Billionaire stock picker calls emerging “Net Zero 2.0” megatrend...

“The Biggest Investment

Bonanza of Our Time”

Editorial Feature | Oct 5, 2022 | Industry

Tiny microcap with transformative sustainability solution could be the next unicorn in critical new industry

Get on board now, or you’ll get left behind by one of the biggest megatrends in human history.

And it could hand you the best investment opportunity of your life.

Visionary investors like Bill Gates, Jeff Bezos, and Sergey Brin seem to think so. The Tech Titans who helped launch the software and internet revolutions are now pouring their fortunes into startups that are fueling the rise of another world-changing mega-industry.

It’s a critical part of the monumental $275 trillion transition to sustainable technology to halt climate change.

But it’s not sustainable energy. It’s bigger than that.

The rapid rise of sustainable energy was Net Zero 1.0.

Now you’re seeing the beginnings of another big market shift.

Get Ready for the New Billion-dollar Companies of Net Zero 2.0

What began as a trickle of market forecasters hailing a coming megatrend has in recent months become a torrent.

High-priced advisory firms like Credit Suisse, UBS, McKinsey, Boston Consulting Group, and JPMorgan are sharing confidential insights with their privileged clients.

Word hasn’t reached the mainstream media yet.

Most Main Street investors have no clue about the big profits just ahead.

But you’re about to find out.

In the next few minutes you’ll see the investment advice that billionaire investors are paying tens of thousands of dollars for.

You’ll see why those investors are getting in now, backing new companies with so much money that it’s setting new records.1

“Big Three” consulting firm Bain & Company says Net Zero 2.0:

“Will transform the nature of business by magnitudes comparable to the digital revolution’s disruption… The shift will upend industries, shift profit pools, challenge areas of historically high returns and, ultimately, open up billion- dollar opportunities in new areas” for investors who get in early.2

And it won’t be unfolding over decades. It’s happening now.

Billionaire stock picker Jim Mellon says:3

“There will be dozens of billion-dollar companies in this field.”

He calls it “the biggest investment bonanza of our time.”

And not just for wealthy investors who can access pre-IPO deals.

There are already a few Net Zero 2.0 companies that trade on stock markets.

Including one that is literally decades ahead of others: Planet Based Foods (CSE:PBF)(OTC:PBFFF)(CSE:PBF)(OTC:PBFFF).

It has a unique sustainability solution that could make it one of the most profitable players in the emerging mega-industry.

An industry that is poised to be:

One of the Fastest Growing Industries in History

Paul Cuatrecasas, head of London-based private equity firm Aquaa Capital says that: “There’s a paradigm shift coming, which will seem to happen almost overnight.”

Net Zero 2.0 is being propelled by governments, scientists, enterprising entrepreneurs, visionary investors, and conscious consumers.

The magnitude of support has driven industry revenues from next to nothing five years ago…

…to $14 billion today…5…to an estimated $1.4 trillion by 2050.6

Making Net Zero 2.0 is one of the fastest growing markets in history.

It’s expanding by a walloping 28% per year, and expected to double on average every three years for the next 28 years.7

Growth like that can turn $5,000 into a half million, $10,000 into a cool million.

It’s underway now. It’s unstoppable. And the time to get in is now.

Billionaire stock picker Jim Mellon says: 8

“It’s Early Days Yet. But the Time to Make the Investments is Now.”

There’s a very good reason why Net Zero 2.0 is unstoppable.

Nearly every country on Earth is on board to cut carbon emissions to “net zero” by 2050.

A global pact was sealed with the Paris Agreement in 2015, signaling the start of the sustainability revolution.

Renewable energy technologies were developed and deployed with unbelievable speed, a herculean effort by industry to meet government, investor, and consumer expectations.

A new mega-industry was built practically overnight.

Net Zero 1.0 companies like Enphase Energy, SolarEdge, and Sunrun are rewarding investors with life-changing profits.

IN LESS THAN THREE YEARS, NET ZERO 1.0 COMPANIES GAVE INVESTORS:

- Enphase Energy (ENPH) 40,251%

- SolarEdge (SEDG) 3,107%

- Sunrun (RUN) 2,007%

The sustainable energy transition has been so successful that renewables now generate more than 38% of global electricity.9

But it’s not enough. Because...

