The Oza field in Nigeria is set to make Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) take advantage of the booming oil market

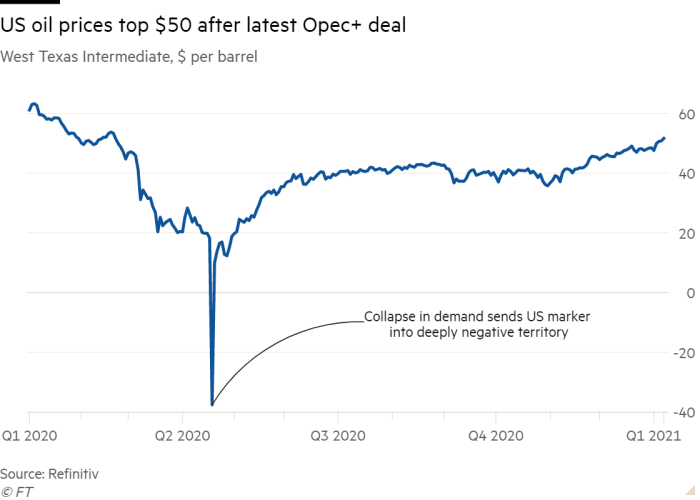

Fear and chaos reigned in the oil markets while pandemic lockdowns destroyed demand, and the ensuing oil price rollercoaster had investors scratching their heads.

Oil crashed into negative territory, forcing traders to unload at huge losses, and fears from COVID-19’s effect on supply and demand continued to surge.

Source: Financial Times

The tide has turned though, as oil prices soared to 6-year highs, reaching $77/barrel on July 6 on the back of a resurgent demand. Although stability has been established by the latest OPEC+ deal, logistical nightmares and supply/demand dynamics remain tight due to uncertain short and long term futures.

The market is ready to turn to the African nation of Nigeria – the country’s recent 30% production cost reduction, with an expected future cost of $10, will boost profits at an estimated summer 2021 price of $80.

If Goldman’s Sachs’ target of $90/barrel is hit, the streets could be paved in gold for Nigerian producers!

Africa’s largest oil producer, Nigeria, contains reserves of 36.97 billion barrels of crude oil and one company is gearing up to unlock Nigeria’s growing oil and gas potential at the Oza field.

That company is Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF), an oil and gas development exploration company that is moving into the production phase at its project with initial production of 4,000 barrels per day before ramping up to 20,000 barrels per day!

That’s a potential 7.3 million barrels per year! But that’s just the beginning…

Decklar is days away from producing oil for the demanding market, yet it’s trading at a much lower price.

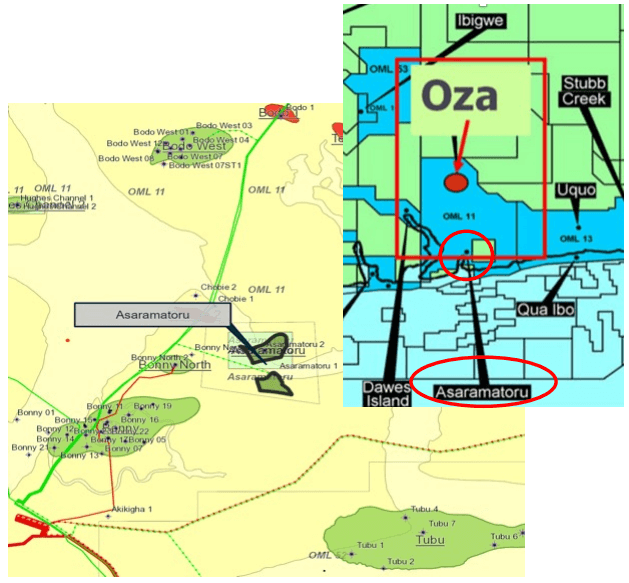

On top of that, the company also recently gained access to the Asaramatoru field, which is right next door to Oza and nearing production.

