Acquisition-hungry Bit Origin (NASDAQ: BTOG) has been buying up smaller players by the thousands, and is now positioned to increase mining capacity 7,200%+ as operations begin in the near-term.

Last summer, Fortune magazine claimed Bitcoin mining might…

“rank as the most profitable major industry on the planet.”

At that time, it seemed that everyone was getting a piece of the action. Mining was easy even for beginners.

In Texas, two kids fresh out of college caught the attention of investors across the globe when they used flare gas from oil wells to power up their computers, and earned themselves a quick $4 million.1

And entrepreneurs from all walks of life rushed in to take part in what could be the most substantial financial shift in centuries.

2021 saw the highest miner revenues to date, raking in a total of $16.7 billion. That’s more than the revenues from the prior three years combined2.

Today those stories are becoming increasingly rare, as the rush of inexperienced operators diluted the mining pool, and then failed to keep up with the demands of this highly technical enterprise.

The summer highs we saw last year crashed. By November, Bitcoin values had bottomed out, dropping close the year’s lowest levels. Big mining pools were bankrupted3 and startups ran for cover.4

Bitcoin’s no place for amateurs anymore. It’s now a game where only the seasoned will prevail.

Alex de Vries, the industry expert who founded Digiconomist, says that 98% of the computers being used to mine Bitcoins will never succeed.

They’ll never earn a single Bitcoin.

That’s why it has become imperative to do your due diligence, and seek out opportunities founded upon the mathematical, programming and hardware expertise you can find at a company like Bit Origin (NASDAQ: BTOG).

There’s something different and more investible about this newly formed Bitcoin miner. No matter how hard it gets, no matter how many others fail, BTOG’s C-Suite execs are ready to win…

- From the top university math and theory expert who has helped develop and teach blockchain programming since 2016

- To the moneymaker with experience in large-scale collaborations and important connections on three continents who will lead the company

- To the hardware strategist who has kept systems at peak performance no matter what changes Bitcoin throws at him.

These experts have put their heads together. And it marks an occasion where astute investors—even with no Bitcoin experience—can succeed alongside them, as we enter the next stage of the fintech revolution.

Looming semiconductor shortage could trigger the next Bitcoin boom

Supply chain woes seem to be the norm these days, affecting nearly every industry across the globe, and fintech is no exception.

The same shortage of semiconductor chips that crippled the automotive industry this past 24 months, is now threatening to slow the growth of bitcoin mining pools across the globe.

Seeing the writing on the wall, the U.S. Department of Commerce has recently become very involved, meeting with semiconductor companies to better address the issues underlying these supply shortages5.

The United States Senate is also on board, recently passing the “U.S. Innovation and Competition Act,” which will inject $52 billion towards increasing domestic manufacturing. They also have introduced the “CHIPs for America Act,” purposed with creating income tax credit for semiconductor companies.5

But… when it comes to investing in bitcoin miners, a semiconductor shortage is not entirely a bad thing.

While it does create a major hurdle for newcomers looking to get into the space, it bodes well for companies that already have the technical expertise, processing power, and hardware in place to take advantage of lowered competition for share of mineable coins.

In fact, it has the potential to multiply the earnings of established miners to many times their current rate.

We got a glimpse of that in January when China banned Bitcoin mining, and about half the computers in the competition to ear Bitcoins were shut down.

Millions of Chinese Bitcoin miners went offline, and as a result the unaffected miners saw their earnings nearly double.7

Over the course of four months, U.S. bitcoin miners doubled their power consumption, hiking the U.S.’s share of global computing power from 17% to 35%8.

And just like that, the US became the world’s leading bitcoin miner, followed by Kazakhstan and Russia.

That ended up being relatively short lived. But it serves as a poignant reminder how quickly the environment can shift when we’re talking about the bitcoin sector, and the significant impact even small changes and transitions can have on a miner’s bottom line.

Will the upward trajectory fall into the same range as the last surge?

We can’t say for certain, but this is the kind of action that’s entirely possible in Bitcoin mining. It’s happened a handful of times now, so there’s good precedent for it to happen again.

The time is right. Bitcoin mining stocks are all far below their peaks. This looks like the classic bottom that sets a new rise in motion.

