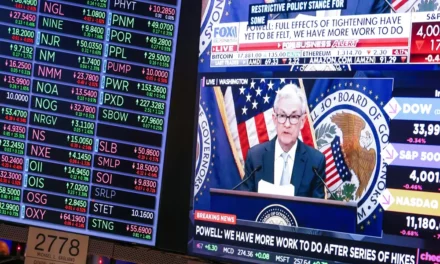

Nervousness over the possibility of another interest rate hike on the part of the world’s central banks led to a dismal week for American stock indices as June came to an end. Likewise, news of an impending economic downturn in the European Union has brought anxiety to traders and analysts alike.

Recent economic reports from France and Germany have been particularly negative and have driven investors in search of safe havens while national Treasuries are in a worldwide bond market rally over a potential recession.

So Much for AI

While the potential of artificial intelligence (AI) stocks dominated the markets throughout much of Q2-2023, analysts note that the second-quarter rally is rapidly losing steam in the face of further rate hikes on the part of the US Federal Reserve, as well as a market bracing for the repercussions of the Fed’s aggressive inflation reduction drive.

As of June 23rd, the S&P 500 dropped by around 1.4%. The tech-centric Nasdaq 100, on the other hand, was down by 1.3%, with investors taking their profits from major IT players. Surprisingly, tech titans like Microsoft and Nvidia were on the losing end, as were chip manufacturers GlobalFoundries Inc and Chipmakers Marvell Technology.

Still, analysts are grateful for the AI frenzy in Q2; if it had not occurred, market performance would have been more dismal.

Keeping a Recession at Home at Bay

At the same time, the downturn in the stock market has again raised worries regarding an economic recession in the United States – something that Treasury Secretary Janet Yellen is struggling to quell. She has, however, acknowledged that it has become a very real possibility that would need to be tempered by a slowdown in consumer spending.

Such a slowdown may come soon enough: manufacturing in the United States and much of the world remains recessionary. Likewise, the country’s purchasing managers’ index went down to 46.3 last month – the lowest it has been since December of last year.