Savvy investors long ago realized that gold and gold stocks have far outperformed most other asset classes over the past 20 years.

Due to unprecedented interventions by the Federal Reserve that pumped trillions of extra dollars into the markets, the prices of stocks have soared – yet gold and gold stocks have beaten them, on average, hands down.

And while hyper-volatile cryptocurrencies such as Bitcoin have seen big gains in recent years – for example, Bitcoin surged as much as 1,800% in 2017-2018 – they have also seen staggering downturns. Some investors have watched in horror as their cryptocurrency windfalls vanished almost overnight.

In contrast, corrections in the price of gold have been far more modest.

Plus, many gold stocks have seen gains that pale in comparison even to Bitcoin’s recent runup – as eye-popping as 700%… 6,700%… even, in one case, 40,000%.

For this reason, gold and gold stocks remain the best safe haven investment for these turbulent times.

new record after

blowing past

$2,000 per ounce.”

prices to

hit $5,000,

economists say.”

ultimately

soar to $7,500

or more”

Gold is a Proven, Reliable Storehouse of Value That Has Beaten Market Indexes for 20 Years!

The old Wall Street claim that stocks outperform gold over the long haul has long ago been proven false.

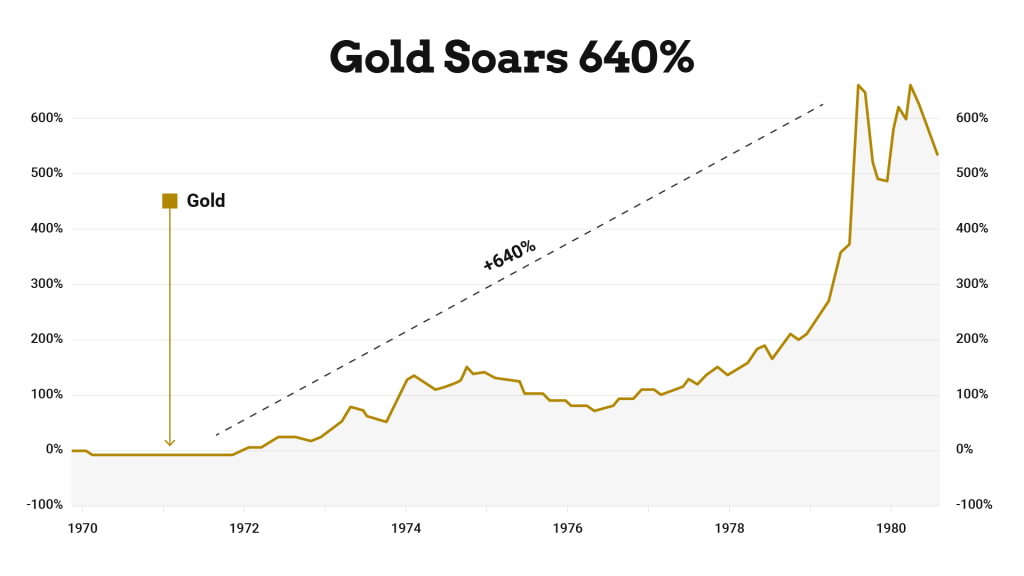

It was once true when it was literally illegal to own gold. But in 1974, President Gerald Ford lifted the ban on gold, and millions of Americans rushed to own gold again. As a result, gold prices soared from $35 an ounce all the way up to $850 by 1980.

Gold then traded in a narrow range between $250 and $400 an ounce for the next 20 years.

