Gold is their next big play and…

This Team Is Ready For Another Big Win

This could be an ideal time for you to profit from what’s coming next.

Launching a startup company to post gains like this takes an exceptional management team. These are winners in their game, players to follow closely. And when you see they’re getting something new started, you could make a fortune if you catch the project early.

The chart below is for Millennial Lithium, a company that was going nowhere until seasoned entrepreneurs, Graham Harris and Farhad Abasov, took charge.

Through their efforts they propelled Millennial Lithium operations to report a massive 4.12 million tonne measured and indicated lithium carbonate equivalent resource.

The discoveries coupled with the state’s aggressive exploration and development of the asset sent share prices soaring. Now the company has a net present value (NPV) of $1.03 billion and is fast on track to its production target of 24,000 tonnes per year of battery grade lithium carbonate.

Early investors saw huge gains as the company progressed from advanced start-up to its current lithium production capability. Now, it was just announced that the company was being bought out, all-cash, for $353 million…$3.60 a share!1

Could Harris and Abasov do it again?

They could be doing it right now in the Mojave desert…and this could be even bigger than Millennial.

Take a moment right now to dig into the details that put them on scene at a decades-old Nevada gold mine project believed to be sitting on a million-plus ounce gold resource. It’s not proven yet, but historic exploration and assays point to an enormous potential gold resource on site.

On the surface it appears to be an early-stage gold project, priced like a junior. But underneath it holds the potential for being an elephant field!

The new project that Harris and Abasov took over is named Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG).

And if you understand how much profit can be made from an early entry into a gold mining start-up, then this is one of the most unique situations you may ever see in this market.

A story you have to read to the last word.

What the market doesn’t yet know…and what Harris and Abasov saw…is a gold operation years ahead of junior counterparts. Exploration had been ongoing at this site for decades. Millions were invested to get mining started…then everything ground to a halt.

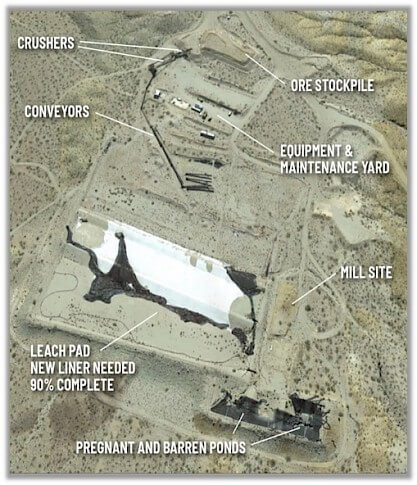

Black Mountain Gold’s Mojave Gold Project is not just getting started…it’s essentially ready to go. The exploration needed to launch mining operations is over 90% complete. The gold targets are defined. The equipment is ready to get started.

Black Mountain Gold’s Mojave Gold Project is not just getting started…it’s essentially ready to go. The exploration needed to launch mining operations is over 90% complete. The gold targets are defined. The equipment is ready to get started.

Production was projected to generate millions in revenue.

Despite this, the Mojave Gold Project sat idle, waiting for someone to hit the ignition.

That was 13 years ago. The owner of the mine site fell sick. Tragedy followed and the mine went to the estate. Squabbling relatives let the mine sit idle and nothing further was done.

But the mothballed equipment still stands, ready to work. The infrastructure remains, as does the thousands of ounces of gold that the previous owner believed he could strip from the surface. The mine was projected to produce 20,000 ounces annually just from the surface.

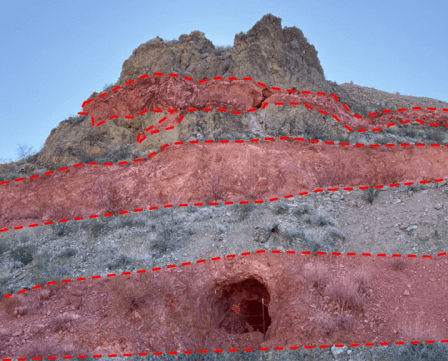

It was easy mining for millions in gold, so the potential for deeper ore was simply dismissed for later. He never looked deeper than about 100 feet!

What could lay below surface…the deep ore that fed gold to the surface…is key to the enormous undisclosed resource potential of the Mojave Gold Project.

The value of deeper ore is yet to be determined, which could dwarf what’s at surface and send Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG) shares rocketing.

Hundreds of thousands more ounces…perhaps even millions more could be found in below surface formations. The thought is, if the gold is so easily located at the top, it has to come from somewhere below.

And where it comes from has already proved to be worth billions.

