New Bank of America forecast says...

US-China Copper Struggle Will Drive Price to $20,000

America’s energy future depends on securing new copper supplies. There’s just one problem: China

Why West Mining (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF) could be the key to US energy security

What you are about to read is a warning.

Or more specifically, a warning and an opportunity.

The warning is that China’s nearly total control of the world’s strategic minerals is now a critical threat to America’s future. It is “the existential threat of our time,” says U.S. Congressman Michael Waltz.1

Two decades of outsourcing mineral supply chains to foreign countries left America vulnerable.

The U.S. needs literally millions of tons of nickel, zinc, lithium, cobalt, and most of all, copper, to build digital and clean energy technologies.

That’s far more than we have in U.S. reserves. It’s far more than the total production of all U.S.-allied nations, in fact.

Where’s it all going to come from?

That’s where the warning becomes an opportunity. An investment opportunity.

Not just the best investment opportunity of 2021, though. And not even the best of the decade.

Instead, investment experts are calling minerals and the energy transition:

“The single biggest investment opportunity in history”

The overwhelming story of this era is going to be the historic move away from the fossil fuel-based energy that drove the industrial revolution.

Investment pros, normally a low-key lot, are calling it:

- “The greatest investment opportunity of our time” – Goldman Sachs analyst Riddhima Yadav

- “The investment opportunity of a generation” – AIMCo pension fund manager Mark Wiseman

- “The biggest global investment opportunity of the century” – Private Equity International

Venture capitalist Bill Gross calls the transition to clean energy:

- “The single biggest investment opportunity in history, not just in this decade, but in history.”2

Energy expert Lester R. Brown, who is described by the Washington Post as “one of the world’s most influential thinkers, agrees.

Brown says that building the renewable energy economy is:

- “The greatest investment opportunity in history.”3

Between now and 2050, nations around the world will spend an estimated $131 trillion to transition from fossil-based to clean energy.

Much of that will be spent on the strategic minerals at the core of every digital and clean energy technology.

$1 trillion over next 15 years to build U.S. mineral supply chains

More than $1 trillion will be spent in the next 15 years to build U.S.-Canada cross-border mineral supply chains.4

Minerals like nickel, zinc, lithium, rare earth elements (REE), and cobalt will be needed in enormous amounts.

Above all, the clean energy economy is going to need copper.

If we can find enough of it, that is.

Which is why…

- West Mining (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF) is fast-tracking a copper project in southeastern British Columbia’s Golden Arc region that is being described as a potential “absolute beast.”

Copper shortage driving price to $20,000

On May 4, a new report from Bank of America asserted that combined low supply and high demand means copper could well exceed $20,000 a ton by 2024.

From it’s current level at around $10,000, that means:

- Copper prices will double in three years

But that’s just the beginning.

A 2020 analysis from global think tank Institute for International and Strategic Affairs (ISA) projected that copper demand will soar from 35 million tons per year now to just over 100 million tons per year in 2050.

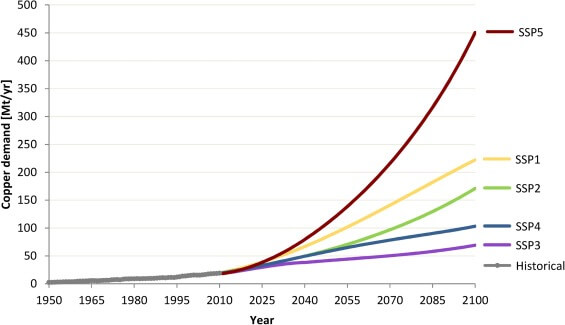

The graph below, from the ISA analysis, shows how copper consumption explodes between 2020 and 2050.

Remember the China-fueled copper bull market of 2002-2006? It’s barely a blip on the graph compared to what you’re about to see.

The ISA estimates cumulative demand of 1.9 billion tons of copper.

That’s a lot of copper. And the U.S. is going to need a good share of it.

There’s just one problem: China.

And that’s where the investment story starts to focus down to the number one opportunity of the energy transition.

Because with China’s stranglehold on global reserves, and demand pressuring price ever-higher, the companies that can add to supply will see their values multiply by 10 or 20 times or more.

Mining companies like West Mining (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF) are fast-tracking large copper projects in mineral-rich North American regions.

West Mining just released a resource estimate on its Kena project of over 2,773,000 ounces of gold inferred and 561,000 ounces indicated.

