Demand for Helium is Set to Soar, and Helium Evolution (TSXV:HEVI)(TSXV:HEVI) is Poised to Become a Leading Developer of Canada’s Helium Resources

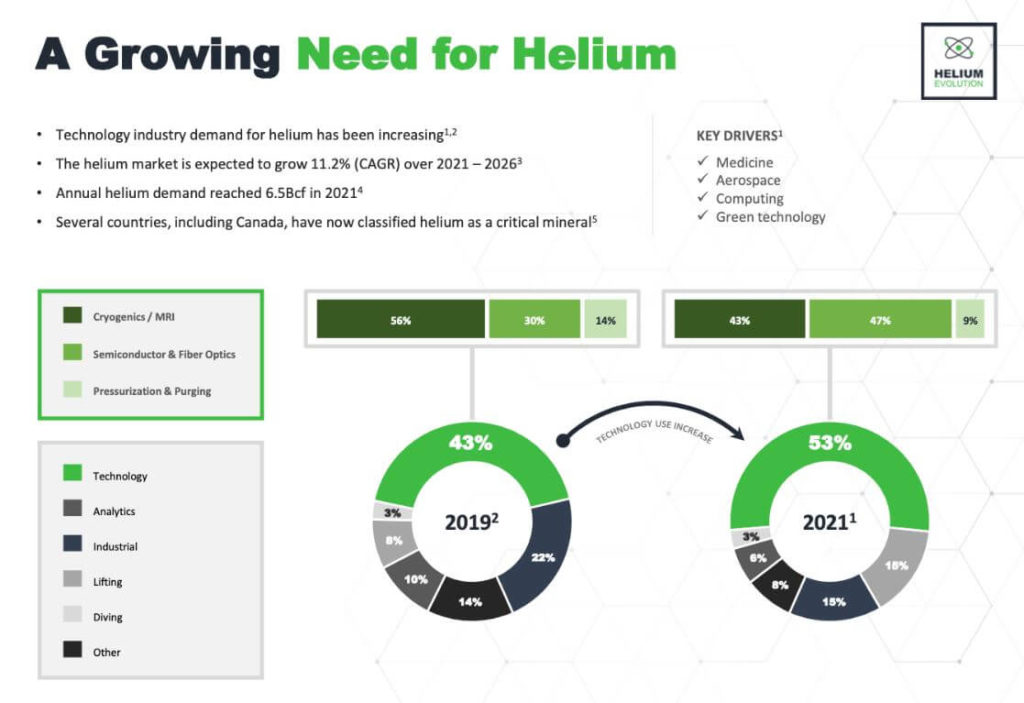

Helium plays a role in nuclear magnetic resonance, mass spectroscopy, welding, fiber optics and computer microchip production, among other technological applications. In addition, NASA uses large amounts annually to pressurize fuel tanks in space shuttles.

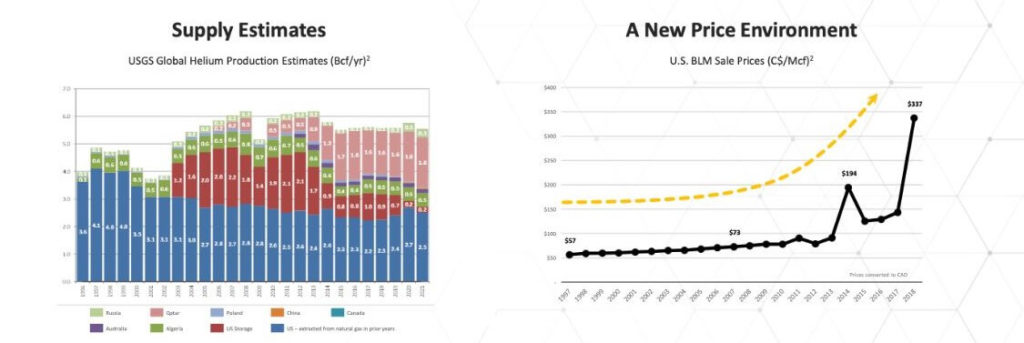

The price of liquid helium has more than doubled in the last two years, from $930 for a 100-liter dewar to $2000 today.1

The shortage of this noble gas has meant lab operators are restricted in how often they can operate certain equipment, such as scanning tunneling microscopes. And while many larger users of helium, like laboratories, have sufficient infrastructure to efficiently use and recycle helium, it is not enough to offset the decline in supply.

