Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) offers patented, scalable, secure, and low-cost production of high-performance lithium-ion battery materials

The lithium battery market has reached a crisis point that is being fueled by rising materials prices along with supply chain bottlenecks and security concerns.

In April, Elon Musk, the owner of Tesla, tweeted: “Price of lithium has gone to insane levels!”1

And it isn’t just lithium, prices for a variety of battery components are soaring – including nickel, cobalt, and more.

At the same time, supply chain security has become a serious issue in recent days, weeks and months as evidenced by the London Metal Exchange suspending nickel trading on the morning of March 8 after Russia’s invasion of Ukraine resulted in ‘disorderly’ price moves.2

An investigation into the shutdown is ongoing but in the aftermath many countries are focusing on securing local supply to “de-risk” scale up and mass production bottlenecks.

When you combine that environment with Nano One’s (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) game-changing technology and its recent acquisition of Johnson Matthey Battery Materials Canada3 which includes its Candiac plant in Quebec (Strategically located in what is a growing battery supply chain hub with recent entrants setting up shop like BASF, General Motors and POSCO), you get a “perfect storm” that could end up revolutionizing the marketplace.

Approaching the Industry Like No Company Has Before

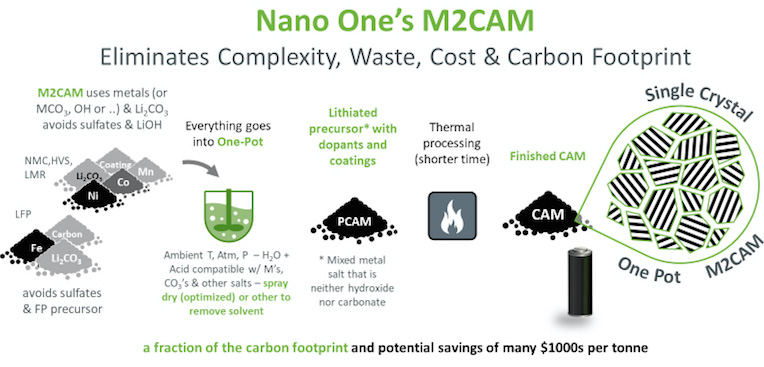

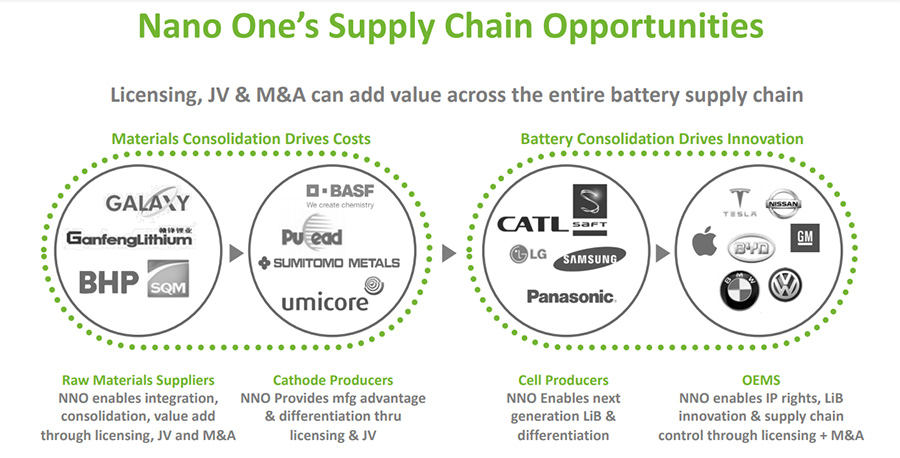

Unlike other companies looking to produce batteries themselves, Nano One’s(TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) main focus is on making the key materials that go into the batteries – the cathode active material or CAM. They are making those materials in a completely different way than the rest of the industry that is greener, cheaper, and high performing. They call it their One-Pot process. They have a three pronged business model approach that will see self production of certain materials like LFP (Lithium Iron Phosphate) and licensing its patented technology or joint venturing with strategic partners on other materials like high nickel CAM.

That means any battery or EV producer could benefit by using the company’s breakthrough process to get a competitive edge…

Allowing Nano One Materials Corp. to potentially achieve massive scale while still balancing its costs.

And, as we said, Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) is coming along at a time when battery prices are reaching new heights due to supply shortages. This is where their Metal Direct to Cathode Active Material (M2CAM®) technology really makes a difference. This allows the use of different battery metals and flexibility in feedstock inputs like lithium, nickel, cobalt etc… reducing supply chain risk.

Reuters reports that lithium-ion battery cells “soared to an estimated $160 per kilowatt-hour in the first quarter” of this year.4 The cells cost $105 last year.