“Sustainable Energy Only Gets Us Part Way to Net Zero 2050”

- Even if all electricity was produced from sustainable sources….

- Even if no cars or trucks or trains or planes burned gas….

- Even if every factory and power plant and automaker around the world cut fossil fuel use to zero…

We would still fail to reduce greenhouse gas emissions enough to meet global goals.

Biggest Source of Greenhouse Gas Emissions Will Surprise You

Nearly all the focus of net zero 2050 efforts have been on decarbonizing electricity generation and transportation.

- Fossil fuel vehicles produce 14% of total greenhouse gas (GHG) emissions.

- Electricity generation from fossil fuels is responsible for 25% of all GHGs.[i]

- But even a complete transition to sustainable energy is not enough.

We also need sustainable food.

A bombshell study published last year in the prestigious journal Nature found that food systems are responsible for more than a third of all GHG emissions.11

The worst offender is meat and dairy.

THE PROCESSES OF PUTTING MEAT ON YOUR TABLE AND MILK IN YOUR REFRIGERATOR CAUSE MORE GHS EMISSIONS THAN ALL SECTORS OF THE US ECONOMY COMBINED! 12

Which is why you’re about to witness:

One of the Biggest Megatrends the World Has Ever Seen

The transition from animal protein to alternative protein will be what venture capitalist Tony Seba and Cambridge chemistry PhD Catherine Tubb call:13

“The deepest, fastest, most consequential disruption in food and agricultural production since the first domestication of plants and animals ten thousand years ago.”

You saw the first sprouts of change a few years ago with the soaring growth of two alternative protein companies, Beyond Meat and Oatly.

The first two alt-protein IPOs would produce some of the most spectacular public market launches of the 21st century.

- Beyond Meat’s (BYND) 2019 public launch at a $1.5 billion valuation quickly soared to $13 billion in just 90 days, becoming the most successful IPO since the 1990s dot com boom.14

- Alt-milk maker Oatly (OTLY) raised $1.43 billion in its May 2021 IPO, its share price jumping 30% in day-one trading and its market cap hitting just under $13 billion.15

Almost impossibly, Beyond Meat became the 13th largest US-listed packaged foods company, just behind industry giants Pilgrim’s Pride and Post Holdings, both founded more than 75 years ago.16

Oatly grew spectacularly to become the sixth largest US-listed beverage company, with only Coca-Cola, PepsiCo, Keurig, Monster, and Coca-Cola Euro larger.17

Since their public debuts, both BYND and OTLY have seen their share prices decline.

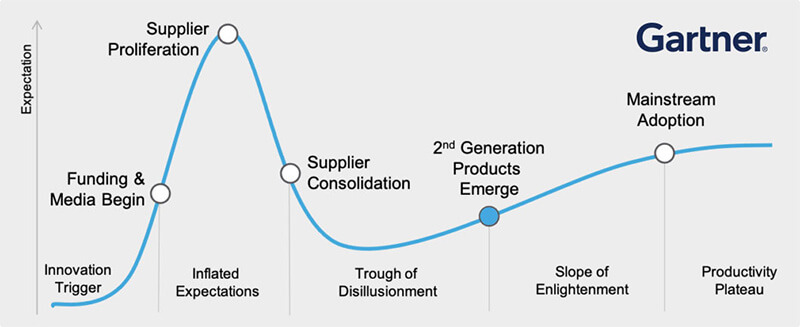

It’s what’s called the “Gartner hype cycle,” a five-phase growth curve common to all emerging technologies.

Investors Take Note: Sustainable Protein Market is on the Launchpad

You saw it with mobile phones, artificial intelligence, and electric vehicles. The first two phases are excitement and unrealistically high expectations, followed by disappointment when unrealistic expectations are not met.

That leads to industry consolidation and the failure of some companies, and then a period of retooling to improve products and lower production costs.

That’s where the sustainable food industry is right now.

The fifth and final stage is mainstream adoption and rapid industry growth.

By that stage the biggest profits will be history.

