With an FDA-approved, non-opioid drug in commercial production, a revolutionary chemotherapy alternative in pre-clinical trials, and a potential COVID therapeutic in the works, Q BioMed (OTCQB: QBIO) is poised for an exciting remainder of 2020.

Q BioMed’s recent announcement of its contract manufacturing facility’s FDA approval and subsequent commercial launch of Strontium89 makes it that rare micro-cap issuer with imminent revenue. The company has a number of potential new drugs in its pipeline, but its commercial ready assets, in particular, are what sets it apart from its peers.

Q BioMed (OTCQB: QBIO) treats its first commercial patient with non-opioid alternative for the alleviation of cancer-related bone pain.

The widespread push to reduce the use of opioids means that clinicians are actively seeking effective alternatives. Opioid addiction is at crisis levels.

But addiction isn’t the only problem with opioids. For those with the most severe pain, there are few alternatives. Yet the side effects of opioids can be so debilitating that many patients prefer the pain.

Brain fog, nausea, vomiting, abdominal distention, and constipation can be excruciating for opioid users. What’s worse, prolonged use can lead to tolerance, which means the drug is no longer able to mask the pain.

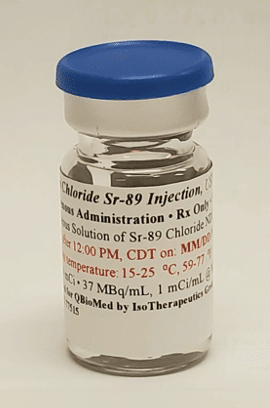

For the hundreds of thousands around the world who suffer with cancer that has spread to the bone, Q BioMed (OTCQB: QBIO) Strontium Chloride offers an effective and welcome alternative to the horrors of opioids and may reduce or even eliminate the need for them in these patients.

Strontium Chloride is non-addictive, works in 80% of patients, and continues working for up to six months with a single dose.[1]

Strontium Chloride is specifically designed to target pain caused by cancer that has spread to bone, which is a common occurrence in prostate, breast, and lung cancers, among others.

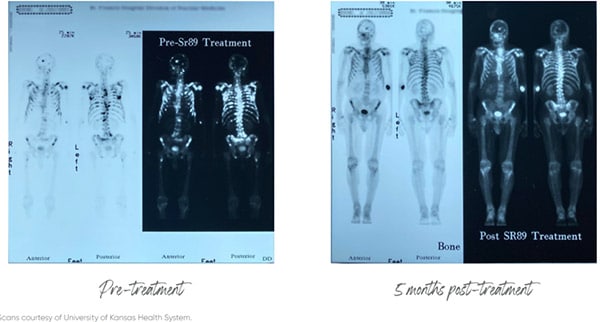

The active ingredient in Strontium 89 Chloride is a radioactive isotope of the chemical element strontium. When injected into the body strontium acts like calcium, being taken into bone at the sites of growing tumors and lesions.

Strontium89’s pivotal clinical trials revealed:

- More patients with ZERO pain

- More patients with ZERO need for analgesics

- Fewer new pain sites

Q BioMed (OTCQB: QBIO) owns both the generic and brand name of Strontium Chloride, Metastron, which it purchased from GE Healthcare in 2018, where it surprisingly never got the marketing resources necessary to grow sales, even though it’s development was hailed by the pharmaceutical and biotechnology industries as a “major advance” in pain control.[2]

Strontium Chloride is FDA-approved, and Metastron, the brand, is approved for sale in 22 countries. It is reimbursable by Medicare and most health plans. On November 20, 2019, the FDA approved Q BioMed’s U.S. based contract manufacturing facility and the Company expects a roll-out of Strontium 89 in early 2020.

Next step for this product is to seek approval for an expanded indication, beyond pain therapy, as a cancer treatment, giving Q BioMed (OTCQB: QBIO) entry into the cancer therapeutic market.

Importantly, there is evidence to support this strategy. For example, a Phase II clinical trial published in the medical journal The Lancet, showed that cancer patients lived nine months longer when given Strontium Chloride as a combination therapy, significantly longer than the comparison cancer drug.[3]

The Company plans to undertake a Phase IV trial, sometimes called a post-marketing study, to confirm those results.

A positive result would allow Q BioMed (OTCQB: QBIO) to market this drug for both therapeutic and pain indications.

