#1 Clean Energy Stock that is Still Dirt Cheap

(but not for long!)

Editorial Feature | March 29, 2022 | Industry

…AND ONE LITTLE-KNOWN COMPANY IS IN THE LEAD.

Bill Gates is investing.

So is Warren Buffett. And billionaire Li Ka-shing, the so-called “Warren Buffett of Asia.”

And super investor David Shaw, whose uncanny ability to catch investment trends before anyone else led Fortune magazine to name him “the most mysterious force on Wall Street.”

They’re all quietly taking huge positions in one surprising segment of the historic, monumental, world-wide clean energy transition.

Clean energy is the biggest and fastest-growing investment trend of this era, a $73 trillion makeover of the world’s power generation systems that must be completed by 2050.1

AND COMPANIES THAT DRIVE THE TRANSITION ARE GIVING INVESTORS LIFE-CHANGING PROFITS.

In just under three years:

- Solar tech company Enphase Energy (ENPH) soared to more than 5,000% gains

- Fuel cell battery developer Plug Power (PLUG) rocketed to more than 3,190% gains

- Polysilicon wafer maker Daqo New Energy (DQ) rewarded investors with profits of more than 2,900%

Plus stocks like Vestas Wind Systems, Siemens Renewable, Sunrun, and Canadian Solar have rewarded investors with double, triple, and even 10 times their money.

But even as high as those profits are, it’s not where the world’s best investors are putting their money.

Gates, Li, Shaw. And other top investors are backing a different technology.

Because a historic mismatch between supply and demand could drive stocks in this space to the biggest gains in a generation.

It is a technology that scientists, energy agencies, and world leaders say is essential to the clean energy transition.

And one fast-growing company you’ve probably never heard of is leading the way in finding the fuel that powers it.

You may be surprised to hear what it is…

White House Says Key Resource is “Critical to America’s Clean Energy Future”

It’s nuclear power, and even though it hasn’t had much love for the past decade, it’s back now, and thanks to technological innovations, it’s cleaner, safer, and cheaper than ever.

And one fast-growing company, Basin Uranium Corporation (CNSX: NCLR, OTC: BURCFCNSX: NCLR, OTC: BURCF) is leading the way in finding the fuel that powers it.

Experts say it’s the true key to meeting clean energy goals.

The powerful Atlantic Council calls nuclear power:

The influential think tank Partnership for Global Security says:

“It will be impossible to meet climate change goals without a significant contribution from nuclear power.”3

And U.S. Secretary of Energy Jennifer Granholm says:

But the most surprising support for nuclear comes from an unlikely place: Texas.

Governor Greg Abbott and Congressman Dan Crenshaw are both putting their weight into the push for more nuclear energy..

THE TWO POWERFUL REPUBLICAN LEADERS OF THE LARGEST OIL- PRODUCING STATE IN THE LARGEST OIL-PRODUCING COUNTRY IN THE WORLD KNOW THE FUTURE IS NUCLEAR.5

A big persuader was the Texas Deep Freeze that happened Valentine’s Day night. Which is estimated to have cost the Texas economy as much as $130 billion.

Adoption of nuclear energy would shore up gaps in the Texas electrical grid caused in part by previous adoption of wind and solar energy – which failed in the hard freeze.

In March, Crenshaw made is support very clear, writing that:

Since then, Republican support for nuclear energy has grown even stronger.

In April, GOP congressional leader Kevin McCarthy said,

In July, California congressman Devin Nunes introduced the Clean Energy Production Act, designed to boost nuclear production.8

It’s a movement happening all over the world, from China and India to Finland, Argentina, and Korea.

