Breaking News: Lynx Global to Acquire Controlling Interest in Philippine Based Binangonan Rural Bank Inc.

President & CEO, Mike Penner states,

“These components along with our partnership with a Major Payment Institution license holder in Singapore, is enabling us to build an end-to-end digital payment platform in the ASEAN and Oceanic region. The addition of a licensed bank with an Electronic Money Issuer license to our Lynx financial ecosystem now enables us to offer a complete suite of payment and financial services to domestic and international enterprises.”

Lynx Global Digital Finance

(OTC: CNONF / CSE: LYNX / FSE:3CT)

Building technology bridges that allow 1/3rd of the global adult population to fully participate in the emerging $52.4 TRILLION digital payment industry. 1,2,3

This could be the last remaining, global payment companies to launch on the market today…a huge potential investment opportunity.

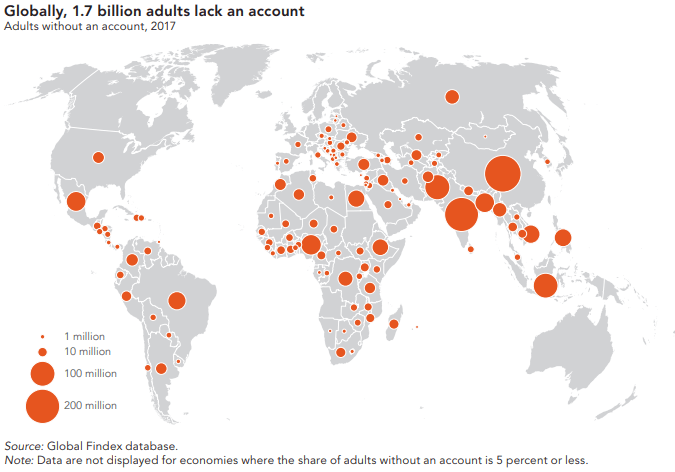

Lynx Global technologies seek to bridge the enormous gap that currently exists between major economies and 1.7 billion people in the world who have little or no access to financial technology resources.

The aggregate market value of these underserved populations now exceeds $6.68 trillion!4 Those trillions could rapidly go mainstream thanks to Lynx Global Digital Finance Corp (OTC: CNONF | CSE: LYNX | FSE:3CT0).

The aggregate market value of these underserved populations now exceeds $6.68 trillion!4 Those trillions could rapidly go mainstream thanks to Lynx Global Digital Finance Corp (OTC: CNONF | CSE: LYNX | FSE:3CT0).

Imagine the revenue potential as Lynx Global opens these enormous untapped cash streams to the world! An ocean of cash through Lynx Global pipelines could propel it to become one of the biggest digital payments companies in the world.

And it’s just getting underway. This is a massive early-stage opportunity that could rocket out of its startup stage. Now is the time to get involved!

One more shot at the financial technology money-making sector.

Digital payment services has already proven itself to be a fast-paced, highly lucrative investment arena. The major companies that have begun flowing massive investments across developed economies have made fortunes for early stakeholders. And they’ve done that while concentrating only on the major markets.

For the sake of their global growth objectives, mainstream companies passed on the potential of smaller, emerging markets.

This left a huge gap in global coverage that Lynx Global (OTC: CNONF | CSE: LYNX | FSE:3CT0) seeks to fill. The scale of it is enormous, totaling over $6.68 trillion, a market size that could send Lynx Global soaring.

Take a hard look at this. It may be the last big chance you’ll find to get an early start in a global digital payments powerhouse.

Lynx Global business strategy clearly reveals its enormous growth potential.

Now is the time to start your due diligence. Financial technology (fintech) stocks have been among the fastest growing in the market. By mid-decade, global electronics payments project to reach $52.4 trillion annually…$52.4 TRILLION!

Prior to the launch of Lynx Global (OTC: CNONF | CSE: LYNX | FSE:3CT0), fully a third of the world’s population could not be efficiently or effectively connected to that market. Bridging that gap is massive step forward in unifying all global economies to digital commerce.