Pain associated with bone cancer is an underserved market

Medications for alleviating the pain occurring from cancer comprise more than 25% of the overall pain management therapeutics market, which is set to reach $83 billion by 2024.[4]

The market for bone cancer treatment is even larger than for cancer bone pain control. In 2018 that market reached $62.9 billion.

While there are treatments currently available, their effectiveness is often limited for long term pain management, they are associated with several undesirable side effects, and/or are constrained by factors like chemotherapy and the health condition of the patient.

Expected full commercial sales and marketing to roll out in Q2 2020

It is estimated that over 10,000,000 people are living with painful skeletal metastatic cancer today. In addition, an expected 20-30% of breast and prostate cancer diagnoses will develop metastatic disease, as well as most other primary cancers.

Q BioMed intends to pursue label expansion to include therapy for bone metastasis from several primary cancers, possibly in combination with other therapies, such as external beam radiation therapy, of which there are 500,000 treatments a year in the US for bone pain.

Strontium Chloride is just one of the drugs in Q BioMed (OTCQB: QBIO) pipeline.

That isn’t the only news driving heightened interest in Q BioMed.

In a recent announcement, Q BioMed (OTCQB: QBIO) entered into a financial restructuring of approximately $7.8 Million. Substantial Positive shareholder equity was achieved when it restructured $3.8 Milllion of debt into equity and raised $4 Million in new capital which is a significant step towards a Nasdaq listing anticipated in the not-too-distant future.

This influx of new capital offers Q BioMed enough runway to bring its FDA-approved, non-opioid, Strontium89 Chloride drug into full commercialization, as well as advance other key pipeline assets.

A robust pipeline of developmental drugs

Q BioMed (OTCQB: QBIO) follows an unconventional business model in the micro-cap pharma sector. The Company conducts its own research to identify innovative technologies that have been under-served, undervalued, or ignored, but which management believes have inherent potential. Although it does not invent those technologies, it attempts to create greater value through the use of its human capital and economic investments.

By carefully building a portfolio of assets in pre-clinical stage, Phase I trials, one commercial ready asset, and one that has just found entrance to the commercial market, the Company hopes to build value for its patients and shareholders for years to come.

Q BioMed partner, Mannin Research Inc., set to fast-track potential Coronavirus therapy.

Q BioMed (OTCQB: QBIO) has been the focus of a lot of investor attention in recent weeks following an aptly timed announcement.

The February press release pointed to a project in the works since last September, when the German state of Saxony awarded Mannin a $7.7 million grant to advance its novel therapeutics.

Mannin has since been fast at work developing a new class of therapeutics that lowers the severity of infection for vascular pathologies, including coronaviruses like COVID-19 and SARS, as well as the common flu, which claims more than 600,000 lives globally every year.

By reducing endothelial dysfunction and loss of endothelial barrier integrity, the companies hope to halt the development of acute lung injury following severe viral or bacterial infections.

Q BioMed CEO Denis Corin states,

“We are working closely with our technology research partner Mannin to develop a potential adjunct treatment for various infectious diseases like the coronavirus. These types of outbreaks are not uncommon. H1N1, SARS, Ebola, pneumonia, influenza and others all can cause vascular leakage and respiratory distress in patients, which can be fatal in the most severe cases. With the interest and support of government institutions, this COVID19 therapy could be in human trials before the end of this year!”

New hope for those with liver cancer, glaucoma, and more

Some of Q BioMed (OTCQB: QBIO) products are preclinical stage therapies for liver cancer, glaucoma, acute kidney injury, pulmonary artery hypertension, and infectious diseases.

The Company is partnering with the Oklahoma Medical Research Foundation, licensing its liver cancer drug candidate, a new type of naturally-derived chemotherapy.