Now the company is preparing a resource estimate for Kena’s contained copper and silver.

You’ll see in a moment why it is expected to be nothing less than spectacular.

Getting West Mining’s copper into the U.S.-Canada supply chain is more critical than ever. Especially because…

“China has the US by the throat”

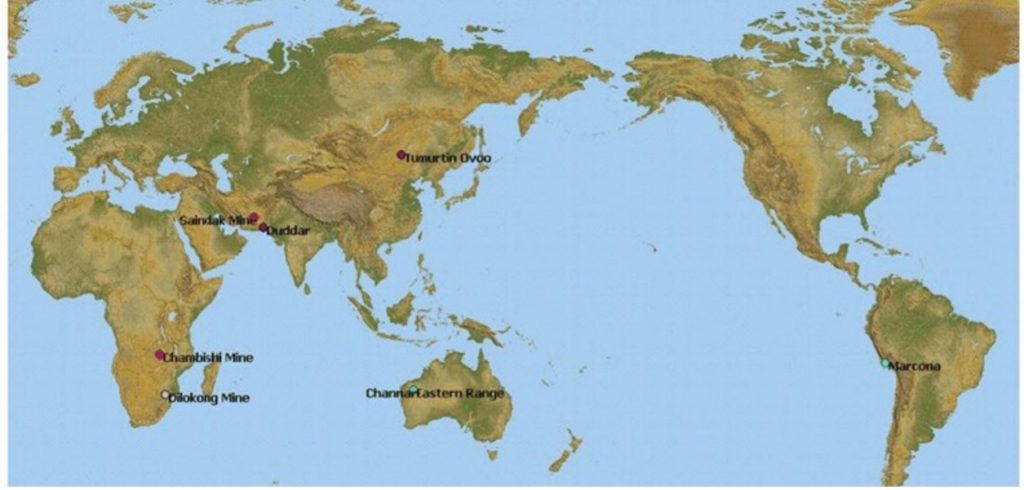

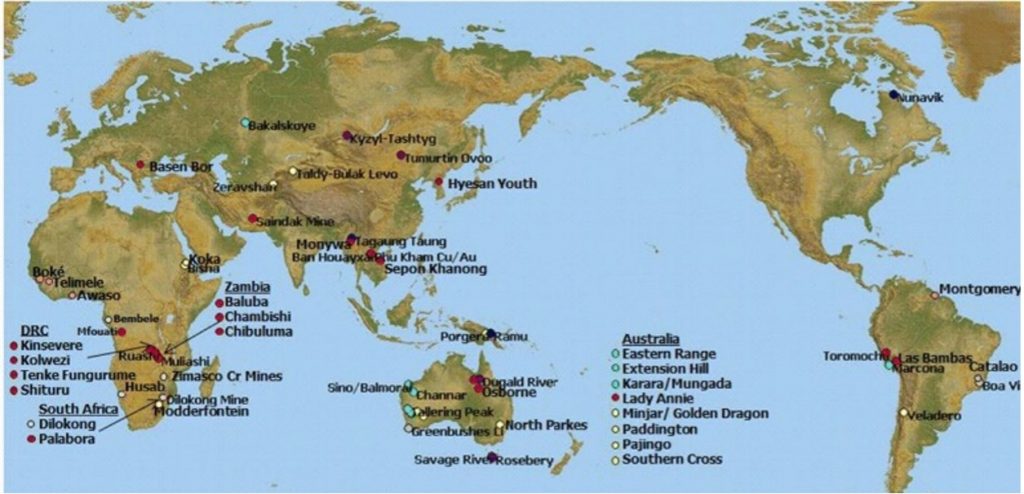

While the U.S. was busy outsourcing critical mineral production to other countries over the past two decades, China was equally busy grabbing control of global resources.

It’s called “the great China takeout.”

By 2005, Chinese control had reached into East and Central Asia, Africa, and Australia.

By 2018, their global domination was nearly complete.5

An estimated $4 trillion bought control of the mineral resources of countries that produce 55% of global economic output and control 75% of the planet’s energy reserves.6

As a result, China is now the main producer of 23 of the 41 most strategically valuable minerals.

What’s more, China has a complete lock on nine of the 10 minerals that are at the highest supply risk.7

Bottom line: America was caught napping. And now we’re scrambling.

“China has the US by the throat,” to use the blunt assessment of Asia Times.

