U.S. Opens Path for Junior to Tap Clayton Valley’s Est. 300,000+ Tons of Lithium1

Editorial Feature | Nov 20, 2022 | Industry

All eyes are on ACME Lithium (CSE: ACME | OTCQX: ACLHFCSE: ACME | OTCQX: ACLHF) to help close critical supply gap.

“We need to act now to develop domestic lithium battery capabilities”– Jennifer Granholm, June 14, 2021

You keep hearing about America’s lithium shortage.

About how we don’t have enough of the critical mineral to fuel the transition to clean energy.

You hear that the U.S. must rely on imports from countries like China, Chile and Bolivia.

So it may surprise you to know that America has more lithium than nearly every country in the world.

Only Bolivia, Argentina, and Chile have more.2

Our vast underground deposits are even greater than Australia’s.

But while Australia produces 42,000 tons of the critical mineral a year, the U.S. produces just a fraction of that, a trickle at 5,000 tons.

- For 55 years only one mine has been allowed to tap America’s vast underground lithium deposits.

Deposits estimate the United States alone could hold more than 7.9 million tons.3

Enough to fuel the clean energy revolution for the next decade.

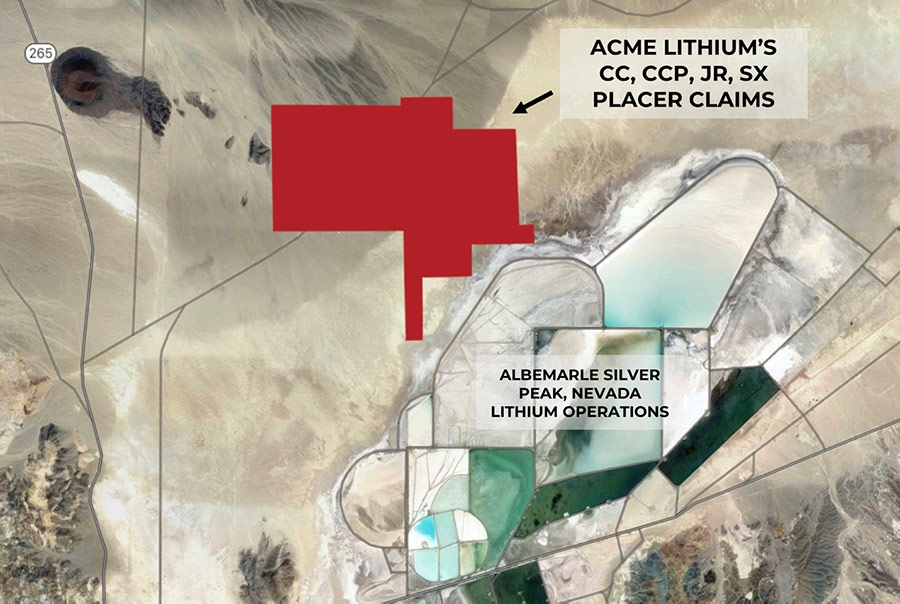

Just one mine, the Silver Peak project owned by Albemarle Corp, is America’s only domestic supplier.

In 2010, the U.S. Department of Energy awarded a $28.4 million grant to expand capacity at Silver Peak, resulting in a doubling of production.

Silver Peak’s output helped make Albemarle the world’s biggest lithium producer for EV batteries.4

Currently this mine produces 3,500 metric tonnes of lithium per year, but has the capacity to produce 6,000. It’s one of two world class mines operated by Albemarle with the other being in the Salar de Atacama, Chile.

ACME Lithium (CSE: ACME | OTCQX: ACLHFCSE: ACME | OTCQX: ACLHF) launches a new era for U.S. lithium explorers

There’s a whole lot more lithium in the vast underground deposits where Silver Peak has been the sole producer.

Washington is pulling out all the stops to get at it.

The Biden administration, following the path of the Trump administration before it, is greenlighting a handful of very well-positioned companies to bring out as much lithium as they can at as fast a pace as they can.

