A new press-release and a new interview show the great success that Mexico-based gold explorer Tocvan Ventures Corp. (CSE: TOC; OTCQB: TCVNF) has achieved with its recently completed phase-2 drilling program – and what's next.

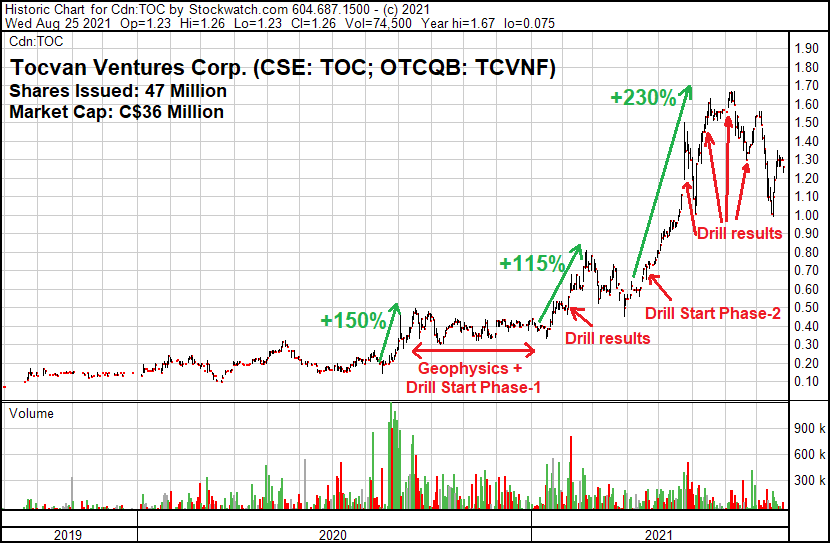

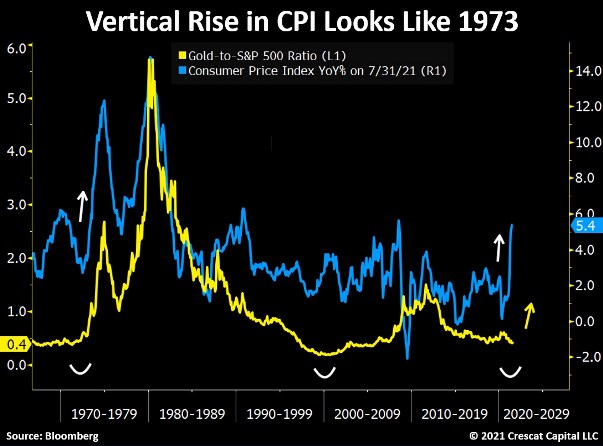

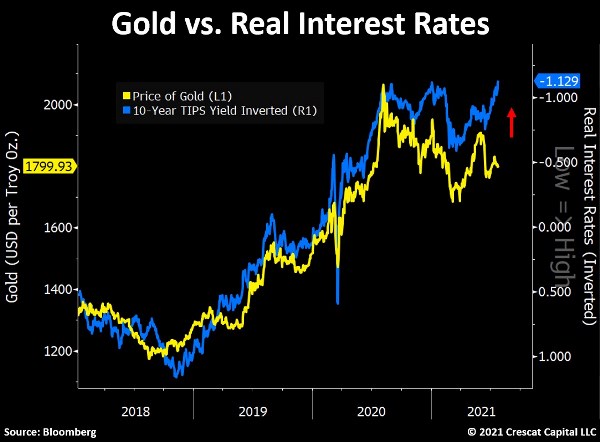

With the possible end of the gold price correction, Tocvan is in a great position to become one of the best performing gold stocks this year, also because the next phase of project development (so-called “trenching” and “mini-bulk-sampling”) is planned to begin in October. In the past, Tocvan’s share price rose sharply before new project phases began and results were published.

A new interview with Tocvan's VP of Exploration, Brodie Sutherland, was publsihed. Brodie explains what Tocvan has accomplished with the recently completed phase-2 drill program and what's next:

The interview impressively shows what a great success the phase-2 drill program was at the Pilar Gold-Silver Project in the Mexican state of Sonora.