Prior to the launch of Lynx Global (OTC: CNONF | CSE: LYNX | FSE:3CT0), fully a third of the world’s population could not be efficiently or effectively connected to that market. Bridging that gap is massive step forward in unifying all global economies to digital commerce.

Now it’s moving faster than ever. The global Covid-19 outbreak poured more fuel into accelerating digital payment services. Opening these services to the remaining third of the global population may be the last big step in the maturation of this transformative global economic system.

Digital payment stocks have been soaring!

In recent years these stocks have been on a tear. Early investors made fortunes.

Here are a couple examples of the stunning gains that have been posted thus far.

As of May this year, the combined market caps for three global companies, PayPal, Square and Shopify now exceeds $500 billion!

Close behind are Stripe, Adyen and Coinbase, each of which carry market caps today in the $50 billion-$100 billion range.5

As a point of reference on how funds flowing through a payment pipeline can impact market cap, PayPal payments (funds flow) now total $950 billion.

That’s one-seventh the aggregate market being targeted by Lynx Global!

These references are not intended to imply a projected valuation for Lynx Global. Instead, these bring to focus the scale of the opportunity that Lynx Global is pursuing.

Lynx Global may be the last major step to a fully integrated global digital economy.

Early investor profited handsomely from the inroads made in the most affluent markets. But there’s much remaining from the markets so far passed by. Immense upside remains as Lynx Global seeks to complete the global digital payments evolution by bringing the final $6.68 trillion into play!

Now is the time to consider if an investment in Lynx Global (OTC: CNONF / CSE: LYNX / FSE:3CT0) fits with your investment goals and strategies.

Lynx Global seeks to exploit its unique competitive position by launching operations in the red-hot Asian markets…then expanding its network capabilities throughout the Middle East and Africa.

Company management believes that its successful launch in Asian markets will pave the way for rapid growth into other areas and ultimately cement it in the top tier of all digital payment companies.

From its strategic Asia-Pacific headquarters, Lynx Global put in place the regional resources to penetrate the enormous economic potential of the area.

This creates a huge competitive advantage for Lynx Global.

“[Asia Pacific] is not just the world’s fastest growing market, but it’s a fragmented market… with different laws, languages, currencies and in some cases currency control.”6

The investment potential here sits completely off radar. Investors have been pouring into mainstream companies. Many of those early entries have been missed. For ground floor investing, Lynx Global is a must-investigate opportunity.

As cited above, the aggregate markets targeted by Lynx Global now exceeds $6.68 trillion, over seven times the funds flowing through PayPal! For perspective, PayPal is now a $284 billion company!

Give that some serious thought!

While some big mainstream players persist in targeting only the deep pocket sectors, Lynx Global intends to become the dominant solution that connects all remaining underserved markets to all global digital economies.

To call this a huge investment opportunity may not be an exaggeration!

Today, the populations being targeted by Lynx Global account for one-third of the word’s adult population and most significant in their cultures, many have no working relationship with a bank.

They are the “unbanked”; they live and work largely with cash and their lifestyles and cultures have kept them out of reach from the mainstream.7

But this does not mean they’re isolated from technology.