“Copper is the new oil”

Just as fossil fuels drove the industrial age, the clean energy age is powered by copper.

On April 13, Goldman Sachs, one of the world’s largest investment banks, issued a startling new investment report.

“Copper is the new oil,” the report says. And “there is no decarbonization without copper.”

Bloomberg calls copper “the most critical metal for global economies.” 8

And analyst James Attwood says that copper is:

- “Arguably, the most critical metal for global economies.” 9

Without copper, there is no $131 trillion clean energy transition.

No solar panels, no wind turbines, no electric or hybrid cars, no high-speed rail lines.

Also no smartphones, no high-speed DSL internet, no circuit boards.

Even carbon-based energy can’t electrify your home efficiently without copper wire and transmission lines.

Even carbon-based energy can’t electrify your home efficiently without copper wire and transmission lines.

Bottom line: without copper, the modern economy ceases to exist.

By 2100, the digital and clean energy economy will consume 18 times more copper per year than today.

From 25 million tons per year to 450 tons.10

There’s one problem, though. This year, the U.S. will consume more copper than it produces — 600,000 metric tons more.

U.S. declares state of emergency

In September 2020, then-President Trump declared a national emergency, titled:

“Addressing the Threat to the Domestic Supply Chain From Reliance on Critical Minerals From Foreign Adversaries and Supporting the Domestic Mining and Processing Industries” 11

Trump stated that “Our dependence on one country, the People’s Republic of China, for multiple critical minerals is particularly concerning,”12

Trump stated that “Our dependence on one country, the People’s Republic of China, for multiple critical minerals is particularly concerning,”12

The executive order applies the Defense Production Act to speed development of mines in the US and allied countries, especially Canada.

America mobilizes its allies in global battle for critical minerals

In January 2020 the U.S. and Canada issued a Joint Action Plan on Critical Minerals Collaboration.

The two governments aim to increase mineral exploration and development by:

- Attracting investment to Canadian exploration and mining projects.

That means more exploration, more development, easier permitting, better financial incentives, more latitude on environmental regulation.

The initiative is helping West Mining (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF)

to fast-track its high-grade, bulk-tonnage, 8,810-hectare copper project in mineral-rich southeastern British Columbia.

The company among the first to mobilize under the new mining-friendly accord.

U.S. and Canada ease way for mineral exploration and development companies

President Trump’s executive order empowered federal agencies to bolster critical minerals mining and processing between the U.S. and Canada.

The new administration in Washington is strengthening the partnership even further.

On February 23, President Joe Biden and Prime Minister Justin Trudeau met virtually to discuss progress on securing supply chains for strategic minerals.

The new U.S.-Canada Joint Action Plan on Critical Minerals Collaboration aims to

- “attract major investment to Canadian exploration and mining projects.”13

On the U.S. side of the border, Washington is working to help American mining companies expand into Canada.

On March 18, Reuters reported on a closed-door meeting between the Department of Commerce and mining industry representatives to strategize ways to boost Canadian production of minerals used in lithium-ion batteries.14

On March 18, Reuters reported on a closed-door meeting between the Department of Commerce and mining industry representatives to strategize ways to boost Canadian production of minerals used in lithium-ion batteries.14

“Washington is increasingly viewing Canada as a kind of ‘51st State’ for mineral supply,” the report said.

Trillions of dollars in value for companies with first-mover advantage

In one of his last official statements before leaving office, former U.S. Secretary of State Mike Pompeo emphasized just how critical copper is to the American economy.

In a vivid illustration, he said:

In a vivid illustration, he said:

- “The world will need to produce the same amount of copper in the next 25 years as human beings produced in the last 5,000.”15

Pompeo called on the private sector to ramp up production.

For mining companies with “first-mover advantage,” he said, “the opportunities are significant, and:

- the potential value is measured in the trillions of dollars.”

Secretary Pompeo added there is now “a narrow window of opportunity” for private sector companies to seize that opportunity.16

On March 9, U.S. Energy Secretary Jennifer Granholm announced the creation of a $40 billion clean energy loan program to encourage domestic mineral exploration and development.17

A week later, the Department of Commerce held a closed-door meeting to discuss ways to incentivize new mine development in Canada, our closest trading partner, in order to secure ongoing supplies of copper, nickel, and rare earth minerals.18

That means…

Hundreds of new mines needed to meet demand

You’re seeing the start of one of the biggest resource mobilizations in the history of the world.

