VANCOUVER, British Columbia, March 12, 2024 (GLOBE NEWSWIRE) — Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (the “Company” or “Calibre”) is pleased to announce the results of the Company’s updated Mineral Resources (“Resources”) and Mineral Reserves (“Reserves”) for its Nicaragua and Nevada properties as of December 31, 2023. Reserves have grown in both jurisdictions net of depletion since acquisition of each asset. As demonstrated by the team’s track record, Calibre continues to efficiently make new discoveries and convert discoveries into Reserves as evidenced at the VTEM gold corridor within the Limon Mine Complex which has seen year over year Reserve growth of 36%. The VTEM corridor now contains 1.25 Mt averaging 8.25 g/t Au for 332 koz in Reserves with multiple kilometres of strike potential and an ongoing 50,000 m drill program.

Nicaragua Mineral Reserves (December 31, 2023)

Highlights

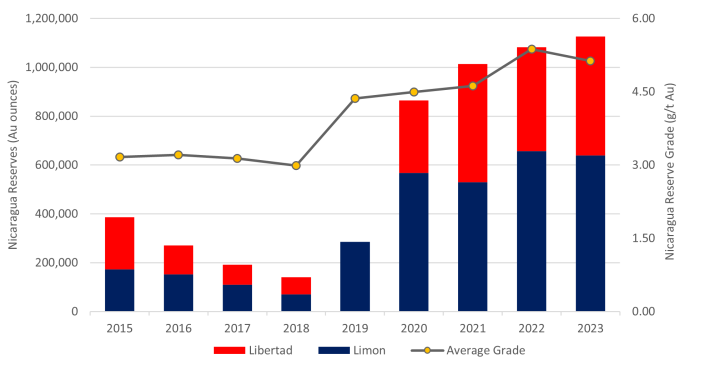

- Nicaragua: Increase in Reserves net of production depletion of 4% in 2023 to 1.13 Moz;

- Nevada: Increase in Reserves net of production depletion of 12% in 2023 to 0.30 Moz;

- Company wide significant mineral endowment of over 4.1 Moz of Reserves, 8.6 Moz of Measured and Indicated Resources (inclusive of Reserves) and 3.6 Moz of Inferred Resources;

- Valentine Gold Mine’s significant mineral endowment of 2.7 Moz of Reserves and 3.96 Moz of Measured and Indicated Resources (inclusive of Reserves) and 1.10 Moz of Inferred Resources (further detailed in the tables below) (see news release dated January 26, 2024); and

- >130,000 m Resource expansion and discovery drill programs underway across all assets.

Darren Hall, President and Chief Executive Officer of Calibre stated: “I am very pleased to see another year of Reserve growth net of depletion in both operating jurisdictions. We have crystalized a significant portion of our Resources into Reserves for a record 1.42 Moz in Nicaragua and Nevada, net of record 2023 production of 283,525 ounces. Nicaragua continues to deliver with Reserves at 1.13 Moz providing a robust base from which to deliver. With our recent acquisition of the Valentine Gold Mine, our company wide consolidated Reserves stand at 4.1 Moz, a more than 10-fold increase since Q4 2019 net of 825 koz of production. Importantly Reserves have grown more 36% year over year at our emerging flagship project, the VTEM gold corridor at Limon. In Nevada we’ve grown Reserves over 50% net of production depletion since closing the acquisition in 2021.”

| Nicaragua Mineral Resource and Reserve Statements – December 31, 20231,2,3,4,5,6 All notes with parameters are at the end of the press release. | |||||

| Tonnage | Grade | Grade | Contained Au | Contained Ag | |

| (kt) | (g/t Au) | (g/t Ag) | (koz) | (koz) | |

| Probable Reserves | 6,822 | 5.13 | 20.9 | 1,126 | 4,593 |

| El Limon Complex | 3,377 | 5.89 | 5.43 | 639 | 589 |

| La Libertad Complex | 3,445 | 4.39 | 36.2 | 487 | 4,004 |

| Measured & Indicated Resources (Inclusive of probable reserves) | 17,333 | 3.34 | 10.37 | 1,862 | 5,779 |