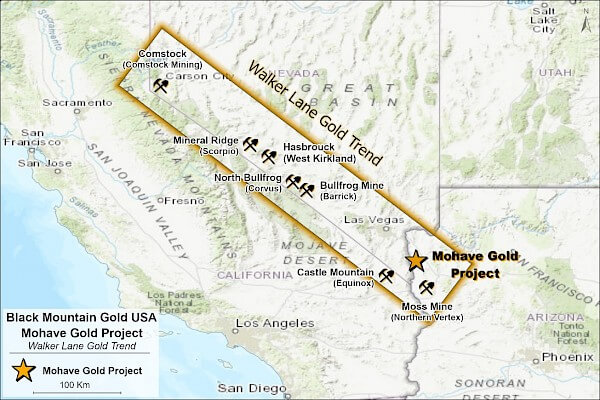

Black Mountain Gold’s Mojave Gold Project sits on one of the most productive gold trends in North America, the Walker Lane Gold Trend.2

Where two colliding continental shelves have pushed millions of ounces of gold to surface.

The Walker Lane Gold Trend is one of the three highly mineralized gold trends in western United States.

The other two, the Carlin Gold Trend and the Cortez Gold Trend have already made history and untold fortunes for those who got in early.

Nearly 170 million ounces of gold has been recovered from these three trends since mining began in the mid-1800s.

Production is still prolific as mining giants Newmont and others work projects primarily in Carlin and Cortez. Many believe that the Walker Lane Trend, which remains relatively untapped, can be a next in line for future large-scale production.

There’s certainly a long history of production all along the Trend and stunning assays from extensive surface exploration and shallow drilling that has accumulated over the years.

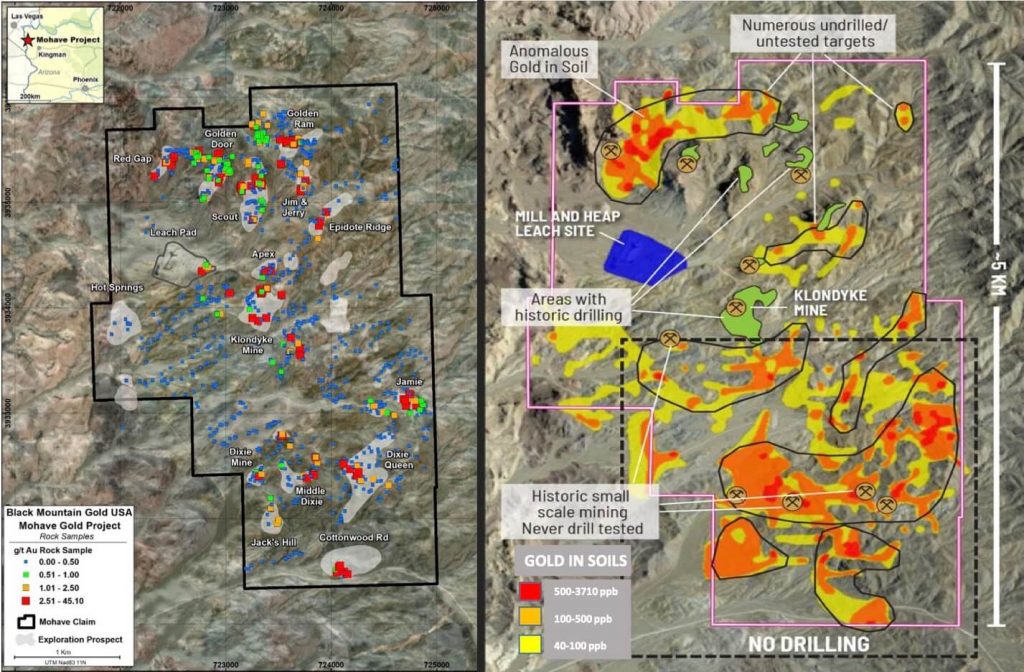

The claims on the Mojave Gold Project date back 60 years, locking in more than 3,200 acres on the southern end of the gold-rich Walker Lane Gold Trend. In the years since, the mining plans for the property focused exclusively on surface recovery. Hundreds of sites were identified through rock and trench sampling. Drilling was never deeper than 100 feet. The accumulated assay data was so impressive that plans were launched for immediate recovery of surface ore.

Over $20 million in current equipment value has been installed along with the groundwork and mine site infrastructure to launch gold production. Initial projections called for producing 20,000 ounces of gold annually, about $36 million a year at today’s prices!

But progress ground to a halt when the owner fell ill. Mining never commenced and the site has lain idle ever since.

The gold is still there of course, along with almost everything needed to begin recovery. But after the original owner, those in charge simply lacked the funds, ambition, or expertise to get things rolling.

After 13 years of inactivity, the mine and all resources are now in the hands of Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG). Judging from the work that management did at their Millennial Lithium project, this project is about to ignite. Investors in Black Mountain Gold can expect some exciting days in the very near future.

And those exciting days won’t just come from picking up where previous owners fell short!

