What If You Met Netflix’s Founder 20+ Years Ago?

Imagine walking into a Blockbuster video store one evening back in 1997.

Viewing your rental options, you see a guy pissed off that he got charged a fee for returning his rentals late.

Somehow, you struck up a conversation with him, and he tells you:

“You know what, screw DVD rentals, what if we could start a business that lets people stream movies on the Internet instead?”

And because of XYZ reasons, he asks you to invest.

As you may have guessed, this guy is Reed Hastings, the co-founder of Netflix.

Given what you know now in 2021, would you ignore him or say “hell yeah”?

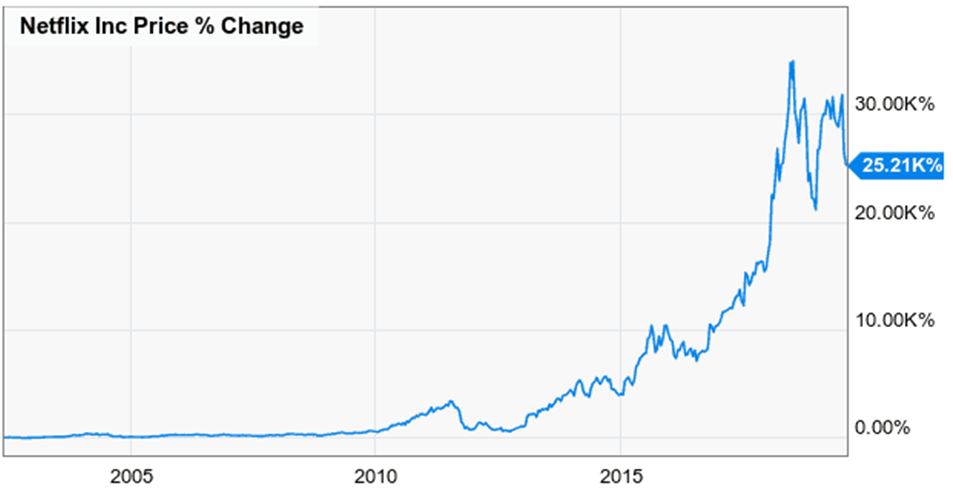

Netflix’s 20+ Years Growth

Well, Decentralized Finance or DeFi is a similar story. Why?

Because it’s a trend that could revolutionize finance the same way Netflix did for entertainment — both aim to eliminate industry middlemen.

And now, we found a company called Wellfield Technologies (TSXV:WFLDTSXV:WFLD) that can help DeFi hit the mainstream by building critical infrastructure and applications to unlock its true potential.

Wellfield just IPO’d on the Toronto Venture Exchange on November 30 after raising over $20 Million.

And with 45% insider ownership1 (over 13% owned by its CEO2) and a tight share structure, it’s clear this company is ready to become a dominant player in the booming DeFi space!

5 Reasons to Put Wellfield Technologies (TSXV:WFLDTSXV:WFLD) On Your Watchlist

- 90% of institutional investors in the UK and US are rushing to increase their stake in DeFi1 and 36% of investors have already flooded into the DeFi sector.2

- First Mover Advantage3 – Wellfield Technologies (TSXV:WFLDTSXV:WFLD) is developing never-before-seen DeFi infrastructure and the first application of its kind, MoneyClip. This gives the company immediate credibility in the market and the opportunity to take market share before any competitors can enter the space (it’s like Apple for smartphones, Coca-Cola for soft drinks, and Kelloggs for cereals).

- The total locked value (asset deposits) of DeFi has hit an all-time high of $236 billion4 as of today (equivalent to 31 Netflixes!), and it could continue to explode as its value has skyrocketed nearly 88 times5 since last year.

- A position that could reach $180M in revenue by 2024 – no other Canadian public company builds decentralized, permissionless, and smart contract solutions in public markets. As such, this position represents a largely untapped opportunity.

- Wellfield is fully financed after raising $20,475,000 at $1.00 in a concurrent subscription receipt financing prior to listing on the TSX Venture.

By 2024, Wellfield Technologies (TSXV:WFLDTSXV:WFLD) could generate $180 million in revenue, with exponential growth year-over-year

What Do They Do?