With oil price chaos reigning and indecision creating supply bottlenecks amid rising demand post-pandemic, Decklar Resources could be set for takeoff with its premier Oza field property in Nigeria.

Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) is Ready for Big-Time Production

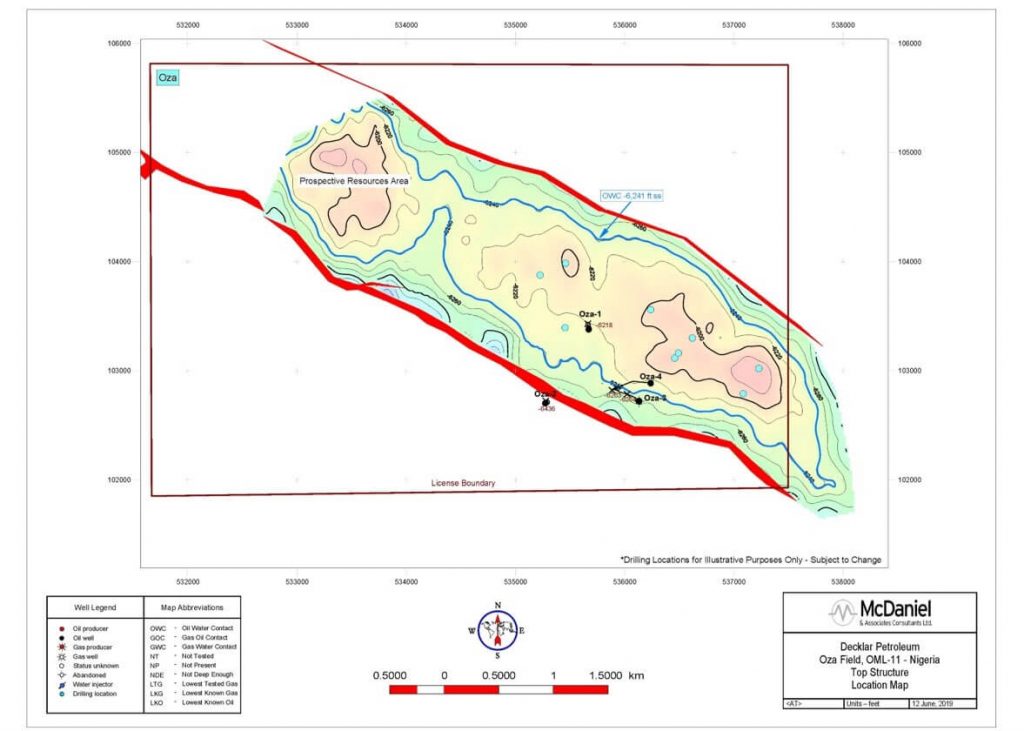

In the past year, Decklar Resources took control of Decklar Petroleum Ltd, an oil and gas company in the Oza field of onshore Nigeria. The Oza field is a concession that spans over 20 square km and has 12 stacked sands.

Through the work done with this project, Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) is transitioning from an oil development firm to an oil production company. So far, Decklar has made positive strides in their Oza well campaign.

In May of 2021, Decklar finished off the first round of financing for a gross total of C$10 million, which the company plans to use to pursue new oil and gas development opportunities in Nigeria.