Helping to reduce helium’s global scarcity is Helium Evolution Incorporated (TSXV:HEVI)(TSXV:HEVI), North America’s largest holder of helium land rights among public companies, who is primed to become one of the world’s next big helium producers.

Helium is non-renewable and irreplaceable and there are no biosynthetic ways to produce an alternative to helium.2

In recent years, helium has become far more scarce since its use is predominantly for healthcare, technology, analytics, and industrial applications rather than just balloons, and helium has been called the “Most Important Resource No One is Talking About”.3

While helium balloons are regularly given away for free at birthday parties, fairs and other social events, a perfect storm of increased demand for helium with limited global capacity for production have caused what many industry experts call the ‘Helium Shortage 4.0.’4

Just months after Russian state-owned Gazprom started operateons at the ‘World’s Largest’ helium hub in 2021, things got complicated5 because it’s an off-limits jurisdiction to the rest of the world.

Making matters worse, the Federal Helium Reserve in the US, which was previously a global supplier of helium, is set to stop selling helium to the public in September 2022 and wind down its strategic helium storage.6

With all of the above, helium prices are set to soar and smart operators have proactively positioned themselves to supply the demand. Such companies include Helium Evolution and North American Helium, with the latter having privately raised $127M to execute its exploration and production plans.7

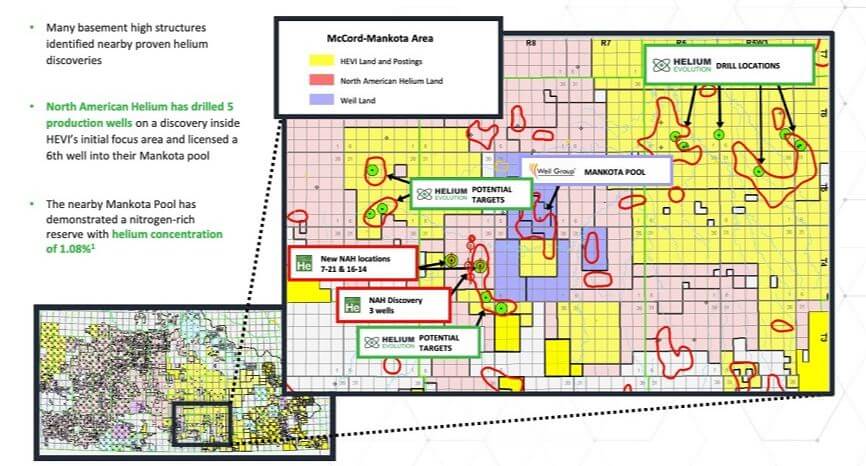

Not only does Helium Evolution (TSXV:HEVI)(TSXV:HEVI) hold land directly adjacent to and surrounding North American Helium’s discovery, but HEVI is also publicly traded, meaning investors just like you can capitalize on this early-mover advantage.

In fact, HEVI is the LARGEST publicly-traded helium landholder in North America.8