Real Money’s Jim Collins points out that the best way to capitalize on the EV battery market isn’t with the materials themselves, but in companies with technologies that make EVs, their batteries, and their use of base materials more efficient. Among his top picks in that category is Nano One (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF).5

7 Reasons Why Nano One (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) Could Dominate the Market

- Improves Charge Life of Lithium-Ion Batteries: Nano One’s patented “One-Pot” process results in individually coated single cathode crystals.

- Saves Time and Costs in Production Process: Eliminates the need for energy-intensive conversion of feedstocks, meaning the process is faster and cheaper with a fraction of the carbon footprint – resulting in higher margins for manufacturers.

- Applicable to Every Type of Lithium-Ion Battery: There are a number of different lithium-ion battery chemistries, each serving different needs, but that doesn’t matter to Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF), because its patented process can be used for every type. It’s a platform technology.

- Three-Pronged Revenue Model: Thanks to the company’s flexible business model it can generate earnings through licensing, joint ventures and primary production.

- Protected by a Fortress of Patents: With 22 currently approved patents and 47+ pending, the company’s technology is protected in multiple jurisdictions, patenting the process, the materials, and the products made with the process and materials.

- Resolves Multiple Battery Material Supply Chain Issues: Nano One (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) makes the battery materials production process more secure and efficient, which is vital in today’s marketplace. Plus, it is doing this while remaining a good global corporate citizen and maintaining ESG mandates.

- Aligned with Sustainability Objectives: The company’s process also reduces the amount of waste products generated. Tighter ESG mandates are being passed by governments, and Nano One (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) can help companies fit under these new laws.

Nano One is a Top Choice Due to Its Game-Changing Technology!

Nano One Materials Corp.’s (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) patented “One-Pot” process simplifies and consolidates the lengthy cathode making process.

It also lowers GHG emissions, removes waste streams and costs by allowing cathode materials to be made directly from metal feedstocks (M2CAM®). This eliminates the conversion of base metals into sulfates – reducing cost, energy, shipping weight, and environmentally problematic waste streams.

The savings lead to increased margins for manufacturers for those that license or JV with the company which ultimately helps reduce the overall cost to the end user. This should position Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) as an attractive strategic partner.

The profit potential in this market is big! The worldwide cathode market is at $17.4 billion and is projected to grow by 6.3% a year to reach $28.3 billion by 2027.6 This addressable market amounts to billions in potential licensing royalty revenues, with even larger revenue opportunities in joint ventures or self production.

Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) is Already Making Significant Commercialization Gains

In a major announcement on May 25, Nano One (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) agreed to acquire 100% of the shares of Johnson Matthey Battery Materials Ltd., a Canadian entity located in Candiac, Québec.

The transaction includes the team, which has over 360 years of combined scale-up and commercial production experience, and its facilities, equipment, land, and other assets.

Nano One (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) officials say the new facility and equipment can serve Nano One’s process needs with room to expand.

Nano One (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) can leverage the province’s skilled and experienced workforce, raw materials, low-cost hydro-electric energy and decades-in-the-making mines-to-mobility battery materials ecosystem.

The company’s Québec location will put it in what is shaping up to be a battery supply chain HUB with recent announcements in the area from General Motors Co. (NYSE: GM) and POSCO Chemical, which are building a new facility in Bécancour, Québec, to produce cathode active material (CAM) for EV batteries7 and BASF, which has acquired a site for North American battery materials and recycling expansion in Québec.

Speaking of BASF, Nano One Materials just signed a Joint Development Agreement (JDA) with the company, which is a global leader in chemistry and high-performance lithium-ion battery cathode materials, to develop a process with reduced by-products for the commercial production of next-generation cathode active materials (CAMs).

The process will be based on BASF’s HEDTM family of advanced CAMs and using the One-Pot process. Nano One‘s patented and metal direct to CAM (M2CAM®) technologies.

In addition, Nano One (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF)has a number of partnerships and technical initiatives underway with global automotive OEMs, upstream mining companies and global chemical companies.

The bottom line is more and more companies are realizing that Nano One (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) has the technology to add value across the entire battery supply chain, whether through licensing, joint ventures, or other business arrangements.

It’s likely only a matter of time before more investors begin to catch on to the value this company presents.

Nano One is Quicky Positioning Itself as a Key Player and the Battery Industry Needs to Take its Growth to a New Level…

Already promising battery companies and the like are seeing multi-billion dollar valuations (see chart below). These companies are all going to need to get their battery materials from somewhere (or will need an updated tech process), which is where Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) steps in.