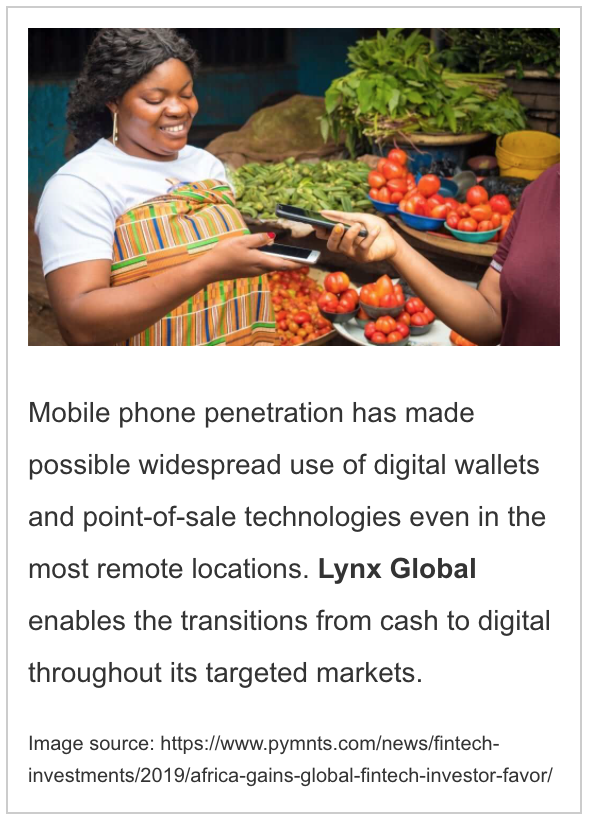

Lynx Global’s expansion into these economies will be driven largely by mobile technologies that are rapidly expanding throughout these populations.

Two-thirds of that population, about 1.2 billion people, have a mobile phone.8 That’s 2017 data, the latest that could be found! Now, four years later, that figure could be much higher.

Looking forward to 2024, projections are that digital wallets are on track to dominate Asia-Pacific e-commerce payments in key markets. It’s already a significant global trend.

“Globally, use of mobile wallets exceeded cash for the first time for in-store payments. Cash usage dropped 10 percentage points in 2020 to account for just one-fifth of all face-to-face payments worldwide.” – paymentsjournal.com 9

So, with millions of mobile phones in hand, thinking that the “unbanked” are technology challenged is a mistake.

So, with millions of mobile phones in hand, thinking that the “unbanked” are technology challenged is a mistake.

It’s certainly not a mistake that Lynx Global (OTC: CNONF / CSE: LYNX / FSE:3CT0) is making!

As consumers increasingly turn to digital wallets and central banks pursue digital currency models (referenced later in this report), trillions of dollars now in their cash currencies will be forced to go digital. As it does, Lynx Global stands to be the foremost facilitator of digital transactions in its markets, from local consumer purchases to international settlements.

With an economic transformation of this scale, this investment opportunity with Lynx Global could be life changing!

A transforming global economy that impacts every person and business on the planet!

In the global transition to digital currencies and transactions, the cash-driven world will evaporate.

In time, every bit of that $6+ trillion Lynx Global is targeting will likely be digitized. To facilitate that transition, pipelines of digital commerce must be established. Lynx Global Digital Finance is moving rapidly to build those pipelines.

Mobile phone technology, the platform for consumer-based digital commerce, is approaching full penetration of adult populations.

For the unbanked, their mobile phones are their connection to real time global financial solutions.. They understand and use available mobile technologies and Lynx Global intends to support their continued access to the world of digital commerce.

The Lynx Global growth strategy is simple; build the digital financial services network necessary to connect its targeted markets with all global digital economies.

Make no mistake, fintech IS the future for global commerce. The transformations from cash to digital have been expanding rapidly over the last few years. From the outset, the growth has largely been concentrated in developed markets where conventional banking penetration approaches 100% of the populations. Early investors have already made fortunes from big tech companies that have paved the highway.

Make no mistake, fintech IS the future for global commerce. The transformations from cash to digital have been expanding rapidly over the last few years. From the outset, the growth has largely been concentrated in developed markets where conventional banking penetration approaches 100% of the populations. Early investors have already made fortunes from big tech companies that have paved the highway.

As of May 2021, according to Google Finance, VISA is largest publicly traded Fintech company in the world with a market capitalization of $495 Billion followed in second place by MasterCard with a market capitalization of $372 billion. These two companies facilitate an enormous flow of funds worldwide and Lynx Global has already established active working relationships with them in multiple global jurisdictions.

Further, Lynx Global has uniquely positioned itself to provide network solutions any and all companies seeking to expand service capabilities into Lynx Global market areas.

