Report Highlights:

- Geopolitical tensions are pushing gold prices to near all-time highs, setting the stage for gold mining companies to see windfall profits.

- Element79 Gold (CSE:ELEM, OTC:ELMGFCSE:ELEM, OTC:ELMGF) stands out as one of the hidden gems, poised to unlock potential value in one of the most prolific gold regions of the world.

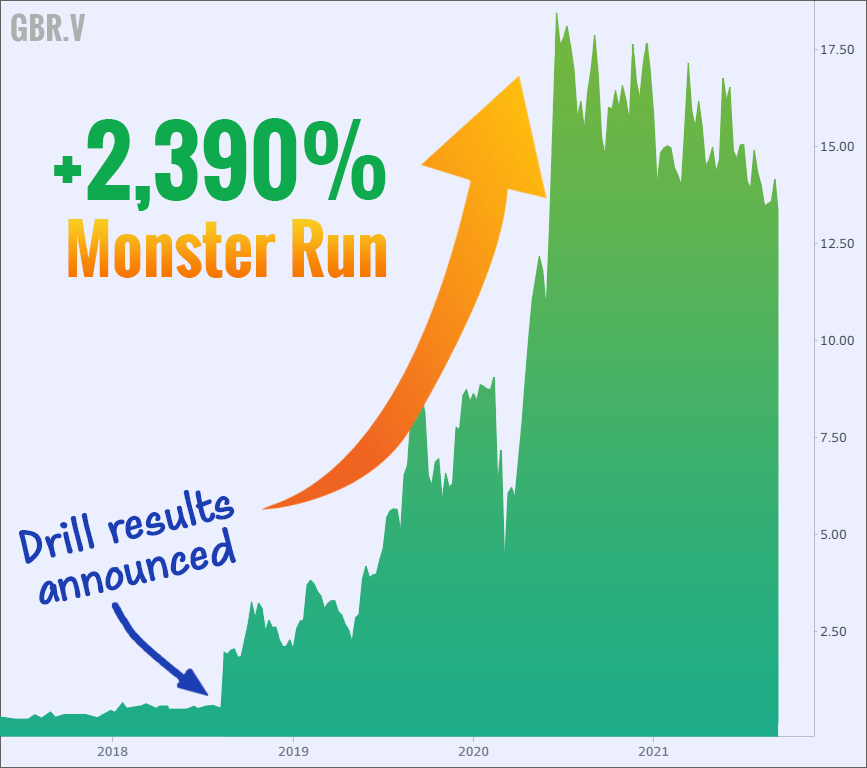

- Early investors in the last company ran by Element79 Gold management, turned every $10,000 invested into well over $150,000 as the stock soared from $1 to over $15 in a matter of months.129 See below to our next point.

- In fact, Element79 Gold’s management team has been instrumental in the some of the biggest success stories in mining history:

-

- Barrick Gold ($43B)

- Eldorado Gold ($1 to $100+)

- Skeena Resources ($1 to $15+)

- Perhaps more astounding, is that Element79 Gold recently reported over 3.7M ounces of gold equivalent at one property and has intersects of 174 g/t Ag over 9.14 meters at another. This is nearly double the famous intersect of New Found Gold, which trades nearly 20x to 30x higher.

