CGS International or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of CGS International or such entities and are not necessarily indicative of future performance of CGS International or such entities.