- MARKET POWER – Driven by rocketing inflation, long stagnant gold prices are showing signs of a resurgence, leading experts like David Garofalo to predict gold could hit $3,000 in the near-term. And silver looks to be heading upward in the near term, with expectations to pass $30 by 20251.

- PEAK DEMAND – As a critical element in the development of electronics and EVs, silver demand is expected to quickly eclipse supply. And with billions now pouring into clean energy infrastructure, new North American sources are in critical need.

- FOLLOW THE NEWS – Exploring in Mexico’s prolific mineral belt, phase 3 drill samples taken by Tocvan Ventures Corp. (CSE: TOC; OTCQB: TCVNFCSE: TOC; OTCQB: TCVNF) come in at bonanza level grades, as high as 3 g/t Au and 49 g/t Ag.

- TIME TO JUMP ON BOARD – Shares appear significantly undervalued as the company announces move towards development.

Investors need to get up to speed in a hurry because political headlines have buried this stunning news: The rate of inflation over the past year jumped to 4.2%— the highest level since 2008.2

In the U.S., consumer prices increased by the most in 13 years as booming demand amid a reopening economy came head to head with bottlenecks in the supply chain3

And now with gold and silver prices closely approaching an all-time high, Tocvan is in a great position to become one of the best performing precious metals stocks this year.

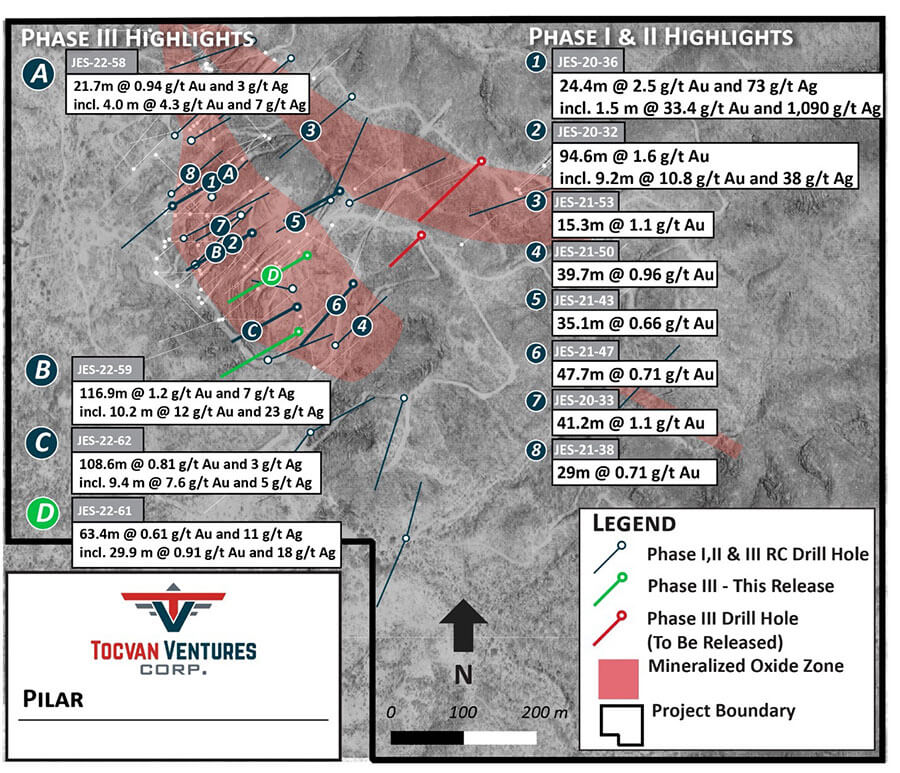

The company just announced phase 3 drill results on the flagship Pilar project, revealing excellent gold and silver grades over long distances with almost every drill hole, considerably increasing the potential for a sizeable open-pit mine.

Drill hole JES-22-61 intersected a significant mineralized zone, grading 2.1 g/t Au, 45 g/t Ag and 6.1% Zn over 8.9 meters. This is the highest-grade base metal mineralization recorded to date.

And now with the discovery of high grades of zinc, a metal that is looking like an increasingly viable replacement for the lithium in EV batteries, the company has another potential path to building value for shareholders.