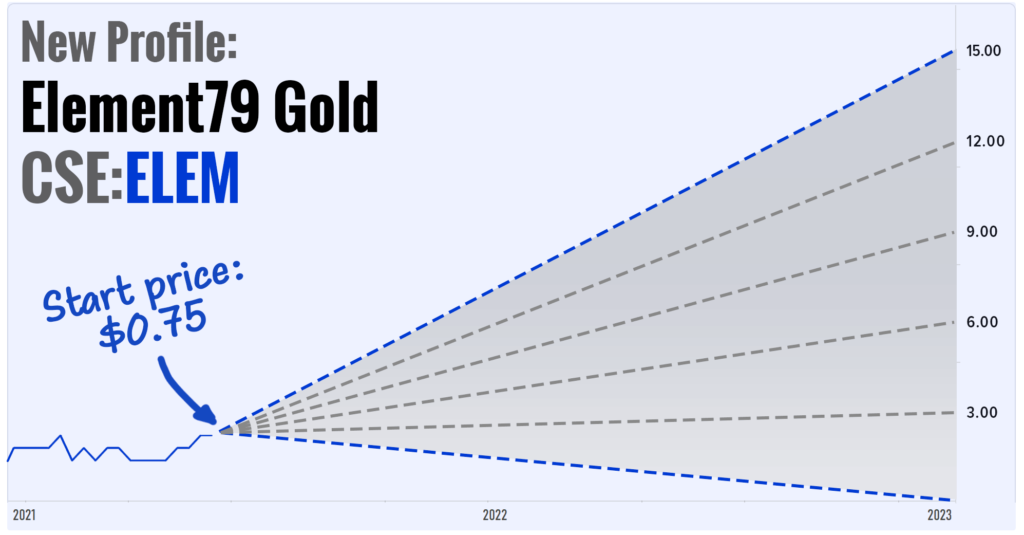

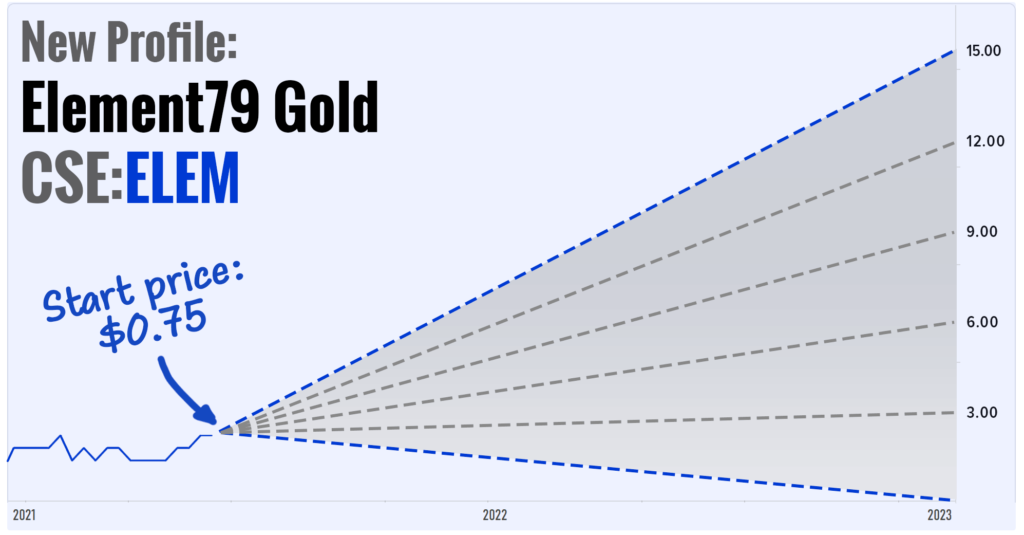

- Based on the current market, investors can gain upside exposure to ELEM for about $1 per share right now. Once gold companies catch momentum, they can be very difficult to buy shares and the opportunity for early-entry timing could be missed.

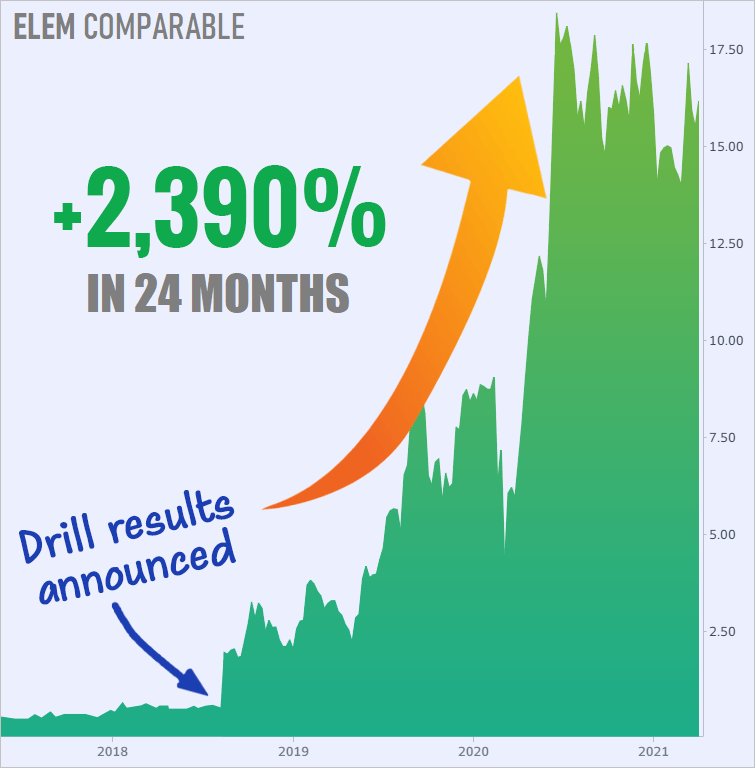

- Stocks like this should be added to the top of your watchlist. Pay close attention as drilling commences at Element79 Gold (CSE:ELEM, OTC:ELMGFCSE:ELEM, OTC:ELMGF), similar companies have returned +2,390% to early investors.102 Keep on reading to find out what company did this.

Important Trading Note

If you’re looking to get shares in early stages, it’s best to place an order before the market opens. Early returns can be extremely meaningful as they compound throughout the investment lifecycle.

Please take a moment to read the full report for yourself — because once you do, we’re certain you’ll agree with us: Element79 Gold is setting up to be the breakout stock of the year.

ELEM’s chart presents a rare opportunity at entry-level prices.

Printing Problems

Governments Forget Fiscal Fundamentals

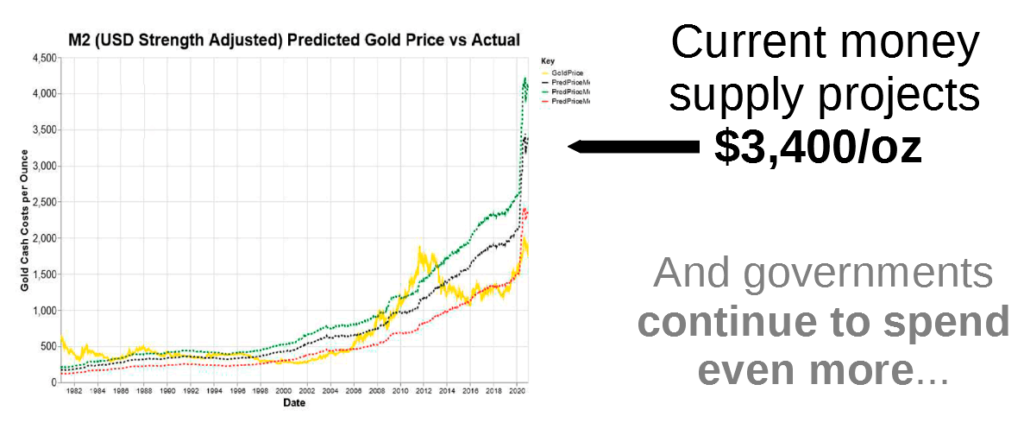

An incomprehensible amount of money has been minted in the last few months. Trillions upon trillions of new dollars have been injected into the system.1,2

Governments around the world are spending future tax revenues in unprecedented ways — it is now politically expedient to print money to solve problems.

