With Investors Seeking Safe Haven Investments & Buying Up All of the Gold They Can, Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) Looks To Be a Potential Gold Producer In The Near Future

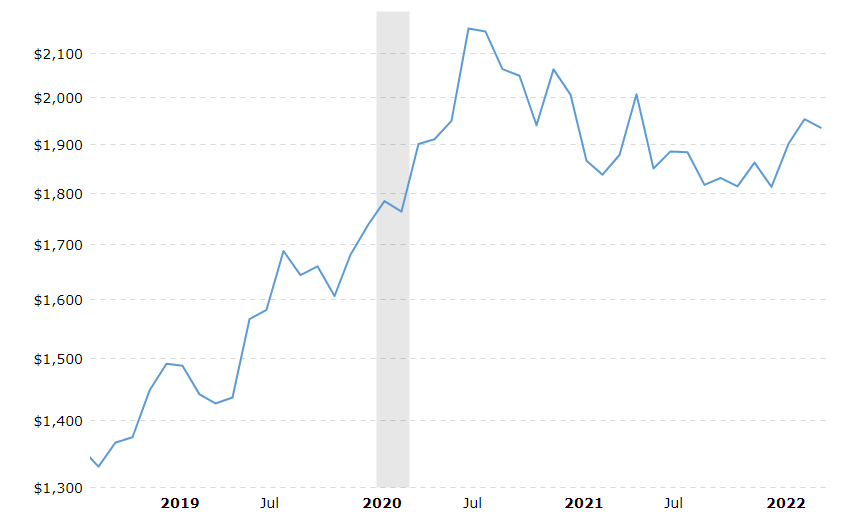

Gold is making a serious comeback that even the biggest market bears can’t ignore.

Investors are realizing that high inflation is here to stay and it‘s created the strongest gold bullion demand in over two decades.1

U.S. Mint just reported its best March performance since 1999, selling 155,500 ounces of its American Eagle Gold bullion coins, a 73% increase from February.

Meanwhile, spot gold price once again surpassed $2,000 per ounce earlier this month and could break its previous record high of $2,072.50 from August 20202 as geopolitical uncertainty and even higher inflation is sending a new wave of inflows into the sector.

According to Equity Capital analyst David Madden, “The gold market is in a very strong uptrend. In the current environment, there is very little that could derail the rally to higher prices.”3

Singapore’s United Overseas Bank (UOB) says it expects the price of gold to end the year at $2,200.4

And when you consider the current state of the world, it’s easy to see why everyone has their eye on safe haven investments like gold.

Just look at what happened to gold prices during the last two years when CV-19 effectively changed the world as we know it.

Not interested in hoarding gold coins or bars? Take the Buffett approach: Don’t invest in gold, but the companiess that surround it.5

Because even though bullion can be a good investment, when gold demand and prices rise like they are now it often means big gains for gold mining companies…

Especially X-factor-type mining stocks like Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF), which just recently unveiled a clear and accelerated path to develop its Kenville gold mine.

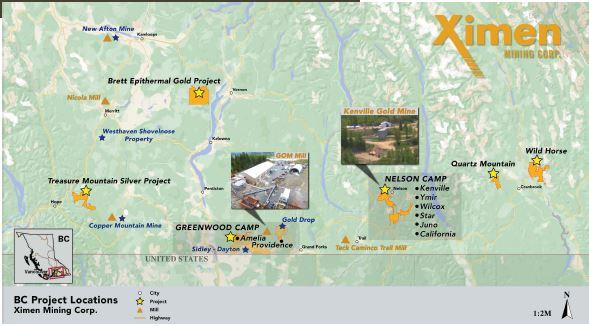

Ximen is on track to becoming the next significant high-grade gold company in southern British Columbia, one of the best mining jurisdictions in the world.

And its progress couldn’t be coming at a better time in the marketplace.

Capital.com says that “rising inflation and a slow-growth environment have increased the likelihood of potential stagflation. While equities generally perform poorly in this kind of economic environment, exposure to gold and energy may help insulate investors.”6

In other words, these economic conditions are the perfect time for mining companies like Ximen to stand out.