It’s not just the public markets. Battery tech company Sila Nanotechnologies raised $590 million in private funding, pushing its implied valuation to $3.3 billion.8

And Swedish battery developer NorthVolt raised $600 million in equity in 2020, giving it a $2 billion valuation.9

But again, these are mostly battery manufacturers who must compete with each other…

Whereas Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) has the option to license its patented technology to nearly anyone in the industry, partner in strategic joint ventures or produce its own battery materials.

“In Europe, they’ve launched this whole battery thing, but they’re stuck with adopting a midstream that has got all these inefficiencies. We in Canada have a tremendous opportunity here to set ourselves apart from everywhere else in the world by cleaning that up,” said Dan Blondal CEO of Nano One.

This is a Company That is Well-Funded & Ready to Exploit Multiple Profit Opportunities

In its Quarterly Update for Q1 2022, Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) reported working capital of approximately C$48.6 million and cash of approximately C$48.7 million.

That solid financial foundation has the company ready to launch some exciting scale-up efforts:

- A 100 tonne per annum (tpa) pilot line with preliminary engineering underway for a multi-1,000 tpa industrial scale commercial demonstration line for lithium iron phosphate (LFP)

- Followed by a 100 tpa multi-CAM pilot line to serve as a launchpad for sulfate-free cathode M2CAM production and technology validation

- Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) also received approval for its 21st and 22nd patents (it has approximately 47 other patents pending)

Nano One Presents Investors With:

- A patented breakthrough technology that can benefit a big fast-growing market…

- A business model that could allow it to gain massive scale…

- A long list of strategic global partners from miners to auto companies.

Nano One’s (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) advantages don’t stop there. The company also has an experienced, talented leadership team that is focused on making this company the next “big name” in the energy transition, over C$48 million in the bank, several major partnerships already in place and a process that benefits every player in the battery supply chain, from miners to cathode producers to electric vehicle manufacturers.

With supply chain bottlenecks expected to get worse, companies offering solutions like Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) are likely to gain in value. That’s why now is the time to do your due diligence on this potential breakout company.

1 https://twitter.com/elonmusk/status/1512505545416224783

2 https://www.standard.co.uk/business/fca-pra-london-metal-exchange-investigation-nickel-market-shutdown-b992277.html

3 https://nanoone.ca/news/news-releases/nano-one-to-acquire-johnson-matthey-battery-materials-canada/

4 https://www.reuters.com/business/autos-transportation/soaring-battery-costs-fail-cool-electric-vehicle-sales-2022-04-19/

5 https://realmoney.thestreet.com/investing/how-to-play-stagflation-buy-resource-names-like-nano-one-materials-15648668

6 https://www.reportsanddata.com/report-detail/cathode-materials-market

7 https://plants.gm.com/media/us/en/gm/home.detail.html/content/Pages/news/us/en/2022/mar/0307-posco.html

8 https://techcrunch.com/2021/01/26/sila-nanotechnologies-raises-590m-to-fund-battery-materials-factory/

9 https://www.forbes.com/sites/mariannelehnis/2020/12/18/these-4-greentech-unicorns-made-billion-dollar-luck-in-2020/?sh=4934bcd7308a

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Nano One Materials Corp. (“NNOMF”) and its securities, NNOMF has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by NNOMF) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company NNOMF and has no information concerning share ownership by others of in the profiled company NNOMF. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to NNOMF industry; (b) market opportunity; (c) NNOMF business plans and strategies; (d) services that NNOMF intends to offer; (e) NNOMF milestone projections and targets; (f) NNOMF expectations regarding receipt of approval for regulatory applications; (g) NNOMF intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) NNOMF expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute NNOMF business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) NNOMF ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) NNOMF ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) NNOMF ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of NNOMF to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) NNOMF operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact NNOMF business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing NNOMF business operations (e) NNOMF may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Nano One Materials Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Nano One Materials Corp. and has no information concerning share ownership by others of any profiled Nano One Materials Corp. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Nano One Materials Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Nano One Materials Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Nano One Materials Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Nano One Materials Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Nano One Materials Corp. industry; (b) market opportunity; (c) Nano One Materials Corp. business plans and strategies; (d) services that Nano One Materials Corp. intends to offer; (e) Nano One Materials Corp. milestone projections and targets; (f) Nano One Materials Corp. expectations regarding receipt of approval for regulatory applications; (g) Nano One Materials Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Nano One Materials Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Nano One Materials Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Nano One Materials Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Nano One Materials Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Nano One Materials Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Nano One Materials Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Nano One Materials Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Nano One Materials Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Nano One Materials Corp. business operations (e) Nano One Materials Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Nano One Materials Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Nano One Materials Corp. or such entities and are not necessarily indicative of future performance of Nano One Materials Corp. or such entities.