Virtually everything appears in place to begin surface mining operations on the known gold findings.

But Black Mountain Gold management has opted to table production for now to focus exclusively on drilling for and mapping the deep gold lode formations that can be the source for what appears at and near surface.

That extended exploration plan could add enormously to the site’s resource potential, which accrues straight to shareholder value every time new assay results are announced.

This could be bigger than anyone imagined or planned.

As reported above, the Mojave Gold Project always promised exceptional income to private owners simply by taking gold from the surface. They anticipated that revenue would soar into the millions and would happen fast. All they had to do was start digging.

But Black Mountain Gold (OTC: BMGCF, TSXV: BMG) management, Harris and Abasov in particular, entered the project with a totally different view. This was not about a quick buck. Their extensive experience in resource exploration and mining told them to dig deeper to find the real riches in the Mojave Gold Project.

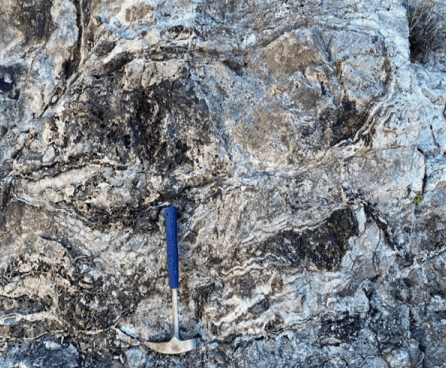

Gold showings like those already documented simply don’t fall from the sky, it’s pushed from below through volcanism and geological fissures created by the tectonic forces in play miles below the surface.

Black Mountain Gold management and geologists felt there could be a million-plus ounces of gold deeper in ground. They’d just have to drill deeper than the historic 100-foot depth to find resource-rich veins.

Black Mountain Gold management and geologists felt there could be a million-plus ounces of gold deeper in ground. They’d just have to drill deeper than the historic 100-foot depth to find resource-rich veins.

To that end, Black Mountain Gold set plans in place to complete an extensive, deep drill exploration program that finds and maps the gold-rich veins that fed the surface.

That has started with what the company describes as a continuation of surface exploration and an “aggressive drilling program aimed to significantly expand on the historic resources on the property.”

There’s more…and it goes directly to shareholder value.

Because the property has been in private hands for decades, public reporting of the impressive gold findings on site were rarely disseminated for market consumption. The original plan was to go straight to production and skip all the reporting. Specifically, many of the 43-101 compliant resource estimates that accrue directly to shareholder value were never produced.

Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG) intends to move swiftly in correcting that shortcoming.

Not an ounce of gold need be mined to reward shareholder patience.

Rather than moving directly to gold production on surface resources, Black Mountain Gold has opted to forego immediate production. Instead, it launched this summer an in-depth, extensive drill program to fully identify the resource potential of the site.

This is a hugely favorable move for shareholders. Unlike a private company where gains are realized in production…gains in publicly traded exploration companies can be realized in the announced results from ongoing exploration and discovery.

As gold is discovered and resources are calculated, the value of those discoveries can send company share prices soaring, even before an ounce of gold is recovered.

That is why now is the ideal time to consider if Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG) fits with your investment goals. This is an outstanding buy-and-hold opportunity that should not be ignored.

This could be much bigger than what appears on the surface.

The growth potential in Black Mountain Gold shares goes far beyond what is known to lie on the surface at the Mojave Gold Project. Historical and recent exploration, along with scattered small-scale mining activities on the property suggest strongly that the Mojave Gold Project holds potential to become a million-plus-ounce mining operation.

Should that prove to be true, the impact on Black Mountain Gold shares could be stunning…and likely to come soon.

Certainly, the management team knows how to make that happen.

When they took over operations of their prior company, Millennial Lithium, shareholders saw prices spike from around 70¢ in May of 2020 to peak at over $5.20 just nine months later.

It doesn’t take long for prices to move when an opportunity is properly managed.

Now is the time to look into this. Keep in mind though that despite the exceptional numbers already in the record, Black Mountain Gold should be considered a high-risk investment opportunity where significant if not complete losses must be considered.

That said, high-risk is an essential element of high-reward opportunity. So, get started with your due diligence while shares still trade under $1.00.

In fact, as of this writing, Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG)has been trading totally off-radar at under 50¢. There’s enormous upside potential if you act on this immediately.

New exploration crews and equipment are rolling in now. With the project’s mining operations nearly ready to go, the long game is on hand to go all the way to a producing operation. But the early gains getting to that point could be spectacular.

New exploration crews and equipment are rolling in now. With the project’s mining operations nearly ready to go, the long game is on hand to go all the way to a producing operation. But the early gains getting to that point could be spectacular.

As you dig into the details, you’ll likely find that Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG)could be one of the rarest of early-entry gold producers. It’s trading at low prices, like an early exploration junior, but it has existing exploration that was so promising, the prior owners developed the property up to the point that mining was set to begin.

