You won't find this in mainstream financial news:

Zinc Demand Set For Parabolic Rise On Breakthrough Battery Tech

Editorial Feature | Jan 27, 2022 | Industry

Is it time to exit your lithium positions? It could be…

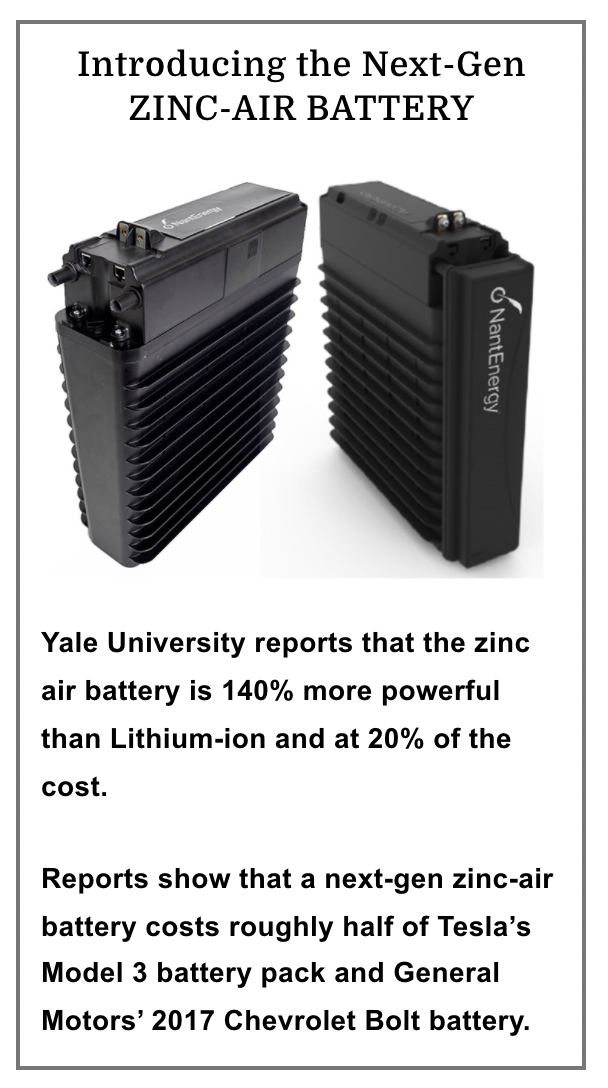

- What’s at play is a green energy future where next-generation batteries made from zinc (not lithium) could send current battery tech to the scrap heap.

- A crippling problem that kept zinc out of energy storage systems appears to have been solved. Newly developed Zinc-ion batteries are reported to be safer, cheaper, and the best part is… the resource is not under Chinese dominance.

- Zinc now stands on the threshold of upending current Li-ion battery technology. And this massive shift is calling attention to Blue Moon Metals (TSX.V: MOON, OTC: BMOOFTSX.V: MOON, OTC: BMOOF), as it proves up one of the very few, new zinc resources in America.

The future was highly dependent on the lithium supply chain… and investors in early-stage lithium exploration companies posted huge gains.

The future was highly dependent on the lithium supply chain… and investors in early-stage lithium exploration companies posted huge gains.

The lithium-ion battery may soon become yesterday’s tech.

Signs are looking favorable for a rise in next gen battery tech with Zinc-ion design.

Driven by projected demand for energy storage over the coming years, zinc could soon eclipse lithium…and that has enormous implications for investors today.

To put the opportunity in perspective, take a quick look back to mid-2020 when things really began cooking for green energy and battery-powered transportation.

The future was highly dependent on the lithium supply chain… and investors in early-stage lithium exploration companies posted huge gains.

Starting in mid-2020 through mid-January this year:

- Lithium America Corp soared from $3.33 to $31.45. A 944% Gain.

- Orocobre Ltd climbed from $1.25 to $6.99. A 559% Gain.

- Pure Energy Minerals shot from 2.7¢ to $1.23. A 5,114% Gain.

- Rock Tech Lithium exploded from 36¢ to $5.03. A 3,717% Gain.

Now, an innovation in Zinc-ion battery design could amplify demand for the industrial staple, just as it did for lithium before. The pressure is on to make it happen.

Zinc has long been an essential base metal for multiple industrial applications, particularly as an essential alloy in steel production.