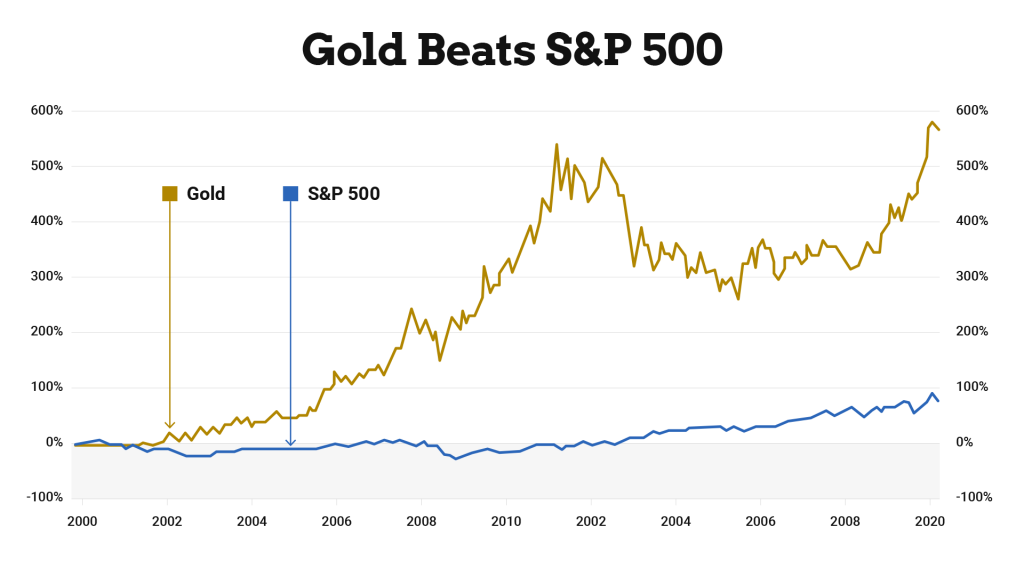

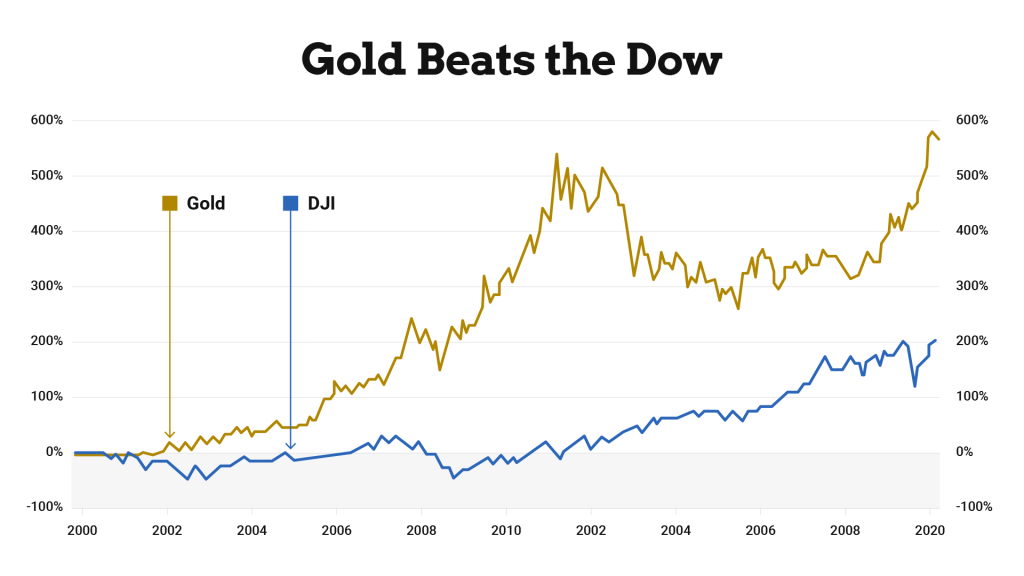

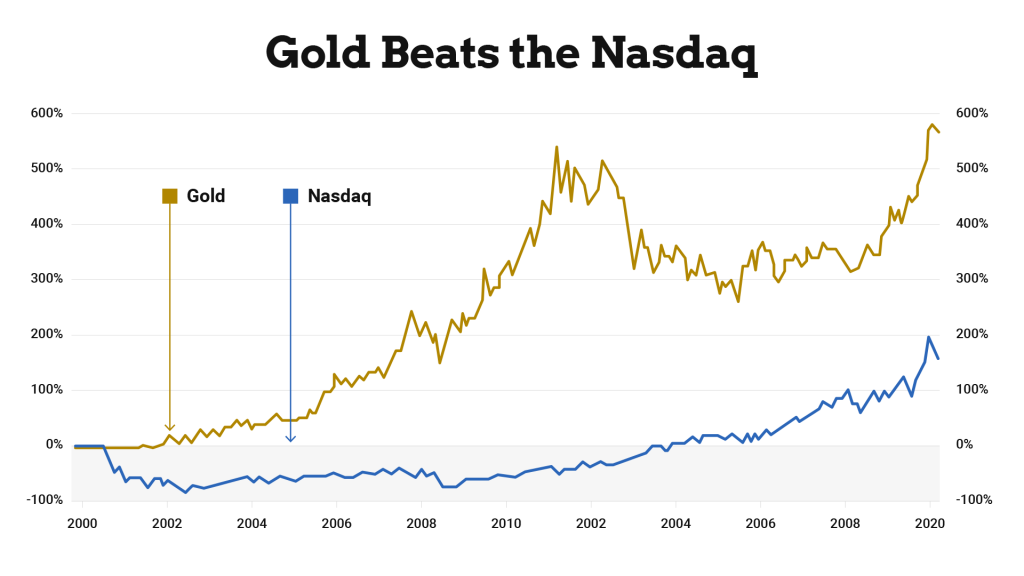

Yet once central banks worldwide began printing money after the dot.com bubble burst in 2000, gold has outperformed stocks as a whole by a significant margin. In fact, historical data reveals that gold has beaten the major stock indexes by a factor of nearly 4 to 1 over the past 20 years.

Take a look at the S&P 500. Since January 2000, this index of America’s 500 biggest stocks has risen from 1,469 to 3,732 – a total return of 154% or about 4.5% a year on average. In contrast, the price of gold has risen from $284 an ounce in early 2000 to $1,895 at the end of 2020 – a total return of 562%. That’s 3.6 times more for your money!

It’s the same story for both the Dow and the Nasdaq.

In January 2001, the Dow was at 10,940 and closed 2020 at 30,409 – a total return of 170% over 20 years.

The Nasdaq did slightly better, rising from 4,041 in January 2000 to 12,888 at the end of last year – a total return of 218.9% compared to 562% for gold.

Some Cryptocurrencies Have Seen Staggering Gains But Also Losses

What about cryptocurrencies such as Bitcoin – which recently nearly doubled in value before pulling back?

Well, Bitcoin was only invented in January 2009 following the 2008 global banking crash, so you can only compare Bitcoin to gold for the past 10 years.

And it’s true, if you were among the very few tech insiders who knew about Bitcoin in the earliest days – when it sold for only $0.0008 to $0.08 per coin – then you could have made staggering profits.

However, the reality is that the general investing public didn’t really know about Bitcoin until around 2015 to 2017 when the price fluctuated from a low of $250 to $13,000 per coin.

Had you bought Bitcoin in mid-2017, when it sold for $2,500 per coin, you would have netted a sizable gain. At a current price of $35,000, you would have made up to a 1,300% return. Even if you had paid $13,000 per coin, you would have made 169% profits at current prices.

Yet there are other factors to consider that still make gold and gold stocks a far better safe haven investment over time.