In 2017, Wellfield Technologies (TSXV:WFLDTSXV:WFLD) was founded by Levy Cohen, CEO and Director, who has vast experience leading technology-driven banking and payments companies in Silicon Valley and Israel while focusing on customer service.

On November 24th, Wellfield announced the completion of a business combination with Seamless Logic and MoneyClip Inc., with both subsidiaries in the DeFi space.

Wellfield Technologies (TSXV:WFLDTSXV:WFLD) purpose is to simplify DeFi mass adoption by building specific protocols and removing the need for financial intermediaries.

How Wellfield Technologies (TSXV:WFLDTSXV:WFLD) Could Usher In A “New Era Of Finance”

DeFi is a financial system3 that isn’t run by banks or governments but rather by Blockchain, a technology that keeps everyone’s records safe and secure without a central authority.

Although Blockchain technology exists, it does not provide DeFi on its own since protocols and applications must be built on top of it as well.

Through Seamless, Wellfield Technologies (TSXV:WFLDTSXV:WFLD) is building the protocols required for exciting DeFi applications, which MoneyClip Inc. helps directly realize at the application layer.

Wellfield Technologies (TSXV:WFLDTSXV:WFLD) MoneyClip app connects your bank with the Blockchain, enabling frictionless peer-to-peer financial transactions (sending and receiving cash, lending, etc.) without involving intermediaries.

In addition, Wellfield Technologies (TSXV:WFLDTSXV:WFLD) aims to make Bitcoin more compatible with DeFi by “docking” it to an advanced blockchain platform called Ethereum, which:

- Offers optimized liquidity for investors who trade Bitcoin and Ethereum

- Allows crypto-holders to earn cash flow in ways never thought possible

- And helps Bitcoin reach its commercial potential

Thus, you can expect Bitcoin-related products on apps like MoneyClip and others in the future, and these products could be as revolutionary as credit cards were in 1951 and PayPal was in 2000.

Disrupting The Financial Industry

Given that DeFi’s total locked value (TLV) grew by nearly 88 times6 since last year, sitting at an all-time high of $236 billion7, it’s easy to see why the potential is growing exponentially in the space.

Experience has taught us that when stakes are this high, and you have a disruptor like Wellfield leading the way, betting on them could be a no-brainer.

What if you invested in disruptors like Netflix, Amazon, Uber, Apple, and Facebook early on?

For more information about Wellfield Technologies (TSXV:WFLDTSXV:WFLD), click here.

1 Wellfield Investor Presentation Slide #21

2 https://ca.style.yahoo.com/early-warning-news-release-regarding-042200607.html

3 THE INSTITUTIONAL INVESTOR DIGITAL ASSETS STUDY

4 THE INSTITUTIONAL INVESTOR DIGITAL ASSETS STUDY

5 The First-Mover Advantage, Explained

6 DeFi Total Value Locked Hits All-Time High of $236 Billion

7 After Growing 88x In A Year, Where Does DeFi Go From Here?

8 What Is DeFi?

9 After Growing 88x In A Year, Where Does DeFi Go From Here?

10 DeFi Total Value Locked Hits All-Time High of $236 Billion

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Wellfield Technologies.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Wellfield Technologies and has no information concerning share ownership by others of any profiled Wellfield Technologies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Wellfield Technologies or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Wellfield Technologies. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Wellfield Technologies’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Wellfield Technologies future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Wellfield Technologies industry; (b) market opportunity; (c) Wellfield Technologies business plans and strategies; (d) services that Wellfield Technologies intends to offer; (e) Wellfield Technologies milestone projections and targets; (f) Wellfield Technologies expectations regarding receipt of approval for regulatory applications; (g) Wellfield Technologies intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Wellfield Technologies expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Wellfield Technologies business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Wellfield Technologies ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Wellfield Technologies ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Wellfield Technologies ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Wellfield Technologies to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Wellfield Technologies operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Wellfield Technologies business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Wellfield Technologies business operations (e) Wellfield Technologies may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Wellfield Technologies or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Wellfield Technologies or such entities and are not necessarily indicative of future performance of Wellfield Technologies or such entities.