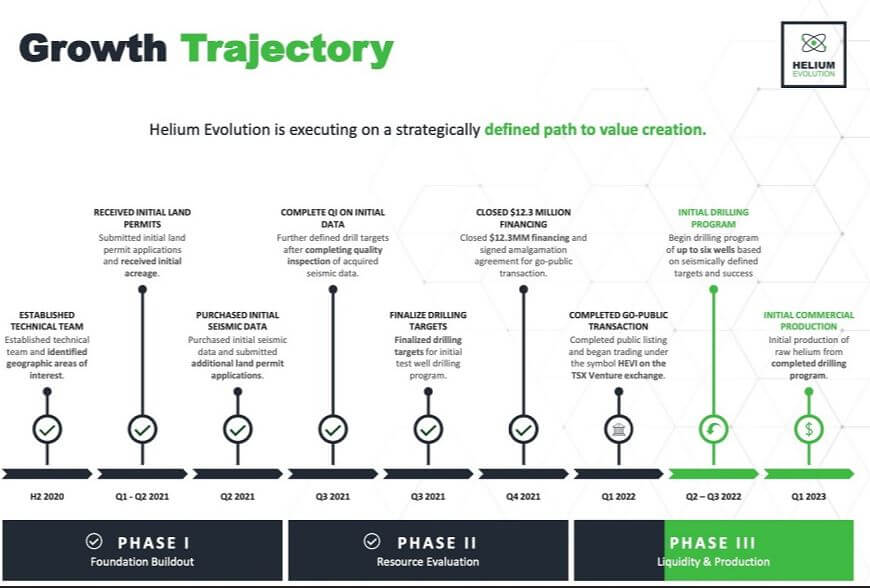

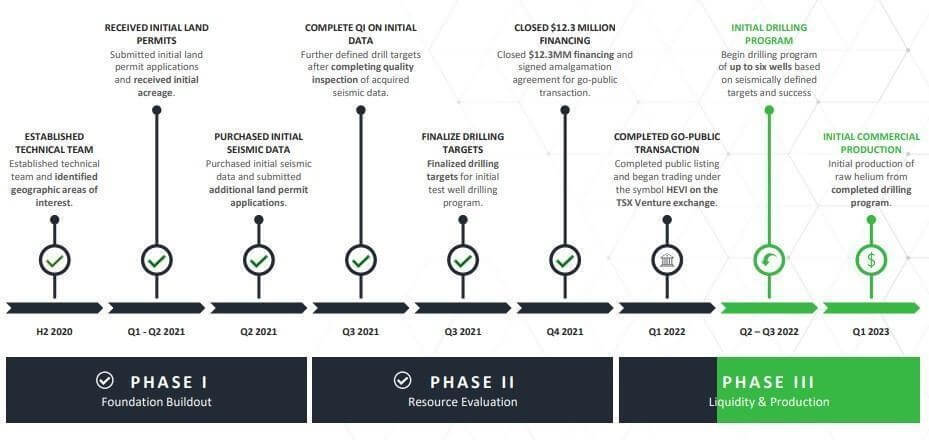

Wasting no time, Helium Evolution expects to begin its drilling program of up to six wells based on seismically defined targets and to begin initial commercial production of raw helium as early as Q1 2023—meaning liquidity and cash flow could soon be right around the corner.

Now, let’s break down the numerous reasons that Helium Evolution represents an ideal way for investors to proactively gain exposure to this unique opportunity in advance of the coming helium shortage crisis.

7 Reasons Why Helium Evolution (TSXV:HEVI)(TSXV:HEVI) is Positioned to Become one of the World’s Next BIG Helium Producers

- World-Class Land Position: Located in the resource-friendly jurisdiction of Saskatchewan, Canada, Helium Evolution holds ~5.5 million acres of permitted land directly adjacent to a recent and proven helium discovery.

- Portfolio of Prospects: Thanks to over 750km of 2D seismic data purchased to date, HEVI has identified an initial six near-term drilling targets through detailed seismic analysis, and an additional 10-12 subsequent prospects that help set the stage for a long runway of future opportunities.

- Strong Cash Position: To date, HEVI has raised $13.6 million, with more than 20% inside ownership aligning the board and management with shareholders and showing internal confidence in the operation.

- Surging Market for Helium: Through supply shortages and growing demand, a perfect storm is brewing in the helium market, laying the groundwork for Helium Evolution (TSXV:HEVI)(TSXV:HEVI) to enter the market with much-needed helium supply.