The problem rests with government’s propensity to spend. Actions of central banks cause short-term contractions of supply, but cannot cheat the underlying fundamentals. The cat is out of the bag. Good-luck convincing politicians to stop spending!

Now combine that with the growing geopolitical tensions pushing gold prices to near all-time highs, the stage is set for gold mining companies to see windfall profits. Some are even calling for gold to exceed $5,000/oz in the near future.128

Only the smartest investors seem to be paying attention:

Legendary investors like Dr. Michael Burry (the man who predicted the sub-prime mortgage crisis), Ray Dalio, Paul Tudor Jones, and Elon Musk are sounding the alarm on inflation.4,5

Golden Opportunity

The ‘Must-Own’ Company of The Year

That’s why our #1 stock to own In 2022 is Element79 Gold (CSE:ELEM, OTC:ELMGFCSE:ELEM, OTC:ELMGF), a junior miner sitting atop one of the largest land packages in Nevada18 smack dab in the middle of the largest gold complex in the world.19

In today’s market, it’s more important than ever to have a firm foundation of solid research. That’s why when we conducted our due diligence…

…and discovered senior management hailing from Barrick Gold, Eldorado Gold, and Skeena Resources…

…including assets surrounded by some of the biggest gold mines in the world…

…and yet trading at valuations a mere fraction of its neighbors…

…we realized how big of a story we had uncovered with Element79 and why it’s the perfect play in the new inflation age.

Location, Location, Location

Prime Locations in the World’s Top Mining Destinations

Any single property can make an entire company’s legacy. Now consider Element79 Gold (CSE:ELEM, OTC:ELMGFCSE:ELEM, OTC:ELMGF), in the short time since its IPO, has already acquired a staggering 17+ properties in prime locations across the world’s top mining jurisdictions.