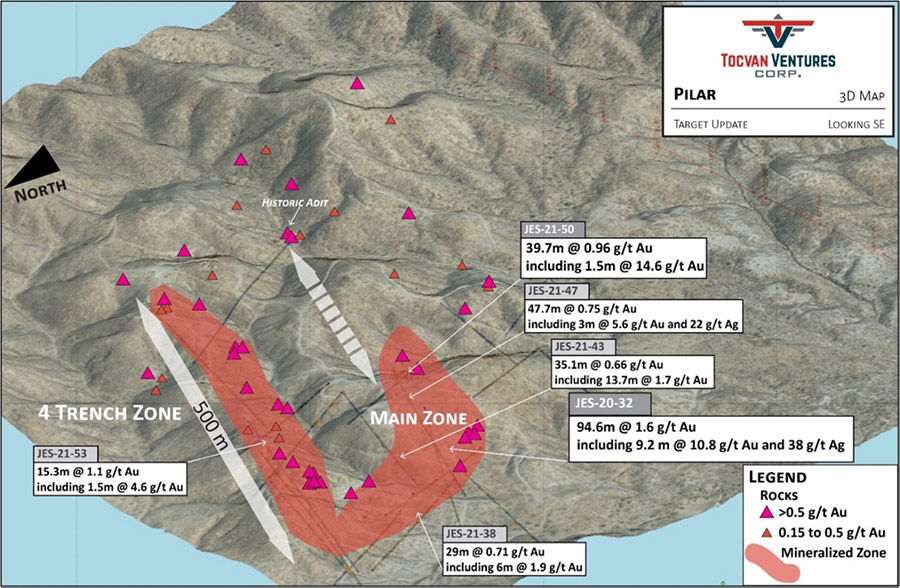

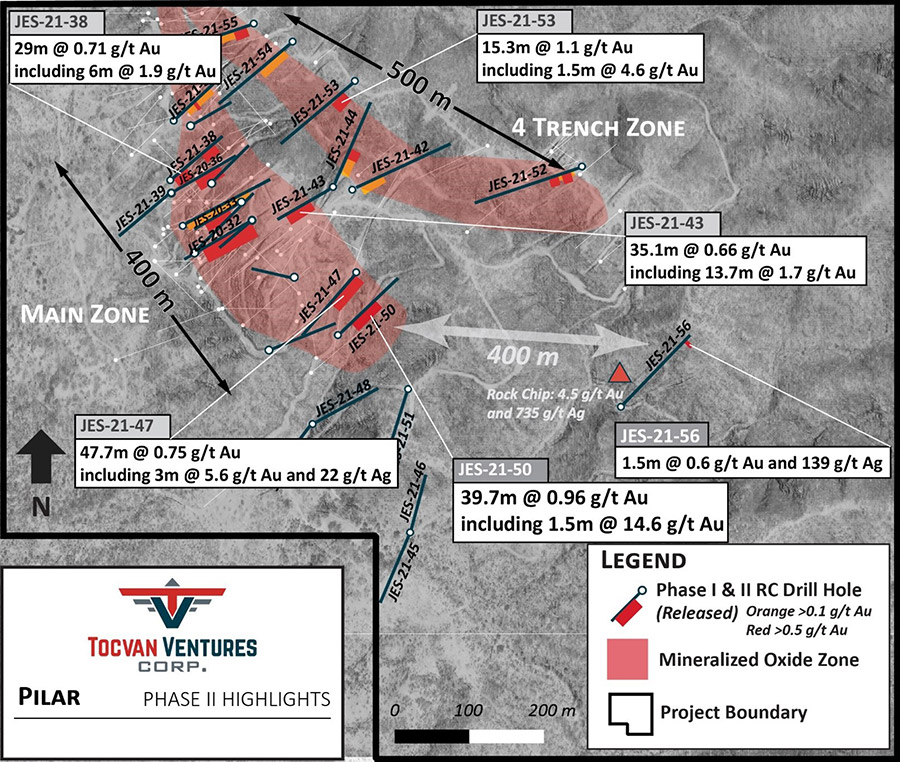

The goal of the drilling program was to expand the known deposit called Main Zone. Expansion drilling is always very risky, as drilling is done outside the known mineralization. But the courage paid off: Tocvan delivered excellent gold grades over long distances with almost every drill hole, thus considerably increasing the dimensions of a potential open-pit.

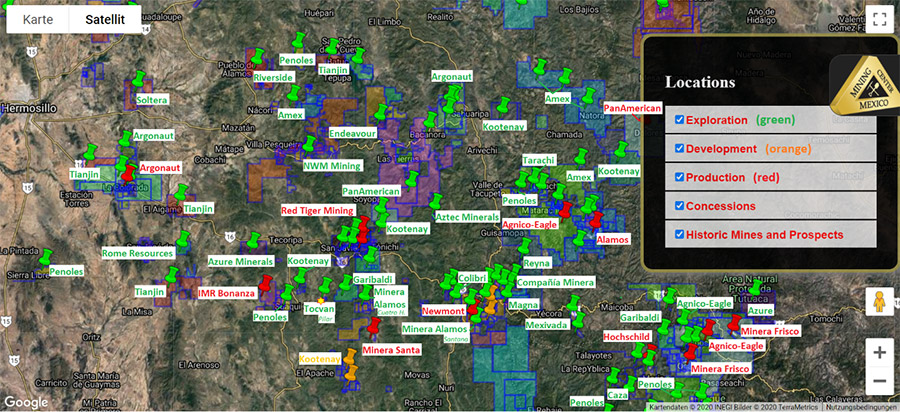

The maps shown in the press-release and interview illustrate the greatly increased extent of the gold-silver mineralization trend.