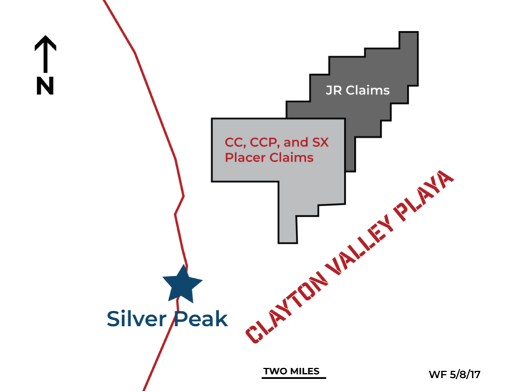

- One shrewd company has maneuvered to secure claims adjoining Silver Peak to the southwest, a massive 2,440 acres.

That positions ACME Lithium (CSE: ACME | OTCQX: ACLHFCSE: ACME | OTCQX: ACLHF) at the epicentre of lithium exploration and production in the US, next to a source which has been a productive supply of lithium for six decades.

No wonder Tesla built its gigafactory here

Albemarle’s Silver Peak mine sits atop Clayton Valley’s world-class brine deposit.5

- A deposit so rich that the U.S. Geological Survey calls it “the best-known [brine] deposit in the world.”6

So it’s no wonder that Elon Musk decided to build his first Tesla battery plant just 200 miles to the north of Silver Peak and ACME.

Because that precise spot, in a desolate corner of Nevada, is:

- One of only three places in the world that produce the lithium chloride needed to make li-ion batteries.7

At full capacity, the gigafactory will consume 35,000 tons of lithium carbonate per year to manufacture its batteries.8

That is equal to around 14% of current global output, and immensely more than the Silver Peak mine alone can produce.

Tesla’s business plan calls for the EV leader to produce 500,000 cars per year, a level that will require today’s entire global supply of lithium.9

Already, the gigafactory makes more li-ion batteries than all other carmakers in the world combined.10

To reach an output of a half million EVs per year, Tesla’s going to need to secure a whole lot more lithium carbonate.

And that puts this strategic location at the center of America’s domestic lithium production goals.

The place is Clayton Valley, a 45-square mile ancient dry lake bed in Esmeralda County, Nevada. The salt-caked valley floor is surrounded by mountains and ridges that were formed about six million years ago by volcanic uprise.

Mining is steeped into the history of Clayton Valley. To date, this region has already proved to be a vital source of lithium, and signs suggest mining operations have only scratched the surface.

For thousands of years, lithium has leached steadily from those volcanic rocks and made its way into the water table of the Clayton Valley.10

Named after Joshua E Clayton, a settler and mining engineer, the lithium rich brines pumped up from the ground here currently provide a third of America’s lithium requirements.

The metal is thought to originate from the Tertiary volcanics which abound in the area. While the region has been producing lithium from rich brine pools since the 60s, it’s only recently garnering heavy attention.

Now it only remains for ACME to tap into these vast underground brine pools.

With it’s upcoming drill program, all eyes are going to be on ACME Lithium

ACME just went public on the CSE in April 2021. Right out of the gate, the junior explorer and developer (E&D) made a bold move on a coveted 122-claim package abutting Albemarle’s prolific Silver Peak project.

There are only three places in the world that produce the lithium chloride needed to make li-ion batteries.

One is the Salar de Atacama region of Chile. Another is the Salar de Hombre Muerto in Argentina.

The third is Clayton Lake, Nevada, where lithium chloride has made Albemarle the world’s biggest li-ion battery supplier, a $27.34 billion behemoth.12

ACME recently completed a two phase geological survey targeting lithium brine, which entailed a gravity survey including a total of 120 gravity stations acquired over the claim area on a grid of 250 meters, as well as a Hybrid-Source Audio-Magnetotellurics (HSMAT) survey.

And now ACME expects to commence drilling in Q2 of 2022, after receiving very exciting results that identified multiple near-surface lithium targets.13

The company just announced it’s project operator GeoXplor Corporation has received a letter of approval under a “Notice of Intent to Drill” from the United States Bureau of Land Management (BLM). They are now in the final stages of completing the preparatory work required to commence drilling operations including securing drilling and hydrogeological services, as well as additional permits required.