Cryptocurrencies Have Seen Stomach-Churning Pullbacks

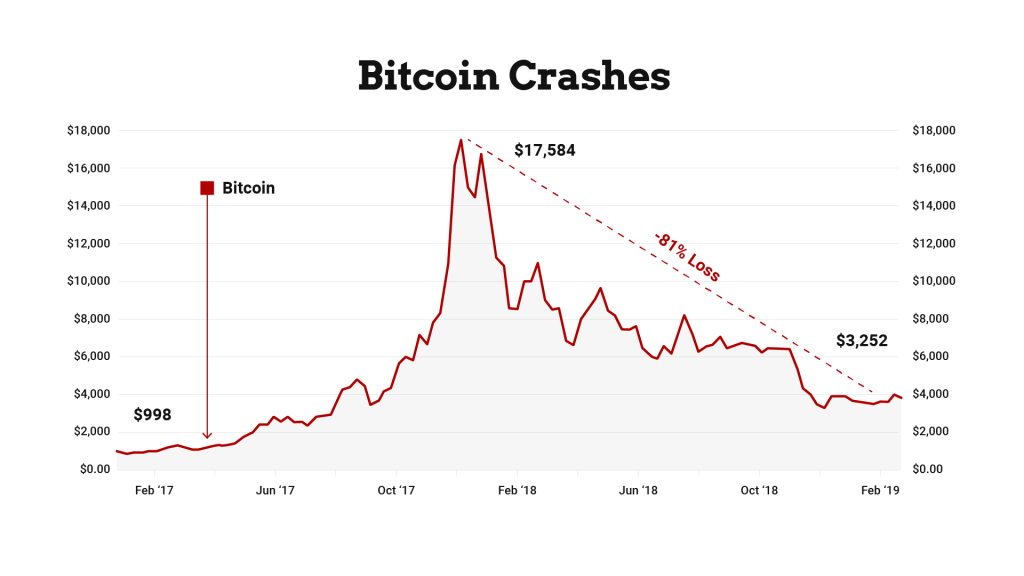

The problem with cryptocurrencies is their volatility.

During the last big runup in the value of Bitcoin, in 2017-2018, the cryptocurrency rose from just $998 per coin to a high, in December 2017, of $17,584. Yet almost immediately, the price of Bitcoin went into free fall, dropping to $3,254 within months – a 81% loss from its highs.

There have been pullbacks in gold but they have been much more modest.

For example, the price of gold dropped from a high of $1,357 per ounce in July 2016 to $1,151 by the end of 2016 – a pullback of 15%. In January 2018, it fell from $1,343 per ounce to 1,183 by October, a decline of 12%.

You Don’t Have to Worry About Gold Disappearing into the Internet Either

Another nice thing about gold is that it is a physical commodity. It may rise or fall in price, depending upon market conditions, but it doesn’t disappear. In fact, gold is one of the most indestructible substances known to science. You can’t say that about cryptocurrencies.

The very features of cryptocurrencies that make them attractive to money launderers and tax evaders – the inability of governments to track ownership or transactions – also make them vulnerable to common, and potentially very costly, Internet glitches.

Many people have heard of the strange case of Stefan Thomas of San Francisco, an early Bitcoin investor who has a fortune now worth $220 million, all tied up

in the currency online. The problem facing Thomas is that he has forgotten the password to his hard drive “key” that can unlock his cryptocurrency account. The key gives him ten attempts before it obliterates its content. After many failed attempts, Thomas now has two tries left.1

Although few cryptocurrency investors have faced problems this large, they are not uncommon.

Contrary to popular belief, cryptocurrencies are not immune to hacking. While the blockchain technology itself is secure, it’s estimated that $1.8 billion2 was stolen between 2010 and 2018 through various applications that use cryptocurrencies.3

Even worse, individual consumers have little if any recourse with cryptocurrencies. If a bank or credit card account is hacked and money stolen, consumers are typically reimbursed. Commercial institutions like banks carry insurance for just this reason.

And that leads to another issue with cryptocurrencies…

The Profits on Gold Stocks Can Equal or Even Surpass the Huge Gains Made with Bitcoin

While Bitcoin has seen impressive gains recently – rising more than 200% since August 2020 – the right gold mining shares have done even better over time.

Plus, unlike the “here today, gone tomorrow” vaporware profits of cryptocurrencies, the gains in gold stocks are tied to a real physical asset – tons of gold metal being extracted from the earth.

