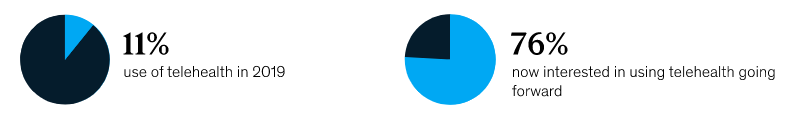

PATIENTS can’t get enough of telemedicine (or “telehealth” as some call it).

CV-19 and the pre-existing trend toward remote healthcare have made sure of that.

Now INVESTORS can’t get enough of telemedicine too.

As investment in the telemedicine space has been supercharged at every level – angel, early-stage, startups, and M&A – all at once! 2

The Teledoc/Livongo merger in August 2020 alone was worth $18.5B.3

Now Teledoc’s stock is up by over 256% between April 15, 2019, and April 15, 2021 4

But while telemedicine in GENERAL is on fire, some believe the specific sector with the big revenue potential is online virtual pharmacies.

That’s where the real money could be…

Amazon knew early on that the online pharmacy sector could be profitable back in 2018 by buying PillPack for US$753 million.5

Then there’s the Canadian market, which is huge in its own right. With $264B in healthcare spending overall, Canada’s pharmacy market is worth $47 billion.6

But while there’s over 10,000 pharmacies in Canada, only a handful have an online delivery model!

That’s what you call serious potential for first-mover advantage for a fully online delivery model…and a major market opportunity inside what could be a blue-sky industry.

Which is why recently-listed Mednow Inc. (TSXV:MNOWTSXV:MNOW) – Canada’s only publicly-traded virtual pharmacy – represents a unique opportunity. Not just for investment directly in the pharmacy sector, but also as both a digital and retail pharmacy disruptor.

Filling Canada's Online Pharmacy Gap

Mednow (TSXV:MNOWTSXV:MNOW) was quick to realize that while telemedicine is here to stay, patients see their pharmacists up to 10x more frequently than their family PHYSICIANS.7

Which makes a lot of sense, especially when you look at the stats for Canada’s fastest growing age segment – seniors, according to a 2016 report by the Canadian Institute for Health Information:8

- Seniors were the biggest users of prescription medications (40% of national total)

- 7% of seniors were prescribed 5 or more medication classes

- 5% of seniors were prescribed 10 or more

- 4% of seniors were prescribed 15 or more

That’s a lot of prescriptions. Then you have to add in all the other Canadians too.

But CV-19 and social distancing have thrown a serious wrench into the old-school model where PATIENTS go to the pharmacy.

That’s why Mednow’s (TSXV:MNOWTSXV:MNOW) model of bringing the pharmacy to the patients is so disruptive.

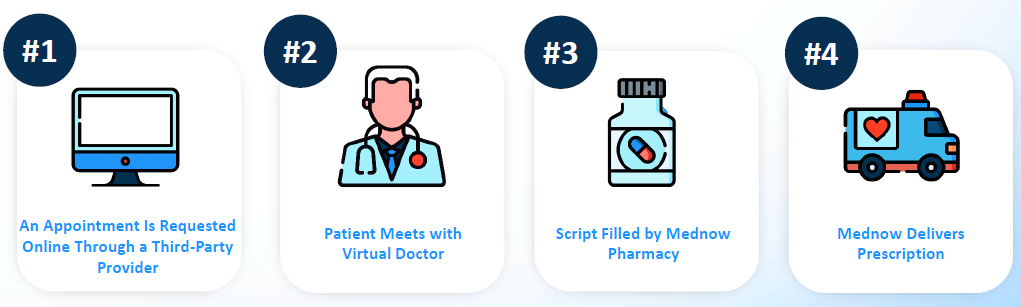

The really important thing to note here is that Mednow (TSXV:MNOWTSXV:MNOW) isn’t yet another dime-a-dozen telemedicine play with no differentiators.

Instead, it’s a fully-licensed and accredited virtual pharmacy that also happens to offer telemedicine services to round out its customer experience.

Mednow (TSXV:MNOWTSXV:MNOW) is on a mission to become a household name known for improving healthcare access.

