Lithium Supply Shortage Ignites Bidding Wars Across Argentina

Resource Analysts Are Now Wondering, Who’s Next?

Editorial Feature | Dec 1, 2021 | Industry

Throwing A Dart Blindfolded Could Score A Huge Lithium Stock Winner These Days… But The Biggest Upside Could Be Found By Taking Careful Aim On Argentina Lithium and Energy Corp. (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF)

- The looming lithium shortage has sent the price of battery-grade lithium up 313% since October 2020.1

- Bloomberg called the rush to lock up supply a frenzy.2

- Now, the “first-family” of Lithium Triangle mining could be set to tap into two extraordinary new lithium mines potentially worth billions.

- And the best part is, the company is exploring near Millennial Lithium, the recent target of a bidding war with a $400 million price tag by Lithium Americas, Ganfeng, and China’s largest battery maker CATL.

- It’s the first time in more than a decade that retail investors have the chance to follow Joe Grosso into what could be a major mining payday.

One of the world’s true mining legends has two new projects with the potential to generate a major new lithium discovery.

And it couldn’t happen at a better time.

That’s because the projects are on two high-plateaus, the Incahuasi Salar and the Salar de Antofalla, both in Argentina’s Catamarca Province. That’s the heart of the world-famous Lithium Triangle.

And, today, the biggest news out of Argentina mining industry is not major discoveries.

It’s about the bidding war for a junior explorer – Millennial Lithium.

Three major lithium miners got in a bidding war to acquire it… the latest bid is in the half-a-billion-dollar range… around $4.70 a share.

That’s going to be a hefty payday for investors who bought Millennial shares in the $1.20 range last November.

And, that’s why investors must quickly zero in on another junior explorer – Argentina Lithium and Energy Corp. (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF).

Imagine Bill Gates, or Elon Musk, or Jeff Bezos Were Pointing You To Their Companies At Their Earliest Stages… Now Meet Joseph Grosso

Argentina Lithium and Energy merits every serious natural resource investor’s immediate attention because preeminent on its Board of Directors is a man named Joseph Grosso.

A Canadian, he is legendary as the man who opened Argentina’s mining industry to the world.

That means he’s also a man so hooked into the Argentina mining, with lifelong friends, that it’s easy to imagine he’s sitting on some of the best properties down there.

Grosso is an industry heavyweight… perhaps the heavyweight.

He successfully formed alliances and negotiated with mining industry majors such as Barrick, Teck, Newmont, Yamana Gold, and Vale S.A.

Though it’s hard to imagine him selling Incahuasi Salar or the Salar de Antofalla properties, the major miners seem desperate, and they know Grosso knows just what his company is sitting on.

The Bidding War

Per Bloomberg, this is what’s happing in Argentina as of November 1.

The bidding war for Millennial Lithium picked up after Lithium Americas Corp. offered to buy its Canadian counterpart for about $400 million during the frenzy for a metal that’s crucial to powering electric vehicles.

The offer to Millennial shareholders was C$4.70 ($3.78) a share payable in Lithium Americas stock and C$0.001 cash.

The offer came a month after the world’s largest battery maker, China’s Contemporary Amperex Technology Co Ltd., agreed to buy Millennial for C$3.85 a share.

CATL looks to have come in second even after had outbid Chinese lithium giant Ganfeng Lithium’s C$353 million July offer for Millennial.

Home Court Advantage

So, the dollars are starting to fly.

And you could assume the spurned majors, CATL and Ganfeng, have moved on to scouting other Lithium Triangle properties.

It’s hard to imagine that Catamarca Province is not on their radars.

And that would be good news for American Lithium because its neighbor, Neo Lithium’s Tres Quebradas project, is forecast to produce an average of 20,000 metric tons of battery-grade lithium carbonate over a mine life that would span three decades.3

Argentina Lithium’s other Catamarca neighbor is U.S.-based Livent Corp. It has a working mine known as the Fenix Project.

The Fenix’s reserves are estimated at 1.2 million metric tons of lithium, meaning it should have no problem doubling its output in 2022 to 40,000 metric tons.4

With gross margin per metric ton now beyond $5,000, that will be an apt reward for the increased output.

Soaring lithium prices, combined with huge profit margins have caused Livent’s shares to soar more than 300% higher since mid 2020.5

Make The Right Move Into Lithium Now

So you can see why the lithium-rich Catamarca Province and Argentina Lithium and Energy Corp. (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF) could be the secret behind 2022’s most significant investment returns.