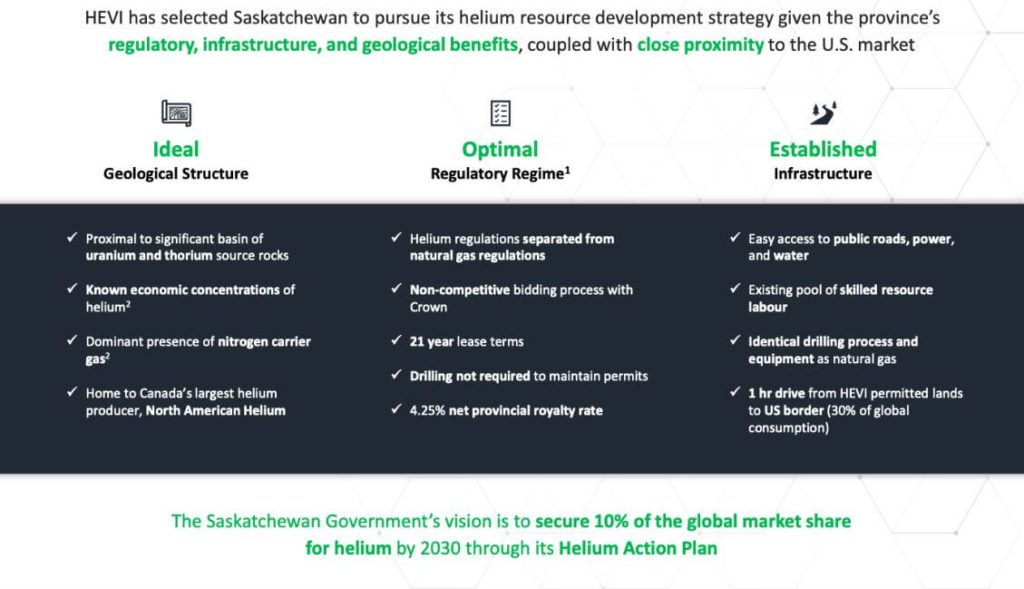

- Government Support: The Saskatchewan government has shown significant support for helium production in the province, with the goal of securing 10% of the global helium market share by 2030 through the offering of a very attractive royalty structure.

- Strong Leadership: A proven management team brings a combined over 150 years of resource development experience in the Western Canadian Sedimentary Basin. In addition, HEVI’s team is governed by a Board of Directors and Advisory Board stacked with heavyweights, including the former Premier of Saskatchewan, former President of the Canadian division of EnCana, and former CEO of FortisAlberta, FortisBC, and Maritime Electric Company.

- ESG-Friendly Solution: Unlike suppliers in certain more challenging jurisdictions such as Russia, Algeria, or Qatar where helium is a by-product of natural gas production,9 Helium Evolution’s (TSXV:HEVI)(TSXV:HEVI) potential helium reserves will be produced along with environmentally-harmless gases such as nitrogen (which exists naturally in the atmosphere), putting Saskatchewan in line to become the world’s most green source of helium.

The Booming Helium Market’s Next Producer?

It can’t be stressed enough how big an opportunity the helium market presents at this point in time. Helium Evolution is well positioned to capitalize on the current environment.

Helium prices have skyrocketed since 2019, when helium from the US Federal Helium Reserve sold at a rate of $280 per million cubic feet (Mcf). Now, wholesale prices have more than doubled to $600/Mcf and retail as high as $2,000/Mcf.10

The helium gas market and the looming shortage represents a lucrative time for investors to learn more about the helium opportunity.

Options for investors at this stage are still quite scarce, especially with the US soon cutting off sales of its reserves, and the ongoing sanctions placed on Russia – where much of the world’s helium comes from.11

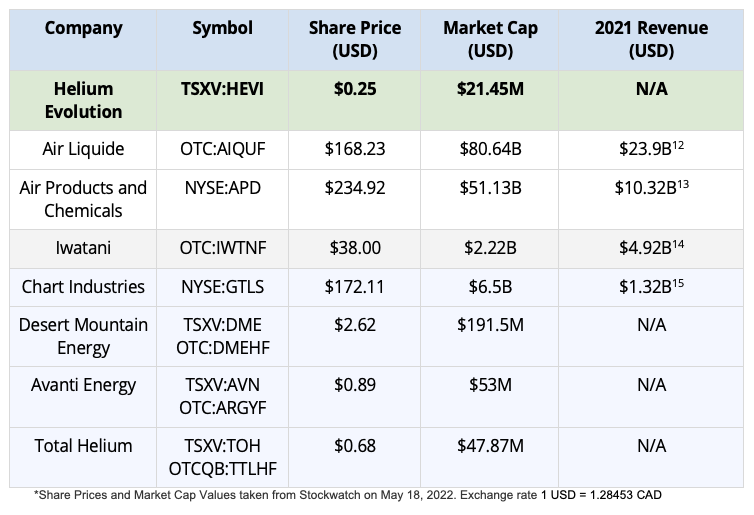

Despite this impending helium supply crunch, it’s fascinating how few publicly-trading entry points investors can actually get into.