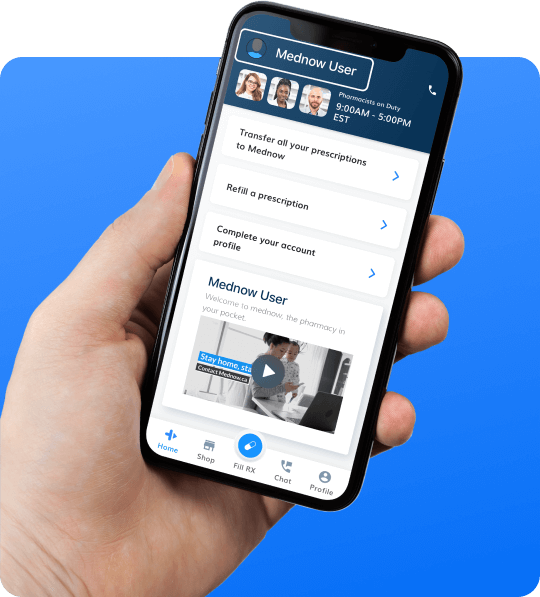

Helping them achieve that mission is an impressive list of disruptive services, including:

- Free, contactless same-day and next-day delivery of prescriptions right to the patient’s doorstep

- User-friendly interface for easy upload, transfer, and refill of prescriptions

- PillSmart™ medication management system that organizes each patient’s pills by dose in an easy-to-use pouch sorted by day and date

- Karie home personal health companion that organizes, schedules, and dispenses pills with one-button technology, ensuring that patients are taking the right meds at the right time

Mednow’s (TSXV:MNOWTSXV:MNOW) unique pharmacy-based model has been key to raising the money it needs to scale. The Company raised C$6.5M in a Q3 2020 seed round.9 Then it recently went public in early March with a $37M upsized IPO.10

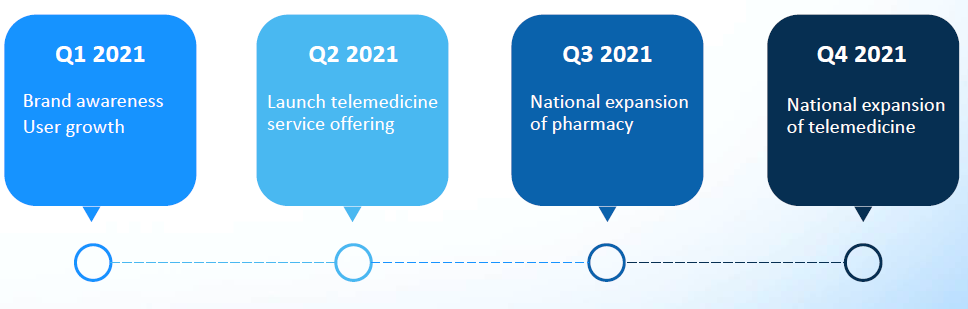

With the net proceeds received from the Company’s recently completed financings, Mednow’s #1 near-term focus is adding fulfillment centers across Canada with the goal of achieving national coverage by the end of 2021.

Mednow’s (TSXV:MNOWTSXV:MNOW) two recent announcements signify that the Company has achieved “a significant operational milestone in advancing its national expansion strategy.”11 The Company just filed an application for a pharmacy license with both the Manitoba College of Pharmacists and the Nova Scotia College of Pharmacists, meaning that, subject to receiving approval, Mednow can add Manitoba and Saskatchewan, as well as Nova Scotia, to its distribution platform once its Manitoba and Nova Scotia fulfillment centers are up and running, targeted to take place in Q3 2021.

Mednow (TSXV:MNOWTSXV:MNOW) is building its own Silk Road. The further it reaches across the country, the more money it can tap into from prescription fulfillment.

Think of it this way. Piece by piece, Mednow is building its national footprint in the hopes of securing big-name clients from coast to coast who want to help their employees during this unprecedented health crisis – something that in all likelihood is going to become the “new normal”.

Best of all, its team is stacked with experts and operators that can execute.

Mednow’s (TSXV:MNOWTSXV:MNOW) co-founders are also co-founders of CarePharmacies.ca, the largest pharmacist-controlled independent pharmacy chain in Canada with over 50 locations from coast to coast.