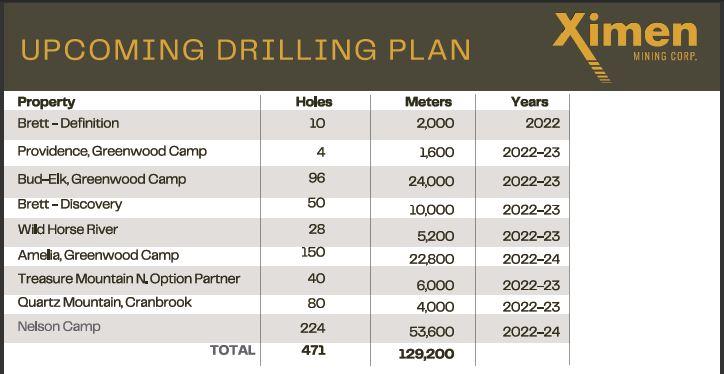

Ximen is not only preparing for mine development that’s aiming for gold production at its Kenville Project but it also has an expansive drill campaign planned for all of its projects (over 130,000 meters in total7) planned through 2024.

This is an exploration and mining company that clearly intends to increase its operations and begin mining gold during a period where gold demand is also expected to be increasing exponentially.

But what separates Ximen from the competition?

6 Reasons to Add Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) to Your Watchlist

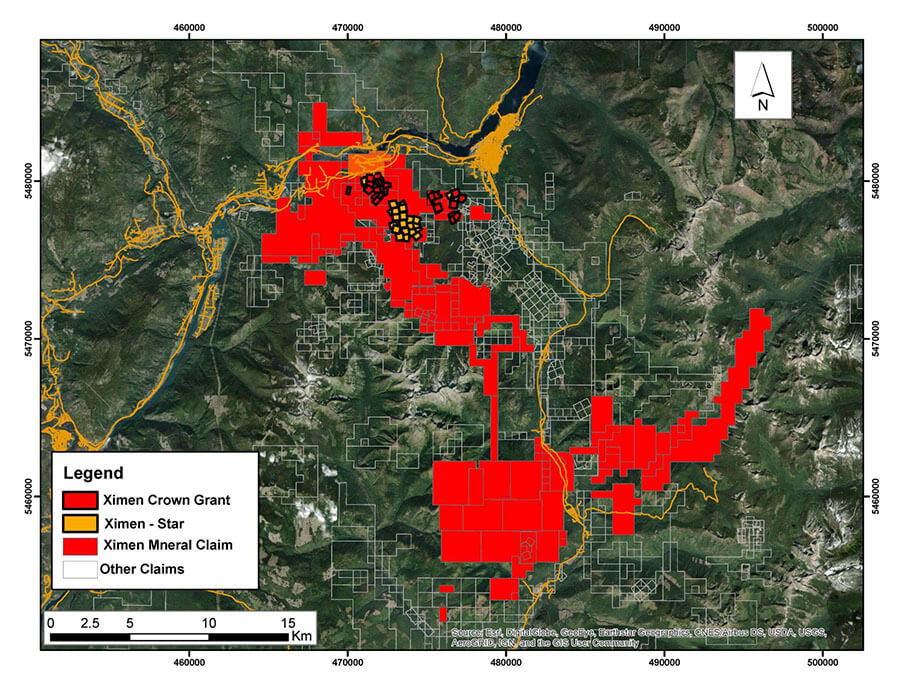

- Ximen holds a HUGE Land Package at a Forgotten Yet Potentially Highly Profitable Mine – Kenville consists of 20,092 hectares of highly valuable land.

- Gold and Gold Stocks are Outperforming Everything – Spot gold ripped through US$2,000 with big momentum to go way higher along with gold mining stocks.

- New Gold’s $2M investment for 9.9% of the company and 26% owned by insiders is a tightly held share structure with a highly-experienced management team.

- More than compliant: Ximen has always had a strong ESG initiative and is a leader in clean exploration practices in BC

- No one trick pony: Ximen’s properties and project portfolio is vast, high-potential, and holds multiple opportunities for profitable high-grade discoveries and potential production in its project pipeline in the short and long-term.

- Management-driven vision and success: Ximen has mining industry veterans that have had multiple successes at the highest level, in difficult bear markets and more.

That’s just a peak at the many positives that Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) has going for it. Let’s take a deeper look at what this gold company has to offer.

Reason #1 – Discovering New Potential in a Historic Mine

Ximen’s flagship Kenville Gold Mine was the first underground mine in British Columbia. It produced 65,381 oz gold and 27,685 oz silver between 1889 and 1954. And then it was ultimately forgotten … until now.