| El Limon Complex | 12,861 | 3.05 | 1.91 | 1,259 | 791 |

| La Libertad Complex | 4,472 | 4.18 | 34.7 | 602 | 4,989 |

| Inferred Resources | 56,584 | 1.23 | 11.88 | 2,235 | 21,606 |

| El Limon Complex | 1,566 | 4.46 | 3.54 | 224 | 177 |

| La Libertad Complex | 3,992 | 4.06 | 37.6 | 520 | 4,824 |

| Primavera (January 31, 2017) | 44,974 | 0.54 | 1.15 | 782 | 13,460 |

| Cerro Aeropuerto (April 11, 2011) | 6,052 | 3.64 | 16.16 | 708 | 3,145 |

| US Mineral Resource and Reserve Statements – December 31, 20237,8,9,10 All notes with parameters are at the end of the press release. | |||

| Tonnage | Grade | Contained Au | |

| (kt) | (g/t Au) | (koz) | |

| Proven & Probable Reserves | 24,634 | 0.34 | 299 |

| Pan Pit Constrained | 24,634 | 0.34 | 273 |

| Pan Probable Leach Pad Inventory | 26 | ||

| Measured & Indicated Resources (Inclusive of probable reserves) | 98,212 | 0.88 | 2,780 |

| Pan Mine | 33,790 | 0.33 | 359 |

| Gold Rock (Mar 31, 2020) | 18,996 | 0.66 | 403 |

| Golden Eagle (Mar 31, 2020) | 45,426 | 1.38 | 2,018 |

| Inferred Resources | 11,643 | 0.75 | 281 |

| Pan Mine | 1,479 | 0.37 | 18 |

| Gold Rock (Mar 31, 2020) | 3,027 | 0.87 | 84 |

| Golden Eagle (Mar 31, 2020) | 5,370 | 0.90 | 155 |

| Valentine Mineral Resource and Reserve Statement – December 31, 202311,12 All notes with parameters are at the end of this press release. | |||

| Tonnage | Grade | Contained Au | |

| (kt) | (g/t Au) | (koz) | |

| Proven & Probable Reserves (November 30, 2022) | 51,600 | 1.62 | 2,700 |

| Marathon | 21,300 | 1.56 | 1,100 |

| Leprechaun | 15,100 | 1.73 | 850 |

| Berry | 15,100 | 1.60 | 800 |

| Measured & Indicated Resources (Inclusive of Mineral Reserves) | 64,624 | 1.90 | 3,955 |

| Leprechaun | 15,589 | 2.15 | 1,078 |

| Sprite | 701 | 1.74 | 39 |

| Berry | 17,159 | 1.97 | 1,086 |

| Marathon | 30,090 | 1.76 | 1,701 |

| Victory | 1,085 | 1.46 | 51 |

| Inferred Resources | 20,752 | 1.65 | 1,100 |

| Leprechaun | 4,856 | 1.58 | 246 |

| Sprite | 1,250 | 1.26 | 51 |

| Berry | 5,332 | 1.49 | 255 |

| Marathon | 6,984 | 2.02 | 454 |

| Victory | 2,330 | 1.26 | 95 |

Link – Detailed 2023 Mineral Resource and Mineral Reserve Tables

Quality Assurance/Quality Control

Canada

QA/QC protocols followed at the Valentine Gold Mine include the insertion of blanks and standards at regular intervals in each sample batch. Drill core is cut in half with one half retained at site, the other half tagged and sent to Eastern Analytical Limited in Springdale, NL. Eastern Analytical is ISO 17025 accredited for Atomic Absorption Spectroscopy for gold following fire assay preparation methods and is independent of Calibre. All samples are analyzed for Au by fire assay (30g) with AA finish. Samples that assayed greater than or equal to 300 ppb gold were subjected to a total pulp metallic sieve procedure. Samples that fall within mineralized zones that are <300 ppb are also reanalyzed by screen metallics. The analytical results are captured in an acQuire database, which is programmed to utilize the screen metallic values over the standard fire assays if data is available.