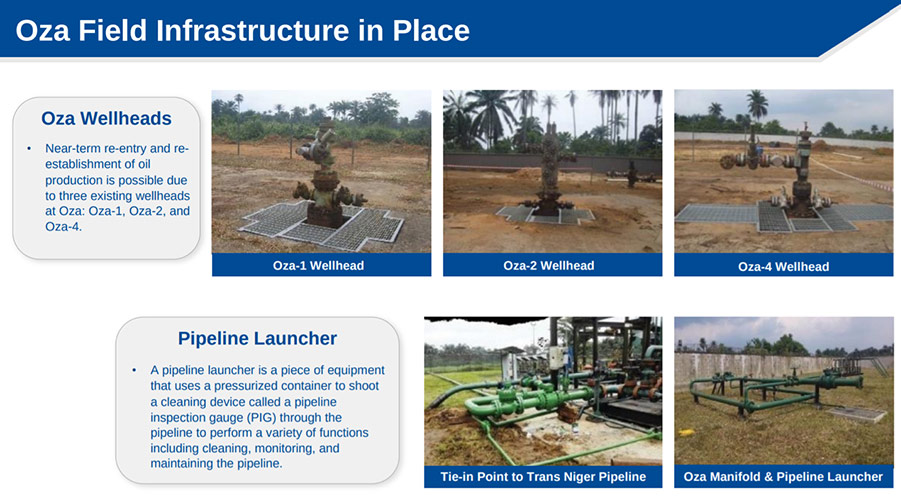

This fuel in the tank is earmarked for accelerating the speed of the transition to production. The timing coincides perfectly with the announcement of the initial re-entry stages commencing at the first Oza field well. With infrastructure in place, including export pipeline access tied into the Trans Niger Pipeline (TNP), which flows to the Bonny Export Terminal on OML 11, the largest terminal on the African continent and operated by Shell, the team was standing by to kick things off immediately once the drill arrived.

Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) has also recently made a deal to buy out Purion Energy Ltd, a company with interests in the nearby Asaramatoru field, which is in the southern part of the OML 11 and like Oza, was formerly owned by Shell. Asaramatoru is also near the Bonny gas plant and oil export terminal and other producing oil fields like Bonny, Bomu, and Alalki. With close to 1.5 million bbls produced from the field between 2014 and 2018 and two wells already in place – it offers a huge head start for Decklar.

The transaction has yet to be fully finalized but Decklar plans to mirror efforts at both the Asaramatoru and Oza fields to eventually produce as much as possible.

Oza is surrounded by producing fields operated by Shell, including Isirmi, Obeakpu, Afam, Obigbo and Umuosi. The area is extremely rich in proven but undeveloped reserves, waiting to be drilled. Asaramatoru benefits from the same rich field grouping, boding well for future well re-entries.

The re-entries have been chosen from proven undeveloped oil fields, putting Decklar at an advantage by avoiding taking on exploration risk. The usual hit-or-miss gamble of exploring oil fields has been properly eliminated by choosing prime locations with already proven reserves.

In this current climate, Decklar’s oil field development turning into production could be the supply gap to fill the market needs. The Oza field was originally operated by a Nigerian subsidiary of Royal Dutch Shell plc, Shell Petroleum Development Company of Nigeria Ltd.

The 20 km field was set aside by the Nigerian Government’s Marginal Field Development Program in 2003 and was given to Millenium Oil and Gas Company Ltd. (“Millenium”). Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) has been developing the field in conjunction with Millenium through a Risk Services Agreement (RSA).

Ever since 2003 when Millenium first acquired rights to the Oza field area, nearly $50 million has been poured into developing infrastructure and connecting the petroleum produced on the field to the Trans Niger Pipeline (TNP). The investment has also gone to acquisition costs, a metering system, and a production facility.

This legwork gives Decklar a running head start toward its target of 20,000 barrels per day. Roads connecting the property to refining sites and the terminal are ready and available.

The drilling rig is currently pulling existing tubing out of the well. Once that is complete a cement bond log will then be completed to confirm integrity of the cement behind casing, and the well will be cleaned before installing new tubing.

Oza Gives Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) A Potentially Low-Risk, High-Reward Opportunity

Decklar Resources has a big advantage since successful testing of the re-entry program.With functional testing and inspection of the rig now complete, the company has proven successful crude oil production, Decklar has now extracted oil sands from the Oza-1 well at a rate of 2,463 barrels a day. The well produced 22 degree API sweet crude oil and transported the crude to processing centers.

After confirmation of well integrity, the rig will be skidded to the same drill pad as Oza-1, and the drilling will begin.

This is the endgame for Decklar – the Oza-1 well and horizontal development well are expected to generate significant production and generate cash flow quickly.

