ADVERTORIAL

You won't find this in mainstream financial news:

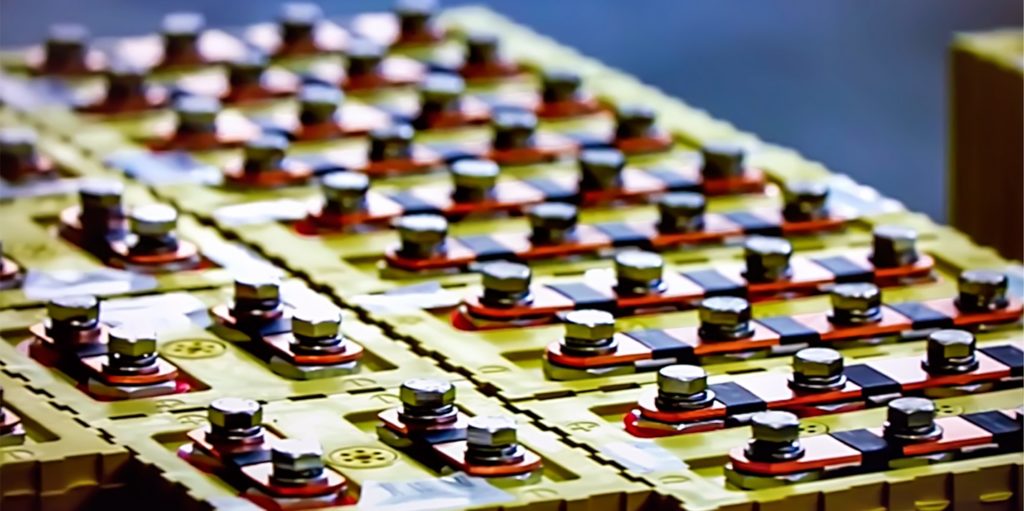

Zinc Demand Set For Parabolic Rise On Breakthrough Battery Tech

Is it time to exit your lithium positions? It could be…

- What’s at play is a green energy future where next-generation batteries made from zinc (not lithium) could send current battery tech to the scrap heap.

- A crippling problem that kept zinc out of energy storage systems appears to have been solved. Newly developed Zinc-ion batteries are reported to be safer and cheaper.

- Zinc now stands on the threshold of upending current Li-ion battery technology. And this massive shift is calling attention to this up and coming company, as it proves up one of the very few, new zinc resources in America.

The lithium-ion battery may soon become yesterday’s tech.

An innovation in Zinc-ion battery design could amplify demand for the industrial staple, just as it did for lithium before. The pressure is on to make it happen.

Zinc has long been an essential base metal for multiple industrial applications, particularly as an essential alloy in steel production.

Even before the promise of new zinc-ion battery tech, heightened demand has been fueling a meteoric rise in the metal’s price, nearly doubling over the last two years and still climbing. That price rise is roughly twice the pace of lithium over the same time frame.

All that considered, it’s not been a focal point for most investors, until now.

Zinc-ion: The Next Step For Green Energy Technologies

Zinc is already an essential metal for existing, current generation Li-ion battery design. That’s not likely to change. Demand in that sector has contributed enormously to current supply-side challenges and foreseeably continue well into the future.

“The global consumption of zinc for battery uses is expected to double between 2021 and 2028, from some 455,000 metric tons in 2021 to around 916,000 metric tons seven years later.” – Statista.com

It goes without saying that major auto manufacturers worldwide are moving heavily into electric vehicle technologies. At the same time, utility companies are pouring billions into wind and solar generation.

These trends are creating an enormous market for safe, reliable energy storage systems. To date, lithium has been the answer, despite its cost and safety challenges.

Now the answer may be shifting to safer, cheaper zinc technology. And investors are just beginning to catch on.

Because it was characterized as an industrial metal, Zinc had languished off-radar with domestic production largely ignored.

In 2020, the prospect of growing supply-side challenges put price pressure on zinc even in the face of covid’s impact. As a base metal, Zinc simply wasn’t prioritized for new discoveries.

Legacy miners kept chugging out what they could, but signs of supply weakness have emerged.

The U.S. now ranks a distant fourth place among the top zinc producers who together outstrip America’s production over nine-fold.

That is quickly changing.

Up and Coming Company announces substantial inferred resource in zinc, copper, gold and silver

Their California project could become one of the largest undeveloped domestic zinc resources. Approximately 771 million pounds of zinc have been identified on the project… and exploration is still not complete.

Results from 2021 exploration remain to be announced, meaning more could be discovered in 2022.

That’s not all. Along with the zinc are substantial resources in copper, gold and silver.

These resources are not speculative. They have been known about for decades, dating back to WW2 when Hecla Mining began producing zinc here to feed America’s steel industry.

With the end of the war, Hecla shifted focus to other metals and has now holds America’s largest silver reserves. As a result, mine operations went dormant near the end of WW2 and exploration and resource development didn’t recommence until the 1970s when zinc, silver and gold prices improved.

Over the ensuing decades, further exploration and mine development work identified extensive resources in gold, silver and copper, but consistently, zinc dominated the findings.

By 2007, sufficient work had been completed that all ownership interests in the project were rolled into the one entity that has evolved into this company today. The rollup was orchestrated by a VP from Westmin who had extensive knowledge of the project.

Within a year a preliminary NI43-101 resource estimate was calculated and in 2018,the new entity released an updated NI 43-101 that verified the tremendous potential in resources at there project site.

“This project is subject to a NI 43-101 Mineral Resource estimate with approximately 7.8 million tons with a grade of 8.07% zinc equivalent for approximately 771 million pounds of zinc, 71 million pounds of copper, 300,000 ounces of gold and 10 million ounces of silver in the Inferred category.” (Emphasis added.)

Those are stunning numbers for a junior resource company. In fact, many early-stage resource companies get started with virtually nothing discovered in the ground.

Recent explorations have uncovered another groundbreaking discovery.

Last year (2021), the company reported intercepts with a volcanogenic massive sulfide (VMS) zone at their project site.. VMS deposits typically hold rich concentrations of copper, gold, silver and other metals, and most importantly, zinc.

Nearly a quarter of global zinc resources are recovered from VMS deposits and there are only about 800 such deposits worldwide. But that’s not the most exciting aspect of this discovery.

VMS deposits are most frequently found in tightly spaced clusters. Find one and you typically find many…each bearing substantial mineralized resources.

Chances are excellent that more VMS structures could be discovered as exploration continues.

2021 and 2022 exploration will tightly focus on the potential of these resources with the ultimate goal of calculating reserves, which can then be fully applied to the share price.

It is extremely rare that any resource company trading in such a low-priced start-up phase could publish resource data of this scale.

What to do now...

With the hunt for new zinc now part of a worldwide crisis you could expect this company to stay in the news for years to come.

That’s why now could be the very best time to latch onto its affordably priced shares.

Sign up to receive more information about the little-known company with the resources necessary to propel the next era of electric batteries.

1https://www.statista.com/statistics/1093612/zinc-consumption-projection-globally-by-type/

2https://www.theglobaleconomy.com/rankings/zinc_production/

3https://www.geologyforinvestors.com/volcanogenic-massive-sulphide-vms-zinc-deposits/

4https://explorationinsights.com/site/assets/files/4062/vms_deposits.pdf

Legal Notice: This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any company or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.