Mednow’s (TSXV:MNOWTSXV:MNOW) co-founders are also co-founders of CarePharmacies.ca, the largest pharmacist-controlled independent pharmacy chain in Canada with over 50 locations from coast to coast.

This +15-year proven track record gives Mednow a solid blueprint that will help it capitalize on the underutilization of technology in the pharmacy industry.

Plus, PricewaterhouseCoopers added Mednow to its all-important Canadian digital health market map, naming the Company as one of the prominent online pharmacies for the Patient segment.12

With patients flocking to digital healthcare solutions and, to the Company’s knowledge, no current serious threat from Canadian virtual pharmacy competitors to speak of, Mednow (TSXV:MNOWTSXV:MNOW) is very well-positioned to capture first mover advantage and potentially deliver some impressive shareholder value in 2021.

- Funding and market attention is driving digital healthcare stocks, generally

- Big gap in Canada’s on-demand virtual pharmacy market

- Mednow (TSXV:MNOWTSXV:MNOW) is Canada’s first publicly traded virtual pharmacy with a recent $37M IPO

- Differentiated from generic telemedicine companies & equipped to disrupt the pharmacy sector

- Free same-day and next-day delivery of medications to doorstep

- On a mission to extend market reach across Canada in 2021

- PillSmartTM system and Karie device help improve medication adherence; these type of products aren’t readily available at most pharmacies, allowing Mednow (TSXV:MNOWTSXV:MNOW) to stand out above the rest

- Team members are also co-founders of CarePharmacies.ca and grew previous venture to $150M in revenue

Telemedicine Alone Lacks a Differentiator

Healthcare is undergoing nothing short of a revolution thanks to CV-19 and the trend of consumers adopting remote, tech-enabled services like DoorDash.

We’ve already seen how that revolution resulted in $14.8B pouring into telemedicine last year alone (up 66% YoY),13 with the biggest story being the $18.5B Teledoc/Livongo merger.14

We’ve already seen how that revolution resulted in $14.8B pouring into telemedicine last year alone (up 66% YoY),13 with the biggest story being the $18.5B Teledoc/Livongo merger.14

Those are big NUMBERS.

But the big challenge for telemedicine companies is to beat out competitors and capture market attention when, to the Company’s knowledge, they currently all pretty much have similar product offerings – online platforms and services that make it easier to access physicians and health services in one way or another.

Yes, San Francisco-based 1Life Healthcare (One Medical) also has in-office care…but its telemedicine services are more of the same

The same holds true for Boston-based American Well (Amwell) also.

To the Company’s knowledge, it’s all currently pretty much just more of the same…which is good news for Mednow (TSXV:MNOWTSXV:MNOW).

Why?

Because while Mednow (TSXV:MNOWTSXV:MNOW) can also tap into all the telemedicine excitement, it has the major advantage over the competition with a different business model and a significant revenue-generating differentiator…

…the ability to sell prescriptions anywhere it can make deliveries.

And Mednow (TSXV:MNOWTSXV:MNOW) has only started scaling up across the country, which, upon being successful, could prove to be a major catalyst for gaining market attention and creating shareholder value in the coming weeks and months.

As seen in the table below, compared to generic telemedicine companies, Mednow’s (TSXV:MNOWTSXV:MNOW) market cap has significantly more upside potential it could realize as it rolls out its market penetration in 2021.

| Company | Symbol | Market Cap (USD)* | Share Price (USD)* |

|---|---|---|---|

| Mednow Inc. | TSXV:MNOW | $62.9 Million | $2.85 |

| WELL Health Technologies | TSX:WELL OTCPK:WLYYF | $87.3 Million | $2.37 |

| American Well | NYSE:AMWL | $253.8 Million | $1.61 |

| 1Life Healthcare | NASDAQ:ONEM | $913.7 Million | $11.09 |

| Teladoc Health | NYSE:TDOC | $29.7 Billion | $192.38 |

| 111 (YiYaoDian) | NASDAQ:YI | $5.8 Billion | $42.70 |

| Castlight Health | NYSE:CSLT | $4.1 Billion | $17.36 |

| Vitalhub Corp | TSXV:VHI OTCPK:VHIBF | $980.2 Million | $6.00 |

After all, Mednow Inc. (TSXV:MNOWTSXV:MNOW) main market target is one of the largest in the world: the prescription medication market, valued at $1.25 trillion as of year-end 2019 (that’s 221% higher than in 2001).15

To get an idea of just how big this industry could become, consider Alto Pharmacy. Alto just completed a funding round that left the company with a $1 billion valuation.16 Then there’s online pharmacy startup, Capsule. Capsule raised $200 million in 2019,17 and Forbes added the company to its list of next billion-dollar startups.18 Money talks, and this industry is having a field day.