Decklar won’t stop there though, as the company will advance on one or two more re-entries shortly after, and plans an additional development drilling program with a potential for eight to ten wells.

This will take Decklar’s prize property into full field development for this brownfield property.

Once development and re-entry are finalized, these fields are expected to initially produce 4,000 barrels per day.

Of course, that’s just the beginning.

The development of the Oza fields is a two-phase development program that also requires a re-entry and development drilling program that goes well into late 2021 and early 2022. Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) believes that towards the end of this development program, it will be able to produce up to 20,000 barrels a day!

That’s a potential 7.3 million barrels a year!

8 Reasons We Believe Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) is an Undervalued Opportunity

- Everything in Place: Since the Oza field is already developed with $50 million spent on infrastructure, there is little need for heavy investment into developing additional infrastructure. Importantly, the Oza field is also connected to Nigeria’s Trans Niger Pipeline (TNP). Decklar is working closely with their field partner, Millenium Oil & Gas Co. Ltd., and has also agreed to help with operations and financing through their RSA agreement.

- Moving Fast: Oza-1 well re-entry gives Decklar a huge running start. After confirmation of integrity, drilling can immediately begin to get the oil flowing.

- Multiple Opportunities for Success: Decklar has eight to ten more well re-entries planned to bring Oza to full field development, multiplying output as fast as possible to achieve initial targets of more than a million barrels a year!

- Prime Location: Decklar’s Oza property is surrounded by producing fields operated by oil behemoth Shell, including Isirmi, Obeakpu, Afam, Obigbo and Umuosi.

- Ideal Market Conditions: With growing oil shortages due to OPEC+ negotiation gridlock and a rapid reduction in global oil inventories, the price of oil has shot up. This provides a massive opportunity for companies like Decklar who can produce large quantities of oil in the coming years.

- Untapped Potential: Despite representing 25% of Africa’s total oil production, Nigeria still has massive untapped resources. The Oza field itself is proven to have large quantities of oil, and due to recent low prices, internal conflicts, and sociopolitics, the oil reserves have yet to be properly utilized.

- Low Production Costs: Along with the pre-existing infrastructure, Nigeria is looking to become one of the lowest cost oil and gas producers in the whole sector at just $10 a barrel which can yield even higher profits for Decklar.

- Near-Term Production: Decklar’s stock price is still only $0.88 but could break out as it transitions to full-speed production in the coming weeks.

Rising Oil Prices and Declining US Crude Stockpiles Create Perfect Environment

With US domestic production struggling to recover, and demand soaring amid re-openings and positive economic outlooks, oil supply is lagging as prices rise.

According to recent reports, domestic supplies of crude oil have fallen by nearly 7 million barrels, while fuel demands have soared to 10 million barrels a day.

Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) is bringing Oza to the market at just the right time. The company is perfectly positioned to rise up and stand out in what is now an underserved and underfollowed market.

As the world starts to open up and oil demand increases, supply chain weaknesses are becoming more and more noticeable. That’s a reason why the current average gasoline price is $3.163 a gallon, over a dollar higher than a year before and the highest it has been in seven years. This, of course, has implications on the oil market.

As one of the rare new conventional oil projects coming online, Oza field is set to potentially profit from the strained supply chain and rising prices!

US Gridlock Requires Other Countries to Fill the Gap

Biden and the US government are currently undergoing talks with other OPEC+ countries to come to a swift deal that would spur global production. Additionally, Biden’s recent green initiative programs have ended tax breaks for domestic fossil fuel producers, further impacting oil prices.

Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) project is coming online right at the moment when the world needs them most. Oza is one of very few onshore developments, giving the company an edge in a market that is constantly asking for more.

If the OPEC+ cartel cannot come to an agreement for increased production, some analysts claim that oil prices could climb to even $90 a barrel.