And when the next peak comes, early shareholders in Bit Origin (NASDAQ: BTOG) should be in line to take advantage of the action. Just like investors saw before with…

Hut 8 Mining (HUT), which shot up + 240% from July to Nov 2021…

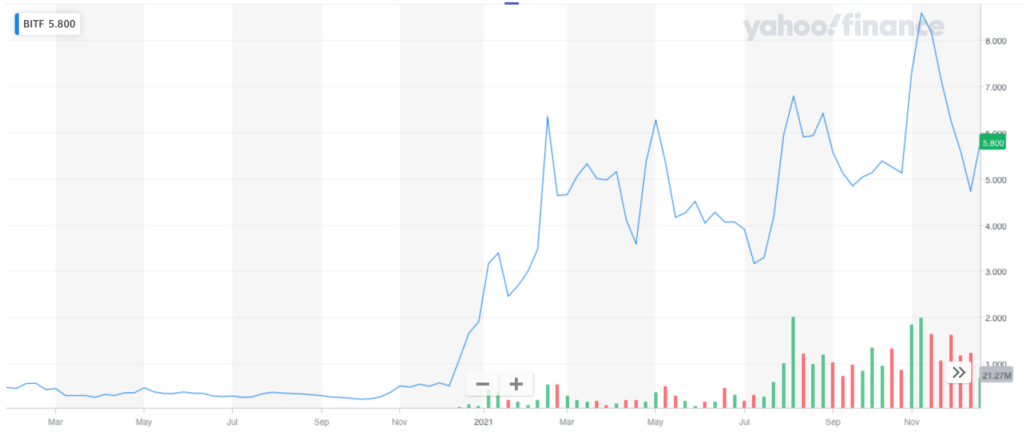

Bitfarms (BITF), which soared + 191% from July 2021 to Nov 2021…

Bit Digital (BTBT), which leapt +305% from July 2021 to Aug 2021…

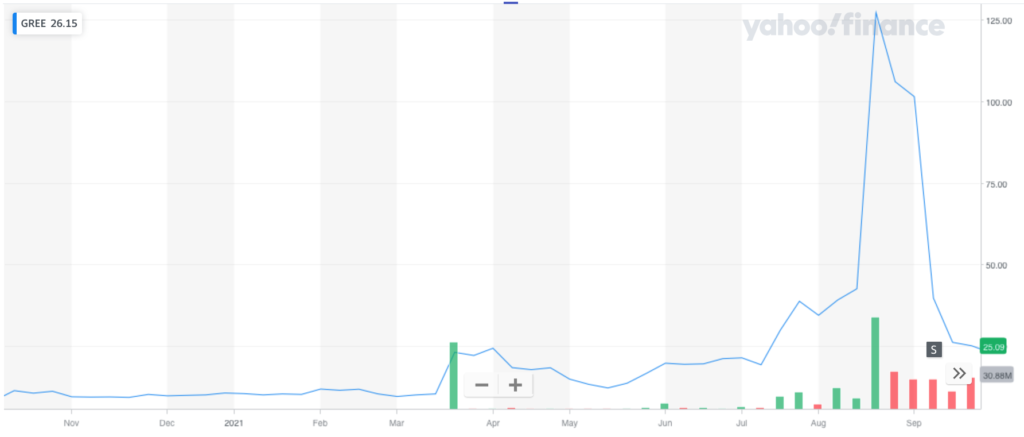

And Greenidge Generation Hldgs (GREE), which skyrocketed a whopping + 812% from July 2021 to Nov 2021.

Interestingly enough, Bitfarms’ profit is higher this year than it was last year when the stock was soaring, likely a result of improved infrastructure following an influx of cash investors made possible.9

7,206 Times The Processing Power In Just 4 Months

Over the course of the last few months, Bit Origin’s team has been on a massive acquisition spree, purchasing a swath of crypto miners to the tune of $19 million.

In January, the company entered into an agreement to acquire 686 spot Bitcoin miners that are worth $6 million in total. The top-tier newly manufactured miner is set to deploy soon in North America with an initial hash rate of 92 TH/s, expecting to ramp up the company’s current hash rate by over 63,000 TH/s.

Mind you, TH/s means “a tera hash per second”. In the simplest terms, that is one trillion (1,000,000,000,000) hashes per second.