Two Ways To Play One Of The World’s Dominant Trends

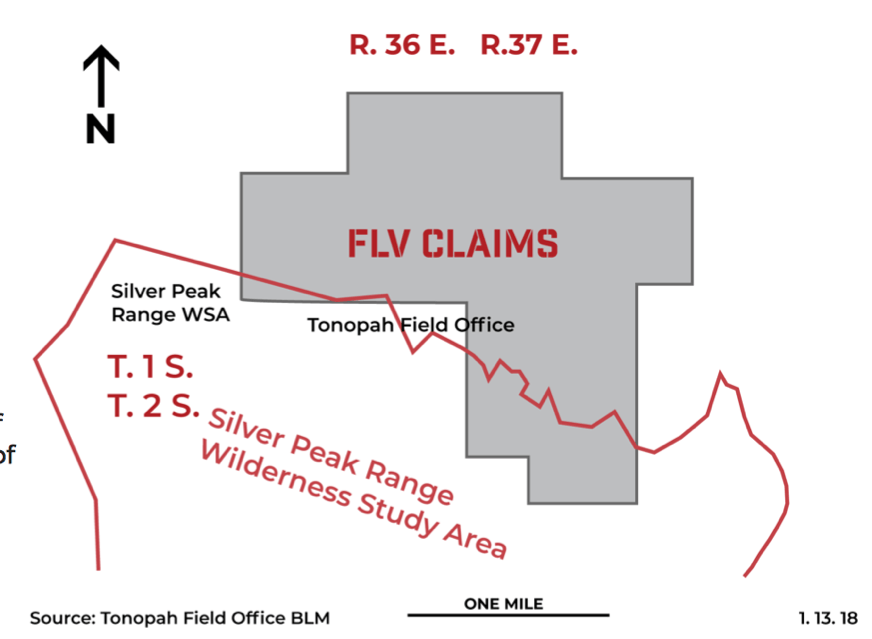

But that’s just the beginning. You see, ACME Lithium (CSE: ACME | OTCQX: ACLHFCSE: ACME | OTCQX: ACLHF) currently holds more than 200 claims on two separate projects, all within the lithium-rich flats of Esmeralda County, Nevada.

Their Clayton Valley project, which boasts a 100% interest in 122 claims totalling 2,440 acres, is raw and bursting with potential because it abuts a famous lithium mine.

And their Fish Lake Valley project looks to hold historic concentrations. ACME currently holds a 100% interest in 81 lode mining claims totalling 1,620 acres there.

Now, the company is undertaking an extensive exploration campaign to uncover targets at both.

Fish Lake Valley, Nevada’s Lithium Windfall

Nearby you’ll find another area rich in significant potential – Fish Lake Valley. This 25-mile-long endothermic valley has long been viewed as a prospective source of lithium. Even back in the 70s analysis of the water in Fish Lake revealed high levels of the white metal.

Until recently it has been unexploited, simply due to lack of demand. But that is changing rapidly.

Just a few months back,ACME Lithium (CSE: ACME | OTCQX: ACLHFCSE: ACME | OTCQX: ACLHF) commenced field work at its claim group in Fish Lake Valley which resulted in surface lithium values up to 410 ppm lithium.

Follow up work, as well as mapping, is intended to better understand the geological model and focus on traverses along a major drainage area where higher lithium values occurred.

Further analysis will assist with drill hole targeting and access routes for potential drill sites25.

One Of The Best Mining Jurisdictions On The Planet

The best part of the story is that ACME can move forward with exploration and drilling plans, without seasonal shifts or bureaucracy slowing their progress.

You see, Nevada is not the only source of lithium in the States… it’s been named the best mining jurisdiction in the world by the Fraser Institute.

The Nevada government has always been mining friendly, going back to the gold rush era, when mines began popping up like wildfire during the mid-1800s.

It was the Nevada’s abundant mineral wealth which established it as a state in the first place. And it remains key to the State’s economy in the modern age. Governments have pledged to the promotion of mineral exploration and development, and see lithium as another key player in its future.

Furthermore, the state benefits from excellent road, rail and air infrastructure, which makes it easily accessible. And the warm climate means mining can continue all year round.

ACME Lithium (CSE: ACME | OTCQX: ACLHFCSE: ACME | OTCQX: ACLHF) Key Milestones Ahead in 2022

Founded in 2020, ACME is well financed with working capital of C$11.9 million and no debt.

