Advertorial

Time to move. As a palladium investor you can be poised for enormous growth in 2021.

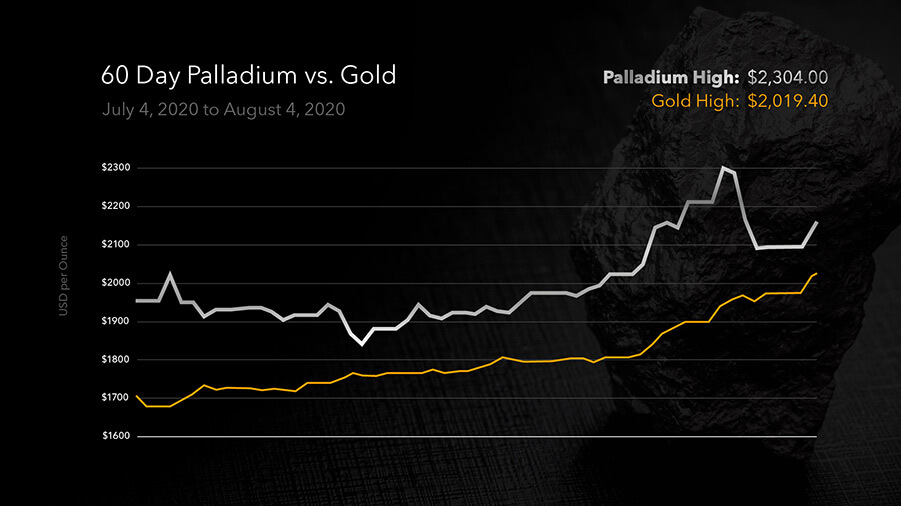

Palladium is crushing gold and silver price growth.

In just six months from August 2019 through February 2020, palladium prices doubled.

Never in recent times have any of the four precious metals (Gold, silver, palladium and platinum) seen such explosive growth.

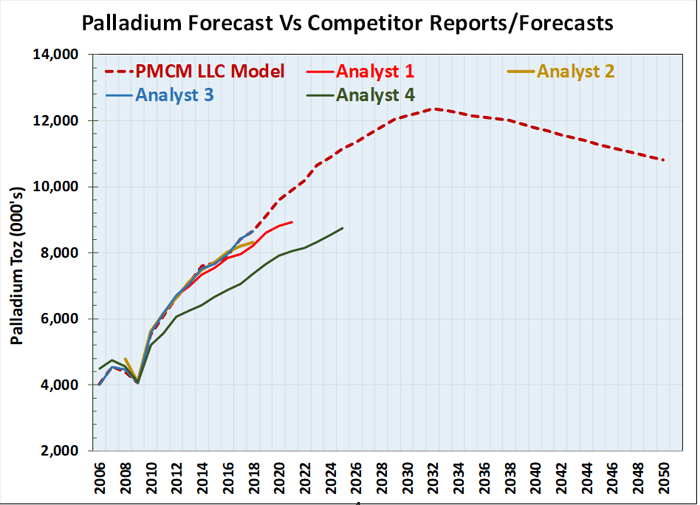

What’s more, the experts never saw it coming.

Industry analysts blatantly failed in forecasting palladium when they projected it declining from $1,400 to $1,300 ounce by the end of 2020.

Boy did they blow that one!

Instead, palladium kept soaring and peaked at $2,304…over $300 higher than gold’s current high…and now trades over $2,100.

While experts licked their wounds, palladium investors rushed to take these unforeseen profits. That triggered a recent correction and a huge opportunity for nimble investors who act quickly.

After a brief profit-taking correction off its $2,300 high, palladium found support just below $2,100 and is now launching on a new upward trend. This is an ideal time to consider palladium for its investment potential as it moves back to its recent growth trajectory.

“Palladium is now the most valuable of the four major precious metals, with an acute shortage driving prices to a record. A key component in pollution-control devices for cars and trucks, the metal’s price doubled in little more than a year, making it more expensive than gold.” – Bloomberg, October, 2019

Here’s what you can expect and more important, what you can act upon.

Over the short term, volatile palladium prices could move to steady growth over growing supply shortages and increasing industrial as well as collectible demand.

On the supply side, industry analysts are forecasting a substantial shortfall of palladium through year end. Investing News reported that: “…palladium will remain the stronger performer in 2019 with a year-on-year price surge of 45 percent” and “…forecasts a palladium supply deficit of 574,000 ounces for the year.”

That trend continues today as demand for palladium continues to climb!