Then in February, through its U.S. subsidiary SonicHash LLC, Bit Origin (NASDAQ: BTOG) entered into agreements with two global Bitcoin mining hardware suppliers to purchase 2200 Bitcoin miners for approximately $13 million.

These new miners are expected to ramp up the total hash rate of the Company’s miner fleet by over 209 PH/s. That relates to a peta hash per second, a shocking one quadrillion (1,000,000,000,000,000) hashes per second.

If you’re not familiar, this relates to the processing speed and capacity of a bitcoin miner. Those with higher speeds and greater power sources can mine a lot more Bitcoin in a shorter time span.

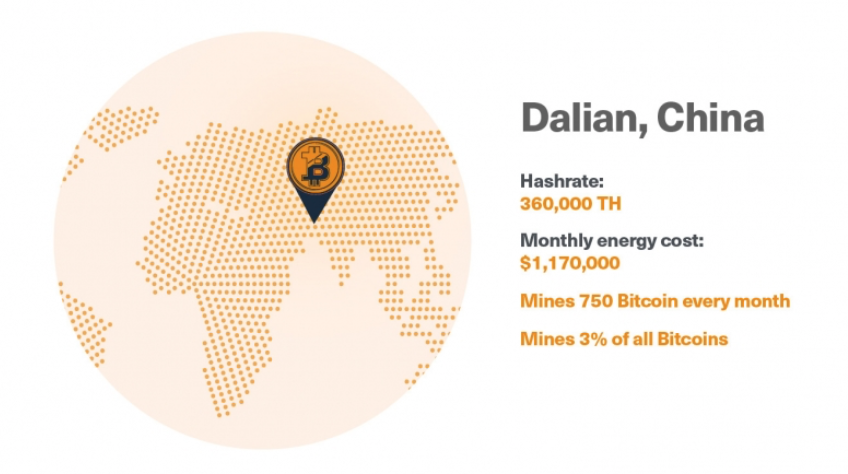

To put that in perspective, 209 PH/s puts them in the rankings of the top bitcoin miners in the world, as you can see from the below competitor charts.

The Countdown to Mining Bitcoin Is Just Days Away

Phase I: Amass Assets and Start Mining

With the newly purchased 2,200 miners expected to be delivered by April 30, 2022, the company’s operation is expected to consist of 3,628 Bitcoin miners producing approximately 341.2 PH/s when operating at full capacity.

Bit Origin expects to generate approximately $21.5 million in revenue and $13.5 million in cash contribution margin in the next 12 months.

The company’s CSO, Dr. Erick Rengifo, had this to say about the purchase:

“We expect that these purchase agreements will significantly bolster the Company’s projected growth. The global shortage of semiconductors and the recent increase in demand for Bitcoin mining have created a bottleneck for many miners to grow their hash rate. We are very pleased to secure long-term strategic cooperation with the world-leading mining hardware suppliers to continue our momentum.”

At the same time, Bit Origin (NASDAQ: BTOG) is raising capital for continued expansion, having just locked down $16 million in private placement funding.

Next Year… Phase II: Improve On System Architecture

Next year, this operation will reach size and move even deeper into the Bitcoin business. Using the expertise of its own team, Bit Origin will develop their own branded miners—powerful computers with outstanding performance metrics that are purpose-built to mine Bitcoin.

Longer term… Phase III: Own the Platform

After successful Phase I and Phase II, Bit Origin plans to build its own cloud computing platform and other 3.0 (very advanced) web assets.

Tech Heavyweights With A Track Record Of Success

Chief Security Officer Dr. Erick Rengifo literally teaches this stuff. He’s a professor of Economics at Fordham U in New York. He’s an investment counselor for the college too. And he’s an expert algorithmic, mathematical, and statistical strategies.

What this means… no matter how many times Bitcoin changes the rules or the algorithms to be solved, Bit Origin (NASDAQ: BTOG) has an expert in the C-Suite that can unpack it and use it to enrich BTGO shareholders.

Chairman and Chief Operating Officer Mr. Jiang is a blockchain pioneer and big time operator. Jiang has been working on blockchain deployment since 2016. Long before most of us ever heard the word. He’s also a seasoned pro at navigating the fast-moving world of crypto technology. And he also teaches it, at Hiyuan Culture Development Ltd and Qisuan Technol Ltd.