Current production leaders like Vale, Glencore, and Freeport-McMoRan can’t meet demand. Their reserves have been shrinking for years. So has grade.

New supply is going to have to come from new mines. Hundreds will be needed to produce what’s required for the digital and clean energy economy.

And they have to be up and running ASAP. We can’t wait for the typical decade or more for financing, permitting, and construction.

Right now there are fewer than 100 greenfield copper projects globally. Many of those are in the earliest stages.19

Which is why the U.S. is looking to Canada to quickly ramp up exploration and development.

“The race is now to bring Canadian mines online”

After years of low copper prices, there was little incentive to develop new mines.

But in March 2020, the B.C. government declared mining and exploration essential.

British Columbia’s premier, John Hogan, pledged “my government will be focused like a laser” on aiding the mining sector.20

Incentives like a rate reduction on power, the elimination of the PST on equipment and machinery, and the extension of permits helped push investment in the sector to its highest in a decade.

But with the beginning of the clean energy push and the new copper supercycle driving up prices, investment capital is pouring into the sector.

“The race is now to bring Canadian mines online,” said a May 11 article in the London Financial Times.

West Mining Corp. (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF) focuses on growing copper reserves for U.S.-Canada supply chains

Up until late 2020, West Mining Corp was a mineral exploration company with three high value projects:

- Kagoot cobalt project in New Brunswick’s Bathurst mining camp, with drill samples showing remarkably high grades of 1,200 and up to 1,600 ppm.

- Spanish Mountain West gold project in the rich Golden Horseshoe area of the famed Golden Triangle in British Columbia’s far northern region.

- Junker gold project in multi-million ounce producing Cariboo region of central-east British Columbia.

Then, in December 2020, the company made a strategic decision to join the drive to secure essential copper reserves for U.S.-Canadian supply chains.

West Mining gains first-mover advantage in famed Golden Arc copper-gold mining region

By mid-2020, the drive for minerals key to the clean energy revolution was getting hotter.

The U.S. and Canada had recently formed a joint partnership to incentivize mineral development.

The price of gold was near its all-time high and copper was on a run with no end in sight.

Venture capital was pouring into Vancouver-based mining companies.

- “Canadian investment bankers have rarely been busier,” said Julian Ovens of Crestview Strategy.21

Mining companies were slow to seize the opportunity.

A decade of low copper prices had led to underinvestment and under-exploration. During that time, Canada’s vast, rich copper deposits remained untapped. With few mining companies interested in copper, claims sunk to bargain-basement values. Which meant that vast untapped resources were still cheap and plentiful.

West Mining focused in on southwestern British Columbia, in a region called the “Golden Arc.” A 19th century gold and silver rush in the Golden Arc produced as much output as the famed California gold rush of the same era.22

Now, 125 years later, the Golden Arc’s rich copper-gold porphyry vein systems are still mostly untapped