Again, that’s one of the reasons Amazon got into the online pharmacy market by buying PillPack for $753M.19

Management believes that Mednow (TSXV:MNOWTSXV:MNOW) could potentially also be a prime acquisition target, going by the M&A activity in the telemedicine space witnessed last year. For instance, mega insurer UnitedHealth Group acquired digital pharmacy DivvyDose, which has a similar model to Amazon’s PillPack, in a deal estimated to be worth $300 million.20 Interestingly, even bankrupt ‘digital pill’ maker Proteus Digital Health managed to find a buyer, with Japanese drug maker Otsuka stepping in to acquire its assets for around $15 million.21

In Canada, the pharmacy market is worth $47B.22

With 10,000+ Canadian pharmacies but only a handful with an online delivery model, Mednow’s (TSXV:MNOWTSXV:MNOW) virtual pharmacy is ideally positioned to potentially prevail in the market and disrupt.

While Mednow already provides same-day and next-day prescription medication delivery in Ontario and BC, it also has a BIG advantage when it comes to quickly extending its market reach: its connection with CarePharmacies.ca.23

Remember how we saw above that Mednow’s co-founders are also co-founders of CarePharmacies.ca, the largest pharmacist-controlled independent pharmacy chain in Canada with over 50 locations from coast to coast?

Remember how we saw above that Mednow’s co-founders are also co-founders of CarePharmacies.ca, the largest pharmacist-controlled independent pharmacy chain in Canada with over 50 locations from coast to coast?

Well, that means Mednow (TSXV:MNOWTSXV:MNOW) can leverage industry insight on how to rapidly expand across the nation, starting with major Canadian cities.

Which is yet another reason to keep your investor radar on Mednow (TSXV:MNOWTSXV:MNOW) stock in the weeks ahead as its expansion news continues to flow.

Solving a Big Pharmacy Problem Through Innovation

Mednow’s (TSXV:MNOWTSXV:MNOW) services also solve a major pharmacy-related problem: when patients fail to take their meds or when they take them incorrectly.

It’s called medication non-adherence, and it’s a big and common issue:

- It can account for up to 50% of treatment failures24

- About 50% of Americans don’t take their meds as prescribed25

- It leads to 125,000 preventable deaths each year in the US and about $300B in avoidable healthcare costs26

In Canada, it costs the healthcare system $4 billion annually.27

What’s the biggest reason for non-adherence?

Forgetfulness. Plain and simple.

What’s the best solution for non-adherence?

Dose packages, like Mednow’s (TSXV:MNOWTSXV:MNOW) PillSmart™ medication management system.28

With no extra cost to the patient, Mednow’s PillSmart™ system organizes each patient’s pills by dose in easy-to-use pouches sorted by day and date.

With no extra cost to the patient, Mednow’s PillSmart™ system organizes each patient’s pills by dose in easy-to-use pouches sorted by day and date.

If a patient wants even more help avoiding non-adherence, they can also get Mednow’s Karie Health Device.

Karie is an automatic medication dispenser that organizes, schedules, and delivers a patient’s medication with the touch of a button.

The device is connected to a cell phone network, so caretakers that have been granted access can see information about which meds have been taken and when, enabling them to take action if needed.[6]

The device is connected to a cell phone network, so caretakers that have been granted access can see information about which meds have been taken and when, enabling them to take action if needed.[6]

Both Mednow’s (TSXV:MNOWTSXV:MNOW) PillSmart™ and Karie help ensure that patients are taking the right medication at the right time, and that helps keep people out of emergency rooms and nursing homes.

That’s the kind of patient care that’s loved by doctors, governments, and caregivers.

Mednow management believes that it’s also the kind of cutting-edge innovation and revenue generation that markets look for when getting behind a company.