And why there’s a good chance that Catamarca Province will become a vital link in the lithium supply chain.

Argentina Lithium could be just months away from discovering new lithium resources.

The company began exploring its Incahuasi Salar basin property four years ago.

And geophysical surveying indicated the potential for lithium-rich brines at depth.

That Argentina Lithium and Energy Corp. (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF) could control this 50-square mile property in the heart of the world famous Lithium Triangle likely comes as no surprise to mining industry insiders.

But the property with the highest buyout potential it would have to be the Salar de Antofalla property.

That’s because his team is so hooked into Argentina’s mining industry that the Salar de Antofalla feels like a pure Joe Grosso play.

You see, Argentina Lithium and Energy snatched 34,500-square acres (55 square miles) of lithium rich land right out from under a huge global miner’s nose.

That miner, the Albemarle Corp (NYSE:ALB), may have lost track of its lease expiration dates, which allowed Argentina Lithium to pounce.

That was after Albemarle reported that its exploration on its Salar de Antofalla property suggests it’s home to 2.2 million metric tons of lithium.

It’s understandable that there’s so much excitement about Argentina Lithium and Energy Corp. (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF) and Grosso’s new projects on two high-plateaus in Northwest Argentina.

In fact, the properties’ potentials are so unfathomably large that the Grosso Group isn’t sharing them with major miners.

Argentina Lithium and Energy is keeping 100% of both properties to itself.

That’s another hint that should steer investors to keeping a sharp eye on Argentina Lithium and Energy Corp. (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF).

All-Star Mining Team Should Deliver In A Big Way

Mining Catamarca lithium should be a straightforward process.

Mining Catamarca lithium should be a straightforward process.

In this case, should a project advance to become a mine, Argentina Lithium would drill into underground salar brine deposits.

The brine would be pumped to the surface and distributed to evaporation ponds.

The brine remains in the evaporation ponds for a period of months until most of the water content has evaporated thanks to heat from the sun.

From there, the brine is treated with a reagent, usually sodium carbonate, to form lithium carbonate.

Then according to S&P Market Intelligence, Argentina Lithium and Energy (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF) could expect to hold a significant margin on each metric ton it mines.6

Argentina Has An Aggressive, Mining-Friendly President

From there, it’s easy to imagine that Argentina Lithium and Energy product would flow to the United States, where it’s needed in great supply.

Globally, Argentina ranks third in terms of largest proven reserves, fourth in lithium production. More importantly though, it’s first among U.S. sources of lithium imports, according to the Americas Society/Council of the Americas.7

The U.S. can expect a huge jump in imports of desperately needed lithium because Argentine President Alberto Fernández intends to increase the country’s production almost sixfold from 40,000 metric tons of lithium carbonate equivalent a year to 230,000 metric tons by the end of 2022.

Estimates are that could boost exports from $190 million a year to somewhere in the $1-billion range.

That super-fast jump in exports is supported by an Inter-American Development Bank report that finds that Argentina has the greatest potential of the Lithium Triangle countries for exploration and mining, thanks to a regulatory framework more open to foreign investment.8

Argentina Lithium and Energy (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF)

should be able to ride this huge wave of high-margin projects.

A 10-Year Mega Trend

“We’ve gone electric, and there’s no going back at this point. Lithium is our new fuel, but like fossil fuels, the reserves we’re currently tapping into are finite — and that’s what investors can take to the bank.” 9

~ USA Today

Of course, when it comes to electric vehicles it’s no longer huge news that they are driving unrelenting demand for lithium.

But, we often lose sight of just how big the trend is now and how massive it is poised to become.

Over the next three years, EVs are forecast to reach parity with internal combustion vehicles – in both price and performance.10

Shortly after that happens, at least half the vehicle sales worldwide will be made up of electric vehicles powered by lithium batteries, according DNV GL, an energy consultancy.11