SMART INVESTORS WILL TAKE ADVANTAGE OF THE MARKET LULL TO GET ON BOARD BEFORE THE SUSTAINABLE FOOD INDUSTRY TAKES OFF LIKE A ROCKET.

The most trusted market forecasters are advising their mega-investor clients.

On July 8, “Big Three” consulting firm Boston Consulting Group advised clients that emerging sustainable food companies are: 18

“By far the best climate investment.” — Boston Consulting Group, July 2022

They’re not alone. In February, JPMorgan advised:

“One of the greatest sector opportunities” 19

A month later, managing director Matt Spence of private equity firm Guggenheim Partners said:

“We’re still in the early innings of this investment sector”

Adding to the growing chorus, $50 billion global advisory Deloitte says:

“The fourth agricultural revolution is already on its way and you should invest now”20

Remember: sustainable energy technologies didn’t really take off until 2019.

And then they soared.

Now, just like you saw with the lightning-speed rise sustainable energy… You’re going to see a whole new crop of sustainable food companies soar to billion-dollar valuations in a few short years.

They’re going to make rich investors richer… and a handful of savvy retail investors millionaires.

GATES, BEZOS, BRIN, AND A HOST OF OTHER BIG INVESTORS ARE PUMPING BILLIONS INTO PRE-PUBLIC COMPANIES, AIMING TO MAKE EXPONENTIAL GAINS WHEN IT GOES PUBLIC.

Retail investors don’t have the option to invest in pre-public companies. There’s only a handful of publicly traded sustainable food stocks yet.

But don’t look to past leaders.

Companies That Will Lead the New Sustainable Food Revolution

The stocks of early alt protein companies soared right out of the starting gate. But they didn’t soar because of the quality or profitability of their products.

They soared because investors know the transition to sustainable food and alternative protein is inevitable and the time is now.

Most of those companies debuted two or more years ago, during the early excitement stage of the Gartner new technology cycle.

Now their stocks are down as much as 98% from initial highs.

And they are not the companies that will rise as leaders of the high-growth mainstream adoption stages.

Their alt-protein products failed to meet expectations of both consumers and investors.

The market is looking for newer, more exciting products that are more sustainable… more cost-efficient…more scalable…and more flavorful.

COMPANIES THAT HAVE:

- A proven and relevant product development track record

- A proven ability to raise capital so tough economic conditions don’t halt progress

- A share-based compensation structure so you know management team has skin in the game

- Consistent high equity to debt ratio so company isn’t in danger of being overburdened by debt

- The right technology to scale up production at sustainably low costs

It’s still early in this emerging mega-industry, but there are a few clear winners.

Including a company that just went public, practically unnoticed in the current turmoil of news.

This budding company’s innovative sustainable food solutions could make it one of the early leaders the crucial rise of the sustainable food revolution.

Planet Based Foods (CSE:PBF)(OTC:PBFFF)(CSE:PBF)(OTC:PBFFF) is Innovating the Future of Food

Unless you’re in the packaged foods market, you probably don’t know the name Robert Davis. But if you are in the business, you probably know Davis as one of the most successful food developers of the era.

Especially in the healthy foods arena, Davis is a legend.

From the very first soy ice cream and almond-based yogurt, Davis has arguably created more plant-based “firsts” than any other food innovator.

He has a unique ability to see what the market is going to want before they know they want it.

And he has a deep-seated commitment dating back to the 1970s to only create foods that are healthy, sustainable, and ethically produced.

Brands he created have achieved wide recognition among consumers, including Believe soy ice cream, Hemp Rella vegan cheese, and Soy Dream “rice cream.”

- In 1990 he developed the first soy/rice ice cream, and marketed them under the brand name

- In 1993 he created the first hemp cheese, marketed as Hemp Rella.

- In 1998 he developed the first organic rice / soy ice cream branded Soy Dream as a partner and R&D director of Good Karma Foods.

- In 2003 Davis designed the first renewable energy powered soy foods production facility.

- In 2008 he developed the first hemp ice cream, branded as

- In 2011 he developed the first nationally distributed brand of almond yogurt,

In 2012, Davis started thinking about the future again.

He saw that consumers were looking for something more from their food.