Nicaragua

Calibre maintains a Quality Assurance/Quality Control (“QA/QC”) program for all its exploration projects using industry best practices. Key elements of the QA/QC program include verifiable chain of custody for samples, regular insertion of certified reference standards and blanks, and duplicate check assays. Drill core is halved and shipped in sealed bags to Bureau Veritas in Managua, Nicaragua, an independent analytical services provider with global certifications for Quality Management Systems ISO 9001:2008, Environmental Management: ISO14001 and Safety Management OH SAS 18001 and AS4801. Prior to analysis, samples are prepared at Veritas’ Managua facility and then shipped to its analytical facilities in Vancouver, Canada. Half core samples are also shipped in sealed bags to ALS’ prep facility in Managua, Nicaragua. ALS has a global quality program that includes internal and external inter-laboratory test programs and regularly scheduled internal audits that meet all requirements of ISO/IEC 17025:2017 and ISO 9001:2015. Prior to analysis samples are prepared at ALS’ Managua facility then shipped to its analytical facility in Lima, Peru. Gold analyses are routinely performed via fire assay/AA finish methods. For greater precision of high-grade material, samples assaying 10 g/t Au or higher are re-assayed by fire assay with gravimetric finish. Analyses for silver and other elements of interest are performed via Induction Coupled Plasma (ICP).

Nevada

Key elements of the QA/QC program include the insertion of assay standards, blanks, and duplicates in the sample stream to ensure the assay lab results are within specified performance levels. Down hole deviation surveys are provided by International Directional Services, utilizing a surface recording gyroscope, and by trained drill crews operating a north seeking gyroscope supplied by REFLEX. RC drilling was performed by Boart Longyear of Salt Lake City, Utah and Alford Drilling from Elko, Nevada. Assays were performed by ALS, Reno where fire assays were determined on a 30-gram charge with an AAS finish. An additional cyanide leach assay was also completed. ALS carries ISO/IEC 17025:2017 certification.

Qualified Persons & Technical Disclaimers

This news release has been reviewed and approved by Benjamin Harwood, M.Sc., P.Geo. of Calibre, who prepared or supervised the preparation of the updated El Limon Complex, La Libertad Complex (Libertad, Pavon, and EBP districts), and Pan Mine Mineral Resource estimates, and is a Qualified Person (“QP”) as set out under NI 43-101.

This news release has been reviewed and approved by Murray Dunn, P.Eng., and Jordan Cooper, P.Eng., of SLR Consulting (Canada) Limited (“SLR”), who prepared or supervised the preparation of the updated El Limon Complex and La Libertad Complex (Libertad, Pavon, and EBP districts) Mineral Reserve estimates reported in this news release and are Qualified Persons (“QPs”) as set out under NI 43-101.

Pan

A technical report for the Pan Gold Project (“NI 43-101 Updated Technical Report on Resources and Reserves Pan Gold Project, Nevada”) was released by SRK Consulting (U.S.) Inc. in accordance with NI 43-101 in March, 2023. The technical report includes details regarding the updated Mineral Reserve and Resource estimates presented herein. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions, and exclusions that relate to the Mineral Resources and Mineral Reserves.

| a) | 2023 Pan Mine Reserves and LOM were audited and re-stated by Mr. Stuart Collins PE of SLR Consulting. | |

| b) | 2023 Pan Mine Resources were audited and restated by Mr. Benjamin Harwood, M.Sc., P.Geo., the Company’s Principal Resource Geologist, who is a “Qualified Person” as defined in NI 43-101. | |

Mr. Roy Eccles, P. Geo. (PEGNL), of APEX Geoscience Ltd., is the Qualified Person responsible for the review and acceptance of responsibility of the July 2022 Mineral Resource estimated prepared by John T. Boyd Company. Mr. Marc Schulte, P.Eng., of Moose Mountain Technical Services, is the Qualified Person responsible for the preparation of the Mineral Reserves estimate. Messrs. Schulte and Eccles are Qualified Persons as set out under NI 43-101 and are independent of Calibre.

Please also see the notes to each table below.

Darren Hall, MAusIMM, President & Chief Executive Officer, Calibre Mining Corp. has reviewed and approved the scientific and technical information in this news release.

David Schonfeldt, P. Geo, Corporate Chief Geologist, Calibre Mining Corp. and a “Qualified Person” under National Instrument 43-101 has reviewed and approved the scientific and technical information contained in this news release.

