New Electric Vehicle Shoppers In China Are Out-Buying Americans 2:1… By 2028, it will be 7:1

Editorial Feature | August 15, 2022 | Tech

Jiuzi Holdings (NASDAQ:JZXN) primed to tap in on this fast-growing 1.4 billion consumer marketplace.

- Jiuzi Holdings showrooms could be the prime mover for thousands of EVs as an ambitious expansion program adds five more major Chinese auto brands to its sales list.

- Jiuzi’s competitive edge means it’s set up to rapidly move into China’s most prosperous and fastest-growing middle class markets, where Toyota, Tesla, and Volkswagen dealers are MIA.

- This is a bred in the bone winner… because Jiuzi’s system is hooked to China’s best-selling New Electric Vehicle (NEV) brands.

- The franchise is also three times more profitable than the big-dealer model,1which allowed the company to move from 0 to 32 showrooms in 3 years. And now through a series of acquisitions and partnerships, Jiuzi has gained access to the coveted commercial and delivery EV sectors.

The Biggest Car Market in the World

With 1.4 billion people—almost a fifth of the entire world’s population—any time the Chinese people embrace something new, they tilt the world on its axis.

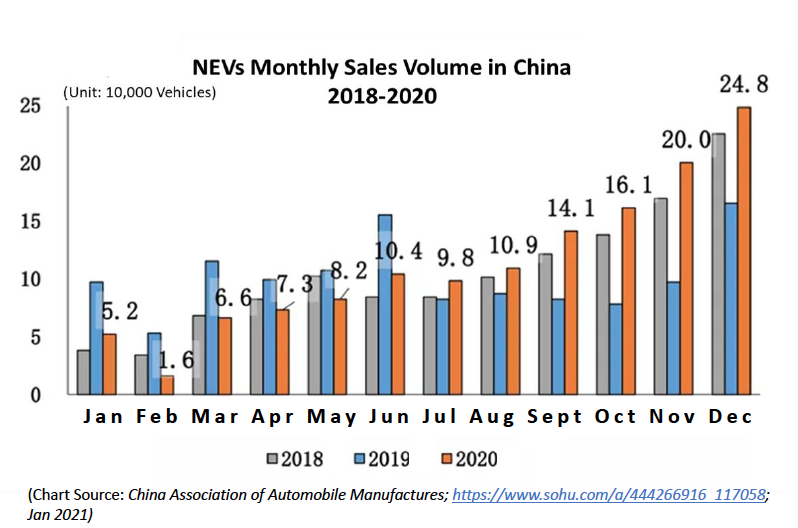

Now they’re buying new electric vehicles (NEV’s) at a torrid pace. In 2021, Chinese buyers accounted for half the NEVs sold in the entire world. And this year, Chinese customers have already doubled the number of NEV’s they bought compared to 2021.

In fact, the Chinese buy almost as many NEVs every year as Europe, North American and the entire rest of the world put together.

By 2028, Chinese buyers are expected to purchase 7 times as many NEVs as Americans, Canadians, and all other North Americans combined.

To put that in round numbers, it comes to about 8.5 million NEVs a year.

While countries around the globe are legislating the switch to NEVs, some by subsidizing buyers or automakers, some by helping businesses like battery makers build factories, China is doing ALL of that.

And as a result, the market for NEVs is unfolding much faster than anticipated. Even Ernst & Young, one of the most respected and largest business consultants in the world was caught by surprise.

E & Y made a bold estimate about NEV sales last year. Now they’re saying that projection was so far below reality that NEV’s will surpass gas vehicles five years sooner than they expected.

And it adds up to the most exciting NEV market in the world, right in Jiuzi Holdings’ back yard.

Jiuzi’s CEO, Shuibo Zhang, recently told reporters that “Since May 2022, more than twenty provinces and cities have issued new energy vehicle stimulus policies, with subsidy up to RMB 10,000 per unit.”

The interest in NEV’s in China is so hot that Tesla has raised its prices twice this year to try to tame the demand.

In the meantime, while Tesla, BMW and western brands cling to the largest cities and their shiny single-brand, showrooms, Jiuzi (NASDAQ:JZXN) has executed an end run with even greater potential.

Jiuzi has perfected its sleek all-NEV operation by opening franchises all across eastern China, specifically zeroing in smaller cities with populations under 3 million.

Jiuzi offers dozens of brands to fit buyers seeking everything from the most basic entry level to luxury vehicles.

As you can see, JZXN has no intention of taming NEV demand… it’s racing to meet it.