As they look to the future, the company is well capitalized to advance its two Nevada projects, as well as potentially acquire accretive projects in the lithium and EV space.

That means the immediate future holds significant growth potential, based on a few factors.

- Drilling results: With roads and drill pad constructed and final permitting in hand, drill equipment has been mobilized and is enroute to commence drilling lithium brine very soon. ACME’s potential for resulting news coverage could continue to garner significant attention

- New economic assessment: Based on positive results, an economic assessment is a potential key milestone ahead.

The Right Address, The Right Market, The Right People

- They sit on a massive opportunity next to a proven source of lithium.

- With geological targets ready to drill.

- And the capital to meet there near term objectives.

Furthermore, their management team has extensive experience in financial markets and mining. They bring an outstanding track record in explorations and production of lithium sources around the world.

Stephen Hanson, Director, president and CEO, has headed up companies in numerous sectors including oil, gas, mining and alternative energies. He’s been successful in a number of M&A strategies including several exits for major firms.

Zara Kanji, CFO and corporate secretary, has worked in financial reporting for junior listed companies, and is a member of the Chartered Professional Accountants of BC and Canada.

Vivian Katsuris, Director, specializes in corporate development, management, consulting and corporate services. She brings almost three decades of financial experience in the brokerage industry.

Yanis Tsitos is a geophysicist with almost 30 years’ experience in the mining industry. He has 19 years with BHP Billiton, group one of the biggest mining companies in the world. He is also currently president of Goldsource Mines a TSXV listed company, and sits on several boards as an independent director.

William Feyerabend is a Certified Professional Geologist and a member of the American Institute of Professional Geologists. He has direct working experience in the exploration and development of lithium projects, including technical reports in Nevada.

What to Do Now…

Everything about the way we live, work and power the economy is evolving, and it’s all happening right now. The companies which benefit from this historic shift have the potential to enjoy dramatic growth over a short space of time.

And lithium is one of the sectors that should be on everyone’s radar.

To get started on your due diligence, head to the ACME Lithium website, which has all the information you need including:

- A lithium fact sheet.

- More information about ACME Lithium.

- Details of both the Clayton Valley and Fish Lake

BREAKING NEWS

ACME Lithium Announces $3 Million Funding Agreement with Lithium Royalty Corporation

ACME Lithium announced it has entered into a $3 Million funding agreement with Lithium Royalty Corporation, a leading battery material investor that partners with companies whose assets exhibit high grade, low cost, and key technical attributes.

LRC will purchase a 2% Gross Overriding Royalty over ACME’s south east Manitoba projects at Euclid-Cat Lake and Shatford Lake, with proceeds directed to exploration.

1https://pubs.usgs.gov/pp/1802/k/pp1802k.pdf pK10

2https://www.nsenergybusiness.com/features/six-largest-lithium-reserves-world/

3https://pubs.usgs.gov/periodicals/mcs2021/mcs2021.pdf

4https://miningglobal.com/top10/5-largest-lithium-mining-companies-world

5https://pubs.usgs.gov/pp/1802/k/pp1802k.pdf pK10

6https://pubs.usgs.gov/of/2013/1006/OF13-1006.pdf

7http://www.meridian-int-res.com/Projects/Lithium_Problem_2.pdf

8https://pubs.acs.org/doi/10.1021/cen-09431-notw8#:~:text=%E2%80%9CTesla%20is%20starting%20to%20lock,measured%20in%20lithium%20carbonate%20equivalents.

9https://www.tesla.com/gigafactory

10Ibid

11https://pubs.usgs.gov/pp/1802/k/pp1802k.pdf

12http://www.meridian-int-res.com/Projects/Lithium_Problem_2.pdf

13https://acmelithium.com/2021/12/20/acme-lithium-files-notice-of-intent-to-drill-lithium-brine-project-at-clayton-valley-nevada/

14Government Takes Historic Step Towards Net Zero: Government takes historic step towards net-zero with end of sale of new petrol and diesel cars by 2030 – GOV.UK (www.gov.uk)

15EU proposes effective bank for new fossil fuel cars: EU proposes effective ban for new fossil-fuel cars from 2035 | Reuters

16https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=5acf1f951a44

17https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=5acf1f951a44

18https://www.cnbc.com/2018/05/30/electric-vehicles-will-grow-from-3-million-to-125-million-by-2030-iea.html