Perfect Timing as Canada’s First Publicly Traded On-Demand Virtual Pharmacy

Here’s what Forbes said the other day:30

“Convenience has become a very interesting component of healthcare as consumers flock to on-demand solutions.”

And here’s how a happy customer described their Mednow (TSXV:MNOWTSXV:MNOW) on-demand virtual pharmacy experience recently:

“First time using mednow and wow order came right away. A direct phone call with the pharmacist and on top of that details of the medicine; side effects, use and everything.. nothing is left unanswered! I even got a personal handwritten thank you note. This company is amazing!”

– Ziba Khemaissia, Toronto

This customer review reflects one of Mednow’s (TSXV:MNOWTSXV:MNOW) primary goals – to provide impeccable market timing.

Not only are consumers adopting remote healthcare solutions faster than ever, but there’s also Canada’s wide-open market for online pharmacy delivery solutions.

While all that’s great news for Mednow (TSXV:MNOWTSXV:MNOW), it’s even better news for growth investors looking for what could be one of the breakout healthcare companies of 2021.

Exceptional Team with Vital Credibility Factor

Mednow’s (TSXV:MNOWTSXV:MNOW) team clearly has the proven ability to build and scale a successful company and range of services.

But that’s not enough for this type of company. Since it’s working in and aiming to win over the medical and pharmacy space, it also needs related credibility.

Fortunately, the large networks and pedigree behind Mednow’s (TSXV:MNOWTSXV:MNOW) co-founders Ali Reyhany and Felipe Campusano are expected to be a big competitive advantage.

Reyhany and Campusano are the team members mentioned earlier that also co-founded CarePharmacies.ca, the largest pharmacist-controlled independent pharmacy chain in Canada with over 50 locations from coast to coast.

They also grew their previous venture to $150M in revenue before securing a $30M investment from the private equity arm of France’s 5th largest bank.

Here’s a brief look at Mednow’s (TSXV:MNOWTSXV:MNOW) top team members.

Karim Nassar, MBA – Chief Executive Officer & Co-Founder

- Computer engineer with 15 years in pharmacy, technology, & healthcare logistics

- International marketing division at VitalAire Home Healthcare, helping build their Western Canada home oxygen logistics network

- Previously led retail & specialty pharmacy strategy initiatives at McKesson and Innomar Strategies, a subsidiary of AmerisourceBergen

- Former Vice President of Digital Strategy at CarePharmacies.ca

Ali Reyhany, RPh – Director, Co-Founder, & President

- 15+ years’ experience in the Canadian healthcare industry

- Proven operator & creator of profitable businesses

- CEO and Co-Founder of CarePharmacies.ca

- One of Canada’s Top 40 Under 40 for 2020 (BNN Bloomberg & Financial Post)[1]

Felipe Campusano, RPh – Director & Co-Founder

- Co-Founder of CarePharmacies.ca

- Purchased first pharmacy upon graduating from pharmacy school

- Has expanded his pharmacy & healthcare operations to 70+ businesses with annual revenue of ~$180M

- Founder and Chair of Liver Care Canada, a network of specialty liver disease treatment clinics

Joshua Lebovic, CPA – Chief Financial Officer

- 10+ years’ experience in managing public & private businesses from start-up to multi-billion-dollar enterprises

- Previously Controller of Foreign Operations for The Stars Group, a multi-billion-dollar online poker & gambling technology company

Sean Hurley – Chief Growth Officer

- 10+ years’ experience in scaling and building growth teams

- Experience scaling start-ups, including Opencare, Animoto, and ChefHero

- Founder of Pathright, an enterprise focused on helping others market and grow their company

- Funding and market attention is driving digital healthcare stocks, generally

- Big gap in Canada’s on-demand virtual pharmacy market

- Mednow (TSXV:MNOWTSXV:MNOW) is Canada’s first publicly traded virtual pharmacy with a recent $37M IPO

- Differentiated from generic telemedicine companies & equipped to disrupt the pharmacy sector

- Free same-day and next-day delivery of medications to doorstep

- On a mission to extend market reach across Canada in 2021

- PillSmartTM system and Karie device help improve medication adherence; these type of products aren’t readily available at most pharmacies, allowing Mednow (TSXV:MNOWTSXV:MNOW) to stand out above the rest