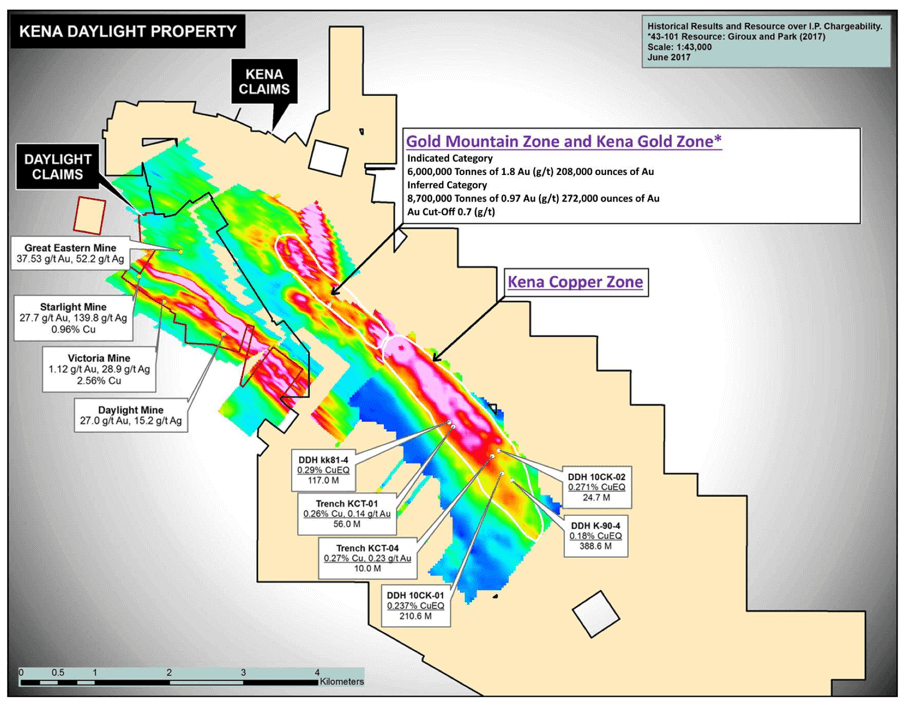

West Mining (CSE: WEST, OTC: WESMF) scores prime copper projects in the heart of Golden Arc

Right in the heart of the Golden Arc, just a stone’s throw from the historic gold rush town Ymir, West Mining Corp scored a set of claims known as the Kena project.

Just to the south of Kena is the historic Le Roi, the mine that helped turn an unknown company into one of the world’s biggest mining companies.

Once the Le Roi came into production in the early 1900s, its stock jumped from fifty cents a share to $40 almost overnight.

During its lifetime, the Le Roi’s output of gold, silver, and copper was a whopping $2.58 billion.23

The company became known as Cominco, which grew into the $13.53 billion behemoth known today as Teck Resources (TECK).24,25

The company became known as Cominco, which grew into the $13.53 billion behemoth known today as Teck Resources (TECK).24,25

About five kilometers northwest of Kena, the Silver King mine produced more than 7,484 tons of copper and 137.5 million tons of silver.26

The nearby Bull River claims produced 7,257 tons of copper, 126 kilograms of gold, and 6,354 kilograms of silver in three years, from 1971 to 1974.27

The area surrounding West Mining’s Kena project is also home to some of today’s biggest producing mines.

West Mining's (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF) Kena project: Untapped riches surrounded by major producers

Today, five of the 10 biggest mines in British Columbia and all of North America are in the same region as West Mining’s Kena and Daylight project.28 Including:

- Tech Resources’ Highland Valley Copper, one of the largest copper mines in the world.

- New Afton, with an estimated 758 million pounds of proven and probable copper reserves, plus a whopping one billion pounds measured and indicated and another 143 million inferred.29

West Mining’s Kena project just might be the next addition to that group.

In early May, the company released its long-awaited NI43-101 technical report.

The report confirms what West Mining execs have been thinking all along:

“This could be an absolute beast”

Luke Montaine is a veteran mining industry dealmaker out of Vancouver, arguably the global capital of mining dealmaking.

Mr. Montaine was instrumental in identifying the Kena opportunity and bringing it to West Mining.

Kena had a 20-year, $20 million history of exploration and sampling, with strong showings of high-grade gold and copper.

Montaine, who serves as Director of Corporate Development for West Mining, pored over stacks of technical reports for Golden Arc projects.

Then he saw the Kena historical report.

After his detailed review of all its previous technical reports, Mr. Montaine was convinced Kena had literal tons of potential.

- “This could be an absolute beast,” he said.

Now the new technical report confirms it. Kena’s mineral resources include:

- Over 2,773,000 ounces of gold inferred and 561,000 ounces indicated.

And they haven’t even assayed the copper yet. Or the silver.

That’s next.

Mining industry fortune-maker Lawrence Roulston joins West Mining

There aren’t many people in the North American mining community who don’t know and respect the name Lawrence Roulston.

He is founder and managing director of mining industry consulting firm WestBay Capital Advisors.

He is also the brains behind the investment newsletter Resource Opportunities, which achieved a track record of 560% average returns for the mining stocks Mr. Roulston identified as high potential opportunities.

Roulston seldom grants his endorsement of any company. Few can achieve the high bar he sets.

West Mining Corp is one that does, though. In March 2021, the company announced that Lawrence Roulston joined West Mining’s advisory board.

In that key role, Mr. Roulston will bring his invaluable knowledge and foresight to help guide the company.

West Mining's (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF) Kena project has top potential

The Kena project has many advantages, including:

- Multiple bonanza grade gold zones throughout 21,769-acre claim package in a world class geological setting.

- Large untested copper – gold porphyry targets on southern end of the property.