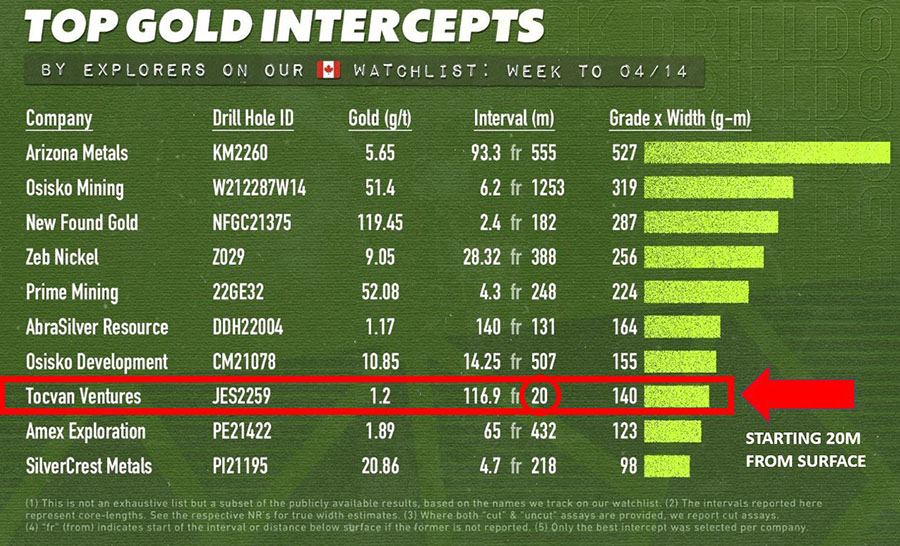

Their last set of drill results returned an impressive 116.9m of 1.2 g/t Au, ranking in high among top global drill results reported for the week of April 14th.

- Tocvan ranked 8th in the Grade x Width Index…

- 2nd for theTotal Width Index…

- And 1st for the Surface Proximity Index

Tocvan CEO, Brodie Sutherland, highlighted the significance of the findings, noting that,

“Drilling southeast of our Main Zone continues to return excellent gold and silver values in intensely silicified breccia-hosted mineralization. Once again, the orientation of drilling has maximized success through this extension zone returning consistent values that warrant more drilling to fully evaluate the potential of the area. We are excited to evaluate the next steps at Pilar as we continue to move the project forward.”

The map above illustrates the greatly increased extent of the gold-silver mineralization trend at Pilar, that saw resource potential in the range of:

- 2.1 g/t Au, 45 g/t Ag and 6.1% Zn at 8.9m

- 0.9 g/t Au and 18 g/t Ag at 29.9m

- 12 g/t Au and 23 g/t Ag at 10.2m

- 2 g/t Au and 7 g/t Ag at 116.9m

- 8 g/t Au and 9 g/t Ag at 48.1m

- 5 g/t Au and 73 g/t Ag at 24.4 m

- 3 g/t Au at 4.0m

- 6 g/t Au at 94.6 m

- 1 g/t Au at 41.2 m

Another three drilll holes on the same trend line are still pending results.

That means there could be millions more ounces of silver and gold in the ground remaining to be discovered.

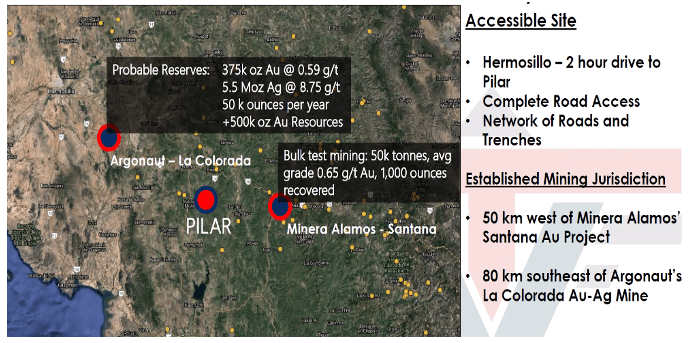

Surrounded By World Class Neighbors

Tocvan’s neighbor Minera Alamos Inc. (market cap: C$253 million) has demonstrated over the past few years how quickly such gold projects can move forward and what is important in making a production decision. For comparison:

Minera Alamos 2018 Phase 1 drill program (highlights):

- 5 m @ 0.65 g/t gold (from 2 m depth)

- 4 m @ 1.05 g/t gold (from 19 m depth)

- 7 m @ 0.85 g/t gold (from 32 m depth)

- 127 m @ 0.81 g/t gold (from 23 m depth)

Magna Gold Corp‘s San Francisco mine has 1.4 million ounces of gold resources (M&I) at an average grade of 0.446 g/t gold.