- Team members are also co-founders of CarePharmacies.ca and grew previous venture to $150M in revenue

1https://tinyurl.com/3jdhpzs5

2https://news.crunchbase.com/news/telehealth-dealthmaking-up/

3https://teladochealth.com/newsroom/press/release/livongo-merger/

4 https://ca.finance.yahoo.com/quote/TDOC/history?period1=1555286400&period2=1618444800&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true

5 https://www.cnbc.com/2019/05/10/why-amazon-bought-pillpack-for-753-million-and-what-happens-next.html

6 https://tinyurl.com/xzpcecdc

7https://journals.sagepub.com/doi/full/10.1177/1715163517745517

8https://tinyurl.com/u333t3sm

9https://betakit.com/mednow-ca-raises-6-5-million-to-connect-canadians-with-pharmacies-virtually/

10https://investors.mednow.ca/mednow-announces-upsized-closing-of-approximately-37000000-initial-public-offering-led-by-gravitas-securities-eight-capital-and-stifel-gmp-and-subsequent-listing-on-the-tsx-venture-exchange-under/

11https://investors.mednow.ca/mednow-advances-national-expansion-through-manitoba/

12https://www.pwc.com/ca/en/technology-industry/assets/digital-health-market-map-pov/p777084-cbi2020-marketing-map-aoda-compliant.pdf

13https://www.mobihealthnews.com/news/mercom-telemedicine-investments-led-2020s-148b-digital-health-fundraising

14https://teladochealth.com/newsroom/press/release/livongo-merger/

15https://tinyurl.com/37wmkdc2

16https://www.reuters.com/article/us-altopharmacy-funding-exclusive-idUSKBN1ZT19K

17https://www.bloomberg.com/news/articles/2019-09-13/pharmacy-startup-capsule-raises-200-million-to-grow-beyond-nyc#:~:text=Capsule%20had%20previously%20raised%20%2470,according%20to%20data%20provider%20PitchBook.

18https://www.forbes.com/sites/amyfeldman/2020/05/28/next-billion-dollar-startups-online-pharmacy-capsule-leads-healthcareand-tech-heavy-list/?sh=23c246d079c3

19https://www.cnbc.com/2019/05/10/why-amazon-bought-pillpack-for-753-million-and-what-happens-next.html

20https://www.mobihealthnews.com/news/unitedhealth-group-reportedly-scoops-digital-pharmacy-divvydose

21https://www.statnews.com/2020/08/19/otsuka-approved-proteus-sale-abilify-mycite/.

22https://tinyurl.com/xzpcecdc

23https://carepharmacies.ca/

24https://www.pillsy.com/articles/medication-adherence-stats

25https://www.pillsy.com/articles/medication-adherence-stats

26https://www.uspharmacist.com/article/medication-adherence-the-elephant-in-the-roomu

27https://www.medaviebc.ca/en/insights/posts/medication-non-adherence

28https://ksusentinel.com/2021/03/16/north-america-medication-adherence-packaging-market-is-predictable-to-reach-us-518-78-million-by-2027-with-cagr-of-6-3/

29https://retail-insider.com/retail-insider/2020/12/all-encompassing-virtual-platform-aims-to-disrupt-canadas-pharmacy-industry/

30https://www.forbes.com/sites/forbesbusinesscouncil/2021/03/15/three-things-independent-pharmacies-can-do-to-compete-in-the-age-of-amazon

31https://www.bnnbloomberg.ca/canada-s-top-40-under-40-the-next-leaders-for-2020-1.1513685

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Mednow Inc.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP

The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Mednow’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Mednow’s industry; (b) market opportunity; (c) Mednow’s business plans and strategies; (d) services that Mednow intends to offer; (e) Mednow’s milestone projections and targets; (f) Mednow’s expectations regarding receipt of approval for regulatory applications; (g) Mednow’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Mednow’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Mednow’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Mednow’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Mednow’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) Mednow’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Mednow to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Mednow’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Mednow’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Mednow’s business operations (e) Mednow may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Mednow undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Mednow nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Mednow nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

Historical Information

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Mednow or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Mednow or such entities and are not necessarily indicative of future performance of Mednow or such entities.