Target: China’s Strongest Selection of NEVs

From its inception, Jiuzi set out to capture business partnerships with the country’s flagship domestic car companies, including BYD, which happens to be the best selling NEV maker in China.i

Their expansion plan is ambitious to say the least, and covers all facets necessary for the transition to clean transportation, from private vehicles for the consumer, to commercial car rental and ride hailing, and even infrastructure development and planning.

So far this year, Jiuzi has forged a string of new deals, that expands their offerings to a total of over twenty EV manufacturers.

- They have entered into an agreement to purchase autos for sale from WM Motor Technology, the leading seller of Weltmeister EV’s. The Company expects to order about 5,000 to 8,000 EV cars from the sales agent in the next three years and become the most significant domestic distributor of Weltmeister EV cars.

- Through newly launched subsidiary, Jiuyao, Jiuzi has gained entrance to operating in the commercial online car rental and ride-hailing sectors.

- To facilitate these needs, Jiuyao then struck a deal with Zhejiang Shuke Automotive Service to purchase 200 customized and standard automobiles. Jiuyao has also entered into an agreement to acquire a 72.05% equity interest in Huizhou Jiwo, a subsidiary of top China automaker Geely Auto Group. Geely focuses on the manufacture of Geometry brand sedans and SUVs. The company is gaining acclaim for the recent launch of an innovative SUV model powered by a liquid-cooled battery that can sustain a range of 200 miles.

- They’ve also partnered with Anji Chuangxing New Energy Auto Sales to promote NEV green travel, sales, and infrastructure through the development of a convenient, country-wide rental and charging service network.

Re-engineered to Maximize Profits and Improve Consumer Buying Experience

In China, full-service car dealers like the ones we know in America are called 4S.

Jiuzi is NOT 4S. It’s dumping the auto-parts store, the repair shop, the acre-sized lots, everything that inflates overhead.

This dedicated focus strips out all the profit-eating costs and headaches that make the traditional American and Chinese 4S dealerships barely profitable.

It’s the car biz’s dirty secret. Massive lots with rows of shiny new cars tie up millions in capital. The reality is, for traditional car dealers the profit margin is brutal:

Traditional Dealers

- Net profits on each car sold—1-2%

- Gross margin—8-10%

- Each deal involves 9 workers on average

- Dealerships make barely more than a fourth of their annual profits on car sales, which is 58% of their business!

- Large stores and acre-sized lots required

- Without selling parts and offering service and repairs, traditional car dealers would lose money2

Compare that to the numbers Jiuzi (NASDAQ:JZXN) is seeing this year… numbers that the company says are getting even better:

The Jiuzi Difference

- Gross margins 73.3%

- Net margin in first six months of 2021 – $3.4 million (= 30.3%)

- Gross profits for the first six months of 2021 – $8.2 million

- Small showrooms, small lots, easily located

- All profits made on franchising and sales, not repairs

Let’s be straight, though. This comparison is to American showrooms. Figures from China are hard to get, but the word is China’s “4S” dealers are running at American margins.

Traditional 4S Dealers Are in Trouble

You may be wondering how a little-known company like Jiuzi could break into an auto industry locked up by large dealers.

The answer is this: Jiuzi is solving a problem beyond the powers of the large dealers.

You see, 4S stands for sales, service, spare parts and surveys. What that really means is these dealers represent car brands. And that means crippling red tape and corporate inertia.

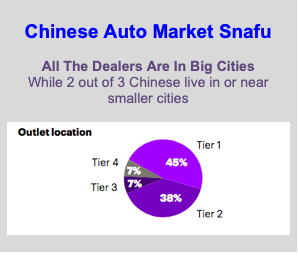

It takes a long time and a lot of capital to open a new 4S operation. Then they’re locked into big cities because that’s where their automaker owners feel secure. As such, they’re missing China’s hottest growth pockets—the Tier 3 and 4 smaller cities.

When all that’s done, a new 4S dealer might not be a moneymaker, with market oversaturation being a key factor.

When the first 4S opened in 1999, that wasn’t a concern, but now there are 30,000 4S dealers in China.3 And as a result, they’re making a tenth as much profit per car as they used to… around 70 renminbi ($11).4

Jiuzi’s New Dealer Model Cuts the Hassle for Everyone

That’s exactly why entrepreneurs have been so eager to launch their NEV venture with Jiuzi Holdings (NASDAQ:JZXN). They can set up faster, achieve a higher profit margin, and they aren’t required to conduct repair operations. In fact, Jiuzi’s plan is so lean and well tuned that a new franchisee company can set up a showroom and start selling cars at a profit within 10 months.

