Why one small company just hit the sweet spot. And fast-acting investors stand to make an absolute fortune.

If you’ve wondered why the rich get richer while the poor get poorer, now’s the perfect example of why. Smart money understands how converging economic forces are about to send the price of gold into orbit. Already yellow metal is on the move.

The price of gold went up by 32% this year, hitting $2,000 per oz. As a result, gold got ranked as one of the world’s best-performing assets and became an attractive investment for many investors. But as experts suggest, gold is still cheap for now. It’s projected to hit $3,000-$7,500 per oz in the near future.

For the first time in a long time, international headlines have been focusing on gold. The worldwide popular media can barely keep up:

new record after

blowing past

$2,000 per ounce.”

prices to

hit $5,000,

economists say.”

ultimately

soar to $7,500

or more”

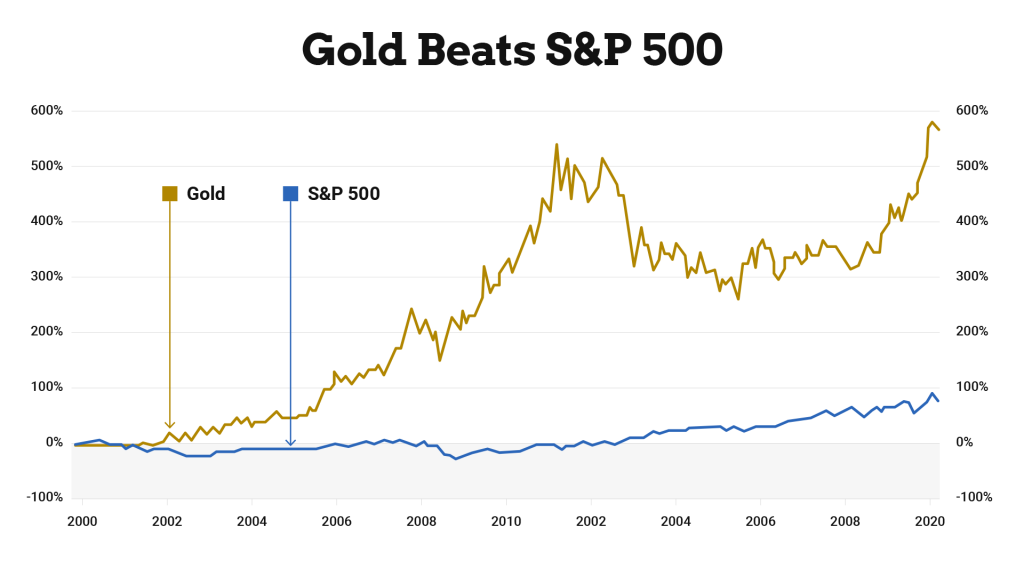

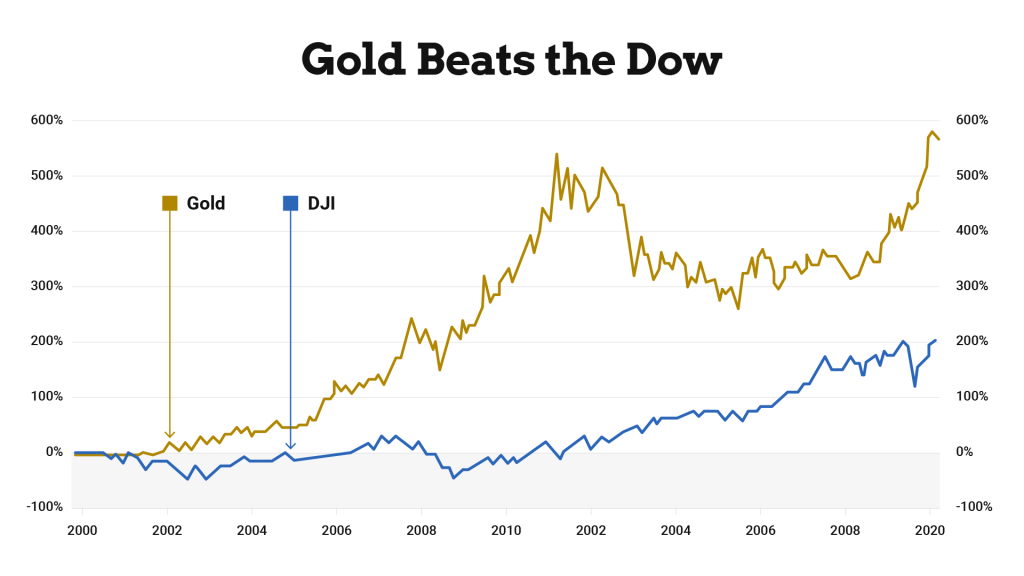

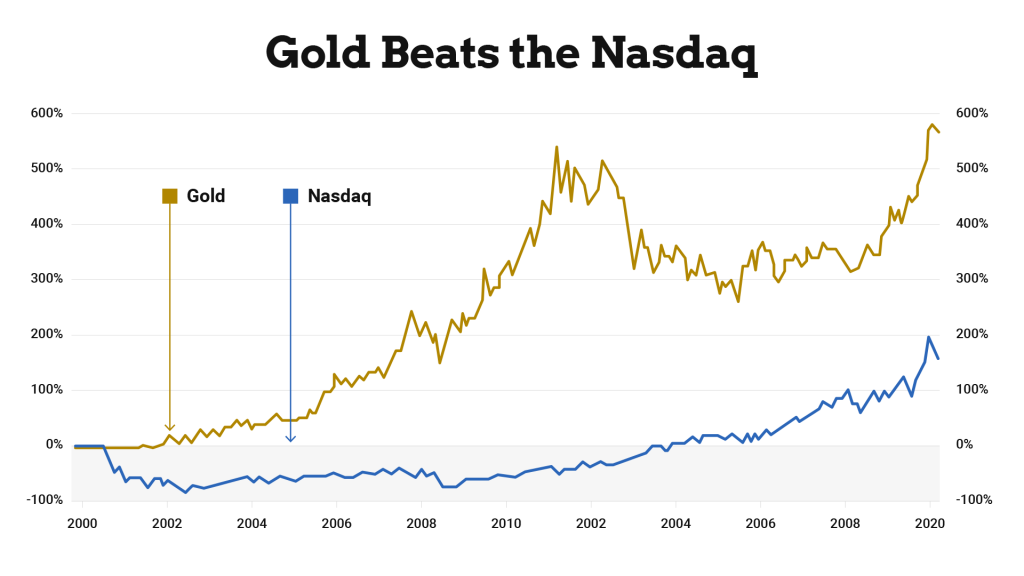

If we take a look at historical data, we can see that gold has outperformed stocks by a factor of nearly 4 to 1 over the past 20 years.

But look at this shocker. Gold has even outshined the tech-heavy Nasdaq by a stunning 6 to 1!

These charts tell a story that the public has missed for years now. One that, if you heed, could reward you handsomely.

While the public at large has missed it, the biggest players in finance haven’t.

Bloomberg highlighted that central banks are purchasing gold at the fastest pace we’ve seen in half a century.

BUT WHY ARE THEY DOING THAT? To answer that, let’s start by reviewing what happened back in the ’70s that caused gold to soar.