In just the past five years, investors in gold shares have pocketed life-changing profits… profits that have not vanished into the Internet ether the way cryptocurrency gains sometimes do. For example…

- Coeur Mining Inc (CDE) is up from $2.56 a share in 2015 to $8.39 today – a gain of 227%.

- Kinross Gold Corp (KGC) has jumped from $1.72 a share in 2015 to $6.96 today – a gain of 304.6%.4

- Sierra Metals Inc (SMTS) shot up from just 77 cents in early 2016 to $3.615 per share today – a gain of 368%.6

- Caledonia Mining Cp (CMCL) rose from $3.03 a share in 2015 to $14.857 today – a gain of 390%.

- B2Gold Corp (BTG) went from 75 cents in early 2016 to $5.048 per share today – a gain of 572%.

These are the solid triple-digit winners. And that’s just the tip of the proverbial iceberg.

If you’re investing in the highly volatile and risky cryptocurrencies market for the chance to make life-changing profits, you should know that the right gold shares sometimes see four- and even five-figure gains on occasion. For example…

- Kirkland Lake Gold (KL) shot up from $4.90 a share at the end of 2016 to $39.32 today – a gain of 702.4%.

- Maverix Metals Inc (MMX) was selling for just 8 cents per share back in June 2015 but quickly rose to $5.449 per share today – a gain of 6,700%

- Metalla Royalty and Streaming Ltd (MTA) skyrocketed from just 3 cents a share in December 2015 to $12.17 today – a gain of $40,466%.

That’s enough to turn every $5,000 into as much as $2 million in five years.

IN SHORT: If you’re looking for big potential gains, they are more likely to be found in small gold mining shares than in cryptocurrencies. The profits can be just as staggering in some cases… and they don’t tend to disappear overnight the way cryptocurrency profits can.

Why Now is the Time to Invest in Gold Mining Shares

The price of gold went up by 20% in 2020, hitting $2,000 per ounce – and some mining shares took off.

Some analysts believe the yellow metal is still undervalued given the massive deficit spending seen all over the world. Some project gold will hit $3,000 to $7,000 per ounce10 in the coming years.

One of the analysts predicting a massive run on gold and gold shares is a multi- millionaire and legend of the gold market – Doug Casey. He believes gold is on its way into the stratosphere.

And as Casey accurately predicted, dozens of gold mining stocks have seen the values of their shares soar from 700% to 6,700% — and even to 40,000%.

How to Choose a Gold Stock to Invest In?

THERE ARE TWO WAYS TO INVEST IN MINING SHARES:

First, investing in large mining conglomerates, such as Barrick Gold11, Newmont Mining12, AngloGold Ashanti13 or Kinross14. These billion-dollar conglomerates have done well over the past five years, earning on average 20% to 35% a year.

The second way is to go for the big gains with junior gold exploration companies – much smaller companies with mining rights in gold-rich areas and that are beginning to drill. These can be speculative investments, yet the potential returns, as we have seen, can also be staggering.

For example, one junior gold exploration company that is catching the attention of investors due to its “dream location” is Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD)

3 Reasons Why We Like Golden Independence

1. Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is located in the top-tier gold mining jurisdiction of Nevada, USA.

The United States is the 4th largest gold producing country in the world – and the State of Nevada is where more than 70% of gold production occurs within the United States.

Source: Golden Independence Presentation

According to the Annual Survey of Mining Companies, Nevada ranks as one of the top 3 mining jurisdictions globally. That’s why the location is attractive to most gold investors.

Golden Independence is located about a tennis ball’s throw away from Nevada Gold Mine’s mega gold project, a joint venture between Barrick Gold and Newmont Gold, the world’s two largest gold producers. They’re expecting to produce 2.1 to 2.25 million ounces of gold this year alone.

This gives Golden Independence some significant advantages over other small gold companies, not only in mineralogy but also in permitting.