An Under-the Radar Growth Stock Opportunity

Decklar stock saw rapid growth in just a single year. On June 19, 2020, Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) was sitting at $0.10. By May 2021, the stock hit $1.32. That’s a 1300%+ jump in just over 11 months! The stock has settled into a new range between support around $0.72 and the first level of resistance at $1.01. As the stock saw a bit of a pullback in September, buyers have an opportunity before any further run at the first resistance level and beyond to the second. Any sustained break above $1.00 would likely set a new support and confirm the bullish bias investors have seen since the middle of 2020.

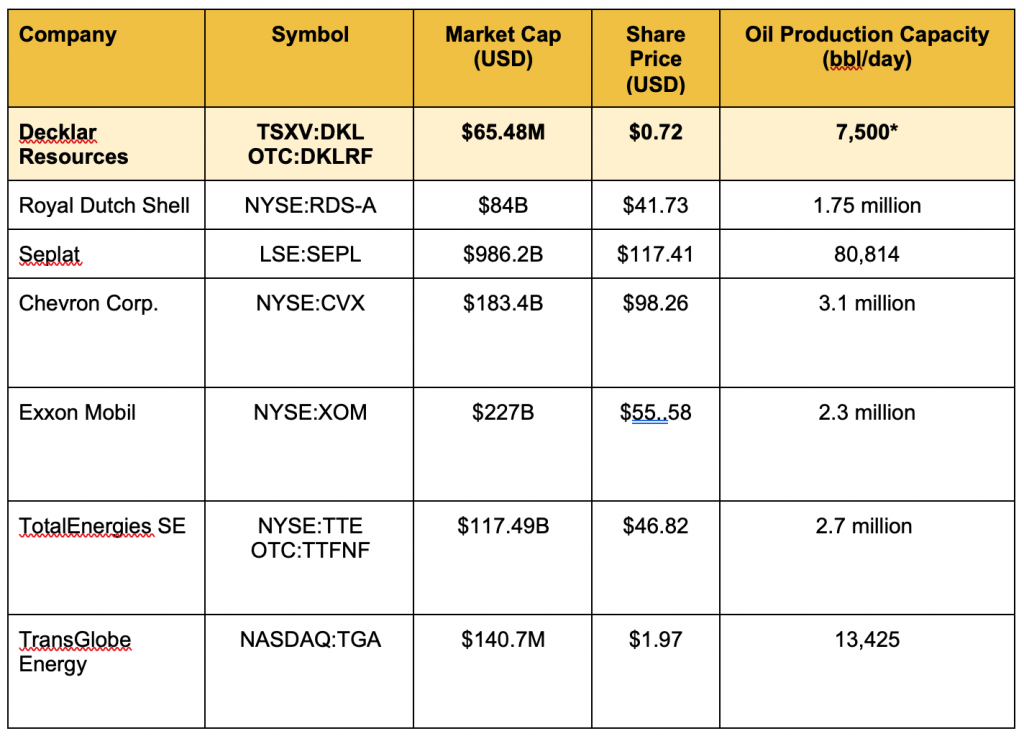

Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) looks like incredible value as a company operating in the same region as some of the biggest players in the world, with a market cap at a fraction of its competitors.

Oza is also a brownfield property, past discovery and into development, meaning the growth ahead would be based on proven reserves and not an unhedged bet on a green field discovery.

| Company | Symbol | Market Cap (USD) | Share Price (USD) | Oil Production Capacity (bbl/day) |

|---|---|---|---|---|

| Decklar Resources | TSXV:DKL OTC:DKLRF | $65.48M | $0.72 | 7,500* |

| Royal Dutch Shell | NYSE:RDS-A | $84B | $41.73 | 1.75 million |

| Seplat | LSE:SEPL | 986.2B$ | $117.41 | 80,814 |

| Chevron Corp. | NYSE:CVX | $183.4B | $98.26 | 3.1 million |

| Exxon Mobil | NYSE:XOM | $227B | $55.58 | 2.3 million |

| TotalEnergies SE | NYSE:TTE OTC:TTFNF | $117.49B | $46.82 | 2.7 million |

| TransGlobe Energy | NASDAQ:TGA | $140.7M | $1.97 | 13,425 |

Nigeria is Full of Untapped Oil Potential

In this poor climate for oil production, there have been some positive developments in Nigeria’s oil and gas industry. In fact, many analysts predict a compound annual growth rate (CAGR) of nearly 2% in the next 5 years. This is at an opportune moment as Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) plans to ramp up production during the latter half of 2021 and the beginning of 2022.