The San Francisco gold mine is also located in Sonora (only 18 km from Tocvan’s second project, Picacho, and about 200 km from Pilar).

Immediate neighbors of Tocvan’s Pilar project include the Santana Gold Mine of Minera Alamos Inc. (market cap: $253 million CAD) with average grades of 0.65 g/t gold from bulk sampling, and Argonaut Gold Inc.’s Colorada Gold Mine. (market cap: $957 million CAD) with grades averaging 0.59 g/t gold.

Argonaut has successfully demonstrated over the past several years that gold grades in the range of 0.5 g/t gold are substantial enough to operate a highly profitable open pit mine in Mexico, where production costs and mine construction costs are comparatively low.

For Osisko Gold Royalties Ltd. (market cap: $2.6 billion), good drill results and a 50,000 t bulk sample were sufficient to acquire a $14 million stake in Minera Alamos, which was used to finance mine construction.

Today, this once small gold explorer Minera Alamos Inc. has a handsome market cap of $253 million, and has been one of the best performing gold stocks in the world with >800% returns over the last 2-3 years.

Breaking Ground At El Picacho

Just this March, Tocvan announced the closing of a private placement totalling $360,803 CAD, the proceeds of which will go towards advancing the Pilar, as well as beginnning exploration on the newly acquired El Picacho project.

“With the recent discovery of a broad mineralized breccia host and the activation of a second drill rig at Pilar, we feel now is the time to keep the momentum going as we come into full-swing of our operating season.”, commented CEO, Brodie Sutherland.

“The use of these funds will ensure we are able to advance Pilar as much as possible this season while starting to evaluate our newest acquisition, the exciting Picacho Au-Ag project, a brownfields project in the Caborca Orogenic Gold Belt.”

Strategically located in a prolific gold belt known for producing gold mines that include La Herradura and San Francisco, El Picacho covers 2,414 hectares that sit just 140 kilometers north of Hermosillo.

So far, five primary zones of mineralization have been identified across the property, offering six kilometers of prospective trends.

Permitting is already in place for up to 15 kilometers of drilling and two kilometers of trenching, with drilling anticipated to take place soon following further assessment targets by mapping, geochemistry and geophysics.

Highlights of the Picacho project are:

- Multi-million ounce gold-silver potential

- 24 km2 area to explore

- 6 km of prospective trend defined thus far

- 18 km from producing San Fransico Mine (3 Moz Au)

- Road accessible (2.5 hrs from Hermosillo)

- National Rail line 3km to the east

- Fully permitted for 2 km trenching and 15 km drilling

It is vitally important to keep a close eye on the company as these projects progress. In the past, Tocvan’s share price rose sharply before new project phases began and results were published.