Earlier this year Kitco reported an even bigger supply crisis,

“The palladium market was in a supply/demand deficit of more than 1 million ounces in 2019, and the shortage is expected to be even worse in 2020…”

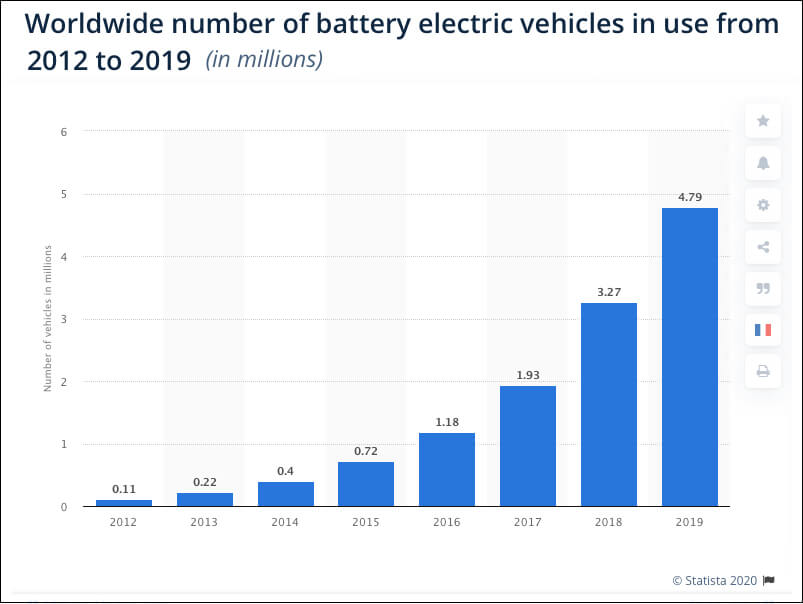

On the demand side, industrial giants should be clamoring to lock in future palladium stocks. Palladium is deemed essential for the evolution of green energy vehicles as it is the preferred element for gasoline light duty vehicles and hybrids. Today, about 90% of the global supply of Palladium goes into emission control systems. With green vehicle sales soaring over the coming decades, the pressure on global palladium supplies is unlikely to abate.

While the boom in hybrid cars (which use the most palladium) has sent demand for the metal skyrocketing, that demand has an underside. Palladium is in such undersupply, and prices have gotten so high, that catalytic converter theft has become an increasingly prevalent issue in urban centers, we’re seeing now in London.

Thus, demand for secured palladium reserves both in the ground and above ground (which will be covered in a moment) is now forecast to soar nearly 50% over the coming decade. Keep in mind that this growth projection is for industrial demand. Collectible demand for bullion and rounds could grow concurrently putting further upside pressure on palladium prices.

Your first thought might be to lock in some physical metal, but the far greater opportunity lies in palladium exploration companies that are currently seeking the new resources necessary to meet soaring future demand.

Tesla insiders hint at next-generation technology with newly reported “Palladium” project

The Palladium project remains cloaked in some secrecy, but word has been released that, “new production lines are needed in order to build the “Palladium” Model S and Model X electric vehicles. The cars are expected to receive new battery modules and drive units, which may potentially facilitate the super-fast “Plaid” mode that Tesla has been testing recently.”

In addition, word is circulating that Musk and Tesla are preparing to announce a new power pack, dubbed the “million-mile battery”. This completely new battery design reportedly packs more power in a smaller package, incorporates significantly new chemistry that can revolutionize battery powered vehicles, and can remain in service for over a million vehicle miles. Does the project title telegraph palladium as a key component in the new design? That’s not yet been verified, but if true, it could put even more pressure on global palladium production that’s already falling short of demand.

Much of the palladium produced in the world today is actually a by-product of mining for the base metals nickel and copper. Very few companies are focused exclusively on palladium production, thus a modest increase in palladium production would require an enormous increase in nickel/copper production…which could overwhelm world markets.

Soaring industrial demand for palladium simply doesn’t match to its “by-product” status. With a recent world supply deficit of 574,000 palladium ounces, it seems clear that dedicated palladium reserves must be brought online to keep pace with future demand.

What to do now…

One thing seems clear, demand for palladium should remain in a strong upward trajectory for the balance of this decade, which can put strong upside pressure on the commodity price as well as strong upside pressure on the shares in companies that bring new resources to the market.

Don’t be caught on the sidelines. Sign up to our newsletter to receive more information about the innovative young company that we think is poised to take the lead.

It’s not often that you get a shot at an opportunity with this kind of growth potential.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Canadian Palladium Resources.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.