Three recent drilling programs discovered a new, untouched vein system directly south and west of the original mine. Here’s what Ximen reports:

- Drilling produced consistent intersections, on multiple veins, over a distance of 700m with 250m dip length

- Veins are open to the south/west/east and to depth. Intercepts range from .28 meters to .94 meters

- Grade ranges between 26.6 g/tonne to 88.1 g/tonne

- Favorable metallurgical results of 99% combined gold recovery

What all that means is this is a significant gold find with lots of potential – and Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) is now the sole owner of the 20K hectare property – No CAPEX!

The company has been quick to create a conceptual development plan for its find.

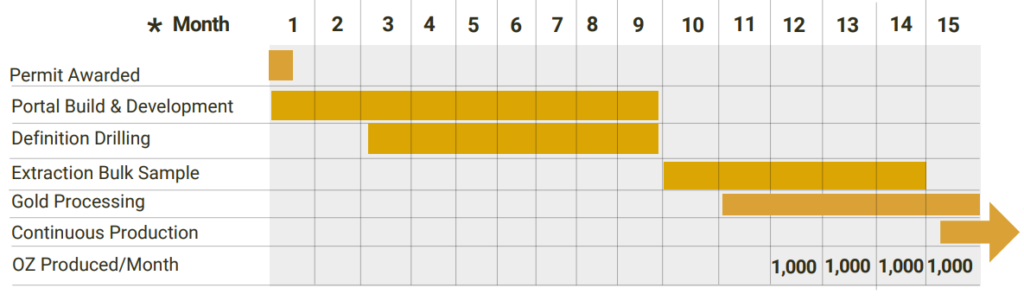

Permit applications have been submitted and on March 15, Ximen was notified that it would receive a draft permit for the proposed mine development and underground drilling within 30 days.8

Once it has received the draft permit, the company will review it and either accept the draft or request revisions. Once accepted by both parties, the permit will be issued. Concurrently, an environmental discharge permit is expected to be issued as well.

That means Ximen could be up and running on its Kenville Gold Mine project sooner rather than later.

Once that permit becomes official, Ximen is planning a 1200-meter decline and 20,000 meters of drilling. Based on current models, it is fully expected that drilling will outline a 10,000-tonne bulk sample. The company then plans to move to a bulk sample permit and a small mine permit to maintain a smooth path to continuous mining.

Another great thing about the Kenville Gold Mine project is that infrastructure – including roads, hydropower and a local experienced workforce – all already exist. That significantly reduces the company’s expected project expenses.

Plus, as stated earlier Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) owns 100% of the projects AND all of its own equipment meaning no CAPEX.

It appears to have everything lined up so that it can become the next exploration company to move into gold mining.

Reason #2 – The Soaring Price of Gold

Fears about stagflation, which refers to when an economy is experiencing both an increase in inflation and a stagnation of economic output, are skyrocketing in the US and Canada.

“Stagflation is a general economic mess, and while we think it’ll only last a year or two while the supply side sorts itself out, gold will be a choice asset,” Seeking Alpha9

Rising inflation along with volatility brought on by the war in Ukraine are sending investors in search of safe-haven investments like gold.

In March, CNBC reported that “gold prices rose to more than a one-week high … as its safe-haven appeal was lifted by concerns over soaring inflation and uncertainty surrounding the war in Ukraine.”10

At that time, spot gold broke past $2,000 per ounce,11 building upon previous gains. At the same time, U.S. gold futures rose to $1,962.20.

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) (TSXV:XIM) (OTCQB:XXMMF)is uniquely positioned to capitalize on the elevated gold prices thanks to its near-term Kenville Gold Mine. Plus, increased investor interest in the market will help fuel the development of its other mining projects.