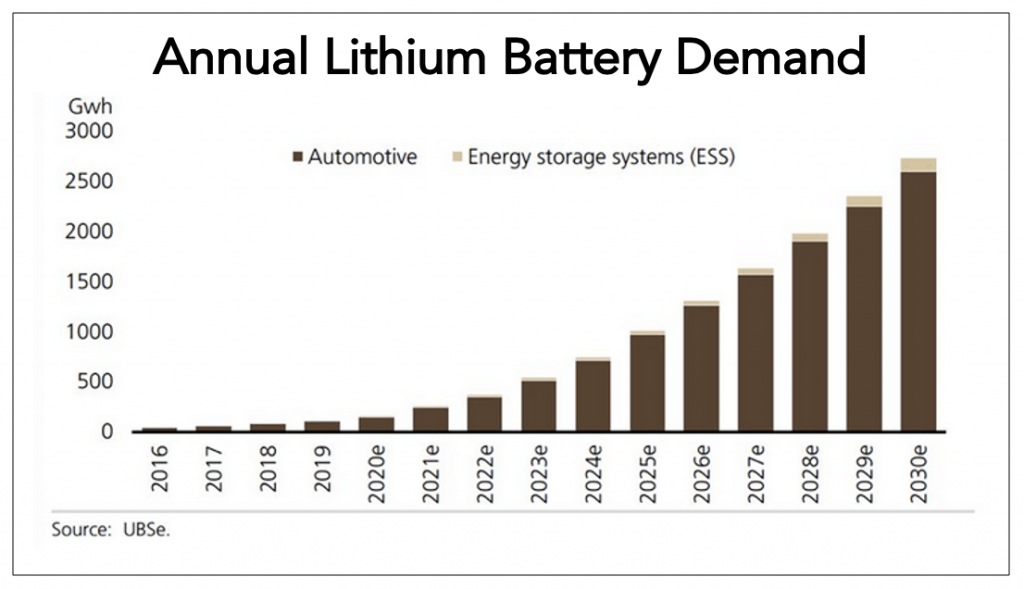

Ultimately, analysts at UBS investment banks forecast that by 2030, EVs will need 2,700 GWh worth of lithium-ion batteries a year.12

For perspective, that’s equivalent to 225 billion iPhone 11 batteries – and 13X more battery power than we use today.13

In fact, UBS analysts estimated that the lithium market will grow 8X by 2030.

Here’s why.

The International Energy Agency forecasts that there will be a combined 125 million EV cars and trucks on the road over the next decade.14

Their batteries will require hundreds of tons of lithium.

That’s because, at an estimated 3 pounds (1.4kg) of lithium per kWh of power, the smallest EV, that runs on 20kWh batteries will use about 60 pounds lithium.

Big cars with 100kWw batteries will use around 300 pounds of lithium.15

Right now, today’s average battery pack is 55.6kWh.16 At 3 pounds per kWh, those batteries could need about 166 pounds of lithium.

This is a significant issues for all EV makers.

Because, if the average EV battery size holds, the world is going to need at least 20.8 billion pounds, or 10.4 million tons, of lithium over the next decade.

That fact should leave all EV makers short of breath, while investors should be dancing in the streets.

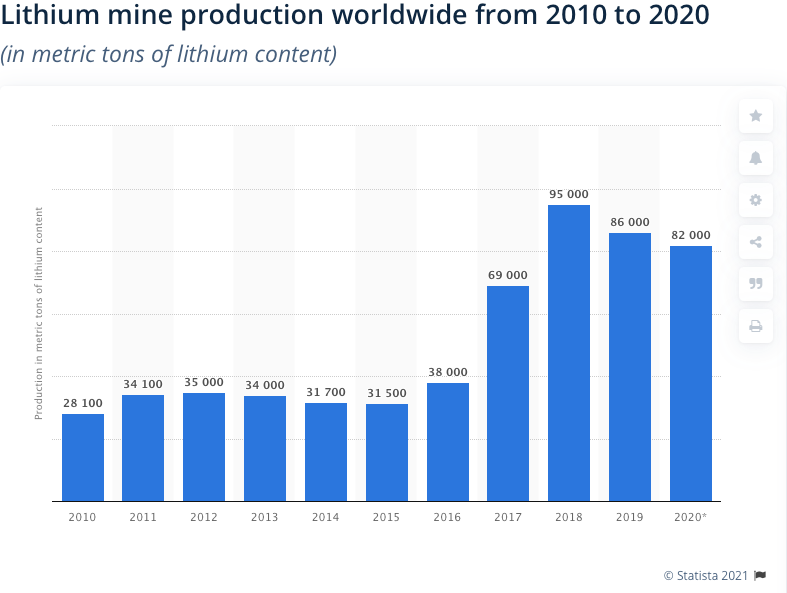

In the 10 years between 2010 and 2020, the world mined a total of 533,800 metric tons of lithium.