Even Saudi Arabia and United Arab Emirates, whose economies are powered by oil, are busy building nuclear power plants.9

The UAE aims to produce 25% of its electricity via nuclear by 2050.10

The private sector is all-in too. Bill Gates and Warren Buffett are leading the charge, teaming up to build a new generation of nuclear power plants that are both cheaper and faster to build, and safer to operate.11

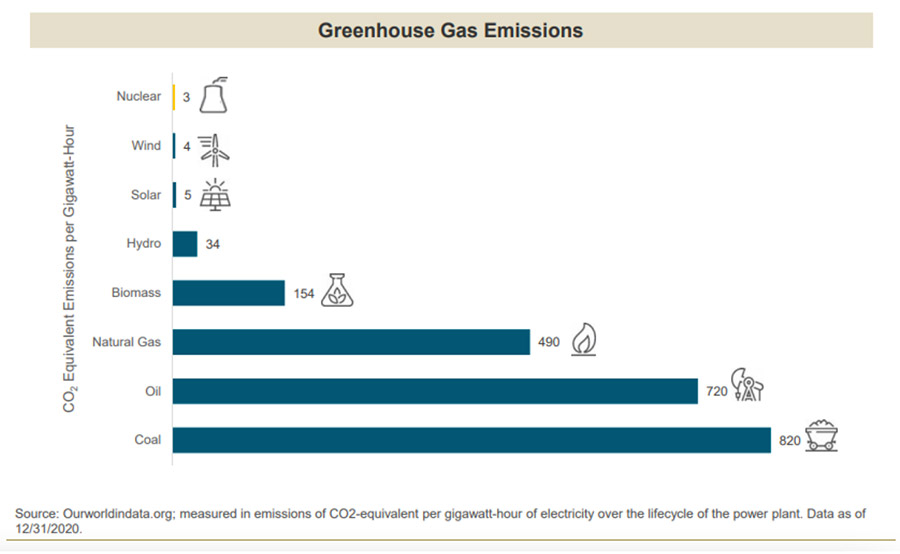

The facts show nuclear power to be the safest form of energy available. And the cleanest.

“Nuclear energy, in terms of an overall safety record, is better than other energy.”12 – Bill Gates

“Nuclear power releases less radiation into the environment than any other major energy source.”13 – Yale

Coal power which we rely in large part to power our homes produces so much air pollution — it’s 35,042% more dangerous than nuclear energy.

When you compare energy sources in terms of how clean they are, coal comes in dead last. Nuclear wins hands down as the absolute cleanest, making it extremely attractive to combat climate change and the Government’s clean energy goals.

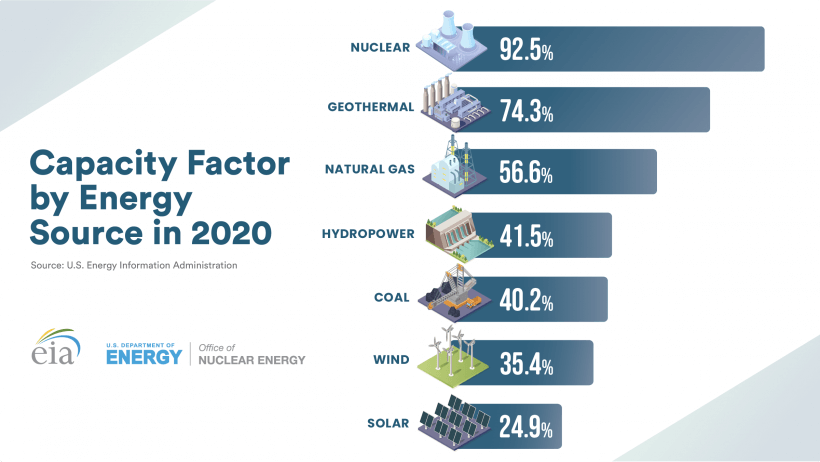

Another reason for nuclear energy’s rising star status is that it’s just more efficient than other sources of energy.

Solar and wind energy once were considered the future of energy but not anymore. They’re not efficient enough and they contradict Democrat climate change initiatives. Lost on a lot of people is the fact that, to generate a considerable amount of energy, it would require massive deforestation to build solar panel and wind turbine farms.

Another problem with solar and wind energy is that the sun doesn’t always shine and the wind doesn’t always blow.

But nuclear power is a 24/7 power source that doesn’t require massive acreage

Plus, it outshines the production capacity of all other forms of energy.

IT BEATS COAL TWO TIMES OVER. AND OUTSHINES SOLAR POWER FOUR TIMES OVER.

There’s just one problem...

Uranium. There’s not enough of it.

Currently 19% of US electricity is powered by nuclear energy, making the US the world’s largest producer of nuclear power, and plans for expansion are well underway.