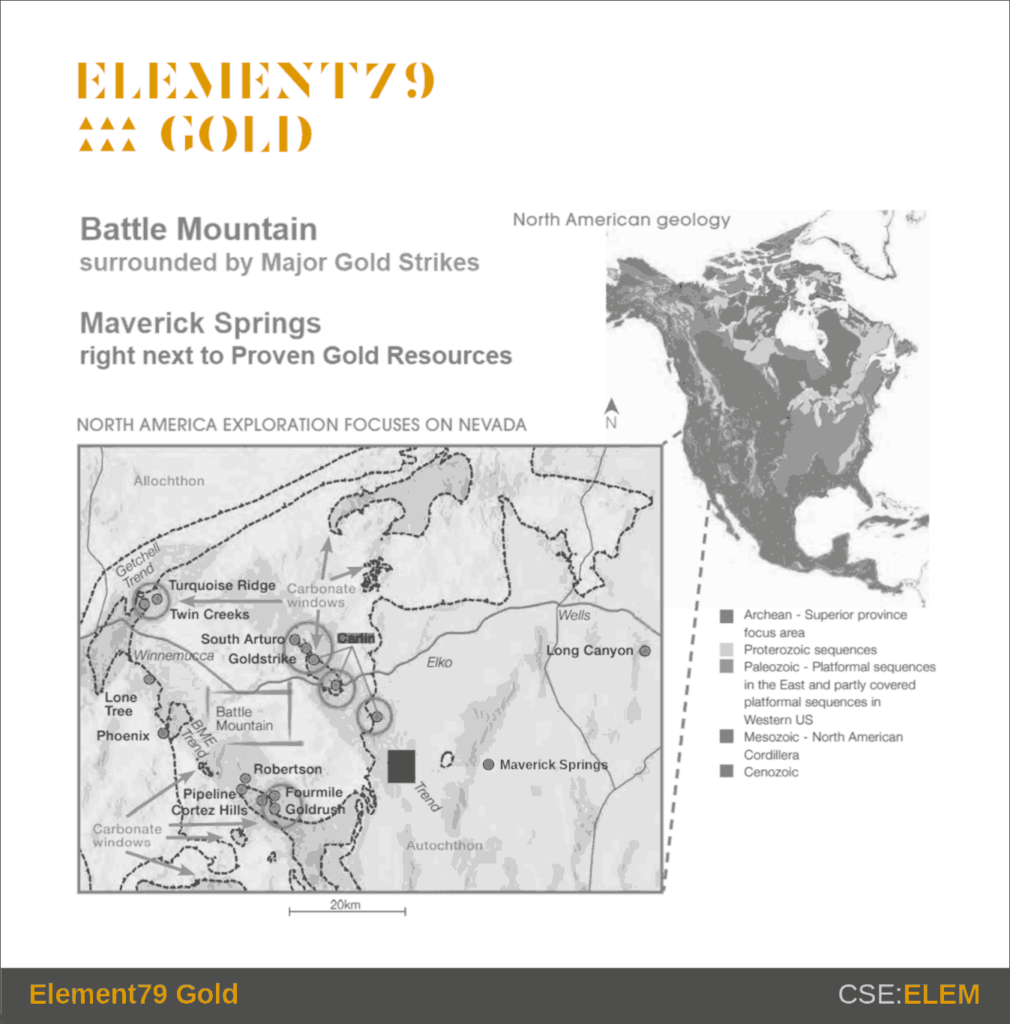

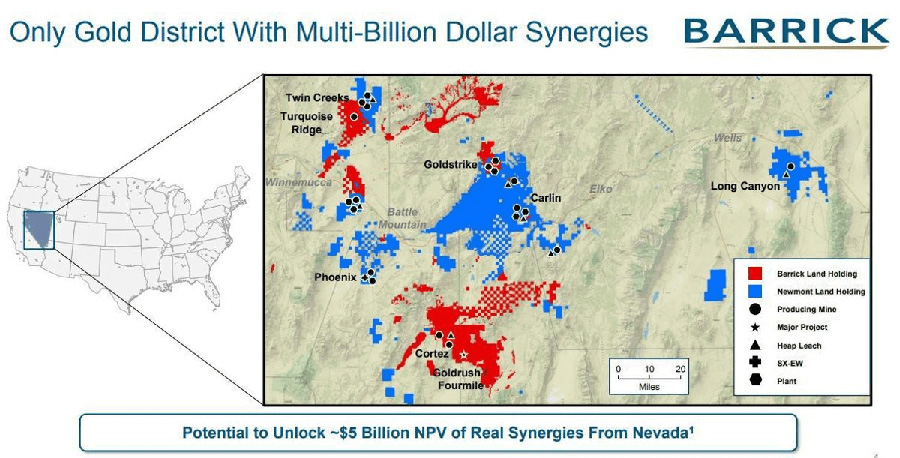

In addition to their initial 1,735 hectare property in Ontario97 and their additional 2,700-hectare property in mineral-rich British Columbia,51 their newest asset includes 18,000 hectares—literally one of the largest land packages in Nevada,79 smack-dab in the middle of the gold region where Barrick and Newmont are operating a joint venture.106

ELEM’s properties stand out in the world’s #1 gold district.

Lightspeed Leadership

These acquisitions demonstrate the speed at which management delivers value to shareholders. At this rate, imagine the progress Element79 will make in the coming months ahead.

The ‘right people at the top’ is a strong leading indicator.

We’ve already seen a work program announced for their Dale Property88 and a Phase 2 drill program outlined in their 43-10189 which could quickly send shares soaring on surprise drill results—we’ve seen it happen before.

Investors Win Big

Drill Results Can Net Life-Changing Returns

A few years ago, one of the most explosive stories in junior mining unfolded before our eyes,102 closing the trading day at just $0.72 on August 21st, 2018.

The very next day, drill results were announced showing several stretches of high-grade gold82 and soon that stock traded up to a high of $17.93.102

Investors who bought early, before the drill results were announced, turned a modest $40,000 stock purchase into nearly a $1 million dollar windfall at its peak.

Returns like that can be life-changing and it didn’t take a lifetime of saving, it was buying the right stock before the crowd.

That’s why it’s important to subscribe to updates, this company is moving fast and our dedicated research team follows it closely.

The Midas Touch

With 18,000 hectares—nearly 70 square miles—this is an unusually large land package for a junior miner sitting in a precious-metals hotspot among elephants like Newmont and Barrick.

Here’s what’s most stunning: with tremendous assets on the Maverick property in Nevada and only 53 million shares outstanding,97 Element79 Gold (CSE:ELEM, OTC:ELMGFCSE:ELEM, OTC:ELMGF) current share price is a bargain compared to peers.

Maverick Springs: Gold at Value Prices

Element79’s latest acquisition, Maverick Springs, is located within the legendary Carlin Trend gold belt92, home of the famed Carlin Mine, the world’s second largest gold mine83 reported a staggering 1.7 million ounces of gold production in 2020.91 In fact, this highly-distinguished gold belt has produced over 90 million ounces of gold to date.90 At present gold prices, that’s in excess of $150 TRILLION dollars worth pulled out of the area.107 It’s clear as day, Element79 Gold’s claims are in the right place.

In fact, just recently news was released revealing millions of gold equivalent in the ground already.

Battle Mountain: Upside, Upside, Upside

The Battle Mountain portfolio includes 15 highly prospective properties just to the west, with several early-stage drill holes revealing promising intercepts and high-grade finds.

The majority of the Battle Mountain Projects are located within the Battle Mountain Trend (see figure below), with several Projects in close proximity to world-renowned gold deposits including Nevada Gold’s Cortez Mine, the third largest gold mine in North America93 and the sixth largest in the world, which reported 2020 gold production at 799,000 ounces.91

The same belt of deposits also contains the recently discovered Goldrush complex that, as of 2016, carries measured and indicated resources of 25.2 million tonnes grading 10.6 g/t, representing 8.6 million ounces of gold in the ground.94 The area is also home to SSR Mining Inc.’s Marigold Mine, which is expected to produce approximately 2.37 million ounces of gold between 2018 and 2028.95

ELEM’s projects highlighted in yellow stars within the legendary belt.

The northernmost Projects in the Battle Mountain Portfolio, the Golconda and Clover Projects, lie just south of the Getchell Gold Belt, which bridges the northwestern ends of the Carlin and Battle Mountain Trends, and contains Nevada Gold’s Turquoise Ridge Mine, the third largest gold mine in the U.S. with 537,000 oz of gold production reported in 2020.91

The Brock and Stargo Projects are situated on the southern end of the Austin-Lovelock Trend, southwest of Eureka and northeast from Kinross Gold Corporation’s Round Mountain Mine, which placed as the fourth largest gold mine in the U.S.91 and, in November of 2018, poured its 15 millionth ounce of gold since beginning operations in 1978.96

The Fraser Institute just ranked this area as the top jurisdiction in the world for investment based on the Investment Attractiveness Index.55

A Key Advantage

Exceptional Access to Infrastructure and Labor

In the mining world, ready-to-go infrastructure means faster progress and lower costs. All of Element79’s projects offer this advantage.

At Snowbird, historic drill roads make it a cheap place to drill. Whereas industry averages are around CDN$343 per meter drilled in British Columbia105 due to the need for helicopters, Element79’s costs are expected to be significantly lower due to its proximity to roads.105Using existing roads also means less rehabilitation and environmental liability in terms of site disturbance and cleanup.

The story is very much the same in Element79’s Nevada properties, which are attractive from an infrastructure perspective, including year-round gravel road access and a long history of pit mining in the surrounding area.98

For Element79’s Dale property, access to all sides is gained by a series of logging roads and year-round by air using a float plane with skis or a combination of trucks, boat, all-terrain vehicle or snow machine.89 As a result, exploration work could be carried out year-round, allowing the company to progress faster than it otherwise might be able to.

Finally, because the properties are in mining-friendly areas, Element79 Gold (CSE:ELEM, OTC:ELMGFCSE:ELEM, OTC:ELMGF) has ample access to talent, from ground-level workers to geologists, engineers, and metallurgists.

The Buyout Scenario

Major Players Seeking New Acquisitions

Most major mining companies focus on their expertise, acquireng and bringing new mines online. They leave the exploration of high potential properties to the junior mining companies.

That’s why Element79’s proximity to so many majors is such a unique opportunity.

In fact, Barrick Gold has directly stated this in their 2020 annual report, “The Carlin Trend remains a target rich environment. The 2019 program focused on merging massive datasets in support of geological modeling. Drilling was initiated to test highly ranked target concepts as well as establish a geological framework in priority areas lacking drill information. Looking forward, the Carlin Trend will become the most active exploration area in Barrick’s portfolio.“117

On their own map, you can literally see Barrick and Newmont’s land holdings surrounding Element79 Gold (CSE:ELEM, OTC:ELMGFCSE:ELEM, OTC:ELMGF)‘s Battle Mountain portfolio.

M&A Hungry Neighbors With Deep Pockets

- Barrick Gold ($35B market cap) paid over $2.3B to acquire Homestake84which held mines in Nevada85

- Newmont Corporation ($45B market cap) acquired Fronteer Gold for more than $2B86

- Nevada Gold Mines is moving quickly to consolidate assets in the area87

With so many majors working alongside you, it’s hard not to be noticed.

Element79 Gold (CSE:ELEM, OTC:ELMGFCSE:ELEM, OTC:ELMGF) will undoubtedly be watched closely by all those in the surrounding area and positive drill results could quickly drive Element79 Gold to the top of every major producer’s M&A wish-list.

Before The Crowd

Because we’re so early to the Element79 story we are privy to a very rare opportunity—the beginning of a breakout, as the stock has remained relatively under-followed since the company hit the market.

If history is any indication—as our last profile started quietly and soon picked up momentum— Element79 may quickly become one of the best performing companies on the entire market.

ELEM may soon be the breakout stock of the year.

1. M&A Hungry Neighbors With Deep Pockets

Element79 will undoubtedly be watched closely by all those in the surrounding area and positive drill results could quickly drive Element79 Gold to the top of every major producer’s M&A wish-list.

2. Acquisition Track Record

The very same companies circling Element79 have a proven track record in taking over junior mining projects and bringing them into full production, often times acquiring projects and companies for hundreds of millions, and even billions of dollars.

A growing list of buyouts from nearby majors:

- $10 BILLION Merger (Newmont buys Goldcorp)63

- $7.1 BILLION Buyout (Kinross buys Red Back)60

- $1.07 BILLION Takeover (Pan American Silver acquires Tahoe)61

- $608M Acquisition (Iamgold takes over Trelawney)99

- $526M Buyout (Goldcorp buys Probe Mines)122

- $500M Valuation (Nevada Gold buys 10% of neighbor)62

- $456M All-Cash Transaction (Newmont acquires GT Gold)123

3. Analysts Predict Gold Buyout Fever

The need to replace gold reserves means the M&A market will be a seller’s market this year, according to Bank of America’s analysts, and they see junior and intermediate producers as potential acquisition targets for larger producers struggling to make up their reserves.56

4. Rare Triple-Threat

Rare triple-threat mineral holdings: Having a mix of locations gives Element79 an advantage of being able to smooth out peaks and valleys, when a given jurisdiction heats up or cools down.

5. Location, Location, Location

Home to one of the richest goldfields in the world,51 the Abitibi Subprovince is where Element79 has acquired the Dale Property and in Nevada, secured the Maverick Springs and Battle Mountain Projects with compliant resources and major upside potential. The entire area is surrounded by a wealth of success stories and major mining corporations.

6. Over 3.7 Million Reasons

Element79’s Maverick Springs Project reported millions of ounces of gold equivalent, read the full press release here for complete details.

7. Major Institutional Financing

Element79 secured a major funding commitment from an international institutional investor. The agreement provides for significant purchases of stock at near market prices, at the option of the company, providing a significant and regularly accessible source of non-debt financing.97

8. Work Program Underway

Element79 has announced a work program underway88 and has already secured funding necessary to pursue even more aggressive drill program expansion in the future. It only takes one major strike to send shares soaring.