By establishing Lynx Global (OTC: CNONF / CSE: LYNX / FSE:3CT0) as a service hub for growing digital payment services, Lynx Global anticipates extremely rapid growth as it builds relationships with global companies of all sizes.

In past, digital payment services have focused almost exclusively on the most lucrative, highly responsive first-world markets. Enormous investments have been made in the competition for securing market share and positioning, particularly in North America and Europe. For good reason. Big tech had to fight hard for reach and share in those rocketing markets.

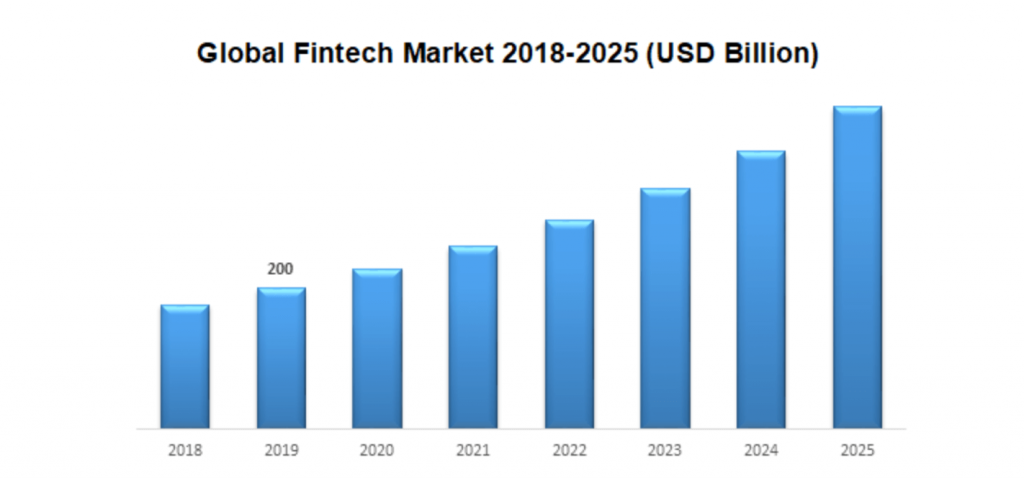

And how fast are they rocketing? Key statistics are stunning. According to a recent report published by financesonline.com, this market’s growth is unprecedented.[1]

- The global fintech market is expected to grow at a CAGR (Compound Annual Growth Rate) of 23.58% from 2021 to 2025.

- Artificial intelligence is one of the leading technologies in the fintech market, with a market share of 38.25% in 2019. (Last reported.)

- Blockchain and regulatory technology are the fastest-growing segments of the fintech industry with a CAGR of 50% in the next six years.

- Regtech is estimated to grow at a CAGR of 52.8%

- Peer-to-peer (P2P) or digital lending is expected to grow through 2026 with a CAGR of 26.6%