Another great interview featuring Tocvan’s CEO Derek Wood:

In October, Tocvan plans to start trenching which has already been permitted by the Mexican authorities along with additional drilling. A total of 7 property sections are planned to be tested with trenching. The subsequent lab results will determine which of these 7 trenches will be mined for a bulk sample of up to 50,000 tonnes. Tocvan’s neighbor Minera Alamos Inc. (TSX: MAI; market cap: C$253 million) has demonstrated over the past few years how quickly such gold projects can move forward and what is important in making a production decision.

Highlights of Tocvan’s drill programs:

- 3 m @ 0.8 g/t gold equivalent directly at surface (hole JES-21-47): this step-out hole extended the Main Zone by 100 m to the south. The first 12.2 m returned 1.1 g/t gold and 12 g/t silver (directly at surface), and 19.8 m @ 1.06 g/t gold from 27.5 m depth.

- 7 m @ 0.96 g/t gold including 12.2 m @ 3 g/t gold from 39 m depth and 13.7 m @ 1.7 g/t gold from 119 m depth (Hole JES-21-50): 50 m southeast of Hole JES-21-47)

- 1 m @ 0.72 g/t gold equivalent from 98 m depth (Hole JES-21-43): This step-out hole extended the Main Zone by 100 m to the east.

- 29 m @ 0.71 g/t gold directly at surface (Hole JES-21-38): This step-out hole extended the Main Zone 30 m to the northwest.

- 4 m @ 0.65 g/t gold (Hole JES-21-38)

- 6 m @ 1.6 g/t gold (hole JES-20-32)

- 2 m @ 1.1 g/t gold (Hole JES-20-33)

- 4 m @ 2.5 g/t gold + 73 g/t silver (Hole JES-20-36)

For comparison:

Minera Alamos 2018 Phase 1 drill program (highlights):

- 5 m @ 0.65 g/t gold (from 2 m depth)

- 4 m @ 1.05 g/t gold (from 19 m depth)

- 7 m @ 0.85 g/t gold (from 32 m depth)

- 127 m @ 0.81 g/t gold (from 23 m depth)

The proposed San Francisco gold mine of Magna Gold Corp. has 1.4 million ounces of gold resources (M&I) at an average grade of 0.446 g/t gold. The San Francisco gold mine is also located in Sonora (only 18 km from Tocvan’s second project, Picacho, and about 200 km from Pilar).

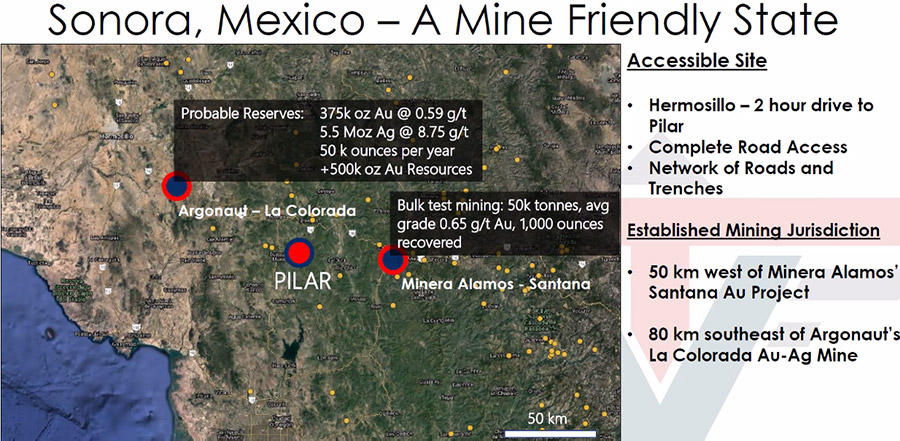

Immediate neighbors of Tocvan’s Pilar project include the Santana Gold Mine of Minera Alamos Inc. (market capitalization: $253 million CAD) with average grades of 0.65 g/t gold from bulk sampling, and Argonaut Gold Inc.’s Colorada Gold Mine. (market capitalization: $957 million CAD) with grades averaging 0.59 g/t gold.

Argonaut has successfully demonstrated over the past several years that gold grades in the range of 0.5 g/t gold are sufficient to operate a highly profitable open pit mine in Mexico, where production costs and mine construction costs are comparatively low.

For Osisko Gold Royalties Ltd. (market capitalization: $2.6 billion CAD), good drill results and a 50,000 t bulk sample were sufficient to acquire a $14 million stake in Minera Alamos Ltd. which was used to finance mine construction. Today, this once small gold explorer Minera Alamos Inc. has a handsome market capitalization of $253 million and has been one of the best performing gold stocks in the world with >800% returns over the last 2-3 years.