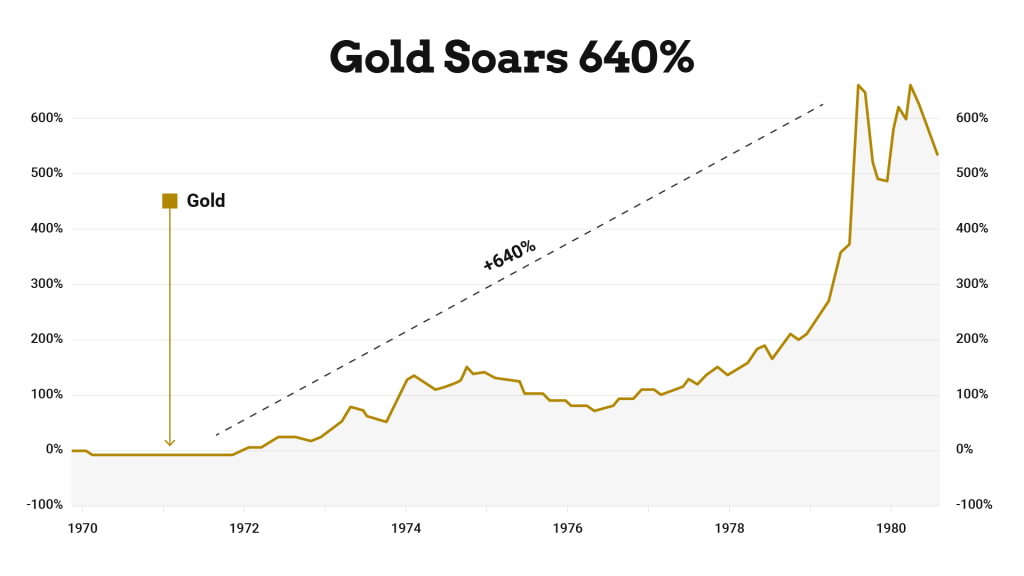

Initially, every American owned gold, using it as a regular currency. Then in 1933, President Roosevelt devalued it and banned owning gold. However, central banks still had gold reserves to settle their accounts.

In 1974, president Gerald Ford lifted the ban on gold, and millions of Americans rushed to own gold again. As a result, gold prices soared from $35 an ounce all the way up to $850.

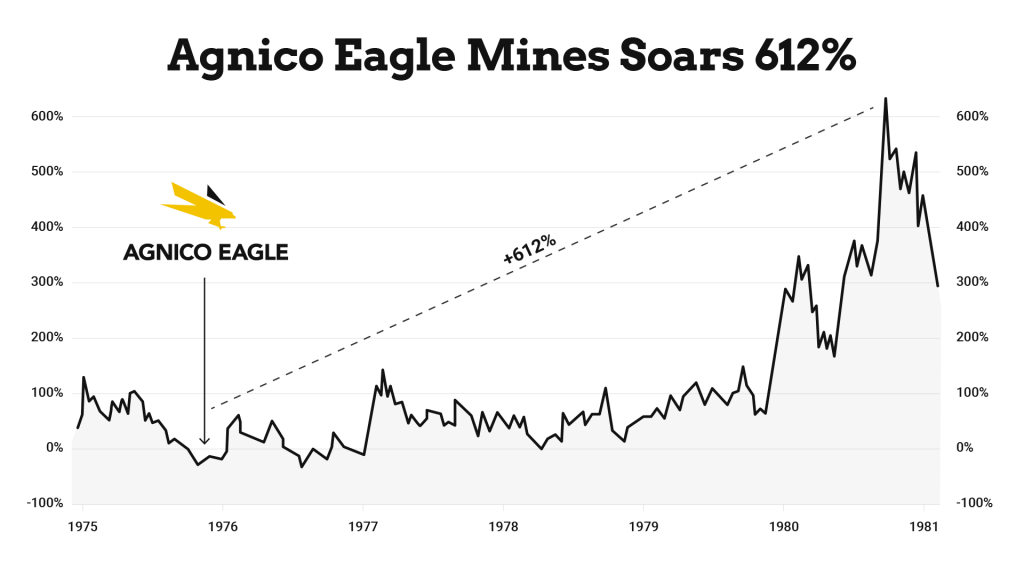

Soaring gold prices caused gold stocks to go crazy. For example, Agnico Eagle Mines shot up by 612%.