9. Insiders Holding Shares Tightly

The number of shares held closely by direct insiders at Element79 speaks volumes to the situation here, with millions of shares directly and indirectly held by its board of directors and senior executive team.97 Given the facts laid out above, it’s no surprise why insiders are holding so much stock in Element79.

10. Growing Momentum and Extremely Limited Share Supply

Very tightly held capital structure at only ~53M shares outstandingg97with company insiders holding significant long-term positions alongside a significant escrow,97 there is little left in the public market. This is no doubt contributing to the growing momentum in Element79 Gold (CSE:ELEM, OTC:ELMGFCSE:ELEM, OTC:ELMGF).

1 https://ca.rbcwealthmanagement.com/fjwealth/blog/3035167-Money-Never-Sleeps–Can-printing-10-trillion-be-all-pleasure-and-no-pain/

2 https://www.nasdaq.com/articles/money-printing-and-inflation%3A-covid-cryptocurrencies-and-more

3 https://www.investopedia.com/ask/answers/042415/what-impact-does-inflation-have-time-value-money.asp

4 https://markets.businessinsider.com/news/stocks/warren-buffett-elon-musk-michael-burry-jack-dorsey-inflation-warnings-2021-10

5 https://www.cnbc.com/2021/11/30/ray-dalio-says-cash-is-not-a-safe-place-right-now-despite-heightened-market-volatility-.html

6 https://www.nytimes.com/2021/12/14/business/economy/turkey-inflation-economy-lira.html

7 https://twitter.com/leadlagreport/status/1295707920823463938

8 https://www.dailyfx.com/us-dollar-index/what-is-us-dollar-index.html

9 Recent changes by the federal reserve have made “M2” the most reliable measure of money supply.10,11

10 https://www.federalreserve.gov/newsevents/pressreleases/bcreg20200424a.htm

11 https://fredblog.stlouisfed.org/2021/01/whats-behind-the-recent-surge-in-the-m1-money-supply/

12 https://seekingalpha.com/article/4397470-gold-is-undervalued-look-money-supply-u-s-dollar-and-gold-prices

13 https://stansberryresearch.com/articles/gold-miners-are-primed-for-a-triple-digit-rally

14 https://www.nyse.com/quote/index/GDM

15 https://www.bloomberg.com/quote/XAU:CUR

16 https://www.bloomberg.com/quote/GDX:US

17 https://www.bloomberg.com/quote/GDXJ:US

18 https://www.rgj.com/story/money/business/2019/07/16/nevadas-second-biggest-land-sale-yields-new-fernley-industrial-park/1740852001/

19 https://www.barrick.com/English/news/news-details/2019/Barrick-and-Newmont-Forge-Nevada-Joint-Venture-Agreement/default.aspx

20 Renaissance Technologies LLC holds an indirect interest of Element79 Gold’s Snowbird Property via their 13F disclosed shareholding of 335,527 shares of Paramount Gold Nevada Corp. which holds a Net Smelter Return Royalty21

21 https://www.element79.gold/projects/

22 https://www.marketwatch.com/story/this-investment-has-outperformed-warren-buffet-by-200x-over-the-past-30-years-but-good-luck-grabbing-a-piece-of-it-2019-11-19

23 Paulson & Co. holds an indirect interest of Element79 Gold’s Snowbird Property via their 2.68% shareholding of Seabridge Gold which holds ~7.48% of Paramount Gold Nevada Corp. which holds a Net Smelter Return Royalty21

24 https://markets.businessinsider.com/news/stocks/john-paulson-quits-hedge-fund-family-focused-investment-firm-2020-7

25 Newmont Corporation holds an indirect interest of Element79 Gold’s Maverick Springs Property via their 28.8% shareholding of Maverix Metals which holds a Net Smelter Return Royalty27

26 Kinross Gold Corporation holds an indirect interest of Element79 Gold’s Maverick Springs Property via their 8.0% shareholding of Maverix Metals which holds a Net Smelter Return Royalty27

27 Maverix Metals Inc., September 1, 2021, Preliminary Short Form Base Shelf Prospectus https://www.investorx.ca/doc/2109011543295711

28 Gold Fields Limited has indirect upside exposure of Element79 Gold’s Maverick Springs Property via their 4,125,000 warrants held in Maverix Metals which holds a Net Smelter Return Royalty29

29 https://www.scribd.com/document/525577738/Maverix-Metals-SEDI-Summary-Report

30 Pan American Silver Corporation holds an indirect interest of Element79 Gold’s Maverick Springs Property via their 17.8% shareholding of Maverix Metals which holds a Net Smelter Return Royalty27

31 Seabridge Gold Inc. holds an indirect interest of Element79 Gold’s Snowbird Property via their ~7.48% shareholding of Paramount Gold Nevada Corp. which holds a Net Smelter Return Royalty21

32 https://www.mining.com/featured-article/ranked-worlds-10-biggest-gold-mining-companies/

33 https://finance.yahoo.com/news/element79-gold-completes-acquisition-nevada-003500329.html

34 https://fortune.com/2021/10/26/bitcoin-electricity-consumption-carbon-footprin/

35 https://coinmarketcap.com/currencies/pax-gold/

36 https://web.archive.org/web/20200301010350/http://wjw.wuhan.gov.cn/front/web/showDetail/2020011109036

37 https://www.businessinsider.com/modern-monetary-theory-mmt-explained-aoc-2019-3

38 https://seekingalpha.com/article/4371587-new-bull-market-for-precious-metals

39 https://www.fxstreet.com/news/global-stock-of-negative-yielding-bonds-declines-by-3-trillion-202102190107

40 https://www.businessinsider.com/todays-gold-market-looks-a-lot-like-the-crazy-1970s-2016-7

41 https://www.jmbullion.com/investing-guide/james/silver-demand/

42 https://sydneynewstoday.com/liechtenstein-gold-experts-say-they-will-maintain-value-together/209062/

43 https://sprott.com/insights/sprott-gold-report-one-of-the-greatest-bubbles-in-history/

44 https://www.fxstreet.com/news/gold-price-forecast-xau-usd-to-rebound-sharply-towards-2000-goldman-sachs-202107210411

45 https://capital.com/gold-analysis-will-the-metal-hit-new-price-record

46 https://www.centerragold.com/operations/mount-milligan/history

47 https://www.newgold.com/assets/blackwater/default.aspx

48 https://www.sierracollege.edu/ejournals/jsnhb/v2n1/motherlode.html

49 https://www.mindat.org/loc-73787.html

50 https://finance.yahoo.com/news/element79-gold-signs-letter-intent-110000506.html

51 https://finance.yahoo.com/news/element79-gold-signs-letter-intent-110000506.html

52 https://pubs.geoscienceworld.org/books/book/2183/chapter/121939235/The-Geology-of-the-Mother-Lode-Gold-Belt-Foothills

53 https://s2.q4cdn.com/610165863/files/doc_downloads/2021/02/FINAL-2020-AIF-Feb-17-2021.pdf

54 https://www.iamgold.com/English/investors/news-releases/news-releases-details/2020/IAMGOLD-to-Proceed-with-Construction-of-the-Ct-Gold-Project-in-Ontario-Canada/default.aspx

55 https://www.fraserinstitute.org/studies/annual-survey-of-mining-companies-2020

56 https://investorplace.com/2021/01/analysts-predict-a-wave-of-mergers-and-acquisitions-among-gold-mining-in-2021/

57 Maverix Metals Inc., September 1, 2021, Preliminary Short Form Base Shelf Prospectus https://www.investorx.ca/doc/2109011543295711

58 https://www.scribd.com/document/525577738/Maverix-Metals-SEDI-Summary-Report

59 https://www.mining.com/featured-article/ranked-worlds-10-biggest-gold-mining-companies

/

60 https://www.kinross.com/news-and-investors/news-releases/press-release-details/2010/Kinross-and-Red-Back-combination-creates-high-growth-gold-producer-in-US71-billion-friendly-transaction/default.aspx

61 https://www.reuters.com/article/us-tahoe-resources-m-a-pan-amer-silver/pan-american-silver-to-buy-tahoe-resources-for-1-1-billion-idUSKCN1NJ0ZD

62 https://www.barrick.com/English/news/news-details/2021/Nevada-Gold-Mines-to-Consolidate-South-Arturo-Property-in-Exchange-for-Lone-Tree-and-Buffalo-Mountain-Properties/default.aspx

63 https://www.newswire.ca/news-releases/newmont-and-goldcorp-combine-to-create-world-s-leading-gold-company-806405145.html

64 https://www.barrons.com/articles/gold-sustained-rally-goldman-sachs-says-51585086840

65 https://www.kitco.com/news/2021-07-21/Goldman-Sachs-is-looking-for-2K-for-Gold.html

66 Newmont Corporation holds an indirect interest of Element79 Gold’s Maverick Springs Property via their 28.8% shareholding of Maverix Metals which holds a Net Smelter Return Royalty,57

67 Kinross Gold Corporation holds an indirect interest of Element79 Gold’s Maverick Springs Property via their 8.0% shareholding of Maverix Metals which holds a Net Smelter Return Royalty,57

68 Gold Fields Limited has indirect upside exposure of Element79 Gold’s Maverick Springs Property via their 4,125,000 warrants held in Maverix Metals which holds a Net Smelter Return Royalty,58

69 Pan American Silver Corporation holds an indirect interest of Element79 Gold’s Maverick Springs Property via their 17.8% shareholding of Maverix Metals which holds a Net Smelter Return Royalty,57

70 Seabridge Gold Inc. holds an indirect interest of Element79 Gold’s Snowbird Property via their ~7.48% shareholding of Paramount Gold Nevada Corp. which holds a Net Smelter Return Royalty100

71 Renaissance Technologies LLC holds an indirect interest of Element79 Gold’s Snowbird Property via their 13F disclosed shareholding of 335,527 shares of Paramount Gold Nevada Corp. which holds a Net Smelter Return Royalty100

72 Paulson & Co. holds an indirect interest of Element79 Gold’s Snowbird Property via their 2.68% shareholding of Seabridge Gold which holds ~7.48% of Paramount Gold Nevada Corp. which holds a Net Smelter Return Royalty100

73 https://www.marketwatch.com/story/this-investment-has-outperformed-warren-buffet-by-200x-over-the-past-30-years-but-good-luck-grabbing-a-piece-of-it-2019-11-19

74 https://markets.businessinsider.com/news/stocks/john-paulson-quits-hedge-fund-family-focused-investment-firm-2020-7

76 Allied Market Research, https://www.alliedmarketresearch.com/electric-vehicles-battery-market

77 https://fpxnickel.com/wp-content/uploads/2020/09/FPX-PEA-Results-Sep-2020.pdf

78 https://minedocs.com/17/FiresideMinerals_AR_2017.pdf

79 https://www.rgj.com/story/money/business/2019/07/16/nevadas-second-biggest-land-sale-yields-new-fernley-industrial-park/1740852001/

80 https://kodiakcoppercorp.com/site/assets/files/5740/2020-09-03_mpd_gate_high_grade_final-1.pdf

81 https://www.usfunds.com/investor-library/frank-talk-a-ceo-blog-by-frank-holmes/how-gold-miners-can-leverage-the-price-of-gold/

82 https://www.newsfilecorp.com/release/38219/Great-Bear-Announces-HighGrade-Discovery-Drills-16.35-m-of-26.91-gt-Gold-and-7.00-m-of-44.47-gt-Gold-in-Two-Holes-at-Hinge-Zone-Dixie-Project-Red-Lake-District

83 https://abcdust.net/the-top-10-biggest-gold-mines-in-the-world/

84 http://edition.cnn.com/2001/BUSINESS/06/25/barrick.homestake/

85 https://www.nrc.gov/docs/ML0124/ML012410007.pdf

86 https://dealbook.nytimes.com/2011/02/03/newmont-mining-strikes-2-billion-gold-deal/

87 https://www.barrick.com/English/news/news-details/2021/Nevada-Gold-Mines-to-Consolidate-South-Arturo-Property-in-Exchange-for-Lone-Tree-and-Buffalo-Mountain-Properties/default.aspx

88 https://finance.yahoo.com/news/element79-gold-announces-dale-property-110000854.html

89 https://sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo=00050741&issuerType=03&projectNo=03170809&docId=5005735

90 https://minerals.nv.gov/uploadedFiles/mineralsnvgov/content/Programs/Geo/GeoLinks-MI2017.pdf

91 https://www.kitco.com/news/2021-04-05/Top-10-biggest-gold-mines-in-the-United-States-report.html

92 http://www.ssrmining.com/assets/pdfs/MaverickSprings.pdf

93 https://education.kitco.com/precious-metals/largest-gold-mines-north-america-q1-2020

94 https://s25.q4cdn.com/322814910/files/doc_financial/quarterly_results/2015/q4/Barrick-2015-Q4-Year-End-Report.pdf

95 http://s22.q4cdn.com/546540291/files/doc_news/2018/2018-06-18-Updated-Marigold-Life-of-Mine-Plan-FINAL.PDF

96 https://kinrossworld.kinross.com/en/round-mountain-celebrates-15-million-ounces-poured/

97 https://webfiles.thecse.com/Form_2A_-_Listing_Statement_32.pdf?ciFiLHFe4V.kXEaeBfI40G4Jea3RRH8n=

98 https://www.accesswire.com/666642/Element79-Gold-Announces-Execution-of-Agreements-for-Acquisition-of-Significant-Gold-Portfolio-in-Nevada

99 https://www.theglobeandmail.com/globe-investor/iamgold-acquires-trelawney-mining-in-608-million-deal/article4103976/

100 https://www.element79.gold/projects/

101 TMAS ran from $0.35 August 5, 2020 to $2.27 January 15, 2021, a gain of 548%

102 https://finance.yahoo.com/quote/GBR.V/chart?p=GBR.V

103 https://www.globenewswire.com/en/news-release/2020/01/07/1967150/0/en/FPX-Nickel-Achieves-Recoveries-up-to-99-5-in-Production-of-High-Grade-Nickel-Cobalt-Solution-for-the-Electric-Vehicle-Battery-Market.html

104 https://www.businessinsider.com/tesla-partners-adviser-nickel-mine-elon-musk-biggest-concern-2021-3

105 https://www.pdac.ca/docs/default-source/priorities/securities/levelling-the-playing-field—final.pdf

106 https://www.barrick.com/English/news/news-details/2019/Barrick-and-Newmont-Forge-Nevada-Joint-Venture-Agreement/default.aspx

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Element79 Gold Corp. (“ELEM”) and its securities, CORPCOMM SERVICES LIMITED, who has been retained by Element79 Gold as investor relations, has provided the Publisher with a budget of approximately $20,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by ELEM) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company ELEM and has no information concerning share ownership by others of in the profiled company ELEM. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to ELEM industry; (b) market opportunity; (c) ELEM business plans and strategies; (d) services that ELEM intends to offer; (e) ELEM milestone projections and targets; (f) ELEM expectations regarding receipt of approval for regulatory applications; (g) ELEM intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) ELEM expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute ELEM business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) ELEM ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) ELEM ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) ELEM ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of ELEM to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) ELEM operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact ELEM business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing ELEM business operations (e) ELEM may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

CORPCOMM SERVICES LIMITED is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Element79 Gold Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Element79 Gold Corp. and has no information concerning share ownership by others of any profiled Element79 Gold Corp. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Element79 Gold Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Element79 Gold Corp. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Element79 Gold Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Element79 Gold Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Element79 Gold Corp. industry; (b) market opportunity; (c) Element79 Gold Corp. business plans and strategies; (d) services that Element79 Gold Corp. intends to offer; (e) Element79 Gold Corp. milestone projections and targets; (f) Element79 Gold Corp. expectations regarding receipt of approval for regulatory applications; (g) Element79 Gold Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Element79 Gold Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Element79 Gold Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Element79 Gold Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Element79 Gold Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Element79 Gold Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Element79 Gold Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Element79 Gold Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Element79 Gold Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Element79 Gold Corp. business operations (e) Element79 Gold Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Element79 Gold Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Element79 Gold Corp. or such entities and are not necessarily indicative of future performance of Element79 Gold Corp. or such entities.