In order to fuel all the nuclear power plants already online and being built over the next five years, the mining industry needs to discover 2.95 million tons of new proven resources.13

Or about 590,000 tons per year.

Right now, global annual production is a woefully inadequate 54,000 tons. Less than 10% of what will be needed.14

Fortunately, the mining industry is quickly ramping up.

And even more fortunately, the world’s richest uranium reserves are in Canada, America’s closest trading partner.

It’s also among the largest reserves, historically accounting for 15-20% of annual global production.

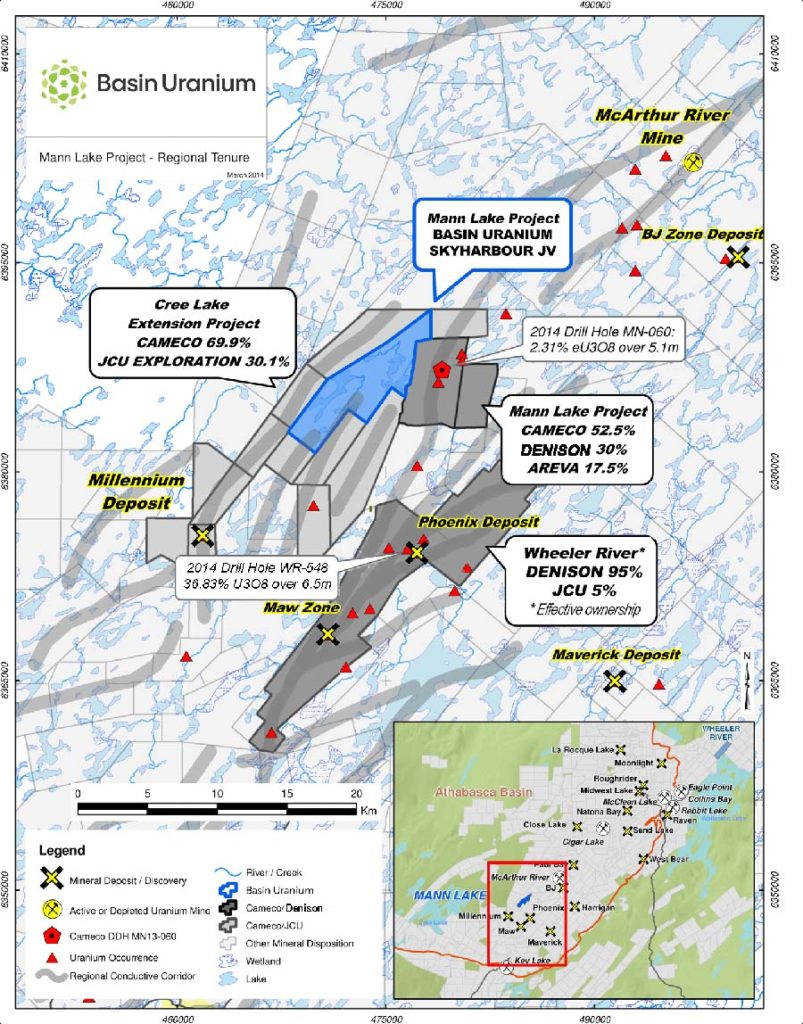

Major producers and developers like $7 billion Cameco, $2 billion NexGen Energy, $1 billion Denison Mines dominate the vast, rich Athabasca Basin.

And right at the center of them, is small but mighty Basin Uranium Corporation (CNSX: NCLR, OTC: BURCFCNSX: NCLR, OTC: BURCF).

With its own capacity for uranium production limited, the US has begun looking to its nearby friends. Thankfully its northern neighbor has the leading sources of high-grade uranium in the world.

That’s why all eyes are turning to the Athabasca Basin in Northern Saskatchewan and Alberta.

Grades are on average 20 times higher here than anywhere else in the world.16

What’s more, with 606,600 tonnes of known reserves, this region currently supplies 20% of the world’s uranium.17

Basin Uranium has partnered with Skyharbour Resources to earn-in on some prime real-estate in the Athabasca basin, the Mann Lake Project.

