Every investment you make will include some degree of risk. Even before you start a new business, it is imperative to be knowledgeable if your money and time will be profitable in the end.

This is where you use the Sharpe ratio. It refers to a method frequently used by professional investment managers to measure their investment returns and risks. Therefore, it’s essential to consider the Sharpe ratio when investing in having total control of your money.

What exactly is the Sharpe ratio?

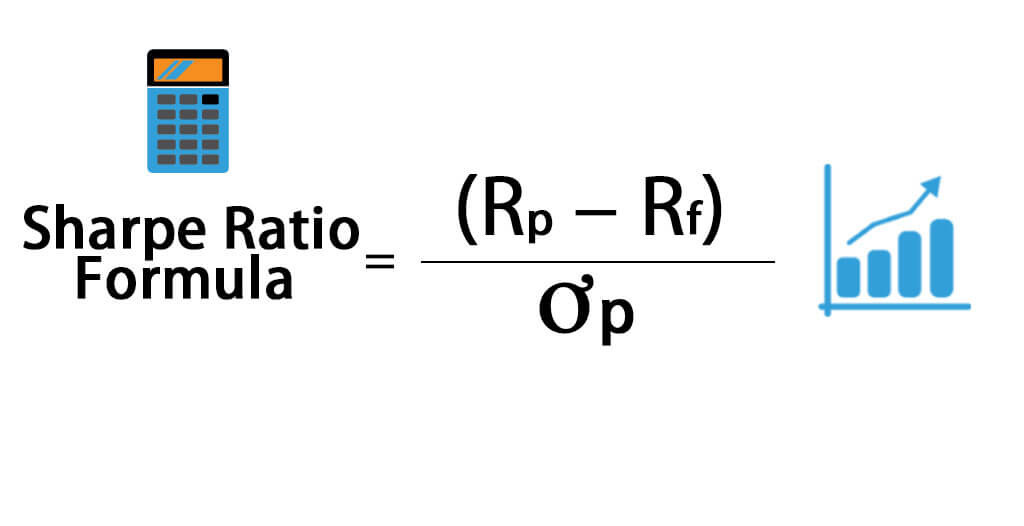

Firstly, it is a risk ratio that estimates the average returns of investment concerning the risks that it may incur. You can get this when you subtract the risk-free rates — like the rate on a US Treasury bond — from the anticipated portfolio return rate and divide it by the standard deviation known as the statistical measurement of your asset’s variability.

Furthermore, it will allow you to evaluate if the risk you took paid off in terms of returns compared to the gains you would have gotten if you hadn’t taken the risk.

How to use the Sharpe ratio

You should first consider it as a metric that provides investors with information about the profitability of their investments. The ratio examines long-term performance to assist investors in determining how to obtain a yield that may not be the highest achievable but is still adequate in the event of a downturn.

In general, the most preferred is the greater Sharpe ratio. A high Sharpe calculation shows that the risk is compensated with above-average profits. A Sharpe ratio higher than zero, on the other hand, is regarded as excellent. A Sharpe ratio of zero indicates that your earnings are comparable to your investment’s “risk-free” form. While this isn’t always a negative thing, you don’t want to take on risks simply to meet that standard.

- It is bad if the value is less than 1.0.

- A score of 1.0 is satisfactory or excellent.

- A score of 2.0 or above is considered very excellent.

- 3.0 or above is good.

How to calculate the Sharpe Ratio?

To do this, you must first know the rate of return on your portfolio.

The risk-free asset rate, like Treasury bonds, is required next. Subtract this rate from the rate of return of your portfolio to get the excess returns. The excess returns are yields that got past your Treasury bond. Lastly, simply divide the discrepancy between those two aspects by the portfolio’s excess return’s standard deviation to get the final result.

- Risk-free rate: It serves as a baseline for what you would have earned if your investment involved no risk. Due to the unlikelihood of default, Treasury securities are used in the calculation of the Sharpe ratio. For instance, when calculating the Sharpe ratio for a 5-year portfolio, you could use the interest rate on a 5-year Treasury note.

- Portfolio Return: This is the amount of money your portfolio has generated or the amount you anticipate earning over a certain period expressed as a percentage of your invested capital.

- Standard deviation: The standard deviation of a return is a measure of volatility that shows how much a return varies over time. Standard deviation The standard deviation takes into account both downward and upward variations.

Sharpe Ratio’s limitations

The Sharpe ratio is not very helpful for short-term traders since the ratio intends to evaluate long-term investments rather than short-term ones. You may even find yourself being too optimistic in the short run if you use it in managing your short-term assets.

The bottom line

The Sharpe ratio is an essential instrument for determining the performance of your investment portfolio.

Calculating the Sharpe ratio of portfolios should not solely be at the discretion of professional asset managers. Instead, an average investor could easily calculate the ratio, who may then consult their stockbroker to understand the implication of the ratio better.