However, of the very few players in the space, those that are producers are worth an estimated BILLIONS of dollars. This means that many of the biggest gains are already off the table.

A few of these larger companies include Chart Industries (US$6.17B), Air Liquide (US$79.5B) and Air Products and Chemicals (US$51.8B).

These valuations are supported by underlying fundamentals as each of these major players surpassed a billion dollars in 2021 revenue.

The helium landscape paints a picture of the potential opportunity that Helium Evolution (TSXV:HEVI)(TSXV:HEVI) is targeting in the near future as it is on its way to commercial production by Q1 2023.

By Q1 2023, Helium Evolution (TSXV:HEVI)(TSXV:HEVI) is Primed for Commercial Production

Location Is Everything

At the core of the Helium Evolution story is an exciting piece of real estate in a jurisdiction with a government that’s making a laser-guided effort to become a serious contributor to the helium market.

HEVI has secured approximately 5.5 million acres of permitted land in Saskatchewan, with over 750km of 2D seismic data on hand to map out their targets.

Historically, North America has represented the largest source of helium demand, with the US alone accounting for 30% of the world’s consumption.16

Right next door to Helium Evolution’s (TSXV:HEVI)(TSXV:HEVI) massive land position is North American Helium, with over 30 wells drilled to date and a $127 million raise to accelerate growth.17

An Extremely ESG-Friendly Play

Where Helium Evolution stands out is not only in its massive land position in one of the most amicable jurisdictions for helium on the planet (Saskatchewan), but also in how ESG-friendly its proposed production will be.

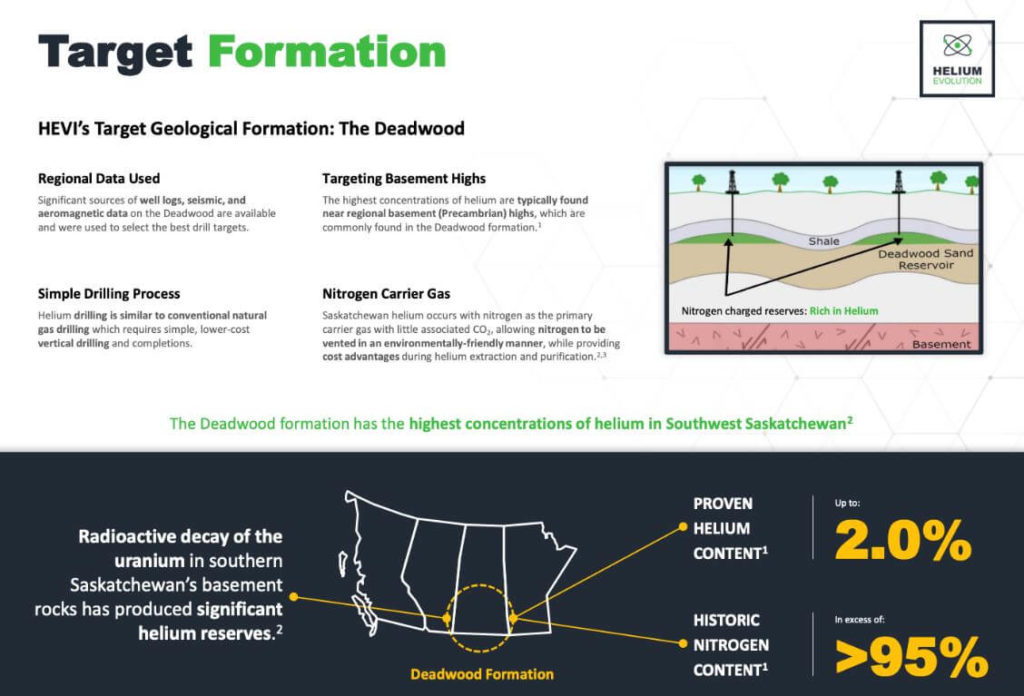

HEVI’s target geological formation, The Deadwood, has the highest concentrations of helium in Southwest Saskatchewan.18

Saskatchewan’s helium occurs with nitrogen as the primary carrier gas with little associated CO2, allowing nitrogen to be vented in an environmentally-friendly manner while providing cost advantages during helium extraction and purification.19

Helium Evolution (TSXV:HEVI)(TSXV:HEVI) potential helium supply will be sourced by drilling directly for helium, unlike most of the world’s current suppliers (Russia, Algeria, and Qatar) which source their helium as a by-product of natural gas production.

