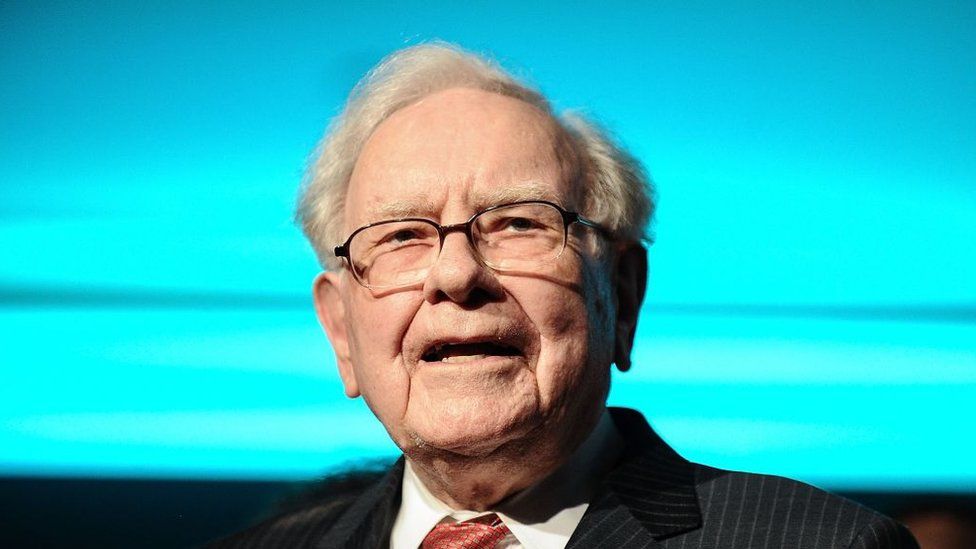

Warren Buffet has named his successor as CEO of Berkshire Hathaway. During an interview with CNBC on Monday, Buffet, serving as the company’s CEO for more than 50 years, revealed that Greg Abel is next in line, followed by Ajit Jain.

According to Buffet, the directors made a unanimous decision to appoint Abel as the heir apparent. Abel is the head of Berkshire Hathaway’s non-insurance business. Jain, on the other hand, heads Berkshire Hathaway’s insurance business.

Both Abel and Jain currently sit as vice-chairmen of the company and were long considered to be Buffet’s successor.

Before the announcement, the conglomerate kept the succession decision secret but assured investors that a detailed plan is already in hand.

It’s All About the Age

During Berkshire Hathaway’s annual meeting, Vice Chairman Charlie Munger hinted that the board selected Abel as the next CEO.

While Buffet praised both men, calling them “wonderful guys,” ultimately, the directors agreed that if something were to happen to the iconic investor, Abel would take over. On the other hand, if Abel cannot perform his role, Jain will assume the position.

A key determinant in the decision was age. Abel, who is 58, tops Jain, 69 in this criterion.

With Buffet’s decade of leadership, there is no sign that he will step down anytime soon.

Nonetheless, with Buffet stepping into his 90s and his health record, the conglomerate prepares their future plans.

When Abel becomes the CEO, he will be in charge of Berkshire Hathaway’s myriad of businesses like Geico insurance, Dairy Queen, Duracell batteries, the Burlington Northern Santa Fe Railway, Forest River, NetJets, and more.

Who Is Greg Abel?

Greg Abel joined Berkshire Hathaway in 1999 when the company purchased a controlling interest in MidAmerican, where he was the company’s president. MidAmerican has changed its name to Berkshire Hathaway Energy (BHE), and Abel was appointed as CEO.

He oversees BHE’s energy holdings covering subsidiaries centering on solar, geothermal, natural, gas, wind, hydroelectric, and nuclear energy.

Apart from BHE, Abel is also part of the board of directors for companies like AEGIS Insurance Services, the Hockey Canada Foundation, and the Kraft Heinz Company.

Buffet has high regard for Abel’s contribution to Berkshire Hathaway. In 2013, the respectable investor mentioned that Abel always brings him innovative and great ideas.

He maintained his passion and active engagement in the company’s success. The Wallstreet Journal even dubbed him as “an astute dealmaker.”

Keeping the Culture and Success

Berkshire Hathaway is known to have a decentralized nature. When asked if the company has become too complicated to manage as a single company, Munger hinted that their institutionalized structure functions well for everyone. He mentioned that “Greg will keep the culture.”

Buffet has charmed the business sector with his strong reputation, magnetism, and personality. Thereby, it is a challenge to rival his era as the company’s CEO.

Nonetheless, according to David Krass, professor of finance at the University of Maryland’s Robert H. Smith School of Business, Abel “exudes extreme competence and success.”