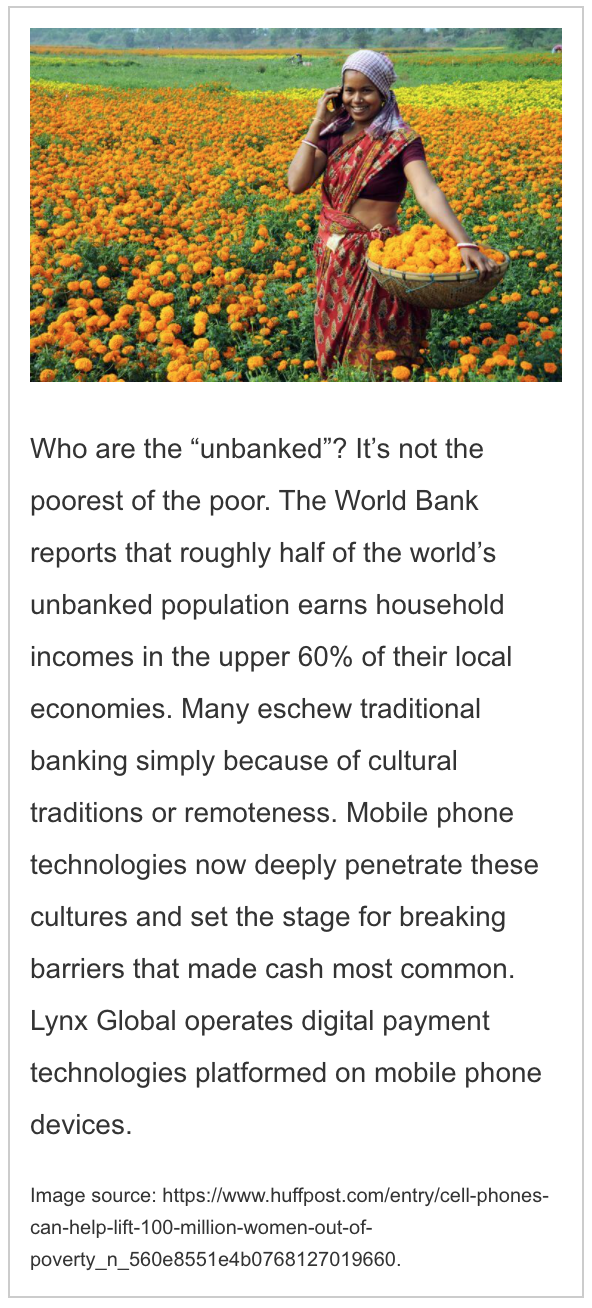

Who are the “unbanked”? It’s not the poorest of the poor. The World Bank reports that roughly half of the world’s unbanked population earns household incomes in the upper 60% of their local economies. Many eschew traditional banking simply because of cultural traditions or remoteness. Mobile phone technologies now deeply penetrate these cultures and set the stage for breaking barriers that made cash most common. Lynx Global operates digital payment technologies platformed on mobile phone devices.

Image source: https://www.huffpost.com/entry/cell-phones-can-help-lift-100-million-women-out-of-poverty_n_560e8551e4b0768127019660.

These statistics are a mere fraction of the story. As you launch your due diligence, you’ll likely uncover a plethora of similar data, all pointing to one thing: This is an enormous global growth opportunity that is just now getting started. As a potential stakeholder in this fast-growing sector, where to start is key to capturing the greatest wealth-building potential.

The world is going digital. So digital payment services will be essential to the future of all economies, regardless of size or wealth.

Of all the statistics you can uncover, perhaps this is the most important. It points squarely at the regions of the world where the growth of financial technologies can be most transformative…and for early stakeholders, enormously opportunistic.

Lynx Global (OTC: CNONF / CSE: LYNX / FSE:3CT0) is moving aggressively to become the leading global resource that connects underpenetrated emerging markets with global mainstream economies.

Lynx Global has focused exclusively on those objectives and plans to bring these technologies to economies with turnkey solutions.

Today, Lynx Global has launched operations in Asia-Pacific regions with longer term plans for expansion into the Middle East and Africa.

The company is accelerating its growth curve by acquiring select licensed businesses and signing several strategic partnerships to immediately control multiple layers of services and capabilities essential to reaching global markets.

Lynx Global plans to become the key facilitator for the billions of dollars that can flow through these layers, generating enormous company revenue through fractional fees. Over the course of a decade, the aggregate value of funds flowing through Lynx Global pipelines could build into the trillions of dollars, which could throw off enormous wealth to Lynx Global and ultimately, Lynx Global stakeholders.

Lynx Global Digital Finance technology layers create seamless pathways to facilitate local and international commerce for the markets it serves.

In a world transitioning to digital, all economies large and small must be fully capable of conducting business through digital networks. The Lynx Global network intends to make that possible.

Lynx Global’s topmost technology layer serves the business-to-business environment. It is here that financial transactions must move efficiently and fluidly both in intra- and inter-economy transactions.

At the core are three key elements necessary to effectively link newly established digital currencies to traditional legacy banking. Lynx Global (OTC: CNONF / CSE: LYNX / FSE:3CT0) reports having technology and services in place to facilitate all three.

- The foundation is licensed operations in each target market country, which includes, but is not limited to these essential economic services: Remittance and forex; card issuing and acquiring; consumer and business banking; cryptocurrency exchange and digital asset custody. Lynx Global now holds a portfolio of licenses that allows it to perform these types of payment services in the markets it serves.

- On top of a foundation of licensed operations, Lynx Global enables network partners, financial institutions, merchants and other companies to link multiple digital revenue sources into a single stream, thus efficiently resolving potential conflicts in income and expenses. This can be vitally important with business-to-business transactions that flow from multiple, separate digital sources.

- The Lynx Global’s proprietary Tech Stack™ system goes further by seamlessly managing all fiat and cryptocurrency types in a single self-managing layer. It allows settlements to be completed in any form or source of currency. With Tech Stack anyone can send or receive payment with any type of currency through any delivery channel.

The Lynx Global strategy for connecting mainstream economies with unbanked and the emerging markets is truly revolutionary. For emerging economies with unbanked populations, Lynx Global makes it possible for any business to easily navigate the rising tide of global digital economies.

Then there’s the consumer layer. Lynx Global offers digital transaction technologies to support commerce at the local community level.

Lynx Global’s (OTC: CNONF / CSE: LYNX / FSE:3CT0) customer-friendly mobile app technologies make possible the consumer financial services that are becoming essential for day-to-day transactions.

Lynx Global’s (OTC: CNONF / CSE: LYNX / FSE:3CT0) customer-friendly mobile app technologies make possible the consumer financial services that are becoming essential for day-to-day transactions.

It could be any number of routine consumer transactions.

Collecting wages, making a consumer purchase, performing a remittance, topping up a digital wallet, paying bills and much more; Lynx Global carries with it the technology and resources to painlessly transition a population from cash to digital.

The necessity of this transition comes down to something as simple as a weekly paycheck. Payments to employees will move from cash to digital.

And to the benefit of Lynx Global stakeholders, the company’s first-in-market competitive advantage could solidify its position in unbanked economies now lacking these services.

Nobody in the world today has approached these markets with the full scope of services that Lynx Global plans to put in place. Just getting started, Lynx Global is launching operations in the Southeast Asian sector, which is rapidly emerging as the world’s megamarket for digital consumer finance.

The intention seems clear: Dominate and become recognized as the go-to player and strategic fintech partner of choice in this sought after geographic location.

Rewards for early Lynx Global stakeholders could be stunning. The company is progressing rapidly, with ever-evolving technologies and infrastructure to serve global financial transactions at both consumer and business-to-business levels.

Every necessary service needed for a fully functional digital economy is now being deployed and made operational, or in development for near future expansion.

As a potential stakeholder in Lynx Global, now is the time to begin your due diligence. This is a rapidly evolving situation that could gain significant near-term traction.

How big could this to become?

Through acquisition and strategic partnerships coupled with its own suite of proprietary technologies, Lynx Global has constructed and now operates a networked financial ecosystem that facilitates virtually all digital financial transactions.

These are geographical areas where the global transition to digital currencies can have the greatest impact on the population. The solutions offered by the Lynx Global Fintech Stack will offer seamless economic benefits to its global user base.

In the new world digital economy, the unbanked and emerging markets must rapidly continue to embrace digital solutions. Lynx Global not only makes this evolution possible, it streamlines the process making it effective from the top down so the entire global population can receive potential benefits.

What then could be the longer-term investment value for a Lynx Global (OTC: CNONF / CSE: LYNX / FSE:3CT0) stakeholder?

It all comes down to funds flowing…how much travels through the financial pipelines of the Lynx Global digital network infrastructure. Given the projected size of the emerging global electronic payments market, the flood of that funds flow could be enormous.