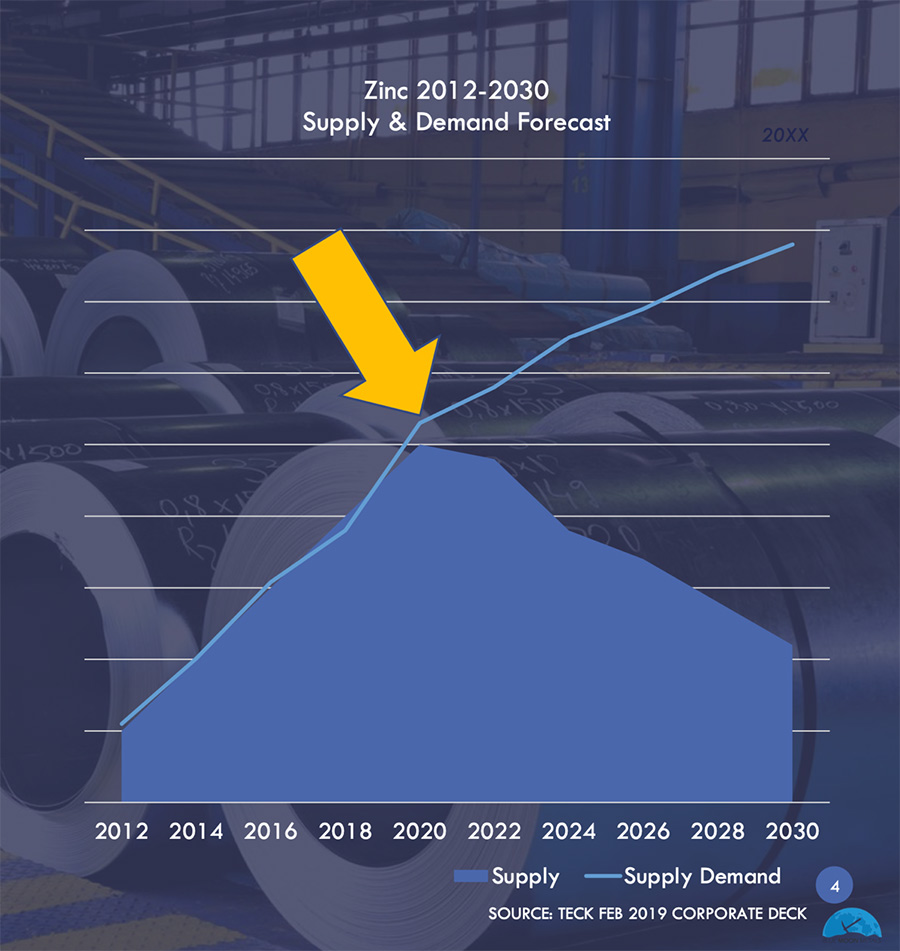

Even before the promise of new zinc-ion battery tech, heightened demand has been fueling a meteoric rise in the metal’s price, nearly doubling over the last two years and still climbing. That price rise is roughly twice the pace of lithium over the same time frame.

All that considered, it’s not been a focal point for most investors, until now.

Zinc-ion: The Next Step For Green Energy Technologies

You may already know that lithium-ion batteries helped launch the green revolution, propelling companies like Tesla to massive valuations over the last few years.

Without lithium, Tesla may not even exist…nor would many other emerging EV manufacturers worldwide. Lithium made the market, but that may be changing fast.

A new Zinc-ion battery technology promises to eliminate the most vexing problems of lithium-ion battery designs.

Let’s start with lithium battery’s tendency to overheat and catch fire. In an auto, those flames are virtually non-extinguishable. When batteries ignite, vehicles become engulfed and are invariably destroyed.

Even the tiny Li-ion battery in a smartphone can trigger massive fires, highly destructive to property and lives, as was seen in an apartment fire sparked in the New York Bronx January 9, 2022.

CNN reported, “A four-alarm fire broke out at an apartment building in the Bronx early Saturday morning when the lithium-ion battery of an electric bike or scooter combusted on its own, according to the FDNY.1“

The next big problem is cost. Lithium batteries have always been expensive; just ask the guy who literally blew up his Tesla because it cost over $23,000 cost to replace its dead batteries.

In December it was reported by the New York Post that, “A Finnish man bought his Tesla in 2013, but when mechanics told him it would cost $23,000 to fix the li-ion battery pack, he decided to blow it up instead.”2

And it’s not a matter of if you have to pay for battery replacement, it’s when.

Longer-lasting and less expensive to mine materials for, zinc-ion technology offers an enormous cost advantage anywhere they can replace lithium-ion.

Then there’s the staggering human, environmental, and political costs of mining for lithium. That’s a subject for another report.

For the U.S. to transition into more electric vehicle and utility scale green energy… the access barriers to these critical battery metals must be resolved.

Zinc's Use In Battery Tech Is Nothing New

Zinc is already an essential metal for existing, current generation Li-ion battery design. That’s not likely to change. Demand in that sector has contributed enormously to current supply-side challenges and foreseeably continue well into the future.

“The global consumption of zinc for battery uses is expected to double between 2021 and 2028, from some 455,000 metric tons in 2021 to around 916,000 metric tons seven years later.” – Statista.com3

Adding incremental zinc demand for the next generation of battery designs could send Zinc prices on a massive spike not unlike what happened to lithium a decade ago.

Why Zinc Stands To Break The Lithium Bubble

It goes without saying that major auto manufacturers worldwide are moving heavily into electric vehicle technologies. At the same time, utility companies are pouring billions into wind and solar generation.

These trends are creating an enormous market for safe, reliable energy storage systems. To date, lithium has been the answer, despite its cost and safety challenges.

Now the answer may be shifting to safer, cheaper zinc technology. And investors are just beginning to catch on.

Because it was characterized as an industrial metal, Zinc had languished off-radar with domestic production largely ignored.

In 2020, the prospect of growing supply-side challenges put price pressure on zinc even in the face of covid’s impact. As a base metal, Zinc simply wasn’t prioritized for new discoveries.

Legacy miners kept chugging out what they could, but signs of supply weakness have emerged.

The U.S. now ranks a distant fourth place among the top zinc producers who together outstrip America’s production over nine-fold.4

That is quickly changing.

The U.S. Defense Logistics Agency now lists zinc as a “strategic material”, essential for production of batteries and solar cells.5

As further evidence of its rising importance, zinc has now been categorized with rare earths. Last year, the Federal Register upgraded zinc to a “Critical Mineral” along with a slew of rare earth elements that also prove essential for emerging technologies.[3]

The evidence is mounting. U.S. zinc production appears on track to become a national priority, and we have some catching up to do.

China already has a huge lead in zinc production, nearly five-times America’s. Fortunately, the U.S. can start closing that gap with new exploration and mining.

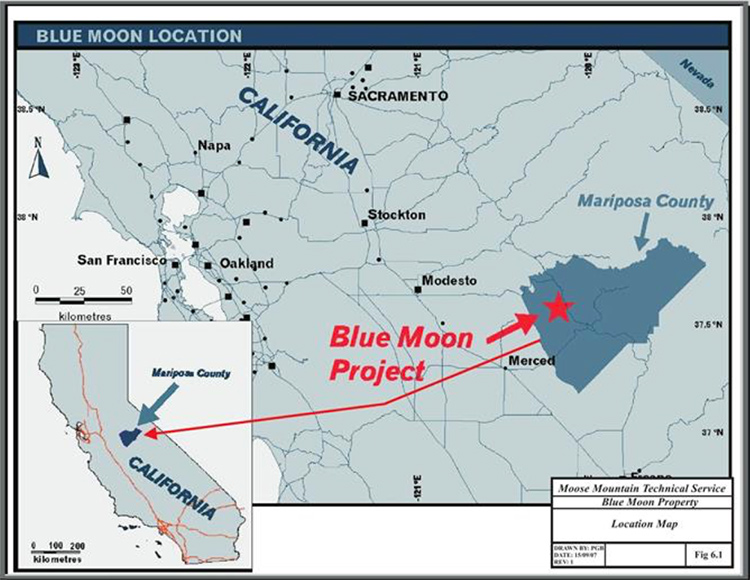

That’s precisely what stands to propel Blue Moon Metals (TSX.V: MOON, OTC: BMOOFTSX.V: MOON, OTC: BMOOF) onto radar screens.

Blue Moon Metals announces substantial inferred resource in zinc, copper, gold and silver

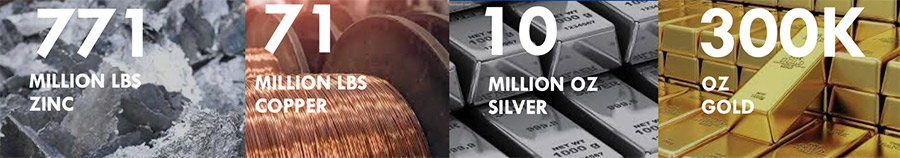

Their California project could become one of the largest undeveloped domestic zinc resources. Approximately 771 million pounds of zinc have been identified on the Blue Moon project… and exploration is still not complete.

Results from 2021 exploration remain to be announced, meaning more could be discovered in 2022.

That’s not all. Along with the zinc are substantial resources in copper, gold and silver.

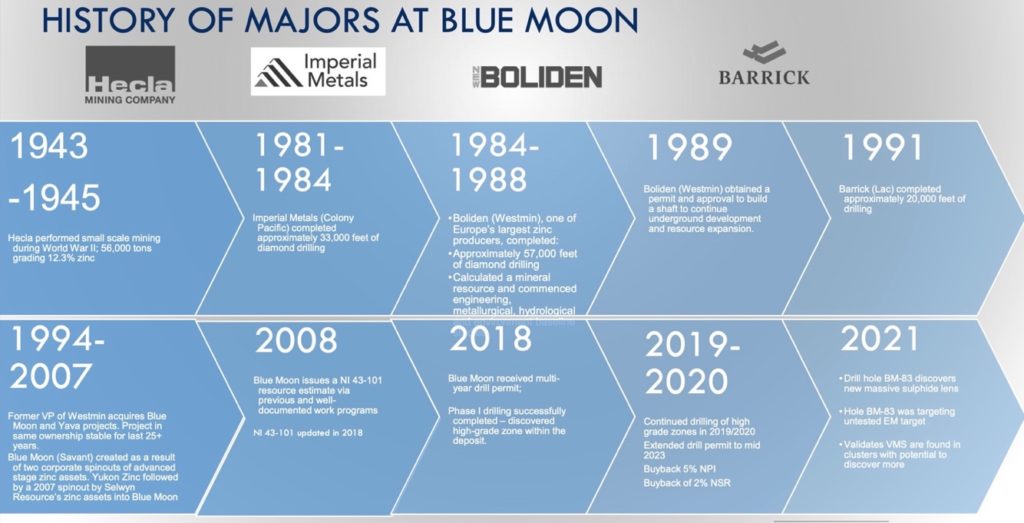

These resources are not speculative. Blue Moon resources have been known for decades, dating back to WW2 when Hecla Mining began producing zinc here to feed America’s steel industry.

With the end of the war, Hecla shifted focus to other metals and has now holds America’s largest silver reserves. As a result, Blue Moon mine operations went dormant near the end of WW2 and exploration and resource development didn’t recommence until the 1970s when zinc, silver and gold prices improved.

Over the ensuing decades, further exploration and mine development work indentified extensive resources in gold, silver and copper, but consistently, zinc dominated the findings.

In that time, three major mining companies, Imperial Metals, New Bolliden (formerly Westmin), and Barrick, had teams on site.

By 2007, sufficient work had been completed that all ownership interests in the project were rolled into the one entity that has evolved into today’s Blue Moon Metals. The rollup was orchestrated by a VP from Westmin who had extensive knowledge of the project.

Within a year a preliminary NI43-101 resource estimate was calculated and in 2018,the new entity, Blue Moon Metals released an updated NI 43-101 that verified the tremendous potential in resources at Blue Moon.

“The Blue Moon project is subject to a NI 43-101 Mineral Resource estimate with approximately 7.8 million tons with a grade of 8.07% zinc equivalent for approximately 771 million pounds of zinc, 71 million pounds of copper, 300,000 ounces of gold and 10 million ounces of silver in the Inferred category.”

Those are stunning numbers for a junior resource company. In fact, many early-stage resource companies get started with virtually nothing discovered in the ground.

That’s not the case here. Blue Moon Metals (TSX.V: MOON, OTC: BMOOF) already appears to be resource rich.

How do those resources add up in above-ground value using mid-January prices? The numbers are impressive.

- Zinc: $1.38 billion

- Copper: $314 million

- Silver: $44.3 million

- Gold: $546 million

- Total: $2.28 billion

Now, to be clear, these numbers do not imply a valuation for the company that can be pro-rated to the stock.

These are provided only as a reference to suggest the extent of mineralization already estimated and quantified in an NI 43-101 report. Do not use them to apply direct value to Blue Moon’s share structure.

What’s more, those numbers are likely to rise soon.

Recent explorations have uncovered another groundbreaking discovery.

Last year (2021), the company reported intercepts with a volcanogenic massive sulfide (VMS) zone at Blue Moon.. VMS deposits typically hold rich concentrations of copper, gold, silver and other metals, and most importantly, zinc.

Nearly a quarter of global zinc resources are recovered from VMS deposits and there are only about 800 such deposits worldwide.7 But that’s not the most exciting aspect of this discovery.

VMS deposits are most frequently found in tightly spaced clusters. Find one and you typically find many…each bearing substantial mineralized resources.7

Chances are excellent that more VMS structures could be discovered as exploration continues.

Blue Moon's executive team stands among the most experienced in the world today.

CEO, Patrick McGrath, was a co-founder and former CFO at what is now Sprott Resource Holdings. Director, Jack McClintock, is a past exploration manager from BHP Billiton. CFO, Varan Prasad, also serves as CFO of Canada’s Western Copper and Gold. Jonathan Gagne brings extensive zinc mining experience from Glencore. Director, Douglas Urch, served as CFO over two energy company acquisitions of aggregate value over $1.47 billion.

For more current information about Blue Moon management and ongoing activities, visit the company website.

Blue Moon’s 2021 and 2022 exploration will tightly focus on the potential of these resources with the ultimate goal of calculating reserves, which can then be fully applied to the share price. That sets the stage for a lucrative buyout.

These numbers also suggest that Blue Moon Metals (TSX.V: MOON, OTC: BMOOF) may be highly undervalued. Blue Moon’s share price and market cap in mid-January sat under 4¢ and $5.4 million respectively.

It is extremely rare that any resource company trading in such a low-priced start-up phase could publish resource data of this scale.

This suggests enormous upside potential in Blue Moon that could lead to substantial growth when the company’s ongoing exploration bears results.

What to do now...

With the hunt for new zinc now part of a worldwide crisis you could expect Blue Moon to stay in the news for years to come.

That’s why now could be the very best time to latch onto its affordably priced shares.

That means it’s time to call your broker or advisor and show him or her this report.

Then discuss this new opportunities in zinc and, in particular, with Blue Moon Metals.

Because, when you take your position now in Blue Moon Metals (TSX.V: MOON, OTC: BMOOFTSX.V: MOON, OTC: BMOOF)

you could find yourself among the earliest and biggest winners.

1https://www.cnn.com/2022/01/09/us/ny-lithium-battery-bronx-fire/index.html

2https://nypost.com/2021/12/24/tesla-explodes-after-mechanics-charge-man-23k-for-new-battery/

3https://www.statista.com/statistics/1093612/zinc-consumption-projection-globally-by-type/

4https://www.theglobaleconomy.com/rankings/zinc_production/

5https://www.dla.mil/HQ/Acquisition/StrategicMaterials/Materials/

6https://www.federalregister.gov/documents/2021/11/09/2021-24488/2021-draft-list-of-critical-minerals

7https://www.geologyforinvestors.com/volcanogenic-massive-sulphide-vms-zinc-deposits/

8https://explorationinsights.com/site/assets/files/4062/vms_deposits.pdf

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Blue Moon Metals

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Blue Moon Metals and has no information concerning share ownership by others of any profiled Blue Moon Metals The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Blue Moon Metals or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Blue Moon Metals Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Blue Moon Metals’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Blue Moon Metals future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Blue Moon Metals industry; (b) market opportunity; (c) Blue Moon Metals business plans and strategies; (d) services that Blue Moon Metals intends to offer; (e) Blue Moon Metals milestone projections and targets; (f) Blue Moon Metals expectations regarding receipt of approval for regulatory applications; (g) Blue Moon Metals intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Blue Moon Metals expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Blue Moon Metals business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Blue Moon Metals ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Blue Moon Metals ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Blue Moon Metals ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Blue Moon Metals to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Blue Moon Metals operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Blue Moon Metals business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Blue Moon Metals business operations (e) Blue Moon Metals may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Blue Moon Metals or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Blue Moon Metals or such entities and are not necessarily indicative of future performance of Blue Moon Metals or such entities.