There’s real proof this approach is succeeding… In the last six months Jiuzi expanded its showrooms by 40%.5

Plus Jiuzi gives its franchisees full access to sell more than one brand… something these dealers can proudly offer every level of buyer.

Jiuzi has direct contracts with China’s top selling NEV brands, including BYD, the best-selling brand in China, Chery, Geely, Letin and more. It’s also in talks with another 12 brands to add to its stable.6A

Four of these brands signed on this summer. You can expect to see more follow as the year unfolds.

With choices like that, these small franchise dealers can compete easily with large operation tied to a single brand.

That’s a competitive edge no 4S dealer can match.

Jiuzi itself starts making money from the beginning on every new showroom. It’s new dealers pay an initial franchising fee up front. Then for as long as they stay in business, royalties are paid on every car they sell.

Franchisers may be common in restaurant stocks. There are thousands of McDonalds and Yum! brand millionaires walking around.

But there’s been nothing of this kind auto services sales until JZXN.

Investors Rarely Get a Shot at Numbers Like These

Just look at the leaders. You don’t see Jiffy Lube, Aamco, Big-O Tires, or Midas Muffler on the stock exchange. They are all franchises.

Jiffy Lube is an example of how powerful franchising is at churning money… Jiffy has over 2,000 franchise stores. There may be 20,000 workers wearing Jiffy Lube shirts—but they’re not parent company employees. The franchisees hire and pay them.

Jiffy corporate employs less than 500 people7. And rakes in $4.1 billion a year in revenues without managing a single oil change. Every time a franchiser makes money, it sends 3% to Jiffy… in addition to $200,000 to $300,000 up front to buy into the franchise.8

That’s the kind of business model Jiuzi (NASDAQ:JZXN) is taking part in. Numbers like that push EPS continually higher.

JZXN's Franchising Approach Lowers Corporate Overhead, Raises Earnings Potential

Up-front franchise fees, royalties on every car sold… together they make Jiuzi a veritable cash flow machine.

And you should expect that to mean cash flow positive and bottom-line profitable.

This is the perfect point to do your due diligence, because Jiuzi has completed and paid for its years of pre-launch planning and development. Now the businesses are out there, on the street.

And from here on, the faster Jiuzi grows, the faster it has the money for more growth.

There will always be costs and new developments ahead in a thriving business, but Jiuzi should have no trouble keeping them in line.

As for the biggest costs… the franchisee bears almost all:

- Franchisees find their property

- Negotiate the lease

- Hire personnel and operate the business

- Provide the capital for furniture and fixtures

Jiuzi (NASDAQ:JZXN) gives them the support of a recognized name for integrity:

- Conducts orientation and training to be sure the franchisees know how to succeed.

- Designed a showroom model that works in operations anywhere between 5,000-20,000 square feet, making it a good business prospect for many more potential franchisees. (A 4S showroom, lot, store, and repair service can run to 80,000 square feet, which is hard to find in some cities). It will continue to control the look and feel of dealerships to maintain brand quality.

- Establishes the partnerships with auto manufacturers so its franchisees can sell high-prestige and popular brands—relieving each franchisee from the long, grueling process of contracting with car brands themselves.

- Designs and delivers all the showroom and dealership lettering, signage, and major fixtures so Jiuzi dealerships are easily identified and uniform.

Focus on Tier 3 and 4 Cities Opens Path to Speedy Expansion.

Another thing Jiuzi is doing right is staying the heck out of big cities.

It doesn’t need the high costs, scarce spaces, heavy regulations and restrictions of Tier 1 cities like Beijing, Shanghai and Guangzhou to find millions of customers.

It doesn’t need the high costs, scarce spaces, heavy regulations and restrictions of Tier 1 cities like Beijing, Shanghai and Guangzhou to find millions of customers.

At present, China’s largest cities have 86% of all car dealerships.9

There’s no good reason to wade in there when….

Millions of customers are waiting in Chinas Tier 3 and Tier 4 “small” cities. 10

“Small” is a relative term. This is China. The population in a Tier 3 Chinese city runs from 150,000 to 3 million people. There are almost 300 cities this size in China, and many of them would count as “big” cities in the US.

Every Tier 3 City in China is bigger than every US city except Los Angeles and New York City.