This 3,472-hectare project boasts a highly strategic location, sandwiched between the McArthur River mine 25km to the northeast (host to 273.6 million lbs proven and probable reserves), and Cameco’s Millennium uranium deposit 15 km to the southwest (host to 75.9 million lbs proven and probable reserves).

To date this project has seen over $3 million in historic exploration. In 2014, a ground-based EM survey focused on a zone where a favorable 2km long aeromagnetic low coincides with possible basement conductor trends. In 2022, the Company will be completing additional geophysical studies on this and previously unexplored parts of the property.

Current targets focus on the main NE trending conductive corridors appear to concentrate uranium as shown at Mann Lake to the East. It is these kind of basement corridors where significant concentrations of uranium are typically found.

Drilling will follow on these targets in the near term.

That means Mann Lake has the potential to propel this relatively small exploration company into the big leagues. 2022 may be the year when the magic happens and proves their project to an already burgeoning market.

A Decade of Potential Parabolic Returns

While the stage has been set for nuclear energy’s mass adoption, here’s where it really gets interesting for investors seeking big returns.

Global demand for energy is surging, with an estimated 76% increase in demand between now and 2030 for more electricity.

Only nuclear energy can provide scalable carbon-free 24/7 baseload power. This is why much of the developing world is shifting to nuclear. There are already about 450 nuclear power plants globally with over 50 more under construction, and hundreds more are being planned.

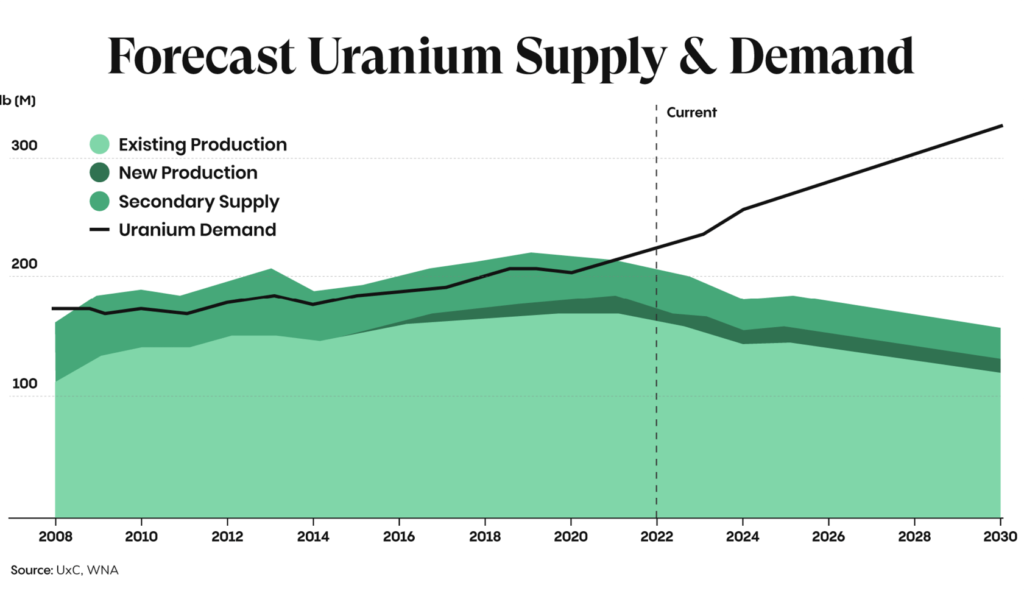

Currently the world’s demand for uranium is 183 million pounds, however global mine production is only at 138 million pounds, leaving a 100-million-pound deficit by 2030.18

In terms of real dollars, the uranium market was worth about $100 billion at one point – and that happened organically, prior the historic energy policy shift in the United States and elsewhere.

Currently the uranium market is worth about $20 billion, leaving plenty of room for the market’s value to grow.

That spells opportunity for uranium investors, and specifically for those watching junior explorers like Basin Uranium Corporation (CNSX: NCLR, OTC: BURCFCNSX: NCLR, OTC: BURCF), who remain highly undervalued relative to their Athabasca peers. That’s at least the case for the time being.

But it could change quickly, as there’s yet another catalyst for uranium prices to pop off.

Sprott’s 28.3 Million lb. Uranium Purchase Adds Fuel To The Fire

Even the big-time mining magnates are taking notice of the money pouring into this sector.