That means reaching those numbers would require a 20X jump in output.

It May Be No Surprise, But That Doesn’t Ease The Looming Supply Crisis

And, that’s no surprise either, for as Global X ETF analyst reports, lithium miners are planning for scenarios where annual demand exceeds 1.1 million metric tons of lithium by 2025.17

This massive demand is why some big EV makers will likely be forced to secure long-term supply contracts with individual mining companies.

That’s a formula that could put companies, such as Albemarle (NYSE:ALB) and Argentina Lithium and Energy (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF), in the driver’s seats when it comes to setting price per ton.

EVs reaching parity with internal combustion engine cars is a mind-bending thought.

So, where’s all this demand coming from.

- In late 2020, Volkswagen has raised its planned investment in digital and electric vehicle technologies to $86 billion over the next five years as it seeks to hold onto its crown as the world’s largest carmaker in a new green era.18

In last year’s plan, the German car and truck maker, which owns brands including VW, Audi, Porsche, Seat and Skoda, had earmarked $72 billion for electric and self-driving vehicles out of its $182 billion budget.

- In February 2021, Ford announced plans to double its investment toward electric and autonomous vehicles to $29 billion through 2025. The bulk of the spending – $22 billion –is for EVs.19

- General Motors plans to only sell EV’s by 2035, It’s spending $27 billion to launch 30 EVs by 2025.20

- Even Amazon.com is on board. It delivers 10 billion packages a year. In mid-September 2019, the world’s largest e-commence company ordered 100,000 electric delivery vehicles from U.S. vehicle design and manufacturing startup Rivian Automotive.

- Anheuser-Busch has rolled out 21 EV truck pilot program in California.

- Volvo Trucks is building 23 heavy-duty electric trucks using a $44.8 million grant from the California Air Resources Board.

- Everyone’s darling, Tesla (NASDAQ:TSLA) built 500,000 EVs worldwide last year.

No Matter How You Play It, Lithium Now Looks Like A No-Brainer Investment

This is why Argentina Lithium and Energy (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF)

could soon be center stage.

Its Incahuasi Salar project, in the lithium rich Catamarca could soon find it exporting lithium north into the U.S.

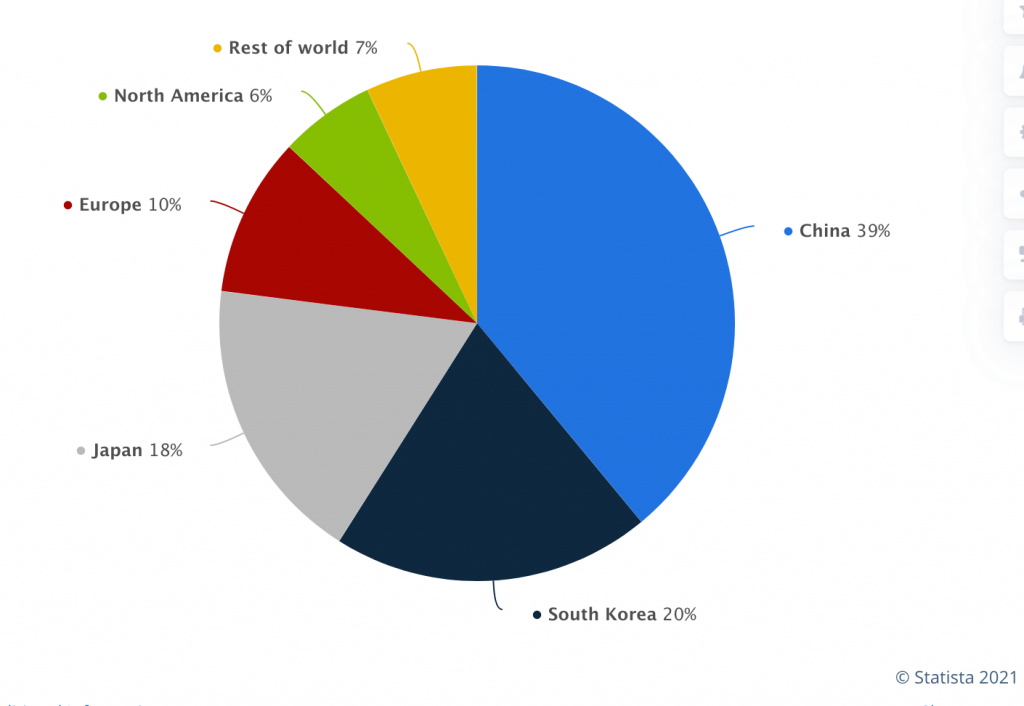

That connection would be vital to U.S. domestic interests because currently China gobbles up 39% of the world’s lithium.