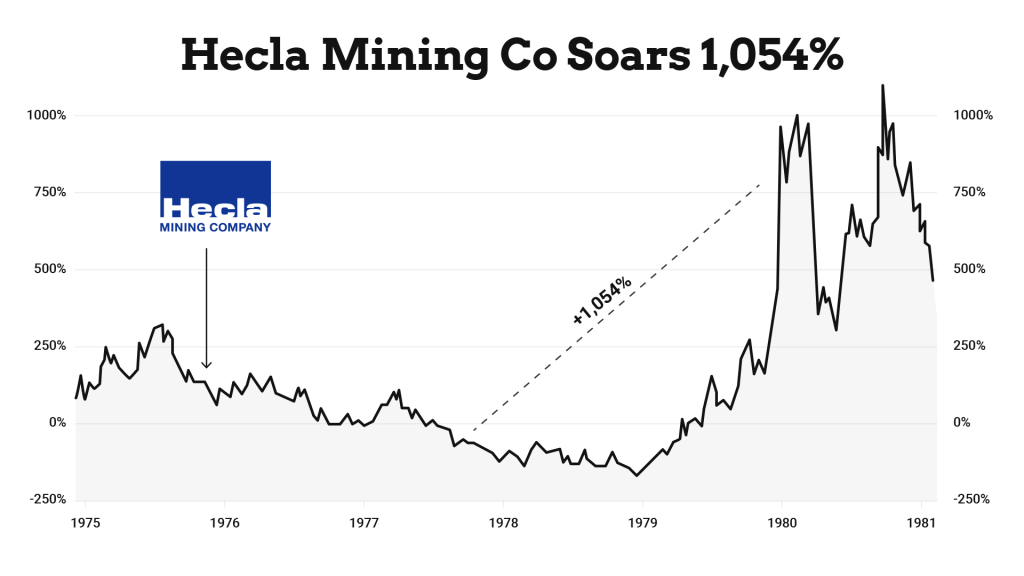

Hecla Mining Co. skyrocketed 1,054%.

That’s 10 times your money.

One of the few people publicly pounding the table on gold is a multi-millionaire and legend of the gold market – Doug Casey. He’s saying that gold is on its way into the stratosphere. Even back in 2002, he said:

“The way I see it now, gold is not only going through the roof, it’s going to the moon.”

And as he predicted, in 2020 alone, dozens of gold mining stocks have soared from 1,350% to 2,750%. We’ve even seen an explosive 8,722%.

Imagine getting on that one and making 87 times your money!

But why is gold increasing at such a fast pace? Here’s what’s happening behind the scenes, influencing the price to take off:

- > The People’s Bank of China increased its bullion reserves to a total of 62.45 million troy ounces.

- > The Central Bank of Russia got rid of 50% of its dollars to buy 8.8 million troy ounces of gold bullion.

- > Poland bought 3.2 million troy ounces in the second quarter, the most by a central bank since 2009. And that’s just a snapshot of the many nations on a gold-buying spree.

In total, over the last two years, central banks have bought 20.9 million troy ounces of gold. Now you’re probably wondering, why are the central banks on this shopping spree?

It’s about geopolitics and economics. And right now, according to Adam Glapinski, the governor of the National Bank of Poland, “gold symbolizes the strength of a country.”

Russia and China have always wanted to break the global financial system’s US dominance since the current economic system has been weaponized against them. And gold is their weapon of choice.

On top of that, nations behind the scenes are unnerved by how Venezuela hasn’t been able to repatriate their gold from London, and Germany’s repatriated bars from the US seem to be different from what their records show.

It’s not just a matter of national security, but it’s also a matter of coping with so much money floating around in the global financial system. It doesn’t matter whether a Republican or Democrat is in control of the levers of government. The printing presses are fired up and won’t stop soon.

Fed Chair Jerome Powell admitted in a 60 Minutes interview that they’re all systems go to print more money. And indeed they have – with Congress approving nearly $6 trillion in stimulus spending.

Before the pandemic, the world was drowning in debt. We’re at the tail-end of a 40-year debt super-cycle, in which all forms of leverage, government, corporate, and private, have been rising since the early 1980s. The global debt load was above $250 trillion, and the United States has been running a $1.4 trillion fiscal deficit with over $23 trillion in national debt.

We’re now at the point where for every ounce of gold minted in the US, the Federal Reserve adds $4 million to the money supply.

All of this devalues the US dollar’s purchasing power. And the devaluation of currency leads to gold breaking out. This time, we’re on the precipice of the most significant devaluation of the dollar in modern history.

And the smart money sees the writing on the wall. That’s why they’re investing in gold to grow their wealth to dizzying new heights.