THE ARRIVAL OF THE CANADIAN LISTED SPROTT PHYSICAL URANIUM TRUST IS ONE OF THE BIGGEST GAME CHANGERS.

Sprott Inc., a global assets management company specializing in precious assets like gold, silver and platinum – has considerable influence over these markets.

Sprott Inc., a global assets management company specializing in precious assets like gold, silver and platinum – has considerable influence over these markets.

Having raised $300 million, they set out on a buying spree of epic proportions, snapping up 28.3 million lbs. of uranium in just a few weeks.19

And there’s more to come – it recently increased its at-the-market offer limit by to US$3.5 billion. In short, demand is surging and supply is struggling to keep up.

So What To Do Next?

Basin Uranium Corporation (CNSX: NCLR, OTC: BURCFCNSX: NCLR, OTC: BURCF) is poised for a breakout driven by this tectonic shift in energy policy that’ll reshape the skyline of neighborhoods and even your energy bill.

Right now the explorer is in a sweet spot for investors. It has a ready market with the US and other countries looking to ramp up uranium production, and it benefits from a highly experienced team with a track record of building successful companies.

At the same time, with exploration still in its beginning stages, Basin Uranium has yet to attract the same level of speculation we’ve seen with other stocks in the same market. But as has happened many times before, once junior mining companies prove out resources, things tend to move very quickly.

You can find out more about Basin Uranium via their website. Once you’ve completed your due diligence, call your broker and put Basin Uranium Corporation (CNSX: NCLR, OTC: BURCFCNSX: NCLR, OTC: BURCF) at the top of your watchlist.

1https://www.brainyquote.com/quotes/bill_gates_626269

2https://e360.yale.edu/features/why-nuclear-power-must-be-part-of-the-energy-solution-environmentalists-climate

3https://www.scientificamerican.com/article/nuclear-power-must-make-a-comeback-for-climate-s-sake/

4https://skyharbourltd.com/_resources/presentations/fact-sheet.pdf

5Fission Uranium Corp (FCUUF) +150% gain on 3-23-2014 Yahoo Finance

6Denison Mines Corp (DNN) +160% gain on 5-6-2007 Yahoo Finance

7NexGen Energy Ltd (NXE) +472% gain on 2-12-2017 Yahoo Finance

8Cameco Corporation (CCJ) +526% gain on 6-10-2007 Yahoo Finance

9https://skyharbourltd.com/_resources/presentations/corporate-presentation.pdf

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Basin Uranium Corporation (“NCLR”) and its securities, NCLR has provided the Publisher with a budget of approximately $200,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by NCLR) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company NCLR and has no information concerning share ownership by others of in the profiled company NCLR. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to NCLR industry; (b) market opportunity; (c) NCLR business plans and strategies; (d) services that NCLR intends to offer; (e) NCLR milestone projections and targets; (f) NCLR expectations regarding receipt of approval for regulatory applications; (g) NCLR intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) NCLR expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute NCLR business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) NCLR ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) NCLR ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) NCLR ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of NCLR to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) NCLR operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact NCLR business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing NCLR business operations (e) NCLR may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Basin Uranium Corporation

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Basin Uranium Corporation and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Basin Uranium Corporation or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Basin Uranium Corporation Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Basin Uranium Corporation’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Basin Uranium Corporation future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Basin Uranium Corporation industry; (b) market opportunity; (c) Basin Uranium Corporation business plans and strategies; (d) services that Basin Uranium Corporation intends to offer; (e) Basin Uranium Corporation milestone projections and targets; (f) Basin Uranium Corporation expectations regarding receipt of approval for regulatory applications; (g) Basin Uranium Corporation intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Basin Uranium Corporation expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Basin Uranium Corporation business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Basin Uranium Corporation ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Basin Uranium Corporation ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Basin Uranium Corporation ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Basin Uranium Corporation to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Basin Uranium Corporation operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Basin Uranium Corporation business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Basin Uranium Corporation business operations (e) Basin Uranium Corporation may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Basin Uranium Corporation or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Basin Uranium Corporation or such entities and are not necessarily indicative of future performance of Basin Uranium Corporation or such entities.