Saskatchewan: An Ideal Jurisdiction

Canada currently has the fifth-largest known helium resource in the world, trapped in considerable underground reservoirs and the country’s largest purification facility located in the province of Saskatchewan.20

Saskatchewan, as a jurisdiction, is making a strong case for becoming the world’s next helium hub, with a stated vision to secure 10% of the global market share by 2030 through its Helium Action Plan.21

The plan comes after an expansion to the Saskatchewan Petroleum Innovation Incentive (SPII) to include helium projects, including the goal of building up to 15 helium purification and liquefaction facilities.

SPII offers transferable royalty/production tax credits for innovative, made-in-Saskatchewan projects at a rate of 25% of eligible costs, including capital and operating expenditures, with up to a maximum of C$5 million in credits.

In April of 2021, North American Helium opened its $30 million Battle Creek Helium Purification Facility, the largest in Canada, which also qualified under the provincial Oil and Gas Processing Investment Incentive (OGPII).

OGPII provides qualified Saskatchewan infrastructure projects with a 15% transferable royalty credit which is based on capital expenditures, with up to a maximum of C$75 million in credits.

Under both programs, government investment follows up-front private investment.

The land base of Helium Evolution (TSXV:HEVI)(TSXV:HEVI) comes with an initial 3-year exploration term with certain minimum capital expenditure requirements and annual lease rentals, with the option to extend the initial term and take lands to a 21 year production lease.

After production begins, a nominal 4.25% net provincial royalty rate is paid to the government.

HEVI’s land position also comes with extremely favorable established infrastructure, including easy access to public roads, power, and water, as well as an existing pool of skilled labour with direct experience in resource extraction, and the site is only a one-hour drive from the US border, making future potential shipping to new markets much easier.

BONUS: One of the Directors of Helium Evolution is Brad Wall, the Former Premier of Saskatchewan.

Money in the Bank, with Skin in the Game

As noted above, the neighboring private company North American Helium raised $127 million to accelerate its growth in November 2021.22

During that same month, Helium Evolution closed an upsized $12.3 million in financing, giving the company strong financial footing to embark on its own drilling.23

To date, the Company has raised $13.6 million, of which more than 20% of HEVI shares are held by insiders.

RAPID Trajectory Towards Helium Production

With the cash on hand to get started, Helium Evolution (TSXV:HEVI)(TSXV:HEVI) is set with at least 6 drill targets initially identified based on seismically defined prospects and chance of success, with 10-12 additional targets that can be pursued subsequently.

The process for drilling helium is essentially the same as drilling for natural gas, allowing the use of the same rigs, tools, and personnel for drilling operations.24

Once a commercially viable helium reserve is discovered, the well is completed and helium production can soon follow, provided processing facilities are also in place.

Helium Evolution (TSXV:HEVI)(TSXV:HEVI)anticipates initial commercial production of raw helium will begin in Q1 2023.

Powerful, Established Leadership Team

For a project such as new helium production to succeed, not only is having talent in resource development a major advantage, but regulatory connections are also needed.

Helium Evolution (TSXV:HEVI)(TSXV:HEVI) has advantages in both of these categories. The Company’s proven management team brings over 150 years of combined resource development experience in the Western Canadian Sedimentary Basin with extensive executive, engineering, geological, commercial, and resource exploration expertise.

HEVI’s leadership team includes:

Greg Robb – President and CEO: Robb has worked as a geologist in Western Canada since 1984, with broad experience in all facets of the oil and gas industry, including exploration and development, acquisitions and dispositions, and reserve valuations. Robb’s held executive-level positions in several exploration and production companies, founding Salvo Energy in 2006. Across his career he’s been involved in heavy oil, shallow gas, coal bed methane, deep basin tight gas and conventional oil and gas plays, evaluating over $500 million of acquired assets.

Patrick Mills – COO: Mills has over 30 years of executive, managerial, engineering, and operations experience in the oil and gas industry in the Western Canadian Basin. He was instrumental in the start-up of Mustang Resources and Pegasus Oil & Gas where he held senior executive and board of director positions in the corporations. In addition, Mills has held various petroleum engineering related technical and managerial positions throughout his career with companies such as Texaco, Imperial Oil, and Startech Energy.