As such, experts are predicting gold could reach $5,000 and even $10,000 per ounce. The needle’s already moving, and we could see mega-returns beyond what’s happened in more than 50 years.

So What’s The Best Way To Invest?

While technically you can directly invest in gold, Doug Casey, a legend of the gold market, says that if you buy raw, physical metal, you could be leaving a lot of money on the table. He says the best returns come from investing in gold stocks, shares of gold mining or exploration companies that mimic the price of gold.

If the price of gold goes up, shares of these companies tend to go up and investors profit by receiving dividends or selling them to other investors for quick gains.

How to Choose a Gold Stock to Invest In?

The best way to invest successfully and eliminate the risks is to know what you’re doing and why. That’s why the last thing you should do is to go out and buy a random stock.

To make a smart decision, you need to know a few factors about the company and its mining project. For instance, the first thing you should always look at is where the project is located. Obviously, investing in a company that is exploring on land that hasn’t proven to be beneficial is not wise.

One gold exploration company that has stood out to us due to its “dream location” is Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD).

3 Reasons Why We Like Golden Independence

-

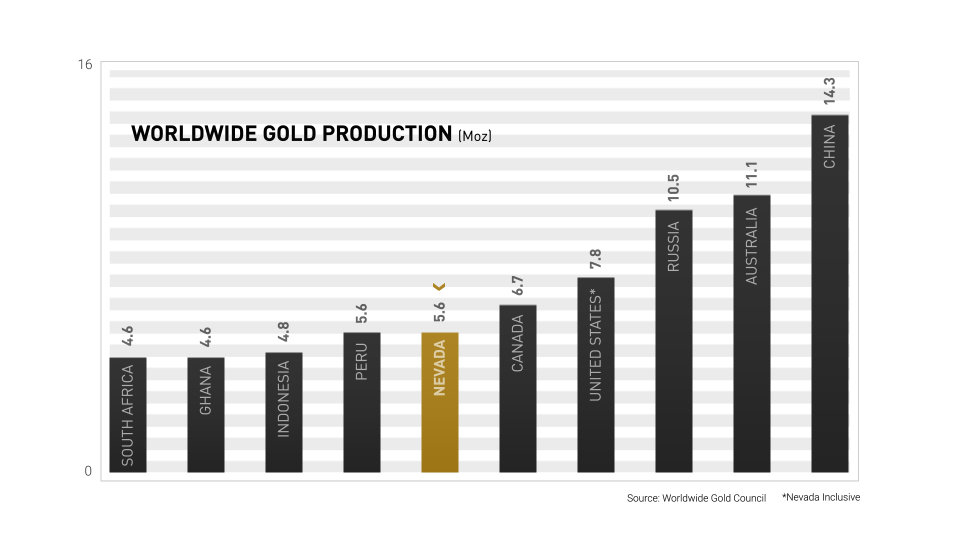

1. Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is located in the top-tier gold mining jurisdiction of Nevada, USA.

The United States is the 4th largest gold producing country in the world. Moreover, Nevada is accountable for over 70% of gold production within the United States.

Source: Golden Independence Presentation

According to the Annual Survey of Mining Companies, Nevada ranks as one of the top 3 mining jurisdictions globally. That’s why the location is attractive to most gold investors.

One of them is the mega gold project, Nevada Gold Mines, a joint venture between Barrick Gold and Newmont Gold, the world’s two largest gold producers. They’re expecting to produce 2.1 to 2.25 Moz of gold this year alone.

Golden Independence is located about a tennis balls throw away from Nevada Gold Mine’s open pit. This gives them some significant advantages, not only in mineralogy but in permitting.

Often exploration and mining companies are harassed and ultimately shut down by environmental groups. But because Golden Independence is within Nevada Gold Mines plan of operations, they can fast track development.

Another advantage is that they’re located in a well-industrialized area with road and rail access. Staff can simply drive to the mine, which is only 15 minutes away from the nearest McDonalds. This comfortable location allows the company to save its resources and focus on producing gold.

-

2. Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is right in the sweet spot, all of the upside of exploration without the downside.