Nigeria ranks 9th on the list of countries with the most global gas reserves and contains the most oil and gas reserves in the region. It contains around 37 billion barrels of oil and 5.4 trillion cubic metres (BCM) of gas. As of 2019, it produced 2.11 million barrels a day, approximately 25% of the entire oil production in Africa.

At the moment, it continues to import the majority of its oil. However, this could change as projects such as Oza, Asaramatoru, and more continue to develop.

Other companies like Shell, Africa Oil Corp, and Seplat have seen tremendous success in the country, and any repeat of those projects by Decklar could drive positive volume and price action for the company.

Another major benefit of Nigeria’s oil production capabilities is its low production costs. According to Mallam Mele Kyari, the Group Managing Director of the NNPC, oil companies can produce oil as low as$10 a barrel.

That’s a $10 production cost, in a market that’s buying at $50, $60, and higher!

According to Kyari, the country is also looking to bring down operating costs by 30%. This bodes well for Decklar’s future profits.

Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) Highly-Experienced Leadership Team Taking Oza to the Next Stage

Duncan Blount – CEO & Executive Director

Duncan Blount – CEO & Executive Director

Mr. Blount has about 15 years of experience focused on the natural resources sector.

He was previously Head of Emerging & Frontier Market Commodities at RWC Partners, where he was responsible for developing their commodity and natural resources portfolio strategy. Throughout his career, Mr. Blount has been an early investor (pre-IPO or IPO) in numerous public and private West African oil & gas companies. He also has experience in physical mineral trading and structuring off-take agreements.

David Halpin – CFO

Mr. Halpin has over 25 years of experience in management and as a finance and accounting consultant for public and private Canadian and international resource companies.

He is the former CFO/Senior Financial Advisor for Mart Resources Inc., a TSX-listed company with oil production in Nigeria that had a peak market capitalization of over CDN $750m. He was also a Director of a TSX-V listed company focused on exploration of oil & gas opportunities in Saskatchewan and Alberta and was a Founder and CFO of a publicly listed healthcare and insurance software company.

Sanmi Famuyide – Managing Director Nigeria

Sanmi Famuyide – Managing Director Nigeria

Sanmi Famuyide has over 20 years of experience focused on structuring natural resources (oil, gas and mining) and infrastructure transactions in West Africa. He is the former Strategic Advisor and subsequently Head, Business Development at Lekoil Limited. He was also the Head of Oil & Gas – Marginal Fields and Upstream Independents at Guaranty Trust Bank in Lagos, where he arranged the financings of many Nigerian independents. In addition, Mr. Famuyide has held executive positions at FBN Capital and MineQore Resources.

5 Reasons Decklar Resources (TSXV: DKL | OTC: DKLRFTSXV: DKL | OTC: DKLRF) is a Growth Play Hiding in Plain Sight

- Low Production Costs: Lower production costs ($10 per barrel), for huge profits ($50/60 per barrel market prices).

- High Oil Prices: During a time of low supply and rising demand post-pandemic, Decklar is filling the scary supply gap.

- Perfect Jurisdiction: Nigerian oil reserves have failed to be properly utilized, creating a massive avenue of opportunity for Decklar.

- Ready-Made: $50 million spent on infrastructure is in place at the Oza field reserves for both production and distribution, further limiting costs and increasing profit margins.

- The Right Moment: Every other company in Nigeria has seen significant growth at the end of the development period including majors like Royal Dutch Shell PLC, Total SA, Chevron Corporation, and Exxon Mobil Corporation, making Decklar’s current status at Oza highly salient for investors.