About Calibre

Calibre is a Canadian-listed, Americas focused, growing mid-tier gold producer with a strong pipeline of development and exploration opportunities across Newfoundland & Labrador in Canada, Nevada and Washington in the USA, and Nicaragua. Calibre is focused on delivering sustainable value for shareholders, local communities and all stakeholders through responsible operations and a disciplined approach to growth. With a strong balance sheet, a proven management team, strong operating cash flow, accretive development projects and district-scale exploration opportunities Calibre will unlock significant value.

ON BEHALF OF THE BOARD

“Darren Hall”

Darren Hall, President and Chief Executive Officer

For further information, please contact:

Ryan King

Senior Vice President, Corporate Development & IR

T: (604) 628-1012

E: [email protected]

W: www.calibremining.com

Calibre’s head office is located at Suite 1560, 200 Burrard St., Vancouver, British Columbia, V6C 3L6.

X / Facebook / LinkedIn / YouTube

The Toronto Stock Exchange has neither reviewed nor accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward Looking Information

This news release includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. Forward-looking statements in this news release include, but are not limited to: the Company’s expectations toward higher grades mined and processed going forward; statements relating to the Company’s 2024 priority resource expansion opportunities; the Company’s metal price and cut-off grade assumptions. Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond Calibre’s control. For a listing of risk factors applicable to the Company, please refer to Calibre’s annual information form (“AIF”) for the year ended December 31, 2023, and its management discussion and analysis (“MD&A”) for the year ended December 31, 2023, all available on the Company’s SEDAR+ profile at www.sedarplus.ca. This list is not exhaustive of the factors that may affect Calibre’s forward-looking statements such as potential sanctions implemented as a result of the United States Executive Order 13851 dated October 24, 2022.

Calibre’s forward-looking statements are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to management at such time. Such assumptions include but are not limited to: the Company being able to mine and process higher grades and keep production costs relatively flat going forward; there not being an increase in production costs as a result of any supply chain issues or ongoing COVID-19 restrictions; there being no adverse drop in metal price or cut-off grade at the Company’s Nevada properties. Calibre does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change other than as required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, undue reliance should not be placed on forward-looking statements.

Note 1 – La Libertad Complex Mineral Resource Notes

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are inclusive of Mineral Reserves.

- Mineral Resources are estimated assuming long-term gold prices from US$1,500/oz to US$1,700/oz and long-term silver prices of US$20/oz to US$24/oz.

- Open pit Mineral Resources are reported within an optimized pit shell above cut-off grades ranging from 0.68 g/t Au to 2.42 g/t Au.

- Minimum mining widths of approximately 1.0 to 2.0 m were used to model Underground Mineral Resources.

- Underground Mineral Resources are reported within mineralization wireframes at block cut-off grades from 2.00 g/t Au to 2.90 g/t Au, where grade, continuity, and thickness were used to demonstrate Reasonable Prospects for Eventual Economic Extraction, or within resource panels generated at cut-off grades from 2.58 g/t Au to 3.59 g/t Au. Exception:

a. The East Dome underground Mineral Resource Estimate used a block cut-off grade of 0.42 g/t AuEq. Gold equivalent values were calculated using the formula: AuEq (g/t) = Au (g/t) + Ag (g/t)/101.8. - Bulk densities vary by deposit and weathering stage and range from 1.70 t/m3 to 2.65 t/m3.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Numbers may not add due to rounding.

The Qualified Person (QP) is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate.

Note 2 – La Libertad Complex Mineral Reserve Notes

- CIM (2014) definitions were followed for Mineral Reserves.

- All Mineral Reserves are classified as Probable Mineral Reserves.

- Mineral Reserves are estimated assuming long-term gold prices from US$1,500/oz to US$1600/oz and long-term silver prices from US$20/oz to US$26/oz.

- Open pit Mineral Reserves are estimated at the cut-off grades ranging from 0.74 g/t Au to 1.98 g/t Au.

- All open pit Mineral Reserve estimates incorporate dilution built in during the re-blocking process and assume 100% mining recovery.

- Underground Mineral Reserves are estimated at fully costed cut-off grades ranging from 2.90 g/t Au to 3.42 g/t Au, and incremental cut-off grades ranging from 1.68 g/t Au to 2.41 g/t Au.

- All underground Mineral Reserve estimates incorporate estimates of dilution and mining losses.