Ryan Tomlinson – CFO – Ryan has extensive financial accounting experience with domestic and international private and public energy companies. He has been involved in start-up companies, raising equity in both the private and public markets and been responsible for structuring financial systems, including fully integrated electronic invoicing, reporting and record keeping, that enable companies to make timely operating and capital spending decisions, improve the accuracy of financial reporting, and minimize administrative processing times.

Brad Wall – Director: Wall is the Former Premier of Saskatchewan who helped lead the province to a period of record population and economic growth, export expansion, record infrastructure investment and tax reductions, while helping to earn Saskatchewan’s first-ever AAA credit rating. Wall is currently a Special Advisor of Osler, where he provides the firm’s clients with his strategic insight and guidance, particularly in relation to the energy and agri-food industries, as well as his extensive understanding of the interconnection between business, politics, and trade on a global scale.

Mike Graham – Director: Graham is the Former President of the Canadian division of EnCana (now Ovintiv) and brings over 35 years of oil and gas experience to the table. Graham served as an Executive VP of EnCana from April 14, 2005 and served as its President of the Canadian Division until February 2012. Today, he also serves on the Board of Directors of Halo Exploration and Saguaro Resources.

Phillip Hughes – Director: A leader in Canada’s energy sector for the past 35 years, Hughes has served as President and CEO of five energy companies across Canada, including Fortis, FortisAlberta, Newfoundland Power, Maritime Electric Company, FortisBC, and TransGas Limited, Saskatchewan. He has extensive North American and international experience in electrical generation, transmission and distribution, oil and gas and natural gas transmission, distribution and processing. He currently serves as Chairman of Oceanic Wind Energy Group and of Kineticor Resources. He’s also a past Officer of the World Energy Council, former Chair of the Canadian Electrical Association and former Chair of the Energy Council of Canada.

James P. Baker – Chairman: Baker brings over 40 years of resource development experience in Saskatchewan and Alberta in field operations, consulting, and executive-level positions, as well as consulting to industry and government in oil and gas, power, and paper recycling. He’s the Former Director of SaskEnergy, Hanson Engineering, and Heritage Gas, and is currently a board member of Keystone Royalty and Kineticor Resource.

Jeff Barber – Director: Barber was a co-founder and managing partner of a boutique M&A advisory firm in Calgary. Prior thereto, he was an investment banker with national investment firms and began his career as an economist with Deloitte LLP. He has served on the board of Standard Lithium Inc. since 2017 and has been an independent businessman since September 2018. Prior thereto he had been a founder, director, and Chief Financial Officer of Hiku Brands Company Ltd. since 2016. He is a CFA charterholder and holds a master’s degree in finance and economics from the University of Alberta

Heather Isidoro – Director: Isidoro has over 20 years of experience in the energy industry, the last 17 of which were focused on business development, most recently as the VP of Business Development with Pine Cliff Energy Ltd. She specializes in acquisitions and divestitures, reserves valuations, and financial modeling and is President and a Director of the Petroleum Acquisitions and Divestitures Association, and a Trustee on the University of Saskatchewan (U of S) Engineering Advancement Trust. She has a B.Sc. in Geological Engineering from the U of S, and an MBA from Athabasca University.

7 Reasons to Consider Helium Evolution (TSXV:HEVI)(TSXV:HEVI) RIGHT NOW!

- World-Class Land Position

- Portfolio of Prospects

- Strong Cash Position

- Surging Market for Helium

- Government Support

- Strong Leadership Team

- ESG-Friendly Solution

In other words, Helium Evolution (TSXV:HEVI)(TSXV:HEVI) is a company that has everything it needs to rise quickly in the marketplace! Thanks to its strong land and cash positions, its knowledgeable leadership team, and all the other benefits listed above this company presents a unique opportunity to investors.

The opportunity couldn’t come at a better time, as helium demand is increasing but quality helium plays are scarce. With the United States soon cutting off sales of its helium reserves, and the ongoing sanctions placed on Russia, companies like Helium Evolution are positioned to capture the upside potential of the current environment!