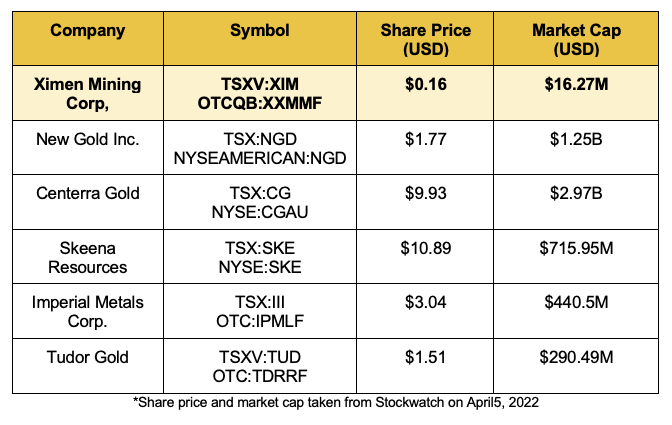

This could be a mining company that sees big gains in the near future. Here is how it compares to its peers in the marketplace:

Gold stocks have been consistently outperforming the broader market lately. Ximen investor and NYSE American-listed New Gold is up 50% in the last six months, from $1.18 on October 6, 2021, to $1.77 on April 5, 2022.

Centerra Gold isn’t far behind, with a nearly 30% gain from C$9.59 October 6, 2021 to C$12.43 on April 5, 2022!

But is it a fluke? Definitely not. Just take a look at Tudor Gold’s 227% gain in just two years! The stock went from C$0.58 on April 9, 2020, to C$1.90 on April 5, 2022.

During one of the biggest financial crises of the era, gold stocks have been crushing it.

And they’re doing it in BC, a world-class mining jurisdiction.

Consider how peers like Skeena Resources are knocking it out of the park, right in Ximen’s backyard of beautiful BC.

Skeena just signed a cash and stock deal to acquire QuestX Gold and Copper for C$48.6 million, which owns several high-value, high-grade properties in BC. And will immediately sell a handful of QuestX properties to mining giant Newmont, for C$27 million.12

Land packages and projects in BC are so hot, they’re trading hands like prime real estate in New York or Miami!

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) could have its breakout at any moment, and investors aren’t just getting a great company – they’re getting exceptional projects.

And remember, Ximen has 100% ownership of its projects and equipment. This is a company that is planning on self-funding exploration in the future once its Kenville project is producing and it has no major long-term capital expenditures (CAPEX) on the books.

Reason #3 – A Vote of Confidence From a Grade-A Mining Company

New Gold Inc, that company that’s up 50% in the last 6 months, is also a major investor in Ximen.

New Gold took a 9.9% stake in Ximen through a non-brokered private placement worth C$2,534,686 and immediately highlighted why this company is so fascinating to investors.

Not to mention, insiders own 26% of the company too. With New Gold’s 9.9% stake there is a strong 35.9% stake controlled by the investors running the company and that are intimately familiar with the value each project brings to the portfolio.

Investors buy low and sell high. And that’s what’s happening here. Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) is highly undervalued right now considering its market cap of just C$19.7 million as of April 5, 2022.

Just the Kenville Gold Mine alone could be worth far more than that. The company owns 100% of the property, comprising an absolutely massive 20,062 hectares.

The roadmap will make this an incredibly valuable asset for these highly sophisticated investors …

And not in 10 years either; the current roadmap leads to a steady 125 tonnes a day and potential gold recovery of over 1,000oz/month in just one year after permits are granted.

Reason #4 – Environmentally-Friendly Mining at its Finest

The Environmental, Social, Governance movement sweeping across numerous industries is having a significant impact on mining.

Shareholders and institutional investors are demanding a strong ESG commitment from the companies they put their money in. It’s reached the point where companies that don’t meet rising demands for sustainable and environmentally friendly mining are going to be left behind.

For instance, BlackRock announced in 2020 that it was divesting coal-related assets and creating funds that avoid fossil fuel stocks.13 Other top mining capital providers also followed suit.

UBS announced it was no longer going to finance new oil sands projects. Norges Bank removed oil sands producers from its trillion-dollar national wealth fund. Mitsubishi UFJ Financial Group added oil sands extraction to its restricted transaction list.14

Access to capital is becoming extremely difficult for companies that do not meet new ESG requirements.

An EY report titled “Top 10 Business Risks and Opportunities for Mining and Metals in 2022” listed environmental and social issues as the number one risk for mining companies operating today.15

The good news for Ximen is that it has long made environmentally-friendly mining practices a central part of doing business.

Ximen is committed to being a leader in sustainable mining and responsible development in BC and has set a goal of maintaining as small an environmental footprint as possible as it moves its many mining and exploration projects forward.