- Minimum mining widths ranging from 1.5 m to 2.0 m are used for UG Mineral Reserves reporting depending on orebody geometry and mining methods.

- Mining extraction factors ranging from 90% to 95% were applied to underground stope designs. Mining extraction factors of 90 to 95% were applied to underground stopes depending on mining method and stope geometry. Where required, a pillar factor was also applied for sill or crown pillars. A 100% extraction factor is assumed for ore encountered during mine access development.

- Bulk densities vary by deposit and weathering stage and range from 1.70 t/m3 to 2.61 t/m3. Underground backfill density is 1.00 t/m3.

- Mineral Reserves are reported in dry metric tonnes.

- Numbers may not add due to rounding.

The Qualified Persons (QPs) are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate.

Note 3 – El Limon Complex Mineral Resource Notes

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are inclusive of Mineral Reserves.

- Mineral Resources are estimated assuming a long-term gold prices from US$1,600/oz to US$1,700/oz and long-term silver prices from US$20/oz to US$24/oz.

- Open pit Mineral Resources are reported within an optimized pit shell above cut-off grades ranging from 1.00 g/t Au to 1.13 g/t Au.

- Minimum mining widths of approximately 1.0 to 2.0 m were used to model Underground Mineral Resources.

- Underground Mineral Resource are reported within mineralization wireframes at a block cut-off grade of 2.25 g/t Au, where grade, continuity, and thickness were used to demonstrate Reasonable Prospects for Eventual Economic Extraction, or within resource panels generated at cut-off grades from 2.00 g/t Au to 3.03 g/t Au.

- Bulk densities vary by deposit and weathering stage and range from 1.86 t/m3 to 2.85 t/m3. Bulk densities for Tailings material range from 1.29 t/m3 and 1.33 t/m3.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Numbers may not add due to rounding.

The Qualified Person (QP) is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate.

Note 4 – El Limon Complex Mineral Reserve Notes

- CIM (2014) definitions were followed for Mineral Reserves.

- All Mineral Reserves are classified as Probable Mineral Reserves.

- Mineral Reserves are estimated assuming long-term gold prices from US$1,500/oz to US$1600/oz and long-term silver prices from US$20/oz to US$23/oz.

- Open pit (OP) Mineral Reserves are estimated at cut-off grades ranging from 1.15 g/t Au to 1.20 g/t Au.

- Underground (UG) Mineral Reserves are estimated at fully costed cut-off grades ranging from 2.30 g/t Au to 3.36 g/t Au, and incremental cut-off grades ranging from 1.92 g/t Au to 2.91 g/t Au.

- Fully costed cut-off grades include sustaining capital cost allocations for mining and processing.

- All Mineral Reserve estimates incorporate estimates of dilution and mining losses.

- Mining extraction factors of 90 to 95% were applied to underground stopes depending on mining method and stope geometry. Where required, a pillar factor was also applied for sill or crown pillars. A 100% extraction factor is assumed for ore encountered during mine access development.

- Minimum mining widths of range from 1.5 m to 2.0 m depending on mining method and stope geometry.

- Bulk densities vary between 2.30 t/m3 and 2.41 t/m3 for all open pit Mineral Reserves and between 2.47 t/m3 and 2.50 t/m3 for all underground Mineral Reserves.

- Mineral Reserves are reported in dry metric tonnes.

- Numbers may not add due to rounding.

The Qualified Persons (QPs) are not aware of any environmental, permitting, legal, title, taxation, socioeconomic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate.

Note 5 – Cerro Aeropuerto (Borosi) Mineral Resource Notes

- The effective date of the Mineral Resource is April 11, 2011.

- CIM definition standards were followed for the resource estimate.

- The 2011 resource models used Inverse Distance grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids and

- A base cutoff grade of 0.6 g/t AuEq was used for reporting mineral resources.

- Gold Equivalent (AuEq) grades were calculated using $1,058/oz Au for gold and $16.75/oz Ag for silver and metallurgical recoveries and net smelter returns are assumed to be 100%.

- Resource Estimates for Cerro Aeropuerto are detailed in the technical report titled ‘NI 43-101 Technical Report and Resource Estimation of the Cerro Aeropuerto and La Luna Deposits, Borosi Concessions, Nicaragua’ by Todd McCracken, dated April 11, 2011.