- Advanced project with bulk tonnage historical* resource of just over 480,000 ounces of gold @ ~1 g/t (with cut off grade of 0.70 g/t Au).

- Excellent area infrastructure, including nearby roads, power, and rail

- District scale trend extending 18 kilometers of strike-length and open to the northwest, southeast and down-dip.

- Close to infrastructure in a geopolitically stable and amenable mining jurisdiction of Canada.

- Daylight claims have four historical high-grade mines over 3.5km.

- Initial targeting of near surface bonanza grade gold zone extensions and untested copper – gold porphyry targets.

- Skilled local workforce and service companies

The company’s next priority will be to confirm Kena’s copper resources.

From there, it is only a matter of time before West Mining Corp will be able to potentially add to the U.S.-Canada strategic copper supply chain.

Kena at more advanced stage than most copper projects worldwide

The Kena project is at a more advanced stage than many if not most other copper projects.

There are currently 72 active copper projects worldwide, according to a February Alliance Bernstein research note.

But the “strong majority” are still in pre-feasibility or scoping stages, the report says.30

Kena has fully advanced from pre-discovery and discovery to the feasibility stage.

- Drill results have revealed mineralization and sample grades

- Historical estimates have been issued and verified

- Exploration targets have been determined

Now the company turns to resource definition, which will determine form, grade, quantity, continuity, and from there, the project’s economic prospects.

At that that point, the possibility for a merger or acquisition becomes promising.

Buyout prospects are high

The average time from pre-discovery to production is more than 10 years. That’s a long time for mining companies and their investors to wait.

West Mining is fast-tracking project development timelines.

The Kena project has quickly progressed through concept and pre-discovery, and is rapidly moving into late-stage discovery and early-stage feasibility.

As work progresses, there’s more and more chance that a succession of positive results will attract the interest of larger mining companies looking to expand resources through strategic buyout.

And with the price of copper rising with no end in sight, plenty of companies are starting to think about expanding reserves.

Plus, many, if not most of those companies are seeing their own reserves shrink. They have to either embark on the long and expensive process of exploration, or take the easy route and buy out a junior that has already done the front-end work.

Craig Stanley, resource analyst at Desjardins Securities, says “more investors are willing to finance start-ups than ever before.”31

WEST.CN soars 372% in 41 days on news

As recently as December 16, you could have bought WEST.CN at just $0.25.

Positive news is a prime driver of mining stock gains. When West Mining began releasing a series of positive news on financing deals, drill results, and superstar additions to its management team, the stock started climbing.

And climbing. And climbing.

From the first trading day of 2021 to March 3, WEST.CN shot up 372%.

- That’s a gain of more than 9% per day, based on 41 trading days for the period.

The next big jump came when the company announced a $5M financing round.

Then another jump 17 days later on news that the financing was oversubscribed by 32%.

With WEST.CN peaking at $1.70, investors naturally took profits at the stock’s high.

That’s healthy and good for any stock.

Now West Mining (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF) is fast-tracking resource identification and estimates.

They’re expanding drill zones and taking core samples.

It won’t be long before they’ll be releasing more news. And based solely on progress so far, there’s a good chance for good news.

The announcement of Kena’s extraordinarily high resource estimate has already been baked into the price.

Over the past 30 days there have been four small upticks in share accumulation.

Savvy investors get in before the news

Investors are starting to notice West Mining Corp. (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF) .

Some are waiting to see what’s next.

Others are making sure they get in before the next big move up.

Savvy investors will consider getting in to WEST.CN before the next big news, which just might be a confirmation of estimated copper resources.

To get a closer look at West Mining Corp visit their corporate website.

You’ll see a detailed presentation of the company’s four prime prospects, including technical reports with assay results, expansion opportunities, and geological maps; plus share structure and management and advisory board bios.

Or ask your broker about West Mining Corp. (CSE: WEST, OTC: WESMFCSE: WEST, OTC: WESMF) today.

And remember to always do your own due diligence on any stock before you buy.