In marketing terms, 2012 was right when the plant-based foods market was entering the second stage of the Gartner new technology cycle.

The disappointment stage.

Planet Based Foods (CSE:PBF)(OTC:PBFFF)(CSE:PBF)(OTC:PBFFF) Launches Game-changing Sustainable Proteins

There are already plenty of alt-protein products lining grocery shelves.

Products made of soy, rice, almond, and oats that claim to taste like beef or chicken or milk or other animal proteins.

But every one of them have left consumers saying, “I want to like it, but it doesn’t taste right.” Or “It’s okay, but it’s too expensive.”

In other words, most products on the grocery shelves today can’t be produced economically. And even if they could, they don’t taste all that good.

That’s what got Robert Davis thinking about the future again.

And that got him thinking about hemp.

Hemp Will “Alter the Future of Plant-based Proteins”

At the time, no one was thinking about hemp. Until 2018, it was illegal to sell hemp-based products.

But way back in 2012 Davis saw restrictions loosening on the state level, and it was only a matter of time before it would on the federal level too.

WHEN THE FARM BILL FINALLY OPENED UP THE MARKET, DAVIS HAD ALREADY BEEN IN DEVELOPMENT FOR SIX YEARS.

Davis already knew that a hemp-based alternative protein could check off all the boxes:

- Hemp is a complete protein, unlike peas, oats, almonds, cashews, or beans.21

- Hemp protein has high fiber content, unlike other highly refined plant proteins.

- Hemp has lots of Omega-6 and Omega-3 and is a rare plant source of essential fatty acids.

He also knew that hemp is a far more sustainable crop than other plants:

- Hemp uses less water to grow

- Hemp doesn’t need pesticides or fertilizers to produce healthy plants

- Hemp naturally regenerates soil, instead of depleting it like soy, nuts, or other plants.

- Hemp helps filter carbon dioxide out of the air, cleaning the air as it grows.22

An April 2022 study from Cornell University sums it up best:

“Hemp could alter the future of plant-based protein sources… Hemp has huge market potential.”23

Which is just one of the reasons why…

Planet Based Foods (CSE:PBF)(OTC:PBFFF)(CSE:PBF)(OTC:PBFFF) is Changing the Future of Alternative Proteins

Food innovator Robert Davis joined with son Braelyn Davis to launch their groundbreaking alt-protein products.

The first products reached markets in 2019, including hemp-based burgers that quickly became popular with diners at Stout Burgers & Beers locations in Southern California.

Now, three years later, Planet Based Foods is already out ahead of the rest, grabbing market share while the rest are still incubating ideas and developing products.

Today consumers can find a full line of Plant Based Foods products on Planetbasedfoods.com, on Amazon.com, and at the wide network of restaurants served by US Foods, one of America’s largest food distributors. They are also available at West Coast retailers New Seasons Market and New Leaf Community Market, in a total of 26 stores.

Look for Exponential Growth in the Next 12 Months

Management is in the final stages of talks with several major national distributors and retail chains.

When those are finalized, you can expect to see explosive sales growth for Planet Based Foods products.

Don’t wait until that happens. It will be too late to take advantage of the greatest share price growth.

Early investors like Bill Gates and Jeff Bezos know that the biggest profits come from taking an early stake.

Then, when the company hits major milestones, new investors pile in and drive up share price.

And early investors see their profits rocket sky-high.

Planet Based Foods (CSE:PBF)(OTC:PBFFF)(CSE:PBF)(OTC:PBFFF) trades at under $1 right now.

As the company releases more positive news, expect investors to discover this alt-protein innovator that is rapidly expanding market share.

Don’t wait till it takes off again.

And remember, never invest in this or any company before conducting your own due diligence.

Follow Planet Based Foods

1https://vegnews.com/2022/3/global-sustainable-protein-sector-5-billion

2 https://www.prnewswire.com/news-releases/shift-to-sustainbility-set-to-rival-impacts-of-digital-revolution-leaving-no-industry-untouched-301045257.html

3 https://events.masterinvestor.co.uk/past-events/the-agrarian-revolution-opportunities-in-alternative-proteins/

4 https://www.futurefoodfinance.com/article/0009_the-next-major-mega-shift-alternative-protein

5 https://cernocapital.com/the-future-of-protein

6 https://www.credit-suisse.com/about-us-news/en/articles/news-and-expertise/sustainable-food-as-an-investment-opportunity-202106.html

7 https://www.credit-suisse.com/about-us-news/en/articles/news-and-expertise/sustainable-food-as-an-investment-opportunity-202106.html

8 Moo’s Law, Mellon 2020 p26

9 https://ember-climate.org/insights/research/global-electricity-review-2022/

10 https://www.researchgate.net/figure/Global-shares-of-GHG-emissions-based-on-CO-2-equivalents-by-economic-sector-a-and_fig102_336613244

11 https://ecbpi.eu/wp-content/uploads/2021/03/Nature-food-systems-GHG-emissions-march-2021.pdf

12 https://gfi.org/resource/a-global-protein-transition-is-necessary-to-keep-warming-below-1-5c/

13 https://www.liebertpub.com/doi/10.1089/ind.2021.29244.rco

14 https://www.forbes.com/sites/oliviergarret/2019/09/11/missed-out-on-beyond-meat-buy-these-2-ipos-this-week/?sh=2a62ba1d1b60

15 https://www.reuters.com/business/oprah-backed-oatly-valued-13-bln-us-debut-2021-05-20/

16 https://finviz.com/screener.ashx?v=111&f=ind_packagedfoods,sec_consumerdefensive&o=-marketcap

17 https://finviz.com/screener.ashx?v=111&f=ind_beveragesnonalcoholic,sec_consumerdefensive&o=-marketcap

18 https://www.theguardian.com/environment/2022/jul/07/plant-based-meat-by-far-the-best-climate-investment-report-finds

19 https://www.jpmorgan.com/content/dam/jpm/cib/complex/content/investment-banking/center-for-carbon-transition/Establishing_a_Framework_for_Food_and_Agriculture_Sustainability_Transition.pdf

20 20 https://www2.deloitte.com/content/dam/Deloitte/de/Documents/consumer-industrial-products/Deloitte-Tranformation-from-Agriculture-to-AgTech-2016.pdf

21 https://www.nutrasciencelabs.com/blog/hemp-powder-heres-why-its-the-future-of-protein

22 https://www.digitaljournal.com/pr/planet-based-foods-has-played-an-instrumental-role-in-introducing-delicious-hemp-based-meat-alternatives-to-an-ever-widening-audience

23 https://research.cornell.edu/news-features/watch-out-chicken-here-comes-hemp

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Planet Based Foods Inc. (“PBF”) and its securities, PBF has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by PBF) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company PBF and has no information concerning share ownership by others of in the profiled company PBF. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to PBF industry; (b) market opportunity; (c) PBF business plans and strategies; (d) services that PBF intends to offer; (e) PBF milestone projections and targets; (f) PBF expectations regarding receipt of approval for regulatory applications; (g) PBF intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) PBF expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute PBF business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) PBF ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) PBF ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) PBF ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of PBF to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) PBF operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact PBF business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing PBF business operations (e) PBF may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Planet Based Foods Inc..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Planet Based Foods Inc. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Planet Based Foods Inc. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Planet Based Foods Inc.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Planet Based Foods Inc.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Planet Based Foods Inc. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Planet Based Foods Inc. industry; (b) market opportunity; (c) Planet Based Foods Inc. business plans and strategies; (d) services that Planet Based Foods Inc. intends to offer; (e) Planet Based Foods Inc. milestone projections and targets; (f) Planet Based Foods Inc. expectations regarding receipt of approval for regulatory applications; (g) Planet Based Foods Inc. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Planet Based Foods Inc. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Planet Based Foods Inc. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Planet Based Foods Inc. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Planet Based Foods Inc. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Planet Based Foods Inc. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Planet Based Foods Inc. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Planet Based Foods Inc. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Planet Based Foods Inc. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Planet Based Foods Inc. business operations (e) Planet Based Foods Inc. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Planet Based Foods Inc. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Planet Based Foods Inc. or such entities and are not necessarily indicative of future performance of Planet Based Foods Inc. or such entities.