- The quantity and grade of reported inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource. It is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category.

- Numbers may not add exactly due to rounding.

- Mineral Resources that are not mineral reserves do not have demonstrated economic viability.

Note 6 – Primavera (Borosi) Mineral Resource Notes

- The effective date of the Mineral Resource is January 31, 2017.

- CIM definition standards were followed for the resource estimate.

- The 2016 resource models used Ordinary Kriging grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids (HG=high grade, LG= low grade, sap=saprolite).

- A base cutoff grade of 0.5 g/t AuEq was used for reporting mineral resources.

- Gold Equivalent (AuEq) grades have been calculated using $1300/oz Au for gold, $2.40/lb for Copper, and $20.00/oz Ag for silver and metallurgical recoveries are assumed to be equal for all metals.

- Resource Estimates for the Primavera project are detailed in the NI 43-101 Technical Report titled ‘Primavera Project ‘by Todd McCracken, dated January 31, 2017.

- The quantity and grade of reported Inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred resources as an indicated or measured resource. It is uncertain if further exploration will result in upgrading them to indicated or measure mineral resource category.

- Numbers may not add exactly due to rounding.

- Mineral Resources that are not mineral reserves do not have demonstrated economic viability.

- Primavera copper resource includes 218,670,000 pounds of copper at a grade of 0.22% Cu, 0.84 g/t AuEq.

Note 7 – Pan Open Pit Mineral Reserve Notes

- Reserves are contained within engineered pit designs based on Lerchs-Grossmann optimized pit shells and using a US$1,600/oz gold sales price.

- The date of the surveyed topography is September 30, 2023, and projected to a December 31, 2023 estimated surface.

- Mineral Reserves are stated in terms of delivered short tons and grade before process recovery. The exception is leach pad inventory, which is stated in terms of recoverable gold ounces.

- Allowances for external dilution are accounted for in the diluted block grades.

- Costs used are ore mining cost of US$2.27/st, a waste mining cost of $2.27/st, an ore processing of US$3.17/st; and a G&A cost US$0.96/st.

- Reserves for argillic (soft) ore are based upon a minimum 0.003 opt Au (0.10 g/t) internal cut off grade (COG), using a US$1,600/oz Au sales price and a gold recovery of 85%.

- Reserves for Silicified (hard) ore are based upon a minimum 0.004 oz/st Au (0.14 g/t) Internal COG, using a US$1,6000/oz Au sales price and a gold recovery of 62%.

- Mineral Resources have been stated inclusive of in situ Mineral Reserves. Stockpile and leach pad inventory are not included in the Mineral Resources estimate.

- Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

Note 8 – Pan Open Pit Mineral Resource Notes

- CIM (2014. 2019) guidelines, standards and definitions were followed for estimation and classification of mineral resources.

- The estimate of mineral resources may be materially affected by environmental, permitting, legal, marketing or other relevant issues.

- Resources are stated as contained within a constrained pit shell; pit optimization was based on an assumed gold price of US$1,700/oz, Silicic (hard) ore recoveries of 60% for Au and an Argillic (soft) ore recovery of 80% for Au, an ore mining cost of US$2.09/st, a waste mining cost of $1.97/st, an ore processing and G&A cost of US$3.13/st, and pit slopes between 45-50 degrees.

- Resources are domain edge diluted and reported using a minimum internal gold cutoff grade of 0.003 oz/st Au (0.10 g/t Au).

- Measured and Indicated Mineral Resources presented are inclusive of Mineral Reserves. Inferred Mineral Resources are not included in Mineral Reserves.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There has been insufficient exploration to define the inferred resources tabulated above as an indicated or measured mineral resource, however, it is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. There is no certainty that any part of the Mineral Resources estimated will be converted into Mineral Reserves.

- Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

- Mr. Benjamin Harwood, M.Sc., P. Geo. of Calibre is responsible for reviewing and approving the Pan mine open pit Mineral Resource Estimate. Mr. Harwood is a Qualified Person (“QP”) as set out in NI 43-101.

The Qualified Person (QP) is not aware of any environmental, permitting, legal, title, taxation, socioeconomic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate.