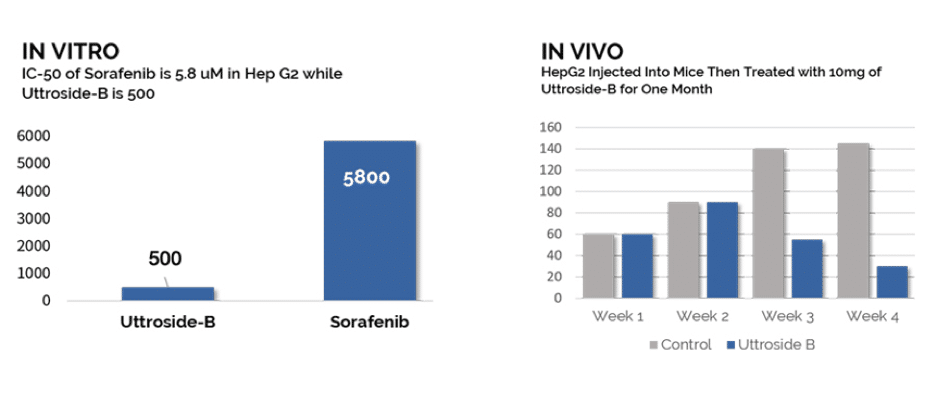

Q BioMed (OTCQB: QBIO) recently announced an important breakthrough in this program. Together with its collaborators, they have successfully synthesized the naturally occurring plant molecule that has shown the potential to be 10 times more potent than the current first line liver cancer drug. Data supporting this conclusion was published in the November 2016 issue of Scientific Reports, a Nature journal.[5]

The potential therapeutic shows remarkable efficacy in HepG2 Cell Lines, the most common form of liver cancer. Q BioMed (OTCQB: QBIO) anticipates filing an Orphan Drug Application followed by an Investigational New Drug Application for a Clinical Program with the expectation of commencement in late 2020.

The compound was isolated and characterized from the leaves of Solanum Nigrum Linn, a plant widely used in traditional medicines. Uttroside B as it is known, drastically shrunk tumors in mice bearing human liver cancer xenografts. In addition, in pre-clinical experiments, Uttroside B induced cytotoxicity in all liver cancer cell lines, and researchers were also able to confirm its biological safety, both by in vitro and in vivo studies.

This means that this potential drug may ultimately be a treatment for liver cancers. The first hurdle of making a synthetic version of it has been achieved. Q BioMed (OTCQB: QBIO) will now advance the most promising candidates into preclinical testing and validation in 2020 in anticipation of an orphan drug application and an IND clinical program.

Chemotherapeutic options for liver cancer are limited, and the prognosis of liver cancer patients remains very challenging.

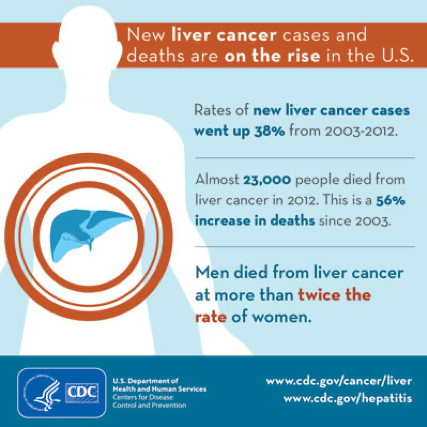

According to the Centers for Disease Control and Prevention, it is the second most common cause of cancer deaths worldwide, claiming approximately 750,000 lives each year.

In the US, the American Cancer Society estimates that 42,000 people will be diagnosed with liver cancer in 2019 and that 32,000 will die from the disease this year.

Liver cancer incidence has more than tripled since 1980 and deaths in the US have increased 56% since 2003.

Q BioMed (OTCQB: QBIO) also has a partnership with Mannin Research Inc, with an option to acquire any or all of its pipeline of drugs. Mannin has made some impressive announcements about its glaucoma program recently that set it apart from its peers, and we expect to see this pipeline develop into other therapeutic areas.

All of these drugs are targeted in large markets with millions of potential patients.

Now is a good time to follow the company

Q BioMed (OTCQB: QBIO) announced FDA approval of their contract manufacturing facility in November 2019. The company has now started producing the drug and is rolling out its marketing and sales plans and we expect Strontium89 to be on the market generating revenue starting in Q2 2020.

Ask your broker about Q BioMed (OTCQB: QBIO) and always remember to do your own due diligence.

[1] J Natl Med Assoc. 1986 Jan; 78(1): 27–32

[2] https://www.thepharmaletter.com/article/metastron-hailed-as-major-advance

[3] Lancet. 2001 Feb 3;357(9253):336-41

[4] Transparency Market Research, “Pain Management Therapeutics Market,” 2016

[5] www.nature.com/articles/srep36318

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Q BioMed, Inc.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

————-

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.