Tocvan’s CEO Derek Wood already talked last year about how happy the whole team is with the Pilar project, with 17,000 m of drilling already completed in the Main Zone (by previous operators mainly in the 1990s when the gold price was below $500, and in the 2010s when the gold price was in a long-term correction).

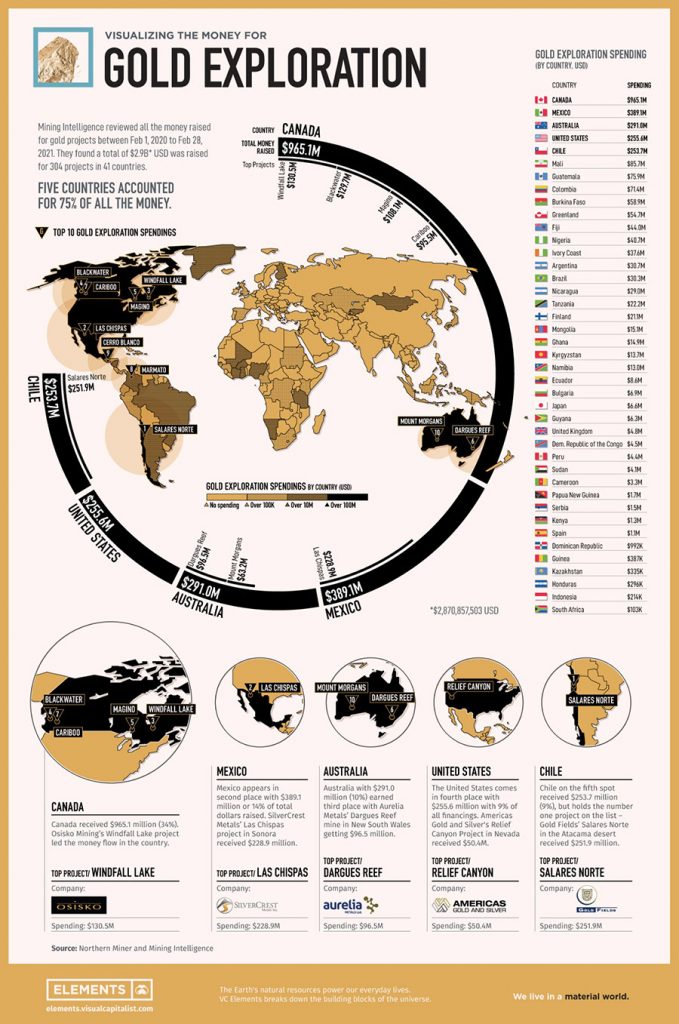

As the chart below shows, Mexico ranks 2nd among all countries worldwide in terms of gold exploration spending. No other country (except Canada) has as much money flowing into gold exploration as Mexico. The mining and exploration companies know exactly why Mexico is so attractive. Mind you, this chart is up-to-date and refers to global exploration spending between February 2020 and February 2021:

Example Minera Alamos: In the last 2-3 years, the gold explorer has impressively demonstrated how quickly a gold project in Mexico can be brought into production. Minera took over the Santana project from another company at a favorable time when the gold price was low. Minera then completed two drill programs and mined a 50,000 t bulk sample, demonstrating gold grades averaging approximately 0.6 g/t gold. With the price of gold rising sharply in recent years, these results alone were enough to attract Osisko Gold Royalties Ltd. as a strategic partner to fund mine construction (i.e., without official resource estimation and feasibility studies). In other parts of the world, it takes much longer to bring a gold project into production. The Santana gold mine was built at record speed, recently completed, and is now set to become a showcase for how quickly things can happen in Mexico.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Tocvan Ventures Corp..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Tocvan Ventures Corp. and has no information concerning share ownership by others of any profiled Tocvan Ventures Corp.. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Tocvan Ventures Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Tocvan Ventures Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Tocvan Ventures Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Tocvan Ventures Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Tocvan Ventures Corp. industry; (b) market opportunity; (c) Tocvan Ventures Corp. business plans and strategies; (d) services that Tocvan Ventures Corp. intends to offer; (e) Tocvan Ventures Corp. milestone projections and targets; (f) Tocvan Ventures Corp. expectations regarding receipt of approval for regulatory applications; (g) Tocvan Ventures Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Tocvan Ventures Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Tocvan Ventures Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Tocvan Ventures Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Tocvan Ventures Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Tocvan Ventures Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Tocvan Ventures Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Tocvan Ventures Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Tocvan Ventures Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Tocvan Ventures Corp. business operations (e) Tocvan Ventures Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Tocvan Ventures Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Tocvan Ventures Corp. or such entities and are not necessarily indicative of future performance of Tocvan Ventures Corp. or such entities.