Even a Tier 4 small city in China has a population to equal American cities like Topeka, Pasadena, Cedar Rapids, New Haven, Abilene, Ann Arbor, or West Palm Beach…. Cities big enough you probably don’t need anyone to tell you they’re in Kansas, California, Iowa, Connecticut, Texas, Michigan or Florida.

Jiuzi Partners With CPT To Make NEV A Reality

When it comes to the practicality of shifting to an electric vehicle, potential buyers have one major concern: battery charge distance.

How far a car can operate before it needs recharging is a hurdle for many. Lack of charging stations is another. And at-home charging is impractical in most of the cities in China because drivers don’t have garages or personal parking spots.

To solve this and encourage buying, Jiuzi is cooperating with China Petroleum Technologies (CPT). The company intends to invest $200 to $500 renminbi in a program to build battery swap stations and battery management systems across China.

CPT and Jiuzi expect to renovate as many as 500 existing gas stations over the next three years.

No Plug, No Problem— Battery Swap Stations Should Bring More Money to Jiuzi’s Bottom Line

A battery swap solves the problem of spending hours waiting for a spent battery to recharge. Instead, technicians remove one battery and swap in a fully charged one within minutes.

A battery swap solves the problem of spending hours waiting for a spent battery to recharge. Instead, technicians remove one battery and swap in a fully charged one within minutes.

Almost as fast as driving to the hardware store to get a new propane tank for your gas grill, and probably with less hassle.

CPT will build these stations in Jiuzi’s sales channel, which will encourage NEV buyers to go all-electric in a broader swath across the country.

Jiuzi calculates that even a single 25-battery outlet working at half its capacity, would generate $1-2 million renminbi profit per year.

Some stations will be larger, but multiply that times 300 stations…imagine some being used more heavily. This battery endeavor alone has the potential to add significantly to Jiuzi’s bottom line within a few years.

Smart Promotion Breeds Momentum

Is Harley Davidson the best motorcycle in the world? Many would doubt that, but in the 1980’s, its Harley Owners Group—HOG—promotions pushed it to iconic, must-have status.

Harley’s HOG program made owners a community and gave them special events.

Jiuzi is doing something similar with its own New Electric Vehicle Life Club. Jiuzi is sponsoring social events, driving tests, charity drives and seminars to promote NEVs and itself.

It’s a smart move, because word of mouth recommendations and a good brand image will help drive sales.

That’s just one more reason to believe that Jiuzi Holdings (NASDAQ:JZXN) is on its way to becoming one of the most important auto dealers in China and the best stock you are likely to find this year.

Take a good look at the potential and make your move.

8 Reasons Jiuzi Holdings (NASDAQ:JZXN) Should Be On Your Radar Today

- Sweet Spot—Already Proven but Just Begun. It’s been a mere four years since Jiuzi Holdings (NASDAQ:JZXN) opened its first prototype showroom. Two years ago, it had 18-locations. This past spring, the number reached 37. And now Jiuzi is ready to expand at an even faster pace. That was the main reason JZXN came to the market—so it can grow even faster than it has in the past.The business is already proving itself, but still small enough for you to enjoy a long rise ahead.

- Open Road to Expansion. There are no practical limits how fast Jiuzi can spread across China because franchisees do all the prep work of locating and setting up a property and hiring staff. Jiuzi doesn’t need to use its own staff for that. Or its own capital. Franchise fees cover the costs of setup, training, and showroom design.

- Success Perpetuates Success. The company gives new franchisees everything they need from bookkeeping and loan support to showroom looks and access to cars from top automakers. It’s already worked in 37 outlets so far. From here on it’s easy repetition.

- Small Is Beautiful. Big cities are more trouble to navigate and more expensive. Tier 3 and 4 cities have growing middle class buyers ready to plunk down the cost of a car. Jiuzi’s network of franchises will be located in these underserved areas. It means easier setup, hordes of customers waiting, and fatter profit margins.

- The Attraction of Big Margins. Jiuzi franchisees are entrepreneurs with choices. On one hand, there’s the usual 4S dealer where they can work hard, invest millions and hope to make 2% profits. Or there’s Jiuzi, where their work pays off with profits that are at least 4 to 5X richer. And they begin rapidly as a Jiuzi dealership can be up and running within 10 months from dream to reality.

- Quality Assured. Jiuzi has the whole package. It chooses dealership colors and signage, indoor displays and advertising. So every outlet looks great. Beyond that, Jiuzi supports its franchisees with training, loan platforms, and access to coveted car brands. Everything stays on track all the way.