1https://amp.ft.com/content/6b6d10b1-acc2-4f9f-9050-1bc4468dd9fb

2https://www.reuters.com/business/energy/goldman-expects-oil-prices-hit-90-by-year-end-supply-tightens-2021-09-27/

3https://www.statista.com/statistics/1178147/crude-oil-reserves-in-africa-by-country/

4https://www.globenewswire.com/news-release/2021/06/09/2244229/0/en/Decklar-Resources-Inc-Announces-Letter-of-Intent-to-Participate-in-Asaramatoru-Field-in-OML-11-in-Nigeria-and-Appointment-of-New-Chief-Financial-Officer.html 5https://www.decklarresources.com/our-assets/oza-oil-field/overview/

6https://www.decklarresources.com/news/decklar-resources-inc-announces-10-million–first-closing-of-unit-offering

7https://www.decklarresources.com/news/decklar-resources-inc-announces-10-million–first-closing-of-unit-offering 8https://www.decklarresources.com/our-assets/oza-oil-field/overview/

9https://www.decklarresources.com/our-assets/oza-oil-field/overview/

10https://www.decklarresources.com/our-assets/oza-oil-field/overview/

11https://www.globenewswire.com/news-release/2021/07/15/2263227/0/en/Oza-1-Well-Re-Entry-Update.html 12https://www.decklarresources.com/our-assets/oza-oil-field/overview/

13https://investingnews.com/company-profiles/decklar-resources-tsxv-dkl/

14https://www.mordorintelligence.com/industry-reports/nigeria-oil-and-gas-market

15https://www.vanguardngr.com/2021/07/nigeria-can-achieve-10-oil-production-cost-kyari-insists/

16https://www.marketwatch.com/investing/stock/dkl?countrycode=ca

17 https://www.worldoil.com/news/2021/7/8/oil-prices-climb-as-us-reports-rapidly-declining-crude-stockpiles

18https://gasprices.aaa.com/

19https://www.npr.org/2021/07/07/1013721716/oil-prices-are-in-turmoil-right-now-here-are-5-things-you-need-to-know

20https://www.statista.com/statistics/1105472/oil-and-gas-liquids-production-of-royal-dutch-shell/

21https://leadership.ng/seplat-energy-posts-62-1m-pbt-as-shareholders-get-interim-dividend/amp/

22https://www.chevron.com/-/media/chevron/stories/documents/2Q2021-earnings-press-release.pdf

23https://www.offshore-technology.com/news/totalenergies-results-q2-2021/

24https://www.trans-globe.com/news/news-details/2021/TransGlobe-Energy-Corporation-Announces-Year-End-2020-Financial-and-Operating-Results/default.aspx

25https://www.newswire.ca/news-releases/africa-oil-announces-2020-fourth-quarter-results-and-2021-management-guidance-830710080.html

26https://www.mordorintelligence.com/industry-reports/nigeria-oil-and-gas-market

27https://www.statista.com/statistics/265329/countries-with-the-largest-natural-gas-reserves/

28https://www.vanguardngr.com/2021/07/nigeria-can-achieve-10-oil

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Decklar Resources.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Decklar Resources and has no information concerning share ownership by others of any profiled Decklar Resources. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Decklar Resources or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Decklar Resources. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Decklar Resources’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Decklar Resources future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Decklar Resources industry; (b) market opportunity; (c) Decklar Resources business plans and strategies; (d) services that Decklar Resources intends to offer; (e) Decklar Resources milestone projections and targets; (f) Decklar Resources expectations regarding receipt of approval for regulatory applications; (g) Decklar Resources intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Decklar Resources expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Decklar Resources business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Decklar Resources ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Decklar Resources ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Decklar Resources ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Decklar Resources to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Decklar Resources operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Decklar Resources business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Decklar Resources business operations (e) Decklar Resources may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Decklar Resources or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Decklar Resources or such entities and are not necessarily indicative of future performance of Decklar Resources or such entities.