1 https://physicstoday.scitation.org/do/10.1063/PT.6.2.20220404a/full/

2 https://source.wustl.edu/2007/12/helium-supplies-endangered-threatening-science-and-technology/

3 https://www.baystreet.ca/stockstowatch/12313/Helium-The-Most-Important-Resource-No-One-is-Talking-About

4 https://www.gasworld.com/helium-markets-now-experiencing-helium-shortage-40/2022650.article

5 https://www.gasworld.com/worlds-largest-helium-hub-comes-onstream-in-russia/2021635.article

6 https://www.cips.org/supply-management/news/2022/february/helium-supply-crunch-looms-as-us-alters-storage-strategy/

7 https://www.gasworld.com/north-american-helium-raises-127m-to-execute-exploration-and-production-plans/2022234.article

8 https://www.heliumevolution.ca/wp-content/uploads/2022/05/22-04-27-Helium-Evolution-Corporate-Presentation-5Q-April-Final2.pdf

9 http://www.gazprominfo.com/articles/helium/

10 https://www.bloomberg.com/press-releases/2022-04-13/avanti-energy-confirms-major-helium-discovery

11 https://www.barrons.com/news/sanctions-on-russia-add-to-troubles-facing-global-helium-industry-01646337907

12 https://www.airliquide.com/group/press-releases-news/2022-02-16/2021-results-excellent-year-across-all-performance-criteria

13 https://www.statista.com/statistics/278158/revenues-of-air-products-and-chemicals/

14 https://www.wsj.com/market-data/quotes/JP/8088/financials/annual/income-statement

15 https://finance.yahoo.com/quote/GTLS/financials?p=GTLS

16 https://www.mordorintelligence.com/industry-reports/helium-market

17 https://www.businesswire.com/news/home/20211123005514/en/North-American-Helium-Raises-127-Million-To-Accelerate-Growth

18 Helium in Southwestern Saskatchewan: Accumulation and Geological Setting; Melinda Yurkowski; 2016

19 Global Helium Market Update; Edison Investment Research; 2021

20 https://www.saskatchewan.ca/government/news-and-media/2021/april/27/canadas-largest-helium-purification-facility-opens-in-saskatchewan

21 https://www.saskatchewan.ca/government/news-and-media/2021/november/15/government-of-saskatchewan-launches-helium-action-plan

22 https://www.businesswire.com/news/home/20211123005514/en/North-American-Helium-Raises-127-Million-To-Accelerate-Growth

23 https://www.heliumevolution.ca/helium-evolution-closes-upsized-12-3-million-financing/

24 https://northstardst.com/industry-applications/helium-exploration-northstar-dst/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Helium Evolution Incorporated (“HEVI”) and its securities, HEVI has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by HEVI) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company HEVI and has no information concerning share ownership by others of in the profiled company HEVI. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to HEVI industry; (b) market opportunity; (c) HEVI business plans and strategies; (d) services that HEVI intends to offer; (e) HEVI milestone projections and targets; (f) HEVI expectations regarding receipt of approval for regulatory applications; (g) HEVI intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) HEVI expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute HEVI business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) HEVI ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) HEVI ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) HEVI ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of HEVI to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) HEVI operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact HEVI business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing HEVI business operations (e) HEVI may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Helium Evolution Incorporated.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Helium Evolution Incorporated and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Helium Evolution Incorporated or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Helium Evolution Incorporated. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Helium Evolution Incorporated’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Helium Evolution Incorporated future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Helium Evolution Incorporated industry; (b) market opportunity; (c) Helium Evolution Incorporated business plans and strategies; (d) services that Helium Evolution Incorporated intends to offer; (e) Helium Evolution Incorporated milestone projections and targets; (f) Helium Evolution Incorporated expectations regarding receipt of approval for regulatory applications; (g) Helium Evolution Incorporated intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Helium Evolution Incorporated expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Helium Evolution Incorporated business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Helium Evolution Incorporated ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Helium Evolution Incorporated ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Helium Evolution Incorporated ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Helium Evolution Incorporated to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Helium Evolution Incorporated operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Helium Evolution Incorporated business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Helium Evolution Incorporated business operations (e) Helium Evolution Incorporated may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Helium Evolution Incorporated or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Helium Evolution Incorporated or such entities and are not necessarily indicative of future performance of Helium Evolution Incorporated or such entities.