Compared to similar companies at their stage, Golden Independence is ahead of its peers and already permitted. Their drill program is underway, and the property already has a historical resource of 1,072,600 ounces of gold. That’s more than some of their competitors who are even farther into the mining process.

Golden Independence is set to conclude its drilling project in a few months and evaluate the final results. It’s predicted that by the end of the project, the above-mentioned number of gold ounces could double or even triple.

-

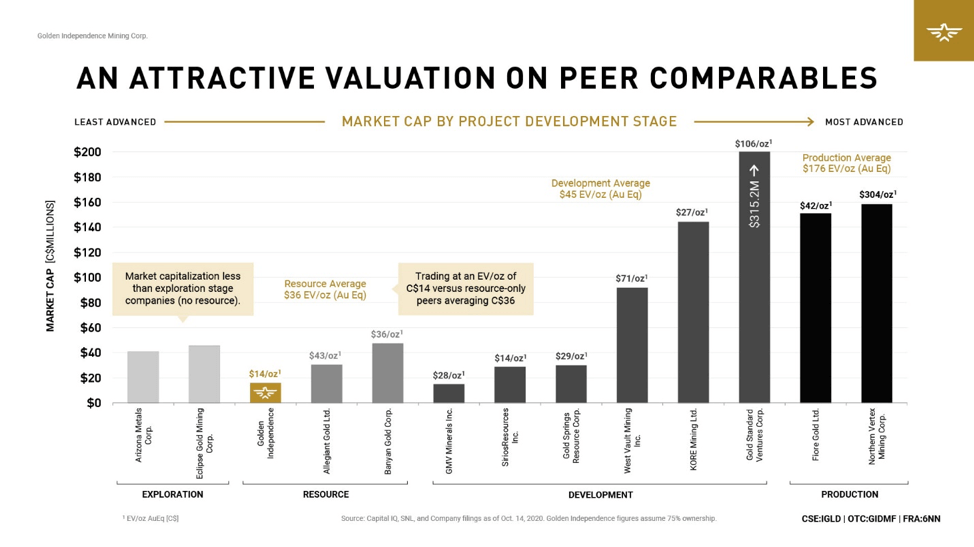

3. Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is greatly undervalued compared to its peers.

If we compare the up-to-date data, we can see that Golden Independence is already ahead of many comparable gold exploration companies valued much higher.

Source: Golden Independence Presentation

Right now, Golden Independence has a market capitalization of under C$16 million (US$11.7 million), which is a fraction of earlier-stage exploration companies with values of C$40–50 million. These are companies that do not even have defined resources and therefore are a much higher risk.

They are also grossly undervalued for the gold ounces they already have defined with a valuation of C$14 per ounce (market capitalization less cash divided by ounces) compared to resource-stage peers trading at over C$36 per ounce and development-stage peers up to C$106 per ounce. This is a relatively low valuation for Golden Independence as the company has the requisite infrastructure in place with a drill program already in progress.

Simply put, even if they find no more gold, there is still an opportunity for a significant return just by its share price catching up with the peers. As it stands now, their drill program is set to expand the resource significantly, which will only multiply shareholder returns.

What Does This All Mean For Investors?

It means that we’re currently at a very attractive entry point for Golden Independence trading at a 60% discount to its peers. But this could be just beginning. As gold soars past $3,000 an oz, $5,000 an oz and glides beyond, the payday could be extraordinary!

Six Key Takeaways:

- Gold is the best asset you can invest in times of uncertainty.

- The biggest central banker gold-spree since 1971 is happening now.

- Experts predict that gold will soon hit record highs.

- The smart money believes that we could be the beginning of the most significant gold bull market of all time. And are stockpiling gold and gold stocks in particular for the biggest potential returns.

- Golden Independence is located in one of the best gold-mining locations in the world. They’re permitted, already drilling, and have a historical resource of 1,072,600 ounces of gold – putting them ahead of their peers.

- Golden Independence stock, being undervalued compared to its peers, has the built-in potential to more than double your money. It’s also expected to double or triple its gold resources. As the price of gold goes vertical, shareholders could see a substantial return.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Golden Independence Mining Corp.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.