By the looks of it, this is ready to go. And public announcements of newly documented gold resources may not be the only driver of share prices. Gold itself, the physical metal, appears set to rocket.

Inflation. Monetary easing. Unfettered money creation. All of it is building pressure on gold prices that simply cannot be ignored…nor held back.

Metals market publisher, Kitco, recently reported, “The overall trend in gold has shifted to the bullish side after the precious metal bottomed out at $1,680 at the end of March and started its approach to the $1,900 an ounce level.” 4

Deeper dives into gold price forecasts put the metal as high as near $10,000 by mid-decade.

That may be a stretch, but it’s illustrative of a building trend. Many believe that there is far more pressure on gold to the upside rather than the downside. An increase in the price of gold can have a multiplying impact on Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG)shares because the share price is tied directly to the value of the underlying resources.

What to do now…

First and foremost, get started on your due diligence. Those release dates could start coming at any time now, so quick action ensures you get an early start.

5 Reasons To Act On Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG) Without Delay

- Past exploration was so good on the Mojave Gold Project that mining equipment had already been set up, ready to go with nearly complete infrastructure and site development. It was only the untimely death of the original owner that brought progress to a halt.

- Exploration to date has been limited to surface and near surface only. Rock and dirt sampling, alsong with shallow drilling no deeper than 100 ft. returned stunning gold findings. Black Mountain Gold intends to go much deeper in its 2021 exploration program to discover the true potential of the site.

- Gold findings have been shown to be significant across much of the 3,200 acre project area. (See map above.) Geologists believe that such significant surface findings can be highly indicative of deeper lode veins that become the source of surface gold.

- The Mojave Gold Project is well situated in the southern section of the Walker Lane Gold Trend, one of three world-class trends that have produced over 170 million ounces of gold since prospectors first began recoveries in the mid-1800s. The other two, The Carlin Gold Trend and the Cortez Gold Trend, are now being largely mined by majors, such as Newmont Mining. The Walker Lane Trend is considered by some to be where the next big production trend will be launched.

- Beyond the importance of the resources themselves, the value to a shareholder in Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG)

can also be amplified by the proven records of the company’s key management team, Graham Harris and Farhad Abaso. Their work at bringing a languishing lithium operation, Millennial Lithium, out of the ashes to rocketing gains that peaked from a 70¢ low to a $5.21 peak posted a stunning 744% gain in about nine months. Some expected profit taking at that valuation brought the shares down, but the underlying value of the company held firm and is now testing new highs at $3.46, a 494% rise off that prior low.

Bonus reason:

- Take a look at the world around you: pressure is building for a major break out in gold prices. A quick run past $2,000 is back in the cards…and by mid-decade, with all that’s going on many see gold flying to highs never seen. Now is the time to make that decision…should you be buying gold right now? It appears to be the smart, conservative play.

For more current information about Black Mountain Gold (OTC:BMGCF, TSXV:BMGOTC:BMGCF, TSXV:BMG) and its Mojave Gold Project, please visit the company website, download the latest investor publication, and be sure to register your email address for future news and updates.

You can expect news to begin flowing at any time now, so getting in early keeps you in front of the crowds.

1All prices Canadian denominated. https://www.millenniallithium.com/news/2021/ganfeng-lithium-co-ltd-to-acquire-millennial-lithium-corp-in-an-all-cash-offer-for-353-million

2Image source: https://insidexploration.com/pamlico-ridge-the-geological-forces-driving-nevadas-mining-industry/

3https://investingnews.com/innspired/walker-lane-gold-trend-nevada/

4https://www.kitco.com/news/2021-05-19/Reversal-of-money-flows-Big-institutional-players-exit-crypto-and-turn-to-gold-says-JPMorgan.html

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Black Mountain Gold.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Black Mountain Gold and has no information concerning share ownership by others of any profiled Black Mountain Gold The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Black Mountain Gold or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Black Mountain Gold Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Black Mountain Gold’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Black Mountain Gold future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Black Mountain Gold industry; (b) market opportunity; (c) Black Mountain Gold business plans and strategies; (d) services that Black Mountain Gold intends to offer; (e) Black Mountain Gold milestone projections and targets; (f) Black Mountain Gold expectations regarding receipt of approval for regulatory applications; (g) Black Mountain Gold intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Black Mountain Gold expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Black Mountain Gold business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Black Mountain Gold ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Black Mountain Gold ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Black Mountain Gold ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Black Mountain Gold to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Black Mountain Gold operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Black Mountain Gold business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Black Mountain Gold business operations (e) Black Mountain Gold may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Black Mountain Gold or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Black Mountain Gold or such entities and are not necessarily indicative of future performance of Black Mountain Gold or such entities.