They may share a title, but they don’t share points of view regarding the possible performance of ten-year treasury bond yields in the new year.

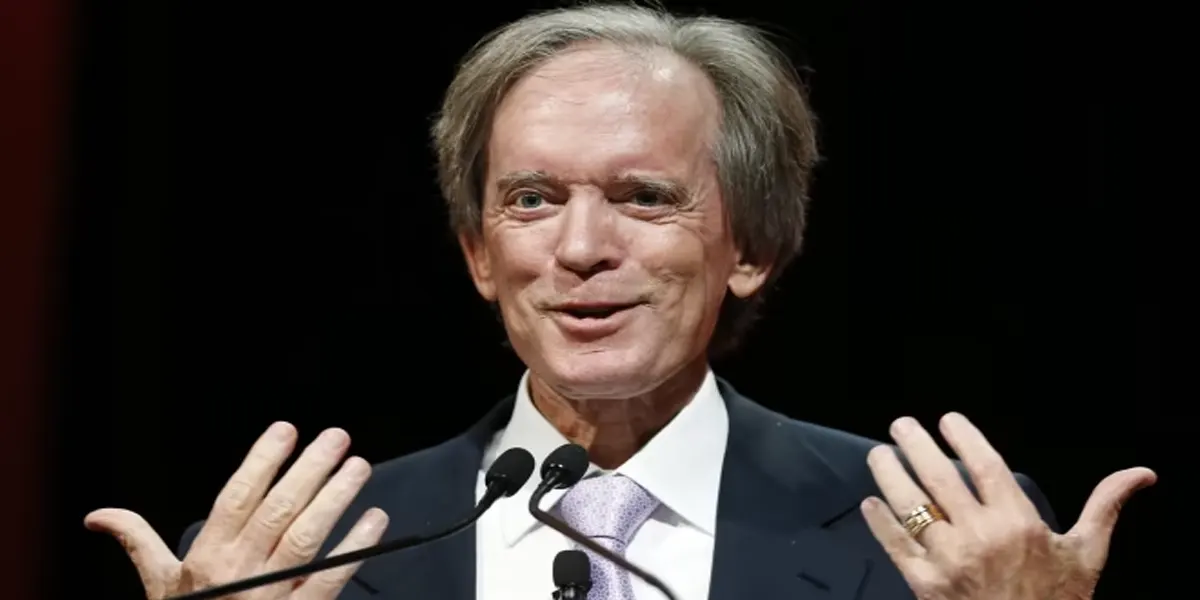

Both Bill Gross, co-founder of the investment management firm PIMCO, and Jeffrey Gundlach, founder and chief executive of DoubleLine Capital recently shared their respective takes on bond yields for 2024. The two Bond Kings have strikingly different opinions which they expressed both in mainstream and social media.

The Gundlach Angle

Gundlach appeared on CNBC recently and declared that he expects a pullback on treasury bonds. In his statement, he believes the ten-year Treasury rate will remain within a relatively low 3% zone.

About the economy in general, Gundlach remains rather pessimistic as he adheres to his belief that the US economy is headed for a recession despite recent improvements.

The Federal Reserve’s comments following its final policy meeting of the year have not sweetened Gundlach’s perspective. Indeed, he has gone on to say that the American economy will be veering towards the downside as it undershoots targets. He also believes that the Fed will need to take measures to offset the impact of such an occurrence.

Gross Speaks Up

On the other hand, Gross has openly scoffed at his fellow Bond King’s gloomy outlook. Indeed, one of his latest posts on X (formerly Twitter) thumbs his nose at Gundlach as he sees the possibility of ten-year yields dropping into the low 3% range as a big joke.

At present, ten-year bond yields currently stand within the 4% level – and, according to Gross, that’s where they ought to be at this point.

The PIMCO co-founded and added that any bond strategies need to focus on returning to a positive yield curve in the coming year.