South Korea at 20% and Japan at 18% are next in line as consumers of lithium, which is used to produce high-performing batteries.

It’s shocking, when you consider North America’s security to find that 77% of all the world’s lithium is used in Asia.

It’s Not A Secret… It’s Now Obvious

As you can see, by 2025 swelling lithium demand will most likely outgrow the supply of all the known lithium projects.

“There is not sufficient supply to meet this demand projection based on our knowledge of known projects today. That includes all projects whether they are under construction, in feasibility or still in exploration,” Glyn Lawcock, Global Head of UBS’ Mining Research, wrote in a recent report.21

Of course, as you probably know, for the past couple of decades lithium-ion batteries proved their worth powering billions of devices: bluetooth earbuds, cameras, laptops, and e-scooters—anything you don’t need a cord for.

But all the world’s gadgets are just a drop in the ocean compared to the battery power that 3,500-pound to 5000-pound vehicles will eat up.

It’s why EVs will explode battery demand compared to their lithium-ion cousin in the coming years:

Three Solid Ways To Play One Of The World’s Most Dominant Trends

You don’t have to be a Wall Street trader to connect the dots here.

Millions of battery-powered cars will hit the road in the 2020s. And each year they’ll need more and more lithium.

Lithium demand will go up. One bullish point to lithium producers who will sell more lithium.

Then as lithium demand soars, so will lithium prices to spur the build-out of new mines and meet the growing demand from EVs. Another bullish point to lithium producers.

All this hints that lithium producers might be in for a hell of a decade. And there are three solid ways to invest in this.

You could look into major lithium producers – such as Albemarle (NYSE:ALB), the world’s largest lithium producer, or Livent (NASDAQ:LTHM), which, like Argentina Lithium and Energy, has a Catamarca Province operation.

And, quite frankly, in this environment of heavy demand you could close your eyes, throw a dart and likely hit a lithium winner.

Or, as we suggest, you could swing for the fences with Argentina Lithium and Energy (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF)

. It’s a junior explorer, now in the heart of the lithium mega trend.

9 Reasons To Put Argentina Lithium and Energy Corp. (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF) On Your Investment Radar Now

- Quadrupling of Supply Just to Stay Even – Analysts believe the world’s annual lithium output needs to be about 1.1 million tons a year. That is a four and half times jump from 2018’s global demand of approximately 270,000 metric tons

- Argentina Lithium and Energy Is Set In A Sweet Spot – Argentina Lithium and Energy (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF) controls more than 100-mile-square property in the heart of the world famous Lithium Triangle. Estimates suggest that the triangle holds about 54% of the world’s lithium resources.

- Catamarca Dreaming – Argentina Lithium is fully licensed and permitted to begin immediate exploration on its lithium-rich Catamarca Province property. Catamarca is home to a Livent Corp. mine that is supposed to double its output to 40,000 metric tons next year. And it’s home to a new project which estimated to yield 20,000 metric tons for the next 35 years.

- Salar de Antofalla – Argentina Lithium is just now ready to begin exploration here. The hope is Antofalla hold something in the range of a neighboring property, which is an estimated 2.2 million metric tons of lithium.

- First Family – Argentina Lithium and Energy (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF) is run by, for lack of a better term, the godfather of Argentina mining. He’s Joe Grosso who is often credited to reopening Argentina to mining back in 1993.

- The Welcome Mat Is Out – Argentine President, Alberto Fernández, has lowered export taxes from 12% to 8%… Fernández also intends to increase the country’s lithium production almost sixfold from 40,000 metric tons of lithium carbonate equivalent a year to 230,000 metric tons by the end of 2022.

- Massive New Output – Fernández’s plan could find Argentina Lithium and Energy a major player as the plan could boost exports from $190 million a year to somewhere in the $1-billion range

- 125 million EVs in the Next Decade – Volkswagen will lead this drive with a goal of building 15 million EVs in the next five years. GM wants to build 1 million EVs a year.

- Demand Will Likely Outstrip Supply – If the average EV battery size holds, the world is going to need at least 20.8 billion pounds, or 10.4 million tons, of lithium over the next decade.