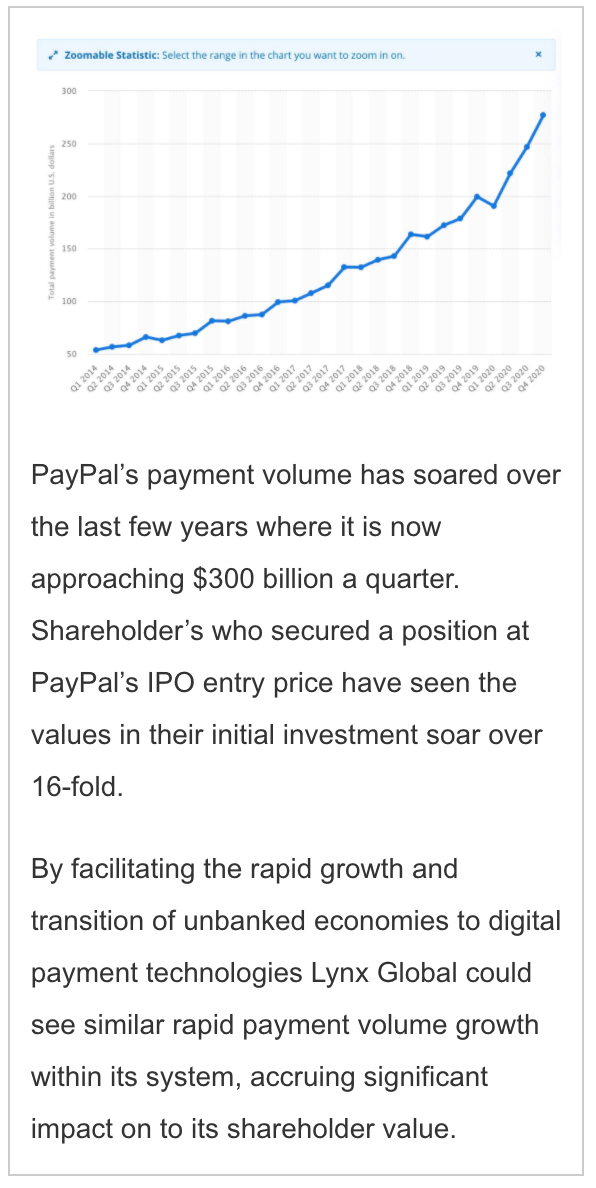

For a benchmark, the growth of PayPal provides a proxy example.

For a benchmark, the growth of PayPal provides a proxy example.

PayPal’s core busines revenue is generated entirely from the flow of money that travels through its payments network (just as in Lynx Global’s revenue model). So, what does a trillion dollars look like to a PayPal shareholder?

The adjacent chart depicts PayPal’s total payment volume from 1st quarter 2014 to 4th quarter 2020. The total payment volume for 2020 totals roughly $950 billion.

Starting from scratch, PayPal went public in 2002 at $13/share. Had you started with $10,000 at PayPal’s initial IPO price, your investment (including the value of eBay shares that survived eBay’s divestment of PayPal) would be worth nearly $165,000 on top of quarterly dividend checks of around $168.11

Will this go the same for Lynx Global? It’s impossible to say. Lynx Global’s revenue model compares to PayPal, the variable is funds flow and for Lynx Global (OTC: CNONF / CSE: LYNX / FSE:3CT0), that flow could quickly grow to be enormous.

Remember, there’s $6+ trillion in play here!

This is just getting started…an early entry opportunity to what might become one of the world’s top investments.

What to do now…

Start your due diligence without delay. This is a rapidly moving situation that has accelerated dramatically over the last year due to the COVID-19 pandemic. (A topic for a future article.) As you do, keep in mind that Lynx Global must be considered as a high-risk, high reward investment opportunity. While the company shows great promise for capturing significant share of a burgeoning $6.685 trillion market, the possibilities for falling short of its objectives are significant. Should you choose to invest, limit your investment to only that amount that you feel comfortable putting at high risk of substantial if not complete loss.