“A greener economy cannot exist without mining,” said Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) President and CEO Christopher R. Anderson. “It is our responsibility as a mining exploration and development company, to implement green solutions and technology in all our operations whenever feasible. We believe we are being part of the solution contributing to the survival of our industry and our planet.”

Anderson and other Ximen officials are taking their role of bringing greater environmental safety to the mining industry seriously.

Ximen represents a new generation of mining companies that are committed to environmental safety.

Reason #5 – Ximen is Not a ‘One Trick Pony’

In addition to the Kenville Gold Mine Project, Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) has a number of other promising projects in its pipeline. For instance:

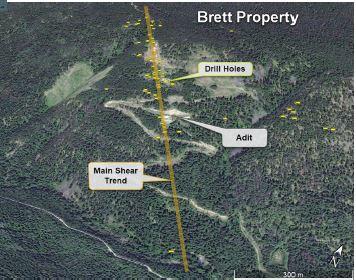

Brett Epithermal Gold Project

Ximen has 100% ownership of this 20,025 hectare gold project situated in Southern British Columbia near the city of Vernon. Historical intercepts from this property include up to 168 g/t over 1.3m core length, with visible gold being common. In 1995-1996, 291 tonnes of surface trench samples graded at 28 g/t gold and 64 g/t silver.

Ximen says Northwest trending gold shears are located roughly 50 to 60 meters apart and can be followed along strike for at least 1200 meters and occur over at least 1 kilometer in an east-west direction. The potential exists for 15-20 parallel gold-bearing shears.

Amelia Gold Mine Project

Ximen acquired mineral properties covering the historic Cariboo-Amelia gold mine in Camp McKinney near Mt. Baldy Mountain Resort in Southern British Columbia. This acquisition added to Ximen’s significant property holdings in the region.

The Cariboo-Amelia was BC’s first dividend-paying lode gold mine and was the most significant producer from Camp McKinney. Over its intermittent 68-year mine life from 1894 to 1962, the Cariboo-Amelia produced 124,452 tonnes ore, of which 112,254 tonnes are reported as milled on site. Recovery included 81,602 ounces of gold, 32,439 ounces of silver, 113,302 pounds of lead and 198,140 pounds of zinc (lead and zinc since 1940). The average recovered gold grade was 24.68 grams per tonne gold (from BC Minfile).

Permitting for drilling was completed in 2021 and Ximen is ready to begin testing this property for its huge gold potential. Amelia is only one part of the Ximen’s Greenwood Camp holdings, which also include Bud-Elk and Providence properties.

And Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF)has a solid upcoming drill plan that includes nearly 130,000 meters of drilling through to 2024.

Reason #6 – Exceptional Leadership Team With Proven Mining Experience

Members of the Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) leadership team include:

Christopher R. Anderson – President, CEO & Director

Mr. Anderson brings over 30 years of entrepreneurial experience with an astute emphasis on strategic planning, communications, and creative marketing. He has been instrumental in facilitating tens of millions of dollars of financing for both public and private enterprises.

Matt Ball (Ph.D. P.Geo.) – Vice President of Exploration

Dr. Mathew Ball, Ph.D. P.Geo., has over 40 years of worldwide geological experience, including underground precious metals mine development programs. Presently Dr. Ball is also President and Chief Geologist of Golden Dawn Minerals, located near Greenwood, B.C. Previously he held positions as President and Chief Operating Officer at the Bralorne gold mine in British Columbia.

Al Beaton (P. Eng) – Advisor & Active Member of the Technical Team

Mr. Beaton has been actively involved in mining operations for over 40 years. Since becoming a member of the Association of Professional Engineers and Geoscientists of British Columbia in 1974, he has had more than three decades of experience as a mine manager for mining and development operations throughout Africa and Canada. Mr. Beaton was the mine manager for Erikson gold mine from 1979 to 1986, which, at its peak, was the No. 1 gold producer in B.C. Mr. Beaton was also the mine manager for Huldra Silver Inc., producing ore from the Treasure Mountain mine in B.C. He has been president of A.J. Beaton Mining Ltd. since 1987.

Sophy Cesar – Investor Relations

Ms. Cesar has over 15 years of experience specializing in investor relations, communications, marketing and branding. Before joining Ximen, Ms. Cesar has held several investor relations positions, including Vice President of Investor Relations for a leading TSX-V company.