19http://www.meridian-int-res.com/Projects/How_Much_Lithium_Per_Battery.pdf

20Powering Smart Cities with Lithium Ion Batteries: Powering Up Smart Cities with Lithium-ion Batteries (reuters.com)

21Lithium price: Lithium | 2017-2021 Data | 2022-2023 Forecast | Price | Quote | Chart | Historical (tradingeconomics.com)

22Lithium Prices Q2: Lithium Market Update: Q2 2021 in Review | Price, Supply, Demand | INN (investingnews.com)

23Global Lithium Demand to More than Double by 2024: Global lithium demand to more than double by 2024 on EV growth: GlobalData | S&P Global Platts (spglobal.com)

24ACME Lithium Completes Phase 1 Geological Survey: ACME Lithium Completes Phase 1 Geophysical Survey Targeting Lithium Brine (investingnews.com)

25ACME commences Field Work at Fish Lake Valley: ACME Lithium Commences Field Work at Fish Lake Valley Nevada (investingnews.com)

IMPORTANT NOTICE AND DISCLAIMER — PLEASE READ CAREFULLY!

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of ACME Lithium (“ACME”) and its securities, ACME has provided the Publisher with a budget of approximately $150,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by ACME) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company ACME and has no information concerning share ownership by others of in the profiled company ACME. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to ACME industry; (b) market opportunity; (c) ACME business plans and strategies; (d) services that ACME intends to offer; (e) ACME milestone projections and targets; (f) ACME expectations regarding receipt of approval for regulatory applications; (g) ACME intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) ACME expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute ACME business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) ACME ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) ACME ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) ACME ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of ACME to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) ACME operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact ACME business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing ACME business operations (e) ACME may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling ACME Lithium .

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled ACME Lithium and has no information concerning share ownership by others of any profiled ACME Lithium . The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any ACME Lithium or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the ACME Lithium . Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled ACME Lithium ’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding ACME Lithium future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to ACME Lithium industry; (b) market opportunity; (c) ACME Lithium business plans and strategies; (d) services that ACME Lithium intends to offer; (e) ACME Lithium milestone projections and targets; (f) ACME Lithium expectations regarding receipt of approval for regulatory applications; (g) ACME Lithium intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) ACME Lithium expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute ACME Lithium business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) ACME Lithium ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) ACME Lithium ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) ACME Lithium ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of ACME Lithium to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) ACME Lithium operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact ACME Lithium business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing ACME Lithium business operations (e) ACME Lithium may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of ACME Lithium or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of ACME Lithium or such entities and are not necessarily indicative of future performance of ACME Lithium or such entities.

CAUTIONARY NOTE TO INVESTORS CONCERNING ADJACENT PROPERTIES:

This presentation contains information about adjacent properties on which we have no right to explore or mine. Investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on our properties.

FORWARD-LOOKING STATEMENTS:

This communication contains certain statements which may constitute forward-looking statements, such as estimates and statements that describe future plans, objectives or goals, including words to the effect that the company expects or management expects a stated condition or result to occur. Such forward-looking statements are made pursuant to the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995.

Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The following list is not exhaustive of the factors that may affect any of forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on forward-looking statements.

Actual results relating to exploration, mine development, mine construction, mine operation, and mine reclamation related to projects could vary materially from those expectations. Capital costs and operating costs could vary materially from those expectations. Resource and reserve calculations could vary materially from those expectations. Reason or factors that may cause such variability in expected results includes resources and reserves differing from expectations, changes in general economic conditions and conditions in the financial markets, changes in demand and prices for the products that may be produced. Other factors may include litigation, legislative, environmental and other judicial, regulatory, political and competitive developments in domestic and foreign areas in which we operate, technological and operational difficulties encountered, productivity of our resource properties, changes in demand and prices for minerals, labor relations matters, labor, material, and supply costs, and changing foreign exchange rates. This list is not exhaustive of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Further information regarding these and other factors is included in our filings with the Canadian provincial securities regulatory authorities (which may be viewed at www.sedar.com (http://www.sedar.com/)).

*Please note, proximity of location to Albemarle’s property is no indication that ACME Lithium’s exploration will show similar findings.