ADVERTORIAL

With Prices Set to Soar, Junior Miner’s New Copper Discovery Now Even More Significant

Editorial Feature | Aug 1, 2022 | Industry

Recent Discovery Demonstrates Potential To Deliver a New, High-Grade Copper-Gold Deposit

All signs are pointing to another copper price rally.

According to S&P Global, demand from copper-intensive tech, like electric vehicles (EVs), charging stations, solar, wind, and batteries, is expected to nearly triple by 2035.1

That’s on top of all the other growing demand for traditional copper uses, from jewelry to healthcare, construction, and more.2

Another factor driving up copper prices is that copper production grades are on a decades-long, steep downward trend.

Industry giant BHP estimates that by 2030, declining grades will decrease the global copper mine supply by around 2 million tonnes.3 And that’s YEARLY!

Meanwhile, the rate and size of major copper discoveries over the past decade has dropped significantly.4

With demand surging and grades and discoveries shrinking, copper supply is expected to be in increasing deficits for decades to come.5

It all adds up to the perfect recipe for record-high copper prices in the near and long term.

It’s also the perfect market environment for exploration companies with the potential to deliver new, major high-grade copper discoveries.

This is exactly what this innovative new company brings to the table.

High-Potential Holdings, Proven Team & Significant Discovery Drill Holes to Build From

This Canadian-based copper and gold exploration company comes with a rare level of quality.

With 3 premium holdings in prominent mining belts in the world’s top copper-producing country, Chile,6 it’s well-positioned to potentially deliver a world-class discovery.

The company already scored an important brand-new copper-gold discovery at its Margarita project in May – 90 meters of 0.94% copper and 0.84 g/t gold7 – and the follow-up drill program is now underway.

Behind it all is an innovative management team. They’ve monetized exploration successes before and know how to raise capital, even in difficult markets.

They also know how to leverage in-country expertise and deal-flow connections through their Chile-based technical team.

This group of in-country mining veterans has had their eyes on the project now for over 15 years. And they’re not the only ones – according to an analyst report by Beacon Securities, both Exeter Resources and Barrick Gold made large cash offerings for the Santa Cecilia project, which were rejected by the owner. The project is now the crown jewel in this companies’ portfolio.

Their Chilean team, has a first-rate reputation in the country, having contributed to multiple globally significant discoveries throughout their careers… far beyond what’s expected in a junior miner.

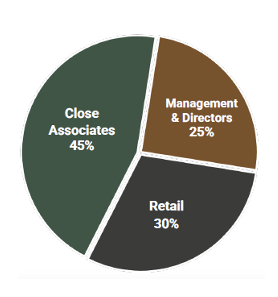

That base includes key investments from industry-leading mining professionals and a high percentage of skin in the game (25%!) from management and directors.

That base includes key investments from industry-leading mining professionals and a high percentage of skin in the game (25%!) from management and directors.

With a C$5.28 million private placement recently completed8 and $4.7 million in their treasury as of March,9 the company is ready to advance its Chile projects in 2022.

With the markets being down, the company has been largely overlooked despite their copper-gold discovery and the acquisition of their coveted Santa Cecilia project, all of which happened in the last several months.

This project is so appealing that former Newmont global structural geologist Michael Henrichsen has called the asset “extremely rare.”

But that just means this junior miner is a grossly undervalued company, especially when you look at their drilling data along with all the geochemistry and geophysics pointing to large-scale targets, which represent a lot of upside potential.

Investors should keep a close watch on this company as it ramps up 2022 exploration and starts spinning out greater news flow in the near term.

Adjacent to One of the Largest Undeveloped Gold & Copper Deposits

This company flagship gold-copper Santa Cecilia project is the type of extremely rare asset that other companies can only dream of:

- Option to own a 100% interest

- Located in the world-class Maricunga belt

- Surrounded by multi-million-ounce gold and gold-copper deposits (Salares Norte, La Coipa, Cerro Maricunga, Marte, Lobo, La Pepa, El Volcan, Caspiche and Cerro Casale)

- Immediately adjacent to Norte Abierto project, one of the world’s largest undeveloped gold and copper deposits10

That proximity to Norte Abierto means there’s Proven & Probable reserves of 23.2 million ounces of gold and 5.8 billion pounds of copper right beside this company’s property.11

Even more incredible is the limited amount of exploration performed on Santa Cecilia to date.

It’s like the project was frozen in time for 30 years.

That’s when a major international mining company drilled 47 holes (~14,000 meters) and made the first two discoveries on the property.

They drilled a clearly defined epithermal gold system as well as a high-grade gold and silver system. They hit grades that undoubtedly would have been pursued if they were drilled in this decade.

When you combine the epithermal gold drilling near surface with the 925 meter hole directly below it, that’s over 1.5 km of vertical mineralization that has never been followed up on.

The property was held by a private owner for over 30 years…until this company became the first junior exploration company to option it in October 2021.12

“In my years in the junior market, I have never come across something as significant as this before. It’s very rare for a junior exploration company to be in a position to acquire something of this magnitude.”

– Michael Henrichsen, Torq’s Chief Geological Officer13

Now this companies technical team plans to aggressively explore multiple undrilled opportunities to potentially define large-scale mineralized bodies.

Near-term exploration catalysts & news to watch for:

It all adds up to a story you can’t afford to let slip off your radar.

With one drill program already underway and more exploration unfolding, this company could be announcing results in 2022 with serious impact on the market and their stock.

Don’t miss any of it. Do your due diligence. And make sure to click here to sign up for the newsletter so you stay on top of the latest news and milestones.

1https://www.prnewswire.com/news-releases/looming-copper-supply-shortfalls-present-a-challenge-to-achieving-net-zero-2050-goals-sp-global-study-finds-301586242.html

2 https://www.visualcapitalist.com/sp/copper-critical-today-tomorrow-and-forever/

3 https://www.argusmedia.com/en/news/2134947-grade-declines-resource-depletion-to-impact-cu-bhp

4 https://www.spglobal.com/marketintelligence/en/news-insights/research/copper-discoveries-declining-trend-continues

5 https://www.mining-journal.com/resourcestocks-company-profiles/resourcestocks/1422932/chile-the-worlds-most-prolific-copper-producing-country

6 https://www.trade.gov/country-commercial-guides/chile-mining

7 https://www.torqresources.com/news-media/news/2022/torq-makes-new-discovery-at-its-margarita-iron-oxide-copper-gold-project-90-metres-of-0.94-copper-and-0.84-g-t-gold/

8 https://www.torqresources.com/news-media/news/2022/torq-increases-and-closes-c-5.28-million-private-placement/

9 https://www.torqresources.com/investors/corporate-presentation/

10 https://www.barrick.com/English/operations/exploration-and-projects/default.aspx

11 https://www.mining.com/web/chiles-supreme-court-orders-new-evaluation-of-norte-abierto-project/

12 https://www.torqresources.com/news-media/news/2021/torq-options-santa-cecilia-gold-copper-project-in-maricunga-belt-in-chile/

13 https://nationalpost.com/sponsored/business-sponsored/torq-resources-new-gold-copper-project-a-game-changer-for-investors

Legal Notice: This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any company or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.