Payment giants Visa Inc and PayPal Holdings, Inc are hopping on the crypto VC train as Blockchain Capital limited partners. This is their first-ever attempt to tread crypto VC territory, but are optimistic that they could leverage this partnership towards supporting the future of digital currencies.

The companies are among Blockchain Capital’s investors in their fifth fund (Fund V) capitalization amounting to $300 million. Both Visa and PayPal have a history of investing in several crypto startups, but they are newbies in the crypto VC space.

They have joined Blockchain Capital as limited partners or LPs. Being a limited partner requires that an external manager makes and handles investments in their place. In a statement to CoinDesk, PayPal verified that it is the company’s first partnership with a crypto VC firm.

Blockchain Capital

Blockchain Capital is one of the most prominent and pioneering crypto venture capital firms responsible for investing in nearly 110 successful startups. With an extremely large war chest of $1.5 billion, it has inside its investment portfolio companies such as DeFi bigwigs UMA, Nexus Mutual, and Aave, Coinbase, Anchorage, and NFT company OpenSea.

The VC firm’s Fund V was supported by pension funds as well as university endowments, in addition to PayPal and Visa.

Asked on what the prospects hold for PayPal and Visa, Blockchain Capital believes that both payment companies want “bolder investment opportunities” but need help to learn the ropes before fully navigating the space.

Blockchain believes that both their interests and that of the payment giants’ are in direct synergy.

On the part of PayPal, its crypto head Jose Fernandez da Ponte said that their journey into the crypto VC field provides opportunities to engage and learn so that they can someday drive “the future of digital currencies and blockchain.”

Meanwhile, Visa Inc.’s CFO Vasant Prabhu, said in a statement that the company supports moves to enhance whatever form of money movement, may it be Visa or any other company.

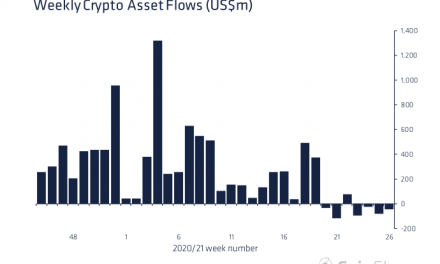

The fact that crypto seems to be tumbling more than often recently did not impact Blockchain’s strategic partnership prospects.

Recently, Bitcoin, along with other crypto currencies dwindled last month due to China’s suppression of bitcoin mining and Elon Musk’s very public trashing of Bitcoin.

Blockchain’s Fund V will zero in on building infrastructure to support DeFi and the now-viral non-fungible tokens (NFTs).