Mexico, A Mining Friendly Jurisdiction

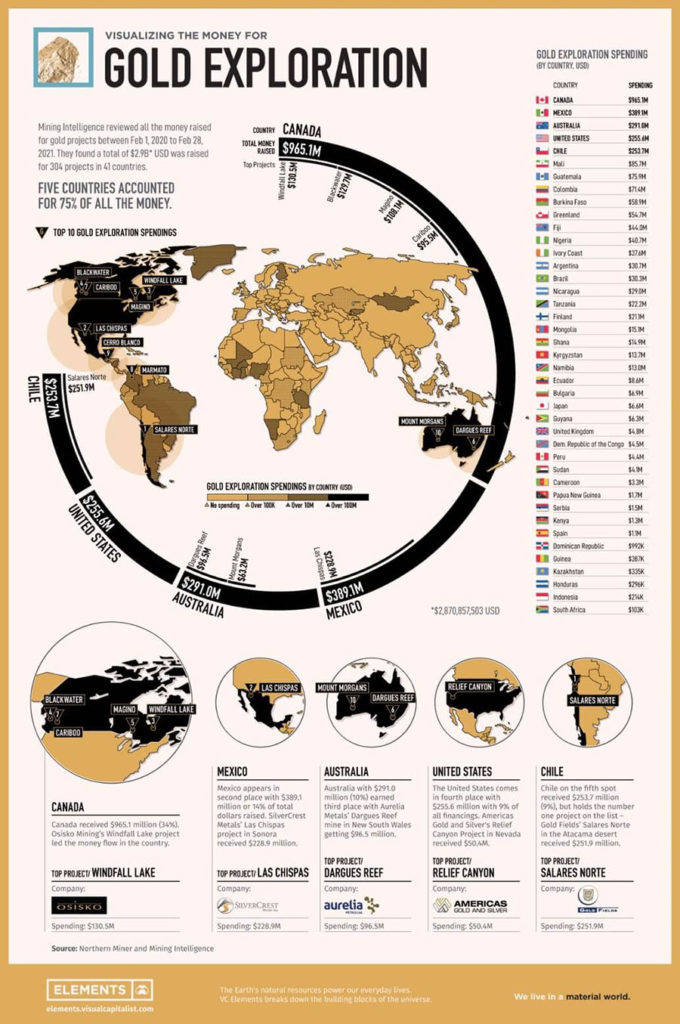

As the chart below shows, Mexico ranks 2nd among all countries worldwide in terms of gold exploration spending.

No other country (except Canada) has as much money flowing into gold exploration as Mexico. The mining and exploration companies know exactly why Mexico is so attractive. Mind you, this chart refers to global exploration spending between February 2020 and February 2021:

Take, for example, Minera Alamos.

In the last 2-3 years, the gold explorer has impressively demonstrated how quickly a gold project in Mexico can be brought into production.

Minera took over the Santana project from another company at a favorable time when the gold price was low. Minera then completed two drill programs and mined a 50,000 t bulk sample, demonstrating gold grades averaging approximately 0.6 g/t gold.

With the price of gold rising sharply in recent years, these results alone were enough to attract Osisko Gold Royalties Ltd. as a strategic partner to fund mine construction (i.e., without official resource estimation and feasibility studies). In other parts of the world, it takes much longer to bring a gold project into production.

The Santana gold mine was built at record speed, recently completed, and is now set to become a showcase for how quickly things can happen in Mexico.

Tocvan Ventures Corp (CSE: TOC; OTCQB: TCVNFCSE: TOC; OTCQB: TCVNF) Offers Immediate Access To What Looks To Be A Long-Term Trend

Gold recently moved past the $2,000 mark, driven by a weak dollar, no-yield interest rates, record inflation, and spiking global debt.

The conclusion is simple. Now is an ideal time to be making a move on gold.

Everything is aligned for growth and few investments in the market today offer the potential of a gold exploration company like Tocvan Ventures. To get started, due your due dligence by visiting the company website. Make sure you enter your email address for future information so you can stay ahead of the market as news breaks.

1https://coinpriceforecast.com/silver

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Tocvan Ventures Corp. (“TCVNF”) and its securities, TCVNF has provided the Publisher with a budget of approximately $15,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by TCVNF) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company TCVNF and has no information concerning share ownership by others of in the profiled company TCVNF. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to TCVNF industry; (b) market opportunity; (c) TCVNF business plans and strategies; (d) services that TCVNF intends to offer; (e) TCVNF milestone projections and targets; (f) TCVNF expectations regarding receipt of approval for regulatory applications; (g) TCVNF intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) TCVNF expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute TCVNF business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) TCVNF ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) TCVNF ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) TCVNF ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of TCVNF to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) TCVNF operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact TCVNF business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing TCVNF business operations (e) TCVNF may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Tocvan Ventures Corp..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Tocvan Ventures Corp. and has no information concerning share ownership by others of any profiled Tocvan Ventures Corp.. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Tocvan Ventures Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Tocvan Ventures Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Tocvan Ventures Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Tocvan Ventures Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Tocvan Ventures Corp. industry; (b) market opportunity; (c) Tocvan Ventures Corp. business plans and strategies; (d) services that Tocvan Ventures Corp. intends to offer; (e) Tocvan Ventures Corp. milestone projections and targets; (f) Tocvan Ventures Corp. expectations regarding receipt of approval for regulatory applications; (g) Tocvan Ventures Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Tocvan Ventures Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Tocvan Ventures Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Tocvan Ventures Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Tocvan Ventures Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Tocvan Ventures Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Tocvan Ventures Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Tocvan Ventures Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Tocvan Ventures Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Tocvan Ventures Corp. business operations (e) Tocvan Ventures Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Tocvan Ventures Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Tocvan Ventures Corp. or such entities and are not necessarily indicative of future performance of Tocvan Ventures Corp. or such entities.