- You Get a Fair Share. Jiuzi just listed on NASDAQ with 21 million shares outstanding. That means investors are getting reasonable pieces of the business… enough so these shares can show significant earnings.

- Value, Growth, Momentum… It’s All Here. If you’re a value hunter, Jiuzi is at a ridiculously low PE of 4.8 (Yahoo Finance, as of Dec. 20, 2021). If you want growth, Jiuzi went from 0 to 37 showrooms in three years and is starting to move even faster. We expect earnings to follow that same upward curve. And if it’s momentum you’re after, what could be better than a stock that just listed on the Nasdaq as it expands its brand catalog and reach across China?

Take a Look Today at China’s Biggest Growing NEV Industry, and Specifically Jiuzi Holdings (NASDAQ:JZXN)

You should take any investment seriously. Dig in to Jiuzi. Look at its numbers. Consider its potential. Think about how it fits your investment goals.

Show your broker everything you learned. We’re confident you will find that the Jiuzi numbers and potential stand up.

But make your decision soon, because Jiuzi is still a very inexpensive stock. That makes it a rarity among stocks in this price range, and it’s unlikely to last.

1https://www.thefreemanonline.org/car-dealership-profit-margin/ JZXN gross margin is 73.3% per investor deck for first six months of 2021. Traditional US car dealers have a gross margin around 26% on new cars, net profit 1-2%.

2https://www.thefreemanonline.org/car-dealership-profit-margin/

3https://inf.news/en/auto/da645d9a290ab19b96e10d254121c96d.html

4Average net margin is 1-2% of sales price. See thefreemanonline article above.

5https://www.prnewswire.com/news-releases/jiuzi-holdings-inc-provides-comments-on-recent-policy-and-gives-updates-on-business-operation-301418289.html

6https://www.prnewswire.com/news-releases/jiuzi-holdings-inc-provides-comments-on-recent-policy-and-gives-updates-on-business-operation-301418289.html

7https://www.linkedin.com/company/jiffy-lube-international

8https://www.franchisehelp.com/franchises/jiffy-lube/

9https://www.accenture.com/_acnmedia/PDF-147/Accenture-Study-The-Future-of-Automotive-Sales-in-China.pdf

10https://www.statista.com/statistics/278566/urban-and-rural-population-of-china/ Per CNBC: https https://www.cnbc.com/2019/04/01/china-economy-smaller-cities-offer-hopes-of-growth-amid-slowdown.html 70% of China’s population lives in smaller cities and areas account for . Rounded down to 2 out of 3 (66.7%) as easier to understand than 7 out of 10.

ihttps://www.nytimes.com/2021/12/22/business/china-catl-electric-car-batteries.html

IMPORTANT NOTICE AND DISCLAIMER — PLEASE READ CAREFULLY!

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Jiuzi Holdings (“JZXN”) and its securities, JZXN has provided the Publisher with a budget of approximately $40,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by JZXN) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company JZXN and has no information concerning share ownership by others of in the profiled company JZXN. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to JZXN industry; (b) market opportunity; (c) JZXN business plans and strategies; (d) services that JZXN intends to offer; (e) JZXN milestone projections and targets; (f) JZXN expectations regarding receipt of approval for regulatory applications; (g) JZXN intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) JZXN expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute JZXN business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) JZXN ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) JZXN ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) JZXN ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of JZXN to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) JZXN operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact JZXN business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing JZXN business operations (e) JZXN may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Jiuzi Holdings.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Jiuzi Holdings and has no information concerning share ownership by others of any profiled Jiuzi Holdings. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Jiuzi Holdings or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Jiuzi Holdings. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Jiuzi Holdings’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Jiuzi Holdings future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Jiuzi Holdings industry; (b) market opportunity; (c) Jiuzi Holdings business plans and strategies; (d) services that Jiuzi Holdings intends to offer; (e) Jiuzi Holdings milestone projections and targets; (f) Jiuzi Holdings expectations regarding receipt of approval for regulatory applications; (g) Jiuzi Holdings intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Jiuzi Holdings expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Jiuzi Holdings business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Jiuzi Holdings ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Jiuzi Holdings ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Jiuzi Holdings ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Jiuzi Holdings to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Jiuzi Holdings operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Jiuzi Holdings business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Jiuzi Holdings business operations (e) Jiuzi Holdings may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Jiuzi Holdings or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Jiuzi Holdings or such entities and are not necessarily indicative of future performance of Jiuzi Holdings or such entities.