Jiang knows how to work crypto mining from the ground up. He’s invested in 10+ blockchain data centers and he personally owns more than 10,000 crypto mining machines.

He’s widely known in the business as the creator of “Big Cabbage” online community and he’s published many white papers teaching others about blockchain and cryptocurrency fundamentals and strategies.

What this means… Bit Origin has an executive with expertise in both crypto theory and hardware, to make sure machinery keeps humming along as efficiently as possible.

President Jiamin Li brings it all together. With 10 years+ experience in finance, private equity, real estate and fixed income in UK, USA and Latin America under his belt, he as already created several successful Bitcoin mining and data centers.

He’s adept in the world of big finance. As CEO of the Asset Management Center of a China top 40 Insurance Company for 2 years, he managed a RMB 75 billion portfolio.

5 Reasons To Consider Bit Origin (NASDAQ: BTOG) BEFORE The Next Stage Of The Fintech Boom

- Only the seasoned will succeed. The computers, miners, that succeed at Bitcoin are specially built, expensive, and they are outmoded in one to two years. That’s why it matters that Bit Origin has in-house expertise with leaders who have proven ability to stay relevant and on task.

- Supply chain woes could trigger a new crypto boom. A major shortfall of semiconductors could cripple smaller, newer upstarts, leaving established companies like Bit Origin with lowered competition, and a larger share of available coin to mine.

- Vertically integrated approach. This year the company is undergoing massive expansion that will boost mining capacities more than 7,200%. Then next year, Bit Origin plans to expand into making and selling advanced computers for mining. Eventually the company has plans for building its own proprietary blockchain platform.

- Bet on expertise. Bit Origin’s seasoned teams of pros not only helped develop the industry, they have already proven they can keep up.

- Sector pullback allows for a favorable entry price. After scores of miners lost ground last November, established miners were at work in January doing better than ever, as profit margins rose from 39% to 73% for the miners who kept up. That’s the kind of future ahead now for Bit Origin.

1

2https://www.forbes.com/sites/lawrencewintermeyer/2022/03/13/what-does-the-future-hold-for-bitcoin-mining/?sh=3846c117e9aa

3https://www.coindesk.com/markets/2020/11/13/blockchain-bites-bankrupted-creds-missing-millions-bitcoin-miners-quarterly-losses-and-more/

4https://www.buybitcoinworldwide.com/mining/profitability/

5https://www.commerce.gov/news/press-releases/2021/09/readout-biden-administration-convening-discuss-and-address

6https://news.bitcoin.com/global-chip-shortage-looms-over-bitcoin-mining-industry-asic-supply-tightens/

7https://fortune.com/2021/08/05/bitcoin-mining-is-suddenly-one-of-the-most-profitable-businesses-on-the-planet/

8https://qz.com/2080281/us-bitcoin-miners-doubled-their-power-consumption-in-four-months/

9https://fortune.com/2021/08/05/bitcoin-mining-is-suddenly-one-of-the-most-profitable-businesses-on-the-planet/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Bit Origins. (“BTOG”) and its securities, BTOG has provided the Publisher with a budget of approximately $35,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by BTOG) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company BTOG and has no information concerning share ownership by others of in the profiled company BTOG. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to BTOG industry; (b) market opportunity; (c) BTOG business plans and strategies; (d) services that BTOG intends to offer; (e) BTOG milestone projections and targets; (f) BTOG expectations regarding receipt of approval for regulatory applications; (g) BTOG intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) BTOG expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute BTOG business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) BTOG ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) BTOG ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) BTOG ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of BTOG to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) BTOG operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact BTOG business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing BTOG business operations (e) BTOG may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Bit Origins

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Bit Origins and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Bit Origins or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Bit Origins Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Bit Origins’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Bit Origins future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Bit Origins industry; (b) market opportunity; (c) Bit Origins business plans and strategies; (d) services that Bit Origins intends to offer; (e) Bit Origins milestone projections and targets; (f) Bit Origins expectations regarding receipt of approval for regulatory applications; (g) Bit Origins intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Bit Origins expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Bit Origins business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Bit Origins ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Bit Origins ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Bit Origins ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Bit Origins to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Bit Origins operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Bit Origins business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Bit Origins business operations (e) Bit Origins may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Bit Origins or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Bit Origins or such entities and are not necessarily indicative of future performance of Bit Origins or such entities.