Exploration and mining companies are often harassed and ultimately shut down by environmental groups. But because Golden Independence is within Nevada Gold Mines plan of operations, the company can fast-track development.

Another advantage is that the company’s operations are located in a well- industrialized area with road and rail access. Staff can simply drive to the mine, which is only 15 minutes away from the nearest McDonalds. This comfortable location allows the company to save its resources and focus on producing gold.

2. Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is right in the sweet spot, all of the upside of exploration without the downside.

Compared to similar companies at this stage of development, Golden Independence is ahead of its peers – with permits already in place and drilling already underway. The target property already has a historical resource of 1,072,600 ounces of gold. That’s more than some of their competitors who are even farther into the mining process.

Golden Independence is set to release the results now from its resource expansion drill program and revise its resource estimate in the coming 30 – 60 days. The expectation is that updated resource will increase materially.

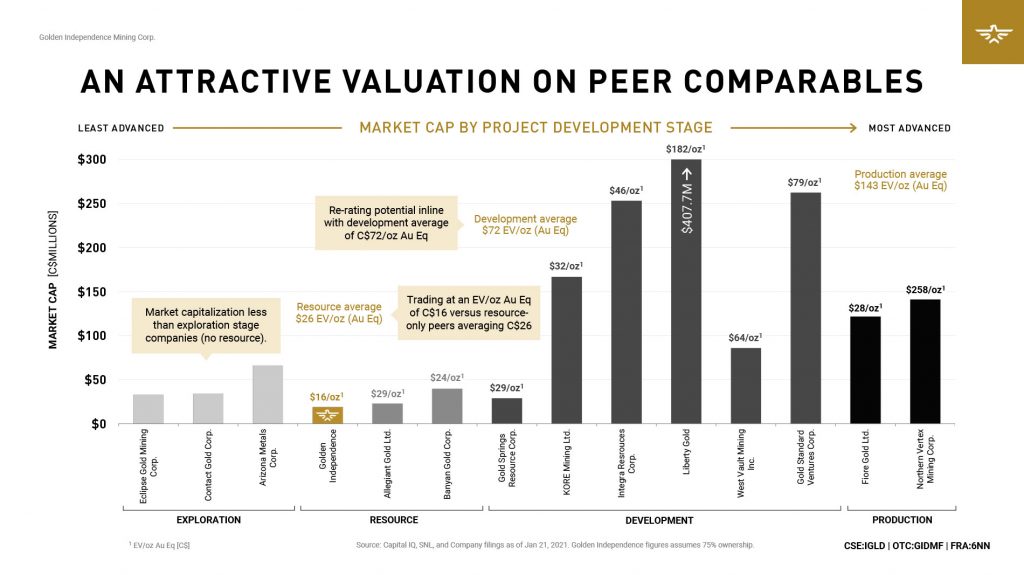

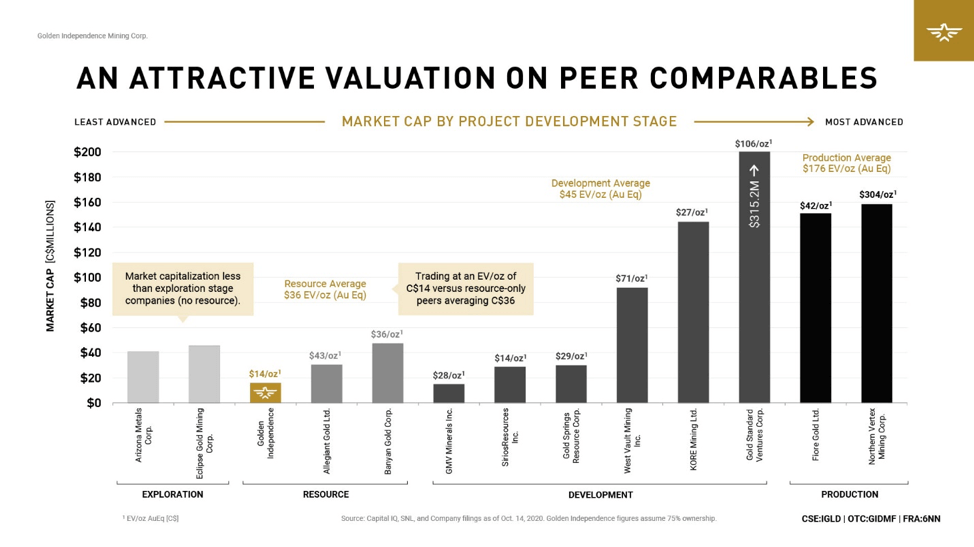

3. Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is greatly undervalued compared to its peers.

If you compare the data on Golden Independence with that of its peers, you can see that Golden Independence is undervalued.

Source: Golden Independence Presentation

Right now, Golden Independence has a market capitalization of under $15 million (C$20 million), a fraction of earlier-stage exploration companies with values in the C$30–70 million range. These are companies that do not even have defined resources and therefore are a much higher risk.

Golden Independence is also grossly undervalued when you consider the amount

of gold projected in the property — with a valuation of C$16 per ounce (market capitalization less cash divided by ounces) compared to resource-stage peers trading at an average of C$26 per ounce and development-stage peers up to C$180 per ounce.

Given that Golden Independence has the requisite infrastructure in place with a drill program already in progress, this means that Golden Independence is available at bargain basement prices.

That is fantastic news for investors. It means that even the company did not find a single ounce of additional gold, investors could very well see a significant return just by the company’s share price catching up with those of its peers. Yet as it stands now, Golden Independence’s drill program is set to expand the resource significantly, which will only multiply shareholder returns.