Note 9 – Gold Rock Mineral Resource Notes

- The effective date of the Mineral Resource is Mar 31, 2020.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any part of the Mineral Resources estimated will be converted into Mineral Reserves.

- The preliminary economic assessment for Gold Rock is preliminary in nature and includes Inferred Mineral Resources that are too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary economic assessment will be realized.

- In the table above and subsequent text, the abbreviation “st” denotes US short tons.

- Mineral resources stated as contained within a constrained pit shell; pit optimization was based on an assumed gold price of US$1,700/oz, an ore mining cost of US$2.09/st, a waste mining cost of $1.97/st, an ore processing and G&A cost of US$3.13/st, and pit slopes between 45-50 degrees.

- Mineral resources are reported using an internal gold cut off grade of 0.003 oz/st Au for blocks flagged as Argillic altered or as unaltered and a cutoff of 0.004 oz/st Au for blocks flagged as Silicic altered.

- Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

Note 10 – Golden Eagle Mineral Resource Notes

- The effective date of the Mineral Resource is Mar 31, 2020.

- The Qualified Person for this estimate is Terre Lane of GRE.

- Mineral Resources are not Mineral Reserves and do not demonstrate economic viability.

- Numbers in the table have been rounded to reflect accuracy of the estimate and may not sum due to rounding.

- The Mineral Resource is based on gold cutoff grade of 0.014 troy ounces per short ton (0.48 grams per tonne) at an assumed gold price of $1,500/tr oz, assumed mining cost of $1.06/st waste, assumed mining costs of $2.02/st mineralized mineral, assumed processing case of $12.75/st mineralized material, assumed G&A cost of $0.74/st mineralized material, an assumed metallurgical recovery of 80% and pit slopes of 45 degrees.

- The pit layback is not constrained to Fiore controlled land. Additional land must be acquired or otherwise made available for the pit layback, waste rock dumps, tailings facilities, and other surface infrastructure.

Note 11 – Valentine Gold Mine Mineral Resource Notes

- CIM (2014) definitions were followed for mineral resources.

- The effective date for the Leprechaun, Berry, and Marathon MREs is June 15, 2022. The effective date for the Sprite and Victory MREs is November 20, 2020. The independent Qualified Person, as defined by NI 43-101, is Mr. Roy Eccles, P.Geo. (PEGNL) of APEX Geoscience Ltd.

- Open pit mineral resources are reported within a preliminary pit shell at a cut-off grade of 0.3 g/t Au. Underground mineral resources are reported outside the pit shell at a cut-off grade of 1.36 g/t Au. Mineral resources are reported inclusive of mineral reserves.

- Mineral resources are estimated using a long-term gold price of US$1,800 per ounce, and an exchange rate of 0.76 USD/CAD.

- Mineral resources reported demonstrate reasonable prospect of eventual economic extraction, as required under the CIM 2014 standards as MRMR.

- The mineral resources would not be materially affected by environmental, permitting, legal, marketing, and other relevant issues based on information currently available.

- Numbers may not add or multiply correctly due to rounding.

Note 12 – Valentine Gold Mine Mineral Reserve Notes

- The mineral reserve estimates were prepared by Marc Schulte, P.Eng. (who is also an independent Qualified Person), reported using the 2014 CIM Definition Standards, and have an effective date of November 30, 2022.

- Mineral reserves are mined tonnes and grade; the reference point is the mill feed at the primary crusher.

- Mineral reserves are reported at a cut-off grade of 0.38 g/t Au.

- Cut-off grade assumes US$1,650/oz Au at a currency exchange rate of US$0.78 per C$1.00; 99.8% payable gold; US$5.00/oz off-site costs (refining and transport); and uses an 87% metallurgical recovery. The cut-off grade covers processing costs of $15.20/t, administrative (G&A) costs of $5.30/t, and a stockpile rehandle cost of $1.85/t.

- Mined tonnes and grade are based on a smallest mining unit (SMU) of 6 m x 6 m x 6 m, including additional mining losses estimated for the removal of isolated blocks (surrounded by waste) and low-grade (<0.5 g/t Au) blocks bounded by waste on three sides.

- Numbers have been rounded as required by reporting guidelines.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0d5bd7ca-0442-42f6-bbb5-30e964427841