1https://radio.foxnews.com/2021/05/08/the-fox-news-rundown-5-8-2021-2/

2https://www.barrons.com/articles/the-trillion-dollar-investing-opportunity-in-green-innovation-51593647742

3https://cfpub.epa.gov/ols/catalog/advanced_brief_record.cfm?&FIELD1=AUTHOR&INPUT1=BROWN%20AND%20LESTER%20AND%20RUSSELL&TYPE1=ALL&LOGIC1=AND&COLL=&SORT_TYPE=MTIC&item_count=3

4https://www.ft.com/content/f5d41e8d-95d8-45b1-9fff-12d4036f8f44

5file://ls210d62e/share/Cynthia/Cynthia%20Z%20Drive%203-24-15/My%20Life/Clients/Finn/Claire%20Stevens/West%20Mining/China/Chinese_control_over_African_and_global_mining-pas.pdf

6https://tnsr.org/2019/07/unlocking-the-gates-of-eurasia-chinas-belt-and-road-initiative-and-its-implications-for-u-s-grand-strategy/

7https://tnsr.org/2019/07/unlocking-the-gates-of-eurasia-chinas-belt-and-road-initiative-and-its-implications-for-u-s-grand-strategy/

8https://www.bnnbloomberg.ca/the-world-will-need-10-million-tons-more-copper-to-meet-demand-1.1579571

9https://www.bloomberg.com/news/articles/2021-03-19/the-world-will-need-10-million-tons-more-copper-to-meet-demand

10https://www.sciencedirect.com/science/article/pii/S0921344918300041

11https://www.steptoe.com/en/news-publications/us-and-eu-actions-to-address-supply-chain-threats-caused-by-reliance-on-critical-mineral-imports.html

12https://www.metaltechnews.com/story/2020/10/07/tech-metals/trump-declares-critical-mineral-emergency/349.html

13https://www.canada.ca/en/natural-resources-canada/news/2020/01/canada-and-us-finalize-joint-action-plan-on-critical-minerals-collaboration.html

14https://www.reuters.com/article/us-usa-mining-canada-exclusive-idCAKBN2BA2AJ

15https://foreignpolicy.com/2021/01/14/responsible-clean-energy-supply-chain-minerals-renewables/

16https://foreignpolicy.com/2021/01/14/responsible-clean-energy-supply-chain-minerals-renewables/#:~:text=The%20private%20sector%E2%80%94including%20buyers,responsible%20supply%20chains%20by%202030.

17https://www.reuters.com/business/energy/energy-secretary-granholm-says-us-needs-produce-more-ev-minerals-2021-03-09/

18https://www.reuters.com/article/usa-mining-canada-idINKBN2BB052

19https://www.investors.com/news/mining-stocks-how-copper-the-red-metal-is-becoming-the-green-metal/

20https://www.mining.com/british-columbia-records-banner-year-for-exploration/

21https://www.ft.com/content/f5d41e8d-95d8-45b1-9fff-12d4036f8f44

22https://aris.empr.gov.bc.ca/ArisReports/34786.PDF

23http://www.lostmines.net/leroi-mine.html

24https://aris.empr.gov.bc.ca/ArisReports/34786.PDF

25https://www.raremaps.com/gallery/detail/28146/map-of-rossland-and-its-mines-compiled-from-surveys-and-late-ellacott

26https://aris.empr.gov.bc.ca/ArisReports/26356.PDF

27https://web.archive.org/web/20181212142419/http://www.empr.gov.bc.ca/Mining/Geoscience/PublicationsCatalogue/Fieldwork/Documents/1999/GF22_Hoy_307-314.pdf

28https://www.mining.com/top-10-british-columbias-biggest-mines-87979/

29https://www.newgold.com/assets/new-afton/default.aspx

30https://www.spglobal.com/marketintelligence/en/news-insights/blog/covid-19-impact-recovery-metals-mining-outlook-for-h2-2021

31https://www.nytimes.com/2008/02/20/business/worldbusiness/20gold.html

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling West Mining Corp.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP

The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding West Mining Corp.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to West Mining Corp.’s industry; (b) market opportunity; (c) West Mining Corp.’s business plans and strategies; (d) services that West Mining Corp. intends to offer; (e) West Mining Corp.’s milestone projections and targets; (f) West Mining Corp.’s expectations regarding receipt of approval for regulatory applications; (g) West Mining Corp.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) West Mining Corp.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute West Mining Corp.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) West Mining Corp.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) West Mining Corp.’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) West Mining Corp.’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of West Mining Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) West Mining Corp.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact West Mining Corp.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing West Mining Corp.’s business operations (e) West Mining Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, West Mining Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does West Mining Corp. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither West Mining Corp. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of West Mining Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of West Mining Corp. or such entities and are not necessarily indicative of future performance of West Mining Corp. or such entities.