What Does This All Mean For Investors?

It means that Golden Independence is currently trading at almost a 70% discountto its peers – and could be a very attractive candidate for a big gain trade. No guarantees, but if governments continue to spend trillions they don’t have and gold soars past $3,000 and then $5,000 an ounce, the payday could potentially be extraordinary!

Six Key Takeaways:

- Gold is the best asset you can invest in times of uncertainty.

- Due to record government spending worldwide, many experts predict that gold will soon hit record highs.

- While cryptocurrencies such as Bitcoin have seen 200% gains in recent months, gold mining stocks have historically produced even bigger profits – as much as 6,700% or more.

- The smart money believes that we could be in the midst of the most significant gold bull market of all time – and are recommending junior gold exploration stocks for the biggest potential returns.

- Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is located in one of the best gold- mining locations in the world. It has permits in place, drilling underway, and have an historical resource of 1,072,600 ounces of gold plus silver.

- Significantly undervalued compared to its peers, Golden Independence has the built-in potential to more than double your money just due to its low share price alone. If its drilling program goes as planned, then all bets are off. Shareholders could potentially see a substantial return.

1 https://abc7chicago.com/stefan-thomas-bitcoin-password-san-francisco/9652903/

2 https://hackernoon.com/tech-explained-top-24-blockchain-hacks-in-history-first-half-40c390dc4a96

3 https://theblockstalk.medium.com/the-biggest-problems-of-bitcoin-that-people-are-not-speaking-about-8ce2493e9609 4. https://www.barchart.com/stocks/quotes/KGC/overview

5 https://www.barchart.com/stocks/quotes/SMTS/interactive-chart

6 https://www.barchart.com/stocks/quotes/BTG/interactive-chartntages calculated with https://percentagecalculator.net/ 7. https://www.barchart.com/stocks/quotes/CMCL/interactive-chart

8 https://www.barchart.com/stocks/quotes/MMX/interactive-chart

9 https://www.morningstar.com/stocks/xnys/gold/trailing-returns 10.https://www.morningstar.com/stocks/xnys/nem/trailing-returns

11 https://www.morningstar.com/stocks/xnys/au/trailing-returns 12.https://www.morningstar.com/stocks/xnys/kgc/trailing-returns

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Golden Independence Mining Corp.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.