This is clearly a company that has a lot of things going for it and that’s why we are recommending that you begin doing your due diligence on it right away. To help you get started, here is a recap of the primary reasons to consider investing in Ximen.

RECAP: 6 Reasons Ximen Could Quickly Surpass Its Peers in the Gold Exploration & Mining Market

- Stagflation, the Ukraine War and other volatility is driving interest in safe haven investing and putting well-positioned gold mining companies like Ximen in the spotlight.

- Ximen Mining Corp. holds a HUGE Land Package at a Forgotten Yet Potentially Highly Profitable Mine – Kenville consists of 20,092 hectares of highly valuable land.

- New Gold’s $2M investment (9.9% ownership) and 26% insider ownership creates tightly held share structure

- ESG-Focused: Ximen has always had a strong ESG initiative and is a leader in clean exploration practices in BC

- No one trick pony: Ximen’s property and project portfolio is vast, high-potential, and holds multiple opportunities for profitable high-grade discoveries and possible production in its project pipeline in the short and long-term.

- Management-driven vision and success: Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF)(TSXV:XIM) (OTCQB:XXMMF) is guided by some of the top mining officials in the marketplace, including a CEO who successfully navigated one of the most challenging bear markets in mining history.

1 https://www.kitco.com/news/2022-04-04/U-S-Mint-sees-strongest-gold-bullion-demand-in-23-years-sells-426k-ounces-in-Q1.html

2 https://www.mining.com/gold-price-breaks-new-record/

3 https://www.kitco.com/news/2022-03-25/Wall-Street-analysts-retail-investors-still-see-2k-gold-in-the-near-term.html

4 https://www.kitco.com/news/2022-03-23/Gold-price-to-end-the-year-at-2-200-as-stagflation-fears-take-hold-says-UOB.html

5 https://seekingalpha.com/article/4493056-is-now-good-time-invest-gold

6 https://capital.com/stagflation-and-the-stock-market

7 Corporate Presentation Page 20

8 https://www.ximenminingcorp.com/2022/03/15/ximen-mining-development-permit-kenville-gold-mine-nelson-bc/

9 https://seekingalpha.com/article/4493056-is-now-good-time-invest-gold

10 https://www.cnbc.com/2022/03/24/gold-markets-dollar-russia-ukraine-war.html

11 https://www.telegraph.co.uk/business/2022/03/07/gold-hits-2000-amid-market-scramble-precious-metals/

12 https://www.mining.com/skeena-inks-deals-to-acquire-bc-based-questex-and-sell-selected-properties-to-newmont/

13 https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/investment-giant-blackrock-marks-a-major-milestone-in-coal-divestment-movement-56669181

14 https://rsmcanada.com/what-we-do/industries/energy/esg-is-now-a-top-priority-and-canada-oil-and-gas-companies-must.html

15 https://www.ey.com/en_gl/mining-metals/top-10-business-risks-and-opportunities-for-mining-and-metals-in-2022

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Ximen Mining Corp. (“XIM”) and its securities, XIM has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by XIM ) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company XIM and has no information concerning share ownership by others of in the profiled company XIM . The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to XIM industry; (b) market opportunity; (c) XIM business plans and strategies; (d) services that XIM intends to offer; (e) XIM milestone projections and targets; (f) XIM expectations regarding receipt of approval for regulatory applications; (g) XIM intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) XIM expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute XIM business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) XIM ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) XIM ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) XIM ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of XIM to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) XIM operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact XIM business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing XIM business operations (e) XIM may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Ximen Mining Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Ximen Mining Corp. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Ximen Mining Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Ximen Mining Corp. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Ximen Mining Corp. ’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Ximen Mining Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Ximen Mining Corp. industry; (b) market opportunity; (c) Ximen Mining Corp. business plans and strategies; (d) services that Ximen Mining Corp. intends to offer; (e) Ximen Mining Corp. milestone projections and targets; (f) Ximen Mining Corp. expectations regarding receipt of approval for regulatory applications; (g) Ximen Mining Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Ximen Mining Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Ximen Mining Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Ximen Mining Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Ximen Mining Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Ximen Mining Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Ximen Mining Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Ximen Mining Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Ximen Mining Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Ximen Mining Corp. business operations (e) Ximen Mining Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Ximen Mining Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Ximen Mining Corp. or such entities and are not necessarily indicative of future performance of Ximen Mining Corp. or such entities.