When other data indicators provide mixed signals, the yield on the 10-year Treasury note is typically a good indication of how Wall Street sees economic growth prospects.

From stock market performance to the most recent unemployment statistics to inflation, many indicators exist to evaluate how the economy is doing. Yet if all these indicators still fail to provide a clear picture of the economy, look at the yield on the 10-year Treasury note.

T-Note yield: a telling sign of the economy

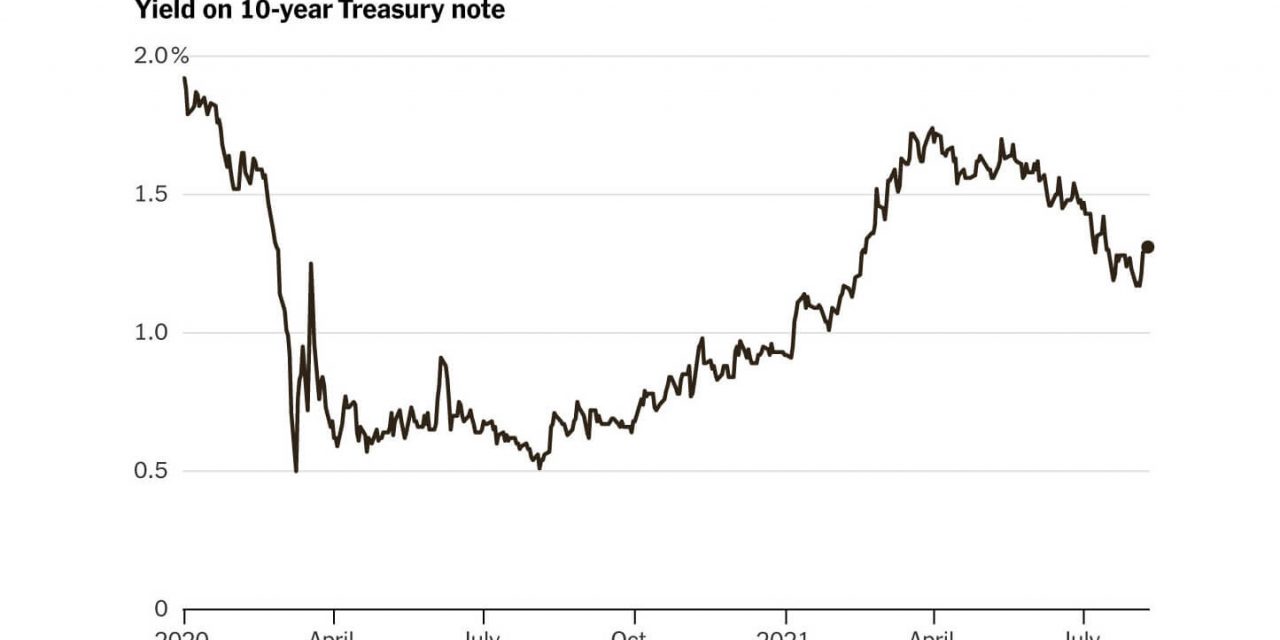

T-note yield fell below 1.20 percent early this month to a record-low 1.13 percent. Since February this year, it has gradually risen over 1.30 percent.

The T-note refers to a closely followed indicator of Wall Street mood. When T-note yields grow, it usually indicates that expectations for economic growth and inflation are also rising.

It’s because when investors are optimistic, they sell bonds, which are considered safe assets, and purchase stocks, which are considered riskier. Bond prices fall, and yields rise as a result. Conversely, when investors get worried about the economy, products fall due to more bond purchases, which raises the cost of the bonds. As a result, bond yields offer a shortcut to investors’ reasoning.

The bond market’s rocky journey reflects a broader development that investors have grown used to during the last decade or so. After the 2008 financial crisis, the economy has recovered slowly. Growth has steadied at an average of 2.3% since 2010. The sluggish recovery has disappointed several analysts.

Treasury rates fell to historic lows in 2012 as investors raced to purchase bonds in response to a significant reduction in government expenditure, as well as slowdowns in China and Europe, which impacted on GDP. Bond rates fell significantly in 2016 when the economy experienced a growth slowdown that some now refer to as an “invisible recession,” reaching record lows in July.

The Delta effect

The Delta variant’s effect, which is beyond the United States, impacts global economic prospects. Escalating infection rates in Vietnam, Indonesia, Japan, and South Korea have once again triggered lockdowns and putting pressure on the global supply chain.

However, the problems do not end with Delta. Federal spending that propped up the US economy last year has dipped. Furthermore, income growth and consumer expenditure have also scaled down. In addition, with government stimulus checks already spent, savings rates have also fallen.

Meanwhile, the stock market remains robust, with the S&P 500 up nearly 18% in 2021. Although stock market investors do not seem to be too worried about slower growth, some of the market’s activity results from reduced bond rates.

Bond investors get lower interest payments due to low bond yields, prompting some to invest their money elsewhere. The most obvious choice is to invest in the stock market.