ADVERTORIAL

The best way to play the coming renewable energy boom for maximum upside potential.

The birth of a truly disruptive technology has exposed dangerously low supply of what is now one of world’s most critical minerals… vanadium.

News of vanadium’s shortage driving a sensational price spike, 596% in since January 2016, has been a closely held among mining insiders.

Follow the Smart Money While the Opportunity Is At Its Peak

That’s because they knew only a handful of companies are ready to capitalize on the unstoppable new disruptive trend.

Because of that, vanadium’s price per ton is forecast to continue soaring.

Demand for vanadium tripled in the last 18 months.

The hungry demand is fueled by a single mega trend that’s forming now – energy storage.

It’s nothing less than the birth of a brand-new industry.

The biggest demand for vanadium is domestic which could lead to the U.S.A. becoming vanadium’s dominant market.

Because of that, vanadium miners like the one we’re highlighting could be investor’s top commodities move for 2021.

That’s because it solves problems that the lithium-ion and cobalt batteries used in electric vehicles and small storage plants can’t handle.

You see, vanadium forms the core of giant batteries that store energy created by solar, and wind power.

Most investors are aware that minerals, such lithium, are used at the core of batteries.

But the lithium boom is over. Investors are on the wrong road if they’re looking for major gains from lithium and cobalt stocks.

Because lithium is so plentiful the days of massive profits on it are long gone. That’s why investors with a taste for commodities need to shift focus to vanadium.

Visionaries like Bill Gates and Jeff Bezos are already taking their stakes in Flow batteries, which vanadium is at the heart of.

- Bill Gates says the breakthrough batteries cure one of the world’s most pressing crises.

- Jeff Bezos, Jack Ma, and Richard Branson and other tech leaders a betting a $1 billion on this undisputed disruptive technology.

- FORBES says vanadium is the crucial mineral powering a “breakthrough” energy storage battery.

- Now, a Utah company is reopening an old mine where massive vanadium reserves were once ignored.

Temple Mountain Is Ready to Make Energy History Again

One undervalued miner is in an advantageous position because its Temple Mountain, Utah, USA, mining site positions it to be a potentially huge player in the race to supply find and supply vanadium to North American battery makers.

Their 1,074-acre tract Emery County, Utah was actively mined before World War II. Past mineral reports showed vanadium values as high as 4.97%, which is considered superb. And, a strong supply of domestic vanadium could be music to Bill Gates’ and Jeff Bezos’ ears.

They know exactly what the Flow battery means to the world’s top companies, major utilities, and entire countries.

That’s why Gates’ Breakthrough Energy Ventures fund is already betting big on energy storage batteries.

The Alt-Energy Industry’s Biggest Management Hurdle Solved—Vanadium Answers

The Flow battery is a cutting-edge design for energy storage. But it’s well beyond theory. That’s why this is the perfect moment to invest in companies that supply the one thing it must have to succeed – vanadium.

Flow batteries are already proving their worth on remote islands, in harsh deserts, in frozen subarctic outposts, and near busy, industrial urban centers.

Research & Markets predicts Flow batteries will be a billion-dollar industry by 2023. It’s expanding 32.7% a year now. There’s nothing else like it going on in alt fuels today.

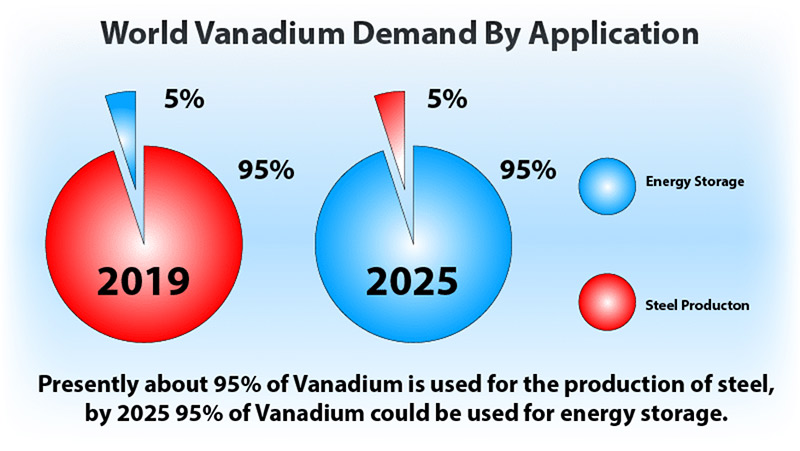

This is a mega-trend that changes everything about the vanadium market.

This is the technology that is set to change local solar and wind generation from community-scale to state- and region-wide transmission. It will allow storage in places where everything else is a problem because temperature extremes don’t matter.

Long idles are no problem at all.

And unlike lithium, cobalt, and every other rechargeable storage technology, the Flow battery goes on, and on, and on. When Li-ion batteries drop dead, the Flow has years of life in it.

Why You Should Get This Company On Your Radar Right Now

Made in the USA – US demand for vanadium is outpacing every other country. That’s why the rare all-American Temple Mountain property is so appealing.

100% Rights with Royalties – When this company closes the pending deal for 52 vanadium lodes, it owns mining rights to 98% of the project. And that means its shareholders max out their potential.

Vanadium-Rich Country – Temple Mountain is uranium country, which means vanadium is likely there too. But we already know that because historic reports show rich reservoirs of vanadium up to 4.7%!

The Billionaires Know – Bill Gates, Jeff Bezos, Michael Bloomberg, they’re all in battery technology now.

Growth Tops Everything – the EV car battery boondoggle is over. The need for cheap, efficient, and safe energy storage is the next critical hurdle in the world’s transition to renewable energy. And in that market, Flow batteries should meet or exceed 3,100% in the next 10 years.

Sign up to learn more about this aggressive young company in the heart of a mega trend.

Legal Notice: This work is based on what we’ve learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It’s your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Don’t trade in these markets with money you can’t afford to lose. Investing in stock markets involves the risk of loss. Before investing you should consider carefully the risks involved, if you have any doubt as to the suitability or the taxation implications, seek independent financial advice. Invictus News expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Invictus News, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast.