The latest report from the US Treasury Department casts a damper on the possibility of post-COVID economic recovery as the country’s gross national debt soared past $31 trillion.

According to the Peter G. Peterson Foundation, an organization formed to increase awareness regarding the US government’s long-standing fiscal issues, this essentially means that every American now owes over $93,000.

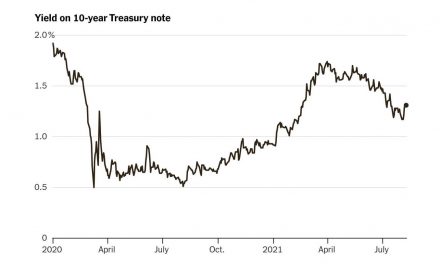

As if that wasn’t enough in terms of bad news, it is possible that rising interest rates will drive debt growth even faster in the coming months.

How Did This Happen?

According to financial experts, this staggering increase in the amount of America’s national debt is the result of an ongoing budgetary deficit that has grown exponentially over the past two years.

Deficits occur when governments spend more money than the amount of taxes collected. In the case of the United States, a number of recently passed bills are to blame for a hefty deficit that has pushed its debt higher than it has ever been.

The American Rescue Plan Act, which was geared towards assisting people in the economic aftermath of COVID-19, has cost the government $1.9 trillion. Likewise, the Biden Administration’s push to forgive student debts amounted to a staggering $750 billion.

Even the Inflation Reduction Act passed in August of this year isn’t expected to do much to decrease the amount. While it was drafted to reduce the economic deficit by around $240 billion, other government initiatives and policies will continue piling on additional amounts well into the next decade.

Indeed, representatives from the Committee for a Responsible Federal Budget (CRFB) believe that the national deficit will be up by $4.8 billion by 2031, warning that excessive borrowing leads to more inflationary pressure on the economy and is also expected to triple federal interest payments over time.

A Matter of Debt Ownership

At the moment, the public holds the bulk of the national debt: a sum of around $24 trillion. But the people aren’t the only ones involved here.

Private investors and foreign governments collectively own $7.7 trillion, while intergovernmental debts make up $6.5 trillion of the total amount.

Also, while increasing interest rates are expected to halt inflation, or at least slow it down, these make it harder for the government to act upon a general economic slowdown.

In this case, experts like Peter G. Peterson Foundation CEO Michael A. Peterson call upon policymakers to take a more proactive approach to the situation.