The Smart Play Is To Get Into Argentina Lithium and Energy Corp. (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF) Now Before The Looming Demand Crisis Starts Making Huge Headlines

The news loves a crisis, and sooner than later, it will move on from the pandemic and politics to the next big threat…

That’s likely the fact that unless there’s a huge new supply, the world’s EV market could collapse.

That’s why you’ll likely see companies such as Telsa, Ford and Volkswagen assure their survival by going out and buying mines to lock down supply.

Argentina Lithium and Energy (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF)

is in the heart of the Salta and Catamarca Provinces in the world famous Lithium Triangle. It could be home to more than 54% of all the world’s lithium.

With the hunt for new lithium now part of a worldwide crisis you could expect Argentina Lithium to stay in the news for years to come.

That’s why now could be the very best time to latch onto its affordably priced shares.

That means it’s time to call your broker or advisor and show him or her this report.

Then discuss this new opportunities in lithium and, in particular, with Argentina Lithium and Energy.

Because, when you take your position now in Argentina Lithium and Energy Corp. (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF)

you could find yourself among the earliest and biggest winners.

Learn More About Argentina Lithium and Energy (TSX:LIT, OTC:PNXLFTSX:LIT, OTC:PNXLF) at your brokerage today!

1https://www.greencarcongress.com/2021/10/20211030-benchmark.html

2https://www.bloomberg.com/news/articles/2021-11-01/bidding-war-for-millennial-lithium-heats-up-with-ev-metal-surge?sref=VcSM8PCz

3https://www.nsenergybusiness.com/projects/tres-quebradas-lithium-project-catamarca/

4https://www.nsenergybusiness.com/projects/fenix-lithium-mine-salar-del-hombre-muerto/

5https://finance.yahoo.com/quote/LTHM/history?p=LTHM

6https://pages.marketintelligence.spglobal.com/Lithium-brine-vs-hard-rock-demo-confirmation-MJ-ad.html

7https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

8https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

9https://www.usatoday.com/story/money/markets/2016/08/26/could-lithium-shortage-derail-electric-car-boom/87684224/

10https://www.utilitydive.com/news/electric-vehicle-models-expected-to-triple-in-4-years-as-declining-battery/592061/

11https://blogs.dnvgl.com/energy/ev-uptake-will-be-fast-and-vast

12https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=5acf1f951a44

13https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=5acf1f951a44

14https://www.cnbc.com/2018/05/30/electric-vehicles-will-grow-from-3-million-to-125-million-by-2030-iea.html

15http://www.meridian-int-res.com/Projects/How_Much_Lithium_Per_Battery.pdf

16https://evadoption.com/ev-statistics-of-the-week-range-price-and-battery-size-of-currently-available-in-the-us-bevs/

17https://www.globalxetfs.com/whats-driving-the-electric-vehicle-lithium-and-battery-markets-in-2019/

18https://www.reuters.com/article/volkswagen-strategy/vw-boosts-investment-in-electric-and-autonomous-car-technology-to-86-billon-idUSKBN27T24O

19https://www.motortrend.com/news/ford-ev-investment-2025/

20https://www.motortrend.com/news/ford-ev-investment-2025/

21https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=5acf1f951a44

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Argentina Lithium and Energy Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Argentina Lithium and Energy Corp. and has no information concerning share ownership by others of any profiled Argentina Lithium and Energy Corp. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Argentina Lithium and Energy Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Argentina Lithium and Energy Corp. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Argentina Lithium and Energy Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Argentina Lithium and Energy Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Argentina Lithium and Energy Corp. industry; (b) market opportunity; (c) Argentina Lithium and Energy Corp. business plans and strategies; (d) services that Argentina Lithium and Energy Corp. intends to offer; (e) Argentina Lithium and Energy Corp. milestone projections and targets; (f) Argentina Lithium and Energy Corp. expectations regarding receipt of approval for regulatory applications; (g) Argentina Lithium and Energy Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Argentina Lithium and Energy Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Argentina Lithium and Energy Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Argentina Lithium and Energy Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Argentina Lithium and Energy Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Argentina Lithium and Energy Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Argentina Lithium and Energy Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Argentina Lithium and Energy Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Argentina Lithium and Energy Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Argentina Lithium and Energy Corp. business operations (e) Argentina Lithium and Energy Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Argentina Lithium and Energy Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Argentina Lithium and Energy Corp. or such entities and are not necessarily indicative of future performance of Argentina Lithium and Energy Corp. or such entities.