That said, as you proceed with your due diligence, keep these five key facts in clear focus:

- Lynx Global Digital Finance Corp. appears to be one company in the world today that is focused specifically on delivering a full spectrum of services that can allow an underserved economy to function seamlessly in a global digital marketplace.

- The global population of unbanked consumers now totals 1.7 billion people worldwide with an aggregate market value of $6.685 trillion. Lynx Global is setting the stage to link the entire spectrum of those populations and economies to the emerging $52.4 trillion digital future.

- Lynx Global may emerge as the first mover and premier enabler of digital payments capabilities to the unbanked, which carries with it massive upside potential for early investors.

- While not discussed in this article, Lynx Global assembled a deeply experienced team of experts who have both the cultural experience and connections to the company’s Asia-Pacific headquarters. The cultural connections are particularly important for making inroads to these markets. (Learn more about this on the company website, address provided below.)

- Lynx Global investors have the world’s central banks propelling the opportunity. At present, 56 of the world’s 65 central banks are moving forward with evaluation and planning for a transition from cash to digital currencies. The hard fact of the matter is that regardless of where you are located in the world, your wallet will likely become digital.

Begin your due diligence into the investment potential of Lynx Global Digital Finance (OTC: CNONF / CSE: LYNX / FSE:3CT0) at the company website.

174% of 7.8 billion https://www.statista.com/statistics/265759/world-population-by-age-and-region/

21.7 billion unbanked adults https://globalfindex.worldbank.org/sites/globalfindex/files/chapters/2017%20Findex%20full%20report_chapter2.pdf

3The overall transaction value of the Global Electronic Payments Market is forecast to be US$52.4 Trillion (by 2026), according to Nielson

4(As reported by Statista) – US$6.685 Trillion in 2021 – with an expected annual growth rate of 12% (CAGR 2021-2025), resulting in a Digital Market expectation totaling US$10.52 Trillion by 2025

5https://techcrunch.com/2021/04/30/amid-the-ipo-gold-rush-how-should-we-value-fintech-startups/

6https://www.finextra.com/newsarticle/37126/stripe-plots-asian-expansion

7https://www.visualcapitalist.com/banking-unbanked-emerging-markets/

8https://medium.com/cotinetwork/financial-inclusion-for-the-over-2-billion-unbanked-around-the-world-has-been-amplified-by-digital-3f342998c743

9https://www.paymentsjournal.com/fis-shows-the-growth-of-digital-wallet-use-in-recent-report/

11https://www.fool.com/investing/2019/11/22/if-you-invested-10000-in-paypals-ipo-this-is-how-m.aspx

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Lynx Global Digital Finance Corp.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP

The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Lynx Global Digital Finance Corp. ’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Lynx Global Digital Finance Corp. ’s industry; (b) market opportunity; (c) Lynx Global Digital Finance Corp. ’s business plans and strategies; (d) services that Lynx Global Digital Finance Corp. intends to offer; (e) Lynx Global Digital Finance Corp. ’s milestone projections and targets; (f) Lynx Global Digital Finance Corp. ’s expectations regarding receipt of approval for regulatory applications; (g) Lynx Global Digital Finance Corp. ’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Lynx Global Digital Finance Corp. ’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Lynx Global Digital Finance Corp. ’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Lynx Global Digital Finance Corp. ’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Lynx Global Digital Finance Corp. ’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) Lynx Global Digital Finance Corp. ’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Lynx Global Digital Finance Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Lynx Global Digital Finance Corp. ’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Lynx Global Digital Finance Corp. ’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Lynx Global Digital Finance Corp. ’s business operations (e) Lynx Global Digital Finance Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, Lynx Global Digital Finance Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Lynx Global Digital Finance Corp. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Lynx Global Digital Finance Corp. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

Historical Information

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Lynx Global Digital Finance Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Lynx Global Digital Finance Corp. or such entities and are not necessarily indicative